Full Terms & Conditions of access and use can be found at

http://www.tandfonline.com/action/journalInformation?journalCode=cbie20

Download by: [Universitas Maritim Raja Ali Haji] Date: 18 January 2016, At: 19:25

Bulletin of Indonesian Economic Studies

ISSN: 0007-4918 (Print) 1472-7234 (Online) Journal homepage: http://www.tandfonline.com/loi/cbie20

Restructuring Indonesia's sub-national public

debt: reform or reversion?

Blane Lewis & David Woodward

To cite this article: Blane Lewis & David Woodward (2010) Restructuring Indonesia's sub-national public debt: reform or reversion?, Bulletin of Indonesian Economic Studies, 46:1, 65-78, DOI: 10.1080/00074911003642245

To link to this article: http://dx.doi.org/10.1080/00074911003642245

Published online: 17 Mar 2010.

Submit your article to this journal

Article views: 143

View related articles

ISSN 0007-4918 print/ISSN 1472-7234 online/10/010065-14 © 2010 Indonesia Project ANU DOI: 10.1080/00074911003642245

RESTRUCTURING INDONESIA’S

SUB-NATIONAL PUBLIC DEBT: REFORM OR REVERSION?

Blane Lewis David Woodward

National University of Singapore World Bank, Jakarta

Borrowing can be an effi cient way for sub-national governments to acquire capital assets, but it also carries risks of fi scal distress and insolvency for borrowers. To minimise these risks, many governments around the world have developed ex-post insolvency remedies, including, most importantly, debt-restructuring mechanisms. In an effort to resurrect borrowing for local infrastructure development, the Indo-nesian government has designed and begun to implement debt-restructuring pro-grams for sub-national government and sub-national government-owned water supply company defaulters. These programs constitute a major effort to reform an important, long-neglected and problematic aspect of sub-national public fi nances in Indonesia. There are a number of potential diffi culties with the design and execu-tion of the reforms, however, which collectively do not inspire much optimism for rapid progress in reviving fi nancial fl ows to the sub-national public sector. Still, even halting advances in debt restructuring can substantially increase local infra-structure investment in the long run.

INTRODUCTION

Borrowing is a common method of fi nancing sub-national public capital

spend-ing. All across the world, sub-national governments borrow from banks and other

fi nancial institutions or issue bonds to acquire non-fi nancial assets of various

kinds (such as fi xed assets and land) for use in delivering public services and

stimulating economic development. Usually such borrowing is uneventful from a

fi nancial point of view. But sub-national borrowing does create at least some risk

of fi scal distress and insolvency among debtors. Fiscal distress occurs when a

sub-national government’s fi scal position deteriorates signifi cantly – for example, as

a result of large and growing annual debt repayment obligations. A sub-national becomes insolvent if it is unable to make good on some fi nancial obligation, such

as a loan repayment that falls due.

Fiscal distress may well result in the need for some kind of debt restructur-ing. Debt restructuring is a key element in the design of any broader insolvency resolution mechanism. But the latter may include other components as well, such as bankruptcy procedures and fi scal adjustments. Bankruptcy is a legal status

that formally connotes fi scal insolvency. A sub-national may be insolvent but not

necessarily bankrupt. The former is simply a (sometimes loosely defi ned) fi scal

condition of government, while the latter requires a court decision and is a legal condition. The term ‘fi scal adjustments’ refers to the changes in a sub-national

government’s fi nancial management practices that are needed to overcome its

insolvency. Some kind of fi scal adjustment is typically necessary for successful

debt restructuring (Liu and Waibel 2008).

Fiscal insolvency mechanisms in general and debt-restructuring efforts in par-ticular are of two general types: administrative and judicial. Higher-level govern-ments assume the lead in organising administrative insolvency remedies, while the courts take priority in implementing judicial insolvency procedures. The benefi t of administrative procedures is that higher-level governments are

typi-cally well positioned to structure and execute any fi scal adjustments needed at

the lower level; the disadvantage of such efforts is that they may become overtly political. For judiciary-led mechanisms, the situation is reversed: the courts are typically seen as more neutral in their dealings with creditors and debtors, but they are at a disadvantage in insisting on sub-national fi scal adjustments (Liu and

Waibel 2008).

There is a small but growing academic literature on sub-national insolvency remedies.1 Most of the literature focuses on specifi c case studies, including,

most prominently, those of Brazil (Dillinger 2002), Hungary (Jokay, Szepesi and Szmetana 2004), South Africa (Glasser 2005) and the United States (Laughlin 2005). Liu and Waibel (2008) provide a review and synthesis of these cases and suggest some broad best practices in the development of insolvency procedures. In this regard, the authors stress that well planned insolvency mechanisms encourage voluntary participation, are perceived as fair to all parties involved and make apparent to future debtors the risks of borrowing. Most importantly, however, the review makes clear that the appropriate design and implementa-tion of sub-naimplementa-tional insolvency and debt-restructuring mechanisms is necessar-ily very specifi c to the history, economies, fi nancial systems and institutions of

the particular countries undertaking the reforms. Thus, while broad guidelines may have some utility for the development of insolvency mechanisms, much depends on context.

