The preparation of the

Financial Stability Review (FSR)

is one of the avenues

through which Bank Indonesia achieves its mission

≈to safeguard the stability of the Indonesian

Rupiah by maintaining monetary and financial system stability for sustainable national

economic development∆.

Publisher :

Bank Indonesia

Jl. MH Thamrin No.2, Jakarta Indonesia

Information and Orders:

This edition is published in September 2009 and is based on data and information available as of June 2009, unless stated otherwise.

The PDF format is downloadable from: http://www.bi.go.id

For inquiries, comments and feedback please contact:

Bank Indonesia

Directorate of Banking Research and Regulation Financial System Stability Bureau

Jl.MH Thamrin No.2, Jakarta, Indonesia Phone : (+62-21) 381 8902, 381 8075 Fax : (+62-21) 351 8629

Email : BSSK@bi.go.id

FSR is published biannually with the objectives:

To improve public insight in terms of understanding financial system stability.

To evaluate potential risks to financial system stability.

To analyze the developments of and issues within the financial system.

iii

Foreword vi

Overview 3

Chapter 1 Macroeconomic Conditions and

the Real Sector 9

Macroeconomic conditions 9

Real Sector Conditions 14

Chapter 2 The Financial Sector 21

Indonesian Financial System Structure 21

Financial Sector Resilience 22

Banking Industry 22

Funding and Liquidity Risk 22

Credit Growth and Risk 25

Market Risk 29

Profitability and Capital 31

Non-Bank Financial Institutions And The 34

Capital Market

Finance Companies 34

Insurance Companies 36

Capital Market 38

Table of Contents

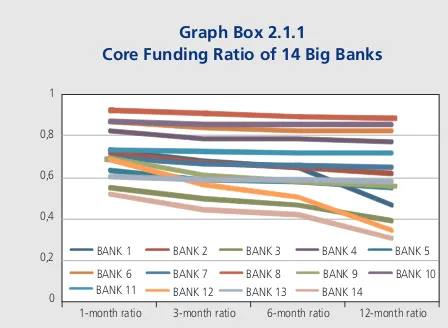

Box 2.1. Bank Liquidity Resilience Indicators 43

Box 2.1. Bancassurance Performance 45

Chapter 3 Financial Infrastructure and Risk

Mitigation 49

Payment System Performance 49

Financial Sector Assessment Program (FSAP) 52

Box 3.1. Implementation of

Payment-versus-Payment (PvP) Link 55

Box 3.2. ATM and Debit Card Fraud 57

Box 3.3. Credit Card Risk Mitigation 58

Chapter 4 Indonesian Financial System Outlook 61

Economic Prospects And Risk Perception 61

Bank Risk Profile : Level And Direction 62

Potential Vulnerabilities 64

Articles

Article 1 Market Competition, Interest Margin and

Indonesian Financial System Stability 67

Article 2 The impact of Monetary Shocks on

iv

List of Tables and Graphs

Tables

1.1 World Economic Indicators 11

1.2 The Effect of Rupiah Depreciation on Corporate

Equity 18

2.1 Bank Profitability 31

2.2 Integrated Stress Test Scenarios 33

2.3 Financial Ratios of Finance Companies 35

2.4 NPL Finance Companies 36

2.5 NPL of Finance Companies 36

2.6 Indices of Regional Markets 39

2.7 Sectoral Indices 40

2.8 VaR by SUN Tenure 41

2.9 SUN Ownership 41

4.1 Economic Indicator Projections 62

1.1 Consumer Confidence in G3 Countries 9

1.2 Purchasing Manager Index (PMI) and Industrial

Production (IP) Index in G3 Countries 10

1.3 Capital Inflows to Asian Market 10

1.4 Global Economic Growth 10

1.5 Total Layoffs U.S. Non-Agricultural Sector 10

1.6 GDP Growth in various Emerging

Market Economies 11

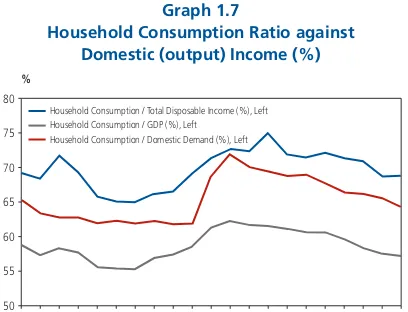

1.7 Household Consumption Ratio against

Domestic (output) Income (%) 11

1.8 Price Index of several Commodities 12

1.9 Non-oil/gas Export Value in Indonesia 12

1.10 Import/Export Growth 12

1.11 IDR/USD Exchange Rate 12

1.12 Estimation Results IDR/USD 13

1.13 Global Exchange Rates 13

1.14 Global Share Price Index 13

1.15 Share Price Indices by Sector 13

1.16 Inflation in ASEAN-5 Countries 14

1.17 Real Interest Rate in Indonesia 14

1.18 Production Index and Production Capacity

Utilization Industrial Sector 15

1.19 Growth of Industrial Sector Export Value

and Industrial GDP 15

1.20 Growth of Automobile and Motorcycle Sales

and Industrial GDP 15

1.21 Manufacturing Sector Credit and GDP 15

1.22 Leading Indicators for the

Trade, Hotels and Restaurants Sector 16

1.23 Composite Prompt Indicator

for the Trade, Hotels and Restaurants Sector 16

1.24 Retail Sales Index 16

1.25 Domestic Consumer Confidence Index 16

1.26 ROA and ROE of Public Listed Non-Financial

Companies 16

1.27 Key Indicators of Corporate Finance 17

1.28 DER and Debt/TA of Public Listed Non-Financial

Companies 17

1.29 Probability of Default (PD) of Public Listed

Non-Financial Companies (a) 17

1.29 Probability of Default (PD) of Public Listed

Non-Financial Companies (b) 17

1.30 Ratio of Net Foreign Exchange Liabilities

against Corporate Equity 18

v

2.1 Asset Composition of Financial Institutions 21

2.2 Financial Stability Index 22

2.3 Sources of Funds - Banks 22

2.4 Deposits by Component 23

2.5 Foreign Exchange Deposits IDR/USD

Exchange Rate 23

2.6 Bank Liquid Assets 24

2.7 Liquid Assets by Bank Group 24

2.8 Liquid Assets Ratio 25

2.9 Transaction Volume O/N Interbank

Money Market (daily average) 25

2.10 Interbank Money Market Interest Rate 25

2.11 Interbank Money Market Interest Rate 25

2.12 Growth of Credit and Deposits 26

2.13 Credit Growth by Type 26

2.14 Credit Growth by Economic Sector 26

2.15 Credit Growth by Currency 26

2.16 MSM and non-MSM Credit Growth 27

2.17 Non-performing Loans 27

2.18 NPL Ratio by Sector 27

2.19 NPL Ratio of the Manufacturing Sector 28

2.20 NPL Ratio of Trade Sector 28

2.21 NPL Ratio of Trade Subsectors 28

2.22 NPL Ratio by Usage Type 28

2.23 NPL Ratio for Consumption Credit 29

2.24 Credit Risk Stress Test 29

2.25 Rupiah Maturity Profile 29

2.26 Forex Maturity Profile 29

2.27 Interest Rate Risk Stress Test 30

2.28 Net Open Position (overall) 30

2.29 Exchange Rate Risk Stress Test 30

2.30 SUN Share 31

2.31 Stress Test - SUN Price Decline 31

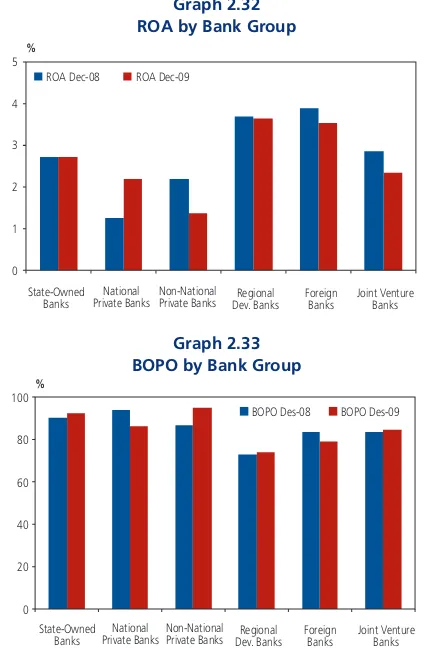

2.32 ROA by Bank Group 31

2.33 BOPO by Bank Group 31

2.34 Monthly Profit/Loss 32

2.35 Interest 32

2.36 Capital, Risk-Weighted Assets and CAR 32

2.37 CAR by Bank Group 32

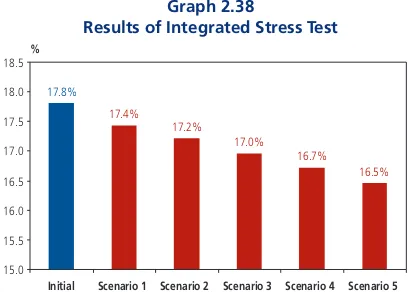

2.38 Results of Integrated Stress Test 33

2.39 Interbank Stress Tests 34

2.40 Business Activity of Finance Companies 34

2.41 Composition of Financing for Financing

Companies 35

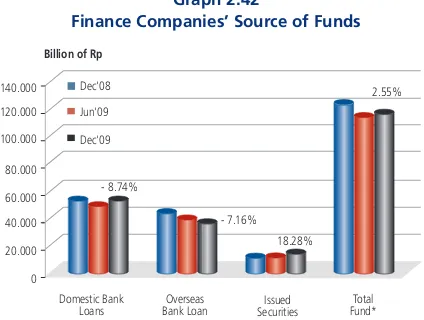

2.42 Finance Companies» Source of Funds 35

2.43 Penetration of General Insurance in several

Asian Countries 37

2.44 Penetration of Life Insurance in several

Asian Countries 37

2.45 Insurance Industry Performance

Assets-Gross Premiums-Investment 37

