Bringing

Indonesia

and our subsidiaries.

This Annual Report contains “forward-looking statements”, including statements regarding our expectations and projections for our future operating performance and business prospects. The words “believe”, “expect”, “anticipate”, “estimate”, “project” and other similar words identify forward-looking statements. In addition, all statements other than statements of historical facts included in this Annual Report are forward-looking statements. Although we believe that the expectations relected in the forward-looking statements herein are reasonable, we can give no assurance that such expectations will prove to be correct. These forward-looking statements are subject to a number of risks and uncertainties, including changes in the economic, social and political environments in Indonesia. This Annual Report discloses, under “Risk Factors” and elsewhere, important factors that could cause actual results to difer materially from our expectations.

To obtain further information on Telkom, please contact Investor Relations, Grha Citra Caraka on 5th loor, Jl. Jend. Gatot Subroto Kav. 52 Jakarta 12710, Indonesia. Tel.: (62-21) 521 5109, Fax: (62-21) 522 0500 or e-mail: [email protected]. You can download this document from our online site http://www.telkom.co.id.

incorporated by reference into the Form 20-F. The information and data presented in this Annual Report draws upon the consolidated inancial data of the Company

relected in the forward-looking statements herein are reasonable, we can give no assurance that such expectations will prove to be correct. These forward-looking

discloses, under “Risk Factors” and elsewhere, important factors that could cause actual results to difer materially from our expectations.

To obtain further information on Telkom, please contact Investor Relations, Grha Citra Caraka on 5th loor, Jl. Jend. Gatot Subroto Kav. 52 Jakarta 12710, Indonesia. Tel.: (62-21) 521 5109, Fax: (62-21) 522 0500 or e-mail: [email protected]. You can download this document from our online site http://www.telkom.co.id.

US currency. Certain igures (including percentages) have been rounded up. Save as otherwise noted, all inancial information is presented in Indonesian Rupiah

Digital Society

The digital society has become a global trend today, with the

near-universal access and use of Device Network Application ("DNA")

convergence environment based on Information and Communication

Technology in our daily activities: at home and the workplace, for

education and recreation, as well as in interacting with friends and

family. In Indonesia, the development of broadband networks and

universal access, and telecommunications services as part of a digital

lifestyle is also an important component of national connectivity, one

of the pillars in the Master Plan for the Acceleration and Expansion

of Indonesia's Economic Development ("MP3EI") declared by the

Government of Indonesia.

MANAGEMENT'S DISCUSSION AND

ANALYSIS OF THE COMPANY’S

PERFORMANCE

Operational Overview by Segment Financial Overview

Obligations and Commitment Liquidity

Net Working Capital Solvency

Receivables Collectability Capital Structure

Capital Expenditures

Material Commitment for Capital Investment

Changes in Accounting Policies Changes in Laws and Regulation Exchange Controls

Quantitative and Qualitative Disclosures about Market Risks

Related Party Transactions Property and Equipment Insurance

Material Information and Facts

PREFACE

HIGHLIGHTS

Financial Highlights Operational HighlightsCommon Stock and Bond Highlights Events Highlights

Awards and Certiications

MANAGEMENT REPORT

Report from the President Commissioner Report from the President Director

BUSINESS OVERVIEW

Telecommunication Industry in Indonesia Corporate Strategy

Business Outlook Business Portfolio

Sales, Marketing and Distribution

Telecommunication Services Tarifs

Customer Services Consumer Protection

Billing, Payment and Collection Risk Factors

Network Infrastructure Network Development Human Capital

2

1 6 18 20 24 26

30 34

42 43 45 46 51 52 53 55 56 58 72 76 78

90 93 106 107 108 108 108 109 109

110 110 1 1 1 1 1 1

Internal Control System Independent Auditor Risk Management

Legal Proceeding and Lawsuits Involving the Company

Administrative Sanctions Public Access to Information

Code of Ethics and Corporate Culture Whistleblowing System

GCG Implementation Consistency GCG Evaluation

SOCIAL AND ENVIRONMENTAL

RESPONSIBILITY

Environment

Employment, Health, and Work Safety Social and Community Development Consumer

Subsidiaries and Associated Companies

Proile of The Board of Commissioners Proile of The Board of Directors

Stock Overview Addresses

ADDITIONAL INFORMATION (FOR ADR

SHAREHOLDERS)

Summary of Signiicant Diferences between

Indonesian Corporate Governance Practices and the US’s

Summary of Signiicant Diferences

between IFAS and IFRS Articles of Association

Relationship with the Government and Government Agencies

Capital Market Trading Mechanism and Telkom ADS

Taxation

Research and Development Legal Basis and Regulation Competition

Licensing

Trademarks, Copyrights, Industrial

Designs and Patens

APPENDICES

DeinitionCross Reference to Bapepam-LK Regulation No.X.K.6

156 158 158

159 160 160 161 163 166 171

1 94 198 200 202 207

175 178 182 187

2 12

2 13 2 13

2 13

2 15 2 16 2 17 2 17 222 225

228

230

STRENGTH

BORN

OF A LONG HISTORY...

1991

1974

1980

PERUMTEL became PT Telekomunikasi Indonesia or Telkom, and operations were organized into twelve regional units (“Witel”). These were later reorganized into seven regional divisions: Division I Sumatra, Division II Jakarta and Surrounding Area, Division III West Java, Division IV Central Java and DI Yogyakarta, Division V East Java, Division VI Kalimantan and Division VII Eastern Indonesia.

PN Telekomunikasi was split into two divisions, PT Industri Telekomunikasi Indonesia (“PT INTI”), which manufactured telecommunications equipment, and Perusahaan Umum Telekomunikasi (“Perumtel”), which supplied domestic and international telecommunication services.

1995

We held our Initial Public Ofering on November

14, 1995 on the Jakarta Stock Exchange and the Surabaya Stock Exchange. On May 26, 1995, we established Telkomsel, our cellular business subsidiary.

The international telecommunication business was taken over by Indosat.

On October 23, 1856, the Dutch colonial government

deployed the irst electromagnetic telegraph

in Indonesia, connecting Batavia (Jakarta) with Buitenzorg (Bogor).

The Dutch colonial government established a government agency to operate post and telecommunications services in Indonesia. In 1965, the post and telecommunications services were separated and brought under the control of two state companies, PN Pos and Giro and PN Telekomunikasi.

2005

2009

2010

2011

2012

1999

2001

2002

2004

The Telkom-2 Satellite was launched to replace all satellite transmission services previously provided by the Palapa B-4 satellite. This brought our total number of satellites launched to eight, including the Palapa A-1 satellite.

We underwent a transformation from an infocom to a TIME company. The new Telkom was introduced to the public with the new corporate logo and tagline, ‘the world in your hand’.

The JaKaLaDeMa submarine and iber optic cable

project linking Java, Kalimantan, Sulawesi, Denpasar and Mataram was successfully completed in April 2010.

We commenced the reform of our telecommunications infrastructure through the Telkom Nusantara Super Highway project, which unites the Indonesian archipelago from Sumatra to Papua, and the True Broadband Access project, which will enable customers all over Indonesia to have broadband access to the internet.

The Telecommunications Law (Law No. 36/1999),

which went into efect in September 2000,

facilitated the entry of new players, intensifying the competition in the telecommunications industry.

We acquired Indosat’s 35.0% shareholding in Telkomsel, making us the majority shareholder with a stake of 77.7%. Indosat then took over our 22.5% shareholding in Satelindo and 37.7% share in PT Aplikanusa Lintasarta. At the same time, we

lost our exclusive right to be the sole ixed line

telephone operator in Indonesia.