Indonesia has recently begun to implement its own administrative program of debt restructuring for sub-national governments – known collectively as ‘regional governments’ (pemerintah daerah, or Pemdas) and including the governments of both provinces and districts/municipalities (kabupaten/kota) – and for local govern-ment water supply companies (Perusahaan Daerah Air Minum, PDAMs), whose borrowing represents a large share of total regional borrowing. At this stage, the restructuring framework focuses just on the default on loans made to Pemdas and PDAMs by the central government (often acting as an intermediary in respect of loans from international donors). These loans constitute the vast majority of such lending. The government plans to broaden the scope of the procedures in the near future by developing a more comprehensive set of insolvency mechanisms, and by introducing sub-national public sector bankruptcy regulations.

This paper provides a description and analysis of current debt-restructuring efforts. As such, it makes a contribution to the emergent academic literature on a topic of considerable importance in sub-national public fi nance. In addition, the

1 Insolvency measures are referred to as ex-post remedies, as distinguished from ex-ante

controls. Ter-Minassian and Craig (1997) provide a discussion and some examples of ex-ante borrowing mechanisms.

paper provides some detailed information on, and analysis of, Indonesia’s sub-national debt-restructuring program that may be of use to various stake-holders working in this area.

The paper proceeds as follows. First, it presents some background information on sub-national government and water supply company borrowing in Indonesia. Second, it describes recent past and current efforts at sub-national debt restructur-ing, and highlights the current status of implementation. Third, it enumerates and discusses some unresolved problems, and offers a near-term prognosis for suc-cess. The last section of the paper summarises the main points and draws some conclusions related to decentralisation policy making in Indonesia.

BACKGROUND: SUB-NATIONAL BORROWING AND REPAYMENT ARREARS

Sub-national governments in Indonesia are allowed to take out long-term loans for capital development subject to several conditions.2 First, borrowing must be

used to fi nance infrastructure that directly generates sub-national own-source

revenue. This precludes Pemdas from borrowing to build non-toll roads or fl ood

control systems, for example. It is understood that the Ministry of Finance (MOF) is at the time of writing preparing a regulation to overturn this stipulation. Sec-ond, the outstanding debt of a sub-national government may not exceed 75% of the previous year’s general revenues (defi ned as all revenues except special

pur-pose grants and emergency grants), and its debt-service coverage ratio (defi ned as

general revenues net of civil servant salaries and local parliament expenditures, divided by debt-service obligations) must be at least 2.5. Collectively, sub-national governments may not borrow more than the maximum amount determined by the central government annually in the context of the budget law. For example, consolidated sub-national borrowing may not exceed 0.35% of projected national GDP in 2010.3 Finally – and most importantly for this paper – sub-national

govern-ments may not borrow if they have arrears on past loans. This (reasonable) legal restriction has limited Pemda and PDAM borrowing and thus constrained public capital spending at local government level. Sub-nationals have taken out only 10 loans from the MOF on-lending channel since decentralisation began in 2001.4

This low level of borrowing has had highly negative consequences for investment in infrastructure and for the delivery of public services – especially water.

Historically, sub-national governments in Indonesia have not borrowed much to fi nance their capital spending. Lewis (2007) estimates that the cumulative

bor-rowing (in real terms) of sub-national governments and their water supply com-panies between 1975 and 2004 was less than 1% of GDP in 2004. Since the vast bulk of these loans have been from the central government, there has been only a small amount of borrowing from other fi nancial institutions such as state or

2 The ex-ante borrowing framework for sub-national governments is discussed in more detail in Lewis (2007).

3 GDP is projected to be approximately Rp 6,050 trillion in 2010. As at 18 January 2010, $1 = Rp 9,225.

4 A further fi ve Pemdas have arranged to borrow from the central government, but had not yet drawn down on these loans at the time of writing.

commercial banks, or regional development banks owned by the provincial gov-ernments themselves. An early study (Lewis 1991) estimated that less than 5% of total sub-national government borrowing was derived from sources other than the central government (or foreign aid agencies via the central government).

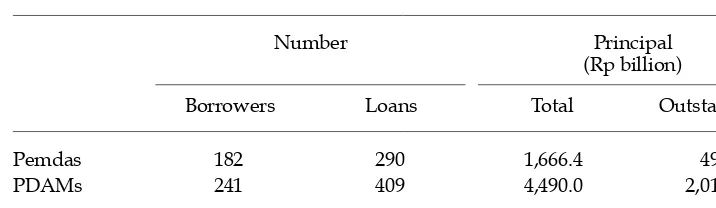

Table 1 sets out the most recent information available about Pemda and PDAM borrowing from the central government. As at December 2007, 423 borrowers had taken on 699 loans from the central government, amounting to just under Rp 6.2 trillion. Most borrowing was by water enterprises: PDAM borrowing comprised almost three-quarters of the total amount. Outstanding principal (not including arrears) was just over Rp 2.5 trillion, a sum equal to just below 0.1% of GDP in 2007.

