This

Financial Stability Review (FSR)

is one the report Bank Indonesia provides

to public in order to achieve its mission ≈to achieve and maintain stability of the Indonesian

Rupiah through maintaining monetary stability and promotes on financial system stability for

safeguarding long-term and sustainable national development.∆

Financial System Stability Bureau

Directorate of Banking Research and Regulation Bank Indonesia

Jl. MT Thamrin No.2, Jakarta 10010 Indonesia

Information and Order:

This document was used data as of 30 June 2004, unless otherwise state. This completed document is available at http//www.bi.go.id.

Any requests, comments and advises should be directed to :

Bank Indonesia

Directorate of Banking Research and Regulation Financial System Stability Bureau

Jl. MT Thamrin No.2, Jakarta, Indonesia Tel: (+62-21) 381 7990, 7353

Fax: (+62-21) 2311 672 Email: BSSK@bi.go.id

FSR issued biannually and has the following objectives:

-

To foster public vision on financial system stability issues, both domestically and internationally;

-

To analyze potential risks to financial system stability; and

fsr

Financial Stability Review

Foreword v

Executive Summary ix

Chapter 1 Overview 3

Chapter 2 Development of International & Domestic Economies 7

1. Development of International Economy 7 2. Development of Domestic Economy 9 3. Development of the Real Sector 12

Box 2.1: Potential Pressures on Several Industries due to Oil Price Hikes 16

Chapter 3 Indonesia»s Banking Industry 21 1. Structure of Banking Industry 21

2. General Picture of Banking Industry 21 3. Credit Risk 22

4. Liquidity Risk 29 5. Market Risk 34 6. Operational Risk 37 7. Profitability 39 8. Capital 41

9. Directon of Banking Policies 43

9.1. Indonesian Banking Architecture 43 9.2. Rural Bank (BPR) 44

9.3. Sharia Banking 45 Box 3.1: Financial Safety Net 46

Chapter 4 Non-Bank Financial Institutions 49 1. Condition of Insurance Industry 49

2. Development of Pension Fund Industry 50

Box 4.1: Cases of Bankruptcy Pronouncements of Insurance Companies : PT. Prudential Indonesia dan PT. Manulife Indonesia 51

Chapter 5 Capital and Money Markets 55 1. Stock Market 55

2. Development of Bond Market 57 2.1. Corporate Bonds 57

2.2. Surat Utang Negara 58 3. Development of Mutual Funds 59 4. Money Market 60

Box 5.1: Oversubscribed Foreign Currency Bonds: Momentum of Rising Foreign Confidence 62

Chapter 6 Payment System 65

APPENDIX

1. Table 1. Balance of Payment 71 2. Table 2. Macroeconomic Indicators 71 3. Table 3. State Budget 72

ARTICLES

1. Analysis of Foreign Bank»s Role in Enhancing Indonesia»s Real Sector Recover 75

2. The Model To Predict Bankruptcy for Commercial Banks in Indonesia 95

List of Table and Chart

Table

2.1. GDP of Major Trading Partners 2.2. GDP of Some Asian Countries

2.3. Export Performance of Some Major Industrial Countries 2.4. Euro and Yen Exchange Rates Against USD S1-2004 2.5. Exchange Rates of Asian Currencies Against USD Chart Box 2.1 Loan Classification of Airline Industry - July

2004

3.1. Earning Assets 3.2. Loans by Group 3.3. Loan to Deposit Ratio 3.4. NPL of Consumer Loan

3.5. New Disbursed Loan 2002, 2003, 2004 3.6. Undisbursed Loan by Sector

3.7. Undisbursed Loan by Usage 3.8. NPL Gross and Net

3.9. NPL to Capital

3.10. NPL of ASEAN Countries 3.11. Stress Test of NPL - June 2004 3.12. Loan by Sector

3.13. NPL by Sector - June 2004

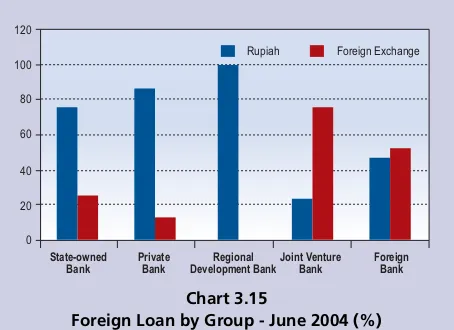

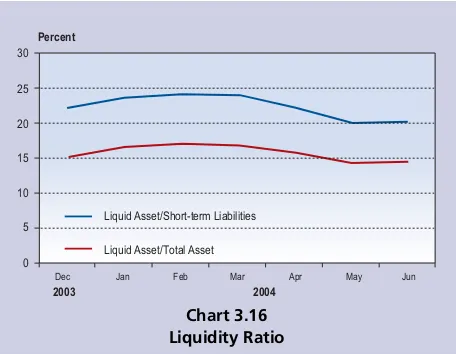

3.14. NPL by Agriculture, Mining and Manufacture 3.15. Foreign Loan by Group - June 2004 (%) 3.16. Liquidity Ratio

3.17. Deposits Ownership

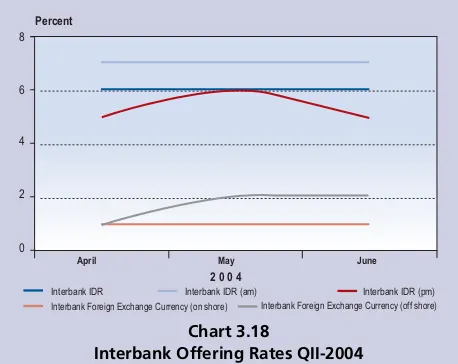

3.18. Interbank Offering Rates QII-2004

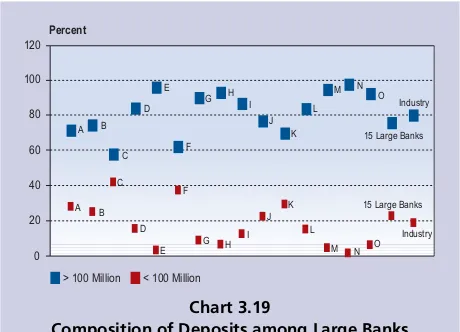

3.19. Composition of Deposits among Large Banks 3.20. Stress Testing of Exchange Rate

3.21. Interest Rate Stress Testing

3.22. Net Open Position to capital of Large Banks 3.23. Composition of Interest Income of Large Banks 3.24. Composition of Interest Income of All Banks