We divested 12.7% of its our shares in Telkomsel to Singapore Telecom Mobile Pte Ltd. (“SingTel Mobile”).

We launched our international direct dial ixed line

service.

We sought to achieve widespread broadband penetration throughout Indonesia through the implementation of the Indonesia WiFi program towards the development of Indonesia Digital Network.

We sought to improve business value creation by

reconiguring our business portfolios from TIME to

TIMES (Telecommunications, Information, Media, Edutainment & Services).

PROVIDING

Our customers inspire us to develop

better products, improve the quality of

our networks and set a high standard of

service quality. Our products, services

and employees are totally focused on

customers to consistently develop the

best solutions since to only satisfy our

customers is insuicient for us.

BY LEARNING

FROM OUR

Mission

Vision

VISION,

MISSION AND

VALUES...

To

become

a

leading

Telecommunication, Information,

Media, Edutainment and Services

(“TIMES”) player in the region.

• To provide TIMES

services with excellent

quality at competitive

price.

• To

be

the

role

model as the best

managed Indonesian

corporation.

Corporate

Culture

The New Telkom Way

Basic

Belief

Always The Best

Key

Behaviours

Imagine, Focus, Action

Solid, Speed, Smart

Core

1

3

5

4

2

..STRATEGIC

INITIATIVES...

Center of Excellence.

Facilitating broadband

implementation through service

convergence.

Management of wireless portfolio.

Integrating the Telkom Group’s

ecosystem solutions.

9

6

10

8

7

Maximizing asset value on

inter-related businesses.

Investing in information technology

services.

Integrating

Next

Generation

Networks (“NGN”) and Operational

support system, Business support

system,

Customer

support

system and Enterprise relations

management (“OBCE”) to achieve

costs improvements.

Investing in the wholesale business

and strategic international business

opportunities.

SUPPORTED

BY TELECOMMUNICATION

NETWORKS THAT SPREAD

THROUGHOUT INDONESIA

Western Telkom Division

Eastern Telkom Division

(Central Java, East Java,

Kalimantan and Eastern Indonesia)

60,011

19.1

125.1

26.8

BTS

million

broadband

subscribers

million

cellular

subscribers

million ixed

EXCELLENT

HUMAN

CAPITAL

Number of

Employee-Telkom

08

25,016

21,138

19,780

19,185

23,154

09 10 11

12

Number of

Employee-Subsidiary

08

5,197

5,709

6,243

6,498

5,596

09 10 11

12

Employee per

December 2012

25,683

19,185

6,498

Telkom

RESULTING

IN HIGHER

ACHIEVEMENT

• Telkom’s

Solid Bottom

Line

17.2%

Net income

increased by

• Strengthening

Telkomsel’s

network

2x

82.8%

Broadband

subscribers grew more

than double to

19.1

million

16.9%

Cellular subscribers

grew by

125.1

million

54,297

Telkomsel BTS

Financial

Highlights

Financial Highlights (Based on IFAS)

Consolidated Statements of Comprehensive Income

(in billions of Rupiah, except for net income per share and per ADS)

Years ended December 31,

2012 2011 2010 2009* 2008*

Total Revenues 77,1 4 3 7 1,253 68,629 68,220 64,974

Total Expenses 54,004 49,960 46,240 44,1 3 9 43,606

Adjusted EBITDA 40,1 5 4 36,821 37,549 38,056 33,700

Operating proit 25,698 21,958 22,937 24,081 21,368

Proit for the year 18 ,362 15,470 15,870 16,043 14,725

Proit for the year attributable to:

Owners of the parent company 12,850 10,965 1 1 ,537 1 1 ,399 10,672

Non-controlling interest 5, 5 1 2 4,505 4,333 4,644 4,053

Total comprehensive income for the year 18,388 15,481 15,904 16,048 14,729

Total comprehensive income attributable to:

Owners of the parent company 12,876 10,976 11,571 1 1 ,404 10,676

Non-controlling interest 5, 5 1 2 4,505 4,333 4,644 4,053

Net income per share 669,19 559,67 586,54 579,52 540,38

Net income per ADS (1 ADS : 40 common stock) 26,767.6 22,386.8 23,461.6 23,180.8 21,615.2

Consolidated Statements of Financial Position

(in billions of Rupiah)

Total Assets 1 1 1 ,369 103,054 100,501 97,931 91,256

Total Liabilities 44,391 42,073 44,086 48,436 47,662

Total equity attributable to owners of the parent company 51,541 47,510 44,419 38,562 33,910

Net working capital 3,866 (931) (1,744) (1 0,797) (1 2,596)

Investment in other entities 275 235 254 151 169

Capital Expenditures (in billions of Rupiah)

Telkom 4,040 4,202 3,623 5,652 6,087

Telkomsel 10,656 8,472 8,197 12,673 15,9 15

Others Subsidiaries 2,576 1,929 831 836 243

Total 17,272 14,603 12,651 19,161 22,245

Consolidated Financial and Operational Ratios

Return on Asset (ROA) (%)1 1 1 .5 10.6 1 1 .5 1 1 .6 1 1 .7

Return on Equity (ROE) (%)2 24.9 23.1 26.0 29.6 31.5

Operating Proit Margin (%)3 33.3 30.8 33.4 35.3 32.9

Current Ratio (%)4 116.0 95.8 91.5 59.9 53.7

Total Liabilities to Equity (%)5 86.1 88.6 99. 3 125.6 140.6

Total Liabilities to Total Assets (%)6 39.9 40.8 43.9 49.5 52.2

* As restated. See Note 2p to our Consolidated Financial Statements.

(1) ROA is calculated as proit for the year attributable to owners of the parent company divided by total assets at year end December 31. (2) ROE is calculated as proit for the year attributable to owners of the parent company divided by total equity attributable to owners of the

parent company at year end December 31.

(3) Operating proit margin is calculated as operating proit divided by revenues.

(4) Current ratio is calculated as current liabilities divided by current liabilities at year end December 31.

Total Revenues

(in billions of Rupiah)

08

64,974

68,629

71,253

77,143

68,220

09 10 11

12

Total Expenses

(in billions of Rupiah)

08

43,606

46,240

49,960

54,004

44,139

09 10 11

12

Operating proit

(in billions of Rupiah)

08

21,368

22,937

21,958

2

5,698

24,081

09 10 11

12

FinancialHighlights

Total Assets

(Rupiah)

08

91,256

100,501

103,054

111,

3

6

9

97,931

09 10 11

12

Total Liabilities

(Rupiah)

0

8

47,662

44,086

42,073

44,391

48,436

09 10 11

12

Total equity attributable

to owners of the parent

company

(Rupiah)

08

33,910

44,419

47,510

51,541

38,562

09 10 11

12

Owners of the parent

company

(in billions of Rupiah)

0

8

10,672

11,

537

10,965

12,

8

5

0

11,399

09 10 11

12

Net income per share

(Rupiah)

0

8

540.38

586.54

559.67

669.19

579.52

09 10 11

12

Adjusted EBITDA

(Rupiah)

08

33,700

37,549

36,821

40,154

38,056

Operational

Highlights

Unit Years ended December 31,

2012 2011 Changes (%)

Broadband Subscribers

Fixed broadband (Speedy) (000) subscribers 2,341 1,789 30.9 Mobile broadband (Flash) (000) subscribers 1 1 ,039 5,532 99.5

Blackberry (000) subscribers 5,764 3, 1 5 3 82.8

Total Broadband Subscribers (000) subscribers 19,144 10,474 82.8 Cellular Subscribers

