REPUBLIC OF INDONESIA

Recent Economic Developments

Published by Investors Relations Unit –Republic of Indonesia

Address Bank Indonesia

International Directorate Investor Relations Unit

Sjafruddin Prawiranegara Building, 5thfloor Jalan M.H. Thamrin 2

Jakarta, 10110 Indonesia

Tel +6221 381 8316

+6221 381 8319 +6221 381 8298 Facsimile +6221 350 1950

E-mail Elsya Chani: elsya_chani@bi.go.id Firman Darwis: firman_darwis@bi.go.id

Table of Contents

I. Executive Summary

II. Indonesia Story: as Acknowledged by Rating Agencies

Executive Summary

The economy grew

by 6.2% in Q2-2010. The whole year it forecasted to grow within the range of 5.5%-6.0% by the end of 2010, and estimated to reach the upper limit projection, bolstered by Indonesia's external sector performance, investment, and consumer spending. The latest macro economic indicators supported us to believe that the economy, in line with the development in the global economy, is steadily moving on an upward trend accompanied by financial system stability. It bolstered Indonesia's external sector performance and investment, with domestic recovery gaining strength as the economy is no longer reliant solely on consumption. The optimism also supported by the latest development in the

perception

indicators such as a sovereign rating upgrade to investment grade by Japan Credit Rating Agency, narrowing yield spread, lower CDS, improving Credit Risk Classification by the OECD, etc. An assessment of the economic developments during July 2010 points to improvement in the domestic economy amid persistent risks of global uncertainties. Japan Credit Rating Agency (JCR) on July 13th2010 upgraded Indonesia's

sovereign rating

to Investment Grade, from BB+ to BBB-.This upgrade was the first investment grade for Indonesia in 13 years. Currently, the Republic of Indonesia’s sovereign rating BB+ /Stable from Fitch, BB+/Stable from R&I, BB/Positive from S&P, and Ba2/positive from Moody’s. On the monetary policy front, the latest Board of the Governors Meeting of Bank Indonesia convened in August 2010 resolved to hold the policy rate,

BI Rate

at 6.5%. For the time being, the current rate considers adequate to safeguard future inflation expectations. However, Bank Indonesia is taking careful note of the recent onset of higher inflationary pressure and will pursue the necessary monetary and banking policy actions to ensure that future inflation remains on track with the established target at 5%+1% for 2010 and 2011. Bank Indonesia will soon respond with measures to tighten liquidity management without disruption to the bank intermediation function, implemented through changes in the statutory reserve requirement. Regarding prices, the Board of the Governors is closely monitoring the onset of

rising inflationary pressure.

July 2010 recorded fairly brisk CPI inflation at 1.57% (mtm) or 6.22% (yoy). Inflationary pressure was driven mainly by higher inflation in the foodstuffs category and particularly rice, due to seasonal uncertainties. In contrast, pressure from core inflation has been kept at modest levels as a result of adequate supply-side response to increases in demand and the appreciating trend in the exchange rate.Executive Summary

Overall, banking industry remains in a stable condition and convinced to be run prudently, which is reflected in the well-maintained Capital Adequacy Ratio of 17.4%, and safe level of Non-Performing Loans at 3.3%, as of end of June 2010. By end of 2010, lending growth is projected to reach 22%-24%. Up to July 2010, banking industry has reached the remarkable lending growth at 19.6%. Improved market confidence also bring more optimism to further

banking intermediation function.

Going forward, BI will keep a close watch on bank lending growth to keep it within the range envisaged in the Bank Business Plans. Special efforts will be devoted to increase credit for productive purposes. The purpose of these measures is to ensure that demand-side increase will be adequately offset on the supply-side and thus not generate excessive inflationary pressure.

