D am pak Tingkat P engungkapan Inform asi P erusahaan Terhadap Volume P erdagangan dan R eturn Saham 1

Ju rn a l A k u n tan si d a n K e u a n g a n In d o n esia

Ju li-D e se m b e r 2 0 0 5 , Vol. 2 , N o . 2 , p p. 1-28

D A M P A K T I N G K A T P E N G U N G K A P A N I N F O R M A S I

P E R U S A H A A N T E R H A D A P V O L U M E P E R D A G A N G A N D A N

R E T U R N S A H A M :

P E N E L I T I A N E M P I R I S T E R H A D A P P E R U S A H A A N - P E R U S A H A A N Y A N G T E R C A T A T D I B U R S A E F E K J A K A R T A

D e d i J u n a e d i

D ed i J u n a e d i a d a la h s t a f p e n g a ja r D e p a rte m e n A k u n ta n s i F E U I

A b s tr a c t

The p u r p o s e o f th is stu d y is to eva lu a te th e e ffe c t o f d isclo su re le v e l to m a rket indica tors, su c h as tra d in g vo lu m e a ctivity (TVA) a n d s to c k returns. This s tu d y also tries to eva lu a te th e d ifferen ce in m a rket in d ic a to rs f o r c o m p a n ies w ith differen ces in d isclo su re level: co m p reh en sive a n d no n -co m p reh en sive.

This s tu d y a d o p ts co n te n t a n a lysis a p p ro a ch in g e n e r a tin g d isclo su re index, u sin g data fr o m a n n u a l rep o rts o f fir m s liste d in th e J S X in th e p e r io d s o f 2 0 0 0 - 200 2. This s tu d y uses m ea n co m p a riso n a n a ly sis a n d reg ressio n an alysis, bo th lin ea r a n d h g is tic , in testin g the e ffe c t o f d isclo su re le v e l to m a rket in d ica to rs o f co m p a n ies w ith co m p reh en sive a n d n o n -co m p reh en sive disclosure.

This stu d y does n o t p ro v id e em p iric a l evid en ce to su p p o rt th e effect o fd isc lo su re le v e l to both m a rket in dicators. H ow ever, th is s tu d y fin d s th a t there is a d iffe re n c e in TVA betw een com pa nies w ith com prehensive a n d non-co m prehen sive disclosure. These resu lts le a d to a co n clu sio n th a t d isclo su re in th e a n n u a l rep o rts m a y s till n o t b e a m a tte r o f c o n sid e ra b le in terest a n d im p o rta n ce to in vestors. This s tu d y a lso fin d s th a t fir m s iz e a n d rep o rted in co m e a ffe c t d isclo su re level.

2 J u r n a l A k u n t a n s i d a n K e u a n g a n I n d o n e s i a , J u l i - D e s e m b e r 2 0 0 5 , Vol. 2 , N o . 2

I . P E N D A H U L U A N

D a la m e ra p e rsa in g a n d u n ia u s a h a y a n g se m a k in k o m p e titif d e w a s a in i, k e lan g su n g a n

h id u p s e r ta k e s e m p a ta n b e r k e m b a n g b a g i s u a tu p e r u s a h a a n s a n g a t d ip e n g a r u h i o le h

k e te rse d ia a n d a n a d a n a d a n y a ak se s p e ru sa h a a n te rse b u t k e p a d a s u m b e r d a n a y a n g te rse d ia .

D a la m p e r e k o n o m ia n m o d e m , s a la h s a tu s u m b e r d a n a e k s te rn a l b a g i p e r u s a h a a n a d a la h

p a s a r m o d a l. P a s a r m o d a l m e m b e r ik a n k e s e m p a ta n k e p a d a p e r u s a h a a n u n tu k b e r s a in g

s e c a ra s e h a t u n tu k m e n a rik m in a t p a r a in v e sto r u n tu k m e n an a m k a n m o d a ln y a d i p e ru sa h a a n

te rs e b u t. D i s is i la in p a s a r m o d a l j u g a m e n y e d ia k a n a lte r n a tif in v e s ta s i b a g i p a r a in v e s to r

b a ik y a n g in g in m e la k u k a n in v e s ta s i j a n g k a p e n d e k m a u p u n j a n g k a p a n j an g .

D a la m m e lak u k a n in v estasi d i p a sa r m o d a l, b a ik d a la m b e n tu k sah am , o b lig asi ata u p u n

b e n tu k in v e s ta s i lain n y a , in v e s to r y a n g ra sio n a l u m u m n y a m e la k u k a n s e ra n g k a ia n a n a lisis

te n ta n g in v e s ta s i y a n g a k a n d ila k u k a n n y a . K h u s u s u n tu k in v e sta s i d a la m s a h a m , b ia s a n y a

in v e sto r ak an m e lak u k a n analisis fu n d am en tal atau p u n analisis teknikal. A n alisis fu n d am en tal

m e n g g u n a k a n in fo rm a s i y a n g b e ra s a l d a ri p e rg e ra k a n earnings, p r o s p e k d iv id e n , tin g k a t s u k u b u n g a y a n g d ih a r a p k a n s e rt a e v a lu a s i ris ik o p e r u s a h a a n d a la m m e n e n tu k a n h a r g a

s a h a m . S e d a n g k a n a n a lis is te k n ik a l m e n g g u n a k a n p o la p e rg e ra k a n (trend) h a rg a s a h a m d a la m m e n g e s tim a s i h a rg a s a h a m (B o d ie e t a l 2 0 0 2 ).

S a lah s a tu s u m b e r in fo rm a si g u n a m e n d a p a tk a n g a m b a ra n ten tan g k in e ija p e ru sa h a a n

a d a la h la p o ra n ta h u n a n (annual report) y a n g d ik elu ark an o le h p e ru sa h a a n . L a p o ra n ta h u n a n t e r s e b u t m e m b e r ik a n g a m b a r a n te n ta n g k i n e i j a p e r u s a h a a n s e c a ra k o m p r e h e n s i f b a ik

m e n g e n a i in fo rm a si k e u a n g a n 1 m a u p u n in fo rm a si n o n -k e u a n g a n 2 y a n g p e rlu d ik e tah u i o le h

p a r a p e m e g a n g sa h a m , c a lo n in v esto r, p e m e rin ta h atau b a h k a n m a sy a ra k a t. P e n g u n g k a p a n

y a n g d ila k u k a n p e ru sa h a a n m e la lu i la p o ra n ta h u n a n a k a n m e n ja d i sa la h s a tu b a h a n ru ju k a n

b a g i p a r a in v e sto r d a n c a lo n in v e sto r d alam m e m u tu sk a n a p a k a h a k a n b e rin v e sta si d i d a la m

p e r u s a h a a n te r s e b u t. P e n je la s a n te r s e b u t s e c a ra tid a k la n g s u n g m e m b e r ik a n g a m b a r a n

b a h w a tin g k a t p e n g u n g k a p a n 3 (d isclosure level) y a n g d ib e rik a n o le h p ih a k m a n a je m e n p e r u s a h a a n a k a n b e r d a m p a k k e p a d a p e r g e ra k a n h a r g a s a h a m y a n g p a d a g ilira n n y a j u g a

a k a n b e r d a m p a k p a d a v o lu m e s a h a m y a n g d ip e r d a g a n g k a n a ta u li k u id ita s s a h a m . H a l

te r s e b u t d ik a re n a k a n p e n g u n g k a p a n in fo rm a si k e u a n g a n d a n n o n -k e u a n g a n y a n g d ib e rik a n

o le h p ih a k m a n a je m e n p e ru sa h a a n m e ru p a k a n sa la h s a tu c ara u n tu k m e m b e rik a n g a m b a ra n

1 I n f o r m a s i k e u a n g a n b ia s a n y a m e n g a c u k e p a d a la p o r a n k e u a n g a n ( f i n a n c i a l s t a t e m e n t s ) y a n g m e r u

p a k a n b a g ia n d a r i p e n g u n g k a p a n w a j i b ( m a n d a t o r y d i s c l o s u r e ) y a n g d is y a r a t k a n B a p e p a m .

2 I n f o r m a s i n o n - k e u a n g a n m e n g a c u k e p a d a p e n g u n g k a p a n k u a li t a t if d a la m la p o r a n t a h u n a n d i lu a r la p o r a n k e u a n g a n , b a ik y a n g b e r s i f a t w a j i b ( m a n d a t o r y ) a t a u p u n s u k a r e la ( v o l u n t a r y ) .

3 S e l a i n t i n g k a t p e n g u n g k a p a n ( d i s c l o s u r e l e v e l ) , k u a li t a s p e n g u n g k a p a n ( d i s c l o s u r e q u a l i t y ) j u g a

p e n t i n g n a m u n s a n g a t s u li t u n t u k d iu k u r . S e b a g a im a n a d ij e la s k a n o l e h B o t o s a n ( 1 9 9 7 ) p a r a p e n e l i t i

D am pak Tm gkat P engungkapan Inform asi Perusahaan Terhadap Volume P erdagangan dan R elu m Saham 3

te n ta n g k in e ij a p e r u s a h a a n k e p a d a p a r a stakeholder. D e n g a n d e m ik ia n , te r lih a t b a h w a tin g k a t p en g u n g k a p a n p e ru sa h a a n m e m ilik i d a m p a k terh a d a p in d ik a to r-in d ik a to r k e u an g an ,

s e p e r ti cost o f equity, co st o f d e b t a ta u p u n li k u id ita s d a n v o la tilita s h a r g a s a h a m , y a n g a k a n d ija d ik a n d a s a r o le h p a r a in v e s to r d a la m m e la k u k a n in v e sta s i.

P e n e litia n in i d ila k u k a n u n tu k m e lih a t s e c a ra le b ih d a la m a p a k a h te rd a p a t p e rb e d a a n

p e n g a ru h tin g k at p e n g u n g k a p a n p e ru sa h a a n terh a d a p in d ik a to r la in se p e rti return d a n v o lu m e p e r d a g a n g a n s a h a m s e te la h p e n g u n g k a p a n t e r s e b u t b a g i p e r u s a h a a n y a n g s e c a r a

k o m p r e h e n s i f m e la k u k a n p e n g u n g k a p a n d e n g a n p e r u s a h a a n y a n g t id a k a ta u k u r a n g

k o m p re h e n s if d a la m m e la k u k a n p e n g u n g k a p a n in fo rm a s i k e u a n g a n .