2.46 Insurance Industry Performance

Claims-Premiums 37

2.47 Performance of Life Insurance 37

2.48 Investment Performance by Business Type 38

2.49 Performance of Loss Insurance

and Re-assurance 38

2.50 Foreign Investment in SBI, SUN, Stock 38

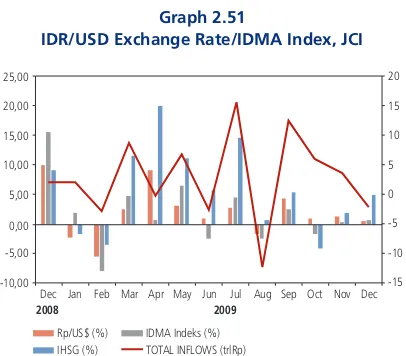

2.51 IDR/USD Exchange Rate/IDMA Index, JCI 39

2.52 JCI and Global and Regional Indices 39

2.53 Volatility of Several Asian Stock Indices 39

2.54 Bank Share Prices 40

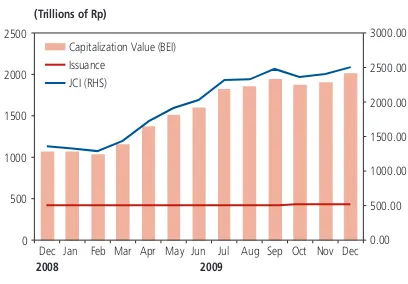

2.55 Stock Market Capitalization and Issuance Value 40

2.56 Benchmark FR Series SUN Price 41

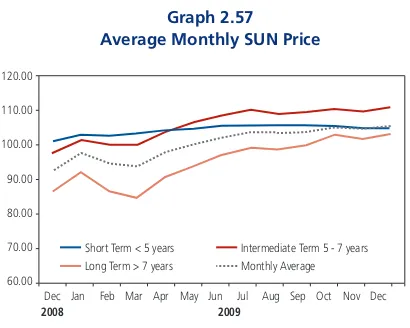

2.57 Average Monthly SUN Price 41

2.58 SUN VaR 41

2.59 SUN Maturity Profile 42

2.60 Issuance and Corporate Bonds Value 42

2.61 Growth of Mutual Funds 42

2.62 Net Asset Value by type of Mutual Fund 42

3.1 Nominal Transaction Value 49

3.2 Transaction Volume 50

3.3 BI-RTGS System Transaction in 2009 50

3.4 SKN-BI Transactions in 2009 51

3.5 Debit Card Transaction in 2009 52

3.6 Credit Card Transactions in 2009 52

3.7 E-money Transactions in 2009 52

4.1 Economic Growth Projections 61

4.2 Risk Perception in Indonesia 62

vi

I welcome the publication of Financial Stability Review No. 14 March 2010. The publication of the Review is critical

as it communicates to a large audience developments and prospects of financial system stability.

This issue of the Review comes to us at a time in which the world economy has started to show signs of recovery

even though the global crisis has not completely dissipated. In fact, we have actually recently witnessed the emergence of

new international issues such as the fiscal crisis in Greece. We view that recovery on a global level is very important as the

increasingly integrated global financial system potentially allows shocks from the international economy to immediately

impact Indonesia. It is therefore essential for us to maintain vigilant towards our financial system.

The Indonesian economy and financial sector has fared much better compared to that of on a global level. Such is

the result of various policies taken by the Government and Bank Indonesia in 2008 and 2009 aimed at taming impacts of

the crisis which peaked in November 2008. The successful policies allowed the economy to grow at a relatively high level

while inflation is kept relatively low and exchange rate adequately managed. With this background, the BI rate has been

maintained at a low and stable level of 6.5% since August 2009.

Riding on the back of such a conducive economy, the banking industry continues to showcase good performance.

At the end of December 2009 the Capital Adequacy Ratio was recorded as exceeding 17% with well-controlled earning

asset quality as reflected by gross and net NPLs of 3.3% and 0.3% respectively. With such well-managed asset quality,

banks were able to produce relatively high levels of profit with ROAs at approximately 2.6% while keeping liquidity

well-controlled.

Meanwhile the stock market and non bank financial market performance shows encouraging signs and thus

breed-ing optimism about better conditions in the financial system ahead. Such optimism appears to be appropriately called for

as the sovereign rating and rating of several of Indonesia»s big banks are increasing and nearing investment grade.

Such developments are encouraging, however, they should not distract us from the challenges which potentially

can become sources of instability. One of the challenges faced is the low credit growth level which in 2009 only reached

10% (year-on-year). The slow credit growth deserves our serious attention. If the credit slump continuous, the growth of

the economy as a whole will be at stake. Such credit slump also potentially impedes financing of the corporate and

vii

Another important challenge we must face is the increase in short term capital inflows. Such inflows potentiallyincrease as the economy improves and will put the financial system to be more vulnerable to sudden reversals. As such, it

is very important to maintain investors» trust by continuously promoting effective market discipline supported by

improve-ments in financial sector governance. The Financial Sector Assessment Program (FSAP) which was conducted from the

end of 2009 to early 2010 is expected to become an important reference for efforts in improving the financial sectorƒ

with the banking industry as no exception.

By knowing the opportunities and challenges faced by the financial sector as mentioned above, the financial sector

is expected to continue its advancement and be spared from excess risks. As such, improvements in surveillance must

continue. This can be achieved by, among others, renewing and perfecting the tools and methodologies used for early

detection. In closing, it is my hope that the Review is able to serve its mission to communicate to the public surveillance

results of financial system stability developments and its prospects ahead.

Jakarta, 31 March 2010

Deputy Governor of Bank Indonesia

viii

Overview

Overview

Overview

Overview

1. SOURCES OF INSTABILITY

1.1. Slow Global Recovery

The global economic crisis has not completely

subsided. While the crisis persists a number of new

problems have emerged triggering a subsequent rise in

global instability, for example the Dubai World financial

crisis and the fiscal crisis in Greece.

Therefore, tight vigilance is required to avoid a

domino effect creating vulnerabilities in the domestic

financial sector and economy.

1.2. Sluggish Credit Growth

Post-global crisis, bank credit growth experienced

a significant slowdown, in particular foreign exchange

(forex) credit. In 2009, total credit grew by just 10%

(y-o-y). This issue requires serious attention as languid credit

disbursements has the potential to spur instability. On a

macro scale, the decline in credit growth places additional

pressures on future economic growth. From a micro

perspective,∆the decline in credit growth causes

difficulties

Overview

for the corporate sector and households in terms of

obtaining funds to finance their business activities. This,

in turn, potentially undermines the debt repayment

capacity of the corporate and household sectors, which in

general are bank debtors. From a macro and micro

standpoint, both have the potential to raise

non-performing bank loans (NPL).

