QUARTERLY REPORT

For the Fourth Quarter of the Year 2014

PT. PERENTJANADJAJAin subconsultancy with '-' Yongma Engineering Co. Ltd and ;iilPT. Epadascon Permata Engineering Consultant CTCOffice: JI. Ciniru VII No. 25, Kebayoran Baru, Jakarta Selatan, 12180

Phone /Fax: (021) 7229823

Direktur Jenderal Bina Marga Inspektorat Jenderal, Kementrian PU Direktur Transportasi - Bappenas

Direktur Pengelolaan Kas Negara (PKN), Kementrian Keuangan Direktur Bina Program, DitJen Bina Marga

Direktur Bina Teknik, Dit.Jen Bina Marga Direktur Bina Pelaksanaan Wilayah I, DJBM

Biro PerencanaanzyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA& KLN, Kementrian PU Kasubdit Kawasan Strategis dan Andalan, Kementrian Dalam Negeri

Kasubdit Pembiayaan dan Kerjasama Luar Negeri, Dit. Bipran, DJBM Kasubdit Wilayah I B, Direktorat Bina Pelaksana Wilayah I, DJBM Kasubdit Wilayah I C, Direktorat Bina Pelaksana Wilayah I, DJBM Kasubdit Wilayah I D, Direktorat Bina Pelaksana Wilayah I, DJBM

Kepala SNVT Pembinaan Administrasi dan Pelaksanaan Pengendalian PHLN The World Bank Task Team Leader

PT. Perentjana Djaja Yongma Engineering Co, Ltd

PT. Epadascon Permata Engineering Consultant File

Cc: 1. 2.

3.

4. 5. 6. 7.

8.

9.

10.

11. 12. 13. 14. 15. 16. 17. 18. 19.

Should you have any comment or additional information that need to be incorporated in the Report, please feel free to get in touch with us.

This report is reproduced and submitted in twenty (20) copies for distribution to all concerned authorities. In compliance with Item No.3 (List of Documents To Be Deliyered) of our Consultancy Contract, we submit herewith the Quarterly Progress Report covering the 4th Quarter of the Year 2014 (October, November and December 2014).

: Quarterly Progress Report for the 4th Quarter of the Year 2014 Subject

Ir. Agusta E. Sinulingga, M.T Officer in Charge PMU WINRIP Attention

Directorate General of Highways, MPWzyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

JI. Patimura 20 Kebayoran Baru

Jakarta Selatan Indonesia

Jakarta, January 21, 2015 : 03_1O IC T A lO IQ -4.2014

No

MINISTRY

OF

PUBLIC

WORKS

DIRECTORATE GENERAL OF HIGHWAYS

DIRECTORATE OF PLANNING Core Team Consultant for

1 Executive Summary

1.1 Current Implementation Situation

1.1.1 Civil Works

Implementation of the WINRIP Project is scheduled to be implemented into three (3) Annual Work Programs (AWP’s).

AWP-1 original implementation begun in early 2011 with preparation of detailed engineering design drawings including associated bidding documents, pre-qualifications and the bidding proper. Actual work implementation and commencement of work started in early January 2014.

AWP-2 consist of three (3) implementation stages. The 1st stage is the

preparation of Tender Documents (construction drawings, bid documents, special specs and other related documents) by Design Supervision Consultant (DSC), 2nd stage is the procurement of Works (Prequalifications, Post

Qualifications and Tendering) either thru International Competitive Bidding or National Competitive Bidding and the 3rd stage is the actual implementation of

the Works. AWP-2 was originally scheduled to start in mid 2013 and to be implemented at the beginning of Year 2014.

AWP-3 implementation stages are of the same sequence with that of AWP-2. The only difference is that AWP-3 is originally scheduled to take-off beginning the 1st month of the Year 2013 and to be implemented in the 1st month of the

Year 2015.

But to due some unavoidable circumstances, the original schedules incurred delays. Actual implementation status are shown inTable 1.

Table 1

AWP PackagesNo. of Implementation Status

as of December 31, 2014

AWP-1 4 4 Nos. Under construction

AWP-2 9

1 No. Bid Evaluation Report (BER) and recommendation to award the contract were forwarded to the World Bank (WB) for request of No Objection Letter (NOL).

Detailed clarifications and justifications as required by the Bank are still to be submitted by POKJA.

2 Nos. Contract Agreements signed between Government of Indonesia and the winning bidders.

1 No. Bids were submitted and opened. Preparation of Bid Evaluation Report by POKJA is underway.

4Nos. Detailed Engineering Design drawings were forwarded to World Bank for NOL. Drawings are under finalization in line with Bank comments.

2014 Quarterly Progress Report 4thQuarter : October-November-December

Western I ndonesia National Roads I mprovement Project 2

AWP-3 8

1 No. Contract Agreement signed. World Bank concurred the Contract Agreement and issued Form 384 for disbursement

1 No. Bids were submitted and opened. Preparation of Bid Evaluation Report by POKJA is underway.

1 No. Draft Bidding Documents for ICB (Post Qualification) had been concurred by World Bank with issuance of No Objection subject to incorporation of minor comments by the Bank.

4 Nos. Detailed Engineering Design (DED) drawings completed. Final review is on-going.

1 No. Replacement roads, still to be finalized.

TOTAL 21

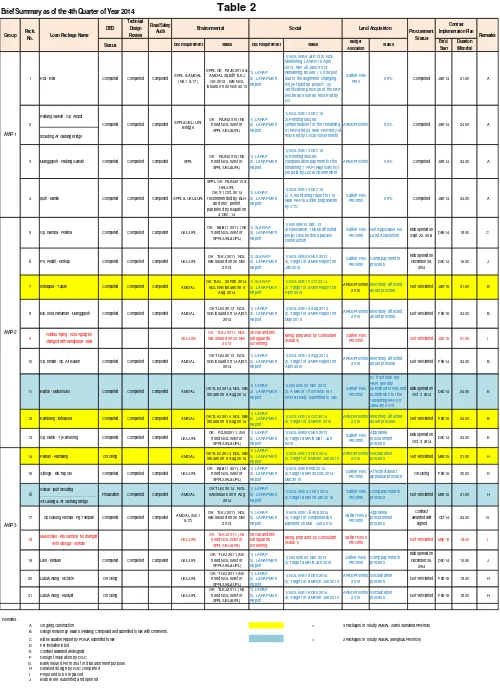

For contract packages under AWP-2 and AWP-3 which have a combined total of 17 sub-projects (Packages), a consolidated updated status ending on the 4thQuarter of the Year 2014 are presented inTable 2.

1.1.2 Consultancy Services

TA Consultant Planned

Mobilization

Contract Signed

Actual Mobilization

CTC Jul 2012 5 Nov 2012 12 Nov 2012

DSC Jul 2012 11 Jun 2013 19 Jun 2013 Capacity Building for

Disaster Risks Reduction Still to beprocured Capacity Building for

Environmental Management

Still to be procured Capacity Building for Road

Safety

Still to be procured

1.1.3 Goods

Table 2

Brief Summary as of the 4th Quarter of Year 2014

DED Technical Design Review Road Safety Audit

Status Doc Requirement Status Doc Requirement Status Budget

Allocation Status

Est'd. Start

Duration (Months)

1 Krui - Bha Completed Completed Completed SPPL & AMDAL(No.1 & 17)

SPPL OK P2JN 2010 & AMDAL Subdit TLKJ

OK 2012 . WB NOL issues on 20 Nov 2013

1).LARAP 2). LARAP Mon Report

1).NOL WB 4 Jan 13 2).NOL Monitoring LARAP 18 April 2013, Rev 26 June 2013. Remaining issues: (1) one plot due to the alignment changing not yet paid by project. (2) Certification process of the PAP w ill be as soon as resolved by LG

Satker PJN

Prov 98% Completed Jan-14 21.00 A

Padang Sawah - Sp. Ampat

Including Air Gadang Bridge

3 Manggopoh - Padang Sawah Completed Completed Completed SPPL

OK P2JN 2010.(No need NOL WB for

SPPL/UKL&UPL)

1).LARAP 2). LARAP Mon Report

1).NOL WB 13 Dec 12 2).Pending issues: compensation payment for the remaining 1 PAP (Rajo Sati) not yet paid by Local Government

APBD Provinsi 99% Completed Jan-14 24.00 A

4 Ipuh - Bantal Completed Completed Completed SPPL & UKL&UPL

SPPL OK P2JN 2010 & UKL/UPL OK, 31 Oct. 2014 recommended by BLH

and env, permit published by Bupati on

4 Dec. 14

1).LARAP 2). LARAP Mon Report

1).NOL WB 10 Dec 12 2). A monitoring report for 15 New PAP is under preparation by CTC

Satker PJN

Provinsi 98% Completed Jan-14 24.00 A

5 Sp. Rampa - Poriaha Completed Completed Completed UKL/UPL

OK Balai 1 2011. (No need NOL WB for

SPPL/UKL&UPL)

