Vol. 42 (2000) 385–404

Disclosing own subsidies in cooperative research projects

Maite Pastor Gosálbez

a, Joel Sandon´ıs D´ıez

b,∗aUniversitat Autònoma de Barcelona, C.E.U. San Pablo-Elx, Spain

bDepartamento de Fundamentos del Análisis Económico, Universidad del Pa´ıs Vasco, Avd. Lehendakari Aguirre 83, 48015 Bilbao, Spain

Received 25 February 1998; received in revised form 14 September 1999; accepted 29 September 1999

Abstract

This paper analyzes in a theoretical framework, including asymmetric information and uncer-tainty first, why firms participating in cooperative research projects may be interested in hiding information about own subsidies to their partners and second, whether the public disclosure of subsidies would be welfare improving. We show that the answers to those questions depend mainly on whether the efforts are strategic complements or substitutes and on the way in which the firms ex ante share the total expected profits from the project. © 2000 Elsevier Science B.V. All rights reserved.

JEL classification: D82; O31; O38

Keywords: Cooperative R&D; R&D subsidies; Public disclosure of subsidies

1. Introduction

Gaps between social and private incentives may lead to suboptimal levels of R&D, which justifies public intervention in the innovation process. Reasons for that divergence include the public good nature of R&D, implying that private firms can not fully appropriate the results of their R&D investments, the existence of economies of scope and scale in R&D, un-certainty over the results, asymmetries of information, or suboptimal diffusion of R&D out-puts. One way to overcome market failures is direct R&D subsidization. Another is to relax antitrust policies, allowing private firms to cooperate in R&D projects. The latter policy has been implemented in recent years in Europe, the USA and Japan and has received substantial attention in economic literature. Among others, we can mention Katz (1986), d’Aspremont and Jacquemin (1988), Kamien et al. (1992), Suzumura (1992) and Katsoulakos and Ulph

∗Corresponding author. Tel.:+34-4-6013823; fax:+34-4-6013774. E-mail address: [email protected] (J.S. D´ıez)

(1998). Some of the advantages of R&D cooperation are well known, such as internaliz-ing spillovers and facilitatinternaliz-ing the dissemination of proprietary firms’ know-how and R&D outputs. This enables firms to capture economies of scale, critical resources, skills or spe-cialization that they would be unable to obtain alone, to share risks and sunk costs, and to avoid needless duplication of efforts.

On the other hand, probably due to the huge amount of money used by governments to subsidize R&D projects, the effectiveness of those subsidies has been the subject of several empirical and theoretical works. Interestingly, many of these works report that the effect of subsidies on R&D efforts is weak. Among others we can mention Fölster (1995), Rubinstein et al. (1977) and Mart´ınew-Sánchez and Navarro (1991). In a theoretical paper, Kauko (1996) shows that the inefficiency of subsidies may reflect strategic oligopolistic behavior. He shows that not to apply for subsidies is a strategic commitment to non-aggressive behavior. In particular, firms may be willing to apply for subsidies mainly when they are not going to affect their R&D efforts significantly.

In other works, different kinds of R&D subsidies are compared. Pérez-Castrillo and Verdier (1993) show that in a perfect information context and from a budgetary point of view, a government prefers to subsidize R&D costs than to award an additional prize to the patent. However, Pérez-Castrillo and Sandon´ıs (1996) show that in cooperative R&D projects characterized by cost uncertainty, cost subsidies could negatively affect the incentives of the partners to share their know-how, while patent subsidies could be a help. Curiously, only cost subsidies are used in Europe.

Cooperative research and development programs, such as those encompassed by the European Union (EU) Technology Framework Program, have become well-established tools of European research policy. However, the EU is not the only institutional locus for European cooperative R&D. For example, Eureka was launched in 1985 as a pure intergovernmental mechanism following an initiative by the French government. It was formed by the six European Free Trade Association (EFTA) states and Turkey as well as by the EU states. Eureka allows governments to fund downstream, product-oriented, near-market cooperative projects without the restrictions placed by EU competition law on the Framework Program, which limits it to more upstream, generic precompetitive R&D (Peterson, 1993). Organizationally, Eureka is very simple. The central bureaucracy is kept to the barest minimum. Eureka exists only as a small secretariat, which serves no administrative function. Rather, periodic ministerial meetings approve projects for the Eureka ‘label’. Member States are then free to select approved projects to fund. States fund their own firms and no funding crosses borders (Watkins, 1991).

Interestingly, Peterson reports that a high percentage of the firms participating in Eureka projects complain about the fact that they do not know whether their partners are being subsidized by their own governments. Trying to explain that empirical observation one can observe, first, that Eureka’s loose rules on information exchange between governments make that lack of information possible. Second, it implies that, in many cases, the subsidized firms prefer to hide that information to their partners.

