Company Report | Nov 21, 2018

TP to Consensus Price -5.3%

vs. Last Price +14.3%

Shares data

Last Price (IDR) 1,325

Price date as of Nov 19, 2018 52 wk range (Hi/Lo) 1,500 / 925

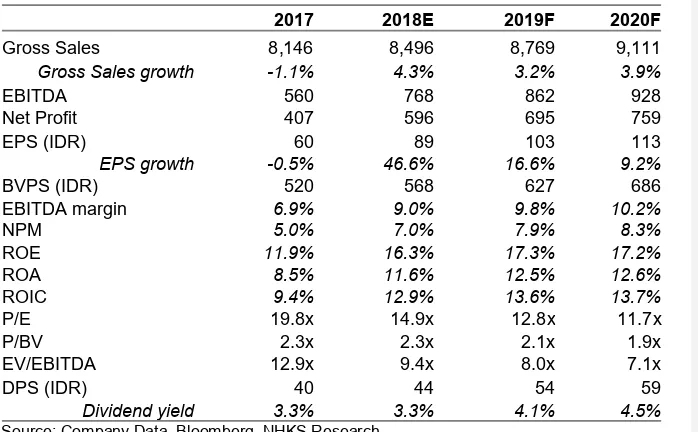

Ramayana Lestari Sentosa Tbk | Summary (IDR bn)

2017 2018E 2019F 2020F

Gross Sales 8,146 8,496 8,769 9,111

Gross Sales growth -1.1% 4.3% 3.2% 3.9%

EBITDA 560 768 862 928

Net Profit 407 596 695 759

EPS (IDR) 60 89 103 113

EPS growth -0.5% 46.6% 16.6% 9.2%

BVPS (IDR) 520 568 627 686

EBITDA margin 6.9% 9.0% 9.8% 10.2%

NPM 5.0% 7.0% 7.9% 8.3%

Dividend yield 3.3% 3.3% 4.1% 4.5%

Source: Company Data, Bloomberg, NHKS Research

YTD 1M 3M 12M

Abs. Ret. 10.4% 10.9% 7.3% 38.0% Rel. Ret. 15.9% 8.0% 5.4% 38.8% Boosted by SSSG Performance of September 2018

RALS’s 3Q18 revenues were at IDR1.50 trillion (+6.5% y-y): the highest growth

figure in 2018. In 9M18, its gross sales grew to IDR6.68 trillion (+4.5% y-y). The

increase in top line, coupled with the decrease of 6.5% y-y in COGS,

spurring the gross profit margin to 29.5% (vs. 26.8% in 9M17). Its September’s

SSSG consistently gearing higher to 11% was underlined by SSSG of 12.2% in

Java Island, non-greater Jakarta.

The strategy of rejuvenation of groceries stores in 2017 caused the groceries

store segment to post the growth of 10.3% q-q to IDR23 billion in EBIT. This performance caused the 3Q18 EBIT to buoy to IDR2 billion, in a stark contrast to the 3Q17 loss of IDR47.9 billion. The 3Q18 net profit also grew to IDR41 billion.

To Launch Two Stores in 4Q18

In 4Q18, RALS plans to launch two new stores in Java Island non-greater

Jakarta (September’s SSSG of 12.2%) completing 3 new stores launched in

1H18. Besides, RALS will keep increasing its margins by performing efficiencies and keeping COGS in check.

The government’s plan to increase the regional minimum wage (UMR) by 8% in

2019, coupled with a number of the government’s subsidy projects can trigger

the improvement in RALS’s consumer purchasing power. In contrary, the

increase in UMR is likely to stunt EBIT margins in 2019. Besides, it also

faces the challenge of downbeat commodities’ prices prevalent in out Java.

Target Price of IDR1,515

We use an estimate of the forward P/E of 13.5x (0.3 SD lower than the last 4

-year estimate). The target price implies a 2019E P/E of 14.7x. Now, RALS is traded at a2019E P/E of 12.8x.