Postpaid (kartuHalo) (000) subscribers 2,1 4 9 2,1 8 8 (1.8) Prepaid (simPATI, Kartu As) (000) subscribers 122,997 104,829 1 7.3 Total Cellular Subscribers (000) subscribers 125,146 107,0 1 7 16.9

Fixed Line Subscribers

Fixed wireline (000) subscribers 8,946 8,602 4.0

Fixed wireless (000) subscribers 1 7,870 14,238 25.5

- Postpaid (Classy) (000) subscribers 428 468 (8.5)

- Prepaid (Trendy) (000) subscribers 1 7,442 13,770 26.7

Total Fixed Line Subscribers (000) subscribers 26,8 1 6 22,840 17.4 Other Subscribers

Pay TV (000) subscribers 1 , 1 9 1 1 ,000 19.1

Satellite transponder (000) MHz 2,650 2,360 12.3

Network

BTS unit 60, 0 1 1 48,341 24.1

Customer Services

PlasaTelkom unit 572 727 (2 1 .3)

Grapari unit 85 32 165.6

Broadband Subscribers

(in thousands)

11

Speedy Flash Blackberry

1,789

5,532

11,0

39

2,341

12

11

12

11

12

3,153

5,764

Cellular Subscribers

(in thousands)

11

2,1

88

kartuHalo simPATI, kartu AS

104,829

122,997

2,149

12

11

12

11

8,

602

Fixed Wireline Fixed Wireless

1

4

,23

8

17,870

8,946

12

11

12

Fixed Line Subscribers

Oper

a

tional

Highlights

11

727

Plasa Telkom Grapari

32

572

12

11

12

85

Customer Services

(in unit)

11

1,000

Pay TV Satellite transponder

2,360

1,191

12

11

12

2,650

Other Subscribers

(in thousands)

11

12

48,341

60,011

BTS

(in unit)

e-banking

Common

Stock

and

Bond Highlights

Volume

Price

Volume

(in million shares)

Price (Rp)

10,000

8,000

6,000 80

70 60 50 40 30 20 10 0

Telkom Share Price and Trading Volume

on the Indonesia Stock Exchange 2011-2012

First Quarter

2011

First Quarter

2012 Second

Quarter 2011

Second Quarter 2012 Third

Quarter 2011

Third Quarter

2012 Fourth

Quarter 2011

Fourth Quarter 2012

First Quarter

2011

First Quarter

2012 Second

Quarter 2011

Second Quarter

2012 Third

Quarter 2011

Third Quarter

2012 Fourth

Quarter 2011

Fourth Quarter 2012

Volume

Price

Volume

(in thousand ADS)

Price (US$)

Telkom ADS Price and Trading Volume

on the New York Stock Exchange 2011-2012

2,5

2

1,5

1

5

0

50

40

30

Trade Price and Volume

Table Trade Price and Volume

The table below shows the high, low, closing quoted prices, trading volume, outstanding shares and market

capitalization for our common stock on the IDX during the periods indicated:

Common

S

tock

and

Bond Highlights

Calendar Year

Price per Share of Common Stock(1)

Volume Outstanding Shares

Market

High Low Closing Capitalization

(in Rupiah) (shares) (Rp billion)

2008 10,250 5,000 6,900 6,1 6 2 ,1 2 6 ,500 19,669,424,780 135,719 2009 10,350 5,75 0 9,450 4, 1 74 ,413,500 19,669,424,780 185,876 2010 9,800 6,950 7,950 5,707,850,000 19,669,424,780 156,372 2011 8,050 6,600 7,050 4,441,579,000

First Quarter 8,050 6,600 7,350 1 ,297,346,000 19,669,424,780 144,570 Second Quarter 7,850 6,800 7,350 957,638,000 19,627,724,280 144,264 Third Quarter 7,900 6,900 7,600 1 , 2 61 ,616,000 19,527,516,280 148,409 Fourth Quarter 7,75 0 6,900 7,050 924,979,000 19,386,339,320 136,674 2012 9,950 6,650 9,050 4,600,560,500

First Quarter 7,1 5 0 6,650 7,000 1 ,039, 57 1 ,000 19,219,393,820 134,536 Second Quarter 8,700 7,000 8,1 5 0 1 ,386,964,000 19,184,274,820 156,352 Third Quarter 9,850 7,950 9,450 1 ,020,030,500 19,1 53,568,820 181,001 Fourth Quarter 9,950 8,650 9,050 1 ,1 5 3 ,995,000 19,149,068,820 173,299 September 9,750 9, 1 5 0 9,450 287,944,500 19,1 53,568,820 181,001 October 9,950 9,300 9,750 408,422,500 19,149,068,820 186,703 November 9,900 8,950 9,000 332,146,000 19,149,068,820 172,342 December 9,350 8,650 9,050 41 3,426,500 19,149,068,820 173,299 2013

January 9,800 8,800 9,700 446,61 0,500 19,149,068,820 185,746 February 10,950 9,550 1 0,750 422,448,500 19,149,068,820 205,852

(1) We conducted a two for one split of our common stock from a nominal value of Rp500 per share to Rp250 per share as resolved by the AGMS

on July 30, 2004, efective October 1, 2004. The price per share of the common stock relects this split for all periods shown.

Volume

Price

Outstanding Shares (in billion share)

Market Capitalization (Rp billion)

80,000 140,000 200,000

0 19.0

19.1 19.2 19.3 19.4 19.5 19.6 19.7 19.8 19.9 20

Telkom Outstanding Shares and Market Capitalization on the

Indonesia Stock Exchange 2011-2012

First Quarter

2011

First Quarter

2012 Second

Quarter 2011

Second Quarter

2012 Third

Quarter 2011

Third Quarter

2012 Fourth

Quarter 2011

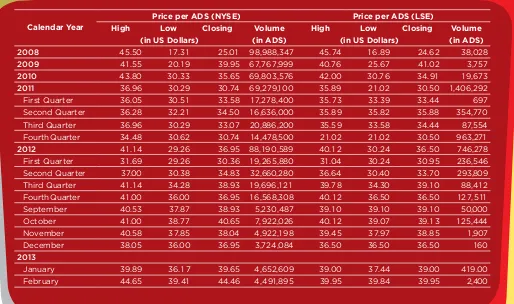

Calendar Year

Price per ADS (NYSE) Price per ADS (LSE)

High Low Closing Volume High Low Closing Volume

(in US Dollars) (in ADS) (in US Dollars) (in ADS)

2008 45.50 1 7.31 25.01 98,988,347 45.74 1 6 .89 24.62 38,028 2009 41 .55 20. 1 9 39.95 67,767,999 40.76 25.67 41 .02 3,757 2010 43.80 30.33 35.65 69,803,576 42.00 30.76 34.91 1 9,673 2011 36.96 30.29 30.74 69,279,1 00 35.89 2 1 .02 30.50 1,406,292 First Quarter 36.05 30.51 33.58 1 7,278,400 35.73 33.39 33.44 697 Second Quarter 36.28 32.21 34.50 16,636,000 35.89 35.82 35.88 354,770 Third Quarter 36.96 30.29 33.07 20,886,200 35.59 33.58 34.44 87,554 Fourth Quarter 34.48 30.62 30.74 14,478,500 21.02 2 1 .02 30.50 963,271 2012 41 . 1 4 29.26 36.95 88,190,589 40. 1 2 30.24 36.50 746,278 First Quarter 31 .69 29.26 30.36 19,265,880 31 .04 30.24 30.95 236,546 Second Quarter 37.00 30.38 34.83 32,660,280 36.64 30.40 33.70 293,809 Third Quarter 41 . 1 4 34.28 38.93 19,696, 1 2 1 39.78 34.30 39.1 0 88,41 2 Fourth Quarter 41 .00 36.00 36.95 16,568,308 40. 1 2 36.50 36.50 127,5 1 1 September 40.53 37.87 38.93 5,230,487 39. 1 0 39.1 0 39.1 0 50,000 October 41 .00 38.77 40.65 7,922,026 40. 1 2 39.07 39. 1 3 125,444 November 40.58 37.85 38.04 4,922,198 39.45 37.97 38.85 1 ,907