1).SLARAP 2). LARAP Mon Report

1).Nol WB 10 Dec 12 2).Relocation 1 kiosk affected project w ill be done paralel construction

Satker PJN Provinsi

Not Applicable. No Land Acquisition

Bids opened on

Sept. 22, 2014 Des-14 18.00 C

6 Ps. Pedati - Kerkap Completed Completed Completed UKL/UPL

OK TLKJ 2011. NOL WB issued on 20 Nov

2013

1).SLARAP 2). LARAP Mon Report

1).NOL WB 20 Nov 2013 2). Target of a Mon Report on Jan 2015

Satker PJN Provinsi

Comp payment in process

Bids opened on December 29, 2014

Dec-14 15.00 J

7 Indrapura - Tapan Completed Completed Completed AMDAL

OK TLKJ , 20 Feb 2014. NOL WB issues on 8

Aug 2014

1).SLARAP 2). LARAP Mon Report

1).NOL WB 10 Oct 2014 2). Target of a Mon Report on April 2015

APBD Provinsi 2015

Inventory affected

asset process Not Yet Started Jan-15 21.00 B

8 Bts. Kota Pariaman - Manggopoh Completed Completed Completed AMDAL

OK TLKJ 2013 . NOL WB issued on 14 April

2014

1).LARAP 2). LARAP Mon Report

1).NOL WB 12 Aug 2014 2). Target of a Mon Report on May 2015

APBD Provinsi 2015

Inventory affected

asset process Not Yet Started Feb-15 24.00 B

9 Rantau Tijang - Kota Agung bechanged with Bengkunat - Biha UKL/UPL

OK TLKJ 2011. NOL WB issued on 20 Nov

2013

Social and Env safeguards screening

Being prepared by Consultant (Balai 3)

Satker PJN

Provinsi Not Yet Started Jun-15 21.00 I

10 Sp. Empat - Sp. Air Balam Completed Completed Completed AMDAL

OK TLKJ 2013 . NOL WB issued on 14 April

2014

1).LARAP 2). LARAP Mon Report

1).NOL WB 12 Aug 2014 2). Target of a Mon Report on April 2015

APBD Provinsi 2015

Inventory affected

asset process Not Yet Started Feb-14 24.00 B

11 Bantal - Mukomuko Completed Completed Completed AMDAL OK TLKJ 2014. NOL WBissues on 8 Aug 2014

1).LARAP 2). LARAP Mon Report

1).Nol WB: 20 Nov 2013 2). A MR (81 from total 183 PAP) already submitted to WB

Satker PJN Provinsi

81 from total 183 PAP) already submitted to WB and submission for the remaining PAP on January 2015

Bids opened on

Oct. 3, 2014 Dec-14 24.00 E

12 Kambang - Indrapura Completed Completed Completed AMDAL OK TLKJ 2014 .NOL WBissues on 8 Aug 2014

1).LARAP 2). LARAP Mon Report

1).NOL WB 10 Oct 2014 2). Target of a MR on 2015

APBD Provinsi 2015

Inventory affected

asset process Not Yet Started Feb-15 24.00 B

13 Sp. Rukis - Tj.Kemuning Completed Completed Completed UKL/UPL

OK P2JN 2011. (No need NOL WB for

SPPL/UKL&UPL)

1).LARAP 2). LARAP Mon Report

1).NOL WB:20 Nov 2013 2).Target a MR in Mar - Jun 2015 Satker PJN Provinsi Appraisal procurement process

Bids opened on

Oct. 3, 2014 Dec-14 24.00 E

14 Painan - Kambang On Going AMDAL OK TLKJ 2014 .NOL WBissues on 8 Aug 2014

1).LARAP 2). LARAP Mon Report

1).NOL WB 19 Des 2014 2). Target of a MR on Jun 2015

APBD Provinsi 2015

Socialization

process Not Yet Started Mar-15 21.00 H

15 Sibolga - Bts.Tap Sel Completed Completed Completed UKL/UPL

OK Balai 1 2011. (No need NOL WB for

SPPL/UKL&UPL)

1).LARAP 2). LARAP Mon Report

1).NOL WB: 5Feb 2014 2).Target a MR on Dec 2014 -Mar 2015

Satker PJN Provinsi

Affected asset

appraisal process On-Going Feb-15 30.00 D

Seblat - Ipuh including

Air Lalang & Air Guntung Bridge

18 Mukomuko - Bts.Sumbar be changed

with Sibolga - Sorkam UKL/UPL

OK TLKJ 2011. (No need NOL WB for

SPPL/UKL&UPL)

Social and Env safeguards screening

Being prepared by Consultant (Balai 1)

Satker PJN II

Provinsi Not Yet Started May-15 18.00 I

19 Lais - Bintuan Completed Completed Completed UKL/UPL

OK TLKJ 2011.(No need NOL WB for

SPPL/UKL&UPL)

1).LARAP 2). LARAP Mon Report

1).Nol WB: 20 Nov 2013 2).Target a MR in Jan 2015

Satker PJN I Provinsi

Comp payment in process

Bids opened on December 29, 2014

Dec-14 10.00 J

20 Lubuk Alung - Sicincin On Going UKL/UPL

OK TLKJ 2011.(No need NOL WB for

SPPL/UKL&UPL)

1).LARAP 2). LARAP Mon Report

1).NOL WB 19 Des 2014 2). Target of a MR on Jun 2015

APBD Provinsi 2015

Socialization

process Not Yet Started Feb-15 18.00 H

21 Lubuk Alung - Kurajati On Going UKL/UPL

OK TLKJ 2011. (No need NOL WB for

SPPL/UKL&UPL)

1).LARAP 2). LARAP Mon Report

1).NOL WB 19 Des 2014 2). Target of a MR on Jun 2015

APBD Provinsi 2015

Socialization

process Not Yet Started Feb-15 18.00 H

Remarks :

A On going Construction = 3 Packages in 1 study AMDAL (West Sumatera Province)

B Design revision by Balai II (Padang) Completed and submitted to WB with comments.

C Bid Evaluation Report by POKJA submitted to WB = 2 Packages in 1 study AMDAL (Bengkulu Province)

D For invitation to bid E Contract awarded and signed F Design finalization by DSC

G Bank issued Form 384 for disbursement purpose H Detailed design by DSC completed I Proposed to be replaced J Bids w ere submitted and opened

Group Pack. No. Procurement Status AWP-1 1).LARAP 2). LARAP Mon Report

1).NOL WB 13 Dec 12 2).Pending issues: Compensation for the remaining 21 PAP and 24 new PAP not yet resolved by Local Government

APBD Provinsi 80% Completed Jan-14

AWP-2

Remarks

Contract Implementation Plan

Loan Package Name

2 Completed Completed Completed SPPL&UKL/ UPL Bridge

OK P2JN 2010 (No need NOL WB for

SPPL/UKL&UPL)

Environmental Social Land Acquisition

24.00 A G H AWP-3 Appraisal procurement process Contract awarded and signed Oct-14 24.00 OK TLKJ 2011. NOL

WB issued on 20 Nov 2013

1).LARAP 2). LARAP Mon Report

1).NOL WB: 16 Sep 2014 2). Target of compensation payment on Mar - Jun 2015

16 Finalization Completed

17 Sp.Gunung Kemala - Pg.Tampak Completed Completed

21.00 Mar-15 Not Yet Started

Comp payment in process Satker PJN

Provinsi

Satker PJN II Provinsi

OK TLKJ 2014 . NOL WB issues on 8 Aug

2014 Completed AMDAL

Completed AMDAL (No.1 &17)

1).NOL WB: 20 Nov 2014 2).Target a MR on Jan 2015 1).LARAP

2014 Quarterly Progress Report 4thQuarter : October-November-December

Western I ndonesia National Roads I mprovement Project 4

1.2 Current Status of Loan

At the end of this quarter ( December 2014) some USD 11.533 million of the USD 123.25 million forcasted expenditures representing 4.61% of the available loan had been disbursed. Disbursement is considerably behind schedule by 44.69% of the forecast expenditures, while 48.57% of the time has already elapsed with the main reason for the delay being the long period waiting for the implementation of the remaining civil works contracts and slow progress of the four (4) on going construction packages.

Total disbursements during this Quarter amounted to USD 4.209 million representing the payments for “Statement of Work Accomplished’ (MC) to civil works Contractor of the four (4) on-going construction packages and advance payment to the Contractor of the newly signed contract, Package No.17 (Pugung Tampak – Sp. Gunung Kemala). Details of the Disbursements and Expenditures Status are presented in Appendix 1. A more detailed and updated status of the loan are fully described and presented in the Eighth (8th) Quarterly Financial Report covering the 4th

Quarter (October, November, December) of the Year 2014 which will be submitted separately.

1.3

Current Problems and Action Required

Program Activity Responsibility

AWP-1

4 Nos. Under construction stage.

Staking out and repair and restoration of deteriorated existing pavements, roadway excavation, embankment formation, spreading of granular pavement for roadway widening, structural works, construction of stone masonry side ditches, stockpiling of raw material, production of crush aggregates, laydown of asphalt pavement structures and other minor works.

