IN ENGLISH

NO AUTHOR INSTITUTION TITTLE SUBJECT

1 Synthia A. Sari Univeristy of Bina Nusantara; synthiaasa2598@yahoo.com

The Effectiveness of Independent Commissioner in Implementing Good Corporate Governance at Indonesian State-Owned Enterprises

STRATEGIC

2 Yie Ke Faculty of Business and Economics-University of Surabaya

yiekefeliana@ubaya.ac.id

Management Style Of Chinese Overseas Companies And Indonesia Companies

STRATEGIC

3 Suresh Kumar; Randy Prasetyo

President University; tb7976sk@gmail.com

PENETRATING INDONESIAN

BANCASSURANCE MARKET: STRATEGIC MANAGEMENT,

PT. ASURANSI CIGNA – INDONESIA STYLE

STRATEGIC

4Alain Widjanarka PT Bi a a Uta a – PPM Co sulti g Jakarta, Indonesia

alainwidjanarka@gmail.com

DEFINE THE CRITERIA TO IDENTIFY CORE AND NON-CORE ACTIVITIES

TO LEVERAGE THE COMPANY’S COMPETIITIVENESS AND

STRENGTHENING THE PARTNERSHIP WITH OTHERS

STRATEGIC

SCHEDULE PRESENTATION PAPER FOR INSYMA 10

Session 1 (11.10 - 12.10 WITA)

Room 1: Denpasar Room 1

IN ENGLISH

NO AUTHOR INSTITUTION TITTLE SUBJECT

1Agung Wahyu Handaru, Widya Parimita, Inna Hadza Sabila

Faculty of Economics State University of Jakarta. Email:

agung_1178@yahoo.com; widya_parimita@yahoo.com; innahadza@gmail.com

Motivational Factors, Entrepreneurship, Ethnicity, and Parental Background: Evidence from the Blok M Square Electronic Center, Jakarta, Indonesia

HRM

2 Sri Wiludjeng SP, Muhammad Madyosa Ibrahim

Faculty of business management Widyatama University;

sri.wiludjeng@widyatama.ac.id, wiludj3ng@yahoo.com

The Impact of the Use of Outsourcing

Employee Against Productivity Companies In PT.Pindad Bandung

HRM

3 May Eka Ubaya Leadership and Five Stage Model of Organizaton Growth at UD "RAMA JAYA"

HRM

4 T. Soemarman Faculty of Bussiness and

Economics, Surabaya University (UBAYA)

CASE STUDY: A PROJECT OF IMPROVEMENT ON THE DESIGN OF JOBS/WORKS FOR PROFESSIONAL WORKERS AT PT. BUKIT

BATUBARA TBK – THE YEAR OF /

HRM

SCHEDULE PRESENTATION PAPER FOR INSYMA 10

Session 1 (11.10 - 12.10 WITA)

Room 2: Denpasar Room 2

IN ENGLISH

NO AUTHOR INSTITUTION TITTLE SUBJECT

1 Suskim Rianti, Harry Setyo Negoro, Alfiah Hasanah

Faculty of Business & Management, Widyatama University, Bandung, Indonesia (writer 1,2); 3Faculty of Economics, Padjadjaran University, Bandung, Indonesia (3)

suskim.riantani@widyatama.ac.id

EVALUATING THE FINANCIAL PERFORMANCE USING THE GROWTH OF EPS, CFO AND EVA AND THEIR IMPACT TO THE STOCK RETURN OF LISTED TELECOMMUNICATION INDUSTRY IN BEI

FINANCE

2 I Putu Sugiartha Sanjaya Atma Jaya University, Yogyakarta;

siputusugiartha@yahoo.com

CASH FLOW RIGHT LEVERAGE AND FIRM PERFORMANCE: CASE FROM FAMILY FIRM LISTED IN INDONESIA STOCK EXCHANGE

FINANCE

3 Aris Armuninggar, DR UNAIR; fimozigha@yahoo.com The Role of Insurance Agreement as Part of Risk Management Process in Indonesian Business Activities

FINANCE

4 Yohanna Handjaja, Deddy Marciano, Liliana Inggrit Wijaya

Faculty of Business and Economics, University of Surabaya, Indonesia Email:

yohanna.handjaja@gmail.com

GAUGING THE FINANCIAL

PERFORMANCE OF BANKING USING CAMEL MODEL: THE PROSPECT OF ISLAMIC BANK IN INDONESIA ACCORDING TO PUBLIC TRUST COMPARED WITH CONVENTIONAL BANK

FINANCE

Moderator : DR. Putu Anom Mahadwarta

SCHEDULE PRESENTATION PAPER FOR INSYMA 10

BAHASA

NO AUTHOR INSTITUTION TITTLE SUBJECT

1Suciaty Debora Ridwan & M.Sienly Veronica

Maranatha Christian University Bandung. Email: sucie7787@ymail.com; lee_pingping@yahoo.com.

Earnings Management Trend Toward Coal Company Listed in the Indonesia Stock Exchange Which Expected To Bankruptcy By Use The Altman Z-score Model, Springate Model And Zmiwisky Model In Period 2009-2011

FINANCE

2Yulius Pratomo Satya Wacana Christian University, Salatiga;

yulius.pratomo@staff.uksw.edu

FOREIGN DIRECT INVESTMENT IN ASEAN, 1994-2010: DOES THE CHINA EFFECT EXIST?

FINANCE

3 M.Nashihin Trilogi University, Jakarta; nashihin.m@gmail.com, m.nashihin@stekpi.ac.id

Strategies to implement the changes in the basis of cash transfer from a household-base to a family-base: the case of PKH in Indonesia

FINANCE

4Hendro Lukman & Stevanus Adree Cipto Setiawan

Tarumanagara University; hendrolukman@gmail.com

THE EFFECT OF FINANCIAL CONDITION, THE FAILURE OF DEBT RATIO, FIRM SIZE AND PUBLIC ACCOUNTING REPUTATION

ON ACCEPTANCE OF GOING CONCERN OPINION

FINANCE

SCHEDULE PRESENTATION PAPER FOR INSYMA 10

Session 1 (11.10 - 12.10 WITA)

Room 4: Tabanan Room

IN ENGLISH

NO AUTHOR INSTITUTION TITTLE SUBJECT

1 Amak Mohamad Yaqoub & Indri Apriani Rahma Pratama

Airlangga University;

amak.yaqoub@feb.unair.ac.id; indriajalah@gmail.com

The Role of Power and Conflict Resolution in Supply Chain Relationship: Small and Medium Enterprises Context

OPERATION

2Weli Imbiri Atmajaya University; weli.imbiri@gmail.com

The Relationship between the Level of the Use of ERP System, SCM,Strategic Alignment,and Firm Performance

Using Balanced Scorecard Approach

OPERATION

3 Tuwanku Aria Auliandri Airlangga University; tuwanku@gmail.com ; aria@feb.unair.ac.id

Improving the company competitive advantages by identifying waste in the production process. Case study at Watutulis Sugar Cane

Manufacturer in Sidoarjo

OPERATION

4 Christine Dwi K.S. Sondang M.R.

Adriana Oktarina Sembiring

Maranatha Christian Univ; christine.dwi.karya.s@gmail.com

INTERNAL AUDIT QUALITY ROLE IN IMPROVING EFFECTIVENESS OF

QUALITY MANAGEMENT SYSTEM ISO 9001:2000

(Case Study PT INTI Bandung)

OPERATION

5 Dianne Frisko UBAYA; dianne@ubaya.ac.id , difrisko@gmail.com

VALUE CHAIN CONCEPT ON STRATEGIC CSR PROGRAM:

Case Study of Martha Tilaar Group

OPERATION

SCHEDULE PRESENTATION PAPER FOR INSYMA 10

Session 1 (11.10 - 12.10 WITA)

Room 5: Amlapura Room

IN ENGLISH

NO AUTHOR INSTITUTION TITTLE SUBJECT

1 Levina Rolanda Tjia, Dudi Anandya & Christina R. Honantha

Faculty of Business and Economics, University of Surabaya, Indonesia

Email: levinarolanda@ymail.com

FACTORS INFLUENCE INDONESIAN YOUNG CONSUMERS’ ONLINE PURCHASE INTENTION IN SOCIAL MEDIA WEBSITES

MARKETING

2 Edo Sri Harsanto & Naafilah Lailatirrohmah

Management Departement Economics and Business Faculty Diponegoro University;

naflaila17@gmail.com

The Relevancy of Using Website for Promoting Healthcare Product and Services

MARKETING

3Rendy May Fandi, Efendi Haslim

Economics Faculty, Atma Jaya Catholic University; efendisan@yahoo.com

Emotional Attachment as a Mediator of the Relationship Between Service Quality and Emotional Brand

