THE IMPACT OF FEMALE DIRECTORS ON FIRM PERFORMANCE:

EVIDENCE FROM INDONESIA

Triana

Faculty of Economics and Business, Universitas Gadjah Mada, Indonesia (trianatan@mail.ugm.ac.id)

Marwan Asri

Faculty of Economics and Business, Universitas Gadjah Mada, Indonesia (marwan.asri@ugm.ac.id)

ABSTRACT

This research shows the impact of female directors on firm performance in Indonesia by using as its sample the public companies listed on the Indonesian Stock Exchange (IDX) from 2011 until 2015. There were 347 companies, with 1,735 samples observed. This research uses the multiple regression method. The model is a modified model from 9 recent articles published between 2012 and 2015. The empirical result shows that a female director has a positive significant effect on firm performance. The control variables, consisting of leverage, firm size and firm age have negative significance for firm performance. This research is conducted across 9 sectors of industrial classification, which support the International Finance Corporation (IFC) in increasing the number of female directors in Indonesia. For managers, this research will promote gender development in the boardroom, female executive training programmes as well as female representation on boards of directors. For regulators, this research may provide a contribution to gender representation in board’s policies, rules and regulations. This research can build awareness of women’s contributions to firms and encourage a greater female presence in the boardroom.

Keywords: female, firm performance, behavior, firm characteristics

INTRODUCTION

Corporate governance consists of either a one-tier or a two-one-tier board system (Jungmann, 2006). A one-tier board invests both managerial and supervisory activities in one unified board of directors. However, a two-tier board separates the managerial board and the supervisory board. This research focuses on the executive board or the board of directors. The board of directors acts as an internal governance mechanism via its appointment, supervision and remuneration of senior managers, as well as its framing of corporate strategy (Campbell & Vera, 2010). In this era, the presence of women on boards of directors have increased (Dezso & Ross, 2012).

McKinsey (2007) mentioned that female directors have leadership traits that increase their firms’ financial performance. The empirical result shows firms with women on their boards

can increase their Return on Equity (ROE) by 10 percent, operating income by 48 percent and stock growth by 17 percent compared to the industry averages. Eagly and Johannesen-Schmidt (2001), highlighted that the presence of female directors improves five leadership traits which are people development, expectations and rewards, becoming a role model, providing inspiration and participative decision making.

possess higher levels of awareness and demons-trate this type of behavior more easily.

According to Dieleman and Aishwarya (2012), the percentage of female directors and commissioners in Indonesia is 11.6 percent. This number is lower than Europe (17 percent), North America (17.1 percent) and Australia (13.8 percent), however, the presence of women in the boardroom in Indonesia is greater than in other developed countries in Asia. The latest study indicates that Indonesia has a higher percentage of female board members than Hong Kong (10.3 percent), Malaysia (7.3 percent), Singapore (7.3 percent) and Japan (1.1 percent), as represented across various sectors of industry.

Dieleman and Aishwarya (2012) examined boardroom’s gender diversity, which could be used as an indicator of firm’s success. The previous result shows about 40 percent of firms listed on the Indonesian Stock Exchange (IDX) had more than one female director. According to the Deloitte Global Center for Corporate Governance (2015), the women of Indonesia are increasingly moving away from their more traditional roles of wife and mother. Indonesian women are more actively working and pursuing careers.

Numerous studies have shown the impact of female directors on firm performance. These focused on the countries where a two-tier board system is applied. Boards of directors with female members tend to increase their firms’ performance (Frink et al., 2003; Erhardt et al., 2003; Krishnan & Daewoo, 2005; Smith, 2006; Dezso & Ross, 2012; Liu et al., 2014; Gulamhussen & Santa, 2015).

Other research has found that female directors have no impact on firm performance (Ellwood & Garcia-Lacalle, 2015). Joecks et al. (2013) mentioned that female directors, at first, negatively affect their firms’ performance, and only after the critical figure of about 30 percent female directors has been reached can they be associated with higher firm performance than a completely male board. On the other hand, Darmadi (2010) and Lam et al. (2013) mentioned female directors will decrease the performance of their firms. There are various

positive and negative opinions towards the empirical results on this topic that covers different research locations and samples. Therefore, this research aims to investigate the impact of female directors on firm performance in Indonesia, specifically by using five-years data across all the sectors of industry, which has not been examined by the previous literature. This research shows the effect of female executives on firm performance in various sectors including the trade, the service and investment sector, the agricultural sector, the financial sector, the property, real estate and building construction sector, the miscellaneous sector, the consumer goods sector, the mining sector, the infrastructure, utility and transportation sector, the basic industry and the chemicals sector. This research supports the International Finance Corporation (IFC) in increasing the number of female directors in Indonesia. For its managerial and practical contributions, this research will promote gender development in the boardroom, female executive training programmes as well as increasing the female composition of Indonesian boards of directors.