Contractor DSC

Civil Works Project Manager

AWP-2 & AWP-3

1 No. Revised Bid Evaluation Report (BER) and recommendation to award the contract still to be resubmitted to World Bank for issuance of No Objection Letter (NOL).

3 Nos. Contract Agreements signed between Government of Indonesia and the winning Contractors.

Commencement of Works still to be issued. 2 Nos. Bids were submitted and opened. Bid Evaluation

Report (BER) and recommendation to award contract still to finalized by POKJA.

1 Nos. Draft Bidding Documents for ICB (Post

Qualification) had been issued No Objection Letter by World Bank but subject to incorporation of Bank’s minor comments.

4 Nos. Detailed Engineering Design drawings are under finalization in line with World Bank’s comments. 4 Nos. Detailed Engineering Design drawings under final

review prior to submission to World Bank. 2 Nos. Replacement roads, still to be finalized and

subjected to economic evaluation

Procurement committee Civil Works Project Manager

Program Activity Responsibility Capacity Building for

Disaster Risks Reduction

Terms of Reference had been finalized with the incorporation of Bank’s comments and formally submitted to World Bank for final review and issuance of No Objection Letter (NOL). Standard Bidding Documents for ICB full e-procurement method is under final preparation. A practical demonstration to present how the e-procurement system for selection of consultants actually works in practice for the selection process is tentatively scheduled on the first working week of January 2015.

Sub-Directorate of Environment & Road Safety - DTA - DGH

Capacity Building for Environmental Management

Terms of Reference On-going preparation

Sub-Directorate of Environment & Road Safety, DTA - DGH Capacity Building for

Road Safety Terms of Reference On-going preparation

2014 Quarterly Progress Report 4th Quarter : October-November-December

Western I ndonesia National Roads I mprovement Project 6

2

General

2.1

Reporting Requirements

Quarterly Progress Reports: This is the Fourth (4rd) Quarterly Progress Report

as required and stipulated in CTC’s consultancy contract and the Loan Agreement. Prior to the production of this report, Monthly Progress Reports have been prepared and have dealt with all aspects of the works. This report attempts to bring the situation up to date by covering overall progress up to the end of Fourth (4rd) Quarter of the Year 2014.

Financial Monitoring Reports: These have been prepared for each quarter

since the beginning of 2013 with the first Report, issued in May 2013, covering the period January – March 2013. Since that date quarterly reports have been prepared and submitted regularly.

Report Period Covered Date Issued

Financial Monitoring Report No. 1 January 2013 – March 2013 15 May 2013 Financial Monitoring Report No. 2 April 2013 – June 2013 15 August 2013 Financial Monitoring Report No. 3 July 2013 – September 2013 15 November 2013 Financial Monitoring Report No. 4 October 2013 – December 2013 15 February 2014 Financial Monitoring Report No. 5 January 2014 – March 2014 15 May 2014 Financial Monitoring Report No. 6 April 2014 – June 2014 15 August 2014 Financial Monitoring Report No. 7 July 2014 – September 2014 15 November 2014 Financial Monitoring Report No. 8 October 2014 – December 2014 Under Preparation

CTC Monthly Progress Reports: These report have been prepared covering

each full month since January 2013. Subsequent reports have been submitted on a regular monthly basis.

2.2

Loan Status

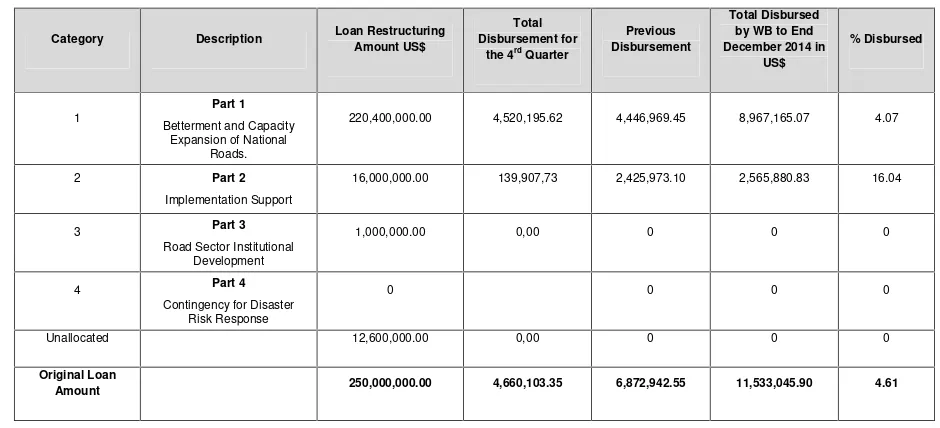

[image:8.595.82.552.568.782.2]The agreed allocation of loan funds from the original loan agreement together with the % disbursed to the end of the quarter date (December 31, 2014) is presented in Table 3

Table 3

Category Description Loan Restructuring

Amount US$

Total Disbursement for

the 4rdQuarter

Previous Disbursement

Total Disbursed by WB to End December 2014 in

US$

% Disbursed

1

Part 1

Betterment and Capacity Expansion of National

Roads.

220,400,000.00 4,520,195.62 4,446,969.45 8,967,165.07 4.07

2 Part 2

Implementation Support

16,000,000.00 139,907,73 2,425,973.10 2,565,880.83 16.04

3 Part 3

Road Sector Institutional Development

1,000,000.00 0,00 0 0 0

4 Part 4

Contingency for Disaster Risk Response

0 0 0 0

Unallocated 12,600,000.00 0,00 0 0 0

Original Loan

2.3

Financial Management

S-Curve for Financial Progress

A report at the end of the quarter (December 31, 2014) is presented inAppendix 2

2.4

Project Cost Monitoring

A detailed summary of the project cost monitoring in tabular format is presented

as Appendix 3 at the end of this report.

2.5

Bank Mission

There was no World Bank mid – term review mission and site visit during this quarter. However, a regular monthly meetings were held to update the “Agreed Key Actions and Plans” that were taken up during the last Bank Mission on April 28 – May 19, 2014.

1.45

4.35 4.35

0.00 10.00 20.00 30.00 40.00 50.00 60.00 70.00 80.00 90.00 100.00

Month

%

C

o

m

p

le

te

Actual Expenditure USD 11.53 mil (4.61 %)

WINRIP ACTUAL PROGRESS UP TO DECEMBER 2014 AND FORECAST UP TO DECEMBER 2017

ACTUAL December 2014

Forecast December 2014 Forecast Expenditure USD

123.25 mil (49.30%)

2014 Quarterly Progress Report 4th Quarter : October-November-December

Western I ndonesia National Roads I mprovement Project 8

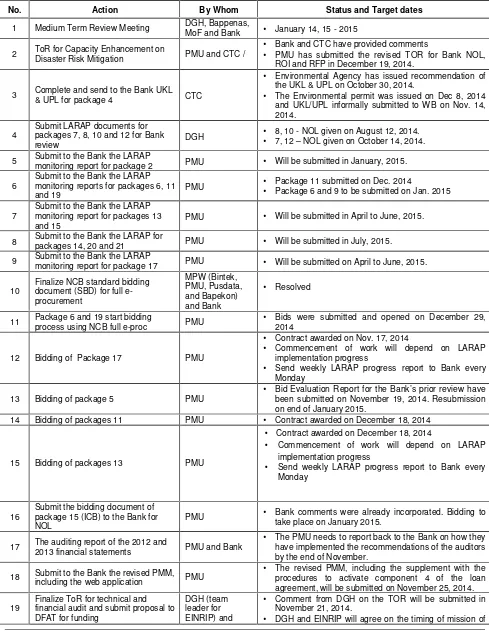

[image:10.595.65.554.154.785.2]Shown in Table 4 are the update “Agreed Key Action and Plans”.

Table 4

Status as of December 2014

No. Action By Whom Status and Target dates

1 Medium Term Review Meeting DGH, Bappenas,

MoF and Bank • January 14, 15 - 2015

2 ToR for Capacity Enhancement onDisaster Risk Mitigation PMU and CTC / •

Bank and CTC have provided comments

• PMU has submitted the revised TOR for Bank NOL, ROI and RFP in December 19, 2014.

3 Complete and send to the Bank UKL& UPL for package 4 CTC

• Environmental Agency has issued recommendation of the UKL & UPL on October 30, 2014.

• The Environmental permit was issued on Dec 8, 2014 and UKL/UPL informally submitted to WB on Nov. 14, 2014.

4 Submit LARAP documents forpackages 7, 8, 10 and 12 for Bank

review DGH

• 8, 10 - NOL given on August 12, 2014.

• 7, 12 – NOL given on October 14, 2014.