(2003-2004)

3.25. Net Interest Income Trends (Excl. Interest Income from Securities)

3.26. Trend of ROA (Peer Group Comparison) - June 2004 3.27. Distribution of ROA - June 2004

3.28. Efficiency and Overhead Cost Ratios - June 2004 3.29. Fee Based to Total Operating Income Ratios 3.30. CAR - June 2004

3.31. Distribution of CAR

3.32. Tier 1 to Total Asset Ratio - June 2004

4.1. Government Bond Ownership

5.1. Equity Index and Market Capitalization 5.2. Volatility of Equity Index

5.3. Equity Index and Transaction of Foreign Investors 5.4. PER of World Stock Exchanges

5.5. Equity Index of Financial Corporations 5.6. NAV per Type of Mutual Funds

5.7. Composition of NAV per Type of Mutual Funds 5.8. Trend of Domestic Interest Rates

5.9. Spread of Interest Rates

6.1. Volume and Value of Real Time Gross Settlement 6.2. Volume and Value of Clearing Settlements 6.3. Real Time Gross Settlement System Transactions 2.1. Repayment Plan of Indonesian Offshore June

-December 2004

2.2. Simulation of Debt Equity Ratio of 3 Major Group of Companies

2.3. Outstanding and Growth of Loans to Small Scale Business

3.1. NPL by Nominal 3.2. NPL By Bank Group 3.3. 25»s Top Debtors (25 TD) 3.4. Loan Restructuring

3.5. Bank Funding & Placement Structure

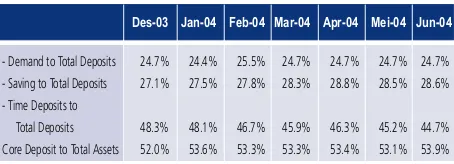

3.6. Development of Deposits and Net Asset Value (NAV) 3.7. Deposits and Core Deposit Ratios

3.8. Interbank Money Market 3.9. Interbank Rates

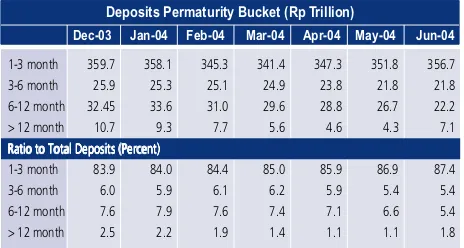

3.10. Deposits Permaturity Bucket 3.11. Exchange Offer

3.12. Fraud Cases in Banks

Table Box 4.1 Fiancial Highlights of Prudential Life Assurance (Indonesia)

5.1. Corporate Bonds

5.2. Auctions of Government Bonds

Table Box 5.1 Long-term Foreign Currency Bonds of the Republic of Indonesia

One of the roles of Bank Indonesia is the maintainance and stability of the national currency. To meet the objective, Bank Indonesia undertakes routine enhancement actions and continually monitors factors that influence domestic financial stability. Results of our monitoring and assessment are presented in the bi-annual Financial Stability Review.

During the first half of 2004, Indonesian financial system was stable and we expect continued stability throughout 2004. Notwithstanding, potential internal and external challenges that could pose greater risks to Indonesian financial system remain threatening. Several positive signs occurred during the first half of 2004, rising international confidence as evidenced by oversubscriptions in Indonesian international bonds sales, Indonesia’s improved ratings, and high foreign investors’ interest in buying Indonesian financial products. Within the country, the legislative and presidential elections went smoothly helping maintain public confidence in the recovery of the Indonesian economy.

There are still several national challenges, however, such as the real sector that has not fully revived, weak enforcement of sound administrative practices and laws. Immediate measures have to be made to pull out Indonesia from prolonged crisis and and therefore become a respected, prosperous country. Considering the broad scope of efforts required to achieve financial system stability, the development and maintenance of financial stability requires joint responsibility of the related authorities and stakeholders. This review is expected to provide useful information to our various stakeholders in conducting their respective roles for more stable economy. We want to express our highest appreciation to those whose contributions in completion of this review improved the quality of the review along with sharper analyses.

In closing, we welcome any suggestions, comments or critiques from all stakeholders to enhance the quality of this review in the coming periods.

Jakarta, June 2004

vii

ix

During the first half of 2004, the Indonesian financial system was reasonably stable. However, at the end of the semester, there was potential for rising risk exposures largely prompted by a slight depreciation of the rupiah and a modest inflation increase. The success of general election on 5 April 2004 helped contribute to the improvements in public confidence and business activities in Indonesia.

The economies of Indonesian trading partners, such as the US, Japan, and ASEAN countries, were stable during semester I/2004. This is expected to continue into the next period. However, there is an uptrend of the Federal Funds rates, which could change global market conditions. Also, competition with exports from China needs to be closely watched in the coming periods.

The changes of economic indicators did not create serious consequences on the financial sector, particularly the banking sector. Financial and operational performances of banks as the most dominant player of Indonesian financial was reasonably stable and adequate, despite a slight drop in CAR, stemming from increases in number of loans granted.