I I . P E N E L I T I A N T E R D A H U L U D A N P E M B E N T U K A N H I P O T E S I S

A . P E N E L I T I A N T E R D A H U L U

P enelitian-penelitian terd ah u lu y an g m e n g a n g k a t to p ik p e n g a ru h tin g k at p e n g u n g k a p a n

te r h a d a p in d ik a to r- in d ik a to r k in e rja k e u a n g a n p e r u s a h a a n s e p e rti co st o f capital, co st o f equity, co st o f debt, earnings, return d a n lik u id ita s s a h a m te la h b a n y a k d ila k u k a n b a ik d i l u a r m a u p u n d i In d o n e s ia s e n d iri. In ti d a r i p e n e litia n - p e n e litia n te r s e b u t p a d a d a s a r n y a

a d a la h u n tu k m e m b e rik a n g a m b a ra n se ja u h m a n a p e n g u n g k a p a n in fo rm a s i te n ta n g k in e rja

k e u a n g a n m a u p u n n o n -k e u a n g a n p e ru sa h a a n y a n g d ila k u k a n m a n a je m e n p e r u s a h a a n y a n g

t e r c e r m i n p a d a p e n g u n g k a p a n d i d a la m a n n u a l rep o rt b e r p e n g a r u h k e p a d a in d ik a to r- in d ik d to r k in e rja p e ru s a h a a n s e b a g a im a n a d ije la s k a n d i atas. P e n e litia n -p e n e litia n te rse b u t,

y a n g b e rtu ju a n u n tu k m e lih a t p e n g a ru h tin g k a t p e n g u n g k a p a n y a n g d ila k u k a n p e ru s a h a a n

te r h a d a p in d ik a to r-in d ik a to r k in e r ja k e u a n g a n s e p e rti te r s e b u t d i a ta s , s e p e rti p e n e li ti a n

y a n g d ilak u k a n o le h A m ih u d (1 9 8 6 ), V e rrec h ia (1 9 8 2 ) s e rta D ia m o n d d a n V e rre c h ia (1 9 9 1 )

m e n u n ju k k a n p e n g a r u h p e n g u n g k a p a n te r h a d a p c o s t o f c a p ita l s e c a ra tid a k la n g s u n g . R is e t y a n g m e re k a la k u k a n le b ih te rfo k u s p a d a d a m p a k p e n g u n g k a p a n in fo rm a s i ak u n tan si

p a d a v a ria b e l y a n g d ih a r a p k a n te r k a it s e c a ra p o s i t i f te r h a d a p c o st o f cap ital. S e d a n g k a n p e n e litia n em p iris y a n g lan g su n g m en g u ji a n ta ra p en g u n g k a p a n in fo rm a si ak u n tan si terh ad ap

c o s t o f e q u ity c a p ita l a d a l a h B o t o s a n ( 1 9 9 7 ) . M e n u r u t n y a t e r d a p a t p e n g a r u h p e n g u n g k a p a n te r h a d a p c o st o f eq u ity cap ital.

P e n e litia n y a n g m e n g u ji p e n g a r u h tin g k a t p e n g u n g k a p a n te r h a d a p c o st o f eq uity s e c a ra lan g su n g a d a la h p e n e litia n y a n g d ila k u k a n o le h K o m a lasa ri (2 0 0 0 ). P en elitian terseb u t

m e n u n ju k k a n b a h w a te rd a p a t p e n g a ru h in fo rm a s i te rh a d a p lik u id ita s p e rd a g a n g a n s a h a m

a n t a r a in v e s to r y a n g w ell-in fo rm ed d a n y a n g t i d a k w ell-in fo rm ed , y a n g p a d a a k h ir n y a m e m p e n g a ru h i n ila i cost o f equity. P e n e litia n la in m e n g e n a i h a l in i u n tu k tu ju a n d ise rta s i d ila k u k a n o le h S ita n g g a n g (2 0 0 2 ) y a n g m e n y im p u lk a n b a h w a a se t, tin g k a t h u ta n g , s e rta

la m a n y a p e ru s a h a a n te rc a ta t d i b u r s a m e m p u n y a i p e n g a r u h te r h a d a p p e n g u n g k a p a n d a n

4 J u r n a l A k u n t a n s i d a n K e u a n g a n I n d o n e s i a , J u l i - D e s e m b e r 2 0 0 5 , Vol. 2 , N o . 2

B . K E R A N G K A P E M I K I R A N D A N P E M B E N T U K A N H I P O T E S I S

In fo rm a s i m e m a in k a n p e ra n a n p e n tin g b a g i in v e s to r d a la m m e n g a m b il k e p u tu s a n

i n v e s t a s i . H i p o t e s i s p a s a r m o d a l e f i s i e n ( E ffic ie n t M a r k e t H y p o th e s is /E M H ) m e n g h u b u n g k a n s e rta m e n g e lo m p o k k a n je n is e fisie n s i p a s a r b e r d a s a r k a n k e t e r s e d ia a n

i n f o r m a s i d a n r e s p o n p a r a in v e s to r te r h a d a p in fo r m a s i te r s e b u t. H ip o te s a te r s e b u t

m e n y im p u lk a n b a h w a in fo rm a s i a k a n m u n g k in m e m b e rik a n k e u n tu n g a n d a la m b e n tu k

a b n o rm a l return k e p a d a p a r a in v e s to r d a la m p a s a r d e n g a n b e n tu k e fisie n si le m a h (w ea k fo r m ) a ta u s e m i k u a t (sem i-strong form ). S e d a n g k a n d a la m p a s a r d e n g a n e fisie n s i b e n tu k

k u a t (strongform ), in fo rm a s i d a la m b e n tu k a p a p u n tid a k a k a n m e m b e rik a n unusual p ro fit b a g i p a r a in v e s to r ( R o s s e t a l 2 0 0 2 :3 4 2 -3 ) .

P e n e litia n in i m e m p u n y a i h u b u n g a n e ra t d e n g a n p e n e litia n -p e n e litia n s e b e lu m n y a ,

te r u ta m a p e n e litia n -p e n e litia n y a n g d ila c u k a n d i In d o n e sia o le h S a ri (2 0 0 2 ), K o m a la s a ri

( 2 0 0 0 ) a ta u p u n S ita n g g a n g (2 0 0 0 ) te r u ta m a d a la m m e lih a t h u b u n g a n a n ta r a p e n g a r u h

p e n g u n g k a p a n y a n g d ila k u k a n p e ru s a h a a n te rh a d a p in d ik a to r-in d ik a to r k e u a n g a n . N a m u n

d e m ik ia n p e n e litia n in i m e m ilik i s e d ik it p e rb e d a a n te r u ta m a d a la m h a l a n a lis is te rh a d a p

tin g k a t p e n g u n g k a p a n m a u p u n k e b e ra d a a n p en g u n g k a p a n itu sen d iri. T in g k at p en g u n g k a p a n

d a l a m p e n e litia n in i b e r m u a ra p a d a p e n g e lo m p o k a n p e ru s a h a a n k e d a la m d u a k e lo m p o k

y a i t u p e r u s a h a a n y a n g m e la k u k a n p e n g u n g k a p a n s e c a ra k o m p r e h e n s if d a n p e r u s a h a a n

y a n g tid a k m e la k u k a n p e n g u n g k a p a n s e c a ra k o m p re h e n sif. S e la in itu p r o s e s p e rh itu n g a n D S C O R E s e b a g a i in d ik a to r tin g k a t k o m p re h e n s ifita s p e n g u n g k a p a n p e ru sa h a a n p u n a g a k s e d ik it b e ib e d rfd e n g a n y a n g d ila k u k a n o le h B o to s a n (1 9 9 7 ) d im a n a p e rh itu n g a n d ila k u k a n

d e n g a n m e n g a c u k e p a d a p e r a tu ra n B a p e p a m te n ta n g p e n g u n g k a p a n w a jib d a n s u k a r e la

y a n g h a r u s d i la k u k a n o le h p e r u s a h a a n - p e r u s a h a a n y a n g te r c a ta t d i B u r s a E fe k J a k a r ta

(B E J ).

B e rd a s a rk a n u ra ia n d i a ta s, te rd a p a t tig a h a l y a n g m e n a rik u n tu k d iu ji d a n d ija d ik a n

kera n g ka p em ikira n d a la m p e n e litia n in i. K e tig a h a l te rs e b u t a d a lah :

1. P e n g a ru h d a n p e rb e d a a n p e n g a ru h peng ungkapan b a ik te rh a d a p v o lu m e p e rd a g a n g a n s a h a m m a u p u n te rh a d a p return s a h a m .

P e n g a r u h k e b e r a d a a n p e n g u n g k a p a n p e ru s a h a a n te rh a d a p in d ik a to r -in d ik a to r

k e u a n g a n , d a la m h a l in i v o lu m e p e rd a g a n g a n y a n g di-proxy d e n g a n T ra d in g V o lu m e A c tiv ity (T V A ) d a n retu rn s a h a m y a n g d i -pro xy d e n g a n a b n o rm a l return s a h a m , a k a n d iu ji m e la lu i h ip o te sis-h ip o te s is se b a g a i b erik u t:

H , : R a t a - r a t a T V A d a l a m p e r i o d e 3 h a r i setelah p e n g u n g k a p a n l e b ih b e s a r d i b a n d i n g k a n d e n g a n r a t a - r a t a T V A d a l a m p e r i o d e 3 h a r i

D am pak Tm gkat Pengungkapan Inform asi Perusahaan Terhadap Volume P erdagangan dan Return Saham 5

H 2: R a t a - r a t a a b n o r m a l r e t u r n s a h a m d a la m p e r io d e 3 h a r i s e t e la h p e n g u n g k a p a n le b ih b e s a r d ib a n d in g k a n d e n g a n r a t a - r a t a a b n o r m a l r e tu r n d a la m p e r i o d e 3 h a r i s e b e lu m p e n g u n g k a p a n .