MARKETING

4Rini Oktavera, Erna Andajani Industrial Engineering Department, WR Supratman University , Surabaya, Management Department Surabaya University; rini.oktavera@gmail.com

IMPLEMENTATION OF VALUE CHAIN ANALYSIS IN THE BROILER SUPPLY CHAIN AGRIBUSSINESS

OPERATION

Moderator : DR. Dudy Anandya

SCHEDULE PRESENTATION PAPER FOR INSYMA 10

5Mudiantono, Rizal Hari Magnadi

Economics and Business Faculty Diponegoro University. Email: Mumuk_undip@yahoo.co.id; rizalharimagnadi@gmail.com

Evaluation of Using Importance Performance Analysis Approach

to Design Service Excelence Strategy for Service Product (Based on RSI Sultan Agung Semarang Case Study)

OPERATION

IN ENGLISH

NO AUTHOR INSTITUTION TITTLE SUBJECT

1 Dini Arwati, Dini Verdania

University of Widyatama Bandung;

rachmawati.rima@yahoo.com

INFLUENCE OF PARTNERSHIP SRATEGIC TO PERFORMANCE OF PRIVATE COLLEGE IN

BANDUNG

STRATEGIC

2 Aluisius Hery Pratono & Suyanto

Faculty of Business and

Economics, Universitas Surabaya E-mail: hery_pra@ubaya.ac.id; suyanto@ubaya.ac.id

INNOVATION SUCCESS IN SMALL BUSINESS CONTEXT:

AN EMPIRICAL EVIDENT FROM INDONESIA

STRATEGIC

3Ida Bagus Made Wiyasha & Ni

Luh Suastuti Sekolah tinggi Pariwisata Nusa Dua Bali; ibwiyasha@yahoo.com; suastuti@gmail.com

The survival of small restaurants: micro analysis of non classified restaurants in Kuta Selatan, Bali

STRATEGIC

4Rohmawati Kusumaningtias UNESA;

rohmawatikusnitia@yahoo.co.id

Corporate Governance, Sustainability, and Islamic Banking Performance

STRATEGIC

SCHEDULE PRESENTATION PAPER FOR INSYMA 10

Session 2 (13.00 - 14.00 WITA)

Room 1: Denpasar Room 1

BAHASA

NO AUTHOR INSTITUTION TITTLE SUBJECT

1I Gede Adiputra Faculty of Economy, Tarumanagara University Jakarta

email: w_wigra@yahoo.com

THE EFFECTS OF INTERPERSONAL COMMUNICATION AND

MOTIVATION TO PRODUCTIVITY OF EMPLOYEES AT HOTEL MULIA JAKARTA

HRM

2Yenny Purwati, Rosaly Franksiska, Eristia Lidia Paramita

Satya Wacana Christian University. Email: yenny.purwati@yahoo.com, rosaly.franksiska@staff.uksw.edu / rosaly_fran@yahoo.com,

eristia.paramita@staff.uksw.edu

SUPPLY CHAIN MANAGEMENT: STRATEGY IN INFORMATION TECHNOLOGY TO REDUCE COST

HRM

3 Luh Kadek Budi Martini Mahasaraswati Univiersity Denpasar; myseruni@yahoo.com

CAREER DEVELOPMENT OF CREATIVITY REVIEWED, AND COURAGE IN BUSINESS INNOVATIVE MULTI-LEVEL MARKETING (MLM)

DISTRIBUTOR ORIFLAME DENPASAR

HRM

4Jun Surjanti, Sanaji, & Dwiarko Nugrohoseno

UNESA, yunsuryanti@yahoo.com SELF-CONCEPT AND SELF-EFFICACY FOR BUILDING AN ACADEMIC PERFORMANCE: A META-ANALISYS APPROACH

HRM

SCHEDULE PRESENTATION PAPER FOR INSYMA 10

Session 2 (13.00 - 14.15 WITA)

Room 2: Denpasar Room 2

5 Verina H. Secapramana University of Surabaya jengverina@gmail.com

THE PREDICTIVE MODEL OF RELATIONSHIP BETWEEN ROLE STRESS, PERSONALITY, AND SALES PERFORMANCE

IN SERVICES MARKETING

HRM

IN ENGLISH

NO AUTHOR INSTITUTION TITTLE SUBJECT

1Tan Ming Kuang Accounting Department, Maranatha Christian University;

tm.kuang@yahoo.com

Can Innovation of Time Driven ABC System Replace Conventional ABC System?

FINANCE

2 Budhi Purwandaya, Eko Kusmurtanto

Trilogi University, Jakarta; bpurwandaya@gmail.com

Revealing the Preferences in Conveying Price Information

FINANCE

3 Anthony Kevin Bandono; Deddy Marciano

UBAYA;

marciano@staff.ubaya.ac.id

FACTORS THAT INFLUENCED

SYNDICATED LOANS DECISIONS IN THE ASEAN OVER THE PERIOD 2006-2010

FINANCE

4 Berto Usman & Eduardus Tandelilin

Program Studi Manajemen Fakultas Ekonomi Universitas Bengkulu

berto_usman@yahoo.co.id Program Studi Manajemen Fakultas Ekonomika Bisnis Universitas Gadjah Mada tandelilin@yahoo.com

GOOGLE SEARCH TRAFFIC AND IT’S INFLUENCE ON RETURN, LIQUIDITY AND VOLATILITY OF STOCK RETURN EMPIRICAL STUDY: MANUFACTURING FIRMS

IN INDONESIA STOCK EXCHANGE

FINANCE

Moderator : DR. Putu Anom Mahadwarta

SCHEDULE PRESENTATION PAPER FOR INSYMA 10

5 Julius Irianto Gunawan; Endang Ernawati

UBAYA;

endangernawati@yahoo.com

THE FACTORS AFFECTING THE COMPANIES CAPITAL STRUCTURE IN THE SECTOR OF INFRASTRUCTURE, UTILITIES, AND TRANSPORTATION LISTED ON INDONESIA STOCK

EXCHANGE DURING PERIOD 2006-2010

FINANCE

BAHASA

NO AUTHOR INSTITUTION TITTLE SUBJECT

1Doddy de Queljoe, Amelia Loresia, Indri Purnama Putri

Faculty of Pharmacy, University of Surabaya,Surabaya, Indonesia; doddyq@gmail.com

Cost Effectiveness Analysis of DiureticsTherapyfor Ascites in Hepatic Cirrhosisat Adi Husada Undaan Wetan

Hospital in Surabaya

FINANCE

2Yeye Susilowati Stikubank University (UNISBANK), Semarang;

Yeye_susilowati@yahoo.co.id

SYSTEMATIC RISK AS MODERATOR OR MEDIATOR OF THE INFLUENCE BETWEEN MACROECONOMIC FUNDAMENTAL FACTORS AND STOCK RETURN

FINANCE

3 Lia Amaliawiati, Edi Winarso

Faculty of business management Widyatama University

lia.amaliawiati@widyatama.ac.id , edi.winarso@gmail.com

THE INFLUENCE OF MONETARY POLICY (BI RATE)

ON PROFITABILITY OF COMMERCIAL BANKS IN INDONESIA

FINANCE

SCHEDULE PRESENTATION PAPER FOR INSYMA 10

Session 2 (13.00 - 14.00 WITA)

Room 4: Tabanan Room

4 Eka Darmadi Faculty of Bussiness and

Economics, Surabaya University (UBAYA)

BETTER INVESTMENT CHOICE IN CRISIS AND AFTER CRISIS:

STOCK VERSUS GOLD

FINANCE

BAHASA

NO AUTHOR INSTITUTION TITTLE SUBJECT

1 Lina Anatan Department of Management, Maranatha Christian University Bandung,

lina_anatan@yahoo.com

FACTORS INFLUENCING THE SUPPLY CHAIN PERFORMANCE

(A Study of Manufacturing Firms in Indonesia)

OPERATION

2Meythi & Riki Martusa Master of Accounting, Faculty of Economics, Maranatha Christian University, Bandung. Email: meycute79@yahoo.com; theofilus2001@yahoo.com

SUPPLY CHAIN MANAGEMENT: STRATEGY IN INFORMATION TECHNOLOGY TO REDUCE COST

OPERATION

SCHEDULE PRESENTATION PAPER FOR INSYMA 10

Session 2 (13.00 - 14.00 WITA)

Room 5: Amlapura Room

3 Sahnaz Ubud Trilogi University, Jakarta; sahnaz@stekpi.ac.id

THE ROLE OF ENVIRONMENTAL

UNCERTAINTY AND IMPLEMENTATION SUPPLY CHAIN FOR INCREASING

COMPETITIVE ADVANTAGE

MANUFACTURING INDUSTRIES IN EAST JAVA

OPERATION

4 Verani Hartati & Wiwik Sulistiyowati

Department of Industrial Engineering, Universitas Muhammadiyah Sidoarjo

FISH DISTRIBUTION SYSTEM DESIGN (Case Study: Fish Auction Place Sidoarjo)