5 Submit to the Bank the LARAPmonitoring report for package 2 PMU • Will be submitted in January, 2015.

6

Submit to the Bank the LARAP monitoring reports for packages 6, 11

and 19 PMU

• Package 11 submitted on Dec. 2014

• Package 6 and 9 to be submitted on Jan. 2015

7

Submit to the Bank the LARAP monitoring report for packages 13

and 15 PMU •

Will be submitted in April to June, 2015.

8 Submit to the Bank the LARAP forpackages 14, 20 and 21 PMU • Will be submitted in July, 2015.

9 Submit to the Bank the LARAPmonitoring report for package 17 PMU • Will be submitted on April to June, 2015.

10 Finalize NCB standard biddingdocument (SBD) for full e-procurement

MPW (Bintek, PMU, Pusdata, and Bapekon) and Bank

• Resolved

11 Package 6 and 19 start biddingprocess using NCB full e-proc PMU • Bids were submitted and opened on December 29, 2014

12 Bidding of Package 17 PMU

• Contract awarded on Nov. 17, 2014

• Commencement of work will depend on LARAP implementation progress

• Send weekly LARAP progress report to Bank every Monday

13 Bidding of package 5 PMU •

Bid Evaluation Report for the Bank’s prior review have been submitted on November 19, 2014. Resubmission on end of January 2015.

14 Bidding of packages 11 PMU • Contract awarded on December 18, 2014

15 Bidding of packages 13 PMU

• Contract awarded on December 18, 2014

• Commencement of work will depend on LARAP implementation progress

• Send weekly LARAP progress report to Bank every Monday

16 Submit the bidding document ofpackage 15 (ICB) to the Bank for NOL

PMU • Bank comments were already incorporated. Bidding to take place on January 2015.

17 The auditing report of the 2012 and2013 financial statements PMU and Bank • The PMU needs to report back to the Bank on how theyhave implemented the recommendations of the auditors by the end of November.

18 Submit to the Bank the revised PMM,including the web application PMU •

The revised PMM, including the supplement with the procedures to activate component 4 of the loan agreement, will be submitted on November 25, 2014.

19 Finalize ToR for technical andfinancial audit and submit proposal to DFAT for funding

DGH (team leader for EINRIP) and

• Comment from DGH on the TOR will be submitted in November 21, 2014.

Bank TFAC consultants by November 24, 2014. TFAC Consultant to mobilize to Padang on February 11, 2015.

20

Make sure that adequate budgets for LARAP implementation are allocated in 2015 for packages all packages, especially packages 14, 16, 20, 21, 12 and 7

DGH

• Budget for LARAP from APBN needs to be supplemented in January 2015 as discussed

• A meeting between DGH, WB, Balai, and Local Government of West Sumatera is planned to take place on November 24, 2014 to check LARAP budget availability. Yes, available by 2015.

21 LARAPs for packages #2 Padang

Sawah – Simpang Empat DGH

• Bank sent a reminder to the PMU to complete the LARAP implementation process and submit documentary evidence

• Will be submitted on Jan. 2015.

22 LARAPs for packages #3Manggopoh - Padang Sawah PMU • Bank sent a reminder to the PMU to complete LARAPimplementation process and submit documentary evidence

23

Engineering design and

review/approval of slope protection design completion and the

nomination of the chief inspector for package 4

DSC • The PMU will send to the Bank a copy of these designs for information by the end of November, 2014.

24 PMU to submit draft DED and EE ofpackage # 7, 8, 10, and 12 PMU

• Bina Marga decided to redesign these four packages based on hybrid standard combining old and new standards: design life of 20 years, the road width (shoulder-road-shoulder) is 2-7-2 m, and the pavement thickness (AC-WC-AC-BC-AC-Base) is 4-6-7.5 cm

• The PMU will send to WB the revised designs and EE on November 21, 2014.

• Bina Marga will confirm to Bank that the hybrid standard is in line with norms and laws, and also endorsed by Bintek

25 PMU to submit draft DED and EE ofpackage # 14, 16, 20, and 21 PMU • The PMU will send draft DED and EE to WB on February. 2014.

26 DSC additional staffs PMU and DSC

• The TL of DSC informed the Bank team that DSC is finalizing the contract addendum #1 for additional staff, asking for one highway inspector, one surveyor, and one laboratory technician for each work package and, for the central office, one highway engineer, one bridge engineer, one quality engineer, one social and environmental specialist, and one QAT operator.

• To expedite the process, the Bank team suggested that PMU and DSC to submit a request letter for some staffs who are urgently needed (e.g. bridge engineer package #2, supervision engineer, and environmental specialist), rather than waiting for the complete addendum.

• DSC will submit the request to the PMU in the end of November, 2014.

27 Submission of IFR PMU • The PMU has submitted the IFR for the period July toSeptember on November 17, 2014. Bank has reviewed and accepted it.

28 Progress of package 1 DSC/DGH

• Overall progress 16.08% (-44.60% from schedule), time elapsed 54.84%

• Field engineering has not been approved

• Contractor has submitted field engineering. According to satker, price submitted by contractor is too high and contractor need to submit detail of the field engineering

• Contractor will resubmit the revised field engineering on November 21, 2014 and will be approved on November 27, 2014

• High level management meeting between DGH and Contractors took place in Padang on December 22, 2014

29 Progress of package 2 DSC/DGH

• Overall progress 33.73% (-10.99% from schedule), time elapsed 48.36%

• Field engineering has not been approved

• Contractor will resubmit the revised field engineering on November 21, 2014 and will be approved on November 27, 2014

• Soil investigation for bridge foundation is not finalized yet

2014 Quarterly Progress Report 4th Quarter : October-November-December

Western I ndonesia National Roads I mprovement Project 10

time elapsed 48.36%

• Field engineering has not been approved

• Contractor will resubmit the revised field engineering on November 21, 2014 and will be approved on November 27, 2014

• AMP is always out of order.

• Shortage of dumptruck and manpower.

31 Progress of package 4 DSC/DGH

• Overall progress 9.35% (-31.53% from schedule), time elapsed 47.81%

• Field engineering has not been approved

• Contractor will resubmit the revised field engineering on November 21, 2014 and will be approved on November 27, 2014

• Construction activities are very late and mismanagement of the Joint Operation.

• There is a plan to change the supervision engineer

• High level management meeting between DGH and Contractors took place in Padang on December 22, 2014

32 Submission of environmentalmanagement plan for packages 2 and 3

CTC/DGH • Submitted on December 19, 2014.

33 Submission of environmentalmanagement plan for packages 1 and 4

CTC/DGH • Informally submitted to WB on January 7, 2015.

34

Status reports to be sent to the environmental agency, which approved the environmental documents.

CTC/DGH

• Submission of status reports at regular intervals as per local law. Please copy the Bank on the submission of these reports. For Package No.4, UKL/UPL submitted to WB on November 14, 2014 and environmental permit on January 12, 2015.

35

Replacement packages for package No. 9 Rantau Tijang – Kota Agung and package No. 18 Mukomuko – Batas Sumbar (Biha – Bengkunat and Sibolga – Sorkam)

CTC/DGH

• If DGH wants to try to include them in this project, design works need to start immediately since no new bidding processes can be started after March 31, 2015 (otherwise works implementation will go beyond the closing date). However, before starting the design works under the project, DGH needs to confirm that they will finance the works with ABPN budget in case the technical and economic evaluation is not satisfactory or the bidding for civil works cannot start 31before March 31, 2015. In addition, DGH needs to provide the Bank with the technical and economic evaluation for the new sections by the end of November at the latest (the Bank is available to meet at your convenience to discuss the scope of this evaluation).

36

Submit Mid Term Review report to Bank as per request email of

November 7, 2014 PMU • Submitted on January 2015

37

Send to the Bank the budget for the whole project using actual costs for ongoing contracts and latest version of cost estimate

PMU • Submitted on January 2015

2.6

Project Steering Committee Meeting

3

Project Management and Implementation

3.1

Procurement Status

(A) Civil Works

Civil Works are now being implemented in Annual Work Programs (AWP) which have been numbered AWP-1, AWP-2, and AWP-3.

All four (4) AWP-1 contract packages were signed by the end of 2013 with actual work commencement on January 2014.

During the Fourth (4th) Quarter of Year 2014, three (3) Contract Agreements

were signed between the Government of Indonesia and the winning Contractors, preparation and finalization of Bid Evaluation Report (BER) for three (3) contract packages, World Bank issued No Objection to bidding documents for ICB for one (1) sub-project and eight (8) Detailed Engineering Design (DED) associated bidding documents are under finalization.

All of these procurement preparations are under the implementation programs AWP-2 and AWP-3..

Presented inAppendix 4 is the current status of procurement management.