2 . P e n g a ru h tingkat pen gungkap an te rh a d a p v o lu m e p e rd a g a n g a n s a h a m m a u p u n return s a h a m

T m g k a t p e n g u n g k a p a n y a n g d ila k u k a n p e ru sa h a a n a k a n d ik e lo m p o k k a n m e n jad i

tin g k a t p e n g u n g k a p a n k o m p r e h e n s if a ta u tid a k k o m p r e h e n s if d a n p e r u s a h a a n y a n g

m e la k u k a n p e n g u n g k a p a n d ik e lo m p o k k a n m e n ja d i p e r u s a h a a n y a n g m e la k u k a n

p e n g u n g k a p a n s e c a r a k o m p r e h e n s i f d a n p e r u s a h a a n y a n g t i d a k m e l a k u k a n

p e n g u n g k a p a n se c a ra k o m p re h e n sif. S e lan ju tn y a p e n g a ru h tin g k a t p e n g u n g k a p a n a k a n

d iu ji m e lalu i h ip o tesis-h ip o tesis di b a w a h ini:

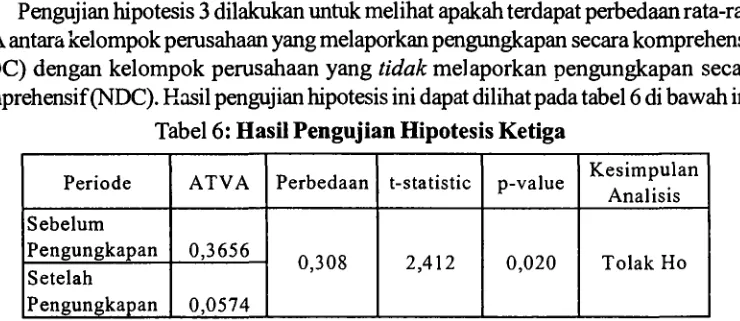

H 3: R a t a - r a t a T V A s e t e la h p e n g u n g k a p a n a n t a r a p e r u s a h a a n y a n g m e la k u k a n p e n g u n g k a p a n in f o r m a s i s e c a r a k o m p r e h e n s i f le b ih b e sa r d ib a n d in g k a n d e n g a n p e r u s a h a a n y a n g t id a k m e l a k u k a n p e n g u n g k a p a n in f o r m a s i s e c a r a k o m p r e h e n s i f .

H ,: R a t a - r a t a a b n o r m a l r e tu r n s a h a m s e t e l a h p e n g u n g k a p a n a n t a r a

p e r u s a h a a n y a n g m e la k u k a n p e n g u n g k a p a n in f o r m a s i s e c a r a k o m p r e h e n s i f le b i h b e s a r d ib a n d in g k a n d e n g a n p e r u s a h a a n y a n g

t i d a k m e la k u k a n p e n g u n g k a p a n i n f o r m a s i s e c a r a k o m p r e h e n s i f

3 . K e c e n d e r u n g a n tin g ka t p e n g u n g k a p a n p e r u s a h a a n d i lih a t d a r i s k a la , s tr u k tu r p e m b ia y a a n d a n p o sisi la b a p e ru sa h a a n a k a n d iu ji m e la lu i h ip o tesis -h ip o tes is di b a w a h

it i

H s: T e r d a p a t p e n g a r u h t in g k a t p e n g u n g k a p a n t e r h a d a p r a t a - r a t a T V A p e r u s a h a a n - p e r u s a h a a n y a n g t e r c a t a t d i B u r s a E f e k J a k a r t a .

H fi: T e r d a p a t p e n g a r u h t in g k a t p e n g u n g k a p a n t e r h a d a p r a ta - r a ta a b n o r m a l r e tu r n s a h a m p e r u s a h a a n - p e r u s a h a a n y a n g t e r c a t a t d i B u r s a E f e k

J a k a r t a .

H 7: T e r d a p a t p e n g a r u h u k u r a n , s t r u k t u r p e m b ia y a a n d a n p o s i s i la b a p e r u s a h a a n t e r h a d a p k e c e n d e r u n g a n t i n g k a t p e n g u n g k a p a n p e r u s a h a a n .

P e n g u jia n h ip o te sis secara statistik d a lam p en e litian in i a k a n d ila k u k a n d e n g a n m e n g

g u n a k a n ru m u s a n h ip o tesis sta tistik seb ag at b erik u t:

1 . H ip o t e s is P e r t a m a

H , o • Mt vA_2 < ^ T V A l ^ l a ' M"TVA_2 > ^ T V A l

Dim ana:

6 J u r n a l A k u n t a n s i d a n K e u a n g a n I n d o n e s i a , J u l i - D e s e m b e r 2 0 0 5 , Vol. 2 , N o . 2

2 . H i p o t e s i s K e d u a

^20 ■ ^AR2 — ^ARJ

^2a * ^AR 2 > ^AR l

Dim ana:

HAR , = R a ta -ra ta abno rm al return d a la m p e rio d e 3 h a ri sebelum p e n g u n g k a p a n Ha r 2 = R a ta - ra ta a b n o rm a l return d a la m p e r io d e 3 h a ri setelah p e n g u n g k a p a n

3 . H i p o t e s i s K e t ig a

Hj o • Mt vA-CDC — ^TVA-A73C

^ 3 a • ^ T V A -C D C > ^T V A -W D C D im ana:

I-W -cd c = R ata -ra ta T V A d a la m p e rio d e 3 h a ri sete la h p e n g u n g k a p a n k e lo m p o k p e r u s a h a a n y a n g m e m ilik i tin g k a t p e n g u n g k a p a n k o m p r e h e n s i f

(C D C )

|oTVAWDC = R a t a - r a t a T V A d a l a m p e r i o d e 3 h a r i s e te la h p e n g u n g k a p a n

k e lo m p o k p e r u s a h a a n y a n g tid a k m e m ilik i tin g k a t p e n g u n g k a p a n

k o m p re h e n s if (NDC)

4 . H ip o t e s i s K e e m p a t

^ 4 0 • ^ A R - C D C — ^ A R -N D C

^ 4 a * ^ A R - C D C > ^ A R - W D C D im ana:

^ a r-c o c - = R a t a _ r a t a a b n o r m a l r e tu r n d a l a m p e r i o d e 3 h a r i s e t e l a h p e n g u n g k a p a n k e l o m p o k p e r u s a h a a n y a n g m e m i l i k i t i n g k a t

p e n g u n g k a p a n k o m p re h e n s if (CDC)

^

ar-

ndc~

R a t a *r a t a a b n o r m a l r e tu r n d a l a m p e r i o d e 3 h a r i s e t e l a h p e n g u n g k a p a n k e lo m p o k p e ru s a h a a n y a n g tid a k m e m ilik i tin g k a tp e n g u n g k a p a n k o m p re h e n s if (NDC)

5 . H i p o t e s i s K e li m a

^ 5 0 • $ D S C O R E -\ ~ ®

^ 5 a ' ^ D SCO RE -1 ^ ®

D i m a n a :

P DSCo « £ -i = S l o p e a t a u k o e f i s i e n p e r s a m a a n r e g r e s i u n t u k v a r i a b e l D S C O R E

d e n g a n v a r i a b e l d e p e n d e n “ l i k u i d i t a s s a h a m ”

6 . H i p o t e s i s K e e n a m

^ 6 0 ' ^D S C O R E -2 ~ ®

^ 6 a ' ^ D S C O R E -2 ^ ®

D i m a n a :

$d s c o r e -2 = S l o p e a t a u k o e f i s i e n p e r s a m a a n r e g r e s i u n t u k v a r i a b e l D S C O R E

D am pak Tm gkat Pengungkapan Inform asi P erusahaan Terhadap Volume Perdagangan dan R eturn Saham 7

7 . H i p o t e s is K e t u j u h

H ,. :

P,

=Pz

=Pj

=P4

=0

H „ : P . - P ^ P j - P , * 0

D i m a n a :

P ( = Slope a tau k o e fisien p e rsa m a a n re g re si u n tu k v a ria b e l-v a ria b e l in d e p e n d e n ( / = 1 , 2 , 3 , 4 )

I I I . P E M I L I H A N S A M P E L , D E S K R I P S I D A N O P E R A S I O N A L I S A S I V A R I A B E L

A . P O P U L A S I P E N E L I T I A N D A N S A M P E L P E N E L I T I A N

P o p u la s i s a s a ra n d a l a m p e n e litia n in i a d a la h s e lu r u h p e r u s a h a a n y a n g te r d a f ta r d i

B u r s a E fe k J a k a rt a (B E J ) s am p ai d e n g a n ta h u n 2 0 0 2 . D a ta d a ri p o p u la s i y a n g d ib u tu h k a n

a d a la h d a ta p a d a p e r io d e ta h u n 2 0 0 0 s a m p a i d e n g a n 2 0 0 2 . A d a p u n d a s a r p e r tim b a n g a n

p e m ilih a n p e rio d e tig a ta h u n te rse b u t a d a lah k a re n a k o n d isi p e re k o n o m ia n In d o n e s ia b e ra d a

d a la m k o n d isi n o rm a l d a n m e n g a la m i p e rtu m b u h a n y a n g r e la tif stab il.

P e n e n tu a n ju m la h s a m p e l y a n g a k a n d ig u n a k a n d a la m p e n e litia n in i m e n g a c u k e p a d a

p e n e n t u a n u k u r a n s a m p e l d e n g a n p e n e n tu a n s a m p e l s e c a r a a c a k (ra n d o m sa m p lin g ). P e n g a m b ila n random sa m p le4 d ila k u k a n s e c a ra a c a k d a ri p o p u la s i y a n g te la h d ite n tu k a n s e b e lu m n y a .D a r i p o p u la s i s e b a n y a k s e k ita r 3 0 0 p e r u s a h a a n p e n u l i s m e n g a m b il 6 0

p e r u s a h a a n s e c a ra a c a k .K a re n a p e r io d e p e n g a m a ta n d a la m p e n e litia n in i a d a la h s e la m a 3

tah u n , m a k a a k a n d ih a s ilk a n 1 8 0 u n it p e n g a m a ta n 5.

S a la h s a tu a s u m s i y a n g m e n d a s a r i p e m ilih a n s a m p e l s e r t a p e n g u j i a n y a n g a k a n

d ila k u k a n a d a la h b a h w a d a la m r e n ta n g w a k tu d u a m in g g u s e b e lu m d a n s e te la h c u t o f f d a te 6 p e r u s a h a a n t id a k m e la k u k a n c o rp o ra te a ctio n s e p e rt i r ig h t issue, m e rg e r a t a u a k u isisi d a n a k tiv itas la in n y a y a n g se c a ra sig n ifik a n m e m p e n g a ru h i p e rg e ra k a n h a rg a s a h a m

p e ru s a h a a n . P e r u s a h a a n s a m p e l y a n g m e la k u k a n h a l te r s e b u t d a la m r e n ta n g w a k tu y a n g

te la h d ite n tu k a n a k a n d ik e lu a rk a n d a ri sa m p e l.