OPERATION

BAHASA

NO AUTHOR INSTITUTION TITTLE SUBJECT

1Sabrina O. Sihombing Universitas Pelita Harapan Jakarta; sabrinasihombing@gmail.com

Consumer Behavior and Indonesian Values Scale: Validation and Short-Form Scale Development

MARKETING

2Yudi Pramudiana & Arinda Ike Wardhani

InstitutManajemenTelkom, Indonesia; yudipram@gmail.com

The Role of Event Sponsorshipin Promoting Tourist Enthusiasm (Studies in SemarangGreat Sale Event)

MARKETING

3 Jessica Adelaide Gusti & Sabrina O. Sihombing

Universitas Pelita Harapan Jakarta; jessica271991@yahoo.com; sabrinasihombing@gmail.com

Contrasting Reflective and Formative Models on E-service Quality:

an Empirical Study

OPERATION

Moderator : DR. Dudy Anandya

SCHEDULE PRESENTATION PAPER FOR INSYMA 10

4Samuel David Lee, Pandam Rukmi Wulandari ,Aris Budi Setyawan

Faculty of Economic, Accounting Departement, Gunadarma University. Email: pandam@staff.gunadarma.ac.id; samueldavidlee@ymail.com;

renny@staff.gunadarma.ac.id

EFFECTIVENESS OF IT GOVERNANCE IN BANKING SECTOR

OPERATION

BAHASA

NO AUTHOR INSTITUTION TITTLE SUBJECT

1 Maria Assumpta Evi Marlina

Ciputra University, Surabaya; emarlina@ciputra.ac.id

IMPLEMENTATION OF FIVE FORCES ANALYSIS IN BUSINESS START UP

STRATEGIC

2 Lim Sanny School of Business Management, Bina Nusantara University; lsanny@binus.ac.id

EFFECT OF RELATIONAL QUALITY AND ENTREPRENEUR ORIENTATION TOWARD

FRANCHISEE PERFORMANCE IN INDONESIA

STRATEGIC

3 Syuhada Sufian Faculty of Economics and Business, Diponegoro University, Semarang, hada_48@yahoo.com

HIERARCHICAL INNOVATION MODEL DEVELOPMENT IN INDONESIAN PHARMACEUTICAL INDUSTRI

STRATEGIC

SCHEDULE PRESENTATION PAPER FOR INSYMA 10

Session 3 (14.00 - 15.00 WITA)

Room 1: Denpasar Room 1

4 Sri Setyo Iriani & Monika Tiarawati

State University of Surabaya (Indonesia)

E-mail :

Srisetyo2009@gmail.com Email:

monikatiarawati@gmail.com

THE ANALYSIS OF INTERNAL AND EXTERNAL FACTORS

IN FORMULATING COMPETITIVE STRATEGIES

ON SKULL-CAP AND TAMBOURINE

INDUSTRIES IN BUNGAH VILLAGE - GRESIK

STRATEGIC

5 Machasin Riau University; m4ch451n@yahoo.co.id

Competitive Business Environment, Market Orientation, Strategic Orientation and

Performance of SMEs (empirical study on small and medium industries Pekanbaru city)

STRATEGIC

BAHASA

NO AUTHOR INSTITUTION TITTLE SUBJECT

1 Irene Rini Demi Pangestuti Diponegoro University; irenerinidp@yahoo.co.id

DETERMINANTS OF THE DECISION TO BUY AND SELL MUTUAL FUNDS

IN INDONESIA

FINANCE

2 Agus Wahyudi Salasa Gama & Ni Wayan Eka Mitariani

Mahasaraswati University Denpasar;

salasa_pc@yahoo.co.id , emitariani@gmail.com

THE INFLUENCE OF MANAGEMENT PERFORMANCE AND INTELLECTUAL CAPITAL TOWARD THE FIRM VALUE

FINANCE

SCHEDULE PRESENTATION PAPER FOR INSYMA 10

Session 3 (14.15 - 15.30 WITA)

Room 2: Denpasar Room 2

3 I Dewa Made Endiana Mahasaraswati University Denpasar; endixdr@yahoo.com

EFFECT OF INVESTMENT OPPORTUNITY SET ON CASH DIVIDEND POLICY WITH AVERAGE OF SALES GROWTH ON EVERY LIFE CYCLE AS A MODERATING VARIABLE

(Studies On Manufacturing Companies In Indonesia Stock Exchange)

FINANCE

IN ENGLISH

NO AUTHOR INSTITUTION TITTLE SUBJECT

1 Niki Jayanthi & Felizia Arni Rudiawarni

Accounting/Faculty of Business and Economics Surabaya University; niQi.888@gmail.com;

felizia@ubaya.ac.id

THE IMPACT OF RELATED PARTIES’

TRANSACTIONS TO MARKET VALUATION OF FIRMS

FINANCE

2 Fidelis Arastyo Andono & Fandy San

Accounting/Faculty of Business and Economics Surabaya University;

nino.a.andono@gmail.com

MALMI AND BROWN’S MANAGEMENT

CONTROL SYSTEM IN PRODUCTION AREA

OPERATION

Moderator : Dra.ec. Liliana Inggrit Wijaya, M.M.

SCHEDULE PRESENTATION PAPER FOR INSYMA 10

3 Stephanie Susilo & Felizia Arni Rudiawarni

Accounting/Faculty of Business and Economics Surabaya University; stephanie.susilo91@gmail.com; felizia@ubaya.ac.id

TRANSITION OF IFRS IN INDONESIA: FINANCIAL POSITION, FINANCIAL PERFORMANCE AND KEY FINANCIAL INDICATORS EFFECTS

FINANCE

BAHASA

NO AUTHOR INSTITUTION TITTLE SUBJECT

1 Sri Harryani , Bagus Nurcahyo,

Re y Nur’ai i Accounting Department, Economic Faculty, Universitas Gunadarma;

bagus@staff.gunadarma.ac.id

I pa t of I telle tual Capital o the Fir ’s Market

Value: The Mediation Role of Financial Performance (Empirical Study From The Indonesian Banking Companies since 2007-2011)

FINANCE

2 Andrea Widianti Maris1), Samuel David Lee2), Dr. Renny Nur’ainy3)

Accounting Department, Economic Faculty, Universitas Gunadarma

THE ROLE OF LEVERAGE IN THE EFFECT OF GOOD CORPORATE GOVERNENCE ON CORPORATE PERFORMANCE

FINANCE

3 Bambang Suko Priyono UNISBANK SEMARANG suko.pri@gmail.com

The Influence of Prospector and Defender Strategies on Performance

With Dimensions of Social Capital As Moderating

FINANCE

SCHEDULE PRESENTATION PAPER FOR INSYMA 10

Session 3 (14.00 - 15.00 WITA)

Room 4: Tabanan Room

4 Christina Yanita Setyawati

Ciputra University, Surabaya; csetyawati@ciputra.ac.id

Managing Global Business by Minimizing Rupiah Volatility

FINANCE

BAHASA

NO AUTHOR INSTITUTION TITTLE SUBJECT

1 R Ait Novatiani, Pondang Widyatama University,

Economics Faculty – Bandung, Indonesia;

aitnovatiani@yahoo.com

The Influence of Total Quality Management (TQM) Applications to Sales Raising at PT. Kereta Api Indonesia (Persero) Bandung The 2nd Operations Area

OPERATION

2 Choirum Rindah Istiqaroh Saraswati Budi Utami

Merdeka University, Madiun; choirum_ri@yahoo.co.id

ACTIVITY PERFORMANCE ANALYSIS OF SUPPLY CHAIN

PERFORMANCE OF ACTIVITY MODEL APPROACH

STUDY AT UKM KRIPIK BUAH KEBONSARI

OPERATION

3 Kabul WahyuUtomo & Lely Dahlia

Trilogi University Jakarta; lelydahlia@stekpi.ac.id

Increasing Wholesale Centers Role as Part of Supply Chain Management of SMEs

OPERATION

4 Yetty Dwi Lestari, MT UNAIR; yettydl76@yahoo.com. IMPROVEMENT BANK CUSTOMER SATISFACTIONWITH SERVICE QUALITY

OPERATION

Session 3 (14.00 - 15.00 WITA)

Room 5: Amlapura Room

BAHASA

NO AUTHOR INSTITUTION TITTLE SUBJECT

1 Victor Wianto Agus Zainul Arifin

MM, Tarumanagara University Jakarta

agusza1808@gmail.com

PLACEMENT EFFECTIVENESS OF AUTOMATIC TELLER MACHINE ON INDONESIAN PRIVATE

BANKING

OPERATION

2 Wasifah Hanim University of Widyatama Bandung; E-mail:

wasifah.hanim@widyatama.ac.id

MODEL PENGEMBANGAN KLASTER BISNIS PADA USAHA MIKRO, KECIL DAN MENENGAH

OPERATION

3 Agustine Eva Maria Soekesi

Unika Soegijapranata Semarang; eva_agt@yahoo.com

PRODUCT QUALITY CONTROL PROFILE ON LASEM BATIK CENTRE

OPERATION

4 Agustine Eva Maria Soekesi; Meniek Srining Prapti; Inneke Hantoro; Alberta Rika Pratiwi

Unika Soegijapranata Semarang; eva_agt@yahoo.com

THE EXISTING MODEL IDENTIFICATION OF CURCUBITA Sp (YELLOW PUMPKIN) AGRO INDUSTRY SUPPLY CHAIN MANAGEMENT IN GETASAN SUB-DISTRICT, SEMARANG REGENCY

OPERATION

Moderator : Christina Honanta, S.E., M.M.