The remainder of the paper is organized as follows: Section 2 presents the model. Sections 3–5 solve the stage of efforts, analyze the participation decision and enter into firm 1’s disclosure decision respectively, for the case of efforts being strategic complements. Section 6 provides a numerical simulation for the case of strategic substitutes. Section 7 analyzes some welfare implications of the asymmetry of information. Finally, Section 8 concludes. All formal proofs are relegated to the Appendices A and B.

2. The model

We consider two symmetric, risk neutral firms denoted byi = 1,2. Firm iis located in countryi. They have the possibility to undertake a cooperative R&D project trying to obtain an innovation. LetV be the known present value of the innovation for each firm. For example, we can consider that the innovation will be sold in geographically separated markets, each of them earning those profits.

Firm 1 may receive with probabilityqa cost subsidy from its government that covers a fractionsof the total R&D costs of that firm.1 On the other hand, country 2 is assumed not to subsidize firm 2.

If firm 1 receives a subsidys, it may decide whether or not to disclose this private information to its partner. This information is assumed to be verifiable: firm 1 can always let firm 2 see the official documents granting the subsidy. However, we do not allow firm 1 to reveal in a credible way that it has no subsidy. In other words, firm 1 can always hide that it has a subsidy but it cannot credibly announce that it has one when this is not true. The announcement of a subsidy without showing the official documents has no signaling power since it has no cost for firm 1.

Let us denote by superscript R the case in which firm 1 has a subsidy and reveals it, by SN that it has a subsidy but it has not disclosed it, by NN that firm 1 has no subsidy (and it can not credibly disclose that information). On the other hand, only two possibilities exist for firm 2: either firm 1 reveals it has a subsidy, which we denote by R, or not, which we denote by N. In the last case, firm 2 cannot distinguish between the NN and SN cases, that is, it does not know whether firm 1 has no subsidy or it is hiding that information.

The probability of achieving the innovation depends on the efforts the two firms devote to the project. LetP (e1, e2)be the probability function, wheree1ande2 are the efforts

exerted by firms 1 and 2, respectively, ande1, e2 ∈ [0,1]. That function is assumed to

be increasing in both efforts. We will use the above notation to denote the equilibrium efforts in each of the possible situations regarding the disclosure of the subsidy. Effort is a non-verifiable variable, which implies the existence of a double moral hazard problem between the partners. Therefore, each firm will decide how much effort to put into the project in order to maximize own profits. We will distinguish two possibilities regarding the

strategic relationship between efforts. They can be either strategic complements or strategic substitutes. This characteristic will affect the total expected profits from the venture, the optimal behavior of the firms and, in particular, firm 1’s decision about whether or not to disclose the subsidy to its partner. We will analyze what the optimal decision is in both cases.

R&D costs are captured by the following increasing and convex cost function:2 c(ei)=

(ei)3 3 ,

On the other hand, if firm 1 receives a cost subsidys, its actual R&D costs are given by

c(e1)=(1−s) (e1)3

3 , (2.1)

wheres∈[0,1].

Now we can define the firm’s expected profits from the venture contingent upon the existence of the subsidy and firm 1’s disclosure decision. They are given by

E5NN1 =PeNN1 , eN2V − e

where the meaning of the superscripts is already known. Parameterq˜represents the condi-tional probability firm 2 assigns to firm 1 being subsidized when the latter has not disclosed that information. In order to define more accurately that conditional probability, let us de-note byt ∈(0,1)the probability that firm 1 discloses the subsidy. In particular,twill be 0 when firm 1 prefers not to disclose, 1 when it prefers to disclose and somewhere between 0 and 1 when it is indifferent between the two options. On the other hand, we have to consider firm 2’s beliefs only if firm 1 does not disclose the subsidy because, otherwise, the asym-metric information problem would disappear. Effectively, if firm 1 decides not to disclose the subsidy, firm 2 cannot distinguish whether firm 1 does not have a subsidy or simply is not interested in revealing its existence. In this case, firm 2 updates its beliefs by using the Bayes rule, resulting in the conditional probabilityq˜ =((1−t )q)/((1−t )q+(1−q)). Notice thatq˜ = 1 only ifq = 1, that is, if firm 1 receives the subsidy with probability

one. On the other hand,q˜ = 0 ift =1,that is, if firm 1 prefers to disclose the subsidy. Finally, ift =0 firm 1 prefers not to disclose the subsidy and therefore, not to receive an announcement is not informative for firm 2, implyingq˜=q.