4 M e n u r u t A g u n g (19 9 2 :15 ) , p e n g e r t ia n s a m p e l r a n d o m a d a l a h h i m p u n a n u n i t / e l e m e n o b s e r v a s i y a n g d i p i l i h s e d e m ik ia n r u p a s e h i n g g a u n i t / e l e m e n d a la m p o p u l a s i m e m p u n y a i p e l u a n g y a n g s a m a u n t u k t e r p ilih

5 J u m la h 1 8 0 u n i t p e n g a m a t a n a t a u u n it s a m p e l ( b e r u p ap e r u s a h a a n - t a h u r i ) t e r s e b u t b u k a n m e r u p a k a n

j u m la h a k h ir s a m p e l p e n e l i t ia n k a r e n a m a s ih h a r u s d i s e l e k s i m e la l u i s e r a n g k a ia n s e l e k s i b e r d a s a r k a n n il a i D C S O R E .

6 C u t o f f d a t e in i b e r a r t i t a n g g a l p e n e r im a a n a n n u a l r e p o r t m a s i n g - m a s i n g p e r u s a h a a n k e B a p e p a m

a t a u m e n g a c u k e p a d a t a n g g a l p e n g u n g k a p a n d a la m p e n e l i t i a n in i ( t = 0 d a la m p e r h it u n g a n s t a t is t ik ) .

D a l a m b a n y a k p e n e li t ia n e v e n t s t u d i e s d ig u n a k a n i s t i la h "e v e n t d a t e ” y a n g m e m i l i k i p e n g e r t ia n y a n g

8 J u r n a l A k u n t a n s i d a n K e u a n g a n I n d o n e s i a , J u l i - D e s e m b e r 2 0 0 5 , Vol. 2 , N o . 2

d ije la s k a n s e b e lu m n y a , p e n g a m b ila n s a m p e l in i d ila k u k a n d e n g a n m e m p e r tim b a n g k a n

b e b e r a p a h a l, a n ta ra lain :

■ K e te rs e d ia a n d a ta -d a ta p e n u n ja n g se p e rti 1 a p o ran ta h u n a n , d a ta -d a ta h a rg a s a h a m d a n

v o lu m e p e rd a g a n g a n , d a ta la p o ra n k e u a n g a n d a n la in se b a g a in y a .

■ W a k tu te r c a ta tn y a p e r u s a h a a n te r s e b u t d i b u r s a . P e r u s a h a a n y a n g te r c a ta t d i b u r s a

s e te la h ta h u n 2 0 0 1 d ik e lu a rk a n d a ri s a m p e l.

■ P e r tim b a n g a n corporate action. P e r u s a h a a n y a n g m e la k u k a n corporate action d a la m

k u r u n w a k tu d u a m in g g u s e b e lu m d a n s e s u d a h cut o f f date d ik e lu a rk a n d a ri s a m p e l.

D a ri h a s il p e n g a m b ila n s a m p e l s e b a n y a k 6 0 p e ru s a h a a n d ip e ro le h 1 8 0perusa haa n-tahun k a r e n a u n it p e n e litia n in i a d a la hperusahaan -tahun. D a r i 1 8 0 u n it s a m p e l te rs e b u t s e la n ju tn y a d i la k u k a n p r o s e s p e n y a r in g a n b e r d a s a r k a n n ila i D S C O R E m a s in g - m a s in g s a m p e l. U n it s a m p e l y a n g te r g o lo n g k e d a la m g rey a rea7d a la m p r o s e s r a n k in g a k a n d ik e lu a rk a n d a ri s a m p e l. D a r i h a s il p e n g e lo m p o k a n (pooling) s e lu ru h p e ru s a h a a n sa m p e l b e r d a s a r k a n n ila i D SC O RE , s e b a n y a k 71 p e ru s a h a a n m a s u k k e d a la m grey area. D e n g a n d e m ik ia n , ju m la h sa m p e l a k h ir p e n e litia n in i b e iju m la h 109 u n it sa m p e l a tau perusahaan-ta h u n d e n g a n r in c ia n 51 p e r u s a h a a n te r g o lo n g k e d a la m p e r u s a h a a n y a n g m e la k u k a n p e n g u n g k a p a n k o m p r e h e n s if (C D C ) d a n 5 8 p e ru s a h a a n te r g o lo n g k e d a la m p e ru s a h a a n

y a n g tid a k m e la k u k a n p e n g u n g k a p a n k o m p re h e n s if (N D C ).

B . T I N G K A T P E N G U N G K A P A N I N F O R M A S I (D IS C L O S U R E L E V E L )

»>■

T in g k a t p e n g u n g k a p a n in fo rm a s i (disclosure level) m e ru p a k a n tin g k a t k e le n g k a p a n d a n k o m p re h e n s i f ita s p e n y a ji a n in fo rm a s i p e r u s a h a a n m e la lu i a n n u a l rep ort y a n g j u g a m e n g g a m b a rk a n tin g k a t k e s e su a ia n (conformity) p e n y a m p a ia n in fo rm asi d e n g a n k e ten tu a n y a n g b e rla k u . T in g k a t p e n g u n g k a p a n in i te la h d ig u n a k a n d a la m b a n y a k p e n e litia n se p e rti

B o t o s a n (1 9 9 7 ) , D e m s e ts (1 9 6 8 ), C o p e la n d d a n G a la t (1 9 8 3 ), A m ih u d d a n M e n d e ls o n

( 1 9 8 6 ) d a n D ia m o n d d a n V e rre c h ia (1 9 9 1 ). B a ik tin g k a t p e n g u n g k a p a n a ta u p u n k u a lita s p e n g u n g k a p a n m e m e r lu k a n p ro s e s k u a n tifik a s i u n tu k m e m u d a h k a n p e rh itu n g a n d a la m

p e n e litia n . B o to s a n (1 9 9 7 ) m e n g g u n a k a n D SC O R E seb ag ai v a ria b e l y a n g m e n g g a m b a rk a n p e r h itu n g a n disclosure in d ex u n tu k tia p p e ru s a h a a n b e rd a sa rk a n s e ra n g k a ia n ra n g k u m a n d a ri b e b e r a p a k a te g o ri u ta m a d a la m an nua l report y an g d ib e rik a n s k o r te rte n tu te rg a n tu n g d a ri k e b e r a d a a n d a n s e b e r a p a k o m p r e h e n s if in fo rm a s i y a n g d is a m p a ik a n d a la m m a s in g

m a s i n g k a teg o ri. D a la m p e n e litian ini p e n u lis m e n g a c u k e p a d a p e n e n tu a n d a n p e rh itu n g a n

disclosure index y a n g d ig u n a k a n o le h B o to s a n (1 9 9 7 ) te n tu n y a d e n g a n m o d ifik a s i terte n tu a g a r s e su a i d e n g a n k o n d is i p e r u s a h a a n -p e ru s a h a a n d i In d o n e sia .

7 g r e y a r e a a d a la h p e r u s a h a a n y a n g m e m il ik i n il a i D S C O R E y a n g b e r a d a p a d a p e r b a ta s a n a n ta ra

D am pak Tingkat Pengungkapan Inform asi P erusahaan Terhadap Volume P erdagangan dan Return Saham 9

C . P R O S E S P O O L I N G S A M P E L P E N E L I T I A N

P ro se s p e n g e lo m p o k a n p e ru sa h a a n k e d a la m k e tig a k e lo m p o k p e ru sa h a a n d ila k u k a n

d e n g a n m e lih a t n ila i r a ta - r a ta d a n s im p a n g a n b a k u n ila i D S C O R E . D a ri p r o s e s te rs e b u t d a p a t d is im p u lk a n p ro se s p e n g e lo m p o k a n p e ru sa h a a n -p e ru sa h a a n s a m p e l s e b a g a i b e rik u t:

■ U n it sa m p e l d e n g a n n ila i D SC O R E leb ih b e s a r d ari 5 6 (lim a p u lu h e n a m ) d ik e lo m p o k k a n k e d a la m p e ru s a h a a n y a n g m e la k u k a n p e n g u n g k a p a n s e c a ra k o m p re h e n s if

■ U n it sa m p e l d e n g a n n ila i D S C O R E k u ra n g d a ri 3 6 (tig a p u lu h e n a m ) d ik e lo m p o k k a n k e d a la m p e ru s a h a a n y a n g tid a k m e la k u k a n p e n g u n g k a p a n s e c a ra k o m p re h e n s if

■ U n it s a m p e l d e n g a n n ila i D S C O R E a n tara 3 6 (tig a p u lu h e n a m ) d a n 5 6 (lim a p u lu h e n a m ) d ik e lo m p o k k a n k e d a la m g rey area d a n d ik e lu a r k a n d a ri s a m p e l p e n e litia n .

A d a p u n d istrib u si p e n g u n g k a p a n p e ru sah aan -p eru sah aan sa m p e l se la m a k u ru n w a k tu

p e n g a m a ta n p e r ta h u n a d a la h seb ag ai b e rik u t:

T a b e l 1 D i s t r i b u s i P e n g u n g k a p a n P e r u s a h a a n S a m p e l

C o m p a n y

G r o u p

T a h u n

T o t a l

2 0 0 0 2 0 0 1 2 0 0 2

C D C 1 4 ( 2 7 , 4 5 % ) 1 7 ( 3 3 , 3 3 % ) 2 0 ( 3 9 , 2 2 % ) 5 1 ( 4 6 , 7 9 % )

N D C 2 7 ( 4 6 , 5 5 % ) 1 8 ( 3 1 , 0 3 % ) 1 3 ( 2 2 , 4 1 % ) 5 8 ( 5 3 , 2 1 % )

T o t a l 4 1 ( 3 7 , 6 1 % ) 3 5 ( 3 2 , 1 1 % ) 3 3 ( 3 0 , 2 8 % ) 1 0 9 ( 1 0 0 % )

B e r d a s a rk a n ta b e l d i a ta s te r lih a t a d a n y a tre n p e n in g k a ta n j u m l a h e m ite n d a la m

s a m p d p e n e litia n y a n g m e la p o rk a n p e n g u n g k a p a n k o m p re h e n s if d a la m la p o ra n ta h u n a n d i

s a tu s is i d a n a d a n y a tre n p e n u ru n a n ju m l a h e m ite n d a la m s a m p e l p e n e litia n y a n g tid a k

m e lap o rk a n p en g u n g k a p a n secara k o m p re h e n sif d a la m lap o ran ta h u n a n d i sisi la in n y a se la m a

ta h u n - ta h u n p e n g a m a ta n . J ik a d a la m ta h u n 2 0 0 0 , p e r s e n ta s e com preh en sive d isclosure m a s ih j a u h le b ih r e n d a h d a ri non-com prehensive disclosure, m a k a te r lih a t d i ta h u n 2 0 0 3 k e a d a a n te rse b u t b e rb a lik d i m a n a comprehensive disclosure m e m ilik i p e rse n ta s e m e le b ih i non-co m preh en sive disclosure. N a m u n d e m ik ia n , s e c a ra a g re g a t p e rs e n ta s e p e ru s a h a a n y a n g m e la p o rk a n p e n g u n g k a p a n k o m p re h e n s if d a la m la p o ra n ta h u n a n n y a s e b e s a r 4 6 ,7 9 %

m a s i h l e b ih r e n d a h d i b a n d in g k a n p e r s e n ta s e p e r u s a h a a n y a n g t id a k m e l a p o r k a n

p e n g u n g k a p a n s e c a ra k o m p re h e n s if d a la m la p o ra n ta h u n a n n y a (s e b e s a r 5 3 ,2 1 % ).