Programs for implementation of the Indonesian Banking Architecture, preparation for implementation of international standards (best practices), including Basel 2, as well as Bank Indonesia»s strong commitments to implement sound risk management principles within the banking industry have contributed to maintaining public confidence on the Indonesian banking industry.

Loans grew quite rapidly by Rp51.5 trillion (10.8%), or 93.8% of banks» business plan for semester I/2004 accompanied by a modest rising of NPLs. NPLs actually

trended downward, however, this was more due to quite large rise in loans. In the short-to-medium term, it is predicted that credit risk would have a slight upward trend, largely prompted by rising interest rates and the remaining sluggish real economy.

In addition, market risk remained stable despite the rupiah depreciation since April 2004. The measures of Bank Indonesia to minimize the excess liquidity has boosted the strength of the rupiah. In addition, results of stress tests show that capital of the major banks stays robust should the rupiah depreciates up to Rp2,500/USD. As banks converted bonds and SBI, profitability of banking industry started to rise in line with growth of loans. Consequently, ROA and NII also improved from 2.5% and Rp3.2 trillion in December 2003 to 2.7% and Rp5.4 trillion as of June 2004. However, potentials for increases in interest rates and credit risk must be carefully watched by bank management in order to maintain and increase their abilities to earn revenues and maintain adequate capitals. Cases of fraud in the banking sector also need special attention, considering that its frequency has relatively increased, particularly in the period 2003/2004. As such, there is a need for early detection approach and effective law enforcement to prevent the recurrence of similar incidents in the future.

Capital markets became relatively more sensitive as reflected by the downward trend of the composite index since April 2004 while it previously experienced a rise since end-2003. This has boosted an upward shift in investment to lower-risk portfolios such as mutual funds with underlying government bonds and bank deposits that are fully guaranteed by the government. This condition is

reflected by rising net asset value (NAV) of Rp16 trillion (23.2%) to Rp85 trillion.

In addition, the payment system, operating both through the BI-RTGS system as well as the clearing system, stayed robust. During the first semester, daily average transaction value of BI-RTGS system has dropped by Rp49.7 trillion (- 35.9%), while that of the clearing system has increased by Rp4.6 trillion (92.3%). Nevertheless, the role of the clearing system is relatively smaller than that of the BI-RTGS, at only 0.02% of BI-RTGS daily average value.

Supervision of the BI-RTGS system continuously strengthen, particularly for ensuring the operational safety of the system, both on the operators as well as the participant side. Supervision of the BI-RTGS system safety on the participant side is also aimed at minimizing the risk of fraud.

Chapter 1

Risks to Indonesia»s financial system stability, and that of several of its major trade partner countries and other ASEAN countries, are moderating in the short-term. However,a rising interest rate environment at a time of relatively high levels of bank credit and domestic government debt would have the potential to increase market and liquidity risks.

In general, Indonesia»s financial institutions and markets, particularly banks, remain sound and growing. Problems, risks, and mitigation of risks will be discussed in more detail in this financial stability review.

International economies have improved in the first half of 2004 as evidenced by rising GDPs of the US, countries in the Euro region, and Japan. However, this opportunity has not been optimally seized by Indonesia as reflected by the low rise in Indonesia»s non-oil/gas international trade volume.

In addition, the domestic condition is susceptibile to an increasing state budget deficit and pressures on several of Indonesia»s largest foreign currency contributing commodities, such as textiles and textile products, footwear products, wood-based products, paper products, etc. However, economic growth is predicted to continue with the support from the consumption sector and productions from micro, small, and medium businesses.

Major risks to Indonesia»s banking industry, such as credit, liquidity, and market risks were relatively under control. However, in the coming few periods, it is predicted that credit and market risks would rise again due to high uncertainty stemming from less supportive domestic economic condition and pressures coming from international factors, namely rising global interest rates and oil price hikes.

Meanwhile, banking operational risk is still quite high. This is evidenced by the few incidents of fraud that have occurred at several banks. This high level of risk results from weak internal controls and loosely applied good corporate governance. Bank Indonesia has taken follow-up actions on violations in the banking sector through cooperation with related authorities and the issuance of enforcement orders dealing with bank risk management practices, including operational risk management.

Improvements in the Banking sector is evidenced by rising profitability resulting from credit expansion that began in the beginning of 2004. ROA rose from 2.5% to 2.7%, while NII rose from Rp3.2 trillion to Rp5.4 trillion. However, there were still many national banks with ROA far below 1.2% (28 banks) due to relatively low efficiency levels, particularly in state banks.

Meanwhile, the downward trend of interest rates during semester I has lowered the profits of non-bank financial institutions, particularly insurance companies and pension funds. However, the potential rise in interest rate in the post-semester I period and expanded business opportunities resulting from new financial product offerings provides for potential improvement in profitability.

The capital market as an alternative source of financing has shown quite encouraging performance. However, it is predicted that a weak performance of world bourse, the potential for rising interest rates and payment failures (defaults) on the part of several large companies in the Asia Pulp and Paper group (PT Tjiwi Kimia, PT Indah Kiat, PT Lontar Papyrus and PT Pindo Deli) and Mulia group (PT Muliakeramik Indahraya and PT Muliaglass) could deteriorate investors» confidence. Meanwhile, the surat

utang negara/SUN (government bond) market condition is still growing positively and liquid, despite having experienced sales cancellations for two consecutive months and the existence of high potential for refinancing risk in a state budget condition that is more burdened.