Balance of payments

on Q2-2010 has posted a significant surplus of US$5.4 billion. The surplus was contributed from both the current account and capital and financial account. The current account posted a US$1.8 billion surplus, bolstered from upbeat performance in non-oil/gas trade balance, the gas trade balance and the current transfers balance. The ongoing world economic recovery has strengthened non-oil/gas exports with growth outperforming non-oil/gas imports. The capital and financial account recorded a US$3.3 billion surplus distributed fairly among all major components. renewed growth in capital inflows in response to the upward revision of the credit rating outlook and more upbeat international perceptions.

International reserves.

By end of Q2-2010, the foreign exchange reserves had increased to USD76.3 billion. The reserves continued to increase to reach USD78.8 billion on 30 July 2010, equivalent to 6.03 months of imports and servicing of official external debt. This helped the rupiah to maintain stable movement throughout July 2010 with an appreciating trend.Indonesia Story: as Acknowledged by Rating Agencies

Resilient economy, which impressively navigates through the global crisis and with growing confidence in economic outlook, the Republic continued to receive good reviews, especially from Rating agencies

Japan Credit Rating Agency, Ltd (July 13, 2010): upgraded Indonesia's sovereign rating to Investment Grade from BB+ to BBB- with stable outlook.The first upgrade to reach investment grade in the last 13 years reflects enhanced political and social stability, sustainable economic growth , alleviated public debt burden as a result of prudent fiscal management, reinforced resilience to external shocks stemming from the foreign reserves accumulation and an improved capacity for external debt management and efforts made by the current administration to outline the framework to deal with structural issues such as infrastructure development.

Moody’s Investors Service (June 21, 2010): revised the outlook of Indonesia’s foreign and local-currency Ba2 sovereign debt ratings to positive from stable. The positive outlook broadly reflects the country's capacity for sustained strong growth, the overall stability and effectiveness of its fiscal and monetary policies, and expectations of further improvements in the government's financial and debt position.

OECD (April 2, 2010): upgraded Indonesia’s Credit Risk Classification (CRC) from category 5 to 4. This upgrade was a timely acknowledgement by the developed economies of the consistent economic improvement. This upgrade would significantly improveIndonesia’scredit standing in front of the creditor countries especially the credit exports creditor countries which eventually would decrease the debt burden.

S & P (March 12, 2010): upgraded Indonesia’slong-term foreign currency rating to BB from BB- with positive outlook which indicates that Indonesia has big possibility to be upgraded within a year, even maybe faster. The main factor supporting this decision is steadily improving debt metrics and growing foreign currency reserves which reduced vulnerability to shock with continued cautious fiscal management.

Fitch Ratings (January 25, 2010): upgraded the Republic of Indonesia’s sovereign rating to ‘BB+’ from ‘BB’ with stable outlook The rating action reflects Indonesia’srelative resilience to the severe global financial stress test of 2008-2009 which has been underpinned by continued improvements in thecountry’s public finances.

Indonesia Development Policy is based on a

‘Triple

Track

Strategy’

1st

Pro-Growth:

Increase Growth by prioritizing export and investment

2nd

Pro-Job :

Boost up the real sector in order to create jobs

3rd

Pro-Poor:

Revitalize agriculture, forestry, maritime, and rural economy

to reduce poverty

Real Sector: Indonesia Development Policy

Economic Growth Sustained

(*): Preliminary

Source: Ministry of Finance, BPS.

Economic data up to end of Q1-2010 supported us to believe that the economy, in line with the development in the global economy, is moving toward better development than we previously expected on the beginning of this year. The optimism also supported by latest development in the perception indicators such as yield spread, sovereign rating, CDS, CRC-OECD, etc. On the backdrops, in the end of Q1-10, BI revised economic growth outlook for 2010 and 2011 to be consecutively within the range of 5.5-6.0% and 6.0-6.5%.

In the 2nd quarter of 2010, the Indonesian economy grew 6.2% (yoy), higher than forecasted at 6.0% and higher than previous quarter (5.7%). The growth driven mainly from investment and consumer spending. The economy is projected to grow within the range of 5.5-6.0% for 2010, and is forecasted to reach the upper limit projection, bolstered by Indonesia's rising export performance, investment, and continued strength of consumption.

