Consolidated Financial Statements

Six Months Ended June 30, 2007 and 2006

JUNE 30, 2007 AND 2006

Table of Contents

Page

Consolidated Balance Sheets ………. 1-3

Consolidated Statements of Income ……….. 4

Consolidated Statements of Changes in Equity ..……….… 5

Consolidated Statements of Cash Flows ……….. 6-7

Notes to the Consolidated Financial Statements ………. 8-47

Notes 2 0 0 7 2 0 0 6

Advances for Plasma plantations, net 2k,8 49,316,664 31,398,019

Notes 2 0 0 7 2 0 0 6

___

LIABILITIES AND SHAREHOLDERS’ EQUITY

CURRENT LIABILITIES

Trade payables 11 91,561,469 54,921,983

Taxes payable 2n,13b 17,791,394 20,629,854

Accrued expenses 14 39,589,249 7,584,351

Sales advances 12 16,846,582 5,984,206

Due to related parties 2p,24a 6,707,641 -

Current portion of bank loan 15 41,648,400 69,000,000

TOTAL CURRENT LIABILITIES 214,144,735 158,120,394

LONG-TERM LIABILITIES

Long term bank loan - net of current portion 15 1,055,751,600 157,427,531 Provision for employee service

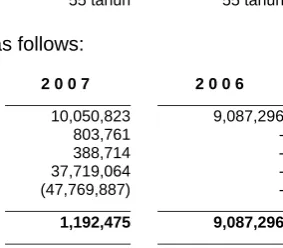

entitlements 2o,16 1,192,475 9,087,296

Other long-term liabilities 2p,24b 4,925,258 5,209,318

TOTAL LONG-TERM LIABILITIES 1,061,869,333 171,724,145

TOTAL LIABILITIES 1,276,014,068 329,844,539

MINORITY INTERESTS IN NET

ASSETS OF SUBSIDIARIES 2b,25a 17,740,270 3,100,678

Notes 2 0 0 7 2 0 0 6

___

SHAREHOLDERS’ EQUITY

Share capital

Authorized – 5,500,000,000

shares at par value per share of Rp200 (full amount) each in 2007 and

2,200,000,000 shares at par

value per share of Rp500 (full amount ) each in 2006

Issued and fully paid – 1,890,000,000 share

in 2007 and 517,660,000 share in 2006 17 378,000,000 258,830,000

Additional Paid In Capital 23 933,130,774 -

Difference in the value of

entities under common control 2s,3,30 (275,971,501) (126,693,758) Assets revaluation increment 2i,2j,10 75,746 26,975,746 Difference in foreign currency

translation 2a 64,444 -

Retained earnings 261,327,409 196,393,206

SHAREHOLDERS’ EQUITY, NET 1,296,626,872 355,505,194

TOTAL LIABILITIES AND

SHAREHOLDERS’ EQUITY 2,590,381,210 688,450,411

Notes 2 0 0 7 2 0 0 6

SALES 2d,18 541,057,345 491,964,304

COST OF SALES 19 355,643,558 363,576,379

GROSS PROFIT 185,413,787 128,387,925

OPERATING EXPENSES 2d,20 (45,404,381) (26,939,866)

OPERATING INCOME 140,009,406 101,448,059

OTHER INCOME (EXPENSES): 2d

Additional severance pay 16 (37,719,064) -

Interest expenses 21 (46,025,496) (18,540,866)

Loss on impairment of assets 2j,10 (7,442,177) (166,480)

Gain on foreign exchange 2c 10,802,213 600,321

Interest income 22 3,514,226 1,607,283

Others, net (6,333,099) (21,714)

Other expenses, net (83,203,397) (16,521,456)

INCOME BEFORE CORPORATE

INCOME TAX 56,806,009 84,926,603

CORPORATE INCOME

TAX BENEFIT (EXPENSE) 2n,13c

Current period (27,333,136) (23,879,113)

Deferred 10,653,830 (1,155,312)

CORPORATE INCOME

TAX BENEFIT (EXPENSE) (16,679,306) (25,034,425)

INCOME BEFORE MINORITY INTERESTS IN NET INCOME/LOSS

OF SUBSIDIARIES 40,126,703 59,892,178

MINORITY INTERESTS IN NET INCOME OF

SUBSIDIARIES 2b,25b (534,004) (483,062)

NET INCOME 39,592,699 59,409,116

Difference in the

value of

restructuring Retained

Additional transactions of Assets Difference in earnings Total

Paid In entities under revaluation Foreign Currency (Accumulated shareholders’ Notes Share capital capital common control increment Translation deficit) equity, net

Balance as of December 31, 2005 258,830,000 - (126,693,758) 26,975,746 - 136,984,090 296,096,078

Net income for 2006 (six months) - - - 59,409,116 59,409,116

Balance as of June 30, 2006 258,830,000 - (126,693,758) 26,975,746 - 196,393,206 355,505,194

Balance as of December 31, 2006 285,730,000 - (126,693,758) 75,746 - 249,134,710 408,246,698

Issuance of new shares 92,270,000 987,289,000 - - - - 1,079,559,000

Initial public offering cost - (54,158,226) - - - - (54,158,226)

Difference in the purchase price of Plama Agro compared to its

net book value 3 - - (275,971,501) - - - (275,971,501)

Reversal in difference in the value of restructuring transaction of entities under common control due to change of common

control / shareholders 2r,30 - - 126,693,758 - - (27,400,000) 99,293,768

Difference in foreign currency

translation 2a - - - - 64,444 - 64,444

Net income for June 2007

(six months) - - - 39,592,699 39,592,699

Balance as of June 30, 2007 378,000,000 933,130,774 (275,971,501) 75,746 64,444 261,327,409 1,296,626,872

(Expressed in thousands of Rupiah, unless otherwise stated)

Cash paid to suppliers and employees,

and for other operating expenses (335,695,736) (282,392,821) Additions to plantation assets -

immature plantations 9b (24,774,158) (1,290,898) Payment for acquisition of

subsidiaries after deducting cash

balances from acquisition date 3 (3,465,217) - Cash received from acquisition of

CASH FLOWS FROM FINANCING ACTIVITIES (Continued):

Additions in deferred charges 1,373,811 -

Proceeds from bank loans 210,336,145 -

Withdrawal of guarantee deposit 1,378,500 1,701,000

Net cash provided by (used in)

financing activities 1,082,985,423 (48,141,115)

NET INCREASE IN

CASH AND CASH EQUIVALENTS 1,164,242,985 68,173,226

CASH AND CASH EQUIVALENTS

AT BEGINNING OF PERIOD 64,237,583 23,146,082

CASH AND CASH EQUIVALENTS

AT END OF PERIOD 4 1,228,480,568 91,319,308

Supplemental information on cashflows Non-cash activities

Bank facility fees deducted

from proceeds of bank loan bank 15 15,961,750 - Acquisition of Subsidiaries

financed by bank loan 3 538,139,000 -

Lending to a related party

financed by bank loan 15 159,663,105 -

1. GENERAL

a. PT Sampoerna Agro Tbk (“the Company”)

The Company is a limited liability company established in Indonesia on June 7, 1993, based on Notarial Deed of Tina Chandra Gerung, S.H No. 8. The Articles of Association were approved by the Ministry of Justice and Human Rights under Letter No. C2-1840.HT.01.01.TH.94 dated February 4, 1994, and published in the State Gazette No. 60, Supplement No. 4842 dated July 29, 1994.