(B) Services

The Core Team (CTC), Design & Supervision Consultant (DSC), and the others Capacity Building Consultancy status are discussed in Section 3.4. The others consultancy packages are as follows :

1) Capacity Building for Disaster Risks Reduction

2) Capacity Building for Environmental Management

3) Capacity Building for Road Safety

3.2

Implementation Status – Civil Works

AWP-1 Packages

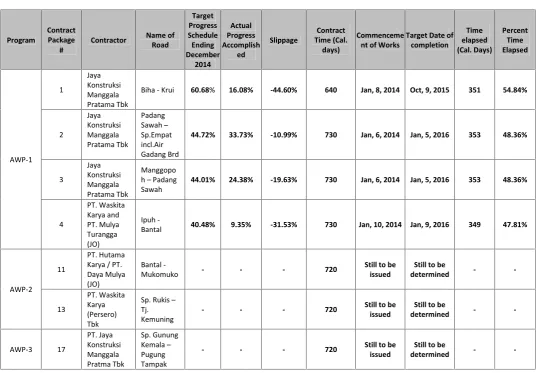

All four (4) contract packages scheduled under AWP-1 are currently under construction by different Contractors. Commencement of Works for all the four (4) packages commenced on the 2ndweek January 2014.

All the 4 Contractors substantially completed their mobilization and construction of Base Camps in all packages have been completed. Other activities done during this quarter were staking out and repair and restoration of deteriorated existing pavements, roadway excavation, embankment formation, spreading of granular pavement for roadway widening, structural works construction of stone masonry side ditches, stockpiling of raw material, laydown of asphalt pavement structures, production of crush aggregates and other minor works. Table 5 presents the

2014 Quarterly Progress Report 4th Quarter : October-November-December

[image:14.595.39.578.100.473.2]Western I ndonesia National Roads I mprovement Project 12

Table 5

Program

Contract Package

#

Contractor Name of Road Target Progress Schedule Ending December 2014 Actual Progress Accomplish ed Slippage Contract Time (Cal. days) Commenceme nt of Works

Target Date of completion Time elapsed (Cal. Days) Percent Time Elapsed AWP-1 1 Jaya Konstruksi Manggala Pratama Tbk

Biha - Krui 60.68% 16.08% -44.60% 640 Jan, 8, 2014 Oct, 9, 2015 351 54.84%

2 Jaya Konstruksi Manggala Pratama Tbk Padang Sawah Sp.Empat incl.Air Gadang Brd

44.72% 33.73% -10.99% 730 Jan, 6, 2014 Jan, 5, 2016 353 48.36%

3 Jaya Konstruksi Manggala Pratama Tbk Manggopo h Padang Sawah

44.01% 24.38% -19.63% 730 Jan, 6, 2014 Jan, 5, 2016 353 48.36%

4 PT. Waskita Karya and PT. Mulya Turangga (JO) Ipuh

-Bantal 40.48% 9.35% -31.53% 730 Jan, 10, 2014 Jan, 9, 2016 349 47.81%

AWP-2 11

PT. Hutama Karya / PT. Daya Mulya (JO)

Bantal

-Mukomuko - - - 720

Still to be issued

Still to be

determined -

-13 PT. Waskita Karya (Persero) Tbk Sp. Rukis Tj. Kemuning

- - - 720 Still to be

issued

Still to be

determined -

-AWP-3 17 PT. Jaya Konstruksi Manggala Pratma Tbk Sp. Gunung Kemala Pugung Tampak

- - - 720 Still to be

issued

Still to be

determined -

-At the end of this reporting quarter of Year 2014, all the four (4) contract packages were still lagging behind schedule. The situation remains the same as in previous quarters as the four (4) on-going contract packages continue to follow a downward trend of delayed schedules.

With time elapsed at the halfway mark (50%) of the contract time for each of the four (4) contract packages, the Contractors may not be able to deliver the Works on the target dates of completion, unless a workable and realistic action plans or “Catch-up Schedules” will be strictly implemented.

Packages No. 1 : Biha – Krui

At the end of this quarter, there was no substantial work accomplished to reduce previous third 3rd quarter slippage of -30.39%, instead the behind works further

went down to – 44.60% as 54.84% of the contract time have elapsed. This problem have been going on for the past several month.

However, the Contractor was able to accomplished only 8.25%, progress for the three (3) major work items out of the combined schedule of 53.43% for the three (3) major works item as of end of the quarter.

The overall situation of this contract package which to date, only 16.08% of progress is attained in the last 12 months of the contract time is so critical with respect to timely completion taking into consideration the short remaining contract time of only ten (10) months to complete the huge deficit of remaining works.

As time is running out and with the balance of remaining works which is equivalent to 83.92% that is still to be completed by the Contractor within the remaining 45% of the contract period or 283 calendar days seems impossible to be attained unless the Contractor start a workable “Action Plan” this coming of January 2015.

A high level management meeting between DGH and Contractor was held in Padang during the middle of the month of December 2014 wherein the main agenda were to resolved all issues and major problems that hampers the progress of the works.

It is expected that in the coming months that results and agreements reached during the meeting will produce positive outcome that will ultimately expedite the progress of the work to be on time at the target date of completion.

A more detailed status of this Package is presented in ANNEX P-I Executive Summary Report.

Packages No. 2 : Padang Sawah – Sp. Empat (Including Air Gadang Bridge)

As of end of this quarter the total overall work progress is 33.73% against scheduled progress of 44.72%.

In the middle month of this quarter, the progress showed signs of slight improvement with respect to delayed progress. However, during this period the delayed works abruptly fell behind from -5.33% at the end of 3rdquarter to -10.99%,

mainly due to inadequate manpower, equipment, financial resources, the delayed construction of Air Gadang Bridge which is yet to be started and the very low accomplishment in the asphalt pavement item due to frequent breakdown of the Aspahalt Mixing Plant (AMP) which to date only 5% of the 52% of the weighted percentage of the contract had been accomplished.

To date, the delayed work is still on a manageable level, but it is already a bit of concern that unless the current problems are addressed immediately, the delayed works will further fall behind in the coming months.

ANNEX P-2 Executive Summary Report present a more detailed status of the Contract Package.

Package No. 3 : Manggopoh – Padang Sawah

2014 Quarterly Progress Report 4th Quarter : October-November-December

Western I ndonesia National Roads I mprovement Project 14

contract time left.

As of end of this 4th quarter, only 24.38% of actual progress has been attained in

the past twelve (12) months of the contract period.

The situation is so alarming with respect to timely completion of the Works considering that almost 50% of the contract time have already elapsed while 75.62% of the works are still to be completed.

The main reason for the minimal progress was the delayed works on the asphalt pavement item which accounted for almost 56% of the entire contract as the Asphalt Mixing Plant is frequently out of order. To date only 5.29% of entire work item out of the 55.81% weighted percentage of the contract items is completed.

In addition, number of unit of dump trucks is insufficient, low productivity of stone crusher and inadequate manpower for drainage work also contributed to the slow progress.

Due to urgency to maximize the output of paving works to attain a considerable progress, the Contractor shall maintain the AMP regularly and address and resolve all issues that are presently hampering the progress of the works.

A more detailed status of the project progress are shown in ANNEX P-3 “Executive Summary Report”.

Package No. 4 : Ipuh – Bantal

The current status of this contract package still remain in critical situation as the negative slippage of -16.35% at the end of 3rd quarter further went down to

-31.53% as of end of this reporting quarter.

The actual progress of only 9.35% since the project started a year ago is of much concern than the slippage. Simply looking at the percentage of work accomplished, it seems that the project is only on the initial stage of construction, whereas by this end of the 12th month period, at least 41% of the works should have been completed.

The major work item which should have been given more concentration in order to attain a modest progress during the period would have been the drainage works (12.26%) granular pavement (18.07%) and asphalt pavement (49.27%) which have a combine total work value of 79.40%.

However, the Contractor was able to accomplished only 7.85%, progress for the three (3) major works item out of the combine total work value of 79.40%.

A high level management meeting between DGH and Contractor was held in Padang during the middle of the month of December 2014 wherein the main agenda were to resolved all issues and major problems that hampers the progress of the works.

Shown in ANNEX P-4 “Executive Summary Report” are the current problem and actions to be taken to attain substantial progress in order to catch-up with the schedule.

For contract packages under AWP-2 and AWP-3 which have a combined total of 17 Packages, a brief summary of the actual activities and status as of this reporting period are presented inTable 2,page 3of this Report.

AWP-2 & AWP-3 Packages

During the Fourth (4th) Quarter of Year 2014, three (3) Contract Agreements

were signed between the Government of Indonesia and the winning Contractors, preparation and finalization of Bid Evaluation Report (BER) for three (3) contract packages, World Bank issued No Objection to bidding documents for ICB for one (1) sub-project and eight (8) Detailed Engineering Design (DED) associated bidding documents are under finalization.

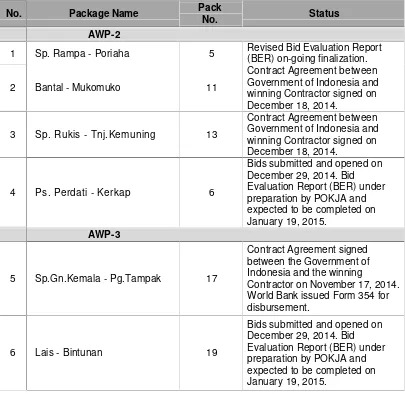

[image:17.595.148.553.337.731.2]As of end of this report period, the procurement status of the four (4) contract packages are shown inTable 6.