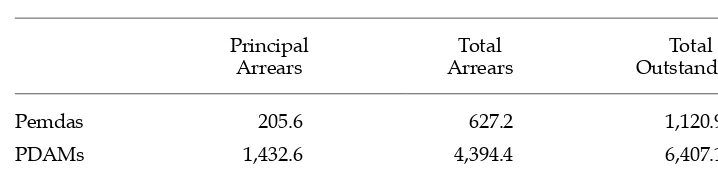

Even though borrowing has been quite limited, repayment of loans has been more than a little problematic. Lewis (2007) estimates that the arrears rate was nearly 50% in 2004.5 Table 2 provides some information on sub-national

pay-ment arrears at the end of 2007. The total amount of arrears is approximately Rp 5.0 trillion. About one-third of the total is arrears on principal; the remainder comprises arrears on interest, service charges, and penalties. Perhaps surprisingly, the arrears on penalties alone make up nearly 30% of the total. Penalties, charged by the central government for late payment or non-payment, have been an item of signifi cant contention between the sub-national and central governments over

the years. Total outstanding debt, which includes outstanding principal and total arrears, amounts to Rp 7.5 trillion.

Of the 182 Pemda borrowers, 124 have arrears.6 The arrears are concentrated

in a small number of borrowers, however. Just fi ve Pemdas – the municipalities

of Medan, Palembang, Banjarmasin, Makassar and Manado – account for nearly two-thirds of total arrears. And 90% of total arrears are held by just 23 Pemda bor-rowers. The vast bulk of Pemda borrowers’ arrears are quite small; 101 Pemdas have less than Rp 5 billion each in arrears.

Of the 241 PDAM borrowers, 201 have arrears. The arrears are heavily con-centrated in 41 PDAMs, each with arrears greater than Rp 20 billion; the arrears of these PDAMs comprise nearly 80% of the total. This category of defaulters

5 The arrears rate is equal to total payments in arrears divided by total payments due. 6 As at 31 December 2009, there are 33 provinces, 492 kabupaten/kota and 320 PDAMs.

TABLE 1 Pemda and PDAM Borrowing as at 31 December 2007

Number Principal (Rp billion)

Borrowers Loans Total Outstanding

Pemdas 182 290 1,666.4 493.7

PDAMs 241 409 4,490.0 2,012.7

Total 423 699 6,156.4 2,506.4

Source: Ministry of Finance.

includes PDAMs in all major and secondary cities in Indonesia with the exception of Surabaya and Balikpapan.

Why has loan repayment been so poor? Many kabupaten and kota offi cials have

complained that the loans were ‘supply-driven’ by international aid agencies and the Ministry of Public Works; in extreme cases, they claim that loans were simply assigned to them by the centre during the pre-decentralisation era. PDAM manag-ers have similar grievances. In addition, they assert that tariff increases needed to cover costs were not approved by Pemdas and local parliaments (DPRDs), largely for political reasons. These and other contentions created signifi cant

disappoint-ment among local offi cials about loans from the central government.There is no

evidence, however, that Pemdas, in general, were unable to repay their loans because of fi scal constraints. It is more likely that Pemdas did not repay simply

because they were unwilling to do so, and because the MOF was unwilling to force them to repay (Lewis 2003). The PDAMs may have been unwilling to make good on their loans as well, but in this case the point is moot. Most PDAMs were

fi nancially unable to repay their loans: tariffs did not cover costs, so they could

not repay even if they were willing to do so.7

In any case, the poor loan repayment record has had negative consequences for investment in infrastructure and the delivery of public services, because of the prohibition on borrowing by sub-national governments and water supply compa-nies that have arrears on past loans.

In response to this situation, the central government has, after many years of neglect, embarked upon a new program of debt restructuring. The next sec-tion of the paper describes the basic elements of the early and more recent debt-restructuring efforts, outlines the basic sanction mechanism embodied in the new debt-restructuring process and describes the experience so far in implementing the procedures.

7 See Woodward (2008, available on request from edw92114@attglobal.net) for a full dis-cussion of possible reasons for arrears among Pemdas and PDAMs.

TABLE 2 Pemda and PDAM Arrears and Outstanding Debt as at 31 December 2007 (Rp billion)

Principal Arrears

Total Arrears

Total Outstanding

Pemdas 205.6 627.2 1,120.9

PDAMs 1,432.6 4,394.4 6,407.1

Total 1,638.2 5,021.6 7,528.0

Source: As for table 1.

DEBT-RESTRUCTURING FRAMEWORK AND STATUS Early efforts

The laws passed by the national parliament (DPR) in 2003 and 2004 included one on State Finances (Law 17/2003) and another on the State Treasury (Law 1/2004). Among other things, these provided a legal basis for writing off public debt under certain circumstances; the detailed framework is provided in Government Regu-lation 14/2005. Also in 2005 the MOF produced a decree (MOFD 107/2005) for the restructuring of PDAM debt. PDAMs were accorded priority because their borrowing is such a large portion of the total, because their arrears position is far more serious than that of the Pemdas and because of the urgency of increasing investment in the water sector.