Based on Notarial Deed Sutjipto, S.H., M.Kn. No. 52 dated February 16, 2007, the Company changed its name from PT Selapan Jaya to PT Sampoerna Agro. The amendment was approved by the Ministry of Justice and Human Rights under Letter No. W7-02335 HT.01.04-TH.2007 dated March 9, 2007.

The Articles of Association have been amended from time to time, the latest amendment of which was made under Notarial Deed No. 87 of Sutjipto, S.H., M.Kn., dated April 11, 2007 concerning about initial public offering plan, change in the share’s par value by stock split, increase in paid up share capital and changes to comply with Indonesian capital market law, including the change in the Company’s name from PT Sampoerna Agro to PT Sampoerna Agro Tbk.

The Company was approved as a Domestic Capital Investment Company (“PMDN”) based on the approval of the Capital Investment Coordinating Board (“BKPM”) through Letter No. 336/I/PMDN/1994 dated June 3,1994.

On January 9, 2007, the Company amended its Articles of Association which were covered by Notarial Deed of Linda Herawati S.H., No. 16 concerning about the change in the Company’s status from Domestic Capital Investment to Foreign Capital Investment.

Based on various letters and permits secured by the Company from local, regional and national government agencies, the Company may develop 25,700 hectares of oil palm plantations in Ogan Komering Ilir, South Sumatera, consisting of 7,200 hectares of its own plantations (referred to as the Nucleus or “Inti”) and 18,500 hectares of Plasma plantations with milling capacity of up to 360 tonnes of fresh fruit bunches per hour. The land right certificate (“Hak Guna Usaha”) for 3,243 hectares of Inti plantations will expire in 2037 but can be renewed up to 2097.

The Company commenced its commercial operations in November 1998 and its head office is located at Jalan Basuki Rahmat No. 788, Palembang, South Sumatera.

On June 7, 2007, the Company received the effective statement from Chairman of the Capital Market Supervisory Agency (BAPEPAM) to carry out Initial Public Offering (IPO) based on the BAPEPAM’s letter No S-2707/BL/2007. On June 18, 2007, the Company was listed on Jakarta Stock Exchange (BEJ).

b. Subsidiaries

On January 26, 2007, the Company acquired 100% shares of Palma Agro Ltd. (PAL), whereas PAL owned 93.6% shares in PT Sungai Rangit.

1. GENERAL (continued)

b. Subsidiaries (continued)

The Company’s investment in Subsidiaries after above mentioned acquisitions consist of the following:

Palma Agro Limited, Republic of Seychelles

(“Palma agro”) 100,00% - 504.540 -

Palma Agro directly owns shares In the following subsidiary: PT Sungai Rangit

(“Sungai Rangit”) 1997 93.60% - 475.810 -

*) Company still in development stage

Summary of operational activities in Subsidiaries:

Maximum capacity of palm oil mill (tonnes of fresh fruit

Subsidiaries Activities bunches per hour)

Aek Tarum Oil palm and rubber plantations and

palm oil mill operations 60

Mutiara Bunda Jaya Oil palm plantations and palm oil mill operations 80 Telaga Hikmah Oil palm plantations and palm oil mill operations 60 Sungai Rangit Oil palm plantations and palm oil mill operations 30

Gunung Tua Abadi Oil palm plantations -

Binasawit Makmur Oil palm plantations and oil palm seedling - Palma Agro Holding company and management services -

1. GENERAL (continued)

b. Subsidiaries (continued)

The details of subsidiaries land right areas, totaling 49,069.09 hectares, are as follows :

Subsidiaries Hectares Valid until

Aek Tarum 2,189.70 August 16, 2096 *

2,579.90 August 22, 2096 *

825.70 July 6, 2040

0.75 January 24, 2020

Mutiara Bunda Jaya 552.24 May 14, 2097 *

1,268.50 September 17, 2098 *

102.00 November 23, 2039 *

2,790.00 July 6, 2040

73.21 August 6, 2031

Telaga Hikmah 2,668.50 December 31, 2082 *

7,175.60 January 12, 2099

126.00 November 23, 2039

6,034.20 July 6, 2040

Gunung Tua Abadi 3,390.00 April 30, 2098 *

1,642.00 November 23, 2039

Binasawit Makmur 588.97 September 21, 2097 *

Sungai Rangit 13,118.00 September 29, 2036

0.32 September 24, 2030

903.45 March 8, 2036

469.01 June 18, 2038

435.23 September 24, 2038

2,135.81 September 24, 2039

*) Already obtained approval for an extention of 25 years and a renewal for another 35 years.

Company and Subsidiaries will be defined as “Group”.

c. Employees, directors and commissioners

Based on Circular Resolution of Shareholders as covered by Notarial Deed of Sutjipto, S.H. M.Kn. No. 235 dated May 25, 2007, the composition of commissioners and directors of the Company is as follows:

Board of Commissioners: Board of Directors:

Michael Joseph Sampoerna - President Commissioner Goh Cheng Beng - President Director

Ekadharmajanto Kasih - Commissioner Ali Gunawan Budiman - Director

Sugiarta Gandasaputra - Commissioner Yasin Chandra - Director

Phang Cheow Hock - Independent Commisioner Chang Poh Sang - Director

Arief Tarunakarya

Surowidjojo - Independent Commisioner Sie Eddy Kurniawan - Director

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The accounting and reporting policies adopted by the Group conform to generally accepted accounting principles in Indonesia. The significant accounting principles applied consistentlyinthepreparationof theconsolidatedfinancialstatementsforthe six months period ended June 30, 2007 and2006 are as follows:

a. Basis of preparation of consolidated financial statements

The consolidated financial statements have been prepared in accordance with accounting and practices generally accepted in Indonesia, which includes Statements of Financial Accounting Standards (PSAK) issued by the Indonesian Institute of Accountants and Regulations and Guidelines on Financial Statements Presentation set out by the Capital Market Supervisory Agency (BAPEPAM).

The consolidated financial statements, presented in thousands of Rupiah unless otherwise stated, have been prepared on accrual basis, except for statements of cash flows, and using historical costs, except for inventories that are valued at the lower of cost or net realizable values and certain items of fixed assets and mature plantations which were revalued on April 30, 2003.

The consolidated statements of cash flows present cash receipts and payments classified into operating, investing and financing activities, and are presented using the direct method.

The reporting currency used in the preparation of the consolidated financial statements is in Rupiah, except for PAL, which has adopted the US Dollar as its fuctional, reporting and recording currency since January 1, 2007. For consolidation purposes, the accounts of PAL are translated into Rupiah amounts on the following basis:

Balance sheet accounts : Prevailing rate of exchange as published by Bank Indonesia at the last banking day as of June 30, 2007 amounting to Rp9,054 (full amount) per US$1.

Income statement accounts : The exchange rates prevailing at the date of transactions.

