DAFTAR LAMPIRAN

Pengungkapan ERM COSO

No. Enterprise Risk Management Dimentions A. Internal Environment

1 Is there a charter of the board?

2 Information on the code of conduct/ethics?

3 Information on how compensation policies align interest of managers with shareholders?

4 Information on individual performance targets?

5 Information on procedures for hiring and firing of board member and management?

6 Information on remuneration policy of board members and management? 7 Information on training, coaching, educational programs?

8 Information on training in ethical values? 9 Information on board responsibility?

10 Information on audit committee responsibility? 11 Information on CEO responsibilities?

12 Information on senior executive responsible for risk management? 13 Information on supervisory and managerial oversight?

B. Objective Setting

14 Information on company‟s mission? 15 Information on company‟s strategy?

16 Information on company‟s business objectives?

17 Information on adopted benchmarks to evaluate results? 18 Information on approval of the strategy by the board?

19 Information on the link between strategy, objectives, and shareholder value?

C. Event Identification Financial Risk

20 Information on the extent of liquidity? 21 Information on the interest rate?

22 Information on the foreign exchange rate? 23 Information on the cost of capital?

24 Information on the access to the capital market? 25 Information on long-term debt instruments? 26 Information on default risk?

27 Information on solvency risk? 28 Information on equity price risk? 29 Information on commodity risk?

Compliance Risk

30 Information on litigation issues?

31 Information on compliance with regulation? 32 Information on compliance with industry codes? 33 Information on compliance with voluntary codes?

34 Information on compliance with recommendation of Corporate Governance Technology Risk

35 Information on data management? 36 Information on computer systems?

37 Information on the privacy of information held on customers? 38 Information on software security?

Economical Risk

39 Information on the nature of competition?

40 Information on the macro-economy events that could affect the company? Reputational Risk

41 Information on environmental issues? 42 Information on ethical issues?

43 Information on health and safety issues?

44 Information on lower/higher stock or credit rating?

D. Risk Assessment

45 Risk assessment of the extent of liquidity? 46 Risk assessment of the interest rate?

47 Risk assessment of the foreign exchange rate? 48 Risk assessment of the cost of capital?

49 Risk assessment of the access to the capital market? 50 Risk assessment of long-term debt instrments? 51 Risk assessment of default risk?

52 Risk assessment of solvency risk? 53 Risk assessment of equity price risk? 54 Risk assessment of commodity risk? 55 Risk assessment of litigation issues?

56 Risk assessment of compliance wih regulation? 57 Risk assessment of industry codes?

58 Risk assessment of compliance with voluntary codes?

59 Risk assessment of compliance with recommendation of Corporate Govenance?

60 Risk assessment of data management? 61 Risk assessment of computer systems?

62 Risk assessment of the privacy of information held on? 63 Risk assessment of on software security?

64 Risk assessment of the nature of competition? 65 Risk assessment of environmental issues? 66 Risk assessment of ethical issues?

68 Risk assessment of lower/higher stock or credit rating?

69 Information on techniques used to asses the potential impact of events combining?

E. Risk Response

70 General description of processes for determining how risk should be managed?

71 Information on written guidelines about how risk should be managed? 72 Response to the liquidity risk?

73 Response to the interest rate risk?

74 Response to the foreign exchange rate risk? 75 Response to the risk related cost of capital? 76 Response to the access to the capital market? 77 Response to long-term debt instruments? 78 Response to litigation risk?

79 Response to default risk? 80 Response to solvency risk? 81 Response to equity price risk? 82 Response to commodity risk?

83 Response to compliance with regulation? 84 Response to compliance with industry codes? 85 Response to compliance with voluntary codes?

86 Response to compliance with recommendation of Corporate Governance? 87 Response to data risk?

88 Response to computer systems risk?

89 Response to the privacy of information held on customers? 90 Response to risk of software security?

91 Response to risk of competition? 92 Response to environemntal risk? 93 Response to ethical risk?

94 Response to health and safety risk?

95 Response to risk of lower/higher stock or credit rating?

F. Control Activites 96 Information on sales control?

97 Information on review of the functioning and effectiveness of controls? 98 Information on authorization issues?

99 Information on documents and record as control? 100 Information on independent verification procedures? 101 Information on physical controls?