LITERATURE REVIEW

The Implicit Leadership Theory views leadership as the outcome of a perceptual process involving both leaders and subordinates. The central idea is the implicit belief about the personal qualities and behaviour of leaders. Leaders affect the performance of subordinates through their behaviour, traits, charismatic qualities and the ability to structure situations and define roles (Levy, 2003: 394).

good impression and thus recall good previous leaders’ behavior and traits, which will lead toward better performance.

According to the Social Role Theory, the differences between male and female behaviour are a function of the different roles men and women hold in society. This theory views gender differences between males and females as the cause of their different roles, especially at work (Eagly, 1987). Social Role Theoryfocuses on the structure of society and its roles, which form the behaviour of a group of people (Helgeson, 2012:165). Currently, gender and role orientation’s focus on masculinity and femininity is associated with their social role at rather than the gender.

The way labour is divided between women and men in society accounts for why women become communal and men become agentic. Men are primarily responsible for work outside the home, which leads to their agentic orientation. Women are primarily responsible for domestic labour and taking care of children, which leads to a communal orientation. However, this traditional perspective has been changed. Nowadays, women may lead in the corporate world because of their work ethic, environmental and social concerns. Ibarra and Obodaru (2009) mentioned that female executives who possess score higher for certain effectiveness criteria than male executives on their study.

Hambrick (2007) mentioned that the leadership of a complex organization is a shared activity and the collective cognition, capabilities and interaction of the entire Top Management Team (TMT) enter into this strategic behaviour. The psychological and social processes by which executive profiles are converted into strategic choice remains a mystery. Gender remains one of the aspects of these psychological and social processes. Gender splits between male and female executives who occupy strategic leading

roles can boost the performance of their companies.

The conflict of interest between both the principal and agent in Agency Theory (Jensen & Meckling, 1976) can be improved because female executives are more cautious than male executives in making important corporate decisions (Huang & Kisgen, 2013). Female executives are more diligent in their monitoring and demand more audit efforts than male directors do (Adam & Ferreira, 2009). It is due to a board’s diversity needing a high degree of independence. Female directors’ oversight could also minimize agency issues (Erhardt, 2003). Women are better able to lower operating costs (Chakrabarty & Bass, 2014) and improve the financial performance (Strom et al., 2014).

Moreover, the basic proposition of the Resource Dependency Theory is the need for environmental linkages between the firm and its outside resources. In this perspective, directors serve to connect the firm with the required external factors by co-opting the resources needed for it to survive (Pfeffer & Salancik, 1978). Pfeffer and Salancik (1978) attribute three benefits to these corporate board linkages: advice and counsel, legitimacy and communi-cation channel. Women have the advantage when it comes to advice and counsel as well as legitimacy. As for communication channels, women leaders’ perspectives are better equipped to connect their firms to customers, labour and society at large (Liu et al., 2014).

1. Hypothesis development

better monitoring role and minimise agency issues.

Krishnan and Daewoo (2005) in research into the upper echelon framework of top management, mentioned that the proportion of female directors has positively significant effect on firm performance. This research was conducted on 679 Fortune 1,000 companies registered since 1998 and leads to large implications for future career women. Smith et al. (2006) researched 2500 companies in Denmark, and the result showed that a more gender diverse board may also improve a firm’s competitive advantage as well as its corporate image and has a positive effect on customers’ behaviour.

Francoeur et al. (2006) undertook research in Canada and found empirical evidence that having a higher proportion of women does generate positive and significant abnormal returns. Ibarra and Obodaru (2009) in the Harvard Business Review mentioned women’s effectiveness in top management scored higher than men’s did. This research was conducted by using a 360 degree assessment of the executive development program in INSEAD. Miller and Triana (2009) mentioned that women will increase firm performance. Post and Byron (2015) combined 140 studies that examined empirical evidence that a female director is positively significant for firm’s performance.

Dezso and Ross (2012) mentioned that female representation in top management will enrich the information and social diversity of a board, which can bring benefits to management, enrich the manager’s behaviour and motivate the women in middle management. Hence, female representation remains an important indicator of the success of firms.