SCHEDULE PRESENTATION PAPER FOR INSYMA 10

BAHASA

NO AUTHOR INSTITUTION TITTLE SUBJECT

1 Kazia Laturette International Business

Accounting, Ciputra University klaturette@Ciputra.ac.id

Impact of Acquisition of PT. Indosiar Karya Media, Tbk by PT. Elang Mahkota Teknologi, Tbk

STRATEGIC

2 Maulana & Sardiyo STIE –STMIK MURA Lubuklinggau;

maulana_57@ymail.com

ANALYSIS EFFECT OF INCENTIVE AND COMPETENCY TO THE WORKING PERFORMANCE OF EMPLOYEES AT SMART MANAGEMENT CONSULTANT PALEMBANG

HRM

3 Ayu Septirini & Agus Frianto Department of Management, Faculty of Economic UNESA; frianto75@gmail.com

INFLUENCE OF JOB MOTIVATION AND JOB SATISFACTION ON EMPLOYEE PERFORMANCE IN ASURANSI JIWA BERSAMA (AJB) BUMIPUTERA 1912

SURABAYA REGIONAL OFFICE

HRM

4 Didik Hadiyatno Misna Ariani

Faculty of Economics, University of Balikpapan

didikhadiyatno@yahoo.co.id

Effect of Competence, Training, Motivation Employee Performance Against PT Thiess Contractors Indonesia at

Balikpapan

HRM

SCHEDULE PRESENTATION PAPER FOR INSYMA 10

Session 4 (15.00 - 16.00 WITA)

Room 1: Denpasar Room 1

BAHASA

NO AUTHOR INSTITUTION TITTLE SUBJECT

1 M.Sienly Veronica Maranatha Christian University Bandung; lee_pingping@yahoo.com

ANALYSIS THE INFLUENCE OF MACRO ECONOMIC FACTORS AND FINANCIAL COMPANY PERFORMANCE TO BUILD A BANKRUPTCY PREDICTION MODEL (STUDY AT LISTED COMPANIES IN IDX FOR YEAR 1999-2010)

FINANCE

2 I Gede Cahyadi Putra Mahasaraswati University Denpasar; cahy4dini@yahoo.com

The Effect of Age, Level of Education, Work Experience and Business Type on the Audit Delay Public Accountant in Bali

FINANCE

3 Rima Rachmawati & Priska Amelia

Faculty Economy at Widyatama University-Indonesia;

rachmawati.rima@yahoo.com

EFFECT CAPITAL ADEQUANCY RATIO (CAR) AND NON PERFORMING LOAN (NPL) ON RETURN

ON ASSET (ROA) BANKING IN INDONESIA (Survey on Indonesia Stock Exchange /IDX)

FINANCE

4 Olivia Idrus & Lely Fera FE Open University The Influence of Company's Concentration of Ownership Toward The Quality Of Corporate Governance's Implementation (Review of Corporate

Governance Perception Index)

FINANCE

Session 4 (15.00 - 16.00 WITA)

Room 2: Denpasar Room 2

Moderator : DR. Dedy Marciano

SCHEDULE PRESENTATION PAPER FOR INSYMA 10

Session 4 (15.00 - 16.00 WITA)

BAHASA

NO AUTHOR INSTITUTION TITTLE SUBJECT

1 Panji Aditya Evindo & Nadia Asandimitra Haryono

Faculty of Economics, UNESA, nadiaasandimitra@gmail.com

A COMPARATIVE STUDY ON RETURN STOCKS BETWEEN VALUE STOCKS AND GROWTH STOCKS IN THE GO PUBLIC

COMPANIES AT THE INDONESIAN STOCK EXCHANGE (Period of 2006-2010)

FINANCE

2 Siti Puryandani STIE BANK BPPD, Semarang; sitipuryandani@yahoo.com

ANALYSIS OF FACTORS THAT INFLUENCE CAPITAL STRUCTURE AND TEST DIFFERENT CAPITAL STRUCTURE IN FINANCIALLY CONSTRAINED (FC) AND NON FINANCIALLY CONSTRAINED (NFC)

FINANCE

3 Ni Wayan Rustiarini Mahasaraswati University Denpasar; rusti_arini@yahoo.co.id

FIRM CHARACTERISTICS, INTELLECTUAL CAPITAL,

AND ENVIRONMENTAL PERFORMANCE (EMPIRICAL EVIDENCE FROM LISTED COMPANIES IN INDONESIA)

FINANCE

4 Dheo Rimbano, Sardiyo, Maulana

STIE – MURA Lu ukli ggau;

maulana_57@ymail.com

THE INFLUENCE OF FINANCIAL PERFORMANCE {EPS (EARNING PER SHARE), PER (PRICE EARNING RATIO), DPR (DEVIDENT PAYOUT RATIO), ROE (RETURN ON EQUITY) AND ROA (RETURN ON ASSETS)} TO SHARE PRICE INDEX

FINANCE

Room 3: Gianyar Room

Moderator : Dra.ec. Liliana Inggrit Wijaya, M.M.

BAHASA

NO AUTHOR INSTITUTION TITTLE SUBJECT

1 Sugiartiningsih Widyata a U iversity – Ba du g

– I do esia;

bu.sugiartiningsih@yahoo.com

THE EFFECT OF ECONOMIC GROWTH ON THE NUMBER OF POOR PEOPLE IN INDONESIA, PERIOD 1994-2010

FINANCE

2 Rosemarie Sutjiati

rosemarie.sutjiati@yahoo.com; Maranatha Christian Univ

The Effect of Financial Ratios to Stock Price in Several Companies listed in SRIKEHATI Group in Indonesia Stock Exchange

FINANCE

3 Sutama Wisnu D & Budi Astuti Master of Management, Islamic University of Indonesia Condong Catur Sleman Yogyakarta;

twotiebudi@yahoo.com

Effect Of Application Corporate Social Responsibility On Image PT . Antam Unit Pascatambang Kijang

FINANCE

4 Etty Soesilowati & Sri Utami

Economics Faculty, Semarang State University;

ettysoesilowati@yahoo.com

POLICY INTEGRATION FOR HOUSEHOLD WASTE MANAGEMENT

THROUGH ESTABLISHMENT OF WASTE BANK

FINANCE

BAHASA

NO AUTHOR INSTITUTION TITTLE SUBJECT

Moderator : Dra.ec. Endang Ernawati, M.M.

SCHEDULE PRESENTATION PAPER FOR INSYMA 10

Session 4 (15.00 - 16.00 WITA)

Room 5: Amlapura Room

1 Lely Dahlia Trilogi University Jakarta; lelydahlia@stekpi.ac.id

Cooperative Entrepreneurship Paradigm as the Pattern of Cooperative Improvement

toAlleviate Poverty in KulonProgo Regency, 2013

OPERATION

2 Ellen Puspitasari, Ceacilia Srimindarti

Faculty of Economy University of STIKUBANK Semarang;

elenmeiranto@yahoo.com

THE PERCEPTION OF ADOPTING AN INFORMATION TECHNOLOGY INNOVATION

ON THE RURAL BANKS OWNED BY LOCAL GOVERNMENT

OPERATION

3 Fidelis Arastyo Andono & Fandy San

Accounting/Faculty of Business and Economics Surabaya University;

nino.a.andono@gmail.com

MALMI AND BROWN’S MANAGEMENT

CONTROL SYSTEM IN PRODUCTION AREA

OPERATION

4Ratna Widiastuti Management Program, Faculty of Economy, Maranatha Christian University; ratna_wid@yahoo.com

Total Quality Management in Education (TQME): Prospective Strategy for University

OPERATION

BAHASA

SCHEDULE PRESENTATION PAPER FOR INSYMA 10

Session 4 (15.00 - 16.00 WITA)