1.3. The Rise in Short-Term Capital Inflows

Short-term capital inflows are resurging back into

Indonesia. This is not only due to the attractive returns

offered by financial instruments in Indonesia, but also due

to the improved sovereign rating as a result of robust

domestic economic performance amid pressures stemming

from the global crisis. The rise in short-term capital inflows

requires close vigilance as it is vulnerable to sudden reversals

which could disrupt financial stability.

1.4. Possibility of Greater Operational Risk

Operational risk can arise due to, among others,

natural disasters and fraud. The recent trend of more

frequent natural disasters, like earthquakes and floods,

that have beset Indonesia has necessitated a contingency

plan that can maintain the functioning of financial

infrastructure under any conditions so as to minimize

potential losses. In addition, greater financial system

dependence on information technology, for example

through the pervasive use of ATM cards and Internet

banking, has dictated the immediate requirement for

all-encompassing security measures and risk mitigation against

fraud.

1.5. The Real Sector and Infrastructure

Real sector conditions remained suboptimal despite

corporate and household performance surpassing that

reported during the peak of the global crisis in quarter IV

2008. Nevertheless, a number of new challenges continue

to emerge, including the inauguration of the ASEAN China

Free Trade Area (ACFTA) at the beginning of 2010.

Furthermore, infrastructure in the country remains

unsatisfactory reflected by, among others, disruptions in

the distribution network that precipitated inefficiencies and

created a high-cost economy. If the problems confronting

the real sector are permitted to persist and no resolution

is sought, financial sector instability will materialize in the

long term.

1.6. Inadequate Legal Protection

Financial sector instability will appear if policymakers

do not receive adequate legal protection. Without clear

legal protection, public officials in the financial sector will

be unwilling to take the immediate decisions necessary to

avoid the widespread impacts of a crisis. This issue requires

the attention of all related stakeholders to ensure that

financial system stability remains under control.

2. RISK MITIGATION

2.1. Strengthening Capital

The most important risk mitigation measure is to

increase capital. The Indonesian banking industry uses

capital strengthening as one method to mitigate risk. As

such commercial banks in Indonesia-are required to

maintain a minimum core capital of Rp100 billion by the

end of 2010. Previously, in 2008, commercial banks were

required to maintain a minimum core capital of Rp80

billion, for which all banks complied. Despite the fact that

in December 2009 several banks had core capital levels of

less than Rp100 billion, experience garnered from the

previous requirement of Rp80 billion indicates that all

Overview

2.2. Increasing Loan Loss Provisions

Loan loss provisions are an effective method of

mitigating credit risk. In 2009, banks increased their

provisions by Rp12.7 trillion. Therefore, despite a rise in

the gross NPL ratio of the banking industry from 3.2%

(December 2008) to 3.3% (December 2009), the net NPL

ratio actually declined from 0.8% to just 0.3%.

Although loan loss provisions are an effective method

of mitigating credit risk, it is important that the amount of

provisions is not excessive or insufficient. Excessive

provisions erode potential bank revenues and insufficient

provisions undermine their effectiveness as an instrument

to mitigate risk.

2.3. Risk Management and Good Governance

Strengthening risk management and good

governance in the financial sector is another method to

mitigate risk. To this end, the risk management certification

program was continued for banks. Bank supervisors are

also obliged to participate in a certification program for

supervisors and apply Risk Based Supervision when in

supervising banks. Additionally, banks are encouraged to

improve the quality of their governance, not only to meet

Bank Indonesia»s regulations but also to nurture market

discipline.

For risk mitigation to be effective from a risk

management and good governance standpoint, banks

should obviously not merely orient themselves towards

acquiring certificates and fulfilling formal aspects;

practicing these disciplines in their business operations on

a daily basis is far more important.

2.4. Surveillance

Risk mitigation is also achieved through the relevant

authorities by strengthening micro and macro prudential

aspects. Microprudential surveillance is implemented on

individual banks by emphasizing the fulfillment of

prudential regulations, through onsite and offsite

supervision. Conversely, macroprudential surveillance

concentrates more on industry-level analysis.

In order to reinforce microprudential surveillance,

supervisors participate in a certification program. In

addition, to strengthen macroprudential surveillance, the

tools and methodologies used in surveillance are

continuously refined, including stress testing, probability

of default analysis, transition matrices, as well as other

early warning mechanisms. One of the techniques used

to refine the tools and methodologies associated with

surveillance is to utilize the assessment results of the

Financial Sector Assessment Program (FSAP) conducted in

September/October 2009 (first mission) and February/

March 2010 (second mission).

3. PROSPECTS FOR FINANCIAL

SYSTEM STABILITY

The prospects for financial system stability looking

forward remain favorable. Despite the ongoing global crisis

and emerging challenges, there are a number of reasons

behind the expectations of a positive outlook. First is that

the global economic recovery is continuing. Furthermore,

domestic economic performance up until now has

remained robust and is expected to improve further in time.

This, in turn, will stimulate banks to actively extend credit,

making a tangible contribution to the economy. In addition,

greater credit disbursements by banks will invigorate the

business community and catalyze business activity, which

will underpin the economy as a whole.

Second, Indonesia»s ratings - the sovereign rating

and the individual ratings of large banks - have improved

and are approaching investment grade. This will attract

more investors and, therefore,-capital inflows into

Overview

short term in nature, the current emphasis on financial

deepening is expected to avail a number of longer-term

financial instruments and minimize the risk of sudden

reversal. Consequently, financial system stability is forecast

to improve in the future.

Third, the banking industry is currently quite prudent

and conservative, concentrating on applying good

governance. Looking ahead, therefore, banks are expected

to become more aware of risk and set out appropriate risk

mitigation measures before taking business decisions.

From 2010 onwards, banks will begin applying

international standards, including the implementation of

Basel II as well as the Indonesian Statement of Financial

Accounting Standard (PSAK) No.50 and 55. In

addition,-follow-up measures extracted from the results of FSAP are

expected to raise the quality of the financial sector and

banks in Indonesia to the benefit of the national economy.

In order to realize these favorable prospects for

financial system stability, support and cooperation is

required from all relevant stakeholders, including creating

conducive conditions legally, politically and in terms of

Chapter 1 Macroeconomic Conditions and the Real Sector

Chapter 1

Chapter 1 Macroeconomic Conditions and the Real Sector

Chapter 1 Macroeconomic Conditions and the Real Sector

1.1. MACROECONOMIC CONDITIONS

Entering semester II of 2009 the global economy

began to display signs of a recovery. This was further

supported by a stabilization process implemented in the

financial market, as well as additional support from

economic stimuli and a low interest rate. Moreover,

consumer confidence was restored and the business sector,

in particular the rapid recovery of domestic demand-based

economies such as in China, further supported the global

economic recovery process. As a result of such

improvements the rate of global economic contraction

began to abate.

Economic conditions in developed countries,

particularly G3-member countries such as the United

States, Japan and European countries using the Euro, also

Macroeconomic stability in Indonesia was well maintained during semester

II of 2009 on the back of strong domestic demand, a stable banking

industry and increasingly optimistic expectations of a global economic

recovery. In addition, an accommodative fiscal and monetary policy stance

buoyed the Indonesian economy in the midst of widespread pressures

stemming from the global crisis. Against this propitious backdrop,

domestic economic growth in Indonesia outpaced that of various other

countries. Looking ahead, the Indonesian economy has the potential to

continue improving in accordance with the growing momentum of the

global economic recovery. Notwithstanding, several risk factors, external

and internal, require continued attention, for example potential hikes in

the global oil price as well as domestic micro-structural challenges, which

include weak industrial sector competitiveness and stagnant infrastructural

development.

Macroeconomic Conditions and

the Real Sector

began to show signs of improvement. The global economic

recovery continued as a result of fiscal stimulus packages

introduced by various governments. In general, public

consumption strengthened, which was reflected by

increasing consumer confidence in G3 countries. From the

Graph 1.1

Consumer Confidence in G3 Countries

Current Condition

Left Scale Future ExpectationRight Scale

Source : Bloomberg (Japan-Economic Watchers Survey, Euro-IFO Survey, US-Univ. Michigan Survey)

Index, ma3m Index, ma3m

0 20 40 60 80 100 120

0 20 40 60 80 100 120

Japan Japan

US US

Euro Euro

JanMarMayJul SepNovJanMarMayJul SepNovJanMarMayJul SepNovJanMarMayJul SepNovJanMarMayJul SepNovJanMarMayJul SepNov

2007 2008 2009 2007 2008 2009

Chapter 1 Macroeconomic Conditions and the Real Sector

production side, it was observed that the Purchasing

Manager Index (PMI) and Industrial Production (IP) index

followed an increasing trend. Nonetheless, the process of

economic recovery in developed countries was still

overshadowed by a number of risk factors such as high

unemployment as well as an income level that remains

sub-optimal.

activity would begin to intensify. Economic growth in

emerging Asian countries has occurred more rapidly than

in other regions and has, therefore, become an engine of

world economic growth.

