Full Terms & Conditions of access and use can be found at

http://www.tandfonline.com/action/journalInformation?journalCode=vjeb20

Download by: [Universitas Maritim Raja Ali Haji], [UNIVERSITAS MARITIM RAJA ALI HAJI

TANJUNGPINANG, KEPULAUAN RIAU] Date: 11 January 2016, At: 18:37

Journal of Education for Business

ISSN: 0883-2323 (Print) 1940-3356 (Online) Journal homepage: http://www.tandfonline.com/loi/vjeb20

Capitalism and crime in the classroom: An analysis

of academic dishonesty and latent student

attitudes

Robert T. Burrus, Adam T. Jones & Peter W. Schuhmann

To cite this article: Robert T. Burrus, Adam T. Jones & Peter W. Schuhmann (2016) Capitalism and crime in the classroom: An analysis of academic dishonesty and latent student attitudes, Journal of Education for Business, 91:1, 23-31, DOI: 10.1080/08832323.2015.1110105

To link to this article: http://dx.doi.org/10.1080/08832323.2015.1110105

Published online: 23 Nov 2015.

Submit your article to this journal

Article views: 11

View related articles

Capitalism and crime in the classroom: An analysis of academic dishonesty and

latent student attitudes

Robert T. Burrus, Adam T. Jones, and Peter W. Schuhmann

The University of North Carolina Wilmington, Wilmington, North Carolina, USA

ABSTRACT

University students’latent attitudes toward capitalism were quantified and used to predict self-reported cheating behaviors. Results suggest that the relationship between student academic dishonesty and attitudes toward capitalism are complex. Students indicating a strong degree of risk aversion are less likely to report cheating behaviors. Students demonstrating a preference for equality over efficiency, while no more likely to be cheaters, may cheat more often. Effi ciency-minded students do not appear to be more likely to cheat, but may engage in fewer instances of cheating. Implications for curriculum development in economics and business programs are discussed.

KEYWORDS

business ethics; capitalism; cheating; instruction

The recent financial crisis and subsequent corporate scandals have drawn public attention to business practi-ces on Wall Street and activities at other large corpora-tions. Critics claim that unfettered capitalism and intense competition breed dishonesty (Bennett, Pierce, Snyder, & Toffel, 2013) and may lead to a short-term focus that incentivizes unethical practices (Siben,2010). Yet the foundation of capitalism rests on a strong set of institutions including trust among market participants. As Bruner (2009) pointed out, without trust between market participants, society is forced to rely on laws to govern all details of transactions and a world of all laws and little trust is neither desirable nor feasible.

The purpose of this study was to explore the relation-ship between academic dishonesty and latent attitudes toward capitalism among university students. Results suggest that the relationship between student academic dishonesty and attitudes toward the basic tenets of capi-talism are multifaceted. These results have implications for curriculum development in economics and business programs.

Ethics in introductory courses

Despite the seeming prerequisite nature of trust and ethi-cal behavior for the efficiency of market outcomes, a review of introductory economics texts reveals scant mention of their importance. The possibility that the promotion of self-interest in introductory business and

economics courses may lead to unethical behaviors by students has been addressed empirically, with mixed results. Carter and Irons (1991) found that training in the rational self-interest model does not influence behav-ior in a simple ultimatum bargaining game. However, they dofind that economics students were more likely to behave in accordance with the rational/self-interest model (i.e., accepting less and keeping more in the game), suggesting that“economists are born, not made.”

Frank, Gilovich, and Regan (1993) found that exposure to the mainstream self-interest model encourages less cooperative behavior in the context of a prisoner’s dilemma game and more unethical behavior in hypothet-ical scenarios. Yet, Yezer, Goldfarb, and Poppen (1996) found that economics students tended to behave more cooperatively than other students in an experiment involving returning a lost envelope holding cash and, in a replication of the scenario aspect of Frank et al. , found no change in unethical behavior related to exposure to the neoclassical economics model. We wish to extend this literature by examining whether student attitudes toward free markets and capitalism are associated with academic dishonesty.

Academic dishonesty

Numerous studies have shown that academic dishonesty at the university level is widespread (for a review, see Whitley,

1998). The literature includes numerous empirical

CONTACT Peter W. Schuhmann schuhmannp@uncw.edu The University of North Carolina Wilmington, Department of Economics and Finance, 601 S. College Road Wilmington, NC 28403, USA.

© 2016 Taylor & Francis Group, LLC

2016, VOL. 91, NO. 1, 23–31

http://dx.doi.org/10.1080/08832323.2015.1110105

examinations of the relationship between cheating by col-lege students and individual, situational, and institutional factors. As noted in Schuhmann, Burrus, Barber, Graham, and Elikai (2013), results are varied. However, studies show that increased probabilities of detection, higher levels of punishment, and decreased perceptions that other students are cheating all tend to deter student cheating. Honor codes, especially traditional codes that require signed pledges, policing of cheating, and student-centric honor councils, also reduce cheating behavior.