Room 6 : Bangli Room

NO AUTHOR INSTITUTION TITTLE SUBJECT

1 Moh. Rofik, Nindria Untarini, Yessy Artanti

Department of Management, Faculty of Economic,

UNESA. Email: yessy.artanti@gmail.com

PERCEPTION OF ACCEPTANCE KOMMUTER TRAIN SIDOARJO-SURABAYA ROUTE TO WORK PLACE AS ALTERNATIVE CHOICE ON PUBLIC TRANSPORTATION

WITH PLANNED BEHAVIOR THEORY

OPERATION

2 Christina Esti Susanti Widya Mandala Catholic University;

susantiesti@yahoo.com

INFLUENCE OF TRUST IN SUPPLIER AND TRUST IN BRAND ON THE PURCHASE AND

ATTITUDINAL LOYALTY FOR RETAILER AT PT SINAR SOSRO IN SURABAYA

OPERATION

3 Anita Wongso UBAYA

anita_wongso@yahoo.com

Activity Complaint Handling the Engineering Department Novotel Surabaya Hotel & Suites

OPERATION

4Samuel David Lee, Pandam Rukmi Wulandari ,Aris Budi Setyawan

Faculty of Economic, Accounting Departement, Gunadarma University. Email: pandam@staff.gunadarma.ac.id; samueldavidlee@ymail.com;

renny@staff.gunadarma.ac.id

EFFECTIVENESS OF IT GOVERNANCE IN BANKING SECTOR

The Effect of Financial Ratios to Stock Price in Several Companies listed in

SRIKEHATI Group in Indonesia Stock Exchange

Rosemarie Sutjiati Njotoprajitno

Maranatha Christian University

Abstract

Now adays most or maybe all company's goal is to improve their values which are shown in stock prices. This paper tries to examine the effects of factors which affect the stock price. This paper tries to study the effect of profitability (ROE), liquidity (CR), leverage (DER, DAR), EPS, and dividend policy (DPR) to stock price in the selected group of Indonesia stock market. The group of companies examined selected from the SRIKEHATI group in Indonesian stock market. This group is formed to adopt the sustainability issues that nowadays become public concern. About how the companies in the groups attain these criteria is not discussed in the paper. The study used quantitative approach. When the statistical process was executed, CR and DER variables have to be expelled since they didn’t pass the statistical test. The result show that ROE didn’t have significant effect to price while DAR, DPR, and EPS have significant effect to stock price which suggested that improvement in these financial ratios can be used as the media to improve stock price in SRIKEHATI listed companies.

Keywords: Profitability, liquidity, leverage, dividend policy, stock price

Introduction

In the past when someone were asked what is the purpose of the establishment of a

company then the answer is to get the largest possible profits that can be obtained. At the

present time, there is a slight shift in which the main objective of the establishment of a

company is to increase the value of the company itself. The value of the company can be

described from the price of the stock of the company itself. Therefore the management of the

company will continue to strive to improve its performance, correcting and improving the

various parts of the company in order to constantly improve the value of the company. The

success or failure of the company's management will be seen from how great the increase or

decrease in the value of the company. Financial ratios are often used as a measurement tool to

measure the improvement/decline of the company; therefore logically it should be directly

proportional to the increase/decrease in the company's stock price. This paper tries to study

policy (DPR) to stock price in the selected group of Indonesia stock market. The group of

companies examined selected from the SRIKEHATI group in Indonesian stock market. This

group is formed to adopt the sustainability issues that nowadays become public concern.

About how the companies in the groups attain these criteria is not discussed in the paper.

There are several theory and research about the relation of financial ratio selected

with stock price that might be different one to another. Basically, companies sell stock to

public to raise funds needed in their operational, investments, and other purpose. The shares

in circulation tend to rise or fall because some internal factors such as the company's

performance and other external factors or even simply because the supply and demands

activities. There are a lot of speculations how the performance of a company might effect to

stock price. Chandra (2009:197) stated that when properly combined, financial ratios may be

used to assess corporate excellence, judge creditworthiness, predict bankruptcy, and value

equity shares.

Return on equity shows how much return can be gained from the money brought by

the shareholders to the company. Logically investors would prefer company with higher ROE

since it shows promise of future profit for the investors. Martaniet.al. (2009:50) stated that

ROE (Return on equity), has significant positive correlation with return. A higher ROEshows

that the firm can earn higher return on shareholder’s equity. A higher ROE also indicates a higher efficiencyin spending money invested by shareholder to earn profit growth. Karaca

and Savsar (2012:62) research also shows that ROE have significant relation with firm value

with negative directions.

Khan (2012:18) shows the significant positive relation between Cash Dividend,

Retention Ratio and Return on Equity with Stock Market Prices while Earnings per Share and

Stock Dividend have negative and statistically insignificant relationship with Stock Market

Prices. About the leverage, Zhou (2008:160) shows that in market level, leverage can be both

statistically and economically important to options pricing. While Modigliani and Miller

(1958) shows that capital structure has no effect to the value of a company. Adami et. al.

(2010:21) stated that returns have a negative, albeit small, relation with leverage in all the

three models used for the estimation. It means an increase in leverage means a slight decline

in price. Hamada (1972) shows that if leverage is rising then price is rising as well, while

Earning per Share and dividends also directly shows the profit of the company and the

dividends which will be distributed to investors. Higher EPS shows that the company has

high capability to earn profit. While about dividend higher dividends will attract investors

that expect to gain profit from dividends while lower ones is assumed to be reinvested and

achieve capital gain. Miller and Modigliani (1961) proved that dividends are not relevant in

determining the value of a company (the theory assumes a world without taxes or transaction

cost, and investors having rational and having the same expectations). It means according to

their theory, a company values is not affected (independent) by dividends. About the

dividend policy, Brigham and Houston (2009:458) use formula Po= D1/(rs-g) that shows if a

company increase dividend payout ratio it will raise D1, which taken alone will cause the

stock price to rise, but at the same time it means less money will be available for

reinvestment and cause expected growth to decline and will tend to lower stock price. This

means dividends policy can be like double-edged sword which need to be considered fully.

These researches, to a larger extent, put attention on how these financial ratios

examined can affect stock price in the SRI KEHATI group and to what extent. There is still a

lot of difference result and theory about the relation of these ratios to stock price up till this

day. Since stock price is an important part to describe companies' values then this study

hopefully can give useful view to the companies to better improve the performance.

Research Methods and Data Collection

There are independent variables such as Return on Equity (ROE), Current Ratio (CR),

Debt to Equity Ratio (DER), Debt to Asset Ratio (DAR), Earning per Share (EPS), and

Dividend Payout Ratio. The dependent variable is Stock Price. The method used is

quantitative method. Quantitative method is done through collecting numeric data, process it

and analyze it in order to acquire scientific information of the numeric data (Martono,

2010:19). The information process is using SPSS programs. The data is collected from all the

go public companies listed in SRI KEHATI group in Indonesian stock market. This group

believed to be a group of company that has a good sustainability practices that represent

nowadays concerns. The data is secondary data from IDX sites collected from 2008-2011

Operational Definition of Variables

This part describes the operational definition for independent and dependent variables

that is discussed in the paper:

1. Profitability

Profitability describes the capability of the company to be profitable or to generate

money. Profitability ratio is the most frequently used financial ratio. Investors and

other parties tend to look at past profitability data and projects future profitability of a

company as their primary basis. They mostly put more attention to the ability of the

company to earn future profits and tend to use analysis that represents this.One of the

ratios of profitability used in this paperis Return on Equity (ROE) measuring the

return of the money investors put into a company. ROE is calculated in the following

way:

The most important goal of company's management is to maximize returns for its

stockholders, about this Rich et.al. (2010:646) stated that although the link between a

corporation's net income and increases in dividends and share price return is not

perfect, the return on equity ratio is still an effective measure of management

performance for the stockholders. It is the underlying assumption that the ratio of

ROE becomes one of the factors that determine the rate of return and stock price.

2. Liquidity

Liquidity ratio is a ratio that measure the capability of a company to pay their

lliability especially short term financial commitments as they become due and it is an

important measure of financial health. Sinha (2009:90) stated that the importance of

short-term liquidity can be felt from the repercussions of the claimants when a firm

fails to meet its obligations, and lack of sufficient liquidity prevents a firm from

taking advantage of favorable discounts or profitable opportunities. Further, shortage

of liquidity means limited opportunities and having constraints within management

work. The ratio used to represent liquidity in this paper is Current Ratio (CR). Current

ratio is the most basic liquidity test that can show the user whether a company has

enough current assets to meet its short term liabilities as they become due.

Current Ratio is calculated in the following way:

Sinha (2009: 93-94) stated that there are merits of current ratio such as:

a. It is able to measure how adequately current abilities are covered. The greater

the ratio, the greater the assurance can be given for meeting the current

liabilities.

b. This ratio indicates the degree of buffer against losses. The larger the ratio, the

larger is the buffer, and the lower is the risk. It helps in signifying the degree

of safety for covering shrinkage in values of non-cash current assets.

c. It shows the volume of liquid assets available as margin of safety against

uncertain shocks to firm from unexpected circumstances.