Economic recovery is inseparable from successful

performance improvements in the financial sector, among

others, characterized by a rebound in asset prices on the

global financial markets and a resurgence of net foreign

capital flows into Asian markets. Consequently, such

improvements would lead to increased optimism of an

economic recovery in the real sector and global economic

Real sector indicators in developed countries, such

as the declining trend in U.S. job layoffs in the

non-agricultural sector, continued to improve indicating that

the economic contraction was beginning to ease.

According to the ADP National Employment Report the

number of layoffs in the U.S. non-agricultural sector from

December 2009 to January 2010 declined from 61,000 to

22,000.

Graph 1.4 Global Economic Growth

Graph 1.5 Total Layoffs U.S. Non-Agricultural Sector Graph 1.2

Purchasing Manager Index (PMI) and Industrial Produc-tion (IP) Index in G3 Countries

Index, 50 =neutral % yoy, ma 3m

Source : Bloomberg

PMI Manuf US

IP US

PMI Manuf JPN

IP JPN

PMI Manuf EU IP EU

25 30 35 40 45 50 55 60 -38 -33 -28 -23 -18 -13 -8 -3 2 7

Jan Jul Jan Jul Jan Jul Jan Jul Jan Jul Jan Jul

2007 2008 2009 2007 2008 2009

Graph 1.3

Capital Inflows to Asian Markets

Juta USD

Source : Bloomberg

-1.3 -0.8 -0.3 0.2 0.7 1.2

Jan Apr Jul Oct Jan Apr Jul Oct

2008 2009

average of 1 week movement average of 4 weeks movement

Source : IMF (WEO Oct-09)

% -6 -4 -2 0 2 4 6 8 10

2006 2007 2008 2009

I II III IV I II III IV I II III IV I II III IV World GDP

Advance GDP Developing Country GDP

2009 Thousands of People

Source : The ADP National Employment Report, January 2010

Total NonFarm Private

(50) -50 100 150 200 250 Service providing Goods producing

Chapter 1 Macroeconomic Conditions and the Real Sector

Expansive economic growth in Indonesia, amid

widespread pressures stemming from the global crisis, was

accomplished due to a favourable economic structure and

sound financial system as well as accommodative fiscal and

monetary policy. The Indonesian economy was principally

underpinned by unrelenting domestic demand, especially

household consumption. During the global economic

contraction, household consumption in Indonesia continued

at a high level, driven by relatively stable purchasing power

and unwavering consumer confidence. Thus, despite the

global economic downturn, strong domestic demand

successfully sustained national economic activity and

ensured a deep correction could be avoided. With improving trends reported for a number of

economic indicators, the global economy in 2009 is

expected to contract by just 0.8% based on the latest

projections by the International Monetary Fund (IMF),

compared to initial projections of more than 1%. In 2010,

the global economy is expected to achieve 3.9% growth1.

In contrast to a number of other countries, the

Indonesian economy in 2009 performed well. Despite an

inevitable decline, economic growth in 2009 achieved

4.5%, establishing Indonesia as one of the few countries

in the world that recorded positive growth.

Graph 1.6

GDP Growth in various Emerging Market Economies

Source : CEIC

%

(11.00) (8.00) (5.00) (2.00) 1.00 4.00 7.00 10.00 13.00

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009

Q2 Q3 Q4 Q1Q2Q3Q4 Q1Q2Q3Q4Q1Q2Q3Q4 Q1Q2Q3Q4Q1Q2Q3Q4 Q1Q2Q3Q4 Q1Q2Q3Q4 Q1Q2Q3Q4Q1Q2Q3

Indonesia Singapore Thailand

South Korea China India Table 1.1

World Economic Indicators

World Output: 3.0 (0.8) 3.9 4.3

Advanced Economies 0.5 (3.2) 2.1 2.4 United States 0.4 (2.5) 2.7 2.4 Emerging & Developing Countries 6.0 2.0 6.0 6.3

Consumer Price:

Advanced Economies 3.4 0.1 1.3 1.5 Emerging & Developing Countries1) 9.2 5.2 5.4 4.4 LIBOR2)

US Dollar Deposit 3.0 1.1 0.7 1.8

Euro Deposit 4.6 1.2 1.3 2.3

Yen Deposit 1.0 0.7 0.6 0.7

Oil Price (USD) - rata-rata3) 36.4 (36.1) 22.6 7.9 Category 2008 2009

(%) (%)(%) (%)(%) Projection

2010 2011

Source : World Economic Outlook - January 2010

1 World Economic Outlook - January 2010

Graph 1.7

Household Consumption Ratio against Domestic (output) Income (%)

The favourable characteristics of the Indonesian

financial system, namely a relatively conservative and simple

banking industry utilizing instruments that are considered

traditional, protected domestic banks and the financial

system from the negative impacts of the global financial

crisis. Furthermore, the accommodative fiscal and monetary

policy stance also reinforced domestic economic resilience.

The application of a free-floating exchange rate system, a

more flexible implementation of an Inflation Targeting

Framework (ITF) monetary policy and a consistent fiscal

policy ensured that the array of policies instituted were

optimal in response to the pressures emanating from the

global economic turmoil. %

50 55 60 65 70 75 80

Household Consumption / Total Disposable Income (%), Left Household Consumption / GDP (%), Left

Household Consumption / Domestic Demand (%), Left

Chapter 1 Macroeconomic Conditions and the Real Sector

Increased economic activity, particularly in emerging

Asian markets that enjoyed a more expeditious recovery

process, strengthened demand for exported goods,

particularly natural resources. This precipitated a rise in

commodity prices on international markets; however, prices

remained lower than that of the previous year. The global

oil price, which had plummeted to US$41.7 per barrel in

January 2009, began to rebound in semester II 2009; rising

to US$79.4 per barrel by December 2009. This hastened

an increase in other commodity prices such as aluminium,

copper, tin, rice and coffee.

Conversely, imports witnessed a significant decline

consistent with weak demand for imported raw materials

from export-oriented industries and a decline in imports

of consumer goods.

Graph 1.8

Price Index of several Commodities

Source : BI 0 100 200 300 400 500 600 0 50 100 150 200 250 300 350 400 450 500

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009

Oil Copper

Tin Gold

Palm Oil Coffee Rice Aluminium

Strong demand and rising commodity prices boosted

export performance. Despite recording negative annual

growth, monthly non-oil exports began to experience

positive growth of 6.0% (Y-o-Y) in quarter IV 2009.

Graph 1.9

Non-oil/gas Export Value in Indonesia

USD Million USD Million Source: BI 0 2000 4000 6000 8000 10000

2006 2007 2008 2009

0 2000 4000 6000 8000 10000 Manufacturing

Mining and Quarrying Agriculture, Hunting, Fishing Total

The Indonesian external sector in general performed

better than previously predicted. In 2009, Indonesia»s

balance of payments»ran a surplus of USD12.5 billion.

Foreign exchange reserves totalled US$66.1 billion;

equivalent to 6.5 months of import payments and servicing

government foreign debt. Consequently, the rupiah

exchange rate strengthened and experienced less volatility.

Compared to the end of semester I 2009, the rupiah

gained about 8% on the US dollar reaching Rp9,404/US$

by the end of the year. The rupiah was strongest during

quarter IV; averaging Rp9,467/$. Meanwhile, rupiah

Graph 1.10 Import/Export Growth % (60) (40) (20) -20 40 60 80 Export Import

2007 2008 2009

Jan Mar May Jul Sep Nov Jan Mar May Jul Sep Nov Jan Mar May Jul Sep Nov

Graph 1.11 IDR/USD Exchange Rate

Source : Bloomberg

0 2,000 4,000 6,000 8,000 10,000 12,000 14,000

2007 2008 2009

0 2000 4000 6000 8000 10000 12000 14000

Chapter 1 Macroeconomic Conditions and the Real Sector

exchange rate volatility against the U.S. dollar during

semester II 2009 averaged 0.36%; lower than average

volatility during the previous semester at 0.65%.