Gains or losses arising from translation of balance sheet and income statements accounts are presented as “Difference in Foreign Currency Translation” in the equity section of the consolidated balance sheet.

b. Basis of consolidation

The consolidated financial statements include the Company’s financial statements and all subsidiaries' financial statements that are controlled by the Company. Control is presumed to exist where more than 50%, directly or indirectly of a subsidiary's voting power, is controlled by the Company; or where the Company is able to govern the financial and operating policies of a subsidiary; or control the removal or appointment of a majority of a subsidiary's board of directors.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

b. Basis of consolidation (continued)

The proportionate share of the minority shareholders in the equity of the subsidiaries is presented in “Minority Interest in Net Assets of Subsidiaries” in the consolidated balance sheets. When cumulative losses applicable to minority interest exceed the minority shareholders’ interest in the subsidiaries’ equity, the excess is charged against the majority shareholders’ interest, except in rare cases when minority shareholders have a binding obligation to make good on such losses and minority shareholders able to cover those losses. Subsequent profits earned by Subsidiaries under such circumstances that are applicable to the minority interest shall be allocated to the majority interest to the extent minority losses previously absorbed have been fully recovered.

c. Foreign currency transactions and balances

Transactions in currencies other than Rupiah are recorded at the prevailing exchange rates in effect on the date of the transactions.

As of the balance sheet dates, all foreign currency monetary assets and liabilities are translated at the middle exchange rates quoted by Bank Indonesia on those dates. The resulting net foreign exchange gains or losses are recognized in the current period’s statement of income.

The exchange rates used as of June 30, 2007 and 2006, Rp9,054, and Rp9,300 per US$1 (full amount), respectively.

d. Revenue and expense recognition

Revenue from sale of goods is recognized when the significant risks and rewards of ownership of the goods have been passed to the buyer.

Expenses are recognized when these are incurred (accrual basis) .

e. Cash and cash equivalents

Cash and cash equivalents consist of cash on hand and in bank, and short-term deposits with maturities within three (3) months or less and not pledged as collateral.

f. Inventories

Inventories are stated at the lower of cost or net realizable value.

Cost is determined using the weighted average method and comprises all costs of purchase, costs of conversion and appropriate overheads incurred in bringing the inventory to its present location and condition.

Net realizable value is the estimated selling price in the ordinary course of business, less estimated costs of completion and the estimated cost necessary to make the sale.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

g. Prepaid expenses

Prepaid expenses are charged to operations over the periods benefited using straight-line method of amortization.

h. Plantation assets

Plantation assets are classified as immature plantations and mature plantations.

Immature plantation

All costs relating to the development of the oil palm and rubber plantations for the Group’s own operations (Inti plantations) together with a portion of indirect overheads, including general and administrative expenses incurred, and also interest expenses from loan used in developing immature plantation are capitalized until commercial production is achieved. These costs will be transferred to mature plantations and amortized over the estimated 20 years productive lives of the oil palm and rubber plantations, starting from the commencement of commercial production.

Mature plantation

In general, oil palm plantations are considered mature four years after planting and rubber plantations are considered mature five to six years after planting. Actual time to maturity is dependent upon vegetative growth and is assessed by management.

Mature plantations are stated at cost, except for certain mature plantations which are stated at revalued amounts, less accumulated amortization.

i. Fixed assets

Fixed assets are stated at cost, except for certain fixed assets which are stated at revalued amounts, less accumulated depreciation.

Fixed assets, except land, are depreciated using the straight-line method over their estimated useful lives as follows:

Years

Buildings 20

Infrastructures 20

Storage tanks 16

Machinery and equipments 12

Vehicles and heavy equipments 4-8

Office equipments 4-8

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

i. Fixed assets (continued)

The cost of repairs and maintenance is charged to expense as incurred; significant renewals or betterments are capitalized. Interest expenses incurred in relation with loan used in constructing the assets are capitalized. When assets are retired or otherwise disposed of, their carrying value and the related accumulated depreciation are removed from the accounts and any resulting gain or loss is reflected in the current period’s statements of income.

Construction in progress represents the accumulated cost of materials and other costs related to the asset under construction until it is ready to be used. When the asset is complete and ready for its intended use, these costs are transferred to the relevant accounts.

j. Impairment of assets

The recoverable amount of an asset is estimated whenever events or changes in circumstances indicate that its carrying amount may not be fully recoverable. Impairment in asset value, if any, recognized as loss in the current year’s statement of income, unless assets are carried at revalued amounts. Impairment losses on revalued assets are recognized directly against the “Assets Revaluation Increment” for the related assets to the extent that the impairment losses do not exceed the amounts recognized in the assets revaluation increment attributable to such assets. The amount of an impairment loss for a revalued asset which exceeds the amount of the “Assets Revaluation Increment” attributable to such asset is recognized in the current period’s statements of income.

k. Advances (investment credit) for Plasma plantations

Plasma plantations is an Indonesian Government policy to develop the plantations on mutual agreements with smallholders or cooperatives. Group (referred to as “Inti”) can acquire land rights to develop plantations only if they develop plantations for smallholders (Plasma participants) in addition to their own plantations. Inti are required to assist and supervise smallholders in technical matters relating to the plantation and to purchase the fresh fruit bunch (FFB) produced by Plasma plantations at prices determined by the Indonesian Government.

Once developed, the Plasma plantations are transferred to the smallholders at a conversion rate determined by the Government, and where the conversion price might be lower than the carrying value of the Plasma plantation transferred. Therefore, Group determine the allowance for loss on conversion based on a periodic review of the estimated difference between the carrying value of the Plasma plantation and the conversion value. The Plasma farmers are required to sell the fresh fruit bunch to Inti.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

l. Nursery

Cost incurred in the preparation of the nursery, purchase of seedlings and their maintenance are stated at cost. The accumulated cost are transferred to “Immature Plantations” account at the time of planting.

m. Deferred land right cost and Deferred charges

Costs incurred in relation to obtain land rights in the form of “Hak Guna Usaha” (HGU) and “Hak

Guna Bangunan” (HGB) are recorded as “Deferred land right cost”, which are amortized on a

straight-line basis over the term of the related land rights.

Fees incurred in obtaining long-term loan facilities are deferred as part of “Deferred charges”, which are amortized on a straight-line basis over the term of the related facilities. If the Company effectively in a technical or payment default position, which has the consequences that the principle amount of the debt together with accrued interest will become due and payable, the related deferred long-term bank loan administration costs are charged to current operations.

n. Corporate income tax

Current tax expense is provided based on the estimated taxable income for the year. Deferred tax assets and liabilities are recognized for temporary differences between the financial and the tax bases of assets and liabilities at each reporting date. This method also requires the recognition of future tax benefits, such as the carry-forward of unused tax losses, to the extent that realization of such benefits is probable.

Deferred tax assets and liabilities are measured at the tax rates that are expected to apply to the period when the asset is realized or the liability is settled, based on tax rates (and tax laws) that have been enacted or substantively enacted at the balance sheet date.

Amendments to tax obligations are recorded when an assessment is received or, if appealed against by the Group, when the result of the appeal is determined.

o. Provision for employee service entitlements

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

p. Transactions with related parties

The Group have transactions with entities which are regarded as having a special relationship as defined under SFAS No. 7, “Related Party Disclosure”. Significant transactions with related parties, whether or not conducted under normal terms and conditions similar to those with non-related parties are disclosed in the notes to consolidated financial statements.

q. Use of estimates

The preparation of consolidated financial statements in conformity with generally accepted accounting principles requires management to make estimations and assumptions that affect amounts reported therein. Due to the inherent uncertainty in making estimates, actual results reported in future periods may be based on amounts that differ from those estimates.

r. Restructuring under common control

Restructuring transactions of entities under common control are accounted for in accordance with PSAK No. 38, “Accounting for Restructuring of Entities under Common Control”. Under this standard, transactions between entities under common control are carried out within the framework of reorganizing entities under the same group and does not constitute a change of ownership based on the economic substance of such transactions, thus, no gain or loss is recognized in the group or to the individual entity within the same group. The underlying object of the restructuring transaction must be recorded at its book value and such transaction is accounted for as a business combination using the pooling-of-interests method. Under the pooling-of-interest method, the financial statements of the restructured company is presented as if the acquired entity had been combined at the beginning of the earliest period presented.