D . M E T O D E A N A L I S I S

D . l . A n a l i s i s T in g k a t P e n g u n g k a p a n

T ah ap aw al d i d a la m analisis y a n g dilak u k an adalah d en g an terleb ih d a h u lu m e n e n tu k a n

d u a k o m p o n e n p e n tin g d i d a la m p e n g u k u r a n tin g k a t p e n g u n g k a p a n p e r u s a h a a n , y a itu

10 J u r n a l A k u n t a n s i d a n K e u a n g a n I n d o n e s i a , J u l i - D e s e m b e r 2 0 0 5 , V ol. 2 , N o . 2

te rse b u t a k a n d ib e rik a n s e c a ra rin c i p a d a p e m b a h a s a n m a s in g - m a s in g k o m p o n e n te rs e b u t

d i b a w a h ini. A n alisis tin g k at p e n g u n g k a p a n terseb u t d ila k u k a n d e n g a n m e n g a n a lisis lap o ra n

ta h u n a n (a n n u a l report) m a s in g - m a s in g p e r u s a h a a n s a m p e l u n tu k p e r io d e ta h u n 2 0 0 0 h in g g a 2 0 0 2 .

P e n g g u n a a n annu al report s e b a g a i p ro x y u n tu k tin g k a t p e n g u n g k a p a n d id a s a r k a n atas p e rtim b a n g a n b a h w a annual report te la h d ig u n a k a n d a la m b a n y a k p e n e litia n -p e n e litia n s e b e lu m n y a s e p e r ti B o to s a n (1 9 9 7 ) d a n S e n g u p ta ( 1 9 9 8 ) a ta u p u n S a r i ( 2 0 0 2 ) d a n

K o m a la s a r i (2 0 0 0 ) . M e n u r u t L a n g d a n L u n d h o lm ( 1 9 9 3 ) d a la m B o to s a n ( 1 9 9 7 ),

p e n g u n g k a p a n d a la m a n n u a l re p o rt b e r h u b u n g a n s e c a r a p o s i t i f d e n g a n j u m l a h p e n g u n g k a p a n y a n g d ila k u k a n p e r u s a h a a n m e la lu i m e d i a la in . S e la in itu a n n u a l rep ort j u g a s e c a ra u m u m d ia n g g a p s e b a g a i s a la h s a tu s u m b e r y a n g p e n t i n g d a la m in f o r m a s i

p e ru s a h a a n d a n d i In d o n e sia k h u su sn y a , an n u a l report s e rin g k a li d ija d ik a n s e b a g a i a c u a n b a i k u n tu k tu ju a n p r a k tis d a la m b e r in v e s ta s i m a u p u n u n tu k tu ju a n p e n e litia n d a n

p e n g u n g k a p a n lain n y a s e rin g k a li m e n g a c u k e p a d a ann u a l report itu s e n d ir .

D . 2 . P e n e n t u a n D i s c l o s u r e I t e m s

D isclosure items m e ru p a k a n se k u m p u la n k o m p o n e n a ta u b a g ia n d a ri p e n g u n g k a p a n p e r u s a h a a n b a ik p e n g u n g k a p a n w a j ib (m and ato ry disclosures) m a u p u n p e n g u n g k a p a n s u k a r e la (volun ta ry disclosures) y a n g a k a n d ija d ik a n a c u a n d a la m m e n e n tu k a n tin g k a t k o m p re h e n sifita s p e n g u n g k a p a n p e ru sa h a a n sa m p e l.P e n g g u n a a n b a ik p e n g u n g k a p a n w a jib

a ta u s u k a re la 'd id a s a rk a n a ta s d u a a la s a n , y aitu :

■ P e n g g u n a a n p en g u n g k a p a n w a jib seb ag ai saia h s a tu k o m p o n e n d a la m disclosure index d ila k u k a n u n tu k m e lih a t se ja u h m a n a tin g k a t k e p a tu h a n p e ru s a h a a n -p e ru s a h a a n y a n g

te rc a ta t d i B E J d a n k e s e su a ia n in fo rm a s i y a n g d is a jik a n p e r u s a h a a n te r s e b u t te rh a d a p

p e r a t u r a n y a n g b e r la k u . H a l in i d id a s a rk a n a ta s p e r tim b a n g a n b a h w a p a s a r m o d a l

In d o n e s ia m a s ih b e r a d a p a d a t a r a f b e r k e m b a n g s e h in g g a k e s e s u a ia n d a n k e p a tu h a n

p a ra e m ite n se rin g k a li lu p u t d ari p e n g a m a ta n p a ra in v e s to r u m u m n y a .

■ P e n g g u n a a n p en g u n g k a p a n su k arela m e n g a c u k e p a d a p e n e litia n y a n g d ila k u k a n B o to san

( 1 9 9 7 ) d a n d a la m p e n e litia n in i d ila k u k a n d e n g a n p e r t im b a n g a n b a h w a d a ri

p e n g u n g k a p a n s u k a re la y a n g d ila k u k a n p e ru s a h a a n d a p a t d ilih a t tin g k a t k e in g in a n d a n

k reatifitas p eru sa h a a n d a lam u p a y a n y a u n tu k m e m b e rik a n in fo rm a si y a n g m e m b e ri n ilai

ta m b a h d i lu a r p e n g u n g k a p a n y a n g te la h d is y a ra tk a n o le h P e ra tu ra n B a p e p a m .

S in g k a tn y a , p e n g u n g k a p a n s u k a r e la m e m a n g le b ih t e p a t u n tu k m e n ila i t in g k a t

p e n g u n g k a p a n p e r u s a h a a n . N a m u n d e n g a n m e lih a t k o n d is i p a s a r m o d a l d i In d o n e s ia

s e b a g a im a n a d ije la s k a n d i a ta s , p e n u lis m e m u tu s k a n u n tu k m e n g g u n a k a n k e d u a j e n i s

D am pak Tm gkal P engungkapan Inform asi P erusahaan Terhadap Volume Perdagangan dan Return Saham 11

D .3 . P e r h itu n g a n D is c lo s u r e I n d e x

P e r h itu n g a n disclo su re in d ex d ila k u k a n d e n g a n m e m b a n d in g k a n k e s e s u a ia n is i a n n u a l report d e n g a n disclosure items. H a s il p e rh itu n g a n te rs e b u t a k a n b e ru p a disclosure sco res (D SC O R E ) y a n g a k a n d ila k u k a n m e la lu i b e b e r a p a ta h a p y a n g h a r u s d ila lu i d a la m m e n e n tu k a n p e n g e lo m p o k a n p eru sa h a a n -p e ru sa h a a n y a n g te rp ilih se b a g a i sa m p e l terseb u t.

T a h a p -ta h a p d a la m p e r h itu n g a n disclosure index a d a la h s e b a g a i b e rik u t:

a . P ro se s I n d e x in g

P r o s e s in d e x in g a d a la h p r o s e s p e n e n tu a n s k o r a ta u p e n ila ia n m a s in g - m a s in g p e r u s a h a a n s a m p e l d e n g a n m e n g g u n a k a n d isclo su re sco re (D SC O R E ) y a n g d ih itu n g b e rd a sa rk a n p e rb a n d in g a n a n ta ra annu al report p e ru sa h a a n sa m p e l d e n g a n k riteria -k riteria k a te g o ri u t a m a a n n u a l rep ort y a n g te la h d ite ta p k a n s e b e lu m n y a d a la m disclosure items.

D isclo su re item s te r s e b u t d ib u a t d e n g a n m e n g a c u k e p a d a p e r a tu r a n B a p e p a m m e n g e n a i p e n g u n g k a p a n in fo rm a s i p e ru sa h a a n j a n g h a ru s d isa jik a n a ta u p u n y a n g b e rsifa t

s u k a r e la d a ri p e ru s a h a a n - p e r u s a h a a n y a n g te r c a ta t d i B E J b e r d a s a r k a n la p o ra n ta h u n a n

(a n n u a l report) p e r u s a h a a n - p e r u s a h a a n te r s e b u t p a d a ta h u n 2 0 0 0 s a m p a i d e n g a n 2 0 0 2 . A d a p u n la n g k a h - la n g k a h d a la m p r o s e s ind exing te rs e b u t a d a la h s e b a g a i b e rik u t:

a. S e tia p a n n u a l rep ort p e ru s a h a a n s a m p e l a k a n d in ila i tin g k a t k e l e n g k a p a n d a n k e s e s u a ia n n y a d e n g a n k rite ria -k rite ria u n tu k tia p -tia p k a te g o ri d i d a la m p e rh itu n g a n

disclosure in dex d e n g a n m e n g g u n a k a n s k o r terte n tu .

b . N ila i indexing d a ri s e tia p k a te g o r i a k a n d itim b a n g d e n g a n b o b o t y a n g s a m a u n tu k m a s in g -m a s in g k a te g o ri d a n k e m u d ia n a k a n d iju m la h k a n d a n d ira ta -ra tak a n

u n tu k tia p -tia p p e ru s a h a a n s a m p e l. D a ri p ro s e s in i a k a n d id a p a t n ila i D S C O R E d a ri m a sin g -m a sin g p e ru s a h a a n sam p e l.

c. N ila i a k h ir in d exin g a ta u D S C O R E s e lu ru h p e ru s a h a a n s a m p e l d a ri p o in t a d i a ta s se la n ju tn y a a k a n d ik u m p u lk a n u n tu k m e n e n tu k a n ranking m a s in g -m a s in g p e ru s a h a a n sam p e l.

b. P r o s e s R a n k in g

P ro s e s ra n k in g in i m e r u p a k a n k e la n ju ta n d a ri p r o s e s indexing d i m a n a p e r u s a h a a n a k a n d iu ru tk a n b e r d a s a rk a n n ila i D S C O R E m e r e k a b e rd a sa rk a n u r u ta n te rb e s a r k e u ru ta n

te rk e c il (descending).

c. P ro se s P o o lin g

D a ri h a s il ra n kin g a ta u p e n e n tu a n u r u ta n p e ru s a h a a n b e r d a s a r k a n n ila i in d exin g -n y a s e la -n ju t-n y a a k a -n d ite -n tu k a -n p e -n g e lo m p o k a -n (pooling) p e r u s a h a a n k e d a la m k e tig a k e lo m p o k p e ru s a h a a n y a n g d ila k u k a n d e n g a n m e n g ik u ti la n g k a h -la n g k a h b e rik u t in i:

a. D a ri d a ta h a s il p e rh itu n g a n D S C O R E p e ru s a h a a n s a m p e l, d ila k u k a n p e rh itu n g a n ra ta -

12 J u r n a l A k u n t a n s i d a n K e u a n g a n I n d o n e s i a , J u l i - D e s e m b e r 2 0 0 5 , V ol. 2 , N o . 2

b . B e rd a s a rk a n ra ta -ra ta d a n s im p a n g a n b a k u terse b u t, s e la n ju tn y a d ite n tu k a n b a ta s -b a ta s

u n tu k k e t ig a k e lo m p o k p e ru sa h a a n .

c . L a n g k a h te ra k h ir a d a la h p e n e n tu a n k e lo m p o k m a s in g -m a s in g p e r u s a h a a n s a m p e l k e

d a la m d u a k e lo m p o k p e ru s a h a a n k a re n a p e ru s a h a a n s a m p e l y a n g m a s u k k e d a la m grey area a k a n s e c a r a o to m a tis d ik e lu a r k a n d a ri sa m p e l.