Accordingly, the Indonesian rupiah appreciated strongly

compared to other Asian and major world currencies

during semester II with the exception of the South Korean

won.

2009 reached 2,534.36; surpassing that of the previous

semester totalling 2,026.78. Superior domestic stock

market performance was in harmony with the enhanced

performance of regional stock markets and markets in

developed countries. By sector, the strongest share price

index gain occurred in the basic industry sector; increasing

by 41.9% from 192.9 in late June 2009 to 273.93 in

December 2009.

Graph 1.12 Estimation Results IDR/USD

Volatility -4 -3 -2 -1 0 1 2 3 4

Period (263 days)

1 31 61 91 121 151 181 211 241 Lower Limit

Upper Limit Actual

Graph 1.13 Global Exchange Rates

2009 Index

30 June 2009 = 100

Increase of Index = Exchange Rate Appreciation 85 90 95 100 105 110 115

Jun Jul Aug Sep Oct Nov Dec IDR SGD THB PHP

KRW EUR JPY

In the financial sector, optimism surrounding a global

economic recovery as well as sound domestic economic

conditions, in turn, attracted foreign capital flows into

Indonesian markets. Therefore, domestic financial market

performance improved; characterized by an improvement

in stock market performance and rupiah appreciation. The

Jakarta Composite Index (JCI) at the end of semester II

Graph 1.14 Global Share Price Index

0 5000 10000 15000 20000 25000 30000 35000

2006 2007 2008 2009

Singapore NYA New York Indonesia Nikkei Source: Bloomberg 0 5000 10000 15000 20000 25000 30000 35000 Graph 1.15

Share Price Indices by Sector

Source : Bloomberg 0 500 1000 1500 2000 2500 3000 3500 4000

2006 2007 2008 2009

0 500 1000 1500 2000 2500 3000 3500 4000 Basic Industry Financial Infrastructure Manufacture Mining Property Consumer

The trend of exchange rate appreciation reinforced

by the full panoply of measures taken by the Government

during the crisis to maintain the supply and distribution of

food commodities helped maintain volatile food inflation

at a level below its historical average. This consequently

alleviated inflationary pressures. Headline inflation, measured

Chapter 1 Macroeconomic Conditions and the Real Sector

December 2009, compared to 3.65% (y-o-y) in June 2009.

Nevertheless, when contrasted against other ASEAN

countries, inflation in Indonesia is still considered high

particularly when compared to Malaysia and Singapore.

Notwithstanding, the investment climate in Indonesia

remained attractive because the interest rate exceeded

inflation despite a gradual decline in Bank Indonesia»s policy

rate since late 2008. The real interest rate in Indonesia

surpassed several other ASEAN countries as well as the

United States.

are replete with challenges, including potential hikes in

the global oil price as well as weak industrial sector

competitiveness amid increasing competition stemming

from the inauguration of ACFTA (ASEAN-China Free Trade

Area). In addition, despite slight improvements, high

unemployment in the U.S. and Europe is a risk factor that

continues to overshadow the global economic recovery

process and inevitably impacting prospects for the domestic

economy.

2. 2. REAL SECTOR CONDITIONS

Along with gradual improvements in global economic

conditions as well as strong domestic demand, the real

sector began to display positive signs of progress,

particularly in the beginning of semester II 2009. Strong

external demand drove growth in tradeables sectors,

namely manufacturing (food, beverages and tobacco

subsector, textile subsector, chemical subsector and

transport subsector, machinery and equipment), agriculture

(plantation subsector), and mining sector (non-oil/gas

mining subsector). Furthermore, growth in non-tradeables,

namely the trade sector, transport and communications

as well as construction, was driven on the strength of stable

domestic demand.

During quarter IV 2009, the manufacturing sector

as well as trade, hotels and restaurants showed a significant

improvement in performance. The manufacturing sector

expanded (y-o-y) from 1.3% in quarter III to 4.2% by

quarter IV. Meanwhile, trade, hotels and restaurants grew

by 4.17% (y-o-y) in quarter IV, after contracting by 0.23%

(y-o-y) in quarter III.

Robust manufacturing sector performance was

reflected by increases in related indices as well as greater

utilization of production capacity, and further supported

by demand side indicators, including industry sector exports

and sales of automobiles and motorcycles.

Graph 1.16

Inflation in ASEAN-5 Countries

Graph 1.17

Real Interest Rate in Indonesia

y-o-y %

Source : CEIC (5)

0 5 10 15

Jan Jun Nov Apr Sep Feb Jul Dec

2007 2008 2009

Philippines Singapore Thailand Malaysia Indonesia

%

Sources : Bloomberg and CEIC

-8.00 -6.00 -4.00 -2.00 0.00 2.00 4.00

2004 2005 2006 2007 2008 2009

Indonesia U S Singapore

Looking forward, the Indonesian economy is

expected to continue expanding despite a variety of risk

factors and potential uncertainty, internally and externally,

that should not be overlooked. Efforts to strengthen

Chapter 1 Macroeconomic Conditions and the Real Sector

In terms of financing, from the beginning of 2009

until the end of quarter III, bank loans to the industrial

sector slowed. Nonetheless, in quarter IV bank financing

to the industrial sector began to recover slightly, despite

not attaining overall average growth for 2009.

Graph 1.18

Production Index and Production Capacity Utilization Industrial Sector Index (%) 95 100 105 110 115 120

2007 2008 2009

1 2 3 4 1 2 3 4 1 2 3 4 60 70 80 90 Utilization of Production Capacity (rhs)

Production Index

Graph 1.19

Growth of Industrial Sector Export Value and Industrial GDP

(%,yoy) (%,yoy) 0,0 1,0 2,0 3,0 4,0 5,0 6,0

1 2 3 4 1 2 3 4 1 2 3 4

2007 2008 2009

-40 -20 0 20 40 60 80 GDP of Industry

Export Value of Industrial Sector (rhs)

Graph 1.20

Growth of Automobile and Motorcycle Sales and Industrial GDP

(%, yoy) (%, yoy)

0,0 1,0 2,0 3,0 4,0 5,0 6,0 2008 2009

1 2 3 4 5 6 7 8 9 10 11 12 1 2 3 4 5 6 7 8 9 10 11 12 -80 -40 0 40 80 120 GDP of Industry

Car Sales (rhs) Motorcycle Sales (rhs)

Government policy to encourage real sector

development, in this case the industrial sector, yielded a

number of positive results, particularly in terms of

improving industrial sector resilience against the impacts

of the global economic crisis. Government policy included

programs to utilize domestic products in the procurement

of government goods and services, programs to restructure

the textile and footwear industry (machinery/equipment),

as well as restrictions on food imports, footwear, clothing,

toys and electronic goods. Pro real sector policies taken to

stimulate industrial sector growth were introduced through

the provision of fiscal stimuli in the form of Government

Borne Import Duty (BMDTP). The industrial sector

successfully absorbed 29.4% of the fiscal stimuli introduced

by the government.

Improved performance in the trade, hotels and

restaurants sector was primarily driven by improvements

in the large trade subsector due to increasing imports and

exports; supported by greater purchasing power. Leading

indicators pointed towards entering an expansionary phase

in the following quarter. The Composite Prompt Indicator

for the trade sector also improved up until mid-quarter IV

2009.

Graph 1.21

Manufacturing Sector Credit and GDP

(%, y-o-y) (%, y-o-y)

0 1 2 3 4 5 6 7

2007 2008 2009 2010

GDP of Industry Manufacturing Credit (rhs) Average Manufacturing Credit (rhs)

Chapter 1 Macroeconomic Conditions and the Real Sector

Stronger public purchasing power stimulated public

consumption for both durable and consumable goods.

Indications of improved trade performance were also

reflected by the Retail Sales Index, which increased up to

the end of quarter IV 2009.

In line with the nascent global economic recovery,

domestic consumption continued at a high level during

semester II 2009 driven by a relatively stable public

purchasing power and robust consumer confidence.

