THE IMPACT OF CORPORATE GOVERNANCE ON EARNINGS

MANAGEMENT: EVIDENCE FROM MALAYSIA

SKRIPSI

Submitted As Partial Fulfillment Of Requirement For The Degree of Sarjana

Ekonomi (SE) at the Sebelas Maret University

By:

MUHAMMAD ANDI D.H.B.A

F0308067

FACULTY OF ECONOMICS

SEBELAS MARET UNIVERSITY

SURAKARTA

MOTTO

· “May the Force be with you” (Star Wars)

· “When you do something for the right reasons, nothing can stop you”

(We Bought A Zoo)

· “Hope for the best, plan for the worst” (The Bourne Ultimatum)

· “Life is made from the choices that we make” (Back To The Future)

· “You have to do the best with what God give you” (Forrest Gump)

· “Happiness only real when shared” (Into The Wild)

· “Money is not the prime asset in life, time is” (Wall Street: Money

Never Sleeps)

· “Yesterday is history, tomorrow is mystery, today is a gift” (Kung Fu

Panda)

DEDICATION

This skripsi and whatsoever success

that I could achieve is dedicated to

MY LOVED FAMILY

There is no kindness love like your truly love

Thanks for all the support and pray all the time.

ACKNOWLEDGEMENT

Assalamu’alaikum Wr. Wb.

Researcher will be grateful to Allah SWT for all the mercy and bless so

that I were able to finish this research well. This Skripsi is proposed to complete

all the requirements of achieves the degree of Sarjana Ekonomi of Accounting

Department, Sebelas Maret University, Surakarta.

Researcher realizes that he could not have finished this skripsi without the

supports and involvement of many parties both directly and indirectly. I owe a

very great debt and thanks to:

1. Dr. Wisnu Untoro, M.S., as the Dean of Economics Department, Sebelas

Maret University, Surakarta.

2. Drs. Santoso Tri Hananto M.Si., Ak., as the Head of Accounting Department,

Sebelas Maret University, Surakarta.

3. Drs. Muh Agung Prabowo, M.Si., Ph.D, Ak., as my supervisor. I wish to

express my deepest thanks to Mr. Agung for his considerable help to give

advices and a very closely improved result.

4. Prof. Dr. Rachmawati, M.Si., Ak., as my academic advisor, thanks for all

your support and advices.

5. My mother, my father, and all my sister. Ibu, all this perspiration is dedicated

to you, the smartest, most beautiful and wisest woman i have ever known.

Bapak, Karina, Sebrina and Dina thank you for the support in this great

6. All lectures and staff in Faculty of Economics, Sebelas Maret University who

have provided knowledge, guidance, and service.

7. My trusted friend Dion Librazky, thanks for your support all the time.

8. My friends Raras and Isnaeni thanks for all your support and valuable advice.

9. My partner in crime, Rahmah Fitriani, finally we finished this study!

10. All of my friends in Accounting Department, I am happy to have you all in

the last four years. I wish that graduation is not the end of our friendship.

11. All of my friends in HMJ Akuntansi, keep on fire guys!

12. Member of GB who have gave happiness and pleasure. Andhika, Miko,

Adrian, Krisnandi, Eja, Nanda, Alfin, Adhi Kur, Peka, Deddy, Rofi and Adhi

Kur.

13. All my friends in KOMPAK Community. Thank you so much for the

friendship in all four years. All Hail Kantin!

14. All of my friends in United Indonesia Chapter Solo.

15. All of my friends in Standup Comedy Solo.

16. My first love,Sukma Rani, thank you for teaching me love. You are the apple

of my eye.

17. For all people that Researcher could not mention one by one, thanks for all

Researcher realizes that this research is far from being perfect. This study

has a lot of constraint, thus any suggestions and critics are expected for the sake of

improving this study.

As I close this acknowledgment, I expect that this writing will be useful to

all parties.

Wassalammu’alaikum Wr. Wb

Surakarta, June , 2012

TABLE OF CONTENTS

Page

PAGE OF TITLE ... i

ABSTRACT... ii

PAGE OF ADVISOR’S APPROVAL... ... iii

PAGE OF APPROVAL ... iv

PAGE OF MOTTO ... v

PAGE OF DEDICATION ... vi

ACKNOWLEDGEMENT ... vii

TABLE OF CONTENT ... x

LIST OF TABLES ... xiii

LIST OF APPENDIXES ... xiv

CHAPTER 1 INTRODUCTION ... 1

A. Background... 1

B. Problem Statements ... 4

C. Research Objectives ... 4

D. Research Benefits ... 5

E. Organization of Literature... 6

CHAPTER II THEORETICAL FRAMEWORK ... 7

A. Agency Theory ... 7

B. Corporate Governance ... 8

D. Hypothesis Development ... 11

1. Chairman Characteristics ... 11

2. Board Structures ... 12

3. Independent Committees ... 14

4. Family Control ... 16

CHAPTER II RESEARCH METHODS ... 18

A. Research Design... 18

B. Population and Sample ... 18

C. Source and Data Collecting Technique ... 19

D. Operational Definition and Measurement of Variables ... 20

1. Independent Variables... 20

2. Dependent Variable ... 21

3. Control Variables... 23

E. Data Analysis Methods ... 23

1. Classic Assumption Test ... 24

2. Descriptive Statistics and Univariate... 25

3. Multivariate ... 26

CHAPTER IV DATA ANALYSIS... 28

A. Total Data Collection ... 28

B. Classic Assumption Analysis ... 28

C. Descriptive Statistics and Univariate ... 29

1. The Impact of Corporate Governance on

Earnings Management... 33

2. The Interaction of Corporate Governance on Earnings Management... 42

CHAPTER V CONCLUSION... 46

A. Conclusion ... 46

B. Research Constraints ... 48

C. Research Suggestions ... 48

REFERENCES ... 49

LIST OF TABLES

TABLE PAGE

IV.1 Sample Selection ... 28

IV.2 Variable Definition ... 29

IV.3 Descriptive Statistics... ... 30

IV.4 Pearson Correlation ... 32

IV.5 Linear Regression (A) ... 34

IV.6 Linear Regression (B) ... 41

IV.7 Regression with Interaction Effect (A) ... 43

LIST OF APPENDIXES

Appendix I Previous Studies

Appendix II List of Companies

Appendix III Corporate Governance and Discretionary Accrual

Appendix IV Descriptive Statistics

Appendix V Pearson Correlation

Appendix VI Classic Assumption Test

ABSTRACT

THE IMPACT OF CORPORATE GOVERNANCE ON EARNINGS

MANAGEMENT: EVIDENCE FROM MALAYSIA

Muhammad Andi D.H.B.A NIM F0308067

The objective in this research is to investigate the impact of corporate governance mechanisms on the earnings management in Malaysia. Specifically, this research examines the effect of chairman characteristics, board structure, independent committees, and family control on earnings management.