D e n g a n d e m ik ia n d ari h a sil po o lin g te rse b u t a k a n d ih a silk a n 3 (tig a) k e lo m p o k p e ru sa h a a n , yaitu:

(1 ) P e ru s a h a a n y a n g s e c a ra k o m p re h e n s if m e n g u n g k a p k a n in fo rm a s i k e u a n g a n n y a a ta u

co m p reh en siv e d isc lo su re co m p a n y (C D C )

(2 ) P e ru sa h a a n y a n g s e c a ra tidak k o m p re h e n s if m e n g u n g k a p k a n in fo rm a s i k e u a n g a n n y a a t a u n o n -co m p reh en sive d isclo su re co m p a n y (N D C )

( 3 ) P e r u s a h a a n y a n g b e r a d a p a d a g rey area. P e r u s a h a a n y a n g b e r a d a p a d a k e lo m p o k g rey area in i se la n ju tn y a a k a n d ik e lu a rk a n d a ri s a m p e l d e n g a n p e r tim b a n g a n b a h w a p e rb a n d in g a n a k a n leb ih m e y a k in k a n m e n g in g a t p e rb a n d in g a n n ila i D S C O R E a n ta ra k e d u a k e lo m p o k p e ru s a h a a n a k a n m e n ja d i le b ih je la s d a n m e y a k in k a n .

D e n g a n d em ik ian , d a ri h a sil pooling in i n a n tin y a h a n y a a k a n d ih a silk a n d u a k e lo m p o k p e r u s a h a a n , y a itu com preh en sive d isclo sure co m p a n y (C D C ) d a n n o n -co m p reh en sive d isc lo su re co m p a n y (N D C ).S k e m a p e n ila ia n d a la m p r o s e s r a n k in g d a p a t d i lih a t p a d a g a m b a r 1.

(g a m b a r 1: S k e m a P e n g e l o m p o k a n P e r u s a h a a n S a m p e l

High

X + 0,5

X - 0,5

Com prehensive-Disclosurer

Company

N o n - Com prehenslve-

Disclosurer Company

Low

D S C O R E

Grey area Companies

D am pak Tingkat P engungkapan Inform asi P erusahaan Terhadap Volume Perdagangan dan R eturn Saham 13

D .4 . P e n e n t u a n R a n g e u n t u k G r e y A r e a

D a la m m e n e n tu k a n b a ta s u n tu k grey area p e rta m a -ta m a d ila k u k a n p e rh itu n g a n rata-rata D S C O R E d a ri k e s e lu ru h a n p e r u s a h a a n sa m p e l. S e la n ju tn y a d ip e rh itu n g k a n j u g a n ilai s ta n d a r d e v ia s i u n tu k D S C O R E te r s e b u t, d im a n a p e n e n tu a n b a ta s a ta s d a n b a ta s b a w a h

u n tu k grey area d ite n tu k a n d e n g a n : ■ B a ta s a ta s : X + 0 ,5o

■ B a ta s b a w a h : X - 0,5*7

D im ana: x = r a t a - r a t a D S C O R E , d a n a = s ta n d a r d e v ia s i D S C O R E

D . 5 . P e n g u k u r a n P e r u b a h a n L i k u i d i t a s S a h a m

S e c a ra u m u m lik u id ita s s a h a m dii ik u r d e n g a n Trading Volume A ctivity (T V A ). T V A m e n g g a m b a rk a n p o rsi s a h a m y a n g d ip e rd a g a n g k a n te rh a d a p to ta l ju m la h s a h a m p e ru sa h a a n

y a n g b e r e d a r p a d a s u a tu w a k tu te rte n tu . T V A d ih itu n g d e n g a n m e n g g u n a k a n r u m u s y a n g

d ip e r k e n a lk a n o le h F o s t e r (1 9 8 6 :3 7 5 ) s e b a g a i b e rik u t:

N u m b e r o f s h a re s o f f i r m i tra d e d in tim e,

TVA' i =

N u m b e r o f sh a re s o f fir m , o u ts ta n d in g in tim et

S etelah T V A setiap p e ru sa h a a n sa m p e l d iketahui, selan ju tn y a d ih itu n g rata-rata v o lu m e

p e rd a g a n g a n u n tu k s e lu ru h p e ru sa h a a n sa m p e l se la m a event w indow d e n g a n m e n g g u n a k a n r u m u s d i b a w a h ini:

X T V A it =

---n

P e r u b a h a n lik u id ita s s a h a m y a n g a k a n d ig u n a k a n d a la m p e n e litia n in i a d a la h r a ta - r a ta

lik u id ita s h a r g a s a h a m p e ru s a h a a n s e la m a p e r io d e p e n g a m a ta n .

D .6 . P e r h i t u n g a n A b n o r m a l R e t u r n

P e r h itu n g a n a b n o rm a l return d e n g a n m e to d e even t stu d y a k a n d i la k u k a n d e n g a n m e n g g u n a k a n m arket adjusted model. M o d e l in i m e n g a n g g a p b a h w a p e n d u g a y a n g te rb a ik u n tu k m e n g e s tim a s i return s u a tu s e k u rita s a d a la h return p a s a r p a d a sa a t p e ris tiw a . A la s a n p e n g g u n a a n m a rk e t a d ju s te d m o d e l d ik a r e n a k a n p a s a r m o d a l d i In d o n e s ia s e p e rti d ik e ta h u i m e m ilik i n ila i d a n v o lu m e tr a n s a k s i p e r d a g a n g a n y a n g r e l a t i f s e d ik it, h a l in i

m e r u p a k a n s a la h s a tu c iri d a la m p a s a r m o d a l y a n g s e d a n g b e rk e m b a n g . H a r g a s a h a m d i

14 J u r n a l A k u n t a n s i d a n K e u a n g a n I n d o n e s i a , J u l i - D e s e m b e r 2 0 0 5 , Vol. 2 , N o . 2

m e n g g u n a k a n m a rket a d ju ste d m o d e l t id a k a k a n d i te m u i k e s u li t a n d i k a r e n a k a n p e rd a g a n g a n d i se k itar h a ri p e n g u m u m a n c e n d e ru n g le b ih b a n y a k . M a rket adjusted m od el d ig u n a k a n k a re n a selain a la sa n d i atas ju g a m e m ilik i efek tifitas y a n g tid a k k a la h d ari m o d e l-

m o d e l la in n y a (B ro w n 1980).

A b n o r m a l return {A R .) d ip e r o le h m e la lu i d u a ta h a p . T a h a p p e r ta m a m e r u p a k a n s e lis ih d a ri return a k tu a l a ta u return s e s u n g g u h n y a (R .) y a n g k e m u d ia n d ik u ra n g i d e n g a n retu rn m a rket (R m ) y a n g d ip e r o le h d a ri ta h a p k e d u a .

m a u p u n u n tu k m a sin g -m a sin g k e lo m p o k p e ru s a h a a n m e la in k a n d e n g a n m e n g u ji ra ta -ra ta

a b n o r m a l return s e c a r a cross sectio n u n tu k tia p -t ia p h a r i p a d a p e r io d e p e n g a m a ta n . P e n g u jia n cross se c tio n d ila k u k a n le b ih k e p a d a u n tu k m e lih a t k e b e ra d a a n a b n o rm a l re tu rn p a d a p e r io d e p e n g a m a ta n (even t w indo w ). R a ta - r a ta a b n o rm a l return u n tu k h a r i k e - / d a p a t d ih itu n g d e n g a n ru m u s:

A bnorm a l return y a n g a k a n d ig u n a k a n d a lam p e n e litia n in i a d a la h ra ta-rata abnorm al re tu rn s a h a m p e ru s a h a a n -p e ru s a h a a n s e la m a p e rio d e p e n g a m a ta n . P e n g u k u ra n te rs e b u t d ila k u k a n m e la lu i b e b e ra p a ta h a p , yaitu:

( I H S I „ )

D i m a n a :

A R = A b n o r m a l r e t u r n u n t u k s e k u r i t a s k e - i p a d a h a r i k e - / R m : = R e t u r n m a r k e t p a d a h a r i k e - /

R . t = R e t u r n u n t u k s e k u r i t a s k e - i p a d a h a r i k e - /

I H S G = I n d e k s H a r g a S a h a m G a b u n g a n

I H S I = I n d e k s H a r g a S a h a m I n d i v i d u / P e r u s a h a a n s a m p e l

D . 7. P e r h itu n g a n R a ta -R a ta A b n o r m a l R e tu r n

P e n g u jia n a d an y a abnorm al return tid a k d ila k u k a n u n tu k m a sin g -m a sin g p e ru sa h a a n

k

R R A R , = ^ — k

D i m a n a :

R R A R , = R a t a - r a t a A b n o r m a l r e t u r n p a d a h a r i k e - t

A R . ( = A b n o r m a l r e t u r n u n t u k s e k u r i t a s k e - i p a d a h a r i k e - t

k = J u m l a h s e k u r i t a s y a n g t e r p e n g a r u h o l e h p e n g u m u m a n p e r i s t i w a