Before the project starts, the partners must negotiate how to share the total expected profits from the project. Given that firm 2 only observes whether or not firm 1 discloses the subsidy, the total expected profits to be shared can only depend on that fact. Therefore, we must calculate the total expected profits as perceived by firm 2, thus taking into account the subsidy only if firm 1 reveals its existence. Notice that firm 1’s decision on whether or not to disclose the subsidy will depend, among other things, on how that decision affects firm 2’s expectation about the total expected profits and therefore, to the part of those profits each firm gets. Let us denote by

E5R=E5R1 +E5R2 (2.7)

and

E5N=(1− ˜q)E5NN1 + ˜qE5SN1 +E5N2 (2.8) the total expected profits from the project as perceived by firm 2 in case of disclosure and non-disclosure, respectively.

Therefore, before the project starts the partners negotiate how to share the total expected profits and we assume that, as a result, firm 1 gets a fractionλand firm 2 a fraction(1−λ) of those profits, withλ∈[0,1]. We considerλas an exogenous variable and do not make it depend on whether or not firm 1 discloses the subsidy. Otherwise, an interesting bargaining problem would arise, but this is outside the scope of this work. We are interested in analyzing firm 1’s incentives to disclose the subsidy for different values of the exogenous parameter λ.3

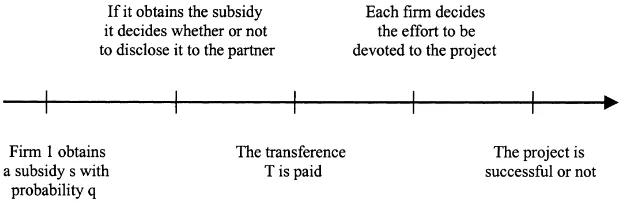

The timing of the game is as follows: in the first stage, firm 1 receives with probabilityq a cost subsidysfrom its government. If the subsidy is granted, in the second stage it decides whether to disclose that information to its partner. Next, a transfer payment takes place in order to share the total expected profits as agreed before. LetTAdenotes the transfer firm 2 pays to firm 1, where A=R if firm 1 disclosed the subsidy and A=N if it did not. A negative TAwould imply that it is firm 1 that pays the transfer to firm 2.

Now, we can define the actual expected profits for each firm, that is, taking into account the transfer payment. They are

E5¯R1 =E5R1 +TR, (2.9)

E5¯SN1 =E5SN1 +TN, (2.10)

E5¯NN1 =E5NN1 +TN, (2.11)

E5¯R2 =E5R2 −TR, (2.12)

E5¯N2 =E5N2 −TN. (2.13)

Fig. 1. Timing of the game.

In the fourth stage of the game, each firm chooses (simultaneously) the effort that maxi-mizes own profits. As a result, and only if the project is successful, they obtain the innovation. Fig. 1 displays the timing of the game.

We will obtain the subgame perfect Bayesian Nash equilibrium of the game, solving by backward induction in two different situations regarding the relationship between efforts, namely, either strategic complements or strategic substitutes. In Sections 3–5 we explicitly solve the game for the case of strategic complements. For the case of strategic substitutes, however, and given the complexity of the explicit expressions we obtain, a numerical sim-ulation illustrates this case in Section 6.

3. Stage of efforts

In the last stage of the game, each firm decides how much effort to exert in the project in order to maximize own expected profits. Notice that the transfer payment of the previous stage does not affect firms’ decisions on efforts at this stage. In this section, we will calculate the Nash equilibrium in efforts for the case of strategic complements.

If the efforts are strategic complements, an increase (decrease) in firmi’s effort is best responded with an increase (decrease) in firmj’s effort (in terms of reaction curves this implies they are positively sloped). In order to obtain explicit solutions we will use the following probability function:

P (e1, e2)=e1e2. (3.1)

This function could represent a situation in which the partners have complementary research abilities and they divide the project in (two) different parts, each firm undertaking the part in which it has a comparative advantage. Therefore, only if the two parts are successfully finished is the patent obtained. The following proposition shows the Nash equilibrium efforts.

Proposition 3.1. The Nash equilibrium in efforts for the case of strategic complements is

given by

e∗1R= V

(1−s)2/3, e

∗R

2 =

V

and

for the cases of disclosure and non-disclosure, respectively. Moreover, they satisfy

e2∗R> e∗2N, e1∗R> e1∗SN and e1∗SN> e∗1NN.

Proposition 3.1 shows4, first, that the equilibrium efforts are higher when firm 1 discloses the subsidy than when it does not. The reason is that under disclosure firm 2 infers a higher effort from its partner and therefore, its best response is also to exert a higher effort. As a result, both firms exert higher efforts in equilibrium. Second, that firm 1’s equilibrium effort is higher whenever it receives a subsidy, regardless of its disclosure decision. Finally, it is easy to check that firm 1’s expected profits increase with the size of the subsidy, because both its direct effect (that reduces firm 1’s R&D costs) as well as its strategic effect (that leads firm 2 to exert a higher effort), positively affect those profits.