Efforts to support financial system stability, particularly regarding the realization of a safe and reliable payment system , are continuously undertaken. Control over risks within the payment system, both settlement and operational risk, is implemented in line with international standards (best practices). In addition, institutions that issue credit cards, debit cards, and ATM cards will be supervised to ensure that the payment system remains safe and efficient and the customer is protected

A bankruptcy prediction model for individual commercial banks and banking groups operating in Indonesia, based on their financial reports has been developed. Results of statistical analyses show that this

model is effective in predicting bankruptcy three months ahead of the occurrence.

In addition, research has been conducted on the role of foreign banks in the recovery of intermediation, particularly in credit channeling. Results of this research confirm that currently foreign banks» activities are more focused on activities that earn fee based income, credit channeling to the consumption sector, and placement of funds in marketable securities. Data also show that foreign banks give priority to non-credit incomes (42.1%) and that their ROA (0.29%) has a negative correlation with credit growth.

Chapter 2

Opportunities that came with improving international economy in the first half of 2004 have not been optimally seized by Indonesia. This is evidenced by relatively low increase in Indonesia»s international (non oil/gas) trade volume, which stemmed from supply problem such as structural problem and weak competitiveness of Indonesia»s industry sectors that produced prime export products.

1. DEVELOPMENT OF INTERNATIONAL ECONOMY

During semester I/2004, world economy still experienced quite high growth (Chart 2.1) although it was overshadowed for a while by a worry over rising uncertainty that has risen from several geopolitical problems such as heightening political condition in the Middle East. Economies of advanced countries such as the US and Britain still showed quite high growth, largely supported by rising domestic demand. Meanwhile, in the Euro region, domestic economic performance was still moving slowly and as such economic growth in that region was more supported by external sector performance. In the particular case of Japan, significant improvement in economic

performance occurred both on the external side as well as on the domestic side.

Economic growth of advanced and Asian countries has given positive influence on Indonesia»s exports as evidenced by Indonesia»s export performance that was still rising, particularly oil and gas exports. However, it has to be realized also that Indonesia»s rising oil and gas export performance was also much influenced by rising international oil prices. Considering the volatile trend of oil prices, Indonesia»s oil and gas industry sector should increase efforts to raise production volume, which would make institutions that finance this sector feel more secured because their debtors» revenue source would be more certain.

Chapter 2

Development of International & Domestic Economies

Chart 2.1

GDP of Major Trading Partners

% y-o-y

Source : Bloomberg

USA EU Japan

-5.0 -4.0 -3.0 -2.0 -1.0 0.0 1.0 2.0 3.0 4.0 5.0 6.0

2000 2001 2002

I II III IV I II III IV I II III IV I II III IV I II 2004 2003

Chart 2.2

GDP of Some Asian Countries

% y-o-y

-10.0 -5.0 0.0 5.0 10.0 15.0

Source : Bloomberg

2000 2001 2002 2003 2004

I II III IV I II III IV I II III IV I II III IV I II

Malaysia

Korea Singapore China Thailand

value of USD1,382.6 million (5.76%). On the other hand, Indonesia»s largest non oil/gas imports came from Japan with total value of USD2,504 million (16.22% of total non oil/gas imports), followed by the US with total value of USD1,510.9 million (9.78%), China with total value of USD1,421.4 million (9.21%), and Singapore with total value of USD1,094.1 million (7.09%).

In several Asian countries, the growth rates of their trades with other countries were still rising, as reflected by indicators of export-import activities in several countries (Chart 2.3). Meanwhile, China»s policy package to solve the overheating of its economy has started to show influence, particularly in the decline of its international (export-import) trade activities. For Indonesia, China»s economic slowing policy has not shown influence in semester I/2004. This is evidenced by non oil/gas exports that still rose by 8.4% relative to the same period in 2003, while non oil/gas imports rose by 30.9%. However, adoption of above policy by China would make it difficult for non oil/gas exports to that country to expand, which currently have only reached 5.76% of Indonesia»s total non-oil/gas exports (compared to Japan, the US, and Singapore each with a share of 15.82%, 15.01% and 10.28%). For certain industry sectors that are looking for alternative export markets

other than the US, this situation poses a heavy challenge. Financing institutions/banks also need to pay close attention to this phenomenon.

Expanding global economic activities and rising oil and gas and non-oil/gas commodity prices have prompted expanding demand, which has accelerated the rise of inflation in several countries. Inflation rate in advance country group went up from 1.5% (yoy) in semester II/ 2003 to 1.9% (yoy) in semester I/2004.

These expanding economic activities have been followed by an uptrend of interest rates in the international money market, which has been prompted by similar trend in advanced countries (except Japan). Meanwhile, offered interest rates in Asian countries were relatively stable. In the international stock market, shares recovered after experiencing a drop for a while as uncertainty regarding US economy lessened and optimism regarding improved profits for corporations in the US rose. In addition, in the foreign currency market, the strengthening trend of the US dollar exchange rate, which was related to expectation over acceleration of US economic growth followed by expectation over the rise of Fed Fund interest rate, was only temporary. The US dollar weakened again because market players considered that the US economy was still in a big problem in the short-term, largely due to existing twin deficits (US deficit in trade transactions and fiscal deficit). In addition, crude oil price hikes also put pressure on the US dollar exchange rate. Fundamentally, oil price hikes occurred because the need for crude oil was larger than its supply, which was quite disrupted by the crisis in Iraq and problem in the world second largest oil company, Yukos.

From the sentiment side, these oil price hikes were related to speculative activities on oil amidst uncertainties over the plan to reduce OPEC oil production quotas, oil company labor strikes in Venezuela, political fighting in Nigeria and Middle East, as well as information on low Chart 2.3

Export Performance of Some Major Industrial Countries

Source: Interntational Financial Statistics, (processed) Jan

2 0 0 2 % y-o-y

USA Japan

U K Germany -20.00

-10.00 0.00 10.00 20.00 30.00 40.00

fuel reserves in several advanced countries, particularly the US and Europe.