102 Information on process control?

G. Information and Communications

104 Information on channels of communication to report suspected breaches of laws, regulations or other improprieties?

105 Information on channels of communication with customers, vendors, and other external parties?

H. Monitoring

106 Information on how processes are monitored? 107 Information on about internal audit?

34 NIRO

35 OMRE Sampel 27

36 PLIN Sampel 28

37 PUDP

38 PWON Sampel 29

39 PWSI

40 RBMS Sampel 30

41 RDTX Sampel 31

42 RODA Sampel 32

43 SIIP

44 SCBD Sampel 33

45 SMDM Sampel 34

46 SMRA Sampel 35

47 TARA 48 ACST

49 ADHI Sampel 36

50 DGIK Sampel 37

51 NRCA

52 PTPP Sampel 38

53 SSIA Sampel 39

54 TOTL Sampel 40

55 WIKA 56 WSKT

Perusahaan Yang Menjadi Sampel

5 BIPP Bhuwanatala Indah Permai Tbk

6 BKDP Bukit Darmo Property Tbk

7 BKSL Sentul City Tbk

8 BSDE Bumi Serpong Damai Tbk

9 COWL Cowell Development Tbk

10 CTRA Ciputra Development Tbk

11 CTRP Ciputra Property Tbk

12 CTRS Ciputra Surya Tbk

13 DART Duta Anggada Realty Tbk

14 DILD Intiland Development Tbk

15 DUTI Duta Pertiwi Tbk

16 ELTY Bakrieland Development Tbk 17 FMII Fortune Mate Indonesia Tbk

18 GMTD Gowa Makassar Tourism Development Tbk

19 JRPT Jaya Real Property Tbk

20 KIJA Kawasan Industri Jababeka Tbk

21 LAMI Lamicitra Nusantara Tbk

22 LPCK Lippo Cikarang Tbk

23 LPKR Lippo Karawaci Tbk

24 MDLN Modernland Realty Ltd Tbk

25 MKPI Metropolitan Kentjana Tbk

26 MTLA Metropolitan Land Tbk

27 OMRE Indonesia Prima Property Tbk 28 PLIN Plaza Indonesia Realty Tbk

29 PWON Pakuwon Jati Tbk.

30 RBMS Ristia Bintang Mahkotasejati Tbk

31 RDTX Roda Vivatex Tbk

32 RODA Pikko Land Development Tbk

33 SCBD Danayasa Arthatama Tbk.

34 SMDM Suryamas Dutamakmur Tbk

35 SMRA Summarecon Agung Tbk

36 ADHI Adhi Karya (Persero) Tbk

37 DGIK Nusa Konstruksi Enjiniring Tbk

38 PTPP PP (Persero) Tbk 39 SSIA Surya Semesta Internusa Tbk

2011 2012 2013 2011 2012 2013 2011 2012 2013 2011 2012 2013 2011 2012 2013 2011 2012 2013

1

APLN

0,33 0,33 0,33 3,00 3,00 3,00 0,47 0,47 0,62 0,53 0,30 0,63 30,01 30,35 30,61 0,50 0,51 0,48

2

ASRI

0,40 0,40 0,40 3,00 3,00 3,00 0,17 0,25 0,27 0,54 0,57 0,63 29,42 30,02 30,30 0,39 0,46 0,43

3

BAPA

0,33 0,33 0,33 3,00 3,00 3,00 0,38 0,34 0,34 0,45 0,45 0,47 25,72 25,79 25,89 0,37 0,39 0,37

4

BCIP

0,33 0,33 0,33 3,00 3,00 3,00 0,52 0,53 0,52 0,23 0,44 0,48 26,19 26,56 26,79 0,53 0,51 0,38

5

BIPP

0,50 0,33 0,33 3,00 3,00 3,00 0,37 0,31 0,40 0,62 0,53 0,23 26,01 25,91 27,05 0,50 0,51 0,37

6

BKDP

0,50 0,50 0,50 3,00 3,00 3,00 0,36 0,36 0,36 0,27 0,28 0,30 27,61 27,53 27,46 0,40 0,39 0,37

7

BKSL

0,50 0,43 0,38 3,00 3,00 3,00 0,30 0,34 0,34 0,13 0,22 0,35 29,30 29,45 30,00 0,48 0,44 0,43

8

BSDE

0,38 0,38 0,38 3,00 3,00 3,00 0,25 0,25 0,25 0,35 0,37 0,41 30,18 30,45 30,75 0,32 0,37 0,44

9

COWL

0,50 0,33 0,33 3,00 3,00 3,00 0,66 0,95 0,85 0,58 0,36 0,39 26,68 28,21 28,30 0,44 0,49 0,39

10 CTRA

0,50 0,40 0,50 3,00 3,00 3,00 0,31 0,39 0,31 0,34 0,44 0,51 30,08 30,34 30,63 0,42 0,40 0,42

11 CTRP

0,40 0,40 0,40 3,00 3,00 3,00 0,58 0,58 0,58 0,16 0,33 0,40 29,09 29,41 29,67 0,44 0,49 0,46

12 CTRS

0,50 0,50 0,50 3,00 3,00 3,00 0,63 0,63 0,63 0,45 0,50 0,57 28,89 29,12 29,38 0,42 0,44 0,36