The Nash equilibrium efforts calculated in this section allow us to calculate the total expected profits, each firm’s expected profits and the transfer payment. The next section goes into this question.

4. The transfer

Before choosing efforts, a transfer payment takes place in order the partners share the total expected profits of the project as agreed before, that is, firm 1 gets a fractionλof those profits and(1−λ)firm 2. Note that if firm 1 does not disclose it has a subsidy, the transfer is calculated using firm 2’s conditional beliefsq.˜ LetTArepresent the transfer firm 2 pays to firm 1 in case A, where A=N, R. It is calculated as the difference betweenλtimes the total expected profits and firm 1’s expected profits

TA=λE5A−E51A, A=N,R. (4.1)

Observe that the transfer may be either positive or negative, the latter case implying that it is firm 1 that pays the transfer to firm 2.

In the non-disclosure case, firm 2 infers lower total expected profits and firm 1’s expected profits than the actual ones because they are calculated as an average between the expected profits if firm 1 has a subsidy and if it has no subsidy. This fact allows firm 1 to strategically use its private information in order to extract, through the transfer payment, a greater share of the actual expected profits than the agreed proportionλ. In particular, for low values ofλ,

4A constraint on the values ofV andsis required to guarantee that 0< P (e

it is firm 1 that pays the transfer and this fact provides firm 1 with incentives not to disclose the subsidy in order to pay a lower transfer. On the other hand, for high values ofλ, it is firm 2 that pays the transfer and, therefore, it is in the interest of firm 1 to disclose the subsidy in order to receive a higher payment from firm 2. If the efforts are strategic complements and firm 1 has disclosed the subsidy, by direct substitution of the equilibrium efforts in (15) we obtain

TR= 2V

3

3(1−s)[2λ−1]. (4.2)

On the other hand, if firm 1 has not disclosed the subsidy, the size of the transfer will depend, among other things, on the conditional probabilityq˜. In this case, direct substitution of the equilibrium values in (15) results in

TN= 2V

3

3

1− ˜q+ q˜

(1−s)1/2 2

[2λ−1]. (4.3)

Notice that the transfer payments increase with both the subsidy and with the patent value. Moreover, for values ofλlower than 1/2,TRandTN become negative, implying that it is firm 1 that pays the subsidy in both cases. Finally, comparing both transfers we obtain that

TR−TNT0 if λT 1 2,

that is, from the point of view of the transfer stage and with strategic complements firm 1 has an incentive to disclose the subsidy only for high enough values ofλ.

In the following section, we will analyze firm 1’s optimal decision on whether or not to disclose the subsidy to its partner. In order to take this decision, the firm will take into account its effect on the transfer payment as well as on the equilibrium efforts.

5. The disclosure decision

If firm 1 receives a subsidys from its government, it has to decide whether or not to disclose that information to firm 2. In order to do that, it compares its actual expected profits if it discloses the subsidy,E5¯R1, and if does not,E5¯SN1 . Those profits depend on the strategic relationship between efforts and on the effect that disclosing has on the transfer. We will analyze the existence of pooling, separating and semiseparating equilibria.5

In a separating equilibrium, firm 2 believes that firm 1 prefers to disclose the subsidy and firm 1, given such beliefs, chooses to disclose the subsidy. Therefore, in a separating equilibrium it is satisfied

n

t =1, E5¯R1 ≥E5¯SN1 o.

In a pooling equilibrium, firm 2 believes that firm 1 prefers not to disclose the subsidy and firm 1, given such beliefs, chooses not to disclose the subsidy. Therefore, in a pooling equilibrium it is satisfied

n

t =0, E5¯R1 ≤E5¯SN1 o.

This is the most interesting equilibrium, as it provides a theoretical explanation for the empirical observation that motivates this work, that is, the lack of information regarding the existence of subsidized partners that some firms participating in Eureka projects report.

Finally, in a semiseparating equilibrium, firm 2 believes that firm 1 will disclose the subsidy with a probabilityt ∈(0,1)and firm 1, given such beliefs, is indifferent between disclosing the subsidy or not. Therefore, in a semiseparating equilibrium it is satisfied

n

t ∈(0,1), E5¯R1 =E5¯SN1 o.

Next proposition displays the different equilibria in the disclosure stage for the case of strategic complements.

Proposition 5.1. If the efforts are strategic complements, there exist two real numbersλS andλP,withλS ≤λP, such that there exist a separating equilibrium∀λ≥λS,a pooling equilibrium∀λ≤ λP and a semiseparating equilibrium∀λ ∈ [λS, λP], whereλS andλP are given by

λS=

(1−s)1/21−(1−s)1/2

2s ,

λP=

(1−s)1/21−q+(q/(1−s)1/2) 21+(1−s)1/2

1−q+(q/(1−s1/2).