The difference between the par value of issued share capital or cash payment made by the Company to acquire the Subsidiaries with the Company’s interests in the net assets of such Subsidiaries is recognized as “Difference in the Value of Restructuring Transactions of Entities Under Common Control”, a component of shareholders’ equity. The difference in value of restructuring transactions of entities under common control resulting from past acquisition of Subisidiaries is realized to the related accounts in accordance with SFAS No. 22 “Accounting for Business Combination” when the transacting parties are no longer under common control.

s. Troubled debt restructuring

Troubled debt restructuring is recorded in accordance with SFAS No. 54, “Accounting for Troubled Debt Restructuring”. Net gain arising from trouble debt restructuring is presented as the “Extraordinary Item”, net of the related income tax effect.

t. Segment information

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

u. Basic net earnings (loss) per share

Basic net earnings (loss) per share is computed by dividing net income with the number of shares outstanding during the year, after considering retroactive effect of a stock split which took place on April 13, 2007 and a distribution of shares bonus from “Asset Revaluation Increment" on September 18, 2006 (Note 18), amounting to 1,890,000,000 in 2007 and 1,428,650,000 shares in 2006. The Company does not have securities with potential dilutive effects. Therefore, fully diluted earnings per share is not computed.

3. ACQUISITION OF SUBSIDIARIES

Acquisition of Palma Agro Ltd. (PAL)

On January 26, 2007, the Company acquired 100% ownership interest in PAL from Carlton Services Limited and Mayfair Trust Group with a purchase price amounting to US$59,000,000 or equivalent to Rp538,139,000. PAL is a holding company, established in Republic of Seychelles, and owns 93.6% shares of Sungai Rangit, another company engaged in oil palm plantation in Central Kalimantan. The Company, Carlton Services Limited and Mayfair Trust Group were considered as entities under common control. Accordingly, this transaction has been accounted for in accordance with PSAK No. 38 “Accounting for Restructuring of Entities under Common Control” as described in Note 2r. The difference between PAL’s book value (after taking up the carrying value of its investment in Sungai Rangit) with the purchase price amounting to Rp275,971,501, was presented as part of equity in the 2007 consolidated balance sheet as part of the account “Difference in the value of restructuring transactions of entities under common control”

The details arising from the acquisition of PAL is computed as follows:

Net book value of assets acquired 262,167,499

Difference in the value of restructuring

transactions of entities under common control 275,971,501

Purchase price (Note 15) 538,139,000

Cash balance received from the acquisition 12,970,290

The audited accounts of PAL and Sungai Rangit as of December 31, 2006 were used as the basis to determine the net book value of their assets for the above calculation. The accounts of PAL and Sungai Rangit in 2006 and prior periods were not retroactively consolidated to the acounts of the Company since PAL and Sungai Rangit, together with the Company, were not under common control during those periods.

Acquisition of PT Sawit Selatan, PT Tania Binatama, PT Sungai Menang, PT Selatanjaya Permai, PT Pertiwi Lenggara Agromas and PT Usaha Agro Indonesia

On March 30, 2007, the Company acquired 99% ownership interest in six (6) non-operating companies (hereafter named Subsidiaries), which own land permits to develop plantation, as follows:

a. PT Sawit Selatan, PT Tania Binatama, PT Sungai Menang, PT Selatanjaya Permai were acquired from PT Nitiagro Lestari, a Company’s shareholder, with the purchase price amounting to Rp3,465,000.

b. PT Pertiwi Lenggara Agromas was acquired from PT Wahana Sekar Agro and PT Berkah Sawitri Nusantara with purchase price amounting to Rp4,950.

3. ACQUISITION OF SUBSIDIARIES (continued)

Acquisition of PT Sawit Selatan, PT Tania Binatama, PT Sungai Menang, PT Selatanjaya Permai, PT Pertiwi Lenggara Agromas and PT Usaha Agro Indonesia (continued)

Prior to the acquisition by the Company, those companies except for PT Usaha Agro Indonesia (UAI) were under common control of Sampoerna Strategic Group. Accordingly, these transactions have been accounted for in accordance with PSAK No. 38 “Accounting for Restructuring of Entities under Common Control” as described in Note 2r. There is no difference between purchase price and the carrying value of the investment of Sampoerna Strategic Group in these Subsidiaries. The goodwill totaling to Rp9,267,695, which resulted from the initial acquisition of these companies (except UAI) by Sampoerna Strategic Group, were transferred to the Company at their respective carrying values and will be amortized over 5 years.

Purchase of UAI was accounted for using purchase method, which resulted to goodwill amounting to Rp162, that will be amortized over 5 years.

The audited accounts of those newly acquired subsidiaries as of December 31, 2006 were used as the basis to determine net book value of their assets for the above calculation.

4. CASH AND CASH EQUIVALENTS

Average annual interest rates on time deposits were as follows:

2 0 0 7 2 0 0 6

4. CASH AND CASH EQUIVALENTS (continued)

Management believes that all trade receivables are fully collectible, and no provision for losses is necessary.

7. INVENTORIES

As of June 30, 2007, inventories owned by Mutiara Bunda Jaya, Aek Tarum and Gunung Tua Abadi were pledged as collateral for bank loans (Note 15).

As of June 30, 2007, all inventories were covered by insurance against losses from fire and other risks under blanket policies with insurance coverage totalling Rp114,782,073, which in the management’s opinion is adequate to cover possible losses from such risks.

Management believes that inventories are realizable, hence no provision for inventory obsolescence is necessary.

8. ADVANCES FOR PLASMA PLANTATIONS – NET

2 0 0 7 2 0 0 6

Advances for Plasma plantations

Beginning balance 47,715,493 40,804,323

Additions:

Development cost 3,589,158 3,360,877

Capitalized expenses (Note 21) 89,843 694,538

Deductions:

Plasma plantations transferred to Plasma participants at

the conversion price - (2,639,607)

Excessive advances over

the conversion price - -

Ending balance 51,394,494 42,220,131

Provision for Plasma plantations

8. ADVANCES FOR PLASMA PLANTATIONS – NET (continued)

Advances for Plasma plantations

Management believes that the provision for Plasma plantations is adequate to cover possible losses arising from unrecoverable Plasma plantations.

The Company is developing Plasma plantations under an “Anak Angkat Bapak Angkat” (AABA) scheme and financed in the form of “Kredit Usaha Kecil” (KUK) and “Kredit Koperasi Primer untuk

Anggota” (KKPA).

Aek Tarum and Mutiara Bunda Jaya are or have been involved in Plasma schemes implemented under Indonesian Government guidelines whereby companies assume responsibility for developing plantations to the productive stage for transfer to Plasma participants under a PIR-Trans (“Perkebunan

Inti Rakyat - Transmigrasi”) scheme.