Indonesia’s economic growth is steadily moving on an upward trend.

9 Source: Bank Indonesia.

Sustainable Economic Growth

0.0 1.0 2.0 3.0 4.0 5.0 6.0 7.0

2006 2007 2008 2009 Q1-2010 Q2-2010

5.5

6.3 6.0

4.5

5.7

Stable rupiah is expected to damp pressure from higher commodity prices and pave the way for lower inflation expectation. From domestic side, in addition to administered price, subtle inflationary pressure would also be the result from higher demand along with higher economic growth while production capacity remain adequate to respond to higher demand. Those conditions is projected to be reflected in inflation rate at 5+1% in 2010.

BI is closely monitoring the onset ofrising inflationary pressure.July 2010 recorded fairly brisk CPI inflation at 1.57% (mtm) or 6.22% (yoy). Inflationary pressure was driven mainly by higher inflation in the foodstuffs category and particularly rice, due to seasonal uncertainties. This pressure is considered temporary. In contrast, pressure from core inflation has been kept at modest levels as a result of adequate supply-side response to increases in demand and the appreciating trend in the exchange rate. Accordingly, the most important factors in mounting inflation are seasonal, requiring action to safeguard against increased expectations of future inflation.

Future inflationary pressure until end of 2010 is predicted mainly from higher electricity tariff, upcoming Ramadhan festivities and higher food prices associated with seasonal uncertainties.

Going forward in 2011, inflationary pressures could be spurred by an increasingly limited capacity. BI will keep a close watch on the rising inflationary pressure and make the necessary adjustments to monetary policy responses to ensure that inflation remains on track with the established targeting range at 5%+1% in 2010 and 2011.

Inflation

10 Source: Bank Indonesia

Inflation Inflation Expectation –Consensus Forecast

1.57 5.27 6.71 9.17 6.22 -5 0 5 10 15 20 Ja n F e b M a r A p r M a y Ju

n Jul

A u g S e p O ct N o v D e c Ja n F e b M a r A p r M a y Ju

n Jul

A u g S e p O ct N o v D e c Ja n F e b M a r A p r M a y Ju

n Jul

A u g S e p O ct N o v D e c Ja n F e b M a r A p r M a y Ju n e Ju ly A u g S e p O k t N o v D e s Ja n F e b M a r A p r M a y Ju

n Jul

2006 2007 2008 2009 2010

Monetary Policy Stance

BI Rate

11

Since December 2008, BI has slashed BI Rate by 300 bps. The monetary relaxation has offered ample support for the economic recovery process and bank intermediation.

In the latest Board Meeting convened in August 2010, BI Rate is kept at 6.50%. For the time being, BI considers the 6.5% BI

Rate adequate to safeguard future inflation expectations while closely monitoring the recent rise in inflation. However, we are taking careful note of the recent onset of higher inflationary pressure and will pursue the necessary monetary and banking policy actions to ensure that future inflation remains on track with the established target at 5%+1% for 2010 and 2011.

Source: Bank Indonesia. 6.5

9.90

6.27 8.25

4 5 6 7 8 9 10 11

Jan-08 Mar-08 May-08 Jul-08 Sep-08 Nov-08 Jan-09 Mar-09 May-09 Jul-09 Sep-09 Nov-09 Jan-10 Mar-10 May-10 Jul-10

Balance of Payments: Q2-2010

Balance of Payments

• Indonesia's Q2-2010 balance of payments posted a significant surplus at US$5.4 billion (Q1-2010: US$6,6 billion surplus). Key to this surplus were positive contributions from the current account and the capital and financial account.

• The current account in Q2-2010 posted a surplus of about US$1.8 billion (Q1-2010: US$2,1 billion surplus). Bolstering this surplus was upbeat performance in the non-oil/gas trade balance, the gas trade balance and the current transfers.