There are two different aspects affecting firm 1’s disclosure decision. First, if the efforts are strategic complements, disclosing is profitable because it leads firm 2 to exert a higher effort in equilibrium, that benefits firm 1. But, on the other hand, ifλis low enough, it is in firm 1’s interest not to disclose in order to pay a lower transfer to firm 2. Forλ <λP,

the second effect dominates, leading to the existence of pooling equilibria.6 However, for λ > λS, the first effect dominates, leading to the existence of separating equilibria. Finally,

forλ∈[λS, λP],the three different types of equilibria coexist.

because, in a separating equilibrium, firm 1 always discloses the subsidy and consequently, not to receive the information signals firm 1 as a subsidized firm.

6. The case of strategic substitutes: a numerical simulation

When the efforts exerted by the firms are strategic substitutes, an increase (decrease) in firmi’s effort is best responded with a decrease (increase) in firmj’s effort (implying negatively sloped reaction functions). We are going to use the following probability function:

P (e1, e2)=e1+e2−e1e2. (6.1)

This function could represent a situation in which the partners have similar research abilities, each firm undertaking the whole project in its own laboratory, and they ex ante agree to share the innovation no matter which firm innovates first. As Morasch (1995) explains, this kind of cooperative agreement is formed because, even if the synergy effects are negligible, they reduce the risk of failure relative to the case of individual R&D.7

Given the complexity of the explicit expressions of efforts and transfer payments, we provide a numerical simulation to illustrate this case. The intuitions behind the results of the simulation are, however, simple. If firm 1 discloses the subsidy firm 2, anticipating a higher effort from its partner, will react by exerting a lower effort, which hurts firm 1. Therefore, we can expect in equilibrium

e2∗R< e∗2N and e1∗R> e∗1SN> e∗1NN.

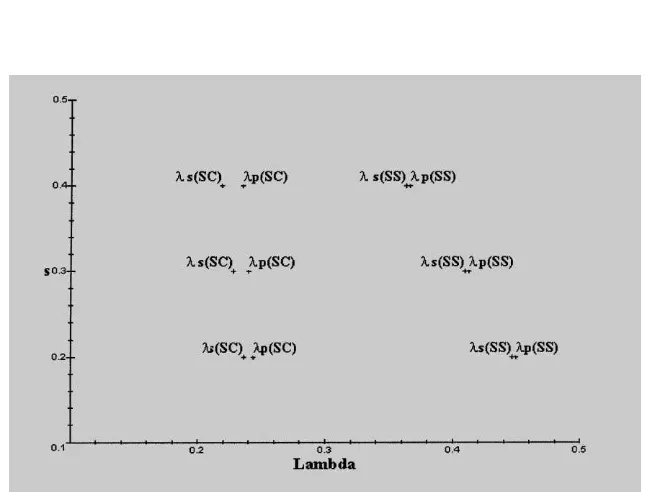

Figs. 2 and 3 display the results of the numerical simulation. In Fig. 2, the equilibrium efforts of both firms are represented in the (e, s) space for three different subsidies (s =

0.2,0.3,0.4). Those efforts have been calculated forλ=1/2,V =0.5 and for a conditional probabilityq˜=1/2. As can be seen, our expectations are satisfied by the simulation.8

In Fig. 3, we have represented in the (λ, s) space theλvalues delimiting the regions of separating and pooling equilibria, for three different values ofs, forV =0.5 andq =0.5 and for the cases of strategic substitutes and complements. In order to do that, we have compared firm 1’s actual expected profits in the cases of disclosure and non-disclosure when firm 2 has beliefs either t = 1 andq˜ = 0 ort = 0 and q˜ = q, for the cases of separating and pooling equilibria, respectively. Regarding notation,λS(SC)stands for

‘separating’ and ‘strategic complements’, whileλP(SS)stands for ‘pooling’ and ‘strategic 7In our setting, cooperative R&D is preferred by the firms to the alternative of individual R&D, simply because cooperation reduces the probability of failure (we need just to compare the probability of success in both cases, that is,eiandei+ej−eiej). However, if the innovation is to be shared between the partners (for example, because they compete in the innovation market), and in order to guarantee that both firms prefer the cooperative option, we would also need to assume the existence of a positive fixed cost incurred to start the project, that the firms can share through cooperation.

Fig. 2. Equilibrium efforts.

substitutes’. As we already know, with strategic substitutes, if firm 1 discloses the subsidy, firm 2 reacts by decreasing effort, which hurts firm 1. This effect should obviously reduce the region of separating equilibria, relative to the strategic complements case. Fig. 3 confirms our intuitions.9 On the other hand, observe that as the subsidy increases, the interval of separating equilibria is enlarged and the interval of pooling equilibria is reduced. Finally, notice that forλvalues lying between each pair (λS,λP)for a given subsidys, both a pooling

and a separating equilibria simultaneously exist.