Table 6

No. Package Name Pack

No. Status

AWP-2

1 Sp. Rampa - Poriaha 5 Revised Bid Evaluation Report(BER) on-going finalization.

2 Bantal - Mukomuko 11

Contract Agreement between Government of Indonesia and winning Contractor signed on December 18, 2014.

3 Sp. Rukis - Tnj.Kemuning 13

Contract Agreement between Government of Indonesia and winning Contractor signed on December 18, 2014.

4 Ps. Perdati - Kerkap 6

Bids submitted and opened on December 29, 2014. Bid Evaluation Report (BER) under preparation by POKJA and expected to be completed on January 19, 2015.

AWP-3

5 Sp.Gn.Kemala - Pg.Tampak 17

Contract Agreement signed between the Government of Indonesia and the winning

Contractor on November 17, 2014. World Bank issued Form 354 for disbursement.

6 Lais - Bintunan 19

2014 Quarterly Progress Report 4th Quarter : October-November-December

Western I ndonesia National Roads I mprovement Project 16

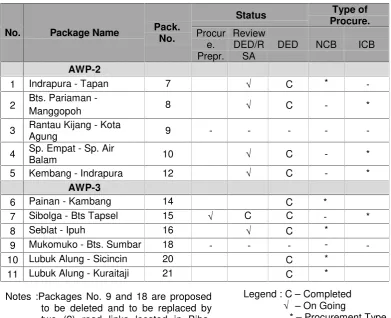

[image:18.595.147.539.125.443.2]The status of the remaining packages are shown inTable 7

Table 7

No. Package Name Pack.

No.

Status Type of

Procure.

Procur e. Prepr.

Review DED/R

SA DED NCB ICB

AWP-2

1 Indrapura - Tapan 7 √ C *

-2 Bts. Pariaman -Manggopoh 8 √ C - *

3 Rantau Kijang - KotaAgung 9 - - - -

-4 Sp. Empat - Sp. AirBalam 10 √ C - *

5 Kembang - Indrapura 12 √ C - *

AWP-3

6 Painan - Kambang 14 C *

7 Sibolga - Bts Tapsel 15 √ C C - *

8 Seblat - Ipuh 16 √ C *

9 Mukomuko - Bts. Sumbar

umbar

18 - - - -

-10 Lubuk Alung - Sicincin 20 C *

11 Lubuk Alung - Kuraitaji 21 C *

Notes :Packages No. 9 and 18 are proposed to be deleted and to be replaced by two (2) road links located in Biha-Bengkunat, Lampung Province and

Sorkam-Sibolga, North Sumatera

Province.

3.3

Variation Order Details

There are still no Variation Order submitted by either the DSC Consultant or the Contractors of the four (4) civil works contract of the on-going contract packages. It is expected that as a result of the finalization of field engineering by the respective Contractors of each package will result in additive cost variations. However, in anticipation of future claims for varied works by the Contractors, a revised costs of additional 5% to the Estimated Cost for each contract package was prepared and submitted to PMU to cover any Variation Orders that may arise during the implementation of the Works.

3.4

Consultancy Services

Technical Assistance for Core Team Consultant (CTC) to Support the Project Management Unit.

Lead Consultant: PT. Perentjana Djaja

CTC Contract No. 06-20/CTC/TA/LN/8043/1112 was signed on 5 Nov 2012 between the Ministry of Public Works , Directorate of Planning, DGH and

Legend : C – Completed √ – On Going

PT. Perentjana Djaja, Yongma Engineering Co. Ltd, PT. Epadascon Permata Engineering Consultant, JV and the work commenced on 12 November 2012. Amendment No.1 to this contract dated 25 October 2013 was signed to accommodate the increase in staffing requirements with the following increase in cost.

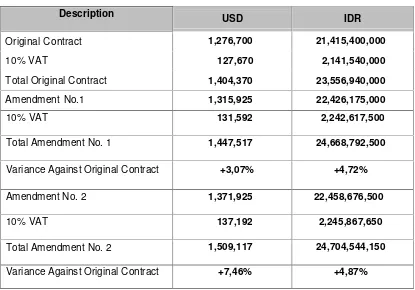

[image:19.595.146.561.271.561.2]Amendment No. 2 is officially approved. Proposed amendment to the Original Contract and Amendment No. 1 are additional man-months for professional and technical staff for international and local, replacement of foreign and local consultants and modification to various reimbursables to match with the actual requirements. Presented inTable 8is the current status of CTC contract.

Table 8

Description USD IDR

Original Contract 1,276,700 21,415,400,000

10% VAT 127,670 2,141,540,000

Total Original Contract 1,404,370 23,556,940,000

Amendment No.1 1,315,925 22,426,175,000

10% VAT 131,592 2,242,617,500

Total Amendment No. 1 1,447,517 24,668,792,500

Variance Against Original Contract +3,07% +4,72%

Amendment No. 2 1,371,925 22,458,676,500

10% VAT 137,192 2,245,867,650

Total Amendment No. 2 1,509,117 24,704,544,150

Variance Against Original Contract +7,46% +4,87%

Technical Assistance for Design & Supervision Consultant (DSC)

Lead Consultant: Renardet S.A

2014 Quarterly Progress Report 4th Quarter : October-November-December

Western I ndonesia National Roads I mprovement Project 18

Table 9

Description USD IDR

Original Contract (exc. VAT)

820,600,00

51,818,705,000

VAT 10% (GOI Portion)

82,060,00

5,181,870,500

Total

902,660,00

57,000,575,500

Technical Assistance for Capacity Building for Disaster Risks Reduction

Lead Consultant: Still to be Procured

Terms of Reference had been finalized with the incorporation of Bank’s comments and formally submitted to World Bank for final review and issuance of No Objection Letter (NOL). Standard Bidding Documents for ICB full e-procurement method is under final preparation. A practical demonstration to present how the e-procurement system for selection of consultants actually works in practice for the selection process is tentatively scheduled on the first working week of January 2015.

Technical Assistance for Capacity Building for Environmental Management

Lead Consultant: Still to be Procured

Draft Terms of Reference still to be prepared.

Technical Assistance for Capacity Building for Road Safety

Lead Consultant: Still to be Procured

Draft Terms of Reference still to be prepared.

Procurement Plan for consulting services is presented in Appendix 5

3.5

Implementation of the Anti-Corruption Ac ti on Plan

Community Representative Officers (CRO)

CROs have been appointed for AWP-1 packages and those appointed for the AWP-1 packages attended the bid opening meetings in Packages 1 and 4 and Packages 2 and 3 in Palembang and Padang, respectively. All CROs are university staff members as prioritized in the PMM and have had extensive training sessions.

During the 4thquarter of the year 2014, appointed CRO’s for Package Nos. 11,13,

6 and 19. attended the pre-bid meetings, site visits and bid openings in Bengkulu.

To date or as of end of this 4thQuarter of the Year 2014, a total of twenty two (22)

(11) Contract Packages during the procurement activities.

A complete list of CROs appointed with corresponding credentials as of end of December 2014 can be found inAppendix 6.

Appendix 7shows their activities since the inception of the Project.

Third Party Monitors (TPM)

During this Quarter were nine (9) appointments of Third Party Monitors that were approved to monitor the progress of the Works for Packages 11, 13 and 17 in Lampung and Bengkulu, respectively. To date a total twenty one (21) appointments have been approved.

List of appointed TPM with their respective occupations and professional affiliations are shown in Appendix 8, while Appendix 9 shows the past to present activities/progress of the TPM.

Complaint Handling System (CHS)

The WINRIP website has been online, and available for reporting all aspects of the Anti-Corruption A c t i o n Plan including the registering of complaints by the general public. The website can be accessed at the URL address

http://www.winrip-ibrd.com.

The CHS application has been completed. The application was put in sub-domain of WINRIP website since February 2014 and in August 2014 socialization were conducted in Padang, Lampung and Bengkulu. To access it, click on the sub-domain URL address http://chs.winrip-ibrd.com. Appendix 10

and Appendix 11 show the Work Plan on CHS System and Work Activities on

Publication/Disclosures.

The CHS team has been monitoring public complain via SiPP and WINRIP website.

As of end of this quarter, no complain have been registered.

3.6

Implementation of the Environmental Management Plan and LARAP

A project category is assigned to each package as either Category A, B or C depending on the likely degree of influence on environmental issues with a brief explanation as follows:

Category A project is one which will have a significant negative impact on the environment and may have an influence on areas outside the actual project area. A project classified as such requires an AMDAL (ANDAL, RKL/RPL) study.

2014 Quarterly Progress Report 4th Quarter : October-November-December

Western I ndonesia National Roads I mprovement Project 20

analysis is a UKL/UPL study only.

Category C project has minimal effect on the people or environment and an environmental analysis is not required. SPPL are used to handle any minor problem which may arise.