13 DART

0,33 0,33 0,33 3,00 3,00 3,00 0,34 0,45 0,45 0,45 0,34 0,39 29,04 29,09 29,19 0,53 0,54 0,43

14 DILD

0,33 0,33 0,33 4,00 4,00 3,00 0,22 0,22 0,22 0,32 0,35 0,46 29,37 29,44 29,65 0,52 0,44 0,42

15 DUTI

0,33 0,33 0,33 3,00 3,00 3,00 0,85 0,89 0,89 0,31 0,22 0,19 29,28 29,52 29,64 0,33 0,39 0,43

16 ELTY

0,40 0,33 0,40 3,00 3,00 3,00 0,12 0,10 0,10 0,38 0,40 0,42 30,51 30,35 30,14 0,63 0,65 0,61

17 FMII

0,33 0,33 0,33 3,00 3,00 3,00 0,47 0,47 0,47 0,29 0,30 0,34 26,59 26,60 26,79 0,44 0,43 0,38

18 GMTD

0,40 0,20 0,33 3,00 3,00 3,00 0,33 0,33 0,33 0,65 0,74 0,69 26,90 27,53 27,90 0,43 0,41 0,31

19 JRPT

0,40 0,40 0,60 3,00 3,00 3,00 0,66 0,66 0,64 0,53 0,56 0,56 29,04 29,24 29,45 0,46 0,48 0,34

20 KIJA

0,50 0,33 0,50 3,00 3,00 3,00 0,23 0,18 0,13 0,37 0,44 0,49 29,35 29,59 29,74 0,41 0,40 0,36

FIN_LEV

FRM_SZE

ERM

No Kode Saham

IND_COM

AUD_COM

OWN_CON

2011 2012 2013 2011 2012 2013 2011 2012 2013 2011 2012 2013 2011 2012 2013 2011 2012 2013

21 LAMI

0,33 0,33 0,33 3,00 3,00 3,00 0,93 0,93 0,93 0,52 0,47 0,41 27,11 27,14 27,14 0,38 0,34 0,31

22 LPCK

0,60 0,50 0,57 3,00 3,00 3,00 0,42 0,42 0,42 0,60 0,57 0,53 28,34 28,67 28,98 0,47 0,54 0,50

23 LPKR

0,71 0,71 0,75 3,00 3,00 3,00 0,18 0,18 0,18 0,48 0,54 0,55 30,54 30,84 31,07 0,57 0,56 0,60

24 MDLN

0,50 0,50 0,40 3,00 4,00 3,00 0,22 0,30 0,30 0,51 0,52 0,52 28,51 29,16 29,90 0,35 0,47 0,50

25 MKPI

0,32 0,32 0,32 4,00 4,00 4,00 0,47 0,47 0,47 0,30 0,33 0,32 28,39 28,57 28,67 0,43 0,38 0,31

26 MTLA

0,33 0,33 0,33 3,00 3,00 3,00 0,38 0,38 0,38 0,22 0,23 0,38 28,18 28,33 28,67 0,51 0,50 0,51

27 OMRE

0,50 0,50 0,40 3,00 3,00 3,00 0,72 0,90 0,90 0,32 0,31 0,35 27,33 27,34 27,44 0,44 0,44 0,34

28 PLIN

0,33 0,33 0,33 3,00 3,00 3,00 0,25 0,38 0,30 0,46 0,43 0,48 29,07 29,00 29,05 0,45 0,53 0,48

29 PWON

0,33 0,33 0,67 3,00 3,00 3,00 0,22 0,21 0,21 0,59 0,59 0,56 29,38 29,65 29,86 0,44 0,47 0,50

30 RDTX

0,33 0,33 0,33 2,00 2,00 2,00 0,38 0,38 0,38 0,23 0,21 0,26 27,71 27,82 28,07 0,39 0,47 0,51

31 RBMS

0,33 0,33 0,33 3,00 3,00 3,00 0,36 0,36 0,36 0,08 0,07 0,20 25,64 25,75 25,79 0,40 0,44 0,45

32 RODA

0,33 0,33 0,33 3,00 3,00 3,00 0,69 0,69 0,68 0,36 0,44 0,37 28,43 28,52 28,64 0,42 0,53 0,53

33 SCBD

0,33 0,50 0,40 3,00 3,00 3,00 0,82 0,82 0,82 0,25 0,25 0,23 28,88 28,90 29,34 0,35 0,41 0,34

34 SMDM

0,33 0,67 0,33 3,00 3,00 3,00 0,74 0,74 0,62 0,16 0,20 0,27 28,53 28,60 28,71 0,45 0,44 0,41

35 SMRA

0,50 0,50 0,50 3,00 3,00 3,00 0,25 0,24 0,25 0,69 0,65 0,66 29,72 30,02 30,25 0,49 0,48 0,52