There is also a growing literature that investigates whether business students are more likely to cheat than other students. Roig and Ballew (1994) and Simha, Arm-strong, and Albert (2012) found business students are more tolerant of cheating than other students with, according to Klein, Levenburg, McKendall, and Mother-sello (2007), a looser definition of cheating. McCabe and Trevino (1995) and Smyth and Davis (2004) found that business school students are more likely to cheat and rationalize their behavior. Crittenden, Hanna, and Peter-son (2009a, 2009b) suggested that business school stu-dents in the United States have similar views on cheating behaviors as those in highly corrupt countries (though incidents of cheating are much higher for students in corrupt countries). Iyer and Eastman (2006), however, tempered these results byfinding that nonbusiness stu-dents are more likely to cheat than business stustu-dents. Nowell and Laufer (1997) used observed cheating behav-ior, comparing self-reported quiz scores with actual scores, and found economics students are no more likely to cheat than others.

Empirical examinations of academic dishonesty and real-world behaviors, including Sims (1993), are consis-tent infinding clear links between cheating in academic settings and dishonest behavior in the workplace. Nonis and Swift (2001) suggested students with weaker morals are more dishonest in both academic and work settings. Carpenter, Harding, Finelli, and Passow (2004) exam-ined a sample of undergraduate engineering students with professional workplace experience and reinforce the consensus that prior academic dishonesty is an indicator of workplace dishonesty. In response to hypothetical aca-demic and business scenarios, Smyth and Davis (2004) found that business majors exhibit a lower degree of ethi-cal behavior in both contexts than nonbusiness majors.

Motivation

Given that our market system depends on honesty, that our institutions of higher education (and business schools in particular) suffer from widespread academic dishonesty, and that dishonesty at the academy translates to the workplace, we seek to understand the linkages

between free market attitudes and academic dishonesty. Using survey data, we identified three dimensions of stu-dent views as externally versus internally focused, risk averse versus entrepreneurial, and efficiency versus equality oriented, with the second and third dimensions most associated with the capitalist mindset promoted in principles of economics courses. Next, we attempted to determine whether these leanings are correlated with the decision to cheat and the frequency of cheating by undergraduate business students.

This research is important for two reasons: the identi-fication of a possible association between undergraduate market philosophy and future business practice and additional business curriculum development. A failure to promote the primacy of trust and morality in a free mar-ket economy might embolden capitalists—through greed—to undermine the system they claim to support.

Data

Data for this study were collected using an online ques-tionnaire administered to more than 1,000 undergradu-ate students in business school classes at a regional stundergradu-ate university at the end of the spring and fall semesters in 2009 and 2010.1The questionnaire included questions regarding perceptions, attitudes, and frequency of cheat-ing, demographics, involvement in scholastic and extra-curricular activities, and statements designed to elicit attitudes toward capitalism. Our survey was anonymous and respondents were reminded of this at the beginning of the survey and before completing survey questions related to cheating. Prior to the cheating questions on the survey, survey respondents were provided with a def-inition of cheating following Burrus, McGoldrick, and Schuhmann (2007).

After removing incomplete questionnaires, responses from students who had completed the survey on a previ-ous occasion, surveys containing incorrect answers to attention checks, graduate students, the relatively few non–business school students, and students with no knowledge or opinion regarding the extent to which cheating occurs, the penalties, or the probability of being

caught, the sample contained 617 completed

questionnaires.

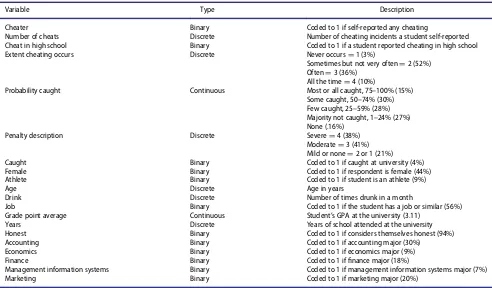

Variable descriptions for demographic and contextual variables are presented inTable 1and descriptive statis-tics are given inTable 2.

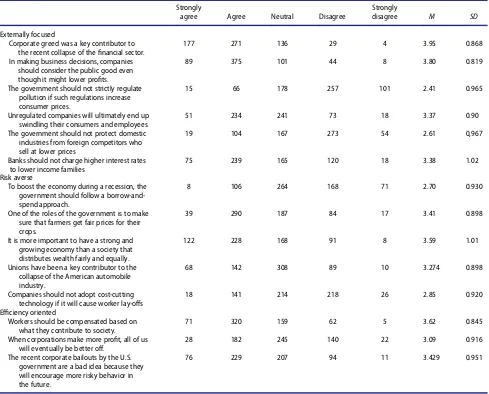

To explore the relationship between attitudes toward capitalism and cheating behavior, students were asked to state the degree to which they agreed with a series of 14 statements. These statements are listed inTable 3.