According to Darmadi (2010), the proportion of female directors is negatively significant to firm performance in Indonesia. This research was conducted over 1 year period, using as its sample 169 companies listed on the Indonesian Stock Exchange (IDX). The research focused on

examining whether women, foreign nationals and younger people in the boardroom influenced the firms’ performance, but was unable to prove any significant impact. Furthermore, Lam et al. (2013) in their research into the China Stock Market Financial Statements and the Shenzhen Stock Exchange, found female directors are negatively significant to firm performance.

Liu et al. (2014) examined the statement that firm performance is positively related to gender diversity and found that a critical mass of at least three women is needed to obtain a positive effect. Peni (2014) in research into 305 companies using 1,525 data observation from Standard and Poor 500 (S&P 500) found empirical evidence that among female CEO leads to better firm performance.

Garcia-Meca et al. (2015) suggest the presence of women on the boards of banks improves their governance, which causes the bank to be more profitable. The findings suggest women directors are not a substitute for the traditional corporate directors with identical abilities, but rather that these qualified women directors have unique characteristics that create additional value for the banks.

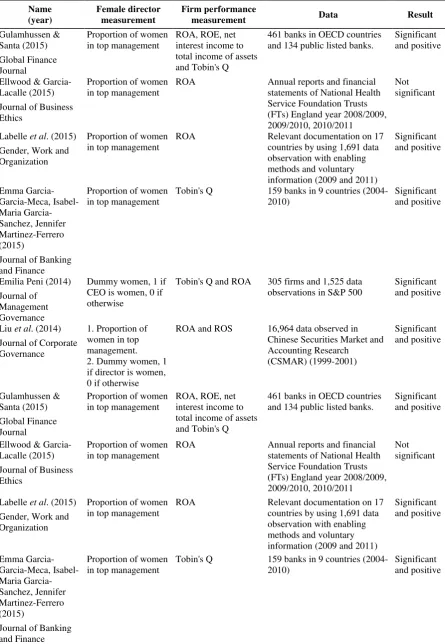

Ellwood and Garcia-Meca (2015) examined the empirical evidence by using annual reports and financial statements posted by National Health Service Foundation Trusts (NHSFTs) in England during 2008/2009, 2009/2010, 2010/2011 and found that female directors made no significant contribution to the trusts’ performance. However, Dezso and Ross (2012), Peni (2014), Labelle et al. (2015), Gulamhussen and Santa (2015) have proven that a female director is positively significant to a firm’s performance. Table 1 shows the summary of 15 previous studies.

Numerous studies into female directorships and firm performance have been conducted. However, they reported the different results. Thus, the hypothesis will be as follows.

H1: Female director will have positive impact

Table 1. Previous Research into Female Directors effect on Firm Performance

measurement Data Result

Gulamhussen & total income of assets and Tobin's Q

461 banks in OECD countries and 134 public listed banks.

Significant

ROA Annual reports and financial

statements of National Health Service Foundation Trusts (FTs) England year 2008/2009, 2009/2010, 2010/2011

ROA Relevant documentation on 17

countries by using 1,691 data observation with enabling methods and voluntary information (2009 and 2011)

Significant

Tobin's Q 159 banks in 9 countries

(2004-2010)

observations in S&P 500

Significant if director is women, 0 if otherwise

ROA and ROS 16,964 data observed in

Chinese Securities Market and Accounting Research total income of assets and Tobin's Q

461 banks in OECD countries and 134 public listed banks.

Significant

ROA Annual reports and financial

statements of National Health Service Foundation Trusts (FTs) England year 2008/2009, 2009/2010, 2010/2011

ROA Relevant documentation on 17

countries by using 1,691 data observation with enabling methods and voluntary information (2009 and 2011)

Significant

Tobin's Q 159 banks in 9 countries

(2004-2010)

Significant and positive

2 Research Model

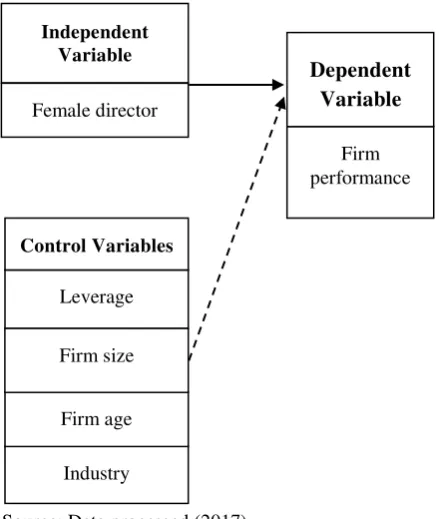

There are 37 previous published studies about females in the boardroom and their effect on firm performance spread over both two-tier board and one-tier board systems. Based on previous hypotheses formulations, the research model is described in Figure 1. The model is modified from 15 articles about the effect of female directors on firm performance in two-tier board countries, as previously researched. Nine of these 15 articles were studies conducted from 2012 to 2015. The independent variable is created using the gender construct, while the control variables are created using the firm characteristics’ construct.