MOFD 107/2005 proposed a write-off of up to 40% and 100% of arrears associ-ated with interest payments and penalties, respectively. This seemingly gener-ous scheme was made less so, however, by the very restrictive conditions it set for PDAM eligibility to participate.8 Furthermore, the scheme required eligible

PDAMs to submit very complicated fi nancial recovery action plans as part of the

process. This latter stipulation necessitated the production of a separate MOF Treasury decree (MOFTD 53/2006) to guide PDAMs in the preparation of these plans. Many of the plans produced suggest that PDAM managers did not fi nd

these guidelines particularly helpful in clarifying the process.

Nevertheless, over the 12-month period following the issue of MOFD 107/2005, the outstanding debt of 12 PDAMs (comprising 16 loans) was fully paid off. The debt was retired not by PDAMs, however, but by their Pemda owners, in return for a small (2%) discount on the loan principal, as provided for in the decree. An additional seven PDAMs (or their Pemda owners) retired a sub-set of their loans with arrears. A year after the issue of MOFTD 53/2006, 40 PDAMs were at various stages of the restructuring process. However, by late 2007, not one PDAM had completed a rescheduling or restructuring pre-qualifi cation exercise up to the

stage of obtaining the required approval of the Minister of Finance. At this point all parties came to recognise fully the rigidities of MOFD 107/2005 and the conse-quent diffi culties for PDAMs in complying with MOFTD 53/2006.

In April 2008 Vice President Jusuf Kalla put forward a new debt-restructuring proposal. In this scheme, 100% of non-principal arrears for both PDAM and Pemda borrowers would be written off, with a view to stimulating investment in urban infrastructure services and to meeting the United Nations Millennium Devel-opment Goals for piped water supply. It was expected that 175 PDAMs would benefi t from some Rp 3.0 trillion of write-offs, and that the government would

provide grant funding for an additional 10 million piped water supply household connections to be installed over the next fi ve years. Given that only 7.5 million

new connections had been installed since independence in 1945, this was cer-tainly an ambitious plan (Bisnis Indonesia, 4 October 2008). In response to the vice

8 Among other things, the regulation required that, for a PDAM to be eligible for the scheme, its fi nancial health had to be classifi ed as something less than ‘good’ (baik). More-over the classifi cation was based on an evaluation system developed by the Ministry of Home Affairs (MOHA) (codifi ed in MOHAD 47/1999), which is known to provide fl awed assessments of fi scal capacity. This eligibility restriction severely limited the number of PDAMs that could participate.

president’s proposal, and to other internal suggestions, MOF issued new debt-restructuring decrees for both PDAMs (MOFD 120/2008, issued 19 August 2008) and Pemdas (MOFD 153/2008, issued 22 October 2008). A third decree (MOFD 129/2008, issued 4 September 2008), which specifi es sanctions in the case of

con-tinued non-repayment, was also promulgated. The substance of these decrees is outlined next. The section concludes with a brief account of the status of imple-mentation.

New PDAM debt restructuring

The new framework for restructuring PDAM debt distinguishes between arrears on principal and non-principal (interest, service charges and penalties). Arrears on principal will not be written off, either in whole or in part. Rather, the frame-work provides for the full write-off of non-principal arrears for those PDAMs that are classifi ed as fi nancially ‘sick’ (sakit) or ‘less than healthy’ (kurang sehat) by the

Finance and Development Supervisory Agency (Badan Pengawasan Keuangan dan Pembangunan, BPKP) in the context of its annual performance audit reports.9

For those PDAMs classifi ed as ‘healthy’ (sehat), non-principal arrears will be

treated through a combination of write-offs and ‘debt swaps’ for new investment in the PDAMs.In this context, ‘debt swaps’ refers to debt that is forgiven on the condition that the borrower undertakes a similar amount of new investment.10

The relative importance of PDAM debt write-offs and debt swaps is determined by the fi scal capacity of the Pemda owners. More specifi cally, PDAMs owned by

Pemdas with ‘high’ (tinggi) fi scal capacity will be able to write off 40% of their

non-principal arrears, with the remaining 60% being swapped for new PDAM investment; PDAMs owned by Pemdas with a ‘medium’ (sedang) fi scal capacity

will be able to write off 50%, with the remaining 50% being swapped; and PDAMs owned by Pemdas with a ‘low’ (rendah) fi scal capacity will be able to write off

60%, with the remaining 40% being swapped. The debt-for-new-investment swap can be funded by PDAMs, Pemdas or both – hence the focus on Pemda fi scal

capacity in determining the write-off/debt swap ratios.11

Unlike the initial regulatory effort, the new framework does not limit access to the restructuring program. Any PDAM can join, as long as it meets certain pre-conditions, including: the adoption of a cost-recovery tariff; a declaration by the Pemda that PDAM management has been subjected to a fi t-and-proper

test; and the submission of a fi ve-year business plan, approved by the head of

the Pemda. PDAM participants must also provide a fi nancial audit report from

9 BPKP uses its own criteria for establishing the fi nancial health of PDAMs, rather than the MOHA criteria referred to in footnote 8.