• The capital and financial account in Q2-2010 recorded a surplus at US$3.3 billion (Q1-2010: US$4,3 billion surplus). All major components of the capital and financial account, encompassing direct investment, portfolio investment and other investment, recorded surplus.

• Accordingly, international reserves at end Q2-2010 mounted to US$76.3 billion, equivalent to 5.8 months of imports and servicing of official external debt.

Sound Banking Sector

Protected by prudential guidelines and conservative practices, the Banking Sector has weathered the global financial turmoil and posted good performance : strong solvency, contained risk exposure and profitability

financial system stability up to July 2010 is well maintained, confirmed by Financial Stability Index (FSI) which was recorded at 1.84 (slightly lower than June 2010 at 1.87). The decrease indicates lower pressure to the financial system which mainly came from lower credit risk and lower volatility in the financial market.

Banking industry remains in a stable condition and convinced to be run prudently, which is reflected in the well-maintained Capital Adequacy Ratio (17.4%, as of end of June 2010) and safe level of Non-Performing Loans at 3.3%, as of end of June 2010.

Intermediary function is steadily improving reflected from 19.6% (yoy) lending growth recorded in end of June 2010.Sufficient CAR (%) Sound level of NPLs (%)

13 Source: Bank Indonesia.

20.5

19.3

16.2

17.4

19.3 19.1 19.2

17.8 17.4

-5.0 10.0 15.0 20.0 25.0

Dec-06 Dec-07 Dec-08 Dec-09 Feb-10 Mar-10 Apr-10 May-10 Jun-10

4.6 4.6

3.8 3.8 4.0 3.8

3.5 3.6

3.3 3.6

1.9

1.5

0.9 1.0 1 0.9 1 0.8

-0.5 1.0 1.5 2.0 2.5 3.0 3.5 4.0 4.5 5.0

Dec-06 Dec-07 Dec-08 Dec-09 Feb-10 Mar-10 Apr-10 May-10 Jun-10

14

In 2010, the Indonesian economy is positioned to grow higher

GDP Growth

is forecasted to be at the upper limit of

5.5%-6.0% projection

With more upbeat confidence to the economy, exports and investment are expected to keep climbing, providing additional boost to mounting consumption in support of higher levels of economic growth.

2010 Forecast Main Factors Behind The Forecast

14 Source: Bank Indonesia.

Inflation

is estimated to be on target at range of

5.0% 1%

Signs of future inflationary pressures until end of 2010 are noted, which mainly predicted from administered prices and volatile food seasonal uncertainties. However, BI is positive to contain the inflation level within the target range, and will keep a close watch on the rising inflationary pressure and make the necessary adjustments to monetary policy responses to ensure that inflation remains on track with the established targeting range at 5% 1% in 2010 and 2011.

Export

is expected to chart higher growth

Global economic recovery will produce renewed acceleration in exports. The global economy is predicted to enter

an expansionary phase in 2010. Renewed momentum is predicted in the economies of Indonesia’s major trading

partners, such as China. This strengthened performance will position exports as one of the main engines of economic growth in 2010.

Indonesian exports characteristics which is based on primary commodities has also supported export growth acceleration.

Private

Consumption

will remain strong

Household consumption is forecasted to remain strong. The strengthening global economic outlook for 2010 will

given added momentum to Indonesia’s exports, which in turn will produce an overall increase in private incomes.

Banking system stability held firm amid the onset of renewed credit expansion (data as of June 2010)

Main Banking Indicators

15 Source: Bank Indonesia

* Preliminary figures, operational risk is calculated in June 2010 figures

Earning Assets (T Rp) 1,353.2 1,556.2 1,792.0 2,170.9 2,385.0 2,347.9 2,368.3 2,416.4 2419.4 2,452.4 2,528.5 - Loans (T Rp) 730.2 832.9 1,045.7 1,353.6 1,470.8 1,435.7 1,459.7 1,485.9 1,516.0 1,561.2 1,615.8 - Bank Indonesia Certificates (T Rp) 54.3 179.0 203.9 166.5 212.1 241.1 237.4 221.5 255.4 253.6 224.3 - Overnight Placements at BI (T Rp) 53.1 38.6 46.8 71.9 84.4 77.7 57.1 82.5 43.2 47.0 97.0