This research focuses on manufacture companies that listed in Bursa Malaysia Berhad for period 2010. The research data were collected from financial statements and annual reports which published by companies. Purposive sampling method was used to determine research sample and 200 samples were collected. Hypothesis was tested by Ordinary Least Square (OLS) regression model using SPSS 17.00 software

The results of this research show that corporate governance mechanism simultaneously effect on the earnings management. Only chairman financial background and size of board that partially and significantly had effect on earnings management. Additionally,the interaction between corporate governance variables and earnings management had insignificant effect.

CHAPTER I

INTRODUCTION

A. Background

Agency relationship is a contract under which one or more persons to

engage another person to perform some service on their behalf which involves

delegating some decision making authority to the agent (Jensen and Meckling,

1976). In the context of the firm, the agent (manager) acts on behalf of the

principal (shareholder). They also claim that separation of authority between the

owner-manage and outside shareholders could cause conflict of interest as

managers tendency to appropriate perquisites out of the firm’s resources for own

consumption. The agency relationship will lead to information asymmetry

problems. Information asymmetry between management (agent) and shareholder

(principal) could cause managers to use it in preparing and reporting financial

statements for their advantage. Richardson (1998) found that information

asymmetry increase the level of earnings management.

Earnings management will reduce the quality of reported earnings and also

reducing investor confidence in the financial reports. Earnings management occur

in some corporate scandals of financial reporting, such as Enron, Global

Crossings, Tyco, WorldCom, and others (Cornett et al., 2006). Because of that

financial scandals, corporate governance now has already used by many entity in

the bussiness world. The implementation of corporate governance mechanism

quality of reported earnings. Effective monitoring from internal corporate

governance is very important to ensure reliable and complete financial report.

According to the statement by Bhattacharyay (2004), there are still a lot of

problems associated with Asian countries in strengthening corporate governance.

He claimed several main problems, such as:

1. Excessive government intervention.

2. Highly concentrated ownership structure.

3. Weak external discipline in the corporate sector.

4. Weak legal systems and regulatory

5. Lack of quality information.

6. Lack of investor’s protection

7. Lack of developed capital market

Those conditions and problems make the importance of coporate governance

mechanisme in Malaysia have possibly similar impact compared to other

countries in Asia.

Corporate governance has become an important issue in Malaysia since

the emergence of the Asia financial crisis in mid-1997. In order to improve the

monitoring function of corporate governance mechanisms in Malaysia, the Code

of Corporate Governance was drafted in1999 and subsequently approved in 2000

by the Ministry of Finance (Saleh et al., 2005). The Code made full effect to

company requirement where public listed companies in Malaysia are now

required to put in their annual report the statement of corporate governance,

of audit committee, and any additional statements by the board of directors

(Hashim et al., 2000). Nowadays, Malaysia’s progress in strengthening its

corporate governance framework has received international recognition. Malaysia

has consistently been ranked 4th for investor protection in the World Bank Doing

Business Report during 2006–2010 (Malaysia Corporate Governance Blue Print

2011).

Previous studies in several country including in Malaysia has investigated

the relationship between different corporate governance factors and earnings

management and the results show many different evidence impacts (can be found

in Appendix 1). The result could be different in Malaysia because each country

has different regulation and culture on corporate govenance mechanism. It’s

supported with statement by Abdullah (1992) that Malaysia has various cultures

which play a significant role in determining the culture of an organization.

Although previous studies have made attempts to reveal factors of corporate

governance that affecting earnings management, there is limited empirical

evidence that connecting family control and independent committees in company

with earnings management. Therefore, the impact of corporate governance

mechanism in Malaysia still be an empirical question.

Hence, the primary aim of this study is expected could give explanation

and emprical evidence about effectiveness corporate governance in constraining

earnings management. This study also investigate the effects of eleven

explanatory variables which consists of chairman tenure, chairman financial

board meeting, remuneration committee independence, nomination committee

independence, audit committee independence, family involvement, and family

ownership on earnings management.

B. Problem Statements

The problem statements in this study consist of:

1. Do chairman characteristics (chairman tenure, chairman financial

background and executive chairman) have impacts to earnings management?

2. Do board structures (independent board, size of board and board meeting)

have impacts to earnings management?

3. Do independent committees (remuneration committee independence, audit

committee independence, and nomination committee independence) have

impacts to earnings management?

4. Does family control (family involvement and family ownership) have

impacts to earnings management?

C. Research Objectives

Main objective in this study is to find empirical evidence about:

1. The impact of chairman tenure related to earnings management in

Malaysia companies.

2. The impact of chairman financial background related to earnings

management in Malaysia companies.

3. The impact of executive chairman related to earnings management in

4. The impact of proportion of independent board related to earnings

management in Malaysia companies.

5. The impact of board meeting related to earnings management in Malaysia

companies.

6. The impact of remuneration committee independence related to earnings

management in Malaysia companies.

7. The impact of nomination committee independence related to earnings

management in Malaysia companies.

8. The impact of audit committee independence related to earnings

management in Malaysia companies.

9. The impact of family involvement related to earnings management in

Malaysian companies.

10.The impact of family ownership related to earnings management in

Malaysia companies.

D. Research Benefits

This study is expected to give considerable benefits to:

1. Investors, creditor, and stakeholder, this papers could enhance them to

understand corporate governance mechanism in Malaysia, so that they can

make a good quality assessment of certain companies before making an

investing decision.

2. Development of literature about the impact of corporate governance on

earnings management in Malaysia. This study is expected could explain

proxies; chairman characteristics which proxies as chairman tenure,

chairman financial background and executive chairman, board of directors

which proxies as independent board, size of board and board meetings,

adding committee monitoring which proxies as independent remuneration

committee, independent audit committee and independent nomination

committee, family control which proxies as family involvement and family

ownership.

E. Organization of Skripsi

Chapter I : Introduction

This chapter contains introduction, problem statement, research

objectives, research benefits and organization of skripsi.

Chapter II : Theoretical Framework

This chapter contains literature review which leads the way to

hypotheses development and research model.

Chapter III : Research Method

Population, sample, measurements of variables and data

analysis method are discussed.

Chapter IV : Data Analysis and Interpretation

The comprehensive interpretation of result in descriptive

statistics and regression analysis are the body of this chapter.