Source: Data processed (2017)

Figure 1. Research Model

METHODOLOGY

1. Population and Sample

This research uses the quantitative research method. The study examines all the public listed companies on the Indonesian Stock Exchange (IDX) as population. The sample used is from 2011 to 2015, therefore the total sample is 1,735 data observation. Secondary data are sourced from the Indonesian Stock Exchange’s (IDX)

website and the companies’ official website. This study is using purposive sampling with the following criteria:

1. Audited annual reports posted in www.idx.co.id from 2011 to 2015.

2. Audited annual reports with complete data of firm performance, female directors, leverage, firm age, firm size and in the selected nine sectors of industry.

2. Regression Model and Variables

The dependent variable used in this study is firm performance measured by Tobin’s Q. The researcher used Tobin’s Q as the firms’ perfor-mance measurement because the aim was to measure market performance as a reflection of firms’ long-term performance (Combs et al., 2005; Gentry & Shen, 2010 in Post & Byron, 2015). Tobin’s Q can be calculated as follows: TOBIN’s Q = The sum of the market price of

equity and the total book value of the liabilities divided by the total book value of the assets.

Female directors is the independent variable used in this research. This variable is measured by the proportion of female directors on each board. Female directors can be calculated as follows:

PWOMEN = Total number of female directors divided by the total number of directors.

This study would like to employ firm characteristics’ construct as the control variables. The control variables are leverage, firm age, firm size and industry. Leverage is measured by the total book value of the liabilities divided by the total book value of the assets. Firm age is measured by the number of years since the company’s IPO, until the sample year. Total assets are measured by the natural logarithm of the total book value of the assets (Campbell & Vera, 2008). The selected industries consist of the agricultural sector, the mining sector, the basic industry and chemical sector, the miscellaneous sector, the consumer goods sector, the property, real estate and Industry

Leverage

Firm age Control Variables

Firm size

Firm performance Dependent Variable Independent

Variable

building construction sector, the infrastructure, utilities and transportation sector, the finance sector and trade, services and investment sector.

3. The Main Model and Estimation Methods For the model’s selection, the researcher used the following models.

Equation 1.1

Q= β0 + βPWOMEN+ βLEVERAGE +

βSIZE + βAGE + βINDUSTRY + ε (1) Equation 1.2

Q= β0 + βPWOMEN+ βLEVERAGE +

βSIZE + βAGE + ε (2)

Equation 1.3

Q= βPWOMEN+ βLEVERAGE + βSIZE +

βAGE + ε (3)

The following is the main regression model:

Q= β0 + βPWOMEN+ βLEVERAGE +

βSIZE + βAGE + βINDUSTRY +

ε

(1)This model was selected as the best model according to the model’s selection criteria, consisting of R-Square (R2), Mean Square Error

(MSE), Adjusted R-Square, Predicted Residual Sum Square (PRESS), Cp Mallows, Akaike

Information Criterion (AIC) and Schwarz Bayesian Criterion (SBC) as shown in Table 2.

Furthermore, this best model was used in a regression employing a multiple linear regres-sion with classical assumptions consisting of test for normality, a test for multicollinearity, a test for autocorrelation and a test for heteroscedas-ticity. Then, an F-test and independent t-test were conducted to examine the significance level of each variable simultaneously and individually.

RESULTS

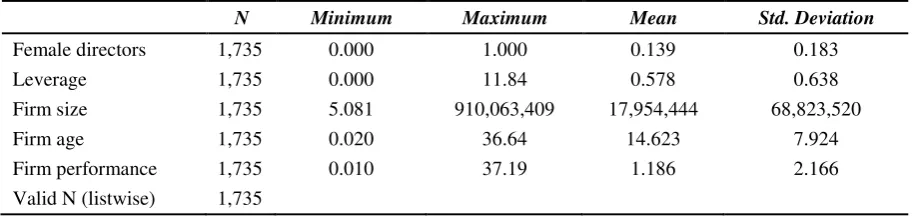

Descriptive Statistic

From the data observation, there are companies where all members of the board of directors are female. One is PT Ristia Bintang Mahkota Sejati Tbk (in 2014), which operates in the property, real estate and building construction sector. Another is PT Pool Advista Indonesia Tbk which operated in the trade, services and investment sector (from 2011 to 2015). PT Inti Agri Resources Tbk involved in the agricultural sector (from 2012 to 2015) is another (Table 3).