Possible responses were rated on a 5-point Likert-type scale ranging from 1 (strongly disagree) to 5 (strongly

24 R. T. BURRUS ET AL.

agree). Statement orientation was mixed such that agree-ment was not always consistent with a procapitalism or anticapitalist response. Responses are summarized in

Table 3.

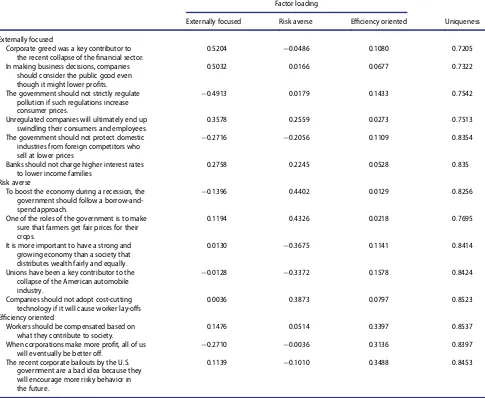

Methods

Exploratory factor analysis was applied to statement responses in order to quantify students’ latent views toward different facets of capitalism. Horn (1965) paral-lel analysis, confirmed with a scree test executed in the manner of Costello and Osborne (2005), was used to determine the number of factors to retain, three. Factors were extracted using the principal factors method.2 We labeled these factors externally focused, risk averse, and efficiency oriented. While labels were chosen arbitrarily for illustrative purposes, the loads assigned to the indi-vidual statements used to generate the factors were driven by the data. Obliquely rotated factor loadings are presented inTable 4 along with each item’s uniqueness. Positive loadings indicate that agreement with the state-ment is positively associated with the factor and negative values indicate that agreement is inversely associated with the factor. Factor values are standardized to mean zero and unit standard deviation.

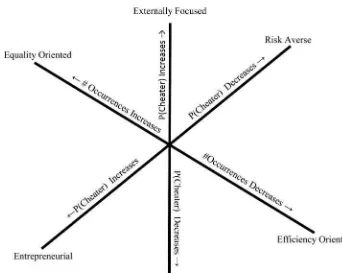

Figure 1provides a representation of the three factors. Each factor represents a latent dimension of students’

views about capitalism and economics rather than identi-fying specific student cohorts.Figure 1includes labels at the terminus of each of the three axes to help put the dimension into perspective. In addition, each axis includes a description regarding the relationship between Table 1.Demographic and contextual variable descriptions.

Variable Type Description

Cheater Binary Coded to 1 if self-reported any cheating

Number of cheats Discrete Number of cheating incidents a student self-reported Cheat in high school Binary Coded to 1 if a student reported cheating in high school Extent cheating occurs Discrete Never occursD1 (3%)

Sometimes but not very oftenD2 (52%) OftenD3 (36%)

All the timeD4 (10%)

Probability caught Continuous Most or all caught, 75–100% (15%) Some caught, 50–74% (30%) Few caught, 25–59% (28%) Majority not caught, 1–24% (27%) None (.16%)

Penalty description Discrete SevereD4 (38%) ModerateD3 (41%) Mild or noneD2 or 1 (21%) Caught Binary Coded to 1 if caught at university (4%) Female Binary Coded to 1 if respondent is female (44%) Athlete Binary Coded to 1 if student is an athlete (9%)

Age Discrete Age in years

Drink Discrete Number of times drunk in a month

Job Binary Coded to 1 if the student has a job or similar (56%) Grade point average Continuous Student’s GPA at the university (3.11)

Years Discrete Years of school attended at the university Honest Binary Coded to 1 if considers themselves honest (94%) Accounting Binary Coded to 1 if accounting major (30%)

Economics Binary Coded to 1 if economics major (9%) Finance Binary Coded to 1 iffinance major (18%)

Management information systems Binary Coded to 1 if management information systems major (7%) Marketing Binary Coded to 1 if marketing major (20%)

Percentages in parentheses represent percent of responses.

Table 2.Descriptive statistics.