D am pak Tingkat Pengungkapan Inform asi Perusahaan Terhadap Volume P erdagangan dan R eturn Saham 15

a. M e n g h itu n g a b n o rm a l return u n tu k tia p p e ru s a h a a n s a m p e l b e r d a s a rk a n d a ta -d a ta retu rn s a h a m s e la m a tig a h a r i s e b e lu m d a n s e s u d a h cu t o f f date.

b . M e n g h itu n g ra ta -ra ta ab n o rm a l return u n tu k tia p -tia p h a r i p a d a p e r io d e p e n g a m a ta n b a ik u n tu k s e lu ru h p e ru s a h a a n m a u p u n m e n u ru t k e lo m p o k p e ru sa h a a n . P e rh itu n g a n

u n tu k m a sin g -m a sin g k e lo m p o k p e ru sa h a a n (b a ik C D C m a u p u n N D C ) p a d a b a g ia n ini

d ila k u k a n h a n y a u n tu k d a ta a b n o rm a l return s a h a m s e te la h cu t o f f date.

c. M e m b a n d in g k a n r a ta - r a ta a b n o rm a l return s e b e lu m d a n s e s u d a h c u t o f f date u n tu k m a s in g -m a s in g p e ru s a h a a n s a m p e l s e rta u n tu k k e d u a k e lo m p o k p e ru s a h a a n y a n g te la h

d ite n tu k a n s e b e lu m n y a u n tu k m e lih a t a p a k a h te rd a p a t p e rb e d a a n y a n g sig n ifik a n se c a ra

s ta tis tik d i a n ta ra m a s in g - m a s in g p e ru s a h a a n s a m p e l s e b e lu m d a n s e s u d a h cu t o f f date d a n k e d u a k e lo m p o k p e ru s a h a a n te rs e b u t s e te la h cu t o f f date. P e rb e d a a n p e rh itu n g a n ra ta -r a ta ab n o rm a l return u n tu k tia p p e ru s a h a a n s a m p e l y a n g d ila k u k a n s e b e lu m d a n s e s u d a h cu t o f f date d a la m p o in t a d a n b d i a ta s d im a k s u d k a n u n tu k m e lih a t te rle b ih d a h u lu a p a k a h m e m a n g te rd a p a t p e n g a r u h tin g k a t p e n g u n g k a p a n te rh a d a p a bno rm al return d e n g a n m e lih a t p e r b a n d in g a n ra ta -ra ta a b n o rm a l return s e b e lu m d a n s e s u d a h c u t o f f date. A p a b il a te r n y a ta m e m a n g te r b u k ti b a h w a te r d a p a t p e n g a r u h tin g k a t p e n g u n g k a p a n te rh a d a p return s a h a m d ari p e n g u jia n d i a tas m a k a p e n g u jia n se la n ju tn y a a d a la h m e m b a n d in g k a n a b n o rm a l return s a h a m te r s e b u t s e te la h cu t o f f date u n tu k k e d u a k e lo m p o k p e ru sa h a a n . P e n g u jia n d ila k u k a n h a n y a u n tu k p e r io d e s e te la h cu t o f f date d ila k u k a n d e n g a n a la s a n b a h w a p e n g u jia n in i h a n y a u n tu k m e lih a t p e n g a ru h p e n g u n g k a p a n p e ru s a h a a n te rh a d a p return s a h a m setelah p e n g u n g k a p a n te rs e b u t d ite p o rk a n a ta u d ip u b lik a s ik a n u n tu k k e d u a je n is p e n g u n g k a p a n y a n g d ila k u k a n

p e ru sa h a a n , b a ik k o m p re h e n s if a ta u p u n tid a k k o m p re h e n sif. O le h k a re n a n y a p e n g u jia n

u n tu k p e rio d e p e n g a m a t a n s e b e lu m d a n s e s u d a h cu t o f f date m e n ja d i tid a k re le v a n k a re n a te la h te rb u k ti p a d a p e n g u jia n s e b e lu m n y a

d . P e n g u jia n u n tu k m e lih a t p e n g a ru h peng ung ka pan d ila k u k a n u n tu k p e rio d e tig a h a ri s e b e lu m d a n s e s u d a h cu t o f f date d e n g a n a s u m s i b a h w a p e n g a r u h p e n g u n g k a p a n a k a n te rs e b a r d a la m h a ri-h a r i d a la m p e n g a m a ta n te rs e b u t ta n p a d a p a t d ip a s tik a n k a p a n

16 J u r n a l A k u n t a n s i d a n K e u a n g a n I n d o n e s i a , J u l i - D e s e m b e r 2 0 0 5 , Vol. 2 , N o . 2

D . 8 . T e s S i g n i f i k a n s i A b n o r m a l R e t u r n

P e n g u jia n s ta tis tik te r h a d a p a b n o rm a l return m e m p u n y a i tu ju a n u n tu k m e lih a t s ig n if ik a n s i a b n o rm a l return y a n g a d a d i p e r io d e p e n g a m a ta n . S ig n if ik a n s i y a n g d im a k s u d k a n ia la h b a h w a abn orm al return te r s e b u t s e c a ra s ta tis tik s ig n ifik a n tid a k s a m a d e n g a n n o l. U n tu k m a k s u d in i d ig u n a k a n /-te s t. P e n g u jia n s ta tis tik in i d a p a t d ila k u k a n

d e n g a n b e r d a s a r k a n s ta n d a r d e v ia s i r e tu rn h a r i k e - / s e c a ra cross sectio n s e la m a p e r io d e p e ristiw a .

C a ra in i m e n g h itu n g standard error estim a si la n g su n g p a d a p e rio d e p eristiw a, a d a la h d e n g a n m e n g g u n a k a n ru m u s d i b a w a h ini:

D i m a n a : £ £ £ ' = S t a n d a r d e r r o r e s t i m a s i u n t u k h a r i k e - t p a d a e v e n t w i n d o w A R . t = A b n o r m a l R e t u r n s e k u r i t a s k e - i u n t u k h a r i k e - / p a d a e v e n t w i n d o w

A R , = R a t a - r a t a a b n o r m a l r e t u r n k - s e k u r i t a s u n t u k h a r i k e - / p a d a e v e n t w i n d o w

k = J u m l a h s e k u r i t a s

S e h in g g a /-te s t y a n g d ig u n a k a n a d a la h s e b a g a i b e r ik u t: t ~ test ~

D ik a r e n a k a n /- te s t d id a s a r k a n p a d a h ip o te s is n o l y a n g m e n y a ta k a n ra ta -r a ta a b n o rm a l return a d a la h s a m a d e n g a n n o l, j i k a t^ > t ^ , m a k a h ip o te s is n o l d ito la k d a n h ip o te s i s a lte r n a tif tid a k d ito la k y a n g b e ra rti abnorm al return tid a k s a m a d e n g a n s a tu d a n s ig n ifik a n s e c a ra statistik.

IV . P E N G U J I A N H I P O T E S I S D A N H A S I L P E N E L I T I A N E M P I R I S

A . P E N G U J I A N P E N G A R U H S E R T A P E R B E D A A N P E N G A R U H P E N G U N G K A P A N ( D I S C L O S U R E S )

P e n g u jia n p e n g a ru h s e rta p e rb e d a a n p e n g a ru h p e n g u n g k a p a n 8 d a la m p e n e litia n ini

a k a n d ila k u k a n d e n g a n m e n g g u n a k a n p e n g u jia n b e d a d u a rata-rata. D e n g a n asu m si b a h w a

ju m l a h sam pel y an g d ig u n a k a n d a lam m a sin g -m a sin g k elo m p o k ad alah u k u ra n sam p el kecil,

m a k a u ji sta tistik y a n g d ig u n a k a n a d a la h u ji /.

8 D a l a m p e n e l i t ia n in i p e n g u n g k a p a n d ib e d a k a n d e n g a n t i n g k a t p e n g u n g k a p a n d im a n a p e n g u n g k a p a n m e n g a c u k e p a d a k e b e r a d a a n p e n g u n g k a p a n ( a n n u a l r e p o r t ) s e d a n g k a n t in g k a t p e n g u n g k a p a n

m e n g a c u k e p a d a t in g k a t k o m p r e h e n s if it a s in f o r m a s i d a la m a n n u a l r e p o r t y a n g d i - p r o x y d e n g a n n ila i

r m ,

D am pak Tingkat P engungkapan Inform asi P erusahaan Terhadap Volume Perdagangan dan R eturn Saham 17

D a la m p e n e litia n in i k e d u a p e n g u jia n d i a ta s a k a n d iu ji d e n g a n h ip o te s is 1 s a m p a i

h ip o te sis 4 d e n g a n rin c ia n h ip o tesis 1 d a n 2 d ig u n ak an u n tu k m en g u ji p e n g a ru h p en g u n g k ap an

s e d a n g k a n h ip o te s is 3 d a n 4 d ig u n a k a n u n tu k m e n g u ji p e rb e d a a n p e n g a ru h p e n g u n g k a p a n

te r h a d a p k e d u a k e lo m p o k p e ru s a h a a n .

B . P E N G U J I A N P E N G A R U H T I N G K A T P E N G U N G K A P A N ( D I S C L O S U R E L E V E L )

P e n g u jia n p e n g a ru h tin g k a t p en g u n g k a p a n terh ad ap lik u id itas s a h a m d a n h a rg a sa h a m

d ila k u k a n d e n g a n m e n g g u n a k a n p e n g u jia n reg re s i s e d e rh a n a . A n a lis is re g re s i s e d e rh a n a

te r s e b u t d i g u n a k a n u n tu k m e lih a t s e b e ra p a b e s a r p e n g a r u h p e n g u n g k a p a n b a i k te rh a d a p

v a r ia b e l lik u id ita s s a h a m a ta u p u n ra ta -r a ta ab n o rm a l return s a h a m . A d a p u n m o d e l re g re s i y a n g d ig u n a k a n yaitu :

Y. = a + /

3D S C O R E . + s .

Dimana:Y . = l i k u i d i t a s s a h a m a t a u r a t a - r a t a a b n o r m a l r e t u r n s a h a m .