10 The decrees on sub-national debt restructuring use the English terms ‘write-off’ to refer to the portions of arrears that are completely forgiven and ‘swap’ to refer to those forgiven in exchange for the promise of new investment. We use the terms in the same manner in this paper.

11 MOF evaluates the fi scal capacity of Pemdas on an annual basis, classifying them as having low, medium or high fi scal capacity. Fiscal capacity is defi ned as the sum of own-source revenues, shared revenues, block grant and other legal revenues net of employee salaries, divided by population. The most recent ‘fi scal capacity map’ can be found in MOFD 224/2008.

the previous fi nancial year;12 the previous year’s performance audit, conducted

either by the Supreme Audit Agency (Badan Pemeriksa Keuangan, BPK) or by BPKP; the PDAM budget and business plan from the previous year; and a letter signed by the head of the Pemda and co-signed by the chair of the DPRD, to the effect that if, for any reason, the PDAM cannot meet its new debt payments, the Pemda will provide fi nancial support to enable it to fulfi l its obligations under the

rescheduled loan agreements.13

Of the total arrears on PDAM loan repayments (Rp 4.4 trillion), about two-thirds – Rp 3.0 trillion – are non-principal arrears. Early indications are that any PDAM borrower with arrears will be categorised as ‘sick’ or ‘less than healthy’. If so, up to Rp 3.0 trillion could possibly be written off under the vice president’s proposal. The government intends to compensate those PDAMs that had responded posi-tively to the earlier restructuring effort as outlined in MOFD 107/2005. This com-pensation takes two forms under the new framework. First, those PDAMs that fully retired their debt some time between the dates of issue of MOFD 107/2005 and MOFD 120/2008 will receive (in addition to the 2% discount provided for in MOFD 107/2005) an incentive payment under arrangements to be decided separately. Second, those PDAMs that made payments according to the sched-ules specifi ed in their loan agreements after the date of issue of MOFD 107/2005

and up to the date of issue of MOFD 120/2008 will receive a 2% reduction in the interest rate on their loan(s) up to the fi nal loan payment, plus technical

assist-ance under arrangements to be determined separately. There are no stipulated sanctions against those PDAMs with arrears that do not join the restructuring program.

The restructuring process is to be carried out in two stages. Initially, over a two-year period, any write-off is ‘conditional’ – that is, temporary. After this two-two-year period, if PDAMs continue to pay their rescheduled loans on time and in full, write-offs become ‘unconditional’ or permanent.

New Pemda debt restructuring

As was the case for PDAMs, the new framework for restructuring Pemda debt distinguishes between principal and non-principal arrears, and arrears on repay-ment of principal will not be written off. Non-principal arrears will be only partially written off, with the remainder being swapped for infrastructure invest-ment. The amount written off is determined by multiplying the proportion of non-principal arrears to total arrears by Rp 5 billion. The remaining non-principal arrears are swapped for Pemda investment in schools, health clinics, roads, irriga-tion, bridges and water supply facilities.

The period over which repayment of principal arrears is rescheduled depends on the amount of arrears. If arrears are less than Rp 15 billion, they must be repaid within four years; if they total Rp 15–25 billion, they must be repaid within six years; and if they are greater than Rp 25 billion, they must be repaid within eight

12 A disclaimer by the auditor disqualifi es a PDAM from entry, unless the disclaimer re-lates to the ‘technical insolvency’ of the PDAM due to its arrears.

13 This latter condition is somewhat puzzling. According to Law 33/2004, Pemdas are pro-hibited from guaranteeing third-party debt, including that of their PDAMs. As such, this stipulation would appear to require Pemdas to break the law or at least the spirit of it.

years. The debt swaps are to be implemented over the same period as the prin-cipal arrears repayment, irrespective of amount, although some extension (as yet undefi ned) may be granted in the event of fi nancial capacity diffi culties. If the

debt swap plan is not maintained to full effect, then the value of the debt swap not implemented is returned to arrears status.

There are only limited pre-conditions for Pemda entry into the program. All Pemdas are invited, provided they make available the required documentation. The latter includes an action plan for implementing the debt swap; a letter agree-ing to give priority to the repayment of debt and to allocate the required funds in the sub-national budget until the loan has been entirely paid off; and a letter consenting to the use of an intercept mechanism, described below, in the event of loan arrears. All plans and letters must be prepared and approved by the head of the Pemda and co-signed by the chair of the DPRD.14

Pemdas collectively hold Rp 421 billion in non-principal arrears. This sum con-stitutes the upper bound on the total amount that can be written off or swapped. Given the size distribution of the arrears across Pemdas, it seems probable that most could settle their arrears problems without the intervention of the MOF, although it is not clear that they would do so in the absence of effective sanctions. In any case, we understand that the restructuring program will focus on the 23 Pemdas that account for 90% of the arrears.

As is the case with PDAMs, Pemdas making early loan repayments will be rewarded with non-principal arrears write-offs equivalent to 2% of the advance repayments made. There is no mention of any sanction for non-participation in the program. The write-off and debt swap must go through the same conditional and unconditional stages as for PDAM debt restructuring.