December 38.05 36.00 36.95 3,724,084 36.50 36.50 36.50 160

2013

January 39.89 36. 1 7 39.65 4,652,609 39.00 37.44 39.00 41 9.00

[image:26.595.31.545.215.519.2]February 44.65 39.41 44.46 4,491,895 39.95 39.84 39.95 2,400

Table of Telkom's Stock Price and Trading Volume on the NYSE and LSE

On December 28, 2012, the last day of trading on the IDX in 2012, the closing price for our common stock was Rp9,050 per share.

The high, low, closing prices and trading volume for our ADSs on the NYSE and the LSE for the periods indicated are shown in the table below. Trading in ADSs is efected “of exchange” on the LSE. Under LSE rules, of exchange

trading means that transactions are carried out on other exchanges and once the transaction has taken place, it is reported to the LSE.

On December 31, 2012, the last day of trading on the NYSE and LSE in 2012, the closing price for one Telkom ADS was

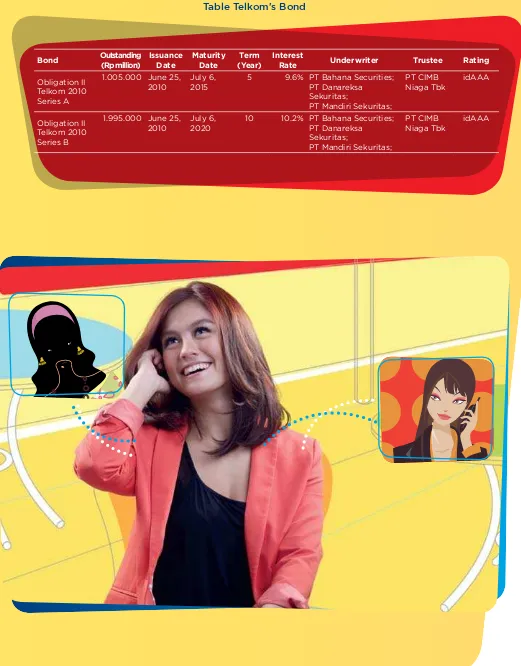

Bond Outstanding (Rp million)

Issuance Date

Maturity Date

Term (Year)

Interest

Rate Underwriter Trustee Rating

Obligation II Telkom 2010 Series A

1.005.000 June 25, 2010

July 6, 2015

5 9.6% PT Bahana Securities; PT Danareksa

Sekuritas;

PT Mandiri Sekuritas;

PT CIMB Niaga Tbk

idAAA

Obligation II Telkom 2010 Series B

1.995.000 June 25, 2010

July 6, 2020

10 10.2% PT Bahana Securities; PT Danareksa Sekuritas;

PT Mandiri Sekuritas;

PT CIMB Niaga Tbk

[image:27.595.43.564.88.754.2]idAAA

01

JANUARY

Telkom is again entrusted by the Ministry of Defense as a provider of Information and Communications Technology (“ICT”) services, particularly in satellite transponder cooperation and data communication network for government agency accounting system (Jarkomta SAI).

04

MAY

1. The General Meeting of Shareholders of Telkom held on May 11, 2012 among other resolutions approves the new formation of its Boards of Commissioners and Directors.

2. On May 22, 2012 the construction of Telkom Landmark

Tower (“TLT”) oicially begins, which is located at the

02

FEBRUARY

After more than 14 years of System Application and Product (“SAP”) implementation, Telkom receives the SAP Customer Center of Expertise (“CCoE”)

certiication, becoming the irst company in Indonesia to achieve SAP CCoE certiication among around 700

corporate or institutional users of SAP in Indonesia.

03

APRIL

Telkom oicially announces its Jatinegara Data Center as Telkom’s irst Green Data Center, with

environment-friendly features such as Zero depletion Refrigerant, Zero depletion FAP, Environment Safe Materials and Energy Saving.

01

04

03

02

E

v

ent

Highlights

05

JUNE

To support the growth of the digital creative industry in Indonesia, Telkom signs a an Agreement of Cooperation for Business Development and Incubation in the area of ICT, participated by 18 communities and software developers that are members of Bandung Digital Valley.

06

JULY

The President Directors of Telkom and Telkomsel at an executive meeting in Jakarta with Steve Wozniak, Co-Founder of Apple, announce that Telkom Group is ready to establish a robust Device-Network-Application (“DNA”) ecosystem and to deliver the best quality broadband technology in Indonesia.

07

AUGUST

1. Telkom and IBM Indonesia agree to cooperate in developing Information Technology (“IT”) services in Indonesia, particularly in providing the best IT solutions to corporate and Micro, Small and Medium Enterprises (“MSMEs”).

2. Telkom facilitates a Video Conference (“Vicon”) on August 29, 2012 at the State Palace that lets Indonesian President, Susilo Bambang

Yudhoyono have a live dialogue

with Liberia President Ellen Johnson and British Prime Minister David Cameron.

08

SEPTEMBER

1. Telkom Indonesia attended the

Investment Day held in New York Stock Exchange ("NYSE") Wall Street, New York on September 24, 2012.

The event was attended by President

Susilo Bambang Yudhoyono which

aims to encourage U.S. businesses to invest in Indonesia.

2. Telkom holds a launching ceremony of Telkom Corporate University on September 28, 2012 as a vehicle for a center of excellence for all employees.

09

NOVEMBER

1. PT Telkom Akses, Telkom's majority-owned subsidiary, is established in November 2012 to support the development of broadband services in Indonesia by Telkom.

2. Synergy in Telkom Group between Telkom-Telkomsel creates an exciting new feature for Telkomsel kartuHalo customers, Groovia Lite, a Mobile

Entertainment service that ofers

digital entertainment such as Live TV, TV on Demand, movies, music, and radio that can be accessed through a

variety of media such as laptops/PCs,

smart phones, and tablets.

10

DECEMBER

Arief Yahya, President Director of Telkom, oiciate the launch of Speedy Instant

Card, Telkom's broadband internet access product, deployed in Bali for initial phase.

05

06

09

10

07

Awards

and

Certiications

Awards

JANUARY

TelkomVision, our PayTV, received the Great Performing Award in Digital Media Award survey, as The Best Market Drive in Marketing Award 2011 survey, and recognized by Indonesia Museum of World Records (“MURI”) as the Pay TV with the highest sales growth (800% within a period of one year).

MARCH

1. International recognition as The Best Environmental Responsibility and The Best Investor Relation Professional in the 2nd Asian Excellence Recognition Award 2012 from the Hong Kong-based Corporate Governance Asia magazine.

2. Award as Leading Company in Promoting Entrepreneurship, for Telkom's commitment in its role as Good Corporate Citizen through the implementation of partnership program with Micro, Small & Medium Enterprises and community development program from Ministry of Cooperative and SME.

FEBRUARY

1. Top Brand award for Speedy, Flexi postpaid and Flexi prepaid in the Top Brand Award 2012 organized by Frontier Consulting Group and Marketing magazine.