7. Should the subsidization of RJVs be made public knowledge?

In the previous sections, we have shown that depending on the way in which the partners ex ante share the total expected profits of the project and on the strategic relationship between the efforts, pooling equilibria exist in which the subsidized firm prefers not to reveal the existence of the subsidy to its partner.

An interesting normative question arising from the previous analysis is whether from a social point of view it might be desirable to impose more strict rules requiring the public disclosure of any subsidy granted in European cooperative R&D programs such as Eureka. In order to answer that question we first need to calculate the optimal efforts from a social point of view (the efforts a supranational institution such as the EU would like to implement) and, second, we have to evaluate and compare welfare with and without information release regulation and check whether the proposed technology policy would be able to increase total welfare. Notice that the proposed policy would affect the equilibrium efforts and welfare only when, in absence of the proposed policy rule, we would have a pooling equilibrium. We shall proceed to compare both regimes, taking as given the cost subsidy granted to firm 1. At the end of this section, however, we will discuss the possibility that the active country could react to the establishment of a rule that enforces information releasing by not subsidizing its firm any longer. Regarding welfare, we obtain that for the case of strategic complements, the proposed policy rule is welfare improving. The line of the arguments is as follows: let us consider the following welfare function:10

W =E51+E52−S, (7.1)

whereSdenotes the total amount subsidized and let us denote by(eC1, e2C)the efforts that maximize functionW. In Appendix B, we calculate the efforts that solve (19) and compare these efforts with the equilibrium efforts for the case of strategic complements. We obtain that if the subsidy is not too high (in particular not higher than 0.646) the equilibrium efforts are suboptimal. Therefore, if we assume that the subsidysis below that level and given that the welfare function is concave in both efforts, all we have to do is to check whether the proposed policy increases the equilibrium efforts. However, these efforts coincide with the equilibrium efforts we obtained for the case of disclosure, that is,(eR1, eR2),and we know

9We have simulations for different patent values but the results are qualitatively identical.

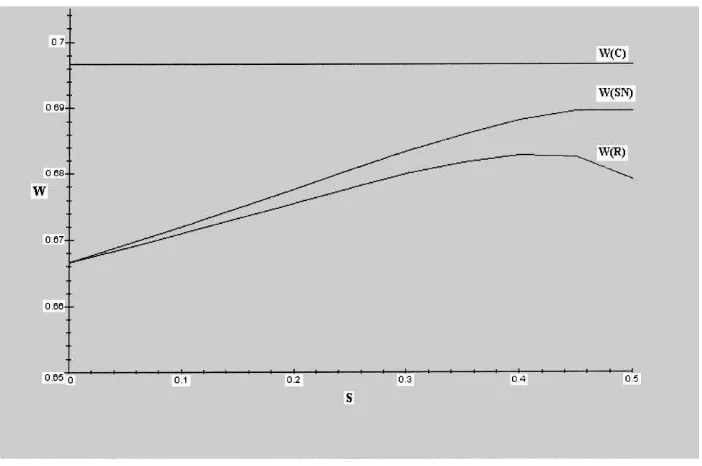

Fig. 4. Total welfare.

by Proposition 3.1 that, with strategic complements, the disclosure of the subsidy leads to higher efforts in equilibrium, that closes the argument. Finally, notice that regarding firms’ relative performance the public disclosure of subsidies would hurt firm 1 and benefit firm 2. On the other hand, if the efforts are strategic substitutes, the public disclosure of the subsidy leads firm 1 to exert a higher effort and firm 2 to exert a lower one. Therefore, in this case we cannot predict in general what the net effect of the proposed policy on welfare would be. In order to illustrate this case, Fig. 4 represents in the (W, s) space the results of a numerical simulation comparing welfare in three different situations, namely, the first best (W (C)), a situation with information release regulation (W (R)) and a situation with no information release regulation (W (SN)).11 The comparison is made forV =0.5 and for the case of a pooling equilibrium in whichq˜ = q = 0.5 and t = 0. Fig. 4 shows that, for those particular values of the parameters, under strategic substitutes the proposed technology policy would, in fact, decrease total welfare.

So far, we have taken as given the subsidizing policy of the active country. However, an interesting question to consider would be the following. Would the imposition of a technology policy that enforces the public disclosure of subsidies lead the active government to cease to subsidize its firm?

does not grant a subsidy to firm 1 (and firm 2 knows it because, under information release regulation, no announcement is interpreted by firm 2 as no existence of a subsidy for firm 1), and a situation in which the government grants a subsidy to firm 1 and that information is publicly announced by the supranational institution. For the case of strategic complements the result of the comparison is unambiguous: a cost subsidy cannot hurt the domestic firm because both the direct as well as the strategic effect of the subsidy are positive. For the case of strategic substitutes however, things are not so clear because, in this case, the strategic effect of the subsidy is negative. Fig. 5(a and b) display, in the (W1, s) space, a numerical

simulation comparing welfare of the active country in the two situations, forV =0.5, for two values ofλ(λ=0.8 and 0.6) and forq =0.5.W1NRrepresents welfare of the active country in the case in which there is no subsidy for the firm and that information is public knowledge andW1R when the government grants a subsidy to firm 1 under information release regulation.