D S C O R E . = n i l a i D S C O R E m a s i n g - m a s i n g s a m p e l

D a la m p e n e litia n in i p e n g u jia n d i a ta s a k a n d iu ji d e n g a n hipotesis 5 d a n hipotesis 6

C . P E N G U J I A N K E C E N D E R U N G A N T I N G K A T P E N G U N G K A P A N v'

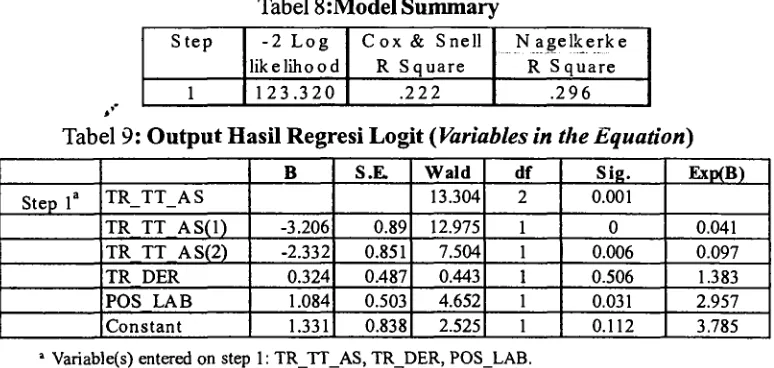

P en g u j ia n p e n g a ru h u k u ra n , stru k tu r p e m b iay a a n d a n p o sisi la b a p e ru sa h a a n terh ad ap

k e c e n d e r u n g a n t in g k a t p e n g u n g k a p a n y a n g d ila k u k a n p e r u s a h a a n d ila k u k a n d e n g a n

m e n g g u n a k a n p e n g u jia n re g re s i b e rg a n d a . A n a lisis reg resi b e rg a n d a d e n g a n m e n g g u n a k a n

m o d e l regresi lo g istik d ig u n a k a n u n tu k m e lih a t k ecen d eru n g an p e ru sa h a a n d a lam m e lak u k a n

p e n g u n g k a p a n d ilih a t d a ri u k u ra n p e ru sa h a a n , s tru k tu r p e m b ia y a a n s e rta p o s is i la b a -ru g i

p e ru sa h a a n .

A d a p u n m o d e l re g re s i y a n g d ig u n a k a n yaitu:

Y . = a + / ? / T O T _ A S T ( l ) . + p 2T O T _ A S T ( 2 ) . + / y > E R . + / 7 J P O S L A B . + s.

D i m a n a :

Y . = P e n g u n g k a p a n p e r u s a h a a n - / ( c o r p o r a t e d i s c l o s u r e ) y a n g m e r u p a k a n

v a r i a b e l d i k o t o m u s ( d i c h o t o m u s v a r i a b l e s ) d i m a n a 1 = k o m p r e h e n s i f

d a n 0 = t i d a k k o m p r e h e n s i f

T O T _ A S T w . = U k u r a n / s k a l a p e r u s a h a a n s a m p e l y a n g d i k e l o m p o k k a n m e n j a d i 3 k a t e g o r i

D E R . = D e b t t o E q u i t y r a t i o s a m p e l y a n g d i k e l o m p o k k a n m e n j a d i 2 k a t e g o r i

P O S L A B . = P o s i s i L a b a - r u g i , y a n g m e r u p a k a n v a r i a b e l d u m m y , d i m a n a

18 J u r n a l A k u n t a n s i d a n K e u a n g a n I n d o n e s i a , J u l i - D e s e m b e r 2 0 0 5 , Vol. 2 , N o . 2

K a re n a n ilai Y h a n y a m e m ilik i d u a k e m u n g k in a n , 1 a ta u 0 , y a n g m a s in g -m a s in g m e w a k ili

p e n g u n g k a p a n y a n g k o m p r e h e n s if a tau tid a k k o m p re h e n sif, m a k a p ro b a b ilita n y a a d alah :

p = P ( Y = 1 ) , a ta u

= P (“p e n g u n g k a p a n k o m p re h e n s if ’)

S e m e n ta r a p e rsa m a a n lo g istik y a n g d ig u n a k a n ad alah :

L n = a + f i xT O T _ A S T ( 1) + /32T O T_ A S T {2) + D E R + f i 4P O S _ L A B . X~ P J

D e n g a n m e n y e le s a ik a n p e r s a m a a n d ia ta s d a p a t d ip e r k ir a k a n k e m u n g k in a n s e b u a h

p e ru s a h a a n , b e rd a sa rk a n u k u ra n , s tru k tu r p e m b ia y a n s e rta p o s is i la b a y a n g d ila p o rk a n n y a

d a la m m e la k u k a n p e n g u n g k a p a n y a n g k o m p r e h e n s if y a n g a k a n d iu ji d e n g a n hipotesis 7.

D . H A S I L P E N E L I T I A N E M P I R I S

D . l . P e n g u j i a n P e n g a r u h P e n g u n g k a p a n

P en g u j i a n u n tu k m e lih a t p e n g a ru h p e n g u n g k a p a n b e rtu ju a n u n tu k m e lih a t p e n g a ru h

k e b e r a d a a n la p o ra n ta h u n a n te rh a d a p lik u id ita s m a u p u n return s a h a m . P e n g u jia n k e d u a h a l te rse b u t d ila k u k a n m e la lu i p e n g u jia n h ip o te sis 1 d a n h ip o te s is 2.

D . 1.1. P e n g u j i’a n H ip o te sis 1

H a s il a n a lis is s ta tis tik ra ta -ra ta Trading Volume A ctivity (ATVA) u n tu k k e s e lu ru h a n p e r u s a h a a n s a m p e l d a p a t d ilih a t d a la m ta b e l 2 d i b a w a h ini:

Tal ?el 2 : H a s iI a n a li s is r a t a - r a t a TV A ( d a la m % ) H a r i A T V A t - s t a t i s t i k p - v a l u e

- 3 0 , 2 8 5 3 3 , 0 8 3 0 , 0 0 3

- 2 0 , 2 3 6 1 3 , 8 9 3 0 , 0 0 0

-1 0 , 1 9 2 1 4 , 1 5 0 0 , 0 0 0

0 0 , 2 8 0 6 2 , 3 8 8 0 , 0 1 9

1 0 , 2 3 7 8 2 , 7 0 3 0 , 0 0 8

2 0 , 1 8 7 0 3 , 3 3 5 0 , 0 0 1

3 0 , 1 7 9 4 3 , 6 2 1 0 , 0 0 0

B e rd a s a rk a n n ilai p -va lu e d i a ta s te rlih a t b a h w a te rn y a ta ra ta -ra ta T V A p a d a s e lu ru h h a r i p e n g a m a ta n sig n ifik an p a d a a = 5 % . S e c a ra sp esifik u n tu k p erio d e setelah p e n g u n g k a p a n

p e ru s a h a a n (h ari 1 ,2 d a n 3 ) te rlih a t b a h w a h a s il in i m e m b u k tik a n b a h w a m e m a n g terd a p a t

p e n g a r u h p e n g u n g k a p a n p e ru s a h a a n te r h a d a p r a ta - r a ta T V A s a h a m s e lu ru h p e r u s a h a a n

s a m p e l. H asil p e n g u jia n d i atas m e n u n ju k k a n a d an y a sig n ifik an si rata-rata T V A b a ik seb elu m

D am pak Tingkat Pengungkapan Inform asi P erusahaan Terhadap Volume P erdagangan dan Return Saham 19

S e la in i tu d a r i h a s il p e n g u jia n s ig n if ik a n s i r a ta - r a ta T V A u n tu k s e b e lu m d a n s e s u d a h

p e n g u n g k a p a n te r li h a t b a h w a m e m a n g r a ta - r a ta T V A u n tu k s e b e lu m m a u p u n s e te la h

p e n g u n g k a p a n s ig n if ik a n p a d a a = 5 % d e n g a np -v a lu e m a s in g - m a s in g s e b e s a r 0 ,0 0 0 d a n

0,0 0 2.

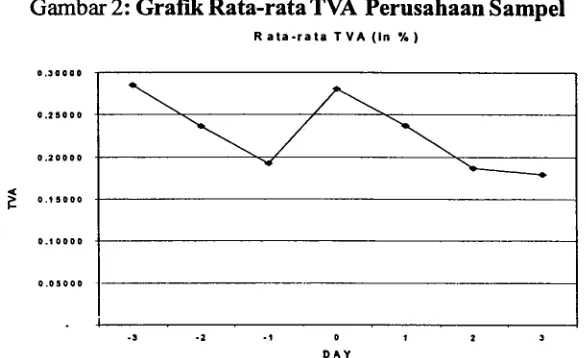

G r a fi k r a ta - r a ta a b n o rm a l return u n tu k s e lu r u h p e r u s a h a a n s a m p e l d a p a t d ilih a t d a la m g a m b a r 2.

G a m b a r 2 : G r a f i k R a t a - r a t a T V A P e r u s a h a a n S a m p e l

R a t a - r a t a T V A ( I n % )

D A Y

D a r i g r a fi k d i a ta s te r lih a t b a h w a r a ta - r a ta T V A m e n in g k a t s ig n if ik a n p a d a s a a t

p e n g iy n u m a n p e n g u n g k a p a n (h a ri k e -0 ) s a m p a i d e n g a n h a ri k e d u a s e te la h p e n g u n g k a p a n .

H a l in i m e n u n ju k k a n b a h w a p a r a in v e s to r m e m a n g m e m a n f a a tk a n in f o r m a s i y a n g

d iu n g k a p k a n p e ru sa h a a n m e lalu i la p o ra n tah u n a n n y a m e s k ip u n trend te rse b u t teru s m e n u ru n p a d a d u a h a ri s e te la h n y a . P e n g u jia n y a n g a k a n d ila k u k a n s e h u b u n g a n d e n g a n h a l d i a ta s,

m e la lu i h ip o te sis 1, a d a la h p e rb e d a a n ra ta -ra ta T V A s e b e lu m d a n s e s u d a h p e n g u n g k a p a n .

H a s il a n a lisis p e n g u jia n h ip o te sis 1 te rs e b u t d a p a t d ilih a t d a la m ta b e l 3 d i b a w a h in i:

T a b e l 3 : H a s i l P e n g u j i a n H i p o t e s i s P e r t a m a

P e r i o d e A T V A P e r b e d a a n t - s t a t i s t i c p - v a l u e K e s i m p u l a n A n a l i s i s

S e b e l u m

P e n g u n g k a p a n 0 , 2 3 7 8

0 , 0 3 6 1 , 0 7 4 0 , 2 8 5 T e r i m a H o S e t e l a h

P e n g u n g k a p a n 0 , 2 0 1 4

D a r i ta b e l d i a ta s te r lih a t b a h w a r a ta - r a ta Tra din g Volume A c tiv ity s e la m a 3 h a r i s e b e lu m p e n g u n g k a p a n m e m a n g te rlih a t le b ih tin g g i d ib a n d in g k a n s e te la h p e n g u n g k a p a n .

H a l in i te n tu s a ja tid a k m e n d u k u n g h ip o te sis p e n g u jia n y a n g m e n d u g a a d a n y a p e n in g k a ta n