This condition has had negative influence for Indonesia, which currently is a net oil importer. It would raise fuel subsidy cost and as a result would increase state spending in the state budget. In the end, it would have the potential to expand Indonesia»s state budget deficit. Meanwhile, financial institutions need to give close attention to potential interest rate increases due to quite large pressure on the rupiah as a result of this condition. In addition, they also have to be cautious in financing projects that are much influenced by oil prices. Oil price hikes have the potential to raise production cost, which in turn will have the potential to threaten the sustainability of these projects. Financing of export-oriented businesses with exports to countries that are very much dependent on oil imports also need to be closely watched. Oil price hikes could have an impact in slowing down these countries» economic growth and reducing their imports.

International capital flows to developing countries, including Indonesia, experienced outflows for a while due to the issue on Fed Fund interest rate rise. During the first few weeks in semester I/2004, outflows that occurred in developing countries reached USD124 million. However, those capitals are predicted to have returned in line with

lessening expectation over US economic recovery in the short-term.

2. DEVELOPMENT OF DOMESTIC ECONOMY

On the side of balance of payments, current transactions in semester I/2004 recorded a surplus of USD659 million, lower than USD3.6 billion in the same semester in 2003 (Table Indonesia»s Balance of Payments, Appendix 2.1). This drop in surplus was prompted by import rise (14.2%) being larger than export rise (1.1%), particularly oil and gas import rise.

During semester I/2004, the rupiah exchange rate experienced depreciation compared to the previous period, along with rising volatility. Up to end of June 2004, the average rupiah exchange rate has reached Rp8,733/USD, or slightly above the beginning estimated range of Rp8,200/USD √ Rp8,700/USD.

Meanwhile, in June the rupiah exchange rate reached

its lowest of Rp9,486/USD for a while. This depreciation

in general was spurred by external and domestic factors.

The external factors were the spill over impact of US dollar

strengthening, which was related to expectation over Fed

Fund interest rate rise and acceleration of US economic

recovery, as well as regional sentiment over China»s

economic slowing, all of which were overreacted by

domestic market players. This attitude has dampened the

Chart 2. 4

Euro and Yen Exchange Rates Against USD S1-2004

JPY/USD

JPY/USD (right axis) USD/EUR (left axis)

Source: Bloomberg USD/EUR 1,1200 1,1400 1,1600 1,1800 1,2000 1,2200 1,2400 1,2600 1,2800 1,3000

1-Jan 21-Jan 10-Feb 1-Mar 19-Mar 8-Apr 28-Apr 18-May 7-Jun 25-Jun

98 100 102 104 106 108 110 112 114 116

2 0 0 4

Chart 2. 5

Exchange Rates of Asian Currencies Against USD

IDR,KRW/USD THB,PHP/USD Source: Bloomberg 1,000 2,000 3,000 4,000 5,000 6,000 7,000 8,000 9,000 10,000 33 38 43 48 53 58

1-Jan 21-Jan 10-Feb 1-Mar 19-Mar 8-Apr 28-Apr 18-May 7-Jun 25-Jun

THB/USD IDR/USD PHP/USD

prompted the formation of public expectation over rising

inflation. If this inflationary pressure persists, it will have

an impact in raising interest rate. As a consequence,

interest rates of credits and domestic bank deposits would

rise. This would make credit channeling more difficult

and the real sector movement would become slower.

Weakening trend of rupiah exchange rate and rising

inflation expectation have prompted a slowing in the

acceleration of SBI interest rate decline, which made SBI

interest rates relatively stable in the last two months.

During semester I/2004, average interest rates of 1-month

and 3-month SBIs came to 7.57% and 7.49%, lower than

11.51% and 11.66% in semester I/2003. Fed Funds

interest rate increase of 25 bps in June 2004 does not

seem to have influenced domestic interest rate

development yet. However, it is predicted that in the

coming period it would influence domestic money market

condition, which would be reflected in the rise of interbank

money market interest rate. The prediction is even stronger

as US interest rate increase is predicted to continue in

several stages.

On the side of state budget realization in semester I/

2004, domestic currency decline against US dollar and

rising trend of crude oil prices in the international market

have influenced realization of state budget aggregates and

made several basic assumptions, used as references in the

calculation of state budget realization, become no longer

valid. This situation has the potential to raise state budget

deficit and as such revision on state budget cannot be

avoided.

State receipt in semester I/2004 came to Rp144,783.3

billion or 41.4% of state budget target. Meanwhile, tax

receipt for the same period reached Rp118,909.2 billion

or 43.7% of state budget target, with the main sources

being non oil/gas income tax and value-added tax.

On the side of state spending, in semester I/2004,

there has been a rise in government spending in relation positive sentiment arising from improvement on Indonesia»s

foreign debt rating.

In May 2004, Standard and Poors has raised

Indonesia»s sovereign rating outlook from stable to positive

while Japan Credit Rating Agency (JCRA) has also raised

Indonesia»s ratings on long-term currency senior debt as

well as long-term local currency senior debt from B to B+.

Meanwhile, in June 2004, Japan»s rating institution Rating

& Investment raised Indonesia»s long-tem debt rating from

B- to B with stable outlook.

Domestic factor also contributed in putting pressure

on rupiah exchange rate through negative market

sentiment at the approach of the general election. In

addition, negative market sentiment was also influenced

by the bandwagon effect from the rupiah exchange rate

weakening, which was evidenced by rising foreign currency

demand by corporations for import financing, foreign

obligations, in addition to speculative motives.

In the framework of reducing pressures on the

rupiah, Bank Indonesia has issued an economic

stabilization policy package, which covers three aspects.