Variable M SD Min Max

Externally focused 0 1 ¡4.96 2.88 Risk averse 0 1 ¡3.28 3.04 Efficiency oriented 0 1 ¡3.08 3.30

Cheater 0.665 0.473 0 1

Number of cheats 2.314 2.68 0 16 Cheat in high school 0.726 0.446 0 1 Extent cheating occurs 2.533 0.704 1 4 Probability caught 45.50 26.13 0 100 Penalty description 3.165 0.776 1 4

Caught 0.036 0.186 0 1

Female 0.441 0.497 0 1

Athlete 0.092 0.290 0 1

Age 20.63 2.266 18 41

Drink 6.348 5.134 0 15

Job .562 .496 0 1

Grade point average 3.113 0.651 0 3.875

Years 2.726 0.969 1 4

Honest 0.942 0.235 0 1

Accounting 0.295 0.456 0 1 Economics 0.092 0.290 0 1

Finance 0.177 0.382 0 1

Management information systems 0.068 0.252 0 1 Marketing 0.204 0.403 0 1

N 617

behavior and the factor. These relationships are dis-cussed below.

The external focus factor is primarily constructed from six statements that suggest that students are distrustful of others’ motives and believe others may not follow an implicit social contract regarding responsibility to society. This position is consistent with an external locus of control (i.e., external events are responsible for an individual’s situa-tion) and corresponds to an emphasis on regulating others’

behavior. Students who believe that companies should con-sider the public good and, if left unregulated, will“swindle consumers and employees” have higher external focus scores, while students who believe“government should not strictly regulate pollution”and that unregulated companies will not swindle their customers or employees have lower external focus scores. These students might be considered internally focused, an attitude that can be associated with favoring self-regulation.

The risk-averse factor is dominated byfive statements which all suggest an emphasis on stability and protection against downside risk for individuals and groups within society. Students who suggest that “government should borrow and spend in a recession,” that the government needs to“ensure high prices for farmers,”or that equality is more important than economic growth have higher scores on the risk-averse factor.Students who believe the government should not stabilize the economy during recession, allow prices to fluctuate, favor growth, and oppose unions have lower risk averse scores. These stu-dents display a higher tolerance for economic risk and are considered entrepreneurial.

The third factor, efficiency oriented is primarily made up of student responses to three statements that suggest that economic efficiency trumps other concerns such as social contracts and stability. Students who believe that workers should be compensated based on their Table 3.Question response distributions.

Strongly

agree Agree Neutral Disagree

Strongly

disagree M SD

Externally focused

Corporate greed was a key contributor to the recent collapse of thefinancial sector.

177 271 136 29 4 3.95 0.868

In making business decisions, companies should consider the public good even though it might lower profits.

89 375 101 44 8 3.80 0.819

The government should not strictly regulate pollution if such regulations increase consumer prices.

15 66 178 257 101 2.41 0.965

Unregulated companies will ultimately end up swindling their consumers and employees.

51 234 241 73 18 3.37 0.90

The government should not protect domestic industries from foreign competitors who sell at lower prices

19 104 167 273 54 2.61 0,967

Banks should not charge higher interest rates to lower income families

75 239 165 120 18 3.38 1.02

Risk averse

To boost the economy during a recession, the government should follow a borrow-and-spend approach.

8 106 264 168 71 2.70 0.930

One of the roles of the government is to make sure that farmers get fair prices for their crops.

39 290 187 84 17 3.41 0.898

It is more important to have a strong and growing economy than a society that distributes wealth fairly and equally.

122 228 168 91 8 3.59 1.01

Unions have been a key contributor to the collapse of the American automobile industry.

68 142 308 89 10 3.274 0.898

Companies should not adopt cost-cutting technology if it will cause worker lay-offs

18 141 214 218 26 2.85 0.920

Efficiency oriented

Workers should be compensated based on what they contribute to society.

71 320 159 62 5 3.62 0.845

When corporations make more profit, all of us will eventually be better off.

28 182 245 140 22 3.09 0.916

The recent corporate bailouts by the U.S. government are a bad idea because they will encourage more risky behavior in the future.

76 229 207 94 11 3.429 0.951

26 R. T. BURRUS ET AL.

productivity, that corporate profits benefit society, and that governments should not bail out failing companies have higher efficiency oriented scores. Students who believe that compensation should be based on factors other than productivity, that corporate profits are bad, and that government bailouts aren’t necessarily bad are viewed as equality oriented.

Table 5shows mean factor scores for different student subsamples. Because the mean values for each factor are normalized to zero for the sample, positive (negative) values for the subsample averages denote relatively high (low) factor scores for that group of students. Mean scores for the external focus factor show a notable associ-ation with age, with seniors having considerably higher values for this factor than freshmen. The most striking difference is the factor scores between men and women. Male students in our sample appeared to be less exter-nally focused, less risk averse, and more efficiency ori-ented than were female students.

To analyze the relationship between students’ atti-tudes toward capitalism and cheating behavior, we esti-mate the following model using two definitions of the dependent variable, academic dishonesty:

academic dishonestyDa CbicapitalismiCλicontexti

CgidemiC ei

;

wherecapitalismiis a the vector of capitalism factor vari-ables constructed from the Likert-type scale responses to the capitalism statements;contexti is a vector of contex-tual variables such asprobability_caught,extent_ cheatin-g_occurs, penalty_description, and honest; demi is a vector of demographic variables; andb,l, andgare vec-tors of the respective coefficients.