- Securities 350.5 342.9 350.2 358.5 346.2 338.5 347.5 350.6 331.7 333.3 327.1

- Inter-bank Placements 159.1 156.8 139.8 213.8 261.5 244.5 255.9 264.9 262.7 246.6 252.9

- Equity Investments 6.1 5.9 5.6 6.6 10.0 10.4 10.7 11.0 10.4 10.6 11.4

Net Interest Income (Cummulated) 70.9 83.1 96.4 113.1 129.3 12.7 24.1 36.1 48.2 60.3 73.1 Capital Adequacy Ratio (%) 19.5 20.5 19.3 16.2 17.4 19.2 19.3 19.1 19.2 17.8* 17.4 Loans/Earning Assets (%) 54.0 53.5 58.4 62.4 61.7 61.1 61.6 61.5 62.7 63.7 63.9 Gross Non Performing Loans (%) 8.3 7.0 4.6 3.8 3.8 3.9 4.0 3.8 3.5 3.6 3.3 Net Non Performing Loans (%) 4.8 3.6 1.9 1.5 0.9 1.1 1.0 1.0 0.9 1.0 0.8 Return on Assets (%) 2.6 2.6 2.8 2.3 2.6 3.1 2.9 3.0 2.9 2.9 2.9 Net Interest Margin (%) n/a 5.0 5.0 5.0 5.0 5.0 5.0 5.0 5.0 5.0 5.0 Ops. Expense/Ops. Income (%) 87.7 86.4 78.8 84.1 81.6 86.3 82.9 83.6 84.8 84.3 84.8 Loan to Deposit Ratio (%) 64.7 64.7 69.2 77.2 74.5 73.7 75.6 75.0 76.5 77.5 77.1

No. of Banks 131 130 130 124 121 121 121 121 121 121 N/A

No. of Bank Office Network 8,236 9,110 9,680 10,936 12,971 13,004 13,048 13,067 13,078 13,092 N/A

Overview of Fiscal Policy for 2009 and 2010

Continue an effective fiscal stimulus 2009 (1.4% GDP), 2010 (1.6% GDP)

Reduce debt to GDP ratio: 2009 (28%), 2010 (27%).

Actual fiscal deficit 1.6% of GDP, lower than 2.4% of GDP target deficit projected in 2009 Revised Budget

Target fiscal deficit 1.6% of GDP in 2010 Budget (budget adjustments is in ongoing discussion with the parliament) .Fiscal Stimulus Policies

Tax and

Administrative Reforms

New Feature of Fiscal Policy

Maintain

Social Welfare

Continue welfare programs (PNPM, BOS, Jamkesmas, Raskin) and provide budget for education sector

Continue tax policy and administration reform, reduce rate for companies, certainty of tax policy for oil companies

Implement the 1st batch of Performance Based Budget (PBB), Civil Service Reform and Remuneration (11 ministries) and multi-years projects

Provide fiscal space for the new government to implement additional priority programs (0.4% of GDP or equal to USD 2.5 billion)

Sufficient fiscal risk for oil and commodity prices, El-Nino, provide guarantee on land acquisition for infrastructure projects, secure financing for power (PLN) and restructuring water services (PDAM), domestic oil price adjustment if necessary

Export promotion (additional capital for Indonesian Exim Bank) and incentives for real sector, climate change projects (geothermal, bio-premium, green funds)Fiscal Policy to Promote Economic Recovery

Provide incentive for geothermal energy through income tax and VAT

Provide tax incentive on imports (both income tax and VAT on imports) for the oil and gas exploration sector

Provide incentive for green energy through for VAT and subsidy EnergyIncentives

Provide custom incentives for select industries

Provide custom incentives for imported capital goods and capex Incentives forIndustry