The first aspect covers controlling policy on the side of

rupiah liquidity by way of absorption of the banking

sector»s excess liquidity that has not been utilized by the

real sector. This is achieved through activation of 7-day

Bank Indonesia Deposit Facility and increase in minimum

reserve requirement for banks. The second aspect covers

enhancement of bank prudential requirement on foreign

currency net position. The third covers increased

monitoring on foreign currency demand.

During semester I-2004, CPI inflation reached 6.83%

(yoy), up from 6.62% (yoy) in the same period last year.

In general, the rise in inflation was prompted by the rise in

telephone tariffs, declining supplies of a number of

commodities that are classified as volatile food due to

seasonal factor, as well as influence of exchange rate

to government policy to give 13th month salaries to civil

servants, members of the Arm Forces/Police, retired civil

servants, and government officials, which were paid in

June 2004, foreign debt interest payments, and other

routine spending related to the cost of holding the general

election. In addition, realization of fuel subsidy reached

Rp8,773.2 billion or 60.4 % of its ceiling in the 2004 state

budget, which was primarily influenced by high realization

of crude oil prices. This realization of fuel subsidy in

semester I/2004 was much higher compared to semester

I/2003 when it reached Rp3,852.9 billion. Development

spending also experienced a slight rise, particularly due to

rupiah financing. Realization of total state spending in

this semester reached Rp163,337.3 billion or 43.6% of

2004 state budget target.

With above developments, semester I/2004 brought

a deficit of Rp18,553.9 billion (3.3% of GDP or 76.0% of

state budget target), which was primarily financed from

the balance of the government account at Bank Indonesia,

particularly investment fund account, yields from

government shares privatization, sales of assets under the

bank restructuring program, and net yields of issuance of

surat utang negara/SUN.

Meanwhile, decline in oil production and increase in

domestic fuel consumption along with rising international

oil prices have the potential to raise deficit. Of course,

rising state budget deficit would have negative influence

for Indonesia because it would lower investors» confidence

in Indonesian government capability to finance that deficit

rise. Further impact would be negative sentiment, which

would bring pressure on the rupiah exchange rate and in

the long-run could also lower Indonesia»s foreign debt

rating.

Indonesia»s foreign debt payments up to May 2004

have reached USD2,142 million, comprising payments on

principals and interests amounting to USD1,900 million

and USD241 million, respectively. Of the total, USD569

million was for government foreign debt payments and

USD1,572 million was for private foreign debt payments.

Of total private foreign debt payments, USD1,195 million

was for financial institutions» foreign debt payments (for

banks amounting to USD1,184 and for non-banks

amounting to USD11 million). The remaining balance of

USD377 million was for non-financial institution foreign

debt payments. These foreign debt payments influenced

the weakening of rupiah exchange rate for a while due to

quite large demand for dollars for the need of these

payments. However, weakening of rupiah exchange rate

was not such that it has endangered Indonesia»s banking

financial condition.

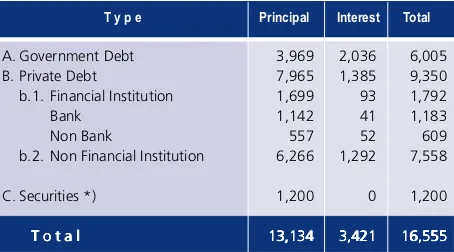

Planned 2004 payments on Indonesia»s foreign debts

(June up to December 2004) are projected to reach

USD16,523 million, comprising payments on principals and

interests in the amounts of USD13,102 million and

USD3,421 million, respectively. Of the total, payments on

government foreign debts are projected to reach USD6,005

million, comprising payments on principals and interests

in the amounts of USD3,969 million and USD2,036 million,

respectively. This payment plan needs to be scheduled

cautiously in order to avoid excessive demand for the dollar

at the same time, which would bring pressure on the rupiah

exchange rate.

Table 2.1

Repayment Plan of Indonesian Offshore June - December 2004

T y p e

*) Marketable securities own by non resident Source: Bank Indonesia

(USD million)

Principal Interest Total

A. Government Debt 3,969 2,036 6,005

B. Private Debt 7,965 1,385 9,350

b.1. Financial Institution 1,699 93 1,792

Bank 1,142 41 1,183

Non Bank 557 52 609

b.2. Non Financial Institution 6,266 1,292 7,558

C. Securities *) 1,200 0 1,200

T o t a l T o t a l T o t a l

this oil price increase has the potential to raise state budget

deficit and companies» production cost, such as airline

companies (see box), with a possibility of threatening the

sustainability of these companies» businesses.

Meanwhile, import value in semester I/2004 rose by

27.2% compared to the same period in 2003. This rise

was brought about by the increases in oil and gas imports

by 36.47% and non-oil/gas imports by 24.5%. Import

growth, which was quite high and exceeded that of

exports, prompted the trade account to drop by 23.8% in

the months of January √ May 2004.

In addition, foreign currency reserve during the period

May √ June 2004 dropped by US$1.9 billion due to among

others payments on foreign debts and Bank Indonesia»s

foreign currency interventions. However, in the month of

June 2004, foreign currency reserve position was still quite

high, reaching US$34.9 billion or equivalent to around 6

months of imports and foreign debt payments. Such level

of foreign reserve was still considered to be safe by investors

as evidenced by the ability of Indonesia to obtain foreign

debts and the existence of foreign investment inflows to

Indonesia.