Chapter V : Conclusion

This closing chapter presents the research result in broad

outline. It also discloses research constrains and future research

CHAPTER II

THEORETICAL FRAMEWORK

A. Agency Theory

Perspective of an agency theory is the basis that has been used widely in

understanding organization. Agency theory explains the relationship between the

company’s executives as an agent with the shareholder or owners as a principal.

Jensen and Meckling (1976) define agency relationship as a contract under which

one or more persons (the principal) engage another person (the agent) to perform

some service on their behalf which involves delegating some decision making

authority to the agent. They also explain that agency relationship between

ownership and control leads to a divergence between manager and owner interest.

A corporation's managers may have personal goals that compete with the owner's

goal in company. Since the shareholders authorize managers to manage the firm's

assets, a potential conflict of interest will exist between these two groups.

Agency theory is concerned with resolving two problems that can occur in

agency relationship (Eisenhardt, 1989). The first problem is the principal cannot

verify that the agent has behaved appropriately and the second problem is that

principal and agent may prefer different actions because of different risks.

Another negative impact which caused by an agency relationship could lead to

information asymmetry problems. Information asymmetry occurs when some

parties in business transactions have an information advantage over others (Scott,

(principal) could cause managers to use it in preparing and reporting financial

statements for their advantage.

B. Corporate Governance

Nowadays, corporate governance has already used by many entity in the

bussiness world. Garcia et al. (2010) think that fact is caused due to two reasons

which are change in the way of companies because of globalization, competition,

new technologies and social and environmental concern and, secondly, as a result

of financial scandals in several companies. Corporate scandals such as Enron,

Global Crossings, Tyco, and WorldCom had a terrible effect on stakeholders.

Most of the financial scandal has happened because of a lack of implementation

of corporate governance by companies.

According to statement of World Bank (2005), corporate governance

refers to the structures and processes for the direction and control of companies.

Corporate governance concerns the relationships among the management, board

of directors, controlling shareholders, minority shareholders and other

stakeholders. The agency problems between owner and management can be

handled by corporate governance mechanism. Corporate governance is one of the

most efficient way in order to reduce occurrence of conflicts of interest and ensure

achievement of company objectives required existence of regulations and control

mechanisms that effectively directs the company operations and the ability to

identify the parties who have different interests.

Effective monitoring from internal corporate governance is very important

misleads users of financial statements by providing them with false information

about firm’s true operating performance, the internal corporate governance serves

a monitoring role in constraining the occurence of earnings management (Chen et

al, 2006). The implementation of corporate gorvernance mechanism in company

could protect investor and creditor from management opportunistic behavior.

C. Earnings Management

Scott (1997) defines earnings management as a management action by

selecting the accounting policy of a certain standard for the purpose of

maximizing their welfare and or the company's market value. He also defines four

different pattern of earnings management, there are:

1. Taking a Bath

This is the pattern of earnings management which done by increasing

company profits become very high or very low.

2. Income Minimization

This pattern is similar to taking a bath, but less extreme. Income

minimization make company profit become lower.

3. Income Maximization

This pattern is done by making company profit become higher.

4. Income Smoothing

This pattern is done by raising or lowering company profits in financial

Healy and Wahlen (1999) define earnings management into several

aspects. First, earnings management interventions over financial reporting can be

done with the use of judgment, for example judgment in estimating the number of

economic events in the future to shown in financial statements, such as the

estimated economic life and residual value of fixed assets, deferred taxes,

receivables losses and the decline in asset values. Second, the purpose of earnings

management is to mislead stakeholders about the economic performance of

companies. This occurs when management has access to information that cannot

be accessed by outsiders. More specifically, Healy and Wahlen argue that

earnings management is an activity where managers use their discretion to

mislead stakeholders about economic performance of the company.

Ortega and Grant (2003) said that earnings management is possible

because of the flexibility in financial reporting in order to transform the operations

of a company's financial results. Earnings management will reduce the quality of

reported earnings and also reducing investor confidence in the financial reports. In

other words, earnings management is manipulating the earning to achieve a

predetermined target set by the management. Earnings management can be

measured by using discretionary accrual proxy inside the management agreement,

where the management can interferee the process of making financial statements.

The higher the value of discretionary accruals, the greater earnings is manipulated

D. Hypotheses Development

1. Chairman Characteristics

The role of the chairman is important to securing good corporate

governance in company. Jensen (1993) defines the function of the chairman

of the board as to run the board meetings, oversee the process of hiring,

firing, evaluating and compensating the CEO. Chairman knowledge and

experience are the significant elements in making sure the effectiveness of

board monitoring function.

The tenure of the company chairman may have an impact on corporate

fraud (Beasley, 1996). Firms that have chairman with shorter tenures are

associated with higher incidences of fraud (Chen et al., 2006). They also

explain that short tenure may imply the chairman lacks experience in the firm

and so detecting fraud is more difficult. Hazarika et al. (2009) find that

chairman tenure has negative influence related to earnings management. It

means the longer chairman tenure in the company, the better the performance

of the firm that could reduce earnings management.

The accounting and financial knowledge are beneficial for a chairman

to understand better financial statements and financial reporting issues in

company. Study recognized that chairman who has financial background are

useful in monitoring management. Isidro and Goncalves (2011) found that

earnings management is more likely to occur in firms that are run by a

Agency theory suggests separation of duties may lead to efficient

monitoring over the board process (Fama and Jensen, 1983). The involvement

of a chairman on board, either as director or chairman may create bias and

inappropriately influence board decisions. Similarly, conflicts of interest may

occur if a chairman is also an executive who is involved in the company

management (Ismail et al., 2010). In such a firm, the executive chairman has

more power over the board and firm without being supervised and evaluated.

Jensen (1993) claimed that boards are less effective when the chief executive

officer is also the chairman. Thus the following hypothesis is developed:

H1a : Chairman tenure is significantly related to the earnings

management.

H1b : Chairman financial background is significantly related to the

earnings management.

H1c : Executive chairman is significantly related to the earnings

management.

2. Board Structures

In general, the board of directors commissioned and given the

responsibility for supervising the quality of the information contained in

financial statements. Board of directors is the highest level of the control

mechanisms in the organization since they possess the ultimate power to

compensate the decisions that are made through the top management (Fama

Agency theory believe that board comprising majority of outside

directors reduce agency conflicts as they provide effective monitoring tool to

the board (Fama and Jensen, 1983). The Malaysian Code of Corporate

governance states that good corporate governance rests firmly with board of

directors and the Code required one third of the board to comprise of

independent directors in order to bring an independent judgment on the

decision process. The outside directors are expert managers from other large

organizations and with its expertise, independence, objectivity and legal

power,outside directors become potentially powerful governance mechanisms

to mitigate agency costs and protect shareholders wealth (Li, 1994).