Sanctions: a new intercept mechanism

The original decentralisation legislation of 1999 and its subsequent amendment in 2004 made provisions for the central government to delay or cut transfer pay-ments to Pemdas under a variety of circumstances, the most noteworthy of which, in the present circumstances, is the non-repayment of loans from the central government. This intercept mechanism was never employed in the case of non-repayment of loans, although it was in other circumstances. A number of regula-tory issues, which ostensibly prevented its full implementation, have now been addressed.

The new framework for implementing the intercept mechanism is codifi ed in

MOF decree 129/2008, issued in September 2008. On the basis of internal MOF legal opinion, it was determined that the intercept as originally defi ned in law

could not be set against central government transfers to Pemdas in the case of non-performing loans that had been made to Pemdas before the decentralisation legislation of 1999, or in the case of non-performing loans made to PDAMs.15

Fol-lowing the issue of the new decree in 2008, the intercept is henceforth applicable

14 A 12-month deadline was imposed on Pemda applications to enter the debt-restructuring program. PDAMs have not been subjected to a deadline for joining their debt-restructuring program.

15 In these instances, the MOF’s only recourse against PDAMs and Pemdas with non-performing loans is through the courts under the civil code.

against any arrears resulting from loans made by MOF to Pemdas since October 1999, and against any arrears associated with loans made following issue of the decree. It is important to note that the latter include those loans made for water supply investment, which must now be made through the Pemdas (for potential on-lending to PDAMs).

A prime concern of MOF in developing the 2008 decree was to ensure that the intercept could be applied without unduly constraining Pemda fi nances and

service delivery. To this end the decree sets maximum amounts of block grant (Dana Alokasi Umum, DAU) and revenue-sharing (Dana Bagi Hasil, DBH) trans-fers that can be intercepted during a fi scal year. The limits are based on the fi

s-cal capacity of Pemdas as determined annually by MOF. More specifi cally, the

intercept limits for low, medium and high fi scal capacity Pemdas are 10%, 15%

and 20%, respectively, of annual DAU and DBH transfers. In the event that these ceilings are insuffi cient to recover all arrears, the balance is to be carried over and

subjected to intercept in the following fi scal year. In most cases, DAU transfers

will be the primary target for the intercept, since the vast bulk of Pemdas receive DAU and the transfers are made in 12 equal monthly instalments per year. For those Pemdas that do not receive DAU, however, the intercept mechanism will be applied to the DBH.

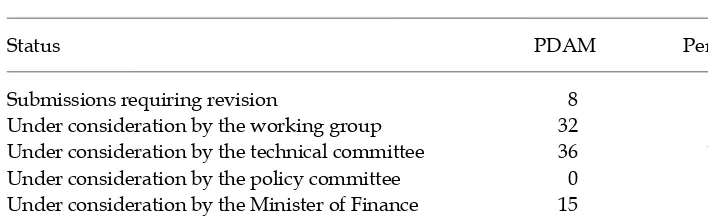

Current status of implementation

Table 3 summarises the status of debt-restructuring proposals by PDAMs and Pemdas as at October 2009. The approval process is one that is typical in Indo-nesia, comprising reviews by a working group, a technical committee and a policy committee. MOF chairs the working group and technical and policy com-mittees; other members include representatives of BPKP, MOHA, the Ministry of Public Works, and the national development planning agency, Bappenas. Pro-posals are ostensibly subject to increasingly rigorous review as they move up the hierarchy from the working group to the policy committee. The fi nal stage

is Minister of Finance approval, which is based on the recommendation of the policy committee.

As at October 2009, 91 PDAMs had submitted proposals for debt restructuring. Of these, eight proposals were found to be problematic in some way and were

TABLE 3 Status of PDAM and Pemda Debt-Restructuring Proposal Submissions as at 31 October 2009

Status PDAM Pemda

Submissions requiring revision 8 0

Under consideration by the working group 32 8 Under consideration by the technical committee 36 18 Under consideration by the policy committee 0 0 Under consideration by the Minister of Finance 15 0

Total 91 26

Source: As for table 1.

sent back for revision; 32 had been accepted as valid proposals and were under review by the working group; 36 had been approved by the working group and were under consideration by the technical committee; and 15 had already been considered and approved by the policy committee. Pemdas had submitted 26 pro-posals, including eight that were under initial review by the working group and 18 that were under consideration by the technical committee. More than a year after the debt-restructuring regulations were issued, not one proposal, whether from a PDAM or a Pemda, had been approved by the Minister of Finance.