3.1 Impact of Changes in Exchange Rates On

Corporate Payment Capability

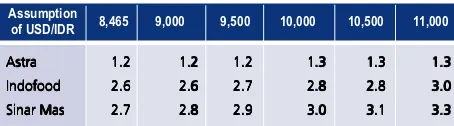

Results of a simulation of exchange rate changes on

debt to equity ratios (DERs) of three large groups show

that DERs of these groups have the potential to worsen

prompted by assumed exchange rate changes. The main

factor for this potential is the fact that each business group

debt structure is still dominated by foreign currency debts,

which are accompanied by relatively low export share in

total sales. Part of their foreign currency debts has been

obtained from national banks. The potential worsening

of these three group»s DERs indicates a potential danger

to the national banking industry and financial system

3. DEVELOPMENT OF THE REAL SECTOR

Indonesia»s economy in semester I/2004 grew 4.66%

(yoy). This growth was still dominated by consumption

activities, while investment and export activities had yet

to gain larger roles. This situation was brought about by

rising public purchasing power as well as availability of

various easy financing facilities. Meanwhile, rupiah

exchange rate weakening has not lowered consumer

expectation of the economy.

Easing in financing by financial institutions was

evidenced by quite active offers for consumer credit

products, which in the end bolstered rapid consumption

credit growth during the reporting period. During semester

I/2004, investment activities (formation of gross domestic

fixed capital), which had occurred since quarter III/2003,

have not shown optimal performance. In the last few

periods, the real sector seemed to start reviving as an

impact of improving economic stability and rising market

confidence over Indonesia»s better economic prospects in

the coming periods. This is reflected by rising approvals

for domestic capital investments by 34.1% from January

√ July 2004 compared to the same period the year before

while foreign capital investment dropped by 33.6%.

However, several investment activity indicators have not

shown satisfactory performances, as reflected in the decline

in capitalization value of the corporate bond market during

semester I/2004 by 38.8% compared to the same period

the year before.

Export performance in semester I/2004 recorded a

growth of 3.14% relative to the same period in 20031.

This growth originated in the increases of oil and gas

exports by 6.29% and non-oil/gas exports by 2.21%. Oil

and gas export rise was prompted by the increases in crude

oil and natural gas exports, while, in contrast, oil product

exports dropped. In addition, although daily level of oil

production dropped, the rise in oil and gas exports was

stability that might come from these groups» lessening

repayment capability.

Under the assumption that the rupiah exchange

rate against USD would become Rp11,000, results of

the simulation show that the Sinar Mas group would

face the largest potential DER decline, from 2.7x to 3.3x

or a drop of 21.2%. This is largely due to the fact that

59% of the groups» debt composition as of December

2003 is dominated by foreign currency debts. Basically,

this group has the potential to adapt to exchange rate

fluctuations, considering that their export sales give

58.94% contribution to total sales. However, the

existing foreign currency debt structure would bring

heavy pressure on this group in its efforts to immediately

raise its income in the short-term to be used for settling

its obligations.

Table 2.2 Simulation of Debt Equity Ratio of 3 Major Group of Companies

Astra AstraAstra

AstraAstra 1.21.21.21.21.2 1.21.21.21.21.2 1.21.21.21.21.2 1.31.31.31.31.3 1.31.31.31.31.3 1.31.31.31.31.3 Indofood

IndofoodIndofood

IndofoodIndofood 2.62.62.62.62.6 2.62.62.62.62.6 2.72.72.72.72.7 2.82.82.82.82.8 2.82.82.82.82.8 3.03.03.03.03.0 Sinar Mas

Sinar MasSinar Mas

Sinar MasSinar Mas 2.72.72.72.72.7 2.82.82.82.82.8 2.92.92.92.92.9 3.03.03.03.03.0 3.13.13.13.13.1 3.33.33.33.33.3 8,465 9,000 9,500 10,000 10,500 11,000 Assumption

of USD/IDR

Source : The related company»s publicized financial report (processed)

in their automotive products, which are the main engine

of the Astra group»s businesses.

The banking industry needs to well anticipate the

potential worsening of DERs as shown by results of this

simulation, which uses an assumption of weakening rupiah

exchange rate. Otherwise, this condition has the potential

to spur these groups» worsening repayment capability,

which in turn would raise banking industry»s

non-performing loans.

3.2 Textiles and Textile Products Industry

One of the industry subsectors that has experienced

quite serious problems is the textiles and textile products

(TTP) industry. Since 2003, credits extended to this industry

have been declining. There are banks that even have

classified the TTP industry into the negative list because

this industry is considered to be an industry that is going

down (sunset industry), with high risk (its debts are

susceptible to becoming non-performing) and not so good

prospects. There are several factors that have influenced

banks» evaluation. First, the TTP industry, which exports

have once been one of the largest foreign currency

contributors for Indonesia, is facing heavy threat because

it has to compete with cheaper TTP products from China

and it has to survive despite the revocation of export quotas

by the European Union, US, and Canada starting 1 January

2005 as part of WTO agreements. Second, the slow down

of the TTP industry also stems from unclear regulations

and labor problems. Third, banks consider the TTP industry

complicated and that it requires special skills to enter this

business due to its specific characteristics. In addition, its

competitiveness is diminishing against China or Vietnam,

who are more aggressive and able to produce cheaper

products.

The main factor that has made Indonesia»s TTP

industry loose in competition against neighboring

countries» products is the fact that the industry»s The second potential DER decline would occur in the

Indofood group, from 2.6x to 3.0x or a decline of 15.4%.

However, this group would face heavier challenge because

its exports share of total sales is only reaching 17.46%. In

order to reach the ASEAN and International markets, this

group plans to build factories overseas (particularly ASEAN),

which will at the same time be the basis for competing in

overseas markets.