Empirical evidence from previous studies generally supports the expectation

that board independence reduces earnings management and fraud accounting

(Beasley, 1996 and Klein, 2002).

Board size is the number of directors on the board and an important

factor in the effectiveness of the board in monitoring management. From

agency perspective, larger board support effective monitoring management

and protect shareholder’s interest. Previous studies that examine the

monitoring effect between board size and earnings management found larger

boards are more effective. Beasley (1996) shows an increasing relationship

between fraudulent information on financial reports and board size. Further,

Abdul Rahman and Ali (2006) find a significant positive relationship between

Habbash (2010) argues that directors on boards that meet frequently

are more likely to discharge their duties in to monitoring issues such as

earnings management, conflicts of interest and monitoring management.

Conversely, boards that rarely meet may have no time to find out about such

complex issues and may perhaps have time only to rubber- stamp

management plans. Xie et al. (2003) claimed that a board that meets rarely

may only have time for signing-off management plans and listening to

presentations and they may not have time to focus on issues such as earnings

management. They also find that earnings management is significantly

negatively related to the number of board meetings. Thus the following

hypothesis is developed:

H2a : The proportion of independent board is significantly related to

the earnings management.

H2b : The total number directors on the board is significantly related

to the earnings management.

H2c : The total board meetings is significantly related to the earnings

management.

3. Independent Committees

Nominating committee (composed from inside the membership of the

firm) suggests nominations and substitutions candidates for office in order to

improve managers and administrator’s selection process and corporate

nomination committee is important for board board effectiveness and

monitoring ability because it takes away the CEO’s power in nominating new

member to the board (Chtourou et al., 2001). Klein (2002), find that there is a

negative association between board independence and whether the CEO sits

on the nomination committee.

Vance (1983) claimed that the remuneration committee plays a

significant role in the board composition. From agency theory perspective,

the remuneration committee is a governance tool of control by the owners

(principals) over top management (the agents) that is expected to set a

compensation package that protects the interest of the shareholders, and to

monitor management. Petra and Dorara (2008) argue that independent

directors of remuneration committees are better able to accomplish their

duties objectively. Furthermore, Dahya and McConnell (2007) also found

that more outside directors sitting on committees leads to better performance

as a result of independence.

The audit committee is charged with the responsibility of overseeing

the firm’s financial reporting process (Klein, 2002). The purpose of the audit

committee is to ensure the accuracy of the financial reports (Buchalter and

Yokomoto, 2003). Audit committee is more effective if all of the members

are independent. Study by Bedard et al. (2004) investigate the impact of audit

committee characteristics including independent committee on earnings

negatively related to earnings management. Thus the following hypothesis is

developed:

H3a : Nomination committee independence is significantly related to the

earnings management.

H3b : Remuneration committee independence is significantly related to

the earnings management.

H3c : Audit committee independence is significantly related to the

earnings management.

4. Family Control

Unlike developed countries such as United Kingdom and United

States of America with dispersed ownership structure. In developing

countries partly large firms are controlled by family ownership. Asian firms

have more concentrated ownership structure where family control is common

in both small and established firms (Mak and Kusnadi, 2005). With most

large corporations owned and controlled by families and with family

members holding key managerial positions, however, the major agency

problem exists not between the management and owners in general, but

between the management (the controlling family) and minority shareholders

(Ali shah et al., 2009).

Due to controlling power in company, the dominant family is able to

influence appointments of top managers as well as board members. The

on networking and personal ties (Johannisson and Huse, 2000). Jaggi et al.

(2009) argues that controlling familes could monitor managerial behavior and

actions effectively, which caused reducing managerial opportunities to

engage in earnings management. They also gave opinion that there will be

less pressure on management to meet short term earnings expectations

because controlling families focus more on the long term. Based from

previous study by Jiraporn and DaDalt (2007) reveal that family firms are

significantly less likely to manage earnings. Thus the following hypothesis is

developed:

H4a : The family involvement on the board is significantly related to the

earnings management.

H4b : The proportion of family ownership is significantly related to the

CHAPTER III

RESEARCH METHODS

A. Research Design

This study is a hypothesis testing study and it aims to test independent

variables that have an impact to dependent variables. This study was conducted to

test and examine the effect of coporate governance mechanism to earnings

management. This is a cross sectional study, which means that the data were only

taken once (the end of 2010). Independent variables in this research consist of

chairman tenure, chairman financial background, executive chairman, board size,

proportion of independent board, board meeting, remuneration committee

independence, nomination committee independence, audit committee

independence, family involvement, and family ownership. Dependent variable is

earnings management which represented by discretionary accruals.

B. Population and Sample

Population refers to the entire group of people, events, or things of interest

that researcher wishes to investigate (Sekaran, 2000). Population of this research

is all annual reports of manufacturing companies listed in Bursa Malaysia Berhad

at the period of 2010. This country is chosen because the implementation of

Sampling is the process of selecting sufficient number of elements from the

population, means that by studying the samples and understanding of the

characteristics of the samples subjects, it would be possible to generalize the

characteristics of population elements (Sekaran, 2000). Sample methods for this

research is purposive sampling which aims to obtain the representative samples

along with researcher needs. For each company, the 2010 annual reports was

obtained from Malaysia stock exchange website. The initial samples were chosen

randomly for 200 annual reports. If the annual report does not meet those criteria

then the firm is excluded from the sample. The criteria of sample are determined

by:

1. The firm is manufacturing company which listed in Bursa Malaysia during

the period 2010.

2. The firm publishes annual report and financial statements at the end of

December 2010.

3. The firm has annual report in English or at least has the English version.

4. The firm has complete data on coporate governance and earnings

management.

C. Source and Data Collecting Technique

This study uses secondary data which means data that refers to information

that obtained from existing sources (Sekaran, 2000). The data comes from annual

1. List of manufacturing companies in 2010 is taken from Bursa Malaysia

Berhard website.

2. Company’s corporate governance data is based on annual reports

disclosures which published by the company.

3. Earnings management data is obtained from the financial statements of

companies. The data includes: comprehensive income, net cash flow from

operating activity, total assets, changes of revenues, property, plant, and

equipment (PPE), and changes in receivables.