Graph 1.26 ROA and ROE of

Public Listed Non-Financial Companies

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 -300 -200 -100 0 100 200 300 400 500 600 700

2003 2004 2005 2006 2007 2008 2009

-200 -100 0 100 200 300 400 ROA (left) ROE (right) Graph 1.24

Retail Sales Index

(%, yoy) (%, yoy)

-2 0 2 4 6 8 10

2008 2009 2009

1 2 3 4 5 6 7 8 9 10 11 12 1 2 3 4 5 6 7 8 9 10 11 12 1 2 3 -20 -10 0 10 20 30 40 GDP of Trading

gSPE_BI (cma, rhs) Graph 1.22 Leading Indicators for the Trade, Hotels and Restaurants Sector

Graph 1.23

Composite Prompt Indicator for the Trade, Hotels and Restaurants Sector

Composite Indicators :

CPI, Hotel Occupancy Jakarta, IPI Machinery Equipments, IPI Paper Products, IPI Rubber Plastic Products,

Exchange Rate, Visitors Arrival at 13 Main Gates

avg. of contraction fase :15.2 month avg. of expansion fase :19.2 month

98 99 99 100 100 101 101 102

2002 2003 2004 2005 2006 2007 2008 2009 2010

I II III IV I II III IV I II III IV I II III IV I II III IV I II III IV I II III IV I II III IV I Trade GDP

CLI

(%, yoy) Index

r = 0.961

-2 0 2 4 6 8 10

2008 2009 2009

1 2 3 4 5 6 7 8 9 10 11 12 1 2 3 4 5 6 7 8 9 10 11 12 1 2 3 -2,0 -1,5 -1,0 -0,5 0,0 0,5 1,0 1,5 GDP of Trading

Composite Prompt of Trading (rhs)

Strong exports and household consumption, in turn,

boosted corporate sector performance, which was

evidenced by the improving financial position of

non-financial companies listed on the Indonesia Stock Exchange

(BEI) that had previously suffered intense pressures during

the first half of 2009. Increases in the Return on Assets

(ROA) and Return on Equity (ROE) were indications of

improved corporate performance compared to the same

period of the previous year.

Graph 1.25

Domestic Consumer Confidence Index

Indeks 140,0 130,0 120,0 110,0 100,0 90,0 80,0 70,0 60,0

Current Economic Condition Index Consumer Expectation Index Consumer Confidence Index

1 2 3 4 5 6 7 8 9 10 11 12 1 2 3 4 5 6 7 8 9 10 11 12 1 12

2008 2009 2010

2007

Chapter 1 Macroeconomic Conditions and the Real Sector

Credit risk in the corporate sector is expected to

intensify in the future, especially for export-oriented

companies due to ACFTA (ASEAN China Free Trade Area).

The potential for increased credit risk is reflected by the

rising trend in the Probability of Default (PD) of public listed

non-financial companies. Estimation results show that the

number of companies with a PD greater than 0.5 will

increase from 24 companies in September 2009 to 27

companies in September 2010.

Graph 1.27

Key Indicators of Corporate Finance

Current Ratio

ROA

ROE

Inventory Turn Over Ratio Collection Period

DER

0 1 2 3 4 5

2008:Q3 2009:Q3 The recovery in Indonesia»s corporate conditions was

evident from the current ratio (liquid assets divided by liquid

liabilities) and inventory turnover ratio (inventory divided

by total sales). During the reporting period, the current

ratio increased while the inventory turnover ratio declined.

The rise in the current ratio reflects an improvement in

corporate liquidity conditions, while the decline in inventory

turnover indicates that the corporate sector was able to

manage its inventory more efficiently. However, the

collection period did not alter significantly.

In terms of financing, there were indications that the

corporate sector continued to rely more on internal capital,

reducing their borrowings, either from banks or through

the issuance of bonds and other securities. This was shown

by the decline in debt-to-equity ratio (DER) and the ratio

of total debt to total assets (Debt/TA).

Graph 1.28 DER and Debt/TA of Public Listed Non-Financial Companies

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 0.00

0.20 0.40 0.60 0.80 1.00 1.20 1.40 1.60 1.80

2003 2004 2005 2006 2007 2008 2009

DER Debt/TA

Probability of Default Total

0 50 100 150 200 250

0.0-0.1 0.1-0.2 0.2-0.3 0.3-0.4 0.4-0.5 0.5-0.6 0.6-0.7 0.7-0.8 0.8-0.9 0.9-1.0 201

5 4 4 0 0 1 0 0

23 Graph 1.29

Probability of Default (PD) of Public Listed Non-Financial Companies (a)

Graph 1.29

Probability of Default (PD) of Public Listed Non-Financial Companies (b)

Probability of Default Total

0 50 100 150 200 250

0.0-0.1 0.1-0.2 0.2-0.3 0.3-0.4 0.4-0.5 0.5-0.6 0.6-0.7 0.7-0.8 0.8-0.9 0.9-1.0 193

11 1 4

2 1 1 0 1

24

In addition to credit risk, companies in the real sector

could also face exchange rate risk, partly due to

approximately 16 large conglomerates that have a ratio

of foreign exchange net liabilities against capital of more

Chapter 1 Macroeconomic Conditions and the Real Sector

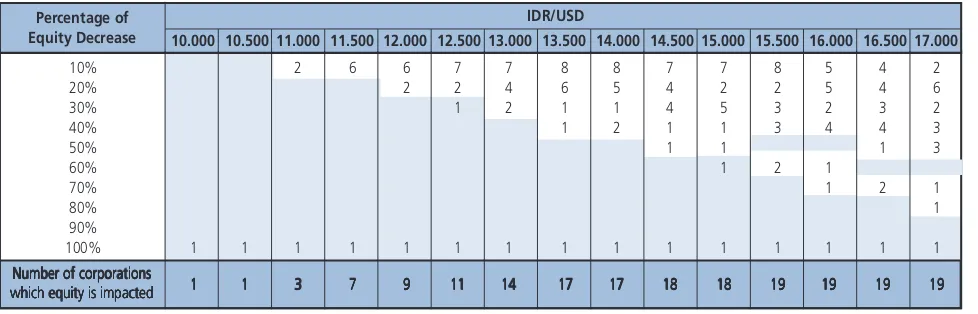

Percentage of Equity Decrease

IDR/USD

10.000 10.500 11.000 11.500 12.000 12.500 13.000 13.500 14.000 14.500 15.000 15.500 16.000 16.500 17.000

Table 1.2

The effect of Rupiah Depreciation on Corporate Equity

10% 2 6 6 7 7 8 8 7 7 8 5 4 2

20% 2 2 4 6 5 4 2 2 5 4 6

30% 1 2 1 1 4 5 3 2 3 2

40% 1 2 1 1 3 4 4 3

50% 1 1 1 3

60% 1 2 1

70% 1 2 1

80% 1

90%

100% 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1

11111 11111 33333 77777 99999 1111111111 1414141414 1717171717 1717171717 1818181818 1818181818 1919191919 1919191919 1919191919 1919191919

of over 100%.In addition, the results of stress tests on 46

large conglomerates in Indonesia as of September 2009

indicate that if the rupiah weakens to Rp17,000/USD, there

Graph 1.30

Ratio of Net Foreign Exchange Liabilities against Corporate Equity

%

(150) (100) (50)

0 50 100 150

R Z AD AK AN AM A AI N F AC AL AO S K M AE AQ I T Q AR W Ratio of Net Forex to

Equity > 25%

is the potential risk that the capital of one conglomerate

would decline by 80%. Therefore, the conglomerate in

question must introduce adequate risk mitigation measures

in order to prevent losses in the event of an exchange rate

shock.

Despite an improvement in real sector performance

during semester II 2009 severe challenges remain, among

others related to financial system stability and economic

resilience. Unstable global financial market conditions could

potentially trigger a sudden foreign capital flow reversal if

the current indicators of economic recovery, especially in

developed countries, weaken again. This would disrupt

domestic financial system stability. In addition, various

micro-structural issues in the real sector remain, such as

weak industrial sector competitiveness and stagnant

infrastructural development, which require close

observation particularly in the face of tighter market

competition following the inauguration of ACFTA.

Chapter 2 The Financial Sector

Chapter 2

Chapter 2 The Financial Sector

Chapter 2 The Financial Sector

The Financial Sector

Chapter 2

2.1. INDONESIAN FINANCIAL SYSTEM

STRUCTURE

There were no significant changes in the structure

of the Indonesian financial system during the reporting

semester. The banking industry, consisting of commercial

banks and rural banks, remained dominant with an 80%

share of total financial sector assets. Meanwhile, the shares

of other financial industry components such as insurance,

pension funds, finance companies, securities and

pawnshops remained relatively low.