Table 2. Model Selection Criteria Result

Equation R2 Adjusted

R2 SE PRESS

Cp

Mallow AIC SBC

1.1 0.198 0.192 102.069 1,823.62 13 84.024 154.988

1.2 0.095 0.093 108.135 2,036.48 5 276.372 303.666

1.3 0.245 0.243 108.161 2,035.45 4 276.211 298.046

Source: Data processed (2017)

Table 3. Descriptive Statistic

N Minimum Maximum Mean Std. Deviation

Female directors 1,735 0.000 1.000 0.139 0.183

Leverage 1,735 0.000 11.84 0.578 0.638

Firm size 1,735 5.081 910,063,409 17,954,444 68,823,520

Firm age 1,735 0.020 36.64 14.623 7.924

Firm performance 1,735 0.010 37.19 1.186 2.166

Valid N (listwise) 1,735

PT Bank Mandiri Tbk is the biggest company is PT Greenwood Sejahtera Tbk which is active in the property, real estate and construction sector, while the oldest company is PT Century Textile Industry Tbk which is in the miscellaneous sector. PT Inti Kapuas Arowana Tbk has a Tobin’s Q of approximately 37.19. The average for the firm performance in Indonesia between 2011 to 2015 is 1.186. All the sectors in Indonesia have female directors, but in some their numbers are limited compared to the number of male directors. The detailed percentage of female directors in Indonesia across various industries is shown in Table 4.

Table 4. Indonesia Board of Director Gender Classification (in %)

Trade, services and investment 22.8 77.2

Finance 11.8 88.2

Property, real estate and

building construction 13.0 87.0

Miscellaneous 9.5 90.5

Consumer goods 7.8 92.2

Mining 8.4 91.6

Infrastructure, utility and

transportation 8.6 91.4

Basic industry and chemical 13.8 86.2

Source: Data processed (2017)

The trade, services and investment sector has the highest representation of female directors, followed by the basic industry and chemical sector and the property, real estate and building construction sector. The sector with the least representation is the agricultural sectors.

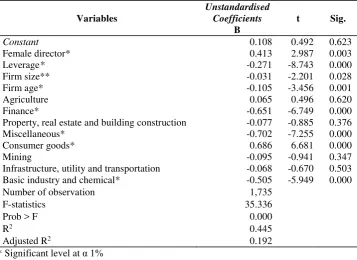

DISCUSSION

The independent t-test shown in Table 7, indicates that female directors are positively significant for firm performance with a significance level of 0.003, thus Hypothesis 1 is supported. The control variables consisting of leverage, firm size and firm age are negatively

significant for firm performance with signi-ficance levels of approximately 0.000, 0.028 and 0.001, respectively. Some sectors have signi-ficance on firm performance, while some do not.

The result is consistent with the previous empirical findings from Frink et al. (2003), Erhardt et al. (2003), Krishnan and Daewoo (2005), Smith et al. (2006), Francoeur et al. (2008). Furthermore, the empirical findings are also consistent with the research of Dezso and Ross (2012) into the S&P 1500, Peni (2014) into the S&P 500, Labelle et al. (2015) who carried Qualified female directors have unique characteristics that create additional value for banks. More female directors may reduce the asymmetry information and associated agency costs. Women often bring a fresh perspective on complex issues and this can help correct informational biases in strategy formulation and problem solving (Francoeur et al., 2008).

Female directors can lead to better firm performance because women tend to be more risk averse and cautious in their decision making. Females tend to think about the wider impacts in democratic and participatory way (Dezso & Ross, 2012). In the realm of social responsibility, female directors care more about the corporate social responsibility and moral issues of their businesses. Moreover, female directors possess better communication skills and listening skills in day-to-day operations (Peni, 2014).

Tabel 7. Independent t-test Result

Variables

Unstandardised

t Sig.