2. Second-place award in the Child and Maternal Health in the Private Sector for the implementation of i-CHAT (I Can Hear and Talk/a language

learning application for the deaf) from the Oice of Special Afairs of

the President of Republic Indonesia.

3. Award Silver Winner InMa 2012 for "KILAU" internal magazine for creative cover page, in the IPMA competition organized by the Worker Union of the Press.

Aw

ar

ds

and

Certiica

tions

MAY

Award as The World’s Biggest Public Companies in Forbes Global 2000 polling by Forbes Indonesia magazine.

APRIL

1. Award as The Best CDMA Operator for Telkom through its Telkom Flexi product, as well as The Best GSM Operator and Best Operator of the Year for Telkomsel, a subsidiary of Telkom, in Selular Award 2012 event organized by Selular Magazine, Handphone Tabloid and Selular Online Tabloid from Global Selular Media group.

2. Award in Indonesia Enterprise Risk Management Award 2012 from Business Review magazine.

JULY

1. Gold award in the Telecommunication Industry category, as well as

citations in Top 100 Worldwide, Top 50 Regional in Asia-Paciic, and

Special Achievement Award – The Most Engaging Annual Report, in 2011 Vision Awards Annual Report Competition organized by the League of American Communications Professionals (“LACP”), San Diego, United States.

2. Recognized among the 8 Best Finalists in the Indonesian Most Admired Knowledge Enterprise (“MAKE”) Study 2012 organized by Dunamis Organization Services.

3. Award as Sales Management Champion and as Communication Management Champion, in the Markplus Insight Award 2012 organized by Marketeers magazine in cooperation with PT JIExpo as the organizer of Jakarta Fair and the research institution Markplus Insight.

4. Citation of Social Business Innovation Award for Telkom for Empowering Information and Communication Technology Community and award as The Best Green CEO in the Telecommunication Sector for Arief Yahya, in the Appreciation Night Warta Ekonomi event organized by Warta Ekonomi magazine.

JUNE

SEPTEMBER

Awards for Most Consistent Dividend Policy and Best Strategic Corporate Social Responsibility in the 6th Best Financial Institution Awards and 2nd

Corporate Awards in 2012 organized by Alpha Southeast Asia magazine.

OCTOBER

1. Awards as The Best for All Criteria, The Best for Employee Net Promoter Score, The Best for Human Capital Initiative Employee Self Service, and The Best for CEO Commitment, in the Indonesia Human Capital Study (“IHCS”) 2012 organized by Dunamis Human Capital and Business Review magazine.

2. Award as Indonesia Broadband Service Provider of the Year 2012 in Indonesia Excellence Awards 2012 event organized by Frost & Sullivan.

3. Award as The Best Innovation in the Marketing Award 2012 event organized by Marketing magazine.

DECEMBER

1. Award as Best Sustainability Report 2011 in the Services Sector category as well as runner up position for Best Website 2012, in the Indonesia Sustainability Reporting Award (“ISRA”) 2012 competition organized by the National Center for Sustainability Reporting (“NCSR”).

2. Award as BEST CEO of Most Innovative SOE 2012 for Arief Yahya, President Director of Telkom, in the Anugerah BUMN 2012 event organized by BUMN Track magazine in coordination with Forum Humas BUMN and CIS School of Innovation.

3. Award as Corporate Governance Perception Index The Most Trusted Companies 2012 as a highly trusted company held by The Indonesian Institute for Corporate Governance (“IICG”) in collaboration with SWA magazine based on a survey of investors, analysts and fund managers.

4. Awards for The Best e-Corp, The Best CIO and The Best Future IT Leader 2012 in the Indonesia Digital Summit 2012 event, by SWA magazine.

5. Award as The Preferred Corporation of Newspaper Workers Unions (“SPS”) 2012 in the 1st SPS-Indonesia PR Summit 2012.

NOVEMBER

1. Award as Best Corporate Overall in the 4th Corporate Governance annual survey conducted by the Indonesian Institute for Corporate Directorship (“IICD”).

2. Award in the Telecommunication Industry Sector in the Economic Challenges Award 2012 organized by Metro TV.

1. ISO 9001:2008 Certiication

Issued to PT Telekomunikasi Indonesia Tbk, Divisi Consumer Service

Barat, by TUV Rheinland Cert GmbH in 2011. Valid until 2013.

3. ISO/IEC 27001:2005 Certiication

Issued to PT Telekomunikasi Indonesia Tbk, Grha Citra Caraka

Building, Divisi Infratel M loor and Divisi Access 7th loor, by TUV

Rheinland Japan Ltd, in 2012. Valid until 2015.

5. Customer Center of Expertise Certiication

Issued to PT Telekomunikasi Indonesia Tbk, by SAP, in 2012. Valid

until 2013.

2. ISO 9001:2008 Certiication

Issued to PT Telekomunikasi Indonesia Tbk, Divisi Telkom Flexi, by

TUV Rheinland Cert GmbH in 2011. Valid until 2014.

4. AS/NZS ISO 9001:2008 Certiication

Issued to PT Administrasi Medika (“AdMedika”), Telkom’s indirect

subsidiary, by Veriication New Zealand Limited, in 2012. Valid until

2015.

Report From

The President

Commissioner

Telkom's investments in broadband

networks and triple-play convergence

services provide the necessary access

for Indonesia to improve its competitive

advantages through the adoption of

the latest in science and technology as

well as the creation of an 'innovation

platform'.

Our investments represent an

anticipatory strategic initiative in line

with the continuing growth of Indonesia's

economy. We will strive for increased

value and business sustainability through

investments in efective networks

and infrastructure towards increased

revenues and corporate value for the

Jusman Syaii Djamal

President Commissioner

R

eport Fr

om T

he Pr

esident Commis

R eport Fr om T he Pr esident Commis sioner

Dear Esteemed Shareholders,

In 2012, Telkom succeeded in posting satisfactory

achievements in terms of eforts to improve business growth as well as inancial performance, as compared

to previous year. Telkom also has made substantial investments in telecommunications infrastructure, especially in broadband networks, and in human capital quality improvement. These are evidence of our

consistency in delivering increased value for the beneit

of shareholders.

Developments in Indonesia's telecommunication industry continue in 2012 shown the general trends of stable growth in the cellular business in addition to the increasingly faster growth in broadband and data services. Telkom has its own strategic mission in relation with the development of broadband infrastructures in Indonesia. Beyond the interest of business growth, our initiatives in broadband infrastructure development represent our contribution in integrating all 17,000 islands in this vast archipelago.

Broadband networks development is part of the national connectivity, which is one of the three strategic pillars in the Master Plan for Acceleration and Expansion of Indonesia's Economic Development ("MP3EI") 2011-2025.

The construction of iber optics backbone networks in

the economic corridors in eastern part of Indonesia will be integrated with the existing infrastructure in central and western Indonesia and followed by the construction of broadband connections to households (homepass). In the MP3EI scenario until 2015, the Government of Indonesia has set a target of deploying a national broadband network covering approximately 30% of households in Indonesia. Thus, our commitment to invest in the development of broadband networks holds an important part towards the successful implementation of MP3EI.

The theme of our 2012 Annual Report, "Bringing Indonesia to the Digital Society", is a suitable expression for Telkom's initiatives in investing in broadband networks and convergence or triple-play (voice-data-video) services capability. Eventually, investments in broadband infrastructure will serve to provide better access to people throughout Indonesia in improving their competitive advantages through adoption of science and technology advancement. Through our capital expenditures in broadband infrastructure we are expected to create a "platform of innovation" to drive higher and faster growth of Indonesia's economy.