UNRESOLVED ISSUES AND NEAR-TERM PROGNOSIS

There are a number of technical and substantive issues that may hinder the suc-cessful execution of the debt-restructuring program described above. This section highlights the major constraints associated with PDAM and Pemda debt restruc-turing, and potential diffi culties with the implementation of the intercept

mecha-nism. It closes with a tentative prognosis for near-term execution of the effort. The adoption of cost-recovery tariffs by PDAMs is the sine qua non for entry into the water supply company debt-restructuring program. Some PDAMs have expressed confusion about the appropriate manner of calculating a cost-recovery tariff. Current MOHA guidelines defi ne the cost-recovery tariff as operating,

inter-est and depreciation costs, divided by the volume of water produced after deduc-tion of an allowance for non-revenue water (that is, leakages or other ‘lost’ water that does not generate revenue). Previously MOHA had used a similar defi nition,

but one in which the denominator was the volume of water sold less non-revenue water. Presumably the change was introduced in recognition of the earlier defi

-nition’s erroneous twice-over allowance for non-revenue water, which yielded a higher (rupiah per unit) cost-recovery tariff than the current defi nition does. A

second issue concerns the extent to which the cost-recovery tariff must be put into effect. That is, the regulation mentions only that the tariff should be ‘ditetapkan’ (‘set’), the precise meaning of which is somewhat ambiguous. One presumes the tariff must be codifi ed in a local regulation (peraturan daerah, Perda), but the extent

to which the tariff actually has to be applied is not obvious: one can envision all kinds of gaming behaviour on the part of PDAMs in ‘setting’ tariffs. Finally – and more signifi cantly – the political acceptability of cost-recovery tariffs must surely

be in doubt. Pemdas and DPRDs have always proved more than a little reluctant to agree to PDAM cost-recovery tariffs, and it is far from certain that concerned offi cials have changed their position on this. Of course, Pemdas could choose to

keep tariffs below cost-recovery levels and subsidise the difference from their budgets, but this would represent a signifi cant departure from usual behaviour.

The current arrangements for PDAM preparation of business plans seem much more fl exible than those required under the earlier regulatory effort. Among other

things, the required format in which the plan must be submitted is simpler. In addition, the new procedures allow PDAMs to set their own annual performance targets instead of these being prescribed, as was the case previously. This is more sensible, because PDAMs start their recovery plans from different baselines. Thus the adequacy of the annual targets will be evaluated by the technical committee as part of the overall review process. However, while the preparation of the business plan is a less onerous task than before, many PDAMs will still fi nd diffi culty in

responding to the requirements – as evidenced by the fact that some have already begun to ask for technical assistance from the Ministry of Public Works and vari-ous aid agencies. In addition, if past experience is suggestive of future outcomes, the multi-level and multi-institutional nature of the review process will almost certainly cause signifi cant delays in implementation.

A fi nal important issue as yet unresolved in the context of PDAM debt

restruc-turing is the treatment of arrears write-offs for tax purposes. The Companies Law (Law 40/2007) prohibits the conversion of loan write-offs into equity; conse-quently, as matters stand, any PDAM write-offs would be treated as non-operating income and therefore be taxable in the year they are credited as such. Obviously, this would defeat a major purpose of restructuring. Originally, MOF had planned to take the matter to the DPR with a view to requesting special dispensation for PDAMs in this specifi c regard. This has apparently not happened yet. Another

way to overcome the problem would be for MOF itself to pay any taxes due.16

The Pemda debt-restructuring program is more straightforward than that for the PDAMs. The major constraint in its successful implementation would seem to be persuading the Pemdas to participate in the program in the fi rst instance.

The incentive to join the program is clear enough, at least in theory: restructuring would permit Pemdas to resume borrowing to fi nance investment in needed

infra-structure, and this would allow improvements to local public service delivery. It is not obvious, however, that most Pemdas place a high priority on delivering qual-ity services to their constituents. As there are no sanctions for not participating in the restructuring program, full Pemda participation is therefore in some doubt.

Finally, at least two issues have the potential to de-rail the implementation of the intercept mechanism, which constitutes the restructuring programs’ only method for assuring compliance with future loan repayments. One possible problem con-cerns the legality of intercepting DAU transfers after the allocations have been codifi ed in the annual presidential decree (as they are required to be before the

start of the fi scal year). A presidential decree holds the force of law in Indonesia;

in theory the allocations cannot be changed after the issue of the decree, whether a lower-order decree authorises such cuts or not. Perhaps this is one reason for requesting Pemdas’ prior agreement to the use of the intercept. But if consent to the application of the intercept against its transfer revenues is voluntary, then it is reasonable to predict that there will be few volunteers.

Just as important a problem concerns the political will of MOF actually to employ the intercept, even if it is available for use. On the one hand, the ministry has, in recent years, delayed payments of DAU to those Pemdas that have not submitted their budgets in a timely manner to the ministry as required by law. This is cause for optimism. On the other hand, MOF has not yet cut any Pemda’s DAU to sanction non-payment of loans, despite having the legal justifi cation and

opportunity to do so.17 This casts some doubt on the ministry’s political will to

16 This would perhaps require an internal-to-MOF transfer from the Directorate General for the Treasury to the Directorate General for Tax.

17 Since October 1999 – the legal start date for possible application of the intercept – 11 Pemdas have defaulted on their loans, resulting in Rp 16 billion arrears as of the end of 2007.

employ the more severe measure of cutting DAU allocations – as opposed to just delaying their payment.