Michael Tjahjadi

+62 21 797 6202, ext:114Source: Company, NHKS Research

RALS Quarterly Net Sales by Region (IDR bn)

Source: Company, NHKS Research

RALS Quarterly Gross Sales (IDR bn) | 3Q16 - 3Q18

Margin Ratios | 3Q17 - 3Q18

Source: Company, NHKS Research

Supermarket Segment’s EBIT (IDR bn) | 3Q16 - 3Q18

Source: Company, NHKS Research

Performance Highlights

RALS Quarterly Net Profit (IDR bn) | 3Q16 - 3Q18

Source: Company, NHKS Research

RALS’ Segment Contribution | 3Q16 - 3Q18

3Q18 review (IDR bn)

Source: Bloomberg, NHKS research

3Q17 4Q17 1Q18 2Q18 Actual Estimate 3Q18 y 4Q18E

-y q-q surprise

Gross Margin -Revised 29.8% 30.2% 30.2%

-Previous 29.9% 29.9% 30.1%

EBIT -Revised 592 694 760

-Previous 602 608 691

-Change -1.6% 14.0% 9.9%

EBIT Margin -Revised 7.0% 7.9% 8.3%

-Previous 7.1% 7.0% 7.7%

EBITDA -Revised 768 862 928

-Previous 778 778 858

-Change -1.3% 10.8% 8.1%

EBITDA Margin -Revised 9.0% 9.8% 10.2%

-Previous 9.2% 8.9% 9.5%

Net Profit -Revised 596 695 759

-Previous 632 651 707

-Change -5.7% 6.7% 7.3%

Net Margin -Revised 7.0% 7.9% 8.3%

-Previous 7.5% 7.5% 7.9%

ASEAN Retailers Company

RALS is a retail-based company selling apparels and accessories through Ramayana Department Store, and selling groceries

through Spar Supermarket. Targeting the low-middle class consumers, it operates 119 stores: 79 stores situated in Java Island

and 40 stores situated outside Java Island.

To jostle for making profit amid the sluggish retail sector, RALS cooperates with F&B tenants, cinemas, and specialties shops to

offer a lifestyle-based concept through Ramayana Prime Store; indeed, it cooperates with Lazada, Tokopedia, and Shopee to

target the e-commerce segment.

Indonesia-based Retail Industry in ASEAN

Indonesia is the home to the biggest population in ASEAN. It furthers Indonesia into the lucrative market for the retail business. LPPF, RALS, MAPI with their stores across Indonesia dominate the retail market in Indonesia. The large number of the middle to low consumer segment across Indonesia is an opportune chance for retailers such as RALS.

The retail industry in ASEAN market is sluggish, for example the negative sales growth Singapore and Thailand based retail industries. This backdrop urge the retailers in ASEAN to strictly curb the operational cost with a view to balancing market. In the

margin outlook, Indonesia retailers are successful in posting higher margin than its ASEAN peers’ margins are.

Source: Bloomberg

SM Investments Corp 21,583 19,205 7,700 678 7.04% 8.8% 10.69% 32.1x 3.3x

Multiple Valuation

Forward P/E band | Last 4 yearsSource: NHKS research

Dynamic Forward P/E band | Last 4 years

Source: NHKS research

Rating and Target Price Update

Target Price RevisionDate Rating Target Price Last Price Consensus vs Last Price vs Consensus

04/04/2018 Hold 1,450 (Dec 2018) 1,310 1,338 +10.7% +8.4%

05/15/2018 Hold 1,400 (Dec 2018) 1,380 1,420 +1.4% -1.4%

09/21/2018 Hold 1,525 (Dec 2019) 1,350 1,306 +13.0% -4.9%

11/19/2018 Hold 1,515 (Dec 2019) 1,325 1,601 +14.3% -5.3%

Source: NHKS research, Bloomberg

Closing and Target Price

Source: NHKS research Analyst Coverage Rating

Source: Bloomberg

NH Korindo Sekuritas Indonesia (NHKS) stock ratings

1. Period: End of year target price

Summary of Financials

DISCLAIMER

This report and any electronic access hereto are restricted and intended only for the clients and related entity of PT NH Korindo Sekuritas Indonesia. This report is only for information and recipient use. It is not reproduced, copied, or made available for others. Under no circumstances is it considered as a selling offer or solicitation of securities buying. Any recommendation contained herein may not suitable for all investors. Although the information here is obtained from reliable sources, it accuracy and completeness cannot be guaranteed. PT NH Korindo Sekuritas Indonesia, its affiliated companies, respective employees, and agents disclaim any responsibility and liability for claims, proceedings, action, losses, expenses, damages, or costs filed against or suffered by any person as a result of acting pursuant to the contents hereof. Neither is PT NH Korindo Sekuritas Indonesia, its affiliated companies, employees, nor agents liable for errors, omissions, misstatements, negligence, inaccuracy arising herefrom.