D. Operational Definition and Measurement of Variables

This study uses the independent variables, dependent variable, and control

variables. The operational definition and measurement of the variables are

described as follows:

1. Independent Variables

Independent variables in this study is good coporate governance which

can be explained by chairman tenure, chairman financial background,

executive chairman, board size, independent board, board meeting,

remuneration committee independence, nomination committee independence,

audit committee independence, family involvement, and family ownership.

a. Chairman tenure is measured by duration of chairman tenure until year t.

b. Chairman financial background is dummy variable. If chairman has

c. Executive chairman is dummy variable. If chairman on the board is

executive= 1, otherwise = 0

d. Board size is measured by the total number of board members on the

board.

e. Propotion of independent board is measured by the proportion of

independent directors on the board, expressed as a percentage.

f. Board meeting is measured by total number of board meeting which held

annualy by the board of directors.

g. Remuneration committee independence is measured by the percentage of

remuneration committee independence to total committee.

h. Nomination committee independence is measured by the percentage of

nomination committee independence to total committee.

i. Audit committee independence is measured by the percentage of audit

committee independence to total committee.

j. Family involvement is measured using ratio family members on the

board to total number of directors.

k. Family ownership is measured by using percentage of direct shares

owned by family members on the board.

2. Dependent Variable

Dependent variable in this study is earnings management. Earnings

management is purposeful intervention in the external financial reporting

Discretionary accruals is used as representative of earnings management

calculated by using Modified Jones Model (Dechow et al. 1995).

This is a equation to calculate Total Accrual:

This is OLS regression equation to estimate Total Accrual:

Non Discretionary Accruals (NDA)can be calculated by the formula:

Discretionary Accrual (DA) can be calculated by the formula:

Explanation :

DAit = Firm’s value of discretionary accrualsin year t

NDAit = Firm’s value of non discretionary accrualsin year t

TAit = Firm’s total accruals in year t

Nit = Firm’s comprehensive income in year t

CFOit = Firm’s net cash flow from operating activity in year t

Ait-1 = Firm’s total assets in year t-1

TAC = Nit – CFOit

TAit/Ait-1 = β1 (1 / Ait-1) + β2 (ΔRevt / Ait-1) + β3 (PPEt/ Ait-1) + e

NDAit = β1 (1 / Ait-1) + β2 (ΔRevt / Ait-1 - ΔRect/ Ait-1) + β3 (PPEt / Ait-1)

ΔRevt = Firm’s change in revenues in year t-1 and t

PPEt = Firm’s value of PPE in year t

ΔRect = Firm’s change in receivables in year t-1 and t

e = error terms

3. Control Variables

Control variables in this study is explained by firm size, leverage and

type of industry.

a. Firm size is control variable which measured by nantural logarithm of

total assets.

b. Leverage is control variable which measured by ratio of total debt to total

assets.

c. Type of indsutry is dummy variables which represented by give score

(1,2,..,5) on each type of manufacturing companies.

E. Data Analysis Methods

In this study, OLS (Ordinary Least Squares) analysis regression is used to

analyze the realationship between independent variables, dependent variable, and

control variables. SPSS 17.00 for Windows is used as an analytical data tool to

test the regression model. Theoretically, the model will give the valid value if

1. Classic Assumption Test

Before testing the hypothesis, classic assumption test is important to

ensure that study results are valid. Classic assumption test consist of several

kinds of tests including normality test, multicollinearity test, autocorrelation

test, and heteroscedasticity test.

a. Normality Test

Normality test is used to determine whether the residual value in

regression model is well- modeled by a normal distribution (Ghozali, 2006).

T-test and F-test is done with underlying assumption that residual value is

normally distributed. Kolmogorov-Smirnov test is applied to test this

assumption. Criteria that operate in this test are two tailed test, comparing

value with significance level. This study use significance level 0.05. If

p-value > 0.05 then the data is normally distributed.

b. Multicollinearity Test

Multicollinearity test is used to determine whether two or more

independent variables in a multiple regression model are highly correlated

(Ghozali, 2006). Tolerance value and variance inflation factors (VIF)

could provide measurement to detect if multicollinearity exist. These

measurements can show which independent variables are explained by

other independent variables. If tolerance value < 0.05 and VIF > 5, then

c. Autocorrelation Test

Autocorrelation test is used to determine whether there is a

correlation between values of the process at different points in time, as a

function of the two times or of the time difference. If there is no

correlation between residual value, then the residual value is random

(Ghozali, 2006). This study use run test to detect autocorrelation. Criteria

that operate in this test are two tailed test, comparing p-value with

significance level. This study use significance level 0.05. If p-value > 0.05

then the residual is random.

d. Heteroscedasticity Test

Heteroscedasticity test is used to determine whether the variance of

the error terms differ across observations (Ghozali, 2006). Tests to detect

existance of heteroscedasticity is look at the graph scatterplot between the

predicted value of the dependent variable (ZPRED) and the residual

(SRESID). When the dots result is spread and random, then there is no

heteroscedasticity.

1. Descriptive Statistics and Univariate

Descriptive statistics used to find the average (mean), standard

deviation, and maximum and minimum value from variables tested in the

study. This analysis is intended to provide idea of distribution and behavior

2. Multivariate

From the hypothesis above, the research model can be explained by

this formula:

DAC = discretionary accruals

β = parameters (i = 1,2,3,...11)

CTE = chairman tenure

CFB = chairman financial background

CEX = executive chairman

BDIND = board independent

BDSZ = board size

BDM = board meeting

NOM = nomination committe independence

REM = remuneration committe independence

AUD = audit committe independence

FAM = family involvement

OWN = family ownership

AST = firm size

LEV = leverage

IND = type of industry

e = error terms

a. Significance Silmutaneous Test (F-Test)

F-Test is used to prove whether all independent variables have a

simultaneously effect on dependent variables.

DAC = β0 + β1CTE + β2CFB + β3CEX+ β4BDIND + β5BDSZ +

β6BDM + β7NOM+ β8REM + β9AUD + β10FAM + β11OWN+

b. Coeffcient of Determination (R2- Test)

Coefficient of determination is used to explain how much of the

variability of regression model can be caused or explained by its

relationship to dependent variable. Each additional independent variable

will make R2 increase.

c. Partial Regression Test (t-test)

This test is to determine whether the independent variables in the

partial will affect the dependent variable, assuming the other independent

variables constant. Criteria of test:

1. If significant value > alpha (5%, 1% , or 10%), it means an

individual independent variable had no effect on the dependent

variable.