3. Leverage

Leverage is also an important measure of a company's financial health. Leverage can

describe a company financing methods. This paper use Debt to Asset Ratio (DAR)

and Debt to Equity Ratio (DER) to represent leverage. DAR or simply called debt

ratio Shows Company's debt percentage compared to total asset. DER is one of the

most important leverage ratios that describe how much is company is financed by

debt holders compared to owners (stockholders). DAR and DER is calculated in the

following way:

Morrell (2007:71) stated that DER is still considered one of the most important ratio

for an assessment of risk and solvency, although some analyst now rely more on the

less problematical interest cover. He stated that ideally net debt to equity should be

calculated, but some resources only allow the more traditional debt/equity to be

higher the lender's own investment (relative to the actual investment by the business's

owners) the riskier is the investment and the less interested they will be in loaning

money while at the owners perspective often seek to maximize their financial leverage

and create total liabilities to total equity ratios in excess of 1.00. The same also goes

for DAR which investors favor more debt while lenders favor less debt to ensure the

safety of loan payment.

4. Earning per Share

Earning per share (EPS) measure how much money earned by each share of stock.

Investors tend to put high attention to EPS. EPS can determine the success or failure

of a company and their ability to pay dividends to stockholders. EPS is calculated in

the following way:

5. Dividend Policy

Dividend policy might be different between companies. Companies that have high

growth rate usually have lower dividends pay rate than a companies that have lower

growth rate. Dividend policy might also differ according to the age of the companies;

younger companies might offer no dividends or low dividends policy. While most

people might prefers company who regularly pay high dividends from time to time

since the company is assumed to be a good one, Moles et.al. (2011:671) argues that it

doesn’t seem that simple, he argue that the companies that pays high dividends might did it because they already have more than enough money for all their future

investments opportunities (while they have a good future investment opportunities).

Or they pay high dividends because doesn't need much money because they have no

future investment opportunities. The second reason shows a bad signal of a company

future growth.

6. Stock Price

The stock price of a company doesn't directly have the same meaning with a company

value. First we have to multiply the stock prices with number of shares in circulation.

Examining stock price movements and the number of shares in circulation can shows

the growth of a company and many other things. But there are also cases of

make high profit or actually in a bad shape. Factors that surely affect stock price

movement is still become concern for many people.

Research Models

The analytical method used in this research is the analysis of linear regression

formulated as follows:

Y = a+b

1X

1+ b

2X

2+b

3X

3+b

4X

4+b

5X

5+b

6X

6Y = variable price X1 = variable ROE X2 = variable CR X3 = variable DER X4 = variable DAR X5 = variable Annual EPS X6 = variable DPR

a = Interception points b1-b5 = regression coefficient

Operation of Variable

1. Dependent variables (Y) is a logarithm transformation of price

2. X1 is a logarithm transformation of ROE

3. X2 is a logarithm transformation of CR

4. X3 is a logarithm transformation of DER

5. X4 is a logarithm transformation of DAR

6. X5 is a logarithm transformation of EPS

7. X6 is a logarithm transformation of DPR

Hypothesis

Based on the problems hypothesis is as follow:

1. Hypothesis 1: Return on Equity (ROE) has a positive and significant effect on stock

price of companies examined.

2. Hypothesis 2: Current Ratio (CR) has a positive and significant effect on stock price

of companies examined.

3. Hypothesis 3: Debt to Equity Ratio (DER) has a positive and significant effect on

4. Hypothesis 4: Debt to Asset Ratio (DAR) has a positive and significant effect on

stock price of companies examined.

5. Hypothesis 5: Earning Price Ratio (EPS) has a positive and significant effect on stock

price of companies examined.

6. Hypothesis 6: Dividend Payout Ratio (DPR) has a positive and significant effect on

stock price of companies examined.

7. Hypothesis 7: ROE, CR, DER, DAR, Annual EPS, DPR simultaneously has a positive

and significant effect on stock price of companies examined

Statistical Tests

The statistical test of financial data being done through classical assumption stages:

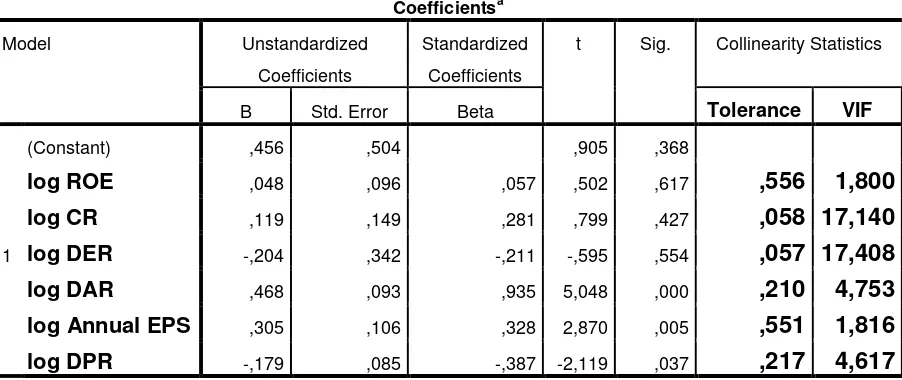

[image:34.595.75.526.373.563.2]multicolinearity test, normality test, heteroscedasticity test.

Table 1 MulticolinearityTest -Stage 1

Coefficientsa

Model Unstandardized Coefficients

Standardized Coefficients

t Sig. Collinearity Statistics

B Std. Error Beta Tolerance VIF

1

(Constant) ,456 ,504 ,905 ,368

log ROE ,048 ,096 ,057 ,502 ,617 ,556 1,800

log CR ,119 ,149 ,281 ,799 ,427 ,058 17,140

log DER -,204 ,342 -,211 -,595 ,554 ,057 17,408

log DAR ,468 ,093 ,935 5,048 ,000 ,210 4,753

log Annual EPS ,305 ,106 ,328 2,870 ,005 ,551 1,816

log DPR -,179 ,085 -,387 -2,119 ,037 ,217 4,617

a. Dependent Variable: log Price

The requirements of multicolinearity are VIF ≤ 10, Tolerance ≥ 0,1, and table 1 shows that from stages 1 test CR and DER didn’t pass the test and have to be abandoned. And the formula customized to:

Y = a+b

1X

1+ b

2X

2+b

3X

3+b

4X

4X1 = variable ROE X2 = variable DAR X3 = variable Annual EPS X4 = variable DPR

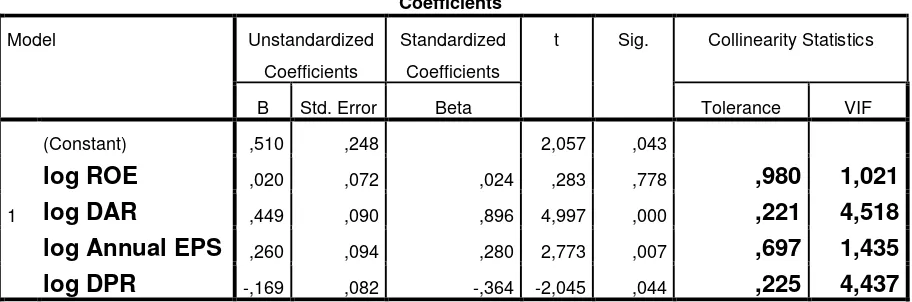

Table 2MulticolinearityTest -Stage 2

Coefficientsa

Model Unstandardized Coefficients

Standardized Coefficients

t Sig. Collinearity Statistics

B Std. Error Beta Tolerance VIF

1

(Constant) ,510 ,248 2,057 ,043

log ROE ,020 ,072 ,024 ,283 ,778 ,980 1,021

log DAR ,449 ,090 ,896 4,997 ,000 ,221 4,518

log Annual EPS ,260 ,094 ,280 2,773 ,007 ,697 1,435

log DPR -,169 ,082 -,364 -2,045 ,044 ,225 4,437

a. Dependent Variable: log Price

[image:35.595.153.443.331.504.2]The 2nd stage test shows that all variables pass the test and can be inserted to the next test.

Table 3 Normality -One-Sample Kolmogorov-Smirnov Test

Unstandardized Residual

N 96

Normal Parametersa,b Mean ,0000000 Std. Deviation ,19382548

Most Extreme Differences

Absolute ,078 Positive ,072 Negative -,078 Kolmogorov-Smirnov Z ,769 Asymp. Sig. (2-tailed) ,596

a. Test distribution is Normal. b. Calculated from data.