Telaga Hikmah has been developing Plasma plantation under KKPA scheme.

Once the plantation areas reach the production stage, these areas will be transferred to Plasma participants who will receive two hectares each.

The Company

The Plasma plantations costs as of June 30, 2007, represent the cost of development of 1,316 hectares of Plasma areas, for approximately 658 Plasma participants. The Company, on behalf of Plasma participants, is in the process of obtaining bank financing for the new Plasma areas through the “Kredit Koperasi Primer Anggota” program.

Mutiara Bunda Jaya

Mutiara Bunda Jaya is involved in developing 8,296 hectares of Plasma oil palm plantations for 4,273 farmers in the vicinity of the Inti plantation area. Following approval from PT Bank Rakyat Indonesia (Persero) Tbk (BRI), the Company has transferred Plasma loan facility to Plasma participants amounting to Rp5,517,088 for 560 hectares to 280 Plasma participants in 2005 and amounting to Rp20,449,576 for 2,308 hectares to 1,154 Plasma participants in 2004. .

Telaga Hikmah

Advances for Plasma plantations in which Telaga Hikmah represent expenditures related to the development of Plasma oil palm plantations still in the development stage. Based on the restructuring agreement between the Telaga Hikmah and Bank Rakyat Indonesia (Persero) Tbk (BRI) No. R.479-MEN/DPB/AKH/08/2000 dated August 21, 2000, Telaga Hikmah’s commitment to develop Plasma areas was reduced from 15,000 hectares to 5,000 hectares. As of June 30, 2007, Telaga Hikmah had planted 3,684 hectares for 1,842 Plasma participants.

8. ADVANCES FOR PLASMA PLANTATIONS – NET (continued)

Investment credit

PT Bank Rakyat Indonesia (Persero) Tbk (BRI)

On November 1, 1989 and May 28, 1996, Mutiara Bunda Jaya and Telaga Hikmah obtained Plasma loans from BRI for the development of 8,238 hectares and 15,000 hectares of Plasma oil palm plantations, respectively. The maximum Plasma loan facilities for Mutiara Bunda Jaya and Telaga Hikmah were Rp72,673,158 (including interest during the four years grace period amounting to Rp25,650,000) and Rp112,068,000 (including interest during construction of Rp40,955,400), respectively. Mutiara Bunda Jaya’s Plasma loan is to be repaid through 2001 and the loan facility for Telaga Hikmah is to be repaid within 16 years through December 31, 2012, including a grace period of seven years through March 31, 2003.

Mutiara Bunda Jaya

On January 29, 2003, BRI through Letter No. R.063-ADK/DKR/01/2003, approved a restructuring program for its Plasma loan to Mutiara Bunda Jaya. Under this restructuring program, the conversion of Plasma areas of 8,238 hectares of Plasma oil palm plantations to 4,273 smallholders is due to be fully made by December 31, 2003. As of December 31, 2005, Mutiara Bunda Jaya has not converted Plasma area of 310 hectares. In this regard, BRI asked MBJ to repay the corresponding Plasma loan amounting to Rp2,801,249 which was fully settled in March 2006.

As of June 30, 2007, Mutiara Bunda Jaya is still in the process of negotiation with Plasma participants to convert the area by using local government assistance as mediator.

As of June 30, 2007, total Plasma loan had been transferred to plasma participants amounting to Rp69,871,909.

The Plasma loan bears annual interest at the rate of 14% in 2006.

Telaga Hikmah

On August 21, 2000, BRI through Letter No. R.479-MEN/DPB/AKH/08/2000, approved a restructuring program for its Plasma loan in Telaga Hikmah. Under the restructuring arrangement, the maximum facilities were changed from Rp112,068,000 to Rp101,646,000 which consists of principal of Rp53,796,000 and interest during construction of Rp47,850,000. The commitment for Plasma development under the loan was reduced from 15,000 hectares to 5,000 hectares. Under this restructuring program, the conversion of Plasma areas to smallholders is due to be made by December 31, 2004.

The loan is to be repaid by Plasma participants on a quarterly basis within five years, commencing in the first quarter of 2007. The Plasma Loan bears floating interest rates ranging from 12% to 14% in 2006.

In 2006, Telaga Hikmah has transferred Plasma loan facility to Plasma participants amounting to Rp4,483,716. As of June 30, 2007, total Plasma loan had been transferred to plasma participants amounting to Rp94,127,184.

9. PLANTATION ASSETS

Plantation assets are classified as immature and mature plantations.

a. Mature plantations

Additions to mature plantations in 2007 included Palma Agro’s acquisition cost of Sungai Rangit’s mature plantations which were consolidated starting in 2007 and the additions to this balance of Rp13,305,714 and its related amortization of Rp665,286 resulting from Palma Agro’s acquisition of Sungai Rangit, as follows:

9. PLANTATION ASSETS (continued)

b. Immature plantations

The immature plantations represents costs incurred relating to the development of the Group’s oil palm plantations (Inti plantations) such as land clearing, planting, fertilizing and other maintenance activities until the oil palm areas are considered mature (Note 2h).

The movement of immature plantations is as follows:

2 0 0 7 2 0 0 6

Additions of immature plantations in 2007 included beginning balance of immature plantations amounting to Rp82,224,340 from Sungai Rangit which was consolidated starting in 2007.

Plantation assets from Mutiara Bunda Jaya, Telaga Hikmah, Aek Tarum and Gunung Tua Abadi are pledged as collateral for bank loans facilities (Note 15).

10. FIXED ASSETS (continued)

As of June 30, 2007, detail of percentage of completion and estimation of completion dated were as follow:

straight-10. FIXED ASSETS (continued)

On April 30, 2003, fixed assets in the Company were revalued by PT Fiera Admiratiara, an independent appraisal, using the market value approach. The difference resulting from the revaluation of the Company’s fixed assets of Rp26,975,746 net of the related tax effect was recorded as “Assets Revaluation Increment” under shareholders’ equity in the consolidated balance sheets.

Fixed assets from Mutiara Bunda Jaya, Telaga Hikmah, Aek Tarum and Gunung Tua Abadi are pledged as collateral for bank loans facilities (Note 15).

Land, machineries, storage tanks, vehicles and heavy equipment with book value amounting to Rp182,724,715 were pledged as collateral for loan facility from Credit Suisse (Note 15).

Additions to fixed assets in 2007, included beginning balances of fixed assets from Sungai Rangit which was consolidated starting from January 1, 2007 as follows:

Cost 128,826,907

Accumulated depreciation (28,863,404)

Net book value 99,963,503

Deductions in fixed assets represent the sales and write-off of fixed assets with details as follows:

2 0 0 7 2 0 0 6

Depreciation of fixed assets and amortization of mature plantations were as follows:

2 0 0 7 2 0 0 6

Depreciation of fixed assets and amortization of mature plantations were charged to the following accounts:

11. TRADE PAYABLES

Trade payables to farmers represent payables from FFB purchases to Plasma farmers, while trade payables to suppliers mostly represent payables from the purchase of fertilizers and spare parts.