36 ADHI

0,40 0,33 0,33 3,00 3,00 3,00 0,52 0,51 0,51 0,84 0,85 0,84 29,44 29,69 29,91 0,53 0,56 0,60

37 DGIK

0,40 0,40 0,40 3,00 3,00 3,00 0,33 0,33 0,33 0,35 0,43 0,50 28,03 28,20 28,37 0,46 0,47 0,49

38 PTPP

0,33 0,33 0,33 4,00 4,00 4,00 0,51 0,51 0,51 0,79 0,81 0,84 29,57 29,78 30,15 0,54 0,41 0,51

39 SSIA

0,40 0,40 0,40 3,00 3,00 3,00 0,12 0,09 0,09 0,59 0,66 0,55 28,71 29,21 29,39 0,39 0,37 0,48

40 TOTL

0,33 0,33 0,29 3,00 3,00 3,00 0,57 0,57 0,57 0,64 0,66 0,63 28,27 28,36 28,43 0,60 0,56 0,56

FIN_LEV

FRM_SZE

ERM

No Kode Saham

IND_COM

AUD_COM

OWN_CON

Universitas

Sumatera

Hasil Olah Statistik

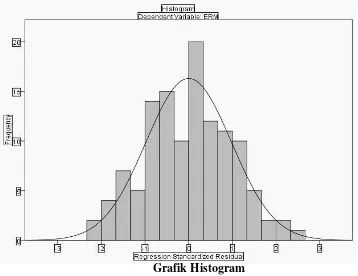

Grafik Histogram

Grafik Normal Probability Plot

Hasil Uji Kolmogorov - Smirnov

a. Dependent Variable: ERM

One-Sample Kolmogorov-Smirnov Test

Unstandardized

Residual

N 120

Normal Parametersa,b Mean ,0000000

Std. Deviation ,06737608

Most Extreme Differences Absolute ,043

Positive ,041

Negative -,043

Kolmogorov-Smirnov Z ,474

Asymp. Sig. (2-tailed) ,978

a. Test distribution is Normal.

b. Calculated from data.

Model Collinearity Statistics

Diagram Scatterplot

Hasil Uji Glejser

Coefficientsa

Model

Unstandardized Coefficients

Standardized

Coefficients

t Sig.

B Std. Error Beta

1 (Constant) ,034 ,084 ,401 ,689

IND_COM -,054 ,038 -,137 -1,425 ,157

AUD_COM -,009 ,011 -,072 -,769 ,444

OWN_CON -,023 ,017 -,129 -1,359 ,177

FIN_LEV ,030 ,022 ,132 1,361 ,176

FRM_SZE ,002 ,003 ,081 ,803 ,424

Hasil Uji Runs

Runs Test

Unstandardized

Residual

Test Valuea ,00574

Cases < Test Value 60

Cases >= Test Value 60

Total Cases 120

Number of Runs 65

Z ,733

Asymp. Sig. (2-tailed) ,463

a. Median

Hasil Uji Durbin – Watson

Hasil Analisis Regresi Berganda

Coefficientsa

Model

Unstandardized Coefficients

Standardized

Coefficients

T Sig.

B Std. Error Beta

1 (Constant) ,182 ,152 1,195 ,234

IND_COM -,004 ,068 -,006 -,065 ,948

AUD_COM -,023 ,021 -,097 -1,087 ,279

OWN_CON -,055 ,030 -,166 -1,834 ,069

FIN_LEV ,078 ,039 ,183 1,993 ,049

FRM_SZE ,011 ,005 ,209 2,188 ,031

\

a. Predictors: (Constant), FRM_SZE, AUD_COM, OWN_CON, IND_COM, FIN_LEV

Nilai Koefisien Determinasi

b. Predictors: (Constant), FRM_SZE, AUD_COM, OWN_CON, IND_COM, FIN_LEV

Hasil Uji Sginifikansi Simultan

ANOVAb

Model Sum of Squares df Mean Square F Sig.

1 Regression ,096 5 ,019 4,037 ,002a

Residual ,540 114 ,005

Total ,636 119

a. Predictors: (Constant), FRM_SZE, AUD_COM, OWN_CON, IND_COM, FIN_LEV

b. Dependent Variable: ERM

Hasil Uji Signifikansi Parsial

Coefficientsa

Model

Unstandardized Coefficients

Standardized

Coefficients

T Sig.

B Std. Error Beta

1 (Constant) ,182 ,152 1,195 ,234

IND_COM -,004 ,068 -,006 -,065 ,948

AUD_COM -,023 ,021 -,097 -1,087 ,279

OWN_CON -,055 ,030 -,166 -1,834 ,069

FIN_LEV ,078 ,039 ,183 1,993 ,049

FRM_SZE ,011 ,005 ,209 2,188 ,031