Our first model examines the extensive margin of a student’s cheating decision (whether to cheat) using a logit model with a binary dependent variable coded as 1 Table 4.Factor loadings.

Factor loading

Externally focused Risk averse Efficiency oriented Uniqueness

Externally focused

Corporate greed was a key contributor to the recent collapse of thefinancial sector.

0.5204 ¡0.0486 0.1080 0.7205

In making business decisions, companies should consider the public good even though it might lower profits.

0.5032 0.0166 0.0677 0.7322

The government should not strictly regulate pollution if such regulations increase consumer prices.

¡0.4913 0.0179 0.1433 0.7542

Unregulated companies will ultimately end up swindling their consumers and employees.

0.3578 0.2559 0.0273 0.7513

The government should not protect domestic industries from foreign competitors who sell at lower prices

¡0.2716 ¡0.2056 0.1109 0.8354

Banks should not charge higher interest rates to lower income families

0.2758 0.2245 0.0528 0.835

Risk averse

To boost the economy during a recession, the government should follow a borrow-and-spend approach.

¡0.1396 0.4402 0.0129 0.8256

One of the roles of the government is to make sure that farmers get fair prices for their crops.

0.1194 0.4326 0.0218 0.7695

It is more important to have a strong and growing economy than a society that distributes wealth fairly and equally.

0.0130 ¡0.3675 0.1141 0.8414

Unions have been a key contributor to the collapse of the American automobile industry.

¡0.0128 ¡0.3372 0.1578 0.8424

Companies should not adopt cost-cutting technology if it will cause worker lay-offs

0.0036 0.3873 0.0797 0.8523

Efficiency oriented

Workers should be compensated based on what they contribute to society.

0.1476 0.0514 0.3397 0.8537

When corporations make more profit, all of us will eventually be better off.

¡0.2710 ¡0.0036 0.3136 0.8397

The recent corporate bailouts by the U.S. government are a bad idea because they will encourage more risky behavior in the future.

0.1139 ¡0.1010 0.3488 0.8453

if the student admits having cheated while at the univer-sity (zero otherwise). The second model considers the intensive margin of cheating (how much to cheat) with the dependent variable equal to the number of incidents of reported cheating including zero values for students who did not cheat. This estimation employs a zero-inflated negative binomial with an exposure control for the number of years a student has attended the university.

Results and discussion

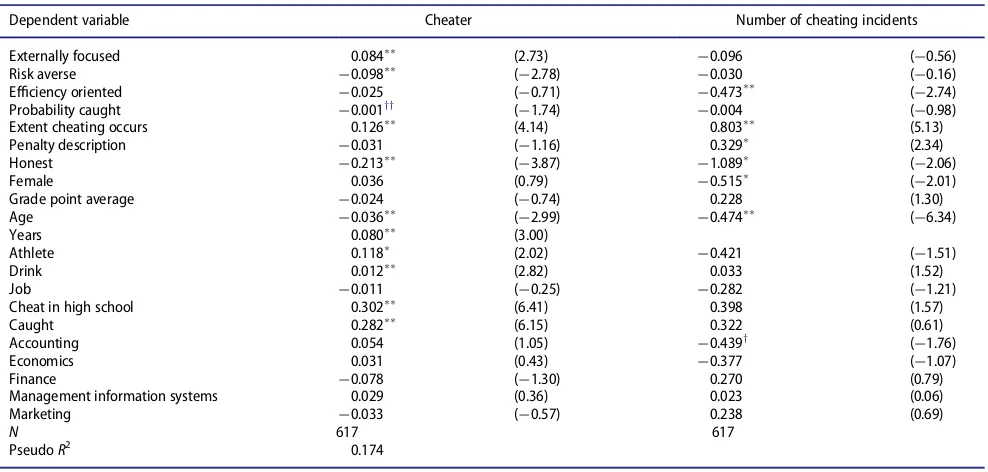

Model estimation results are reported inTable 6.

While contextual variables are broadly consistent with the literature, our analysis suggests that a one standard

deviation increase in the external focusfactor correlates with a 8.4% increase in the likelihood of having self-reported cheating in the past, as demonstrated by the positive and significant coefficient for external focus in the first column of Table 6 and illustrated inFigure 1. This result may suggest that students who favor more corporate regulation to combat greed also require or expect external controls on behavior. The absence of such controls may induce a tendency for cheating behav-ior. This may suggest externally focused students who do not trust others are more likely to cheat, a particularly concerning result in light of Knack and Keefer (1997) finding that trust is positively related to economic growth and Zak and Knack (2001) result that a lack of trust also leads to a reduced levels of investment; one

Table 6.Estimation results.