Coefficients B

Constant 0.108 0.492 0.623

Female director* 0.413 2.987 0.003

Leverage* -0.271 -8.743 0.000

Firm size** -0.031 -2.201 0.028

Firm age* -0.105 -3.456 0.001

Agriculture 0.065 0.496 0.620

Finance* -0.651 -6.749 0.000

Property, real estate and building construction -0.077 -0.885 0.376

Miscellaneous* -0.702 -7.255 0.000

Consumer goods* 0.686 6.681 0.000

Mining -0.095 -0.941 0.347

Infrastructure, utility and transportation -0.068 -0.670 0.503

Basic industry and chemical* -0.505 -5.949 0.000

Number of observation 1,735

F-statistics 35.336

Prob > F 0.000

R2 0.445

Adjusted R2 0.192

* Significant level at α 1%

** Significant level at α 5%

From the sectoral view, the trade, services and investment sector become the reference category. Hence, women’s representation in the agricultural sector is not significant for firm performance. The same case is found for the property, real estate and construction sector, the mining sector and the infrastructure, utility and transportation sector. Meanwhile, the finance sector, the miscellaneous sector and the basic and chemical sector are not better than than the trade, services and investment sector with significant negative sign. The consumer good sector is better than the trade, services and investment sector.

CONCLUSION

This research used the multiple regression method to analyse the data. The result proves that a female director has a significantly positive effect on firm performance. The findings are useful to a contribution for various parties, such as academics, practitioners and regulators for rules and policy forming purposes.

For the academic, this research aims to add to the corporate governance literature in behavioural finance, especially in the area of

gender and its impact on firm performance. For practitioners, this research provides a contribution to gender development in the boardroom, female executive training programs, as well as the female composition of boards of directors. For regulators, this research may contribute to gender representation in policies for boards and their rules and regulations.

Furthermore, this research also supports the International Finance Corporation (IFC) of The World Bank in its efforts to increase the number of female directors in Indonesian boardrooms. This research can build awareness of the contribution of women to firms and to encourage more women to participate. This research leads to future careers for women on boards of directors and women’s career development programs generally.

LIMITATION

has not as yet examined the exact proportion of women in the boardrooms.

SUGGESTION FOR FURTHER RESEARCH

Some suggestions for further research are as follows:

1. To consider more deeply the gender aspect or the related attributes about gender in its impact on firm performance.

2. To use more control variables in creating the firm characteristics’ construct.

3. The research could be more specific about the impact of female directors’ behaviour on firm performance.

ACKNOWLEDGEMENTS

This research was supported by the Indonesian Endowment Fund for Education Scholarship (LPDP) from the Ministry of Finance, Indonesia.

REFERENCES

Adams, R. B., and Ferreira, D., 2009. “Women in the Boardroom and Their Impact on Governance and Performance”. Journal of Financial Economics,94, 291-309.

Campbell, K., and Vera, A. M, 2008. “Gender Diversity in the Boardroom and Firm Financial Performance”. Journal of Business Ethics, 83 (3), 435-451.

Campbell, K., and Vera, A. M, 2010. “Female Board Appointments and Firm Valuation: Short and Long Term Effects”. Journal of Management Governance, 14, 37-59. Chakrabarty, S., and Bass, A. E., 2014.

“Corporate Governance in Microfinance Institutions: Board Composition and The Ability to Face Institutional Voids”. Corporate Governance International Review, 22, 367-386.

Darmadi, S., 2010. “Board Diversity and Firm Performance: The Indonesian Evidence”. Munich Personal RePec Archive Paper, 38721.

Deloitte Global Center for Corporate Governance. Electronic source. Available at www2.deloitte.com/content/dam/Deloitte/gl

obal/Documents/Risk/gx-ccg-women-in-the-boardroom-a-global-perspectivepdf, at September 4th, 2016.

Dezso, C. L. and Ross, D. G., 2012. “Does Female Representation in Top Management Improve Firm Performance? A Panel Data Investigation”. Strategic Management Journal.

Eagly, A. H., 1987. “Sex Differences in Social Behavior: A Social-Role Interpretation”. Lawrence Erlbaum Associates, Hillsdale. Eagly, A. H., and Johannesen-Schmidt, M. C., Firm Financial Performance”. Corporate Governance, 11 (2). 102-111.

Folkman, Z., 2012. “A Study in Leadership: Women do it Better than Men”. Accessed from http://zengerfolkman.com/media/ articles/ZFCo.WP.WomenBetterThanMen.0 33012.pdf at September 20th, 2016.