In sum, it is apparent that implementation of the two debt-restructuring pro-grams will be far from straightforward. At best the reforms will be executed in

fi ts and starts and, in any case, completion of the programs is likely to take

sev-eral years at least. At worst, the programs might stall completely, in which case PDAMs and Pemdas would be extremely likely to revert to their past question-able fi scal practices.

SUMMARY AND CONCLUSIONS

Sub-national government borrowing is ubiquitous around the world. While bor-rowing can be an effi cient way to fi nance capital assets, it also carries some risks,

especially potential fi scal distress and insolvency of the debtor. Given the

inher-ent dangers, many governminher-ents have developed ex-post insolvency remedies for their sub-national borrowers. Debt restructuring is typically a key element of such reforms.

Indonesian sub-national governments and the water supply companies that they own have borrowed for infrastructure development for nearly 30 years. The total amount of borrowing has been very small, however. More to the point in the current context, sub-national loan repayment has generally been weak. Poor repayment performance has led to a lack of creditworthiness among sub-national governments and water supply companies, and has constrained new borrowing for needed improvements to deteriorating infrastructure.

After many years of neglect, the Indonesian government has fi nally started

to address the sub-national borrowing and repayment problem. Among other things, the Ministry of Finance has designed and begun to implement a debt-restructuring program for sub-national defaulters. There are separate efforts for Pemdas and PDAMs, and both programs involve a combination of debt write-offs and swaps. Sanctions in the form of an inter-governmental transfer intercept mechanism have also been developed to guard against future non-repayment. The debt-restructuring program is a signifi cant attempt at reform.

Nevertheless there are a number of problems that might prevent the programs’ timely and successful execution. For PDAMs, the major constraints relate to diffi culties in setting and applying cost-recovery tariffs, capacity constraints in

developing and implementing sensible business plans, and the potential negative effects of central government taxation of loan write-offs. For Pemdas, the most signifi cant problem relates to a possible lack of voluntary participation, given

the dearth of incentives and sanctions to encourage involvement. As regards the intercept mechanism, potential diffi culties relate to the possible illegality of

cut-ting transfers after allocations have been formally set by presidential decree at the beginning of the fi scal year, and a lack of political will on the part of MOF to

employ the device. At the very least, such problems are likely to cause signifi cant

delays in implementation, and they may halt the programs entirely.

The debt-restructuring efforts described in this paper are in many ways quintessentially Indonesian. As is often the case, early design of the relevant reg-ulatory framework was carried out in a rather casual and haphazard manner, and the devised procedures proved, not surprisingly, to be unworkable. More

positively, the government has demonstrated once again that it is (belatedly) will-ing to face up to its miscalculations, and formally revise wayward plans and proc-esses. Only time will tell the extent to which another of Indonesia’s typical public sector behaviours – muddling through – will obtain, or whether the reform efforts will just wither away. Although muddling through is, of course, a sub-optimal process, it at least pushes sub-national public fi nances in a desirable direction.

Even halting advances in debt restructuring have the potential substantially to increase borrowing for local infrastructure investment in the long run.

REFERENCES

Dillinger, William (2002) Brazil: issues in fi scal federalism, Unpublished paper, World Bank, Washington DC.

Glasser, Matthew (2005) Legal framework for local government insolvency, Presentation at a World Bank seminar, 8 March, World Bank, Washington DC.

Jokay, Charles, Szepesi, Gabor and Szmetana, Gyorgy (2004) ‘Municipal bankruptcy frame-work and debt management experiences 1996–2000’, in Intergovernmental Finances: A Decade of Experience, eds Mihaly Kopanyi, Deborah L. Wetzel and Samir El Daher, World Bank Institute, Washington DC.

Laughlin, Alexander (2005)‘Municipal insolvencies: a primer on the treatment of munici-palities under chapter 9 of the US bankruptcy code’, Wiley, Rein and Fielding LLP, Washington DC.

Lewis, Blane (1991) Regional government borrowing in Indonesia, Unpublished report to the Harvard Institute for International Development‘s Urban Project, Jakarta.

Lewis, Blane (2003) ‘Local government borrowing and repayment in Indonesia: does fi scal capacity matter?’, World Development 31 (6): 1,047–63.

Lewis, Blane (2007) ‘On-lending in Indonesia: past performance and future prospects’, Bul-letin of Indonesian Economic Studies 43 (1): 35–57.

Liu, Lili and Waibel, Michael (2008) ‘Subnational insolvency: cross-country experi-ences and lessons’, World Bank Policy Research Working Paper 4496, World Bank, Washington DC, available at <http://www-wds.worldbank.org/external/default/ WDSContentServer/IW3P/IB/2008/01/29/000158349_20080129111544/Rendered/ PDF/wps4496.pdf>.

Ter-Minassian, Teresa and Craig, Jon (1997) ‘Control of subnational borrowing’, in Fis-cal Federalism in Theory and Practice, ed. Teresa Ter-Minassian, International Monetary Fund, Washington DC.

Woodward, David (2008) Restructuring loans to PDAM and Pemda, Unpublished report, Decentralization Support Facility, World Bank, Jakarta.