2. If significant value < alpha (5%, 1% , or 10%), it means an

CHAPTER IV

DATA ANALYSIS

This chapter will describe about data description, data analysis, and

research result that have been performed during the study. Analytical model used

in this study is multiple linear regression using SPSS software version of 17.00

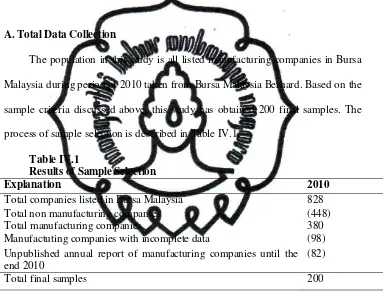

A.Total Data Collection

The population in this study is all listed manufacturing companies in Bursa

Malaysia during period of 2010 taken from Bursa Malaysia Berhard. Based on the

sample criteria discussed above, this study has obtained 200 final samples. The

process of sample selection is described in Table IV.1.

Table IV.1

Results of Sample Selection

Explanation 2010

Total companies listed in Bursa Malaysia 828

Total non manufacturing companies Total manufacturing companies

(448) 380

Manufactuting companies with incomplete data (98)

Unpublished annual report of manufacturing companies until the end 2010

(82)

Total final samples 200

Source: Bursa Malaysia Berhard (2012)

B.Classic Assumption Analysis

The result of classic assumption test in this study can be found in appendix.

The results explained that the residual data have been normally distributed and

that there is no autocorrelation and by using scatterplot graphic shows that there is

no heteroscedasticity. Therefore, the data is passed prom classic assumption test

which include normality test, multicollinearity test, autocorrelation test and

hetercocedasticity test.

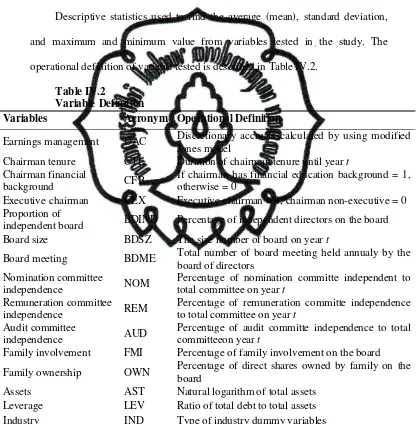

C.Descriptive Statistics and Univariate

Descriptive statistics used to find the average (mean), standard deviation,

and maximum and minimum value from variables tested in the study. The

operational definition of variable tested is described in Table IV.2.

Table IV.2

Variable Definition

Variables Acronym Operational Definition

Earnings management DAC Discretionary accruals calculated by using modified

Jones model

Chairman tenure CTE Duration of chairman tenure until year t

Chairman financial

background CFB

If chairman has financial education background = 1, otherwise = 0

Executive chairman CEX Executive chairman = 1, chairman non-executive = 0

Proportion of

independent board BDIND Percentage of independent directors on the board

Board size BDSZ The size number of board on year t

Board meeting BDME Total number of board meeting held annualy by the

board of directors Nomination committee

independence NOM

Percentage of nomination committe independent to

total committee on year t

Remuneration committee

independence REM

Percentage of remuneration committe independence

to total committee on year t

Audit committee

independence AUD

Percentage of audit committe independence to total

committeeon year t

Family involvement FMI Percentage of family involvement on the board

Family ownership OWN Percentage of direct shares owned by family on the

board

Assets AST Natural logarithm of total assets

Leverage LEV Ratio of total debt to total assets

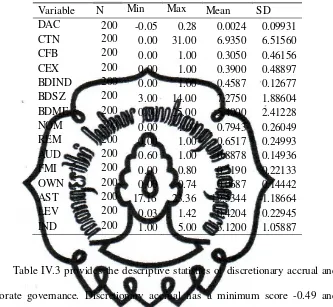

The result of descriptive statistics on manufacturing companies is described

in Table IV.3

Table IV.3

Descriptive Statistics

Variable N Min Max Mean SD

DAC 200 -0.05 0.28 0.0024 0.09931

CTN 200 0.00 31.00 6.9350 6.51560

CFB 200 0.00 1.00 0.3050 0.46156

CEX 200 0.00 1.00 0.3900 0.48897

BDIND 200 0.00 1.00 0.4587 0.12677

BDSZ 200 3.00 14.00 7.2750 1.88604

BDME 200 0.00 25.00 5.4000 2.41228

NOM 200 0.00 1.00 0.7943 0.26049

REM 200 0.00 1.00 0.6517 0.24993

AUD 200 0.60 1.00 0.8878 0.14936

FMI 200 0.00 0.80 0.2190 0.22133

OWN 200 0.00 0.74 0.0687 0.14442

AST 200 17.16 23.36 19.5344 1.18664

LEV 200 0.03 1.42 0.4204 0.22945

IND 200 1.00 5.00 3.1200 1.05887

Table IV.3 provides the descriptive statistics of discretionary accrual and

corporate governance. Discretionary accrual has a minimum score -0.49 and

maximum score 0.28 with an average score 0.0024. Negative value means the

company made earnings management by lowering profits and positive value

means the company made earnings management by raising profit. The average

tenure of chairman is 6.935 and the average of chairman financial background is

30.5%, it means that most chairman did not have education background in

finance. The average position of chairman is 39% as executive member, indicating

the number of executive chairman less than number of non-executive chairman in

The average proportion of independent board is 41% which means the

board is met with what Malaysian’s government requires. The rule states that

proportion of board members should at least contain one third independent

directors. The average size of board is 7.275 and the number of board meetings

which were held has an average score 5.4. The average scores for proportion of

nomination committee independence, remuneration committee independence, and

audit committee independence are 79%, 65%, and 88%. The number of audit

committee has met with the government rule which stated 1/3 of the members

should be independent members.The family involvement in boards has a average

score is 21.9% and the average score of family ownership is 6.87 %.

Control variables for this study are company size (AST), leverage (LEV),

and type of industry (IND). The average score of company size is 19.5344 with a

lowest score 17.16 and a highest score 23.36. Leverage has an average score

0.4204 with a lowest score 0.03 and a highest score 1.42. Type of industry (IND)

is a dummy variables with minimum value 1, maximum value 5 and an average

score 3.12.