Reduce income tax rate for corporations from 28% to 25%

Reduce income tax rate by 5% for listed companies with 40% public ownership

Provide income tax facilities for businesses in specific industries or areas

Free VAT for primary agriculture products

Eliminate many luxury tax items

Provide tax and custom Incentive for special areas in accordance with law on tax and custom

Eliminate non tax revenue for export and import documentation Incentives onGeneral Taxation

The fiscal policy aims to promote economic recovery by providing tax incentives to various sectors and businesses which further promotes private consumption and investment spending

Fiscal Policy to Enhance Competitiveness

Guarantee for 10,000 MW electricity program and IPP Additional funds for land clearing for toll road building

Guarantee obligation for State Water Company and subsidy on interest for clean water, and interest credit for State Water Company, business in Aceh / Nias, and KKPE

Subsidy and VAT for people’s housing (low income housing)

The Indonesian government continues to support the development of infrastructure and enhance the social welfare through the effective fiscal policy and incentives for specific sectors

Infrastructure Development and Social Welfare

Assistance to Support

Specific Sectors

Credit for green fuel development Credit for farming and cow growers

Subsidy for fertilizers, seeds and inventory

Direct assistance for seeds at competitive pricing in order to revitalize plantation, cocoa and sugar industry

Additional capital for LPEI (Indonesian Exim Bank) to finance export related activities, including for SMEs

Provide incentives for high performance regions (e.g. performance on financial, economics and social welfare)

Resolution for troubled asset at SOEs and SMEs loan

Financing Trend 2005-2010

19 Source: Ministry of Finance

20

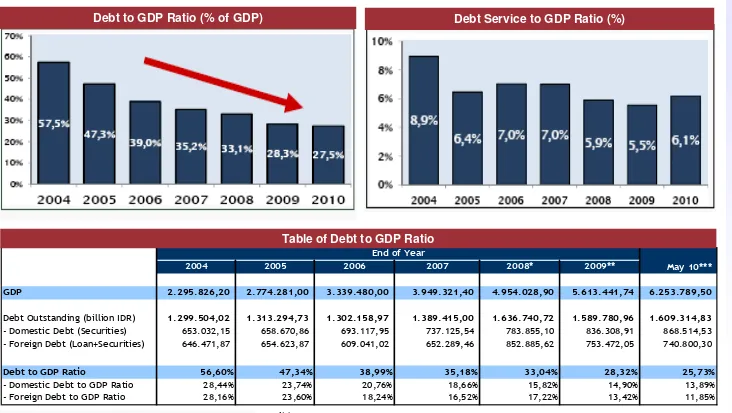

Debt to GDP Ratio (% of GDP) Debt Service to GDP Ratio (%)

Debt Ratio

Source: Ministry of Finance 2004 2005 2006 2007 2008* 2009** May 10***

GDP 2.295.826,20 2.774.281,00 3.339.480,00 3.949.321,40 4.954.028,90 5.613.441,74 6.253.789,50

Debt Outstanding (billion IDR) 1.299.504,02 1.313.294,73 1.302.158,97 1.389.415,00 1.636.740,72 1.589.780,96 1.609.314,83 - Domestic Debt (Securities) 653.032,15 658.670,86 693.117,95 737.125,54 783.855,10 836.308,91 868.514,53 - Foreign Debt (Loan+Securities) 646.471,87 654.623,87 609.041,02 652.289,46 852.885,62 753.472,05 740.800,30

Debt to GDP Ratio 56,60% 47,34% 38,99% 35,18% 33,04% 28,32% 25,73%

- Domestic Debt to GDP Ratio 28,44% 23,74% 20,76% 18,66% 15,82% 14,90% 13,89%

- Foreign Debt to GDP Ratio 28,16% 23,60% 18,24% 16,52% 17,22% 13,42% 11,85%

End of Year

Notes: * = Preliminary ** = Very Preliminary

*** = Very Very Preliminary, GDP number based on Budget 2010 Assumption

[Outstanding as of May, 2010]