Dependent variable Cheater Number of cheating incidents

Externally focused 0.084 (2.73)

¡0.096 (¡0.56)

Risk averse ¡0.098 (¡2.78) ¡0.030 (¡0.16)

Efficiency oriented ¡0.025 (¡0.71) ¡0.473 ( ¡2.74) Probability caught ¡0.001yy (¡1.74) ¡0.004 (¡0.98)

Extent cheating occurs 0.126 (4.14) 0.803 (5.13)

Penalty description ¡0.031 (¡1.16) 0.329 (2.34)

Honest ¡0.213 (

¡3.87) ¡1.089 (

¡2.06)

Female 0.036 (0.79) ¡0.515 (¡2.01)

Grade point average ¡0.024 (¡0.74) 0.228 (1.30)

Age ¡0.036 (¡2.99) ¡0.474 (¡6.34)

Years 0.080 (3.00)

Athlete 0.118 (2.02)

¡0.421 (¡1.51)

Drink 0.012 (2.82) 0.033 (1.52)

Job ¡0.011 (¡0.25) ¡0.282 (¡1.21)

Cheat in high school 0.302 (6.41) 0.398 (1.57)

Caught 0.282 (6.15) 0.322 (0.61)

Accounting 0.054 (1.05) ¡0.439y (¡1.76)

Economics 0.031 (0.43) ¡0.377 (¡1.07)

Finance ¡0.078 (¡1.30) 0.270 (0.79)

Management information systems 0.029 (0.36) 0.023 (0.06)

Marketing ¡0.033 (¡0.57) 0.238 (0.69)

N 617 617

PseudoR2 0.174

Marginal effects;tstatistics in parentheses.

y

p<.10.p<.05.p<.01.

Table 5.Means and standard deviations of factor scores for student subsamples.

Externally focused Risk averse Efficiency oriented

Subsample n M SD M SD M SD

Accounting majors 182 ¡0.0090 0.7945 0.0454 0.7090 ¡0.0374 0.5830 Economics majors 57 ¡0.1580 0.8250 ¡0.2372 0.8305 ¡0.0548 0.5715 Finance majors 109 0.0236 0.9477 ¡0.1025 0.7897 0.0965y 0.5696

Management information systems majors 42 0.2113y 0.8651 0.0761 0.9130 0.1090 0.6941

Marketing majors 126 0.0001 0.6662 0.0714 0.6799 ¡0.0296 0.5229 Management majors 156 ¡0.0180 0.7154 ¡0.0241 0.7393 0.0140 0.5903 Freshman 67 ¡0.1083 0.7389 0.0439 0.6262 ¡0.0335 0.4563 Sophomores 196 ¡0.0335 0.7830 0.0582 0.6787 ¡0.0140 0.5567 Juniors 193 0.0229 0.7706 0.0523 0.6925 ¡0.0026 0.5860 Seniors 161 0.0584 0.7937 ¡0.1519 0.8869 0.0340 0.6550

Females 272 0.1377 0.6147 0.2030 0.5294 ¡0.0742 0.5132

Males 345 ¡0.1085 0.8701

¡0.1601 0.8399 0.0585 0.6265

Asterisk indicate difference from rest of population.

yp

<.10.p<.05.p<.01. 28 R. T. BURRUS ET AL.

would presume this includes educational effort as well. Future research should examine the link between an external focus and perceptions of trust, potentially using additional items in the survey and an interaction term between a measure of trust and the measure of external focus.

An increase of one standard deviation in the risk aver-sion dimenaver-sion, a preference for government interven-tion in the macroeconomy, correlates to a 10% reducinterven-tion in a student’s likelihood to report having cheated. Stu-dents scoring low on the risk aversion dimension, poten-tially considered capitalist along this dimension are termed entrepreneurialin Figure 1, may be more likely to accept volatility in return for reward and are more likely to admit having cheated.

Students scoring high on the efficiency-oriented dimension, while neither more nor less likely to admit having cheated as demonstrated by the insignificance of the coefficient in thefirst model, admit to fewer incidents of cheating. A lower efficiency score, termedequality ori-entedinFigure 1, is associated with more frequent cheat-ing behaviors when they do they report cheatcheat-ing. A one standard deviation movement toward equality suggests the quantity of cheating increases by 47%. Lower scores on this factor are coincident with favoring fair wages (based on social impact) and opposing the notion that corporate profits promote the common good. This result is in line with previous findings such as those by

MacGregor and Stuebs (2012), who found that students did notfind it unethical to cheat when they believed they were at a disadvantage or that they would not gain an advantage through their dishonesty. Lower efficiency scores also seem to correlate with the neutralization tech-niques of condemning the condemners and denial of injury (LaBeff, Clark, Haines, & Diekhoff,1990; McCabe,

1992). The former may involve rationalizing cheating through a perceived need to stay ahead while the latter justification rests on the claim that cheating is acceptable if no harm is induced.