Francoeur, C., Labelle, R. and Sinclair-Desgagne, B., 2008. “Gender Diversity in Corporate Governance and Top Mana-gement”. Journal of Business Ethics, 81 (1), Organization Performance”. Group and Organization Management, 28 (1), 127-147. Garcia-Meca, E., Garcia-Sanchez, I., and Martinez-Ferrero, J., 2015. “Board Diversity and Its Effects on Bank Performance: An International Analysis”. Journal of Banking and Finance, 53, 202-214.

George, W., 2012. “Developing the Global Leader”. Harvard Business School Working Knowledge. Accessed from http://hbswk. hbs.edu/item/developing-the-global-leader at Oktober 1st 2016.

23”. Badan Penerbit Universitas Dipone-goro, Semarang.

Gujarati, D., 2004. “Basic Econometrics 4th

Edition”. McGraw-Hill, New York.

Gulamhussen, M. A. and Santa, S. F., 2015. “Female Directors in Bank Boardrooms and Their Influence on Performance and Risk of Management Review, 9 (2), 193-206. Hambrick, D. C., 2007. “Upper Echelon Theory:

An Update”. Academy of Management Review, 32 (2), 334-343.

Helgeson. V. S., 2012. “The Psychology of Gender”. Pearson Education, New Jersey. Huang, J., and Kisgen, D., 2013. “Gender of

Corporate Finance: Are Male Executives Overconfident Relative to Female Exe-cutives:”. Journal of Financial Economics, 108, 822-839.

Ibarra, H. and Obodaru, O., 2009. “Women and the Vision Thing”. Harvard Business Review. Accessed at https://hbr.org/ 2009/01/women-and-the-vision-thing at September 20th, 2016.

Jensen, M. C. and Meckling, W. H., 1976. “Theory of the Firm: Managerial Behavior, Agency Costs and Ownership Structure”. Journal of Financial Economics, 3 (4), 305-360.

Joecks, J., Pull, K., and Vetter, K., 2013. “Gender Diversity in the Boardroom and Firm Performance: What Exactly Cons-titutes a “Critical Mass?”. Journal of Business Ethics, 118, 61-72.

Jungmann, C. M., 2006. “The Effectiveness of Corporate Governance in One-Tier and Two Tier Board Systems: Evidence from the UK and Germany”. European Company and Financial Law Review, 3 (4), 426-474. Krishnan, H. and Daewoo, P., 2005. “A Few

Good Women on Top Management teams”. Journal of Business Research, 58, 1712-1720.

Labelle, R., Francoeur, C., and Lakhal, F., 2015. “To Regulate or Not To Regulate? Early Compensation and Firm Performance in Chinese-Listed Enterprises”. Pacific-Basin Finance Journal, 21, 1136-1159.

Levy, P. E., 2003. “Industrial/Organizational Psychology Understanding the Workplace”. Houghton Mifflin Company, Boston.

Liu, Y., Zuobao, W., and Feixue, X., (2014). “Do Women Directors Improve Firm Performance in China?”. Journal of Corporate Governance, 28, 169-184. McKinsey & Company., 2007. “Women Matter:

Gender Diversity, A Corporate Performance Driver”. Accessed from http://www. raeng.org.uk/publications/other/women-matter-oct-2007 at September 1st, 2016.

McKinsey & Company., 2008. “Female Leadership, a Competitive Edge for the Future”. Accessed from http:// www.mckinsey.com/global-themes/women-matter at September 1st, 2016.

McKinsey & Company., 2010. “Women at the Top of Corporations: Making It Happen”. Accessed from http://www.mckinsey.com/ search?q=Women at the Top of Corpora-tions Making it Happen at September 1st,

2016.

Miller, T. and Triana, M. C., 2009. “ Demo-graphic Diversity in the Boardroom: Mediators of the Board Diversity – Firm Performance Relationship”. Journal of Management Studies, 46 (5), 755-786. Peni, E., 2014. “CEO and Chairperson

Characteristics and Firm Performance”. Journal of Management Governance, 18, 185-205.

Pfeffer, J. and Salancik, G. R., 1978. “The External Control of Organizations: A Resource Dependence Perspective”. Harper & Row, New York.

Post, C. and Byron, K., 2015. “Women on Boards and Firm Financial Performance: A Meta Analysis”. Academy of Management Journal, 58 (5), 1546-1571.

Smith, N., Smith, V., and Verner, M., 2006. “Do Women in Top Management Affect Firm Performance? A Panel Study of 2500 Danish Firms”. International Journal of Productivity and Performance Measure-ment, 55 (2), 569-593.