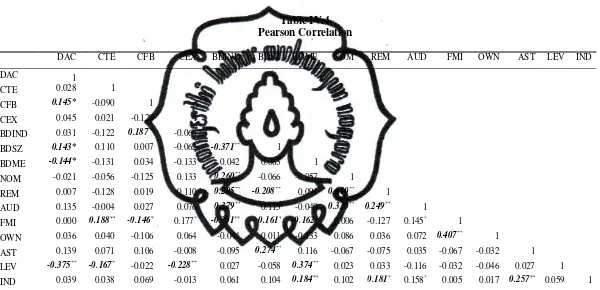

Pearson correlation test results are desribed in Table IV.4. The table shows

that coefficient between independent variables and dependent variable are

relatively low so there is no multicollinearity issues. Independent variables such

as chairman financial background (CFB), board size (BDSZ), and board meeting

Table IV.4 Pearson Correlation

DAC CTE CFB CEX BDIND BDSZ BDME NOM REM AUD FMI OWN AST LEV IND

DAC 1

CTE 0.028 1

CFB 0.145* -0.090 1

CEX 0.045 0.021 -0.129 1

BDIND 0.031 -0.122 0.187** -0.066 1

BDSZ 0.143* 0.110 0.007 -0.062 -0.371** 1

BDME -0.144* -0.131 0.034 -0.133 0.042 0.063 1

NOM -0.021 -0.056 -0.125 0.133 0.260** -0.066 -0.057 1

REM 0.007 -0.128 0.019 0.110 0.295** -0.208** 0.091 0.610** 1

AUD 0.135 -0.004 0.027 0.076 0.379** 0.115 -0.040 0.320** 0.249** 1

FMI 0.000 0.188** -0.146* 0.177* -0.201** 0.161* -0.162* 0.006 -0.127 0.145* 1

OWN 0.036 0.040 -0.106 0.064 -0.044 0.011 -0.133 0.086 0.036 0.072 0.407** 1

AST 0.139 0.071 0.106 -0.008 -0.095 0.274** 0.116 -0.067 -0.075 0.035 -0.067 -0.032 1 LEV -0.375** -0.167* -0.022 -0.228** 0.027 -0.058 0.374** 0.023 0.033 -0.116 -0.032 -0.046 0.027 1 IND 0.039 0.038 0.069 -0.013 0.061 0.104 0.184** 0.102 0.181* 0.158* 0.005 0.017 0.257** 0.059 1

variable chairman tenure (CTE), executive chairman (CEX), proportion of

independent board (BDIND), nomination committe independence (NOM),

remuneration committe independence (REM), audit committe independence

(AUD), family involvement (FMI) and family ownership (OWN) are

insignificantly correlated to earnings management In the control variables,

leverage (LEV) is significantly correlated to earnings management, while

company size (AST) and type of industry (IND) are incorrelated significantly to

earnings management.

D. Multivariate

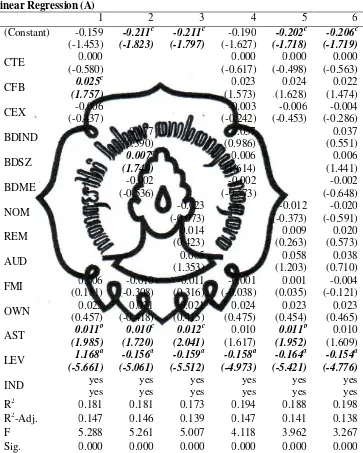

1. The Impact of Corporate Governance on Earnings Management

Table IV.5 show the results of the regression between corporate

governance variables and control variables on earnings management which

represented in discretionary accruals proxy. F value for each regression model

was significant. In addition, models 1 and 4 have the highest adjusted R2 is

equal to 14.7%. It means that variables on the chairman and board of directors

could explain the dependent variable (earnings management) as much as 14.7%.

The rest of 85.3% is explained by other factors.

The test results from model 1 to 6 show the chairman financial background

(CFB) and board size (BDSZ) have significant effect on earnings management at

the level 10%. Simultaneously effect of independent variables toward dependent

variable is known by comparing Sig coefficient. If Sig coefficient is less than

earnings management. The test results from all model show that all independent

variables have simultaneously effect on the earnings management (0.000<0.05).

Table IV.5

The result in all six models explain that chairman tenure (CTE) consistenly

has insignificant negative effect to earnings management. Hypothesis 1a stated

the chairman tenure is significantly related to earnings management is not

accepted. This finding is consistent with study by Cornett et al. (2007) who

found similar result that chairman tenure is insignificant, but it is different from

previous study by Hazarika et al. (2009) who found that chairman tenure is

negatively significant related to earnings management. A possible explanation

for this result because, the average score of chairman tenure in the sample is

very low (seven years only) so there is not enough influence on constraining

earnings management.

The chairman financial background (CFB) is positively significant to

earnings management at 0.10 level in model 1. Hypothesis 1b stated the

chairman financial background is significantly related to earnings management

is accepted. In contrast, from model 4, 5, and 6 show insignificant effect related

to earnings management which means the impact is inconsistent. The result is

not suported by Xie et al. (2003) who claimed that earnings management is less

likely to occur in firms that are run by a member of boards who have a corporate

and financial background. This finding is supported on study by Isidro and

Goncalves (2011) who found that chairman with management and finance

background was more prone to manage earnings. The result proves that

Malaysia companies have different chairman characteristic. Besides the benefits,

financial knowledge could have negative effect because the chairman so much

All models show that executive chairman (CEX) consistently has

insignificant negative effect to earnings management. Hypothesis 1c stated the

executive chairman is significantly related to earnings management is not

accepted.This result is consistent with other study by Ismail et al. (2010) who

found that executive chairman is insignificant related to earnings management. It

can be explained that the involvement of a chairman on executive position has

no impact on constraining earnings management and that is probably because the

families still dominate the mangement decisions in Malaysia companies. In

contrast, there is a different result from study by Gordon and Henry (2005) who

found that executive chairman is negatively and significantly related to earnings

management.

This study find that proportion of independent board (BDIND) is

consistenly has insignificant positive effect related to earnings management.

Hypothesis 2a stated the proportion of independent board is significantly related

to earnings management is not accepted. This finding is however consistent with

previous study in Malaysia by Abdul Rahman and Ali (2004) who found that

with the high presence independent directors on the board have no impact on

earnings management. They claims that the role of the board of directors in

Malaysia companies is inefficient in performing their monitoring duties due to

management dominance over board matters. The results is different with another

study by Beasley (1996) and Xie et al. (2003). Both of them find a negative

Test result from model 2 explains that board size (BDSZ) has positive

significant effect to earnings management at the 0.10 level. Hypothesis 2b stated

the board size is significantly related to earnings management is accepted. But,

from other models show insignificant effect which means the impact is

inconsistent. The result is supported by Kao and Chen (2004) in Taiwan, who

found a significant positive relationship between board size and earnings

management. A possible explanation for this because company with large board

of directors would provide a lack of coordination and communication between

the members and also proves that board characteristic in Malaysia is different

than in Taiwan.