All the twenty one (21) packages require environmental impact investigations. There are a total of fourty one (41) studies required, twenty (20) for environmental impact investigations and twenty one (21) for social studies.

The twenty (20) environmental studies need the approval of the Environmental Agency (BLH) with five (5) of the studies (AMDAL/EIA) to be approved by World Bank (WB).

While the twenty one (21) social studies (SLARAP and LARAP) require the approval of World Bank prior to implementation.

As of end of this quarter reporting period (December 2014), twenty (20) environmental impact studies has been approved by BLH, while all of the five (5) studies that requires World Bank approval, Bank already issued No Objection Letter (NOL). For the social studies , twelve (12) of the twenty one (21) studies were already given No Objection Letter from the World Bank (WB).

Appendix 12 details the list of Environmental Safeguard and Appendix 13

describes the Environmental Management Plan (EMP) Compliance up to the end of this Quarter (December 2014).

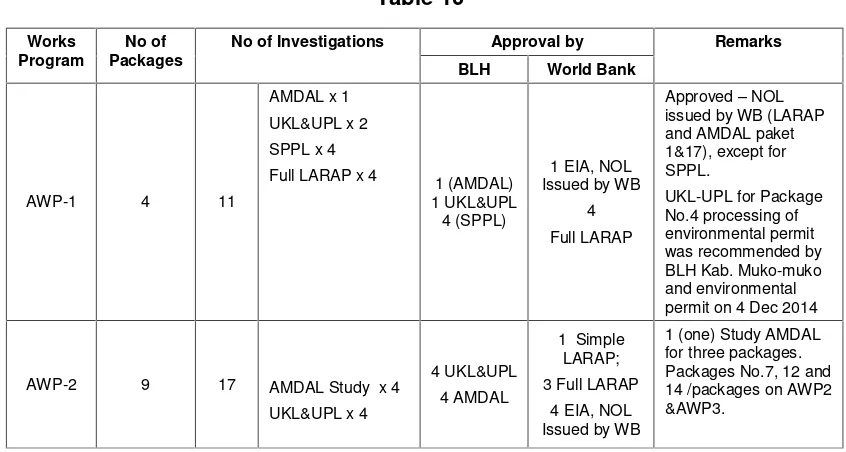

Presented below Table 10 in a tabulated format is the current status of the

environmental and social studies.

Table 10

Works Program

No of Packages

No of Investigations Approval by Remarks

BLH World Bank

AWP-1 4 11

AMDAL x 1 UKL&UPL x 2 SPPL x 4

Full LARAP x 4 1 (AMDAL) 1 UKL&UPL

4 (SPPL)

1 EIA, NOL Issued by WB

4 Full LARAP

Approved – NOL issued by WB (LARAP and AMDAL paket 1&17), except for SPPL.

UKL-UPL for Package No.4 processing of environmental permit was recommended by BLH Kab. Muko-muko and environmental permit on 4 Dec 2014

AWP-2 9 17 AMDAL Study x 4

UKL&UPL x 4

4 UKL&UPL 4 AMDAL

1 Simple LARAP; 3 Full LARAP

4 EIA, NOL Issued by WB

[image:22.595.140.563.556.782.2]Works Program

No of Packages

No of Investigations Approval by Remarks

BLH World Bank

Simple LARAP x 1 Full LARAP x 8

1 (one) Study AMDAL for two packages. Packages No.11 & 16. /packages on AWP2 &AWP3.

AWP-3 8 13

Full LARAP x 4 Simple LARAP x 4 AMDAL Study x 1= Paket No.1 AWP 1 UKL/UPL x 5

AMDAL OK = paket No.1& 17

AWP1 5 UKL&UPL

EIA same with Package 1

1 Simple LARAP; 3 Full LARAP

Approved – NOL issued by WB include AMDAL except for UKL/UPL

Total 21 41 Env=20,Soc=21 20 12

Status of monitoring of environmental mitigation are shown in Appendix 14 and

Appendix 15covers the status of overall land acquisition.

4

Workshops & Training

During this quarter (October, November and December 2014) one (1) training was conducted in Padang for the preparation of Interim Financial Report.

Presented in Appendix 16 is the Summary of Workshop and Trainings since the project

Table Of Contents

Appendix 1 : Disbursement and Expenditures Status

Appendix 2 : Report At The End of The Quarter (December 31, 2014) Appendix 3 : Detailed Summary of the Project Cost Monitoring

Appendix 4 : Procurement Management of Civil Works Appendix 5 : Procurement Plan for Consulting Services

Appendix 6 : List of Names of Community Representative Observers (CRO) Appendix 7 : Anti Corruption Action Plan (ACAP)

Activity Progress of Community Representative Observers (CRO) Appendix 8 : List of Appointed Third Party Monitors (TPM)

Appendix 9 : Progress of Third Party Monitoring (TPM) Activities Appendix 10 : Complaints Handling Mechanism System (CHS) Appendix 11 : Work Activities On Publication/Disclosure Appendix 12 : Environmental Safeguards

Appendix 13 : Environmental Management Plan (EMP) Compliance Appendix 14 : Status of Monitoring of Environmental Mitigation

ANNEXES

Annex P-1 : Package No. 1

Annex P-2 : Package No. 2

Annex P-3 : Package No. 3

MONTH :

Package No. Time Elapsed (Days) 351

Name Time Elapsed (%) 54.84%

Project Manager Scheduled Progress (%) 60.68

Contractor PT JAYA KONSTRUKSI MP, Tbk Actual Overall Progress (%) 16.08

Supervision Consultant Balance (%) -44.60

Commencement Date Progress This Month (%) 3.46

Take Over Date

Time for Complation (Days) 640

Addendum-1 u

Contract Amount Rp. A uu v 16.50%

Contract Amount Add-1 (+ PPN) *) Include advance payment

A u A u A u A u

%

I G e n e r a l 8.25 2.37 0.01 2.38 2.07

II D r a i n a g e 34.19 0.78 1.74 2.52 26.18

III Earthworks 3.95 2.89 0.08 2.97 3.63

IV Pavement Widening &

Shoulders 1.47 -

-V Granular Pavement 9.22 2.14 0.01 2.15 9.22

VI Asphalt Pavement 40.14 2.29 1.29 3.58 18.03

VII S t r u c t u r e s 1.09 1.78 0.31 2.09 1.09

VIII Reinstatement &

Minor Works 1.20 0.15 - 0.15 0.15

IX Day Work 0.14 - 0.07

X Routine Maintenance

Works 0.36 0.22 0.02 0.24 0.24

TOTAL 100.00 12.62 3.46 16.08 60.68

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22

0.22 0.87 1.69 5.62 11.11 18.06 24.50 31.58 38.99 46.36 52.53 60.68 67.46 74.81 80.69 83.98 87.62 91.27 93.71 96.16 98.75 100.00

0.10 0.58 0.79 1.59 2.93 3.71 4.79 5.98 8.60 11.28 12.62 16.08

(0.12) (0.29) (0.90) (4.03) (8.18) (14.35) (19.71) (25.60) (30.39) (35.08) (39.91) (44.60)

- Condacted Show Cause Meeting with contractor decision maker

- Discussion of Field Eng Technical Justification can

- PPK should be clarified to the local government

- Find out another aggregate supplier - Contractor cashflow

- Basecamp location permit has not been issued by local government

- Shortage of aggregate for base and Asphalt Concrt

Scheduled Progress Original (%) Actual Progress (%) Balance (%)

Div Description

PHYSICAL PROGRESS MONITORING TABLE

2014 2015

Year Month

The month of time for complation

PHYSICAL WORK PROGRESS BY CATEGORY

134,909,211,000.00 not meet agreement

DISBURSEMENT *)

22,254,343,915.00 31-Dec-14

- Shortage of labor for drainage work

RENARDET S.A JV SUPARJONO, ST,MT A MO U N T 8-Jan-14 9-Oct-15

EXECUTIVE SUMMARY REPORT

Dec- 14PROJECT DATA SUMMARY OF WORK PROGRESS PROGRESS STATUS

01

T

IME

December 25, 2014

BIHA - KRUI MAJOR PROBLEMS ACTION TO BE TAKEN

0 10 20 30 40 50 60 70 80 90 100

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22

PH Y S IC A L PR O G R E S ( % )

THE MONTH OF TIME FOR COMPLATION

PROGRESS SCHEDULE PACKAGE #01

Schedule

ANNEX P-2

MONTH :

Package No. Time Elapsed (Days) 353

Name Time Elapsed (%) 48.36%

Project Manager Scheduled Progress (%) 44.72

Contractor PT JAYA KONSTRUKSI MP, Tbk Actual Overall Progress (%) 33.73

Supervision Consultant Balance (%) -10.99

Commencement Date Progress This Month (%) 2.28

Take Over Date

Time for Complation (Days) 730

Addendum-1

Contract Amount Rp. A uu ! "