Strom, R. D’Espallier, B. Mersland, R., 2014. “Female Leadership, Performance and Governance in Microfinance Institution”. Journal of Banking and Finance, 42, 60-75.

T. Eckes and H. M. Trautner (Eds.)., 2000. “Social Role Theory of Sex Differences and Similarities: A Current Appraisal”, The Developmental Social Psychology of Gender, 123-174.

APPENDIX

1. Classical Assumption Result

This study has passed the classical assumption test, consisting of the tests for normality, multicollinearity, autocorrelation and heteroscedasticity as follows.

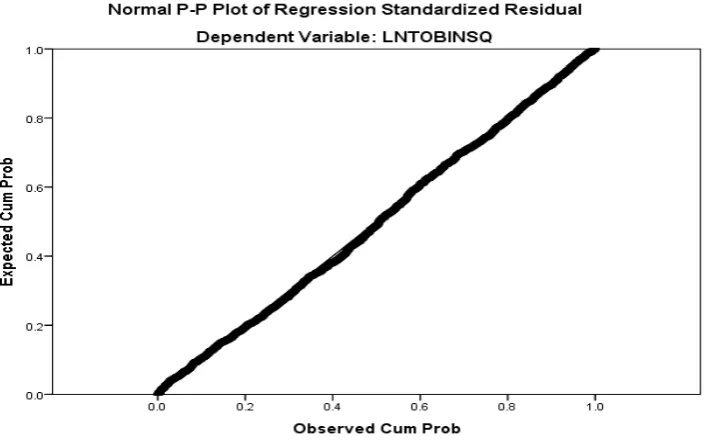

1.1. Test for normality

Figure 2. Test for Normality Result

Normal P-P plot indicates the data is normal. Beside using the normal P-P Plot for testing the normality, Kolmogorov-Smirnov indicates the significance level is 0.299 which means the observed data are normal (0.299 > 0.05). Thus, the normality assumption is complied with.

1.2. Test for multicollinearity

Table 5. Test for Multicollinearity Result

Variables Collinearity Statistics Conclusion

Tolerance VIF

Female director 0.936 1.068 There is no multicollinearity

Leverage 0.905 1.106 There is no multicollinearity

Firm size 0.803 1.246 There is no multicollinearity

Firm age 0.895 1.118 There is no multicollinearity

Agriculture sector 0.852 1.173 There is no multicollinearity

Finance sector 0.619 1.615 There is no multicollinearity

Property, real estate and construction sector 0.708 1.412 There is no multicollinearity

Miscellaneous sector 0.745 1.342 There is no multicollinearity

Consumer goods sector 0.794 1.260 There is no multicollinearity

Mining sector 0.762 1.312 There is no multicollinearity

Infrastructure, utility and transportation sector 0.738 1.356 There is no multicollinearity

Basic industry and chemical sector 0.701 1.427 There is no multicollinearity

1.3. Test of autocorrelation

Table 6. Test for Autocorrelation Result

Dependent variable Durbin-Watson

Firm performance 0.627

Durbin Watson scored 0.627 which is between -2 and 2. The score of dl is 1.915 and du is 1.927. Durbin Watson indicates a positive autocorrelation due to the nature of the economic data.

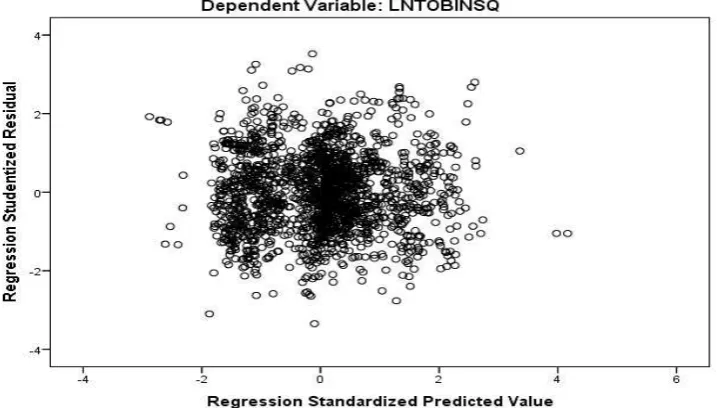

1.4. Test for heteroscedasticity

The data are dispersed and do not accumulate in any certain pattern. The pattern indicates there is no homoscedasticity. Thus, the heterescedasticity assumption is complied with.

Figure 3. Test for Heteroskedasticity Result