An aging analysis of trade payables was as follows: 2 0 0 7 2 0 0 6

13. TAXATION (continued)

c) Components of corporate income tax expense (benefit)

The reconciliation between the consolidated income (loss) before corporate income tax expense as shown in the consolidated statements of income and the current estimated taxable income (tax loss) is as follows:

2 0 0 7 2 0 0 6

Consolidated income (loss) before corporate

Income tax expenses 56,806,008 84,926,603

Taxable income (tax loss) relating to

Subsidiaries, net (90,323,835) (78,439,241)

The current corporate income tax expense and the computation of the estimated income tax payable (claim for tax refund) are as follows:

13. TAXATION (continued)

d) Corporate income tax (continued)

2 0 0 7 2 0 0 6

Estimated income tax payable

The Company - 182,104

Subsidiaries 9,571,446 12,502,620

Total 9,571,446 12,684,724

Claims for tax refund:

The Company - 3,616,037

Subsidiaries 800,823 -

Total 800,823 3,616,037

Tax overpayment for the six-months ended June 30, 2007 was recorded as part of “Prepaid Taxes” since the related tax year was not closed yet.

For plantation companies, tax losses which are subject to the approval of the tax authorities, may be carried forward and utilized to offset taxable income for up to eight years.

e) The reconciliation between income tax expense (benefit), computed using the marginal tax rate of 30% from consolidated income (loss) before corporate income tax expense and corporate income tax expense as shown in the consolidated statements of income is as follows:

2 0 0 7 2 0 0 6

Consolidated income (loss) before

corporate income tax benefit (expense) 56,806,008 84,926,603

Estimated tax expense based on

prevailing tax rate of 30% 17,041,802 25,477,981

Effect on income taxed at statutory rates (87,500) (87,500)

Net permanent difference

at the maximum marginal tax rate (274,996) (356,056)

Corporate income tax expense

(benefit) – net 16,679,306 25,034,425

13. TAXATION (continued)

f) Deferred tax assets (liabilities):

2 0 0 7 2 0 0 6

Deferred tax assets in 2007 has accounted deferred tax liabiities of Sungai Rangit, which was consolidated starting from January 1, 2007, amounted to Rp326,505 as of December 31, 2006.

The utilization of deferred tax assets recognized by the Group is dependent upon future taxable income in excess of income arising from the reversal of existing taxable temporary differences.

g) In January 2007, the Company received tax assessment letters from the Tax Office, which approved to refund the Company's claim for corporate income tax at the amount of Rp3,420,782 from the total claim of Rp3,616,037. Out of the said approved amount, Rp195,255 was charged as part of "Licences and permits" in the General and administration expenses. From the approved amount, Rp136,000 was transferred as current period’s prepaid income tax and Rp3.284.782 was already received.

h) In April 2007, Sungai Rangit received tax assessment letters from Tax Office stating that corporate income tax for 2002 was nil.

15. LONG-TERM BANK LOANS

Less: current portion of long-term loans Credit Suisse, Singapore Branch

- The Company 41,648,400 -

PT Bank Mandiri (Persero) Tbk:

- The Company - 31,250,000

- Gunung Tua Abadi - 11,750,000

PT Bank Rakyat Indonesia (Persero) Tbk:

- Telaga Hikmah - 18,250,000

On January 26, 2007, the Company obtained a term loan amounting to US$100,000,000 from Credit Suisse, Singapore branch. The loan which bears interest at LIBOR plus 2.5% per annum, shall be repaid in sixteen quarterly installments ranging from US$4,600,000 to US$8,300,000 starting April 26, 2008 (after a grace period of 15 months) up to January 26, 2012. Based on the loan agreement, the loan shall be used mainly for the purpose of (i) intra-group lending to the Company’s parent for refinancing its existing financial indebtness, (ii) for funding business expansion, working capital, and repayment of the existing financial indebtness of the Company and Subsidiaries, and (iii) to pay costs incurred relation to the loan facility.

The loan contains certain restrictions on the Company, among others, to enter into a merger or acquisition, provide guarantee, change in business, and enter into treasury transactions. The loan also requires the Company maintain certain financial covenants and financial ratios as mentioned in the agreement.

The loan is collateralized/secured by the following:

1. Corporate guarantee from Binasawit Makmur, Mutiara Bunda Jaya, Aek tarum, Gunung Tua Abadi and Telaga Hikmah, all Subsidiaries of the Company.

2. Shares pledged from the Company, PT Nitiagro Lestari, Venture Max Resources Pte., Ltd., Singapore, and Xian Investment Holdings Limited.

3. Moveable assets owned by the Company and Subsidiaries (Note 10) 4. Land owned by the Company and Subsidiaries (Note 10)

15. LONG-TERM BANK LOANS (continued)

Credit Suisse, Singapore Branch (continued)

The Company has used the loans, among others, for the following details:

1. US$ 17,505,000 was lent by the Company to Venture Max Resources Pte., Ltd., Singapore, its parent company to partially refinance its acquisition of the Company’s shares (Note 25d). This loan shall be due in one day after the receipt of repayment notice from the Company. Based on the amendment to the facility agreement dated March 29, 2007, which were entered into between Venture Max Resource Pte., Ltd. and the Company, this facility shall bear interest at 3 month LIBOR + 2.5% per annum starting July 1, 2007.

2. US$59,000,000 was used for 100% acquisition of the shares of Palma Agro Ltd. (PAL) which was established in Republic Seychelles (Note 3). PAL holds 93.6% shares ownership in Sungai Rangit. On January 16, 2007, based on assesment of PT Fiera Admiratiara, an independent appraisal, the value of Sungai Rangit ranges between US$54,000,000 and US$63,000,000.

3. Equivalent to Rp138,546,841 was lent to Telaga Hikmah and Mutiara Bunda Jaya, to settle their loan to PT Bank Rakyat Indonesia (Persero) Tbk (BRI). On January 29, 2007, Telaga Hilmah and Mutiara Bunda Jaya have fully repaid their loans to BRI, which amounted to Rp71,054,570 and Rp42,426,715. Equivalent to Rp14,969,000 was lent to Telaga Hikmah and Mutiara Bunda Jaya to secure the repayment of their plasma participants’ loans to BRI.

Facility fee incurred in this loan amounting to Rp15,961,750 was recorded net of its amortization of Rp532,058, as part of Deferred Charges in the 2007 balance sheet.

On 26 July 2007, the Company has fully repaid US$ 100,000,000 of loan facility to Credit Suisse, Singapore Branch (Note 31a).

PT Bank Central Asia Tbk (BCA)

Sungai Rangit

On November 15, 2006, Sungai Rangit obtained investment loan facilities from BCA, with the following details:

a) Facility at the maximum of Rp180,000,000, to be used to repay the convertible loan, which is repayable in six (6) years after two (2)-year grace period, starting from the initial withdrawal. b) Facility at the maximum of Rp95,000,000 or its equivalent amount in US dollar, to be used to

expand the plantation activities and for rehabilitation program for palm oil mill and plantation, which is repayable in six (6) years after two (2)-year grace period, starting from the initial withdrawal. c) Facility at the maximum of Rp25,000,000 or its equivalent amount in US dollar, to be used to

15. LONG-TERM BANK LOANS (continued)

PT Bank Central Asia Tbk (BCA) (continued)

Above facilities bore interest at the bank’s prime lending rate minus 2% for Rupiah withdrawal and at 1 month SIBOR plus 1.5% for US dollar withdrawal. The facilities were collateralized by landrights and buildings, new plantation area, and CPO plants, and secured by the Letter of Undertaking from PT Sampoerna Bio Energi.