The figures show that (for those values ofλ) the subsiding country prefers to grant a subsidy to its firm even under information release regulation whenever the subsidy is low enough.12 However, it can be shown that, forλ ≤ 0.5, it would not be optimal for the government to subsidize its firm any longer under information release regulation. This result suggests that supranational institutions should be cautious when designing policies that enforce the public disclosure of subsidies, not only because that policy could reduce the effectiveness of the subsidy, reducing welfare but also because in some cases it could even lead the active government not to subsidize its firm any longer.

8. Concluding remarks

This work provides a theoretical explanation for an empirical observation, namely, that some firms participating in Eureka projects complain about the fact that they do not know whether or not their partners are being subsidized by their own governments. That particular observation suggests the important role played by information when trying to assess the effects that different industrial policies have on industry performance. Governments and supranational institutions such as the EU should design those policies taking into account not only the particular instrument chosen but also the amount of information about them that becomes public knowledge. As we have shown in the paper, a firm may strategically use any information advantage to affect its competitive position in the industry, and the net effect of such behavior on welfare is ambiguous and depends on factors like the strategic relationship between the firms’ decision variables or their bargaining power.

In a model including asymmetric information and uncertainty we have shown that de-pending on whether the efforts are either strategic complements or strategic substitutes and on the way in which the partners share the total expected profits from the project, we can obtain pooling equilibria in which the subsidized firm does not disclose the existence of the subsidy to its partner. In particular, the smaller the bargaining power of the subsidized firm the lower its incentives to disclose the subsidy. On the other hand, while strategic

complementarity gives the subsidized firm an incentive to disclose, when the efforts are strategic substitutes the subsidized has an additional incentive not to reveal the existence of the subsidy to its partner.

Finally, we analyze the impact on welfare of a technology policy that enforces the public disclosure of information about subsidies in European cooperative R&D projects such as Eureka. We have shown that if the efforts are strategic complements, the proposed tech-nology policy would always increase welfare. However, for the case of strategic substitutes we find numerical examples for which information release regulation would reduce total welfare. Additionally, with strategic substitutes we find cases in which that policy could even lead the active government not to subsidize its firm any longer.

Acknowledgements

We would like to thank I. Macho-Stadler, D. Pérez-Castrillo, P. Olivella and two anony-mous referees for very helpful comments. This research has been partially undertaken while the second author was visiting the University of California, Davis. We gratefully acknowl-edge financial support from DGICYT PB94-1372 and UPV 035.321-HB070/96.

Appendix A

Proof of Proposition 3.1. If firm 1 has disclosed the subsidy it solves the following

maxi-mization problem:

Using the reaction functions of both firms

e1=

we obtain the Nash equilibrium in efforts

e∗1R=

If firm 1 has not disclosed it has a subsidy, it solves the following maximization problem:

and if firm 1 has no subsidy it solves

The problem firm 2 solves when it does not know whether or not firm 1 has a subsidy is

Maxe2

we calculate the Nash equilibrium in the case where firm 1 has a subsidy and where it has none obtaining

Proof of Proposition 5.1. First, we calculate the separating, pooling and semiseparating

equilibria for the case of strategic complements.

In a separating equilibrium, firm 2 believes that firm 1 always discloses the subsidy if it has one, that is,t =1. In that case, the conditional probabilityq˜calculated by the Bayes rule for those beliefs isq(t˜ =1)=0. That means that if firm 1 does not disclose the subsidy, firm 2 knows that it has no subsidy. Given those beliefs, we analyze the circumstances under which firm 1 prefers to disclose the subsidy. In order to do that, we compare firm 1’s actual expected profits if it discloses the subsidy, that is,E5¯R1 with its actual expected profits if it does not, that is,E5¯SN1 (note that those profits must include the transference payment). Substituting the equilibrium efforts calculated above we obtain

E5R1 = 2V

Therefore, firm 1’s actual expected profits if it discloses the subsidy are given by

E5¯R1 =E5R1 +TR= 2V

3

3(1−s) + 2V3

Similarly, if firm 1 does not disclose the subsidy we obtain

Therefore, firm 1’s actual expected profits if it does not disclose the subsidy (given firm 2’s beliefs) are

Finally, we compare the two expressions, obtaining that firm 1 prefers to disclose the subsidy if and only if