In addition, total assets of commercial banks

increased by Rp224.3 trillion (9.7%) to Rp2,534.1 trillion

at the end of December 2009. Due to the merger of two

large banks, 70% of bank assets are no longer owned by

15 large banks (as reported in previous editions of the

Financial Stability Review (FSR)) but are currently owned

by 14 major banks. Meanwhile, the non-bank financial

The financial sector Indonesia expanded during semester II 2009 and

stability was maintained due to conducive domestic economic conditions

as well as clearer signs of a global economic recovery. The banking industry

as the dominant industry in the Indonesian financial sector, continued to

perform positively despite suboptimal implementation of the intermediary

function. Notwithstanding, domestic stock market and Government bond

(SUN) market performance improved, thus raising their attractiveness to

investors, both domestic and foreign.

market also demonstrated favorable growth in semester II

2009, evidenced by a 25.04% rally in the Jakarta

Composite Index (JCI) to 2,534.36, whereas the IDMA price

index of Government bonds (SUN) climbed 4.02% to

94.33.

Graph 2.1

Asset Composition of Financial Institutions

1,1%

8,8%3,1%

4,4% 2,7% 0,4%

79,5%

Commercial Banks

Rural Banks

Insurance Companies

Pension Fund

Finance Companies

Securities Companies

Chapter 2 The Financial Sector

2. 2. FINANCIAL SECTOR RESILIENCE

One indicator used to evaluate financial sector

resilience is the Financial Stability Index or FSI.1 Financial

sector resilience improved during the reporting semester,

as reflected by a decline in FSI from 1.94 (June 2009) to

1.91 (December 2009). Consequently, the FSI projection

of 1.90 by the end of 2009 was successfully achieved.

This improvement in FSI was supported by good quality

bank credit, as well as less volatility on the stock market

and SUN market.

As detailed in previous editions of FSR, the maximum

indicative limit of FSI is 2.00. As a comparison, when the

global crisis befell Indonesia FSI peaked at 2.43 in

November 2008. Meanwhile, at the height of the 1997/

1998 crisis FSI soared to 3.23.

It is worth noting that in June 2009 FSI dropped to

1.94, which was the first time below the 2.00 threshold

since the onset of the global crisis. Previously, in the first

half of 2009 (until May), FSI remained consistently above

2.00. Nevertheless, from June 2009 until February 2010

FSI was below 2.00, declining to just 1.90 in January and

February 2010. Such a downward trend in FSI was clear

evidence of greater financial stability.

With distinct improvements in global and domestic

economic conditions, FSI at the end of semester I (June) of

2010 is projected to lie in the range of 1.59 - 2.16, with a

baseline of 1.87. This projection is based on the premise

that bank credit risk will intensify, however, stock market

and SUN market stability will improve. Increasing stability

in both markets is inseparable from improved expectations

regarding economic fundamentals and the shift in

Indonesia»s sovereign rating towards investment grade.

1 Met hodology and approach to calculate FSI can be found in FSR No. 8 March 2007 and No. 9 September 2007.

2.3. BANKING INDUSTRY

2.3.1. Funding and Liquidity Risk

Deposits

Indonesian banks continued to rely upon third party

funds (deposits) as their primary source of funds up to the

end of semester II 2009. When extrapolated over a longer

timeframe, since 2000 deposits have accounted for

86.04%, on average, of banks» funds. Other sources of

funds, such as securities issued, loans and capital make

up 0.95%, 1.24% and 11.77% respectively. Graph 2.2

Financial Stability Index

Crisis 1997/1998 : 3,23

Global Crisis (Nov 2008) : 2.43 Mini Crisis 2005 : 2,33

0.00 0.50 1.00 1.50 2.00 2.50 3.00 3.50 2.16 1.59

1 5 9 1 5 9 1 5 9 1 5 9 1 5 9 1 5 9 1 5 9 1 5 9 1 5 9 1 5 9 1 5 9 1 5 9 1 5 9 1 5 9 1 5 9

19961997 1998 19992000 2001 20022003200420052006 2007 2008 2009 2010 Des

2009: 1.91

Jun 2010 (p): 1.87

FSI 1996 - 2010

Share of Deposits (%)

Time Deposits Savings Capital Giro Loans Marketable Securities 1.000 900 800 700 600 500 400 300 200 100

-2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 89 88 87 86 85 84 83 82 Graph 2.3 Sources of Funds - Banks

As of December 2009, deposits accrued by banks

totaled Rp1,973.00 trillion, representing an increase of

Rp148.8 trillion (8.2%) compared to that of the previous

semester, easily surpassing that of the semester I at Rp71.0

trillion (4.1%). This is verification that improving economic

Chapter 2 The Financial Sector

All components contributed to the increase in

deposits during the reporting period, namely giro accounts,

saving accounts and time deposits. Of the three

components, saving accounts experienced the greatest

increase (Rp90.5 trillion or 17.6%) followed by time

deposits and giro accounts with Rp39.6 trillion (4.6%) and

Rp18.8 trillion (4.2%) respectively.

2 Primary Reserves include Cash and GiroAccounts held at BI. Meanwhile, Secondary Reserves consist of BI Certificates,other placements atBI (BI Facilities/Contraction Adjustments), and SUN (Trading and Available for Sale). Finally, Tertiary Reserves are SUN (Held to maturity).

Rupiah appreciation in 2009 encouraged the general

public to increase placements at banks in the form of

foreign exchange. It is highly probable that this was

motivated by profit-taking behavior in anticipation of a

subsequent decline in the rupiah exchange rate.

Accordingly, during semester II 2009, foreign denominated

deposits increased by USD5.1 billion, equivalent to Rp24.7

trillion, which affected all components with the largest

increases reported for time deposits and checking accounts.

In terms of time deposits, the increase could be due to

expectations of high returns. Whereas giro accounts, the

most liquid component, are easily withdrawn or switched

as necessary.

Liquidity Adequacy

The significant increase in funding sources, moreover

during the period of languid credit growth, provided

relatively widespread opportunities for banks to increase

placements in liquid assets. During semester II 2009, bank

liquid assets consisting of primary reserves, secondary

reserves and tertiary reserves grew by Rp34.2 trillion

(5.1%)2, surpassing that of the previous semester. In the

first half of 2009, banks increased placements in liquid

assets to the tune of Rp23.1 trillion (3.5%).

Significant growth in liquid assets occurred in

December 2009 in harmony with a sharp rise in deposits

triggered by an adjustment to the Statutory Reserve

Requirement that obliged banks to maintain secondary

reserves of 2.5%. This encouraged banks to stockpile liquid

assets in the form of BI Certificates and SUN. However,

the emerging trend of banks exploiting profit taking

through SUN ownership in mid-semester II 2009

precipitated a decline in SUN ownership by banks of around

9.4%.

Based on type, the increase in bank liquid assets

during semester II 2009 principally stemmed from a rise

in primary reserves amounting to Rp27.3 trillion (21.0%) Graph 2.4

Deposits by Component

Rp T

350 400 450 500 550 600 650 700

Dec Oct Dec Feb Apr Jun Aug Oct Dec

2008 2009

600 700 800 900 1.000 Demand Deposits (lhs)

Savings (lhs) Time Deposits (rhs)

2007

Graph 2.5

Foreign Exchange Deposits IDR/USD Exchange Rate

Rupiah USD Billion

22 26 30 34 38 42

Dec Oct Dec Feb Apr Jun Aug Oct Dec

2007 2008 2009

8.000 9.000 10.000 11.000 12.000 13.000 Foreign Exchange Deposits (lhs)

Chapter 2 The Financial Sector

and secondary reserves, excluding SUN, totaling Rp25.9

trillion (6.4%), more specifically BI Facilities/Contraction

Adjustments. The prevalence of short-term liquid assets

indicated widespread caution by the banks in order to

anticipate their liquidity requirement.

assets at a specific amount to alleviate liquidity risk. The

ratio of liquid assets3 to short-term liabilities, i.e. non-core

deposits (NCD)4, demonstrated adequate liquidity. This ratio

confirms the ability of banks to meet their short-term

liquidity requirement.

The liquid asset ratio improved continuously during

2009 after slumping to its nadir (84.9%) in December 2008

due to the global crisis. The ratio subsequently climbed to

114.6%, exceeding the minimum threshold of 100%, and

surpassing its position at the beginning of 2009.

Liquid asset ownership was dominated by banks with

total assets exceeding Rp15 trillion, accounting for 85.72%

of total bank liquid assets. In general, secondary reserves,

consisting primarily of BI Certificates, remained the most

favored component with a share of more than 50%.