The loan contains certain restrictions on Sungai Rangit, among others, to enter into a merger or acquisition, provide guarantee, change in business, obtain of new lending or give borrowing, enter into new investment, and change in the composition of Sungai Rangit’s shareholders (except if the majority shares is still owned by Sampoerna Group).

PT Bank Rakyat Indonesia (Persero) Tbk (BRI)

Mutiara Bunda Jaya

On January 29, 2003, Mutiara Bunda Jaya entered into a bank loan restructuring agreement with BRI. Under this loan-restructuring program, BRI agreed to reschedule settlement of the outstanding loan under the following conditions:

a) The Inti loan facility limit was reduced from Rp64,465,402 to Rp60,670,989. b) BRI loan facilities were restructured as follows:

1. Inti Plantation I with a maximum facility of Rp6,909,426. The loan is repayable on a quarterly basis and is to be fully repaid by the end of 2005. Payments commenced in the fourth quarter of 2004. The loan bears interest at the rate at 19% per annum for 2004 and 2005. The loan facility was settled in 2005.

2. Inti Plantation II and IDC I with maximum facilities of Rp1,996,106 and Rp2,838,742, respectively. The loans are repayable commencing on the first quarter of 2003 on a quarterly basis and are to be fully repaid by the end of 2004. The loans bear interest at the rate of 19% per annum for 2004.

3. Inti Plantation III and IDC II with maximum facilities of Rp45,416,992 and Rp3,509,723, respectively. The loans are repayable commencing on the first quarter of 2006 on a quarterly basis and are to be fully repaid by the end of the second quarter of 2010. The loan bears interest at the rate of 19% per annum for the period October 2002 through December 2010. For the period from October 2002 through December 2004, a portion of the interest at the rate of 4% per annum is deferred. The deferred interest was agreed to be repayable on a quarterly basis commencing in the first quarter of 2009 and was to be fully paid by the second quarter of 2010.

c) BRI agreed to reschedule overdue interest payments of Rp12,224,000. The deferred interest is repayable on a quarterly basis commencing in the first quarter of 2006 and is to be fully paid by the end of 2008.

Mutiara Bunda Jaya’s loans are secured by inventories, plantation assets, fixed assets consisting of palm oil mill and buildings, guarantee deposits, personal guarantees from shareholders and corporate guarantees from the Company dan PT Selapan Permai Lestari (Notes 4, 7, 9 and 10).

The loans from BRI bear annual interest ranging from 12% to 16% per annum in 2006.

15. LONG-TERM BANK LOANS (continued)

PT Bank Rakyat Indonesia (Persero) Tbk (BRI) (continued)

Mutiara Bunda Jaya (continued)

Company’s corporate status, articles of association and the Company’s management, sale or transfer of their fixed assets, investing in other companies, obtaining new long-term loans, payment of payable to shareholders and granting of guarantees.

On January 29, 2007, these loans have been fully repaid to BRI.

Telaga Hikmah

On June 19, 2003, Telaga Hikmah entered into a bank loan restructuring agreement with BRI. Under this loan restructuring agreement, BRI agreed to reschedule the settlement of the outstanding bank loan facilities under the following conditions among others:

a) The limit of the Telaga Hikmah Inti loan facilities remains the same at Rp101,055,000.

b) The outstanding Inti loan balance as of December 31, 2002 of Rp71,145,461 will be repaid on a quarterly basis based on a repayment schedule starting from the first quarter of 2004 through the second quarter of 2009. The remaining Inti loan facility of Rp29,909,539 shall be drawn down in 2003 and shall be repaid on a quarterly basis starting from the first quarter of 2006 through the third quarter of 2009.

c) The interest rate for the Inti loan is a floating rate of 18.5% per annum, and such rate is from time to time subject to adjustment by BRI to reflect prevailing interest rates.

d) Effective for the period starting from January 1, 2003 through December 31, 2003 interest on the Inti loan balance of Rp71,145,461 is due to be paid on a current basis at the rate of 11% per annum. Payment of the portion of the interest incurred at the rate 7.5% per annum is deferred. Payments of such deferred interest are to be made on a quarterly basis starting from the third quarter of 2007 through the end of the third quarter of 2009.

e) BRI agreed to reschedule payment for interest amounting to Rp10,690,613. The deferred interest is repayable, commencing on the first quarter of 2004 on a quarterly basis based on a repayment schedule and is to be fully paid by the end of the second quarter of 2007.

Telaga Hikmah’s loan is secured by plantation assets, fixed assets consisting of palm oil mill, buildings, vehicles and heavy equipment, guarantee deposits, personal guarantees from former shareholders, corporate guarantees from the Company and PT Selapan Permai Lestari and a corporate guarantee from Aek Tarum (Notes 4, 9 and 10).

The loans from BRI bear annual interest ranging from 12% to 16% per annum in 2006.

The restructured loan agreements for Mutiara Bunda Jaya and Telaga Hikmah provide several requirements which need prior written approval from BRI with respect to transactions that exceed certain thresholds agreed with BRI, such as, among others, mergers, acquisitions, change in the Company’s corporate status, articles of association and the Company’s management, sale or transfer of their fixed assets, investing in other companies, obtaining new long-term loans, payment of payable to shareholders and granting of guarantees.

15. LONG-TERM BANK LOANS (continued)

PT Bank Mandiri (Persero) Tbk (Mandiri)

The Company, Aek Tarum and Gunung Tua Abadi

On November 28, 2002, the Company, Aek Tarum and Gunung Tua Abadi entered into bank loan restructuring agreements with Mandiri. Under these loan restructuring agreements, Mandiri agreed to reschedule the settlement of the outstanding bank loan facilities under the following conditions, among others:

a) Maximum loan facilities are revised from Rp337,126,938 to Rp292,214,288 with the investment credit facilities and interest during construction facilities reduced from Rp225,881,189 and Rp111,245,749 to Rp205,911,715 and Rp86,302,573, respectively.

b) The loans should be repaid on a quarterly basis starting from the first quarter of 2003 through the fourth quarter of 2008.

c) The interest rate for the loans granted to the Company and Aek Tarum is a floating rate of 19% per annum and ranges from 16% to 19% per annum, respectively, and such rates are from time to time subject to adjustment by Mandiri to reflect the prevailing interest rates.

d) The interest rate for the loan to Gunung Tua Abadi (Inti Plantation II and IDC II, and Inti Plantation III and IDC III) is a floating interest rate at 18% per annum.

e) The penalty for late payments (principal and interest) is 2% above the commercial interest rate.

The loans are secured by inventories, plantation assets, fixed assets consisting of palm oil mill, vehicles and heavy equipment, guarantee deposits, a corporate guarantee from Aek Tarum for the Company’s loan, and also a guarantee from the Company and Aek Tarum for the Gunung Tua Abadi’s Loan (Notes 4, 7, 9 and 10).

The loans from Mandiri bear interest at rates ranging from 13.8% to 14.4% per annum in 2006. In 2005, Aek Tarum has fully repaid the loan.

Under the terms of the covering restructured loan agreements, the Company, Aek Tarum and Gunung Tua Abadi are required to obtain prior written approval from Mandiri with respect to transactions that exceed certain thresholds agreed with Mandiri, such as, among others, mergers, acquisitions, change in the Company’s status, article of association and Company’s management, sale or transfer of their fixed assets, investing in other companies, obtaining new long-term loans, payment of payables to shareholders, granting of guarantees. The Company, Aek Tarum and Gunung Tua Abadi are also required to maintain cash flow and financial ratios as specified in the agreement.