Assuming that high scores on the efficiency oriented dimension and lower scores along the external focus and risk aversion dimensions are consistent with the free-market connotation of the term capitalist, our results suggest that market-oriented students may be no more likely to cheat than others. A lower external focus factor score corresponds to a decrease in the likelihood that a student self-reports cheating, but a lower risk-aversion factor corresponds to an increased probability of self-reported cheating.

At the other end of the spectrum, the relationship between a preference for government involvement in markets and cheating seems to depend on the target of the government intervention. Students that show a pref-erence for government intervention aimed at regulating corporations (high external focus) appear to be more likely to cheat, yet students who favor government

Figure 1.Dimensions of economic perspective.

involvement directed at economic stability and fairness (high risk aversion) seem less inclined to cheat.

We therefore cannot clearly associate preferences for or against capitalism with cheating behavior. However, our results do suggest that when capitalism-oriented stu-dents do cheat, they are likely to engage in fewer cheating behaviors than their noncapitalist, equality-oriented, peers. Along the same lines, we note that students with efficiency, individualist, and risk-averse orientations demonstrated a lower propensity to engage in academic dishonesty. These students believed that rewards are gen-erated based on productivity and behavior should be reg-ulated as little as pragmatically possible, but were also in favor of a social safety net should market forces fail to adequately provide for market participants.

Conclusion

The finding that externally oriented and equality-ori-ented students cheat and at a higher rate than their peers is certainly alarming for academics and business leaders who may already be concerned about the cheating behavior of students with higher tolerances for risk. Notions of neoclassical economic inefficiency (e.g., self-interest leads to a tragedy of the commons or negative externalities that can only be corrected with regulatory action) may reinforce a distrustful worldview for stu-dents who are oriented toward equality and tend to be externally focused. Promoting such lessons in business and economics courses may strengthen a general skepti-cism with regard to market forces and lead to academic dishonesty. On the other hand, lessons about productiv-ity and efficiency may provide support for internally focused students’ belief that cheating is not necessary to be successful.

If we assume that risk-averse students are less likely to be future entrepreneurs, thefinding that risk aversion is correlated with a reduced likelihood of cheating raises concern about future proprietors and has important implications for business curricula. To the extent that the risk-reward paradigm is a tenet of free markets, busi-ness instructors should take care to delineate risks that are morally acceptable from those that might be consid-ered dishonest.

Finally, while it is possible to conservatively assume that most employees at large corporations are generally honest, media attention may be skewed toward coverage of the dishonest minority. Accepting such distortions as the norm may induce unethical behaviors in those indi-viduals who place importance on equality and are willing to cheat if they believe others are cheating. The results presented here emphasize the importance of ethics edu-cation with an emphasis on honest business practices

and the importance of trust and honesty as a founda-tional institution in a capitalist system.

Our research suggests that there is indeed a relation-ship between preferences for free markets and academic dishonesty, but that this relationship is multifaceted. Future research should attempt to explore how and when these preferences are developed and how attitudes toward capitalism and free markets are affected by busi-ness instruction.

Notes

1. While the data used in this study were collected in 2009 and 2010, the results have implications for current stu-dents. First, it is unlikely that student characteristics have changed significantly since the time of data collection. The 2009/2010 sample is representative of the current University student body in terms of gender, race, gradua-tion rates, and in- versus out-of-state percentages. As well, institutional surveys of students conducted in 2009, 2011, and 2013 show that the percentage of students who report cheating is the same as in 2000, as reported in Burrus et al. (2007). Further, a deep body of literature suggests that many factors related to academic dishonesty have remained relatively consistent over time. For example, fac-tors associated with cheating such as age, fraternity/soror-ity membership and involvement in extracurricular activities found by Baird (1980) and Houston (1986) were confirmed more recently by Burrus et al. (2007), Klein et al. (2007) and Schuhmann et al. (2013). Studies have con-sistently found that students with lower grades are more likely to cheat in college, including Bunn et al. (1992), Kerkvliet and Sigmund (1999), Burrus et al. (2007), and Schuhmann et al. (2013). Attitudes toward the tenets of capitalism and the relationship between these attitudes and student behaviors have not been examined or tracked over time; hence this study serves as an important bench-mark for future research.

2. Alternative factor extraction and rotation methods were used for comparison and with only minor quantitative dif-ferences but identical qualitative results.