[image:35.595.72.528.608.754.2]Normality value is 0.596 (requirement sig value > 1%, 5%, or 10%) all variables pass the test.

Table 4 Heteroscedasticity test

Coefficientsa

Model Unstandardized Coefficients Standardized Coefficients

t Sig.

B Std. Error Beta

1

(Constant) -,728 2,293 -,318 ,751

log ROE -1,719 ,662 -,253 -2,598 ,011

log DAR -1,041 ,831 -,257 -1,253 ,213

log Annual EPS 1,201 ,868 ,160 1,382 ,170

a. Dependent Variable: ln

The test shows that all variables pass the test.

Results

[image:36.595.72.539.266.566.2]This following table shows the result of data process:

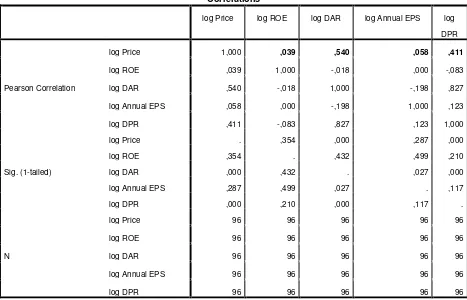

Table5 Correlations Statistics

Correlations

log Price log ROE log DAR log Annual EPS log

DPR

Pearson Correlation

log Price 1,000 ,039 ,540 ,058 ,411

log ROE ,039 1,000 -,018 ,000 -,083

log DAR ,540 -,018 1,000 -,198 ,827

log Annual EPS ,058 ,000 -,198 1,000 ,123

log DPR ,411 -,083 ,827 ,123 1,000

Sig. (1-tailed)

log Price . ,354 ,000 ,287 ,000

log ROE ,354 . ,432 ,499 ,210

log DAR ,000 ,432 . ,027 ,000

log Annual EPS ,287 ,499 ,027 . ,117

log DPR ,000 ,210 ,000 ,117 .

N

log Price 96 96 96 96 96

log ROE 96 96 96 96 96

log DAR 96 96 96 96 96

log Annual EPS 96 96 96 96 96

log DPR 96 96 96 96 96

The results show partial effect of:

ROE to Price = 0,0392. 100% = 0,15%. (not significant and can be ignored)

DAR to Price = 0,5402. 100% = 29,16%.

Annual EPS to Price = 0,0582. 100% = 0,34%.

DPR to Price = 0,4112. 100% = 16,89%.

Model R R Square Adjusted R Square

Std. Error of the Estimate

1 ,593a ,352 ,323 ,19804

a. Predictors: (Constant), log DPR, log ROE, log Annual EPS, log DAR

b. Dependent Variable: log Price

[image:37.595.137.457.73.150.2]Simultaneously Effect = 0,323 or 32,3%

Table 7 ANOVAa

Model Sum of Squares df Mean Square F Sig.

1

Regression 1,937 4 ,484 12,348 ,000b

Residual 3,569 91 ,039

Total 5,506 95

a. Dependent Variable: log Price

b. Predictors: (Constant), log DPR, log ROE, log Annual EPS, log DAR

Simultaneously test proved to be having an effect and significant which it means the

[image:37.595.71.499.224.368.2]hypothesis of the research accepted. Sig value (0,000) < α (1%,5%, or 10%)

Table 8 Results

Coefficientsa

Model Unstandardized Coefficients

Standardized Coefficients

t Sig.

B Std. Error Beta

1

(Constant) ,510 ,248 2,057 ,043

log ROE ,020 ,072 ,024 ,283 ,778

log DAR ,449 ,090 ,896 4,997 ,000

log Annual EPS ,260 ,094 ,280 2,773 ,007

log DPR -,169 ,082 -,364 -2,045 ,044

Regression Formula

Y = a+b1X1 + b2X2+b3X3+b4X4

= 0,510 + 0,020 X1 + 0,449 X2 + 0,260 X3 - 0,169 X4

Y = log (price)

X1 = log (ROE)

X2 = log (DAR)

X3 = log (Annual EPS)

X4 = log (DPR)

a = 0,510 it means when X= 0, then Y (price) = 0,510

b1 = When log (ROE) increase by 1 point, then log (price) increase 0,020

b2 = When log (DAR) increase by 1 point, then log (price) increase 0,449

b3 = When log (Annual EPS) increase by 1point, then log (price) increase 0,260

b4 = When log (DPR) increase by 1 point, then log (price) decrease 0,169

Partial test shows:

Sig log (ROE) = 0,778- > α (1%,5%, or 10%), then research hypothesis is declined, partially

ROE didn’t have significant effect to price.

Sig log (DAR) = 0,000 < α (1%,5%, or 10%), then research hypothesis is accepted, partially DAR have a significant effect to price.

Sig log (Annual EPS) = 0,007 < α (1%,5%, or 10%), then research hypothesis is accepted, partially annual EPS have a significant effect to price.

Sig log (DPR) = 0,044 < α (5%, or 10%), then research hypothesis is accepted, partially DPR have a significant effect to price but whit negative sign.

ROE didn’t have significant effect to price in the SRI KEHATI group this is different

from the previous research and theory mentioned above.This could be affected by the fact

that companies that are in the group are composed of companies of diverse kinds. DAR has

significant effect to stock price. The finding about leverage has the opposite result with

Adami et. Al (2010:21) result mentioned above but somehow consistent with capital structure

theory which show that financing risk imposed by leverage will be rewarded with higher

be a positive sign toward investment and growth. The companies in the group which is a

assumedly as a sustainable companies believed to have strength and long term lifespan makes

the investors attracted while off course there is still limitation on how much the debt can give

this effect. If somehow the debt is pass certain optimum point then the fact could be reversed.

The length of the leverage is not examined here and need further study but it is believed that

the difference of the length of leverage can give opposite effect to stock price.

EPS have significant effect to stock price. This is the same with the other research or

theory mentioned above. Stock price will rise whenever EPS is rising. It also shows that

investors put attention to EPS in their decision.DPR have a significant negative effect to price

it could be means that investors in this group tends to prefer capital gains rather than

dividends.

The variables examined simultaneously shows significant effect to price and therefore

companies need to pay attention to improve their performance in order to shape the financial

ratio in a better form that can attract investor and improve company's value.

Conclusions and Limitations

From the statistical results shows that the variable ROE didn’t have significant effect to stock price, while variables DAR, annual EPS and DPR have significant effect to stock

price. Simultaneously, these variables show important meaning in determining stock price

and company values and therefore need to be considered more. This research also shows the

movement of stock price is also influenced by other factors that is not examined since it

simultaneously effect is 32.3%. Further researches that examine other factors are needed in

order to better describe the movement of stock price. Since SRI KEHATI group is composed

of companies of diverse kinds, further research that sort out these companies absolutely

essential.

Reference

Adami, R., Gough, O., Muradoglu, G., and Sivaprasad, S. (2010).The Leverage Effect on Stock Returns .Social Science Research Network. P 1-34. http://ssm.com /abstract=1690183 (access: 27 February 2013)

Chandra, Prasanna (2009). Investment Analysis and Portfolio Management. New Delhi: Tata McGraw-Hill Education Private Limited.

Dimitrov V and Jain P C (2008). The Value Relevance of Changes in Financial Leverage Beyond

Growth in Assets and GAAP Earnings. Journal of Accounting, Auditing and Finance

191-222.

Dopson, L.R. and Hayes, D.K. (2008).Managerial Accounting for the Hospitality Industry. New Jersey: John Wiley and Sons.

Hamada R S (1972). The Effect of the Firm’s Capital Structure on the Systematic Risk of

Common Stocks.Journal of Finance 27(2) 435-452.

Karaca, S.S. and Savsar, A. (2012).The effect of Financial Ratios on the Firm Value: Evidence from Turkey1. Journal of Applied Economic Sciences.Vol 7(2012), 55-63.

Khan, K.I. (2012). Effect of Dividends on Stock Prices – A Case of Chemical and Pharmaceutical Industry of Pakistan. Proceedings of 2nd International Conference on Business Management.(ISBN: 978-969-9368-06-6), 1-23

Martani, D., Mulyono, and Khairuruzka, R. (2009). The Effect of Financial Ratios, Firm Size, and Cash Flow from Operating Activities in the Interim Report to the Stock Return.Chinese Business Review, Jun. 2009, Volume 8, No.6 (Serial No.72), 44-55

Martono, N. (2010). Metode Penelitian Kuantitatif. Jakarta: PT Rajagrafindo Persada.

Miller, M. H. and Modigliani, F. (1961). Dividend Policy, Growth and the Valuation of Shares. Journal of Business, 34, 411-33.

Modigliani, F. and Miller M. H. (1958). “The Cost of Capital, Corporation Finance and the

Theory of Investment.”American Economic Review 48(3), 261–297.