This study found that the number of board meeting (BDME) consistenly

has insignificant negative effect to earnings management. Hypothesis 2c stated

the board meeting is significantly related to earnings management is not

accepted. This result different from previous study by Chtourou et al. (2001)

who found that meeting number is significantly positive related to earnings

management. The results is consistent with study by Habbash (2010) found that

number of meeting not restrict earning management practices. He argues that

frequent meetings not always be a characteristic of an active board of directors.

Board meetings are not necessarily functional because the limited time in

meeting restrict the important exchange of ideas among directors or with

managers (Lipton and Lorsch, 1992).

All six models explained that nomination committee independence (NOM)

Hypothesis 3a stated the nomination committee independence is significantly

related to earnings management is not accepted. The result is different by

Habbash (2010) who found negative relationship between nomination committee

independence and earnings mangement. However, this finding is consistent with

prior study by Chtourou et al. (2001) that majority of independent members on

nomination committee has insignificant effect on the level of earnings

management. Klein (2002) argues that nomination committee assignments are

influenced by board size, which means large boards have more directors to

contribute to the sub-committees and this enables the work load to be distributed

over a greater number of directors.

Remuneration committee independence (REM) consistenly has

insignificant positive effect to earnings management. Hypothesis 3b stated the

remuneration committee independence is significantly related to earnings

management is not accepted.This finding however consistent with study in

United Kingdom by Habbash (2010) that remuneration committee independence

is insignificantly positive related to earnings management. In contrast, the result

is different with previous study in USA firms by Klein (2002) who found

positive relationship between nomination committee independence and earnings

mangement. Habbash (2010) argues that even though the remuneration

committee has been introduced in many countries to carry out an essential part

of the governance required, these committees have not yet achieved the degree

Audit committee independence (AUD) consistenly has insignificant

positive effect to earnings managemen. Hypothesis 3c stated the audit committee

independence is significantly related to earnings management is not accepted.

This result confirm Klein (2002) conclusion that maintaining a whole

independent audit committee is not be necessary in constraining earnings

management. Larger audit committee which has more resources and capability

could be better than number of independent members in performing the required

duties including to prevent earnings management. However, the result is

different with study by Lin and Hwang (2010) which identifies a negatively

significant relationship between audit committee independence and earnings

management.

The result show the coefficient for family involvement (FAM) is

consistenly negative and has insignificant effect to earnings management.

Hypothesis 4a stated the family involvement is significantly related to earnings

management is not accepted.The result is not supported with prior study by Ho

and Wong (2001) who found that companies with a higher proportion of family

members on the board is more likely to have lower earnings management.

Jiraporn and DaDalt (2007) argues that family involvement has impact on

earnings management because founding families will limit the ability of

managers to manipulate earnings, and there will be less pressure on management

to manage earnings to look good in the short term since the controlling family

The study found family ownership (OWN) consistenly has insignificant

positive effect to earnings management. Hypothesis 4a stated the family

ownership is significantly related to earnings management is not accepted. The

result indicates that family board members who own shares are not effective

constraining earnings management. This results is different with study by

Hosseini (2012) who found that family ownership had significant effect to

earnings management. Earnings management is higher in countries where family

ownership concentration is higher because of weak investor protection (Leuz et

al., 2003). Based on sample studies show that only a small number of directors

who have own shares in firms which means have no influence to earnings

mangement.

Among the control variables, company size (AST) consistenly has positive

significant effect to earnings management except for model 4 and 6 where the

result show insignificant. The models show that leverage (LEV) consistenly has

negative significant effect to earnings management in all six models.

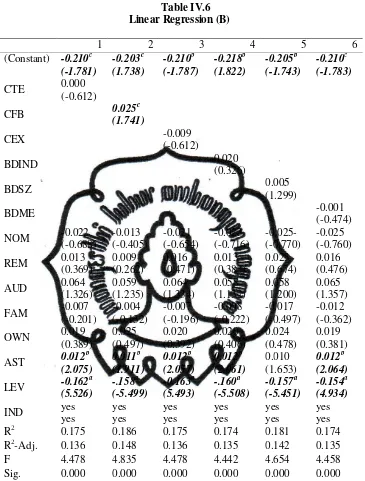

Table IV.6 show the results of the regression between each corporate

governance variables which consists of chairman and board of directors. The

result from model 2 show that only chairman financial background (CFB) has

significant effect related to earnings management which means this variable has

consistent result matching from previous table. The other variables which

consist of chairman tenure (CTE), executive chairman (CEX), proportion of

independent board (BDIND), board size (BDSZ), board meetings (BDME) is

Table IV.6

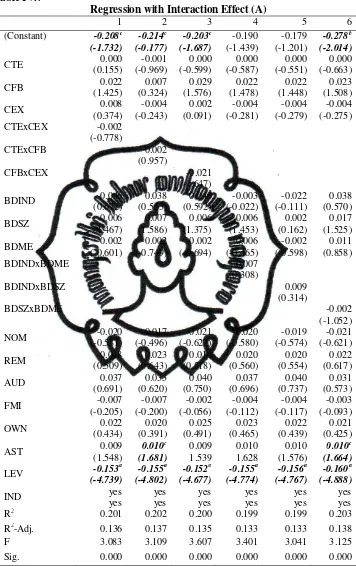

2. The Interaction of Corporate Governance on Earnings Management

Table IV.7 show the regression results with the interaction effects of

chairman variables and board of director variables. Model 1 shows the

interaction between chairman tenure (CTE) and executive chairman (CEX) and

the result is insignificant related to earnings management. Model 2 shows the

interaction between chairman tenure (CTE) and chairman financial background

(CFB) is insignificant to earnings management. Model 3 shows the interaction

between chairman financial background (CFB) and executive chairman (CEX) is

insignificant to earnings management.

Model 4 shows the interaction between proportion of independent boards

(BDIND) and board meeting (BDME) is insignificant to earnings management.

Model 5 shows the interaction between proportion of independent boards

(BDIND) and board size (BDSZ) is not significant to earnings management.

Model 6 shows the interaction between board size (BDSZ) and board meeting

BDME is not significant to earnings management. Therefore, all interactions

between chairman and board variables is insignificant related to earnings

management.

In the control variables, company size (AST) has positive significant effect

to earnings management only in model 6, the others model show insignificant

effect. The models show that leverage (LEV) consistenly has negative

Table IV.7

Regression with Interaction Effect (A)