#6.00%

Contract Amount Add-1 (+ PPN) *) Include advance payment

Comp Accum Actual Accum Accum Total Last this to this Sch to this

% Month Month Month Month

I G e n e r a l 10.46 4.63 0.06 4.69 7.254

II D r a i n a g e 3.53 2.95 - 2.95 3.530

III Earthworks 4.44 3.53 0.24 3.77 4.006

IV Pavement Widening &

Shoulders 2.26 - - -

-V Granular Pavement 10.49 8.31 1.49 9.81 6.017

VI Asphalt Pavement 52.09 4.65 0.27 4.92 13.864

VII S t r u c t u r e s 14.35 6.06 0.22 6.28 9.459

VIII Reinstatement & Minor

Works 1.65 0.96 - 0.96 0.142

IX Day Work 0.12 - - - 0.059

X Routine Maintenance

Works 0.62 0.36 - 0.36 0.389

TOTAL 100.00 31.45 2.28 33.73 44.720

Year

Month Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24

Schedl Progress Original (%) 0.45 0.90 2.20 3.45 7.17 13.58 17.48 20.63 27.88 33.56 38.81 44.72 50.52 56.13 62.58 69.25 73.65 79.35 82.91 85.94 90.59 93.85 97.89 100.00

Actual Progress (%) - 0.13 1.02 2.19 4.11 5.96 9.69 13.85 22.55 25.61 31.45 33.73

Balance (%) (0.45) (0.77) (1.17) (1.26) (3.07) (7.62) (7.80) (6.78) (5.33) (7.95) (7.36) (10.99)

2014 2015

finalized yet

- Contractor has late to produce RCP & U-ditch work - Contractor is preparing RCP's mold - Road widening & granular pavement are late to do - Contractor added 1 fleet equipment for each due to agregate production stopped cause of quary's drainage work,road widenng, pave agregate and

UKL/UPL not approved yet stone crusher

- Frequent breakdown of AMP - Shall be maintained regularly

- Soil investigation for bridge foundation is not - Mobilization for bridge construction

197,936,699,000.00

December 25, 2014

PADANG SAWAH-SIMPANG EMPAT MAJOR PROBLEMS ACTION TO BE TAKEN

EXECUTIVE SUMMARY REPORT

Dec-14

PROJECT DATA SUMMARY OF WORK PROGRESS PROGRESS STATUS

The month of time for complation

DISBURSEMENT *) 31-Dec-14 51,471,114,630 02 T IM E A M O U N T

RENARDET S.A JV

6-Jan-14 5-Jan-16

PHYSICAL WORK PROGRESS BY CATEGORY

Div Description

PHYSICAL PROGRESS MONITORING TABLE

0 10 20 30 40 50 60 70 80 90 100

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24

P H Y S IC A L P R O G R E S ( % )

THE MONTH OF TIME FOR COMPLATION PROGRESS SCHEDULE

PACKAGE #02

Schedule

Actual

MONTH :

Package No. Time Elapsed (Days) 353

Name Time Elapsed (%) 48.36%

Project Manager Scheduled Progress (%) 44.01

Contractor PT JAYA KONSTRUKSI MP, Tbk Actual Overall Progress (%) 24.38 - Shotage of dumptruck

Supervision Consultant Balance (%) -19.63

Commencement Date Progress This Month (%) 5.08

Take Over Date

Time for Complation (Days) 730

Addendum-1 $% &% '() &%*

Contract Amount Rp. A+ +u,u- &% ./*01 2 3454 6%

Contract Amount Add-1 (+ PPN) *) Include advance payment

7 8,1 A+ +u, A+% '&- A+ +u, A+ +u, 98% &- : &(% % ; .( %8% ; .( $+;%8%; . (

% <8=%; <8=%; <8= %; <8=%;

I G e n e r a l > ?2@> >2A> B >2 A> C2D E

II D r a i n a g e > C2>E A 2@ A ? 264 5.89 12.10

III Earthworks 3.04 3.90 0.70 4.60 2.89

IV Pavement Widening &

Shoulders 2.45 - -

-V Granular Pavement 11.27 3.28 1.09 4.37 5.32

VI Asphalt Pavement 55.81 3.02 2.18 5.29 18.18

VII S t r u c t u r e s 0.80 1.62 0.37 1.98 0.80

VIII Reinstatement & Minor

Works 2.27 0.16 0.01 0.16 0.14

IX Day Work 0.22 0.03 0.07 0.10 0.11

X Routine Maintenance

Works 0.76 0.46 0.02 0.48 0.50

TOTAL 100.00 19.30 5.08 24.38 44.01 Note :

Year

Month Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

The month of time for complation 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24

Schedl Progress Original (%) 0.26 1.00 1.67 2.45 4.78 7.45 10.70 14.27 21.53 30.10 36.95 44.01 51.62 58.67 65.63 73.03 79.97 87.04 91.61 93.19 94.30 95.76 97.82 100.00

Actual Progress (%) 0.24 0.48 2.07 2.43 2.87 5.45 5.70 7.01 12.43 14.45 19.30 24.38

Balance (%) (0.02) (0.52) 0.40 (0.02) (1.91) (2.00) (5.00) (7.26) (9.10) (15.65) (17.65) (19.63)

PHYSICAL PROGRESS MONITORING TABLE

143,688,963,000.00

PHYSICAL WORK PROGRESS BY CATEGORY

Div Description

RENARDET S.A JV - Lag of agregate A and B due to stone crusher productivity Need additional dumptruck

DISBURSEMENT *)

6-Jan-14 can not meet aggreagate q'ty requirement

5-Jan-16 - Shortage of labor for drainage work Need additional team work

Need additional dumptruck

EXECUTIVE SUMMARY REPORT

Dec-14

PROJECT DATA SUMMARY OF WORK PROGRESS PROGRESS STATUS

2014 2015

31-Dec-14

33,493,661,044.00 03

T

IM

E December 25, 2014

MANGGOPOH - PADANG SAWAH MAJOR PROBLEMS ACTION TO BE TAKEN

A

M

O

U

N

T - AMP often broken Need improvement of equipment management

0 10 20 30 40 50 60 70 80 90 100

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24

P

H

Y

S

IC

A

L

P

R

O

G

R

E

S

(

%

)

THE MONTH OF TIME FOR COMPLATION PROGRESS SCHEDULE

PACKAGE #03

Schedule

ANNEX P-4

MONTH :

Package No. Time Elapsed (Days) 349

Name Time Elapsed (%) 47.81%

Project Manager Scheduled Progress (%) 40.88

Contractor PT WASKITA KARYA - PT DAYA JO Actual Overall Progress (%) 9.35

Supervision Consultant Balance (%) -31.53

Commencement Date Progress This Month (%) 1.25

Take Over Date masonry Rooler

Time for Complation (Days) 730 - Mismanagement contractor's JO

Addendum-1 F GH GIuJHGK

Contract Amount Rp. AL LuMuNH GOvKP QR STUVW%

Contract Amount Add-1 (+ PPN) *) Include advance payment

X YMQ AL LuM ALGHNu AL LuM ALLuM ZY GHN [H I G G\OI G YG\OI FL\GYG\OI

% ] Y^ G\ ] Y^ G\ ] Y^ G\ ] Y^G\

I G e n e r a l _R`a bR`a bRb c bR60 0.78

II D r a i n a g e 12.26 1.00 - 1.00 8.35

III Earthworks 3.58 0.38 - 0.38 2.53

IV Pavement Widening &

Shoulders 3.39

-V Granular Pavement 18.07 5.21 - 5.21 9.83

VI Asphalt Pavement 49.27 0.50 1.14 1.64 15.37

VII S t r u c t u r e s 2.55 0.18 0.10 0.28 2.24

VIII Reinstatement & Minor

Works 2.95 0.17 - 0.17 1.51

IX Day Work 0.14 0.06

X Routine Maintenance

Works 0.20 0.07 0.01 0.08 0.20

TOTAL 100.00 8.10 1.25 9.35 40.88

Year

Month Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

The month of time for complation 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24

Schedl Progress Original (%) 0.11 0.32 0.75 1.14 6.57 10.29 12.85 15.81 20.08 24.22 32.76 40.88 47.93 55.61 63.45 70.19 77.04 81.55 84.79 90.84 94.62 97.05 98.80 100.00

Actual Progress (%) - 0.18 0.40 0.53 0.56 0.78 0.87 1.45 3.73 5.35 8.10 9.35

Balance (%) (0.11) (0.14) (0.35) (0.61) (6.01) (9.51) (11.98) (14.36) (16.35) (18.88) (24.66) (31.53)

186,936,750,000.00

immediately

PHYSICAL PROGRESS MONITORING TABLE

PHYSICAL WORK PROGRESS BY CATEGORY

Div Description

DISBURSEMENT *)

31-Dec-14

29,301,697,422.00

- Joint Venture shall solve this internal problem - Needed additional Mtr. Grader, Excavator, Vibr. 10-Jan-14

9-Jan-16

EXECUTIVE SUMMARY REPORT

Dec- 14

PROJECT DATA SUMMARY OF WORK PROGRESS PROGRESS STATUS