λ≥λS=

−(1−s)+(1−s)1/2

2s , (A.12)

In a pooling equilibrium firm 2 believes that firm 1 never discloses it has a subsidy, that is, we havet =0. In that case, the conditional probabilityq˜ calculated by the Bayes rule for those beliefs isq(t˜ =0)=q. That means that if firm 1 does not disclose the subsidy firm 2 is not able to update its beliefs. Given those beliefs, we analyze in what cases firm 1 prefers not to disclose the subsidy, that is, we compare firm 1’s actual expected profits if it discloses the subsidy, namelyE5¯R1,with those expected if it does not disclose it, namely E5¯SN1 (q˜ =q)(note that those profits must include the transfer payment). Substituting the equilibrium efforts calculated above we obtain

E5R1 = 2V

Therefore, firm 1’s actual expected profits if it discloses the subsidy are

E5¯R1 =E5R1 +TR= 4λV

3

3(1−s). (A.15)

Similarly, if firm 1 does not disclose the subsidy we obtain

E5SN1 (q˜ =q)= 2V

E5¯SN1 (q˜ =q)=E51SN(q˜ =q)+TN(q˜=q)

Finally, we compare the two expressions, obtaining that firm 1 prefers not to disclose the subsidy if and only if

In a semiseparating equilibrium firm 2 believes that firm 1 will disclose the subsidy with some probabilityt ∈ (0,1). In that case, the conditional probabilityq˜ calculated by the Bayes rule for those beliefs isq(t )˜ ∈(0, q). Given those beliefs, we analyze in what cases firm 1 is indifferent between disclosing the subsidy or not, that is, we compare firm 1’s actual expected profits if it discloses the subsidy, namelyE5¯R1,with those expected if it does not disclose it, namelyE5¯SN1 (q)˜ (note that those profits must include the transfer payment). Substituting the equilibrium efforts calculated above we obtain

E5¯R1 = 4λV

Finally, we compare the two expressions obtaining that firm 1 is indifferent between the two options if and only if

(1−s)1/2−(1−s)

2s ≤λ≤

q+(1−q)(1−s)1/2

21+q+(1−q)(1−s)1/2. (A.22)

Appendix B. Comparison between equilibrium efforts and optimal efforts

We analyze the case of strategic complements. We calculate the optimal efforts from a social point of view (given a subsidy s) and compare those efforts with the equilibrium efforts.

They are

e∗1C=2V and e∗2C=2V .

Notice that neither the welfare function nor the optimal efforts depends on the subsidy. Comparing those efforts with the equilibrium efforts

eR1 = V thane∗2Cdepending onsbeing higher or lower than 0.873.

Therefore, if the subsidy is not very high, in particular if s < 0.646, the equilibrium efforts are lower than the optimal efforts.

References

d’Aspremont, C., Jacquemin, A., 1988. Cooperative and non-cooperative R&D in duopoly with spillovers American Economic Review 78, 1133–1137.

Fölster, S., 1995. Do subsidies to cooperative R&D actually stimulate R&D investment and cooperation? Research Policy 24, 403–417.

Funderberg, D., Tirole, J., 1991. Game Theory, MIT Press, Cambridge, MA.

Kamien, M., Muller, E., Zang, I., 1992. Research joint ventures and R&D cartels. American Economic Review 82 (5), 1293–1320.

Katsoulakos, Y., Ulph, D., 1998. Endogenous spillovers and the performance of research joint ventures. Journal of Industrial Economics 3, 333–357.

Katz, M., 1986. An analysis of cooperative research and development. Rand Journal of Economics 17, 527–543. Kauko, K., 1996. The ineffectiveness of R&D subsidies — an oligopoly theoretic insight. Review of Industrial

Organization 11, 401–412.

Martínez-Sánchez, A., Navarro, L., 1991. Product innovation management in Spain, Journal of Product Innovation Management 8.

Morasch, K., 1995. Moral hazard and optimal contract form for R&D cooperation. Journal of Economic Behavior and Organization 28, 63–78.

Pérez-Castrillo, D., Sandonís, J., 1996. Disclosure of know-how in research joint ventures. International Journal of Industrial Organization 15, 51–75.

Pérez-Castrillo, D., Verdier, T., 1993. On subsidizing R&D, Revista Española de Economía (special issue on R&D), 9–20.

Peterson, J., 1993. Assessing the performance of European collaborative R&D policy: the case of Eureka. Research Policy 22, 243–264.

Rubinstein, A.H., et al., 1977. Management percept of government incentives to technological innovation in England, France, West Germany and Japan. Research Policy 6, 324–357.

Suzumura, K., 1992. Cooperative and noncooperative R&D in an oligopoly with spillovers. American Economic Review 82, 1307–1320.