3 Liquid assets included in this ratio include Cash and Placements at BI.

4 NCD is made up of 30% checking account + 30% savings acount + 10% certificate deposits with a tenure of up to 3 months.

Graph 2.6 Bank Liquid Assets

Rp T

0 90 180 270 360 450

500 550 600 650 700 750

Des Mar Jun Sep Des

2008 2009

Primary Reserves Secondary Reserves Tertiary Reserves TOTAL AL (rhs)

Graph 2.7

Liquid Assets by Bank Group

TA <1 T TA 1-5 T TA 5-15 T TA >15 T 0.71% 4.18% 9.39%

85.72%

Liquid assets were principally accrued by banks in

order to anticipate their immediate and short-term liquidity

requirement. Consequently, banks maintained their liquid

Graph 2.8 Liquid Assets Ratio

60 120 180

0 100 200 300 400

Jul '08 Oct'08 Jun '09 Dec'09

Rp T

Liquid Assets NCD Liquid Assets/NCD

%

Dec '07 147.7

119.3

102.5 92.0

84.9 101.4

95.497.6 109.1

109.2 107.8

104.7 114.6

Interbank Money Market

Activity in the interbank money market intensified

on the back of abundant bank liquidity. In general,

transactions on the Interbank Money Market, both in

rupiah and foreign exchange, during semester II 2009

eclipsed those of the same period in 2008 (during the

global crisis) as well as during semester I 2009.

Nevertheless, observation of data shows that the

Interbank Money Market volume during the last quarter

of 2009 decreased. Such is due to high levels of

day-to-day liquidity and thus causing the need to transact in the

Chapter 2 The Financial Sector

transaction volume level continued to the end of the year.

Such was supported by the following factors:

1. The inflow of currency after the Idul Fitri holidays

causing the majority of market players experienced

better evenly distributed excess liquidity

2. The allocation of funds from the Government to fund

projects nearing the yearend

3. Banks anticipate the withdrawal of cash as

anticipation of the Christmas and New Year»s holidays

by maintaining availability of day-to-day liquidity

through BI Facilities (Fasbi) and Contraction

Adjustments (FTK).

No irregular interbank transactions were apparent

during the reporting semester. Average daily transaction

volume on the interbank money market, in rupiah,

increased slightly despite a small decrease in the final quarter

of 2009. Conversely, average daily forex transaction volume

increased steadily but failed to achieve pre-crisis levels.

conditions reflect relatively well-controlled liquidity risk by

the banking industry.

2.3.2. Credit Growth and Risk

Credit Growth

Similar to conditions in the first half of 2009, credit

growth during semester II was not favorable; following an

opposite trend to the relatively buoyant deposit growth.

However, significant credit allocation did emerge in the

final two months of 2009, amounting to around Rp60

trillion. Consequently, credit growth in 2009 only achieved

10%, which falls far below the target stipulated in the

Bank Business Plan of around 15%. Sluggish credit

allocation was due to several factors, mainly stemming

from the impact of the global crisis, and was reflected by

slow working capital credit growth, lackluster credit

extension to the manufacturing industry and the corporate

sector as well as negative forex credit growth. Graph 2.9

Transaction Volume

O/N Interbank Money Market (daily average)

USD Million Rp T

Jan'08 Jun'08 Nov'08 Apr'09 Sept'09

0 4 8 12

0 100 200 300 400 500 Rupiah PUAB Foreign Exchange

The rate of interest for rupiah interbank money

market transactions remained relatively under control with

normal fluctuations. No transactions applied an interest

rate that deviated far from the weighted average during

the reporting semester. Since the middle of 2009 the

weighted average overnight interbank money market

interest rate remained below the BI rate. In general, such

Graph 2.10

Interbank Money Market Interest Rate (P)

Graph 2.11

Interbank Money Market Interest Rate (O) %

Lowest Overnight Interest Rate Highest Overnight Interest Rate Weighted Average Overnight Interest Rate BI Rate

01/05/09 03/11/09 05/18/09 07/24/09 10/01/09 12/04/09

5 6 7 8 9 10

%

01/05/09 03/11/09 05/18/09 07/24/09 10/01/09 12/04/09 5

6 7 8 9 10

Chapter 2 The Financial Sector

Listless economic growth undermined credit

extension to the manufacturing sector in 2009, achieving

just 8.8% compared to 32% in 2008.

In 2009, bank loans primarily funded consumption

with around 54% of the growth in total credit contributed

by consumption credit. The share of working capital credit,

which falls under the category of productive credit, was

only 14%. During 2009, working capital credit expanded

by just 2.7%. In the two years prior (2007 and 2008),

working capital credit achieved growth of 28%. The decline

in working capital credit growth was due to a slowdown

in economic activity as a result of the global crisis.

However, investment credit growth remained

favorable and in 2009 expanded by 16.4% (Rp42 trillion).

As investment credit is mid/long term in nature and is used

for the procurement of capital goods, relatively strong

growth indicates positive economic prospects according

to the banks.

Graph 2.13 Credit Growth by Type

2009 2008 2007 KMK KI KK %

0,0 10,0 20,0 30,0 40,0

28,6% 28,4% 2,7% 23,2% 37,4% 16,4% 24,9% 29,9% 19,0% Graph 2.14

Credit Growth by Economic Sector % -20 0 20 40 60 80 100 Agriculture Mining Manufacturing Electricity Construction Trade Transportation Business Services Social Services Others 2007 2008 2009 16.1% 9.3% 33.1% 17.0% 8.2% 15.2% -1.0% 18.8% 32.9% -8.8% Graph 2.15 Credit Growth by Currency % -30 -20 -10 0 10 20 30 40 50 2007 2008 2009

Rupiah Foreign Exchange Total

24.0% 33.2% 16.5% 36.8% 20.4% -17.4% 26.5%30.5% 10.0% Graph 2.12

Growth of Credit and Deposits (% y-o-y)

% 0 5 10 15 20 25 30 35 40 45

2003 2004 2005 2006 2007 2008 2009

G_Kredit

G_DPK

In 2009, forex denominated credit contracted by

17.4% as a result of declining exports/imports due to

deteriorating economic conditions in several key trade

partners. The close relationship between forex credit and

export/import activities was clearly evidenced by the high

respective correlation coefficient at around 0.92. Even

when forex credit contracted, rupiah denominated credit

grew at a relatively high rate of around 16.5%.

Banks tended to focus on Micro, Small and Medium

(MSM) credit. Consequently, in 2009 MSM credit expanded

by 16.3% compared to just 4% for non-MSM credit or

corporate credit (credit with a nominal value of above Rp5

Chapter 2 The Financial Sector

an economic recovery as well as the relatively successful

credit-restructuring program. Furthermore, banks

maintained relatively large loan loss provisions in order to

mitigate credit risk. In 2009, loan loss provisions increased

by Rp12.7 trillion, thus precipitating a significant decline

in the net NPL ratio from 0.8% at the end of 2008 to

0.3% by yearend 2009. Conversely, the gross NPL ratio

increased slightly from 3.2% to 3.3% for the same period. Rp500 million, dominated MSM credit as a whole. In

addition to fallout from the global crisis, slow corporate

credit growth was also due to widespread alternative

financing options available to large corporations, such as

through the issuance of bonds or shares, which were

cheaper than credit because of soaring lending rates that

exceeded 13%.

Graph 2.16

MSM and non-MSM Credit Growth

%

2007 2008 2009

22,5% 26,1% 16,3% 30,8% 35,0% 4,0% 0 5 10 15 20 25 30 35 40 MSM Non-MSM

In addition to demand-side factors, slow credit

growth was also affected by internal bank policy (supply

factors). Several banks, mostly those affiliated with foreign

banks, chose to consolidate and reorganize internally

through, among others, credit restructuring in order to

anticipate and mitigate the global crisis. This was reflected

by an unusual decline in non-performing loans in the

manufacturing sector, which should have actually increased

as a result of the global crisis.

Credit Risk

Sluggish credit growth was inseparable from

mounting credit risk, as reflected by the upward trend in

non-performing bank loans. In general, this condition was

a result of the global crisis. Banks tended to become more

selective when extending credit as the probability of

non-performing loans increased.

After peaking in July 2009, credit risk gradually began

to ease in semester II in accordance with the prospects of

Graph 2.17 Non-performing Loans

Loan Loss Provision (rhs)

Nominal NPL (rhs)

(%) (Trillion)

NPL Gross

NPL Net (lhs)

-1 2 3 4 5 6 7 8 9

2006