Board Assessment on the Performance of

Directors

The Board of Directors’ strategic programs in 2012 are focused on three broad areas, namely (i) enhancing our cellular business as the primary contributor to business growth, (ii) construction of backbone infrastructure and broadband networks as a foundation for growth, and (iii) development of new wave businesses as potential sources of new income streams.

The Board of Directors, with the support of the entire

management and staf at Telkom and the Telkom Group,

has shown an exemplary performance. Compared to prior year results, our operating revenues and bottom line have improved considerably, surpassing industry average as well as our initial targets. This achievement is driven by the successful implementation of our strategy in focusing on the cellular business of our subsidiary. The increasing amounts of our capital expenditures over the last few years indicate our consistency to invest in telecommunication infrastructures as a basis for growth of our business. The execution of the Corporate Strategic Scenario, our blueprint for business growth, went according to plan.

Encouraging achievement and progress are also evident in our operational performance. By the end of

2012, preparations for the construction of a iber optics

backbone network in eastern Indonesia, the Sulawesi-Maluku-Papua Cable System project, have been completed, for immediate execution in 2014. This will complement the existing backbone networks in central and western Indonesia. Development of broadband connections to end-user was accelerated through the

deployment of ixed broadband access to households (Fixed to the Home/"FTTH") and WiFi connections.

Users of our data and Internet services, comprising

ixed as well as mobile broadband, were increased signiicantly by 82.8% compared to previous year.

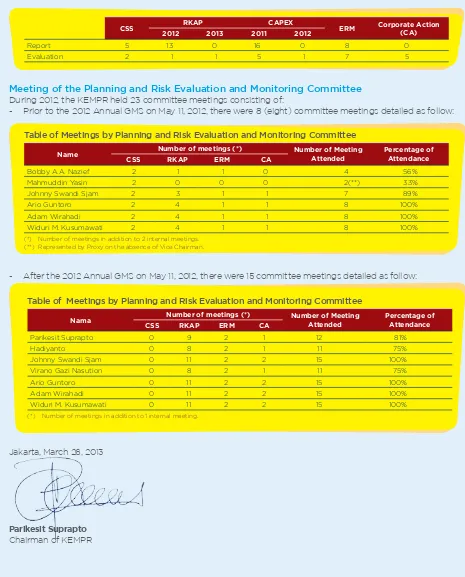

Committees under the Board of Commissioners

The Board of Commissioners has performed its duties in overseeing the Board of Directors in managing the Company throughout 2012. In addition to Commissioner’s internal meetings, our oversight function is also carried out through Board committees in their respective areas of responsibility. The Audit Committee has worked intensively in 2012, among other covers reviewing the independency of the newly appointed external auditors as well as the adequacy

of their inancial audit work plans, and also reviewing

R

eport Fr

om

T

he Pr

esident Commis

sioner

Nomination and Remuneration Committee, inter alia, has proposed candidates for a number of strategic positions at Telkom, and Directors and Commissioners for Telkomsel, and in devising a remuneration formula that can better motivate our Directors in improving

Telkom's proitability. Meanwhile, the Planning and Risk

Evaluation and Monitoring Committee during 2012 has reviewed and monitored the updating of the Corporate Strategic Scenario as our long-term plans, the progress of our capital expenditure deployment and actions by the Board of Directors that need the approval of the Board of Commissioners.

Corporate Governance

Implementation of the oversight function of the Board

of Commissioners is part of ongoing eforts in improving

the quality of Good Corporate Governance ("GCG") practices at Telkom. As a public company whose shares

are also listed at the New York Stock Exchange, Telkom

has long been exposed to high standards of GCG systems and mechanism, such as those related to transparency, mandatory disclosures or accuracy of information. We believe that world-class best practice standards of GCG

will prove to be an efective asset for Telkom to manage

changes in the business cycle and business ecosystem, as well as in mitigating the impact of risks in our business. This is particularly important in an industry and business

environment that is highly afected by market dynamics,

product and services lifecycle, changing regulations and also tighter competition.

The Outlook on Our Business

Compared to conditions a few years ago, current competition among telecommunication operators is healthier, although industry players and telecommunication regulators in Indonesia should anticipate and remain alert for the reoccurrence of a price war. Meanwhile, the immediate challenge for Telkom and telecommunication operators in general is to explore new business models that can accommodate the increasing prevalence of services in social media today. Commonly seen as complementary services to the products and service provided by telecommunication operators, social media services may actually become a threat to the revenue streams of telecommunication operators who have invested in telecommunications network infrastructure.

Our development of new wave businesses in the media industry represents an initiative to anticipate of the above challenge. Concurrently, Telkom will consistently

invests in the development of broadband infrastructure in Indonesia, both as our mission for the nation and as our growth strategy for going forward. Telkom will also push forward with the monetization of completed broadband infrastructure, mainly through the deployment of WiFi access in the Indonesia WiFi program. Also noteworthy is the initiative of the Board of Directors to mold Telkom into a 'learning organization' through the establishment of a Corporate University in developing the capabilities of our human capital as the primary capital for our sustainable existence into the future.

Telkom's current Board of Directors is comprised entirely of internal leadership talents. It is selected from the Company's best and brightest talents that have been groomed from tiered expertise accumulation processes through a series of work rotation, job mutation and internal selection. With all that potentials, the Board of

Commissioners is conidence in the ability of the Board

of Directors to achieve the set targets for 2013 and continue to lead Telkom into sustainable growth.

Changes in the Board

I would like to take this opportunity to express gratitude to my former colleagues in the Board of Commissioners,

Mahmuddin Yasin, Bobby AA Nazief and Rudiantara, for their ine work and contribution during their tenure with

the Board. In their place, I would like to welcome Parikesit Suprapto and Hadiyanto as Commissioner, and Virano Gazi Nasution as Independent Commissioner, who have joined the Board of Commissioners of Telkom.

Appreciation to All Our Stakeholders

On behalf of the Board of Commissioners, I want to

sincerely thank the Directors and all staf at Telkom

for their dedication to the successful transformation of Telkom into a company that continue to generate higher value for shareholders. The Board of Commissioners would also like to appreciate the shareholders and all our other stakeholders for their continuing trust and support to Telkom.

Jusman Syaii Djamal

Report From

The President

Director

Our growth strategy is based

on the principle of 'irst thing

irst' as well as focus on growth

areas. In 2012, this strategy is

outlined through the appropriate

allocation of Company's resources

for investments in our people,

in growing our cellular business,

and in expanding broadband

Arief Yahya

President Director

R

eport Fr

om

T

he Pr

esident Dir

ect

Dear Esteemed Shareholders,

We are pleased to report that Telkom has achieved much progress on its strategic transformation into a dominant provider of Telecommunications, Information, Media, Edutainment and Services ("TIMES") in Indonesia and a leading presence in the region. We are further encouraged that the transformation has begun to demonstrate the expected results as evidenced from

our inancial and operational achievements throughout

2012.

Financial Performance

Telkom ended year 2012 by posting a most satisfactory

inancial performance growth, in revenues as well as in proitability, which were surpassed the industry

average. Compared to prior year results, consolidated revenues grew by 8.3% to Rp77.1 trillion in 2012, derived mainly from a growth of 7.5% in revenues from our cellular business, which contributed 39.8% to our total consolidated revenues. EBITDA increased by 9.1% to Rp40.2 trillion, providing an EBITDA margin of 52.1%.