16. PROVISION FOR EMPLOYEE SERVICE ENTITLEMENTS

The Group recorded the provision for employee service entitlements based on the calculation, performed by an independent actuary, using the “Projected Unit Credit” method, with the following primary assumptions:

The movement in the provision for employee service entitlements are as follows:

2 0 0 7 2 0 0 6

In relation to the change in the Company’s shareholders, in February 2007, the Group has made severance payment totalling to Rp47,769,887 to their employees, which was computed based on Labor Law No. 13. Consequently, the Group has incurred additional severance payments of Rp37,719,064, which was recorded as part of “Other Income (Expenses)” in the statement of income for the three-months ended March 31, 2007.

17. SHARE CAPITAL

The share capital ownership of the Company as of June 30, 2007 and 2006 is as follows:

17. SHARE CAPITAL (continued)

In Notarial Deed No. 16 of Linda Herawati, S.H., dated January 9, 2007, the existing shareholders sold their shares in the Company to Venture Max Resources Pte., Ltd. (VMR), Singapore, which resulted to VMR owning 95% shares of the Company.

On January 26, 2007, based on Notarial Deed No. 102 of Linda Herawati, S.H., Salikin sold his remaining shares in the Company to PT Nitiagro Lestari (NIL), which resulted to NIL owning 5%

shares of the Company.

On January 27, 2007, Aek Tarum and Binasawit Makmur distributed dividends of Rp40,000,000 and Rp12,000,000, respectively, based on their shareholders’ meetings which were both held on December 21, 2006. These transactions did not affect the consolidated financial statements of the Group, unless 1% which was paid to the minority shareholder of those Subsidiaries.

On April 11, 2007, based on notarial deed No. 87 of Sutjipto S.H., M.Kn., due to its Initial Public Offering plan, the shareholders have resolved to the followings:

1. Approve the plan to go Initial Public Offering for the maximum of 551,350,000 shares with the par value of Rp200 per share.

2. Change the par value per share from Rp500 to become Rp200, which increased the number of issued shares to become 1,428,650,000.

3. Increase the issued and fully paid share capital from Rp285,730,000 to Rp396,000,000 or from 571,460,000 shares to 1,980,000,000 shares.

4. Change the Company’s articles of association to be in conformity with capital market law, which includes among others the change in the Company’s name from PT Sampoerna Agro to become PT Sampoerna Agro Tbk.

This shareholders’ resolution has been approved by the Ministry of Justice and Human Rights with its letter No. W7-04137 HT.01.04-TH.2007 dated April 13, 2007 (Note 1a).

Based on Extraordinary Shareholders Meeting which was covered by Notarial Deed No. 110 of Sutjitpto, S.H., M.Kn., dated September 18, 2006, the shareholders approved the amendments to the Company’s Articles of Association regarding share capital as follows:

1. Increase in the authorized share capital from Rp1,000,000,000 to Rp1,100,000,000 represented by 2,000,000,000 shares to 2,200,000,000 shares.

2. Increase in issued and fully paid share capital from Rp258,830,000 represented by 517,660,000 shares to become Rp285,730,000 represented by 571,460,000 shares in connnection with the distribution of bonus shares, taken from assets revaluation increment, proportionally to the existing shareholders.

The above amendments were approved by the Ministry of Justice and Human Rights with its letter No. W7-00788 HT.01.04-TH.2006 dated September 20, 2006.

18. SALES

Sales classified by product were as follows:

2 0 0 7 2 0 0 6

There is no sales to one customer which exceed 10% of total consolidated sales in 2007and 2006.

19. COST OF SALES

Cost of sales were as follows:

2 0 0 7 2 0 0 6

FFB consumed for production – germinated seeds (1,016,212) (991,132)

19. COST OF SALES (continued)

Beginning balance of FFB, CPO and PK in 2007, includes balance of Sungai Rangit which was started to be consolidated on January 1, 2007 amounted to Rp2,352,369.

20. OPERATING EXPENSES

Consolidated operating expenses were as follows:

2 0 0 7 2 0 0 6

Salaries, wages and employees’ compensation 25,373,318 18,476,935

Professional fees 2,169,860 738,395

Less portion capitalized to:

23. ADDITIONAL PAID IN CAPITAL

Additional Paid In Capital are as follows:

2 0 0 7 2 0 0 6

24. RELATED PARTY BALANCES AND TRANSACTIONS

a. Significant related parties intercompany balances are as follows:

2 0 0 7 2 0 0 6

b. Sungai Rangit has an outstanding convertible loan amounting to Rp4,925,258 to POSSE Limited, a related party established in Republic of Seychelles. The convertible loan will be considered due if Sungai Rangit has fully settled its tax assesments fo the fiscal years 1998 to 2005. Sungai Rangit has an option to repay all of the loan into additional share capital. This convertible loan, which is non-interest bearing, was presented as “Other Long-Term Liability” in the 2007 consolidated balance sheet.

c. The Company lent US$ 17,505,000 or equivalent to Rp159,610,590 to Venture Max Resources Pte., Ltd., Singapore, its parent company, to refinance partially its acquisition of the Company’s shares (Note 15). This loan shall be due in one day after the receipt of repayment notice from the Company and bear interest at 3 month LIBOR + 2,5% per annum starting July 1, 2007 (Note 15).This receivable was presented as part of “Other Receivables” in the consolidated balance sheet as of June 30, 2007 (Note 6).

d. Palma Agro has outstanding exchangeable loan to PT Sampoerna Bio Energi (“SBE”), a related party, which entitles Palma Agro to obtain all SBE’s shares, which represented 6.4% share ownership in Sungai Rangit. This exchangeable loan was presented as part of “Other Receivables” in the 2007 consolidated balance sheet (Note 6).

e. The Company and Sungai Rangit have rental commitment with PT Buana Sakti, a related party (Note 26d).

25. MINORITY INTERESTS

a) Minority interests in net assets of Subsidiaries are as follows:

2 0 0 7 2 0 0 6

Minority interests in net assets of Subsidiaries on June 30, 2007 has accounted beginning balance of minority interests in net asset of Sungai Rangit which was consolidated on January 1, 2007 amounted to Rp13,679,112.

b) Minority interests in net income (loss) of Subsidiaries are as follows:

2 0 0 7 2 0 0 6

26. SIGNIFICANT AGREEMENTS, COMMITMENTS AND CONTINGENCIES

a. Under the Plasma loan agreement with PT Bank Mandiri (Persero) Tbk (Mandiri) (Note 8), the Company is required to act as the guarantor (avalist) for the Plasma farmers’ loan repayments. For that purpose, the Company will collect the loan repayments from a portion of the proceeds of fresh fruit bunches (FFB) produced from the farmers’ Plasma areas. If sales of FFB can not fulfill the required installment, then the Company, as guarantor, will guarantee the insufficiency of the installment amount. The Company is required to purchase all Plasma FFB production until all of the Plasma loans are settled. All Plasma plantations have been fully developed and transferred to the farmers in 2001.

As of June 30, 2007, total Plasma loan that must be settled by 139 Plasma farmers (representing 278 hectares Plasma plantation area) amounted to Rp471,000.