Moles, P., Parrino, R. and Kidwell, D. (2011). Corporate Finance. UK: John Wiley & Sons Ltd.

Morrell, P.S. (2007). Airline Finance 3rd eds. England and USA: Ashgate Publishing Limited and Ashgate Publishing Company.

Rich, J.S., Jones, J.P., Mowen, M.M., and Hansen D.R. (2010). Cornerstone of Financial Accounting. USA: South-Western Cengage Learning.

Sinha, G. (2009). Financial Statement Analysis. New Delhi: Asoke K. Ghosh, PHI Learning Private Limited.

Zhou, Yi. (2008). Leverage, Asset Pricing and Its Implications. Los Angeles: University of California.

Financial Report Date September 2009-2010-2011

KODE TAHUN ROE CR DER DAR Annual EPS DPR Price

(%) (%) (Rp) (%)

AALI

2008 76.60 194.42 0.23 0.18 1,670.76 30.23 9,800.00 2009 40.16 182.58 0.18 0.15 1,054.55 85.82 22,750.00 2010 41.10 193.17 0.19 0.15 1,280.70 64.81 26,200.00 2011 39.55 130.97 0.21 0.17 1,586.65 62.71 21,700.00

ADHI

2008 20.97 113.25 7.75 0.88 45.23 25.44 270.00 2009 45.37 115.15 6.69 0.87 91.89 30.75 410.00 2010 37.26 121.37 4.71 0.82 105.19 30.75 910.00 2011 32.96 119.33 5.17 0.84 101.37 29.92 580.00

AKRA

2008 24.31 99.67 1.81 0.60 67.20 31.25 720.00 2009 26.89 95.87 2.20 0.63 87.54 28.56 1,170.00 2010 17.60 104.79 2.01 0.63 81.97 203.73 1,730.00 2011 20.70 135.73 1.32 0.57 133.75 168.22 3,025.00

ANTM

2008 23.93 801.65 0.26 0.21 143.43 40.07 1,090.00 2009 9.62 727.31 0.21 0.18 63.35 40.06 2,200.00 2010 23.72 381.77 0.28 0.22 176.49 40.07 2,450.00 2011 23.85 1,064.23 0.41 0.29 201.79 45.09 1,620.00

ASII

2008 46.44 132.17 1.21 0.50 2,270.30 38.32 10,550.00 2009 41.11 136.88 1.00 0.45 2,480.02 33.47 34,700.00 2010 42.65 126.18 1.10 0.48 3,548.60 13.24 54,550.00 2011 33.98 136.40 1.02 0.51 5,273.25 37.55 74,000.00

BBCA

2008 33.16 110.47 9.55 0.91 234.28 42.68 3,250.00 2009 32.11 110.94 9.14 0.90 276.10 39.84 4,850.00 2010 31.23 111.75 8.51 0.89 343.92 32.71 6,400.00 2011 32.40 112.37 8.09 0.89 436.84 35.94 8,000.00

BBNI

2008 12.52 108.30 12.07 0.92 80.04 10.00 680.00 2009 17.99 118.31 10.88 0.92 162.63 35.00 1,980.00 2010 16.56 115.39 6.50 0.87 219.95 30.00 3,875.00 2011 19.72 114.49 6.90 0.87 321.26 19.45 3,800.00

BBRI

2008 39.46 109.99 10.01 0.91 483.43 34.92 4,575.00 2009 36.29 109.41 10.63 0.91 592.73 22.28 7,650.00 2010 40.65 109.98 10.02 0.91 930.10 12.47 10,500.00 2011 37.65 111.86 8.43 0.89 620.07 19.72 6,750.00

BDMN

2009 30.83 109.82 10.23 0.91 341.22 5.65 4,700.00 2010 33.63 110.32 9.81 0.91 439.04 31.94 6,500.00 2011 26.35 112.81 7.81 0.89 534.83 19.63 6,750.00

INDF

2008 30.59 89.77 3.11 0.67 117.81 39.90 930.00 2009 40.02 116.09 2.45 0.62 236.42 39.34 3,550.00 2010 32.37 203.65 1.34 0.47 336.30 39.55 4,875.00 2011 20.10 190.95 0.70 0.41 571.43 30.62 4,600.00

INTP

2008 27.44 178.57 0.33 0.24 474.16 31.63 4,600.00 2009 35.54 300.55 0.24 0.19 746.12 30.16 13,700.00 2010 32.49 555.37 0.17 0.15 876.05 30.02 15,950.00 2011 29.92 698.54 0.15 0.13 978.35 29.95 17,050.00

ISAT

2008 13.36 90.49 1.95 0.66 345.70 50.00 5,750.00 2009 12.43 54.63 2.05 0.67 275.72 0.00 4,725.00 2010 6.06 51.55 1.94 0.65 119.10 50.00 5,400.00 2011 6.28 55.05 1.77 0.64 171.68 44.75 5,650.00

JSMR

2008 14.39 315.77 1.18 0.53 104.09 49.96 910.00 2009 15.23 115.64 1.17 0.52 145.98 60.22 1,810.00 2010 19.07 165.04 1.37 0.56 175.51 60.22 3,425.00 2011 18.68 106.05 1.32 0.57 194.35 40.59 4,200.00

KLBF

2008 32.52 333.35 0.38 0.24 69.60 17.96 400.00 2009 34.13 298.70 0.39 0.26 91.47 27.33 1,300.00 2010 32.95 439.36 0.23 0.18 126.66 55.27 3,250.00 2011 30.50 365.27 0.27 0.21 151.61 62.66 3,400.00

LPKR

2008 10.48 170.15 1.54 0.59 21.44 0.00 800.00 2009 10.78 177.34 1.40 0.56 22.43 0.00 510.00 2010 9.33 202.55 1.03 0.49 24.29 47.51 680.00 2011 10.47 206.31 0.94 0.48 25.13 31.00 660.00

LSIP

2008 41.50 170.06 0.54 0.35 679.74 30.60 2,925.00 2009 26.44 140.54 0.27 0.21 518.47 40.31 8,350.00 2010 30.34 239.27 0.22 0.18 757.25 8.06 12,850.00 2011 35.80 483.25 0.16 0.14 306.40 32.64 2,250.00

MEDC

2008 68.16 222.50 1.68 0.62 920.71 16.34 1,870.00 2009 7.13 155.40 1.85 0.64 54.44 0.00 2,450.00 2010 27.46 204.24 1.86 0.64 223.77 0.00 3,375.00 2011 42.49 160.52 2.02 0.67 1,323.48 0.00 2,425.00

PGAS

2008 18.11 217.65 2.47 0.69 27.60 151.24 1,860.00 2009 70.30 248.36 1.35 0.55 256.96 60.01 3,900.00 2010 58.14 343.40 1.22 0.53 257.38 60.00 4,425.00 2011 44.54 549.92 0.80 0.45 254.25 52.95 3,175.00 PJAA 2008 21.71 316.76 0.51 0.34 82.65 45.19 355.00

2010 17.87 200.00 0.47 0.31 88.60 46.84 840.00 2011 17.69 135.75 0.47 0.32 101.21 44.46 1,000.00

PTBA

2008 63.82 365.74 0.51 0.33 741.18 0.00 6,900.00 2009 65.98 491.23 0.40 0.28 1,183.84 45.06 17,250.00 2010 40.83 579.05 0.36 0.26 871.86 60.00 22,950.00 2011 49.71 463.25 0.41 0.29 1,339.27 60.03 17,350.00

SMGR

2008 44.48 338.58 0.30 0.23 425.45 50.58 4,175.00 2009 45.65 357.63 0.26 0.20 560.82 55.00 7,550.00 2010 39.33 29.17 0.29 0.22 612.53 50.00 9,450.00 2011 34.83 264.65 0.35 0.26 667.72 49.56 11,450.00

TINS

2008 55.20 262.41 0.51 0.34 2,667.10 4.99 1,080.00 2009 16.01 294.13 0.42 0.29 62.34 0.00 2,000.00 2010 26.82 323.67 0.40 0.29 188.34 50.00 2,750.00 2011 27.58 325.70 0.43 0.30 178.25 49.98 1,670.00

TLKM

2008 59.20 54.16 1.38 0.52 526.76 56.37 6,900.00 2009 57.32 60.58 1.22 0.49 526.76 51.25 9,450.00 2010 48.21 91.49 0.98 0.43 572.27 56.37 7,950.00 2011 34.20 95.80 0.69 0.41 767.91 48.32 7,050.00

UNTR

2008 34.60 163.62 1.05 0.51 799.77 40.01 4,400.00 2009 39.33 165.64 0.76 0.43 1,147.48 28.76 15,500.00 2010 31.37 156.59 0.84 0.46 1,164.13 50.68 23,800.00 2011 28.30 171.64 0.69 0.41 1,571.92 52.17 26,350.00

UNVR