In terms of proitability, Telkom recorded an increase

of 17.2% in net income, from Rp11.0 trillion in 2011 to Rp12.9 trillion in 2012. This amount represents Return on Assets ("ROA") and Return on Equity ("ROE") of 11.5% and 24.9%, respectively, compared to 10.6% and 24.9%, respectively, in 2011. Net income per share in 2012 amounted to Rp669, an increase of 19.6% over the

previous year igure.

Related to our inancials, we would also like to report the

completion of our share buy-back program phase IV in 2012, involving 520,355,960 shares worth of Rp3.8 trillion, representing 76% of program target. Through the share buy-back program, we aim to increase shareholders' value and utilize the Company's current positive cash

lows for future capital funding needs. Meanwhile,

Telkom's capital expenditure deployment during 2012 amounted to Rp17.3 trillion, with approximately 50% of which is used for expansion of radio access network in support of our cellular business.

Telkom's strong fundamentals with excellent

performance ultimately relected on the performance

of our stocks in 2012 with market capitalization at the Indonesia Stock Exchange grew by 28% and our stocks closed at Rp9,050 per share, compared to Rp7,050 a year earlier.

Overall, our excellent inancial achievements in 2012 also

exceeded the initial targets as set out in our Work Plan and Budget for 2012.

2012 Growth Strategy

The excellent achievements described above are the result of Telkom's strategy to carried out a fundamental business transformation, as our response to the dynamic changes that have occurred and continue to occur in this globalization era. Currently, the telecommunication industry has shifted into broadband

(data and Internet) services, for both mobile and ixed

broadband services, with mobile broadband such as 3G and WiFi access experienced highest growth. At the markets side, we observed the emergence of convergence (multi-play and multi-screen) services in the consumer segment and enterprise mobility services in the business or corporate segment.

Our growth strategy is broadly based on the principle

of 'irst thing irst' and focused on future anticipated

growth areas. In 2012, this strategy is implemented by allocating our resources primarily for investments in human capital, in increasing our cellular business and in expanding our broadband penetration in Indonesia.

Center of Excellence

Investing in human capital is an essential requisite, as Telkom's business transformation requires transformation of our corporate culture and work ethics. Telkom should be able to mobilize its human capital in order to prepare for, embrace and drive of changes. Meeting the challenge of changes should become embedded in the mindset and behavior of each our employees. One of our strategic initiatives in this area involves the establishment of Telkom Corporate University ("Telkom CorpU") in 2012.

The establishment of Telkom CorpU represents a means towards realization of Telkom as Center of Excellence, as stated in our Corporate Strategic Scenario. There

are three primary functions of Telkom CorpU: irstly,

as a center of chiefship in creating world-class great leaders; secondly, as a center of competence in creating

great people; and thirdly, as a center of certiication in

creating a human capital pool with global standards. Thus, Telkom CorpU becomes a strategic channel to improve our comparative advantage as a Competence Centric Company.

This program represents Company’s long term investment and is expected to create excellent business leaders as well as competent and professional human

capital with international-standard certiications. In

2012, our initiatives cover the Global Talent Development Program, in which 109 employees are sent to participate in a variety of job assignments with a number of telecommunication companies in Australia, Singapore,

Hong Kong and Timor Leste. These personnel are expected to experience exposure to current best practice and latest future-oriented technologies, in addition to building network and partnership in each of the company they are assigned to, related to the potential value chain of Telkom’s overseas businesses.

In 2012, we have sent 473 employees to participate in

various international-standard professional certiication

programs. As part of Telkom CorpU and being a center of excellence, we have also established the Telkom

Professional Certiication Centre ("TPCC"), which

intended for global recognition as a national and

international certiications institution. Going forward,

we will strive to equip each of our competences, work processes and operations with their own standard

certiication. A ine example of this is the Customer Center of Excellence certiication issued by SAP that was received for the irst time by Telkom in 2012.

Winning Telkomsel

Telkomsel, one of our subsidiaries, is still the main

contributor to our business. In line with the 'irst thing irst' principle, Telkom has established the Team

Operation Support (“TOS”) Telkomsel that focuses on

aligning and ine-tuning the work programs at Telkom

so as to provide the best support to our cellular business

provided by Telkomsel. In 2012, these eforts cover the

improvement of Telkom's networks quality in Jakarta, Central Java and Bali to increase Telkomsel's market share in those regions, and also the development of broadband network in 100 cities in Indonesia aimed for grow in volume of Telkomsel's data communications business.

These eforts have generated encouraging results, as evidenced in the improvement of Telkomsel's inancial

performance until year-end 2012 as mentioned above. In 2012, Telkomsel's revenue, EBITDA and net income grew

signiicantly by double digit of 11.9%, 10.9 and 22.5%,

respectively, in contrast with previous two years which only posted single-digit growth. In terms of operational achievements, Telkomsel's cellular customer base recorded an increase of 16.9% to approximately 125.1 million customers at year-end 2012, which represents market share of approximately 45.3%. Telkomsel's data communications services, delivered through its wireless broadband service (Flash) and Blackberry service, also recorded strong growth of approximately 99.5% and 82.8%, respectively.

Indonesia Digital Network

Meanwhile, the development and expansion of our broadband networks represent our focus on future industries growth. The strengthening of broadband-based infrastructure is to support innovations in products and services toward the Information, Media, Edutainment and Services (“IMES”) businesses, which will provide the Company with new sources of income. Beyond that, we also engage in the development of broadband networks as a direct contribution to the progress of the national economy and the quality of the people of Indonesia, by supporting the objectives of the Master Plan for Acceleration and Expansion of Indonesia's Economic Development ("MP3EI") 2011 - 2025 programs initiated by the Government of Indonesia. Towards this end, Telkom in 2012 launched an initiative for the development of Indonesia Digital Network ("IDN"), whose components comprised of Indonesia Digital Access Access”), Indonesia Digital Ring (“id-Ring”) and Indonesia Digital Convergence (“id-Con”).

The development of broadband networks is part of initiatives in strengthening the national connectivity, which is one of the three core pillars in MP3EI. The objective of MP3EI is to develop a national broadband network that covers 30% of Indonesia's households, or approximately 20 million end customers by 2015. Through id-Access, Telkom will support the target through the

deployment of high-speed broadband access via iber

optics networks that can provide 15 million broadband connections to households (homepass), as well as the provision of a million WiFi access points that can serve up to 10 million end-users. Up until the end of 2012, we have been successful in deploying 4.7 million homepass connections in support of our new product, Speedy Instant. As part of the development of id-Access, we

also went ahead with our ixed wireline modernization

program by replacing the copper cable connections to

households with iber optics cable using the Trade-In Trade-Of (“TITO”) scheme.

The second component of IDN, namely id-Ring, is previously known as the Telkom Nusantara Super Highway program, and represents Telkom's contribution to the Government's Palapa Ring initiative to connect all the regions in the Nusantara archipelago through

a iber optics backbone network of submarine and

ground cables. The Palapa Ring project will integrate the existing networks with a network to be built in eastern Indonesia, namely the Submarine Cable System ("SCS")

Sulawesi-Maluku-Papua connecting Kendari, Ambon, Ternate, Jayapura and Merauke. Currently, Telkom already

operates iber optics backbone networks connecting

points from Banda Aceh to Kupang. This includes the Mataram-Kupang segment that built in 2012. Through the id-Ring initiative, Telkom is committed to develop

iber optics-based as well as IP (Internet

Protocol)-based backbone networks, involving the deployment of 30 terra router nodes and approximately 75,000

kilometers of iber optics cable. A consortium of

telecommunication operators, including Telkom with a 40% investment portion, will undertake the construction of the Sulawesi-Maluku-Papua SCS. The tender process for the project was completed near the end of 2012, and actual construction is expected to begin in 2013.