References

Bennett, V. M., Pierce, L., Snyder, J. A., & Toffel, M. W. (2013). Customer driven misconduct: How competition corrupts business practices.Management Science, 59,1725–1742. Bruner, R. (2009, January 6).Captialism and trust. Retrieved

from http://blogs.darden.virginia.edu/deansblog/2009/01/ capitalism-and-trust/

Burrus, R. T., McGoldrick, K., & Schuhmann, P. (2007). Self-reports of student cheating: Does a definition of cheating matter?Journal of Economic Education, 38,3–16.

Carpenter, D. D., Harding, T. S., Finelli, C. J., & Passow, H. J. (2004). Does academic dishonesty relate to unethical behav-ior in professional practice? An exploratory study.Science and Engineering Ethics, 10,311–324.

Carter, J. R., & Irons, M. D. (1991). Are economists different, and if so, why? The Journal of Economic Perspectives, 5, 171–177.

30 R. T. BURRUS ET AL.

Costello, A. B., & Osborne, J. W. (2005). Best practices in exploratory factor analysis: Four recommendations fro get-ting the most from your analysis. Practical Assessment, Research & Evaluation, 10(7), 1–9.

Crittenden, V. L., Hanna, R. C., & Peterson, R. A. (2009a). Business Students’ attitudes toward unethical behavior: A multi-country comparison.Marketing Letters, 20,1–14. Crittenden, V. L., Hanna, R. C., & Peterson, R. A. (2009b). The

cheating culture: A global societal phenomenon. Business Horizons, 52,337–346.

Frank, R. H., Gilovich, T., & Regan, D. T. (1993). Does study-ing economics inhibit cooperation.The Journal of Economic Perspectives, 7,159–171.

Horn, J. L. (1965). A rationale and test for the number of fac-tors in factor analysis.Psychometrika, 30,179–185.

Iyer, R., & Eastman, J. K. (2006). Academic dishonesty: Are business students different from other college students? Journal of Education for Business, 82,101–110.

Klein, H. A., Levenburg, N. M., McKendall, M., & Mothersello, W. (2007). Cheating during the college years: How do business school students compare?Journal of Business Ethics, 72,197–206. Knack, S., & Keefer, P. (1997). Does social capital have an eco-nomic payoff? A cross-country investigation. Quarterly Journal of Economics, 112,1251–1288.

LaBeff, E. E., Clark, R. E., Haines, V. J., & Diekhoff, G. M. (1990). Situational ethics and college student cheating. Sociological Inquiry, 60,190–198.

MacGregor, J., & Stuebs, M. (2012). To cheat or not to cheat: Rationalizing academic impropriety.Accounting Education, 21,265–287.

McCabe, D. L. (1992). The influence of situtational ethics on cheating among college students.Sociological Inquiry, 62, 365–374.

McCabe, D. L., & Trevino, L. K. (1995). Cheating among busi-ness students: A challenge for busibusi-ness leaders and educa-tors.Journal of Management Education, 19,205–218.

Nonis, S., & Swift, C. O. (2001). An examination of the relationship between academic dishonesty and workplace dishonesty: A multicampus investigation.Journal of Educa-tion for Business, 77,69–77.

Nowell, C., & Laufer, D. (1997). Undergraduate student cheat-ing in thefields of business and economics.The Journal of Economic Education, 28,3–12.

Roig, M., & Ballew, C. (1994). Attitudes toward cheating of self and others by college students and professors.The Psycho-logical Record, 44,3–12.

Schuhmann, P. W., Burrus, R. T., Barber, P. D., Graham, E., & Elikai, M. F. (2013). Using the scenario method to analyze cheating behaviors.Journal of Academic Ethics, 11,17–33. Siben, M. (2010). Investing versus speculating: Short-term

thinking and securities fraud. Retrieved from http://www. dstlegal.com/blog/2010/03/08/investing-speculating-short-term-thinking-securities-fraud/

Simha, A., Armstrong, J. P., & Albert, J. F. (2012). Who leads and who lags? A comparison of cheating attitudes and behaviors among leadership and business students.Journal of Education for Business, 87,316–324.

Sims, R. L. (1993). The relationship between academic dishon-esty and unethical business practices. Journal of Education for Business, 68,207–211.

Smyth, L. M., & Davis, J. R. (2004). Perceptions of dishonesty among two-year college students: Academic versus business situations.Journal of Business Ethics, 51,63–73.

Whitley, B. E. (1998). Factors associated with cheating among college students: A review. Research in Higher Education, 39,235–274.

Yezer, A. M., Goldfarb, R. S., & Poppen, P. J. (1996). Does studying economics discourage cooperation? Watch what we do, no what we say or how we play. The Journal of Economic Perspectives, 10,177–186.

Zak, P. J., & Knack, S. (2001). Trust and growth.The Economic Journal, 111,295–321.