Overall, Telkom allocated approximately Rp1,864 billion for capital expenditure spent in 2012 for the development of backbone and broadband networks. Organization-wise, Telkom is now better able to focus on the various broadband business segments through the establishment of the Broadband Division, the Wireless Broadband Division, and a new subsidiary, PT Telkom Access. The improvement in the capacity and quality of our broadband networks has resulted in an increase in subscribers number of our data and Internet product, Speedy, to 2.3 million subscribers. In 2012, Speedy contributed Rp4.2 trillion in revenues.

Meanwhile, the id-Con initiative represents our efort

to build a convergence platform for broadband-based multi-services and multi-screen products and services in Telkom's IMES business portfolio. These businesses, known as our new wave business, represent our future growth areas and we devoted considerable attention on this development in 2012.

The Digital Society

With the id-Con, Telkom is building an ecosystem of IP-based technology convergence services that will run over a broadband infrastructure, catering to the needs of both consumer as well as business customers. In the consumer segment for individual as well as household consumption, Telkom will focus on the media and edutainment businesses. At present, Telkom already possesses a range of mobile broadband services, and will continue to enhance such services with attractive contents such as music, video and other types of contents. Our IPTV product, the Groovia TV, recorded a satisfactory growth with the addition of some 33,600 new subscribers in 2012. We will develop this service further on the UseeTV platform, aiming to deliver pay-TV services at home or at any place else, accessible through customers' mobile devices.

For our business customers, Telkom will continue to deliver on-demand IT solutions through our cloud computing services. In 2012, Telkom has strengthened its Telkom Cloud capabilities with the acquisition of a new data center at Sentul, while also developing our call center services as well

as new product oferings such as e-Health, e-Education

and e-Tourism. In this segment, we also have machine-to-machine service platform, which Telkom already provides a payment service under the brand Delima. In 2012, we initiated partnerships with a number of banks to capitalize on the high penetration of cellular services in Indonesia,

in order to promote inancial inclusion in serving whole

segments of the society that are as yet outside the reach of the banking industry.

Through id-Con, along with id-Access and id-Ring as the other elements of IDN, Telkom is focusing on developing new wave businesses in the IMES portfolio. This is our answer in response to the increasingly visible global trends toward a converging ecosystem of Device-Network- Application ("DNA") technologies. The phrase "Bringing Indonesia to

the Digital Society" is thus a itting theme for Telkom's 2102

Annual Report.

Corporate Governance

Telkom adheres at all times to high standards of Good Corporate Governance ("GCG") practices, and

particularly in aspects of inancial reporting, in order to

improve our transparency as well as to facilitate impartial assessment of company value by investors and analysts. An important development in this area is the preparation

and presentation of our inancial statements on the basis

of International Financial Reporting Standards ("IFRS").

We have applied these standards for the irst time in our 2011 inancial statements and, in 2012, we have continued

with the next step, i.e. the 'sustain' phase. In this phase, we developed and put into operations the necessary support systems for IFRS implementation, established the required transition process from the 'sustain' phase

to 'business as usual' phase, as well as identiied and

reviewed new IFRS standards as they continue to evolve. At the same time, Telkom is also active in supporting the implementation of IFRS by our subsidiaries in the Telkom Group.

Our continuing irm commitment to the practice of

GCG was recognized by a variety of external parties. In 2012, Telkom received for the fourth consecutive year an award as 2012 Most Trusted Company in the Corporate Governance Perception Index survey by the Indonesian Institute for Corporate Governance ("IICG"). We were also recognized as Best Corporate Overall in a survey conducted by the Indonesian Institute for Corporate Directorship (“IICD”) of GCG practices among 100 publicly-listed companies with the largest market capitalization at the Indonesia Stock Exchange.

Corporate Social Responsibility

Telkom realizes that its continuing existence as a business

entity also depends on how well we can be of beneit

to communities and the environment, in what is more commonly known as Corporate Social Responsibility ("CSR") engagement. For the most part, Telkom delivers its CSR commitments through the Partnership Program, involving the disbursement of revolving loans as well as other activities in support of the Small and Medium-scale Enterprise ("SME") sector, and the Community Development program to help promote better welfare of communities through a variety of activities in the areas of education, healthcare, public facilities, and environment preservation. In 2012, total funding allocated to the Partnership Program and the Community Development Program ("PKBL") amounted to Rp404.9 billion. In addition, Telkom also provides humanitarian assistance to victims of natural disasters through its Telkom Peduli (literally, Telkom Care) program, as well as through its participation in the BUMN Peduli program organized by the State Ministry of State-Owned Enterprises.

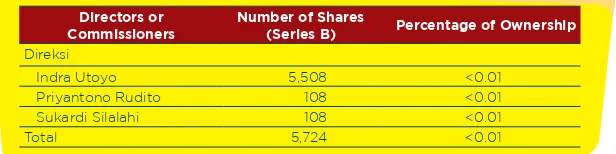

Changes in the Board of Directors

The Annual General Meeting of Shareholders ("AGMS") of Telkom held on 11 May 2012 has appointed new Board

members to replace those whose term of oice have

ended in 2012. I have the honor of continuing to serve in the Board replacing Rinaldi Firmansyah as President Director, while Indra Utoyo was to serve a second term in his current position. The AGMS has appointed Honesti Basyir, Muhammad Awaluddin, Ririek Adriansyah, Priyantono Rudito, Rizkan Chandra, and Sukardi Silalahi

to ill the other Director posts in the Board, whose

membership thus remained unchanged with eight Directors.

On behalf of the entire management and staf at Telkom,

I would like to take this opportunity to thank the former Directors in the Board, namely Rinaldi Firmansyah, Sudiro Asno, Faisal Syam, Ermady Dahlan, I Nyoman G. Wiryanata and Prasetiyo. They all have worked hard in building a solid foundation for Telkom's transformation, as our strategy to sustain growth into the future.

Our Challenges

While we succeeded in achieving satisfactory inancial

performance, the year 2012 also brought a number of challenges for us. Among those challenges are the threat of convergence service by global technology companies as content provider, entering the telecommunications

business - which is Telkom's core business - through the provision of complementary telecommunications services for customers for free, and also the proliferation of over-the-top ("OTT") services from smartphone devices that increasingly provide other communications facilities in addition to voice and message texting ("SMS").

Prospect in 2013

Telkom is highly optimistic over its business prospects. In 2013, we will continue to focus on supporting Telkomsel as our current growth engine with good prospects ahead, mainly through the expansion of Telkom's broadband infrastructure with a target of deploying 10 million homepass, 5 million Speedy, and one million WiFi connections. At the same time, we will continue to build our capabilities in the IMES portfolio, and especially in the Media business for the consumer segment as our intended future growth driver. Telkom is also looking to expand its international presence further into certain regions with suitable growth opportunities for our businesses such as in Macau, Taiwan and Myanmar. In addition, we are considering the prospect of delivering increased value to shareholders by unlocking the value of a number of our business units such as our telecomm tower and our international businesses.

Words of Appreciation

In closing, allow me on behalf of the Board of Directors

to extend our highest appreciation to the entire staf

at Telkom, as it is your dedicated hard work that has enabled such impressive achievements and performance for Telkom in 2012. I would also like to thank the Board of Commissioners for their guidance and direction. To our shareholders, business partners, loyal customers and all other stakeholders, thank you for your continuing trust and support for Telkom.

Victorious Indonesia Victorious Telkom Indonesia

Arief Yahya

President Director/