Meanwhile, results of simulation on the Astra group

show that the DER of this group would worsen, from 1.2x

to 1.3x or a drop of 12.4%. This would largely occur

because its foreign currency debt share to total debts

reaches 35%. Other heavy challenges that would face

machineries are already out-of-date and almost reach

maximum utilization. Therefore, the most important step

that can be taken at this time is to revive the TTP industry

through revitalization. According to the Indonesian Textile

Association, there are 2 options in revitalization. Option

one involves replacement of machinery spare parts and

machineries. If replacement is done using own capital,

only machinery spare parts can be replaced. If bank credits

can be obtained, all machineries can be replaced. However,

in order to increase Indonesia»s TPT competitiveness against

other countries as well as raise production capacity, option

two has to be adopted. As is the case with other industry

sectors, development of several TPT industry sub sectors

still need to be supported. In addition to bringing in foreign

currency, the industry also absorbs high level of labors (it

provides jobs), which is currently a national problem. From

financial system stability side, there is a worry that a

collapsed TTP industry would raise banks» NPLs, both from

the industry sector itself as well as its laid-off workers.

3.3 Micro, Small, and Medium Scale Business

One of the business units that has quite large role in

moving the real sector is the micro, small, and medium

scale business (MSMB). Research has shown that MSMB

has proved to be able to withstand crises compared to

large businesses . In addition, MSMB has also proved to

be a source for economic growth and absorbs extremely

large number of workers. Therefore, various problems that

are facing the MSMB need to be immediately solved so

that MSMB can be developed into a strong part of the

Indonesian economic system and later on can also play a

role in maintaining financial system stability.

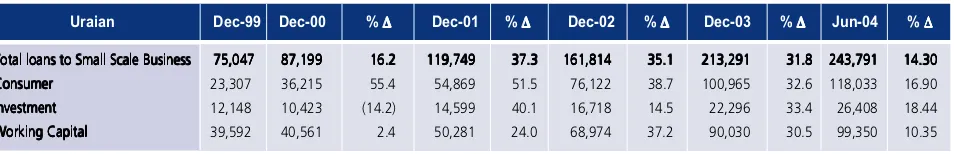

In semester I/2004, bank credits extended to MSMB

experienced a growth of Rp30.5 trillion or 14.3%

compared to its end-2003 position. This figure represents

84.7% of 13 large banks» plan for total credit channeling

to MSMB in 2004, which amounts to Rp36.02 trillion. This

growth reflected the banking industry»s commitment to

continue assistance in developing MSMB although it is

probably still far from optimal.

Several problems that face the banking industry in

channeling credits to MSMB are among others (i) limitation

on number of bank marketing staffs as well as bank outlets/

networks, which makes it difficult to reach remote areas

or centers of small business people, (ii) lack of information

on potential and bankable MSMB debtors, (iii) lack of

proper collaterals, while guarantees through PT Askrindo

and Perum Sarana Pengembangan Usaha will add costs

to potential MSMB debtors, (iv) higher overhead cost for

credit channeling to MSMB.

In order to solve all these various problems and to

raise credits channeled to MSMB in 2004, several efforts

have been made by banks, which cover among others : (i)

actively increase marketing efforts to MSMB centers, (ii)

increase human resource quality through various trainings,

(iii) increase linkage programs through partnership with

BPRs ad Small Business Credit Financing Institutions such

as state pawn company, (iv) develop credit scheme of

core-plasma partnership, and (v) undertake business mapping

of potential Rural Banks (BPRs).

Source: Bank Indonesia

Table 2. 3

Outstanding and Growth of Loans to Small Scale Business

Total loans to Small Scale Business Total loans to Small Scale BusinessTotal loans to Small Scale Business

Total loans to Small Scale BusinessTotal loans to Small Scale Business 75,047 75,047 75,047 75,047 75,047 87,199 87,199 87,199 87,199 87,199 16.2 16.2 16.2 16.2 16.2 119,749 119,749 119,749 119,749 119,749 37.3 37.3 37.3 37.3 37.3 161,814 161,814 161,814 161,814 161,814 35.1 35.1 35.1 35.1 35.1 213,291 213,291 213,291 213,291 213,291 31.831.8 243,79131.831.831.8 243,791 243,791 243,791 243,791 14.30 14.30 14.30 14.30 14.30 Consumer

ConsumerConsumer

ConsumerConsumer 23,307 36,215 55.4 54,869 51.5 76,122 38.7 100,965 32.6 118,033 16.90 Investment

InvestmentInvestment

InvestmentInvestment 12,148 10,423 (14.2) 14,599 40.1 16,718 14.5 22,296 33.4 26,408 18.44 Working Capital

Working CapitalWorking Capital

Working CapitalWorking Capital 39,592 40,561 2.4 50,281 24.0 68,974 37.2 90,030 30.5 99,350 10.35 (Billion rupiah)

Meanwhile, on the side of business people,

constraints coming from banks that face them in

developing their businesses are among others : (i) Banks

are considered to still be hesitant in extending credits to

MSMB. This is evidenced by difficult and lengthy credit

extension procedures, requirement for additional collaterals

along with legal proofs (certificates and licenses to build/

IMB), as well as high interest rates, (ii) The banking industry

does not yet have clear knowledge on MSMB condition,

(iii) Difficulty in communicating with banks» officers

because they are too rigid, (iv) Lack of information on

availability of cheap funds provided by state-owned

enterprises, that are managed by banks, and (v) There is

no sustainable supervision over MSMB debtors.

In the framework of increasing intermediary function

and in order to solve one of the constraints coming from

banks that are facing MSMB, the banking industry needs

to continue holding periodic meetings with business people

and the government. In addition, it is hoped that the

government and the banking sector can provide

information on funds coming from parts of state-owned

enterprises» profits that have been given to and are

managed by several banks for channeling to MSMB.

Micro credits have become segmentation target of

several commercial banks such as Bank Danamon, BNI,

and Bank Mega through the establishment of micro

business units so that this business segment can develop

rapidly in line with these banks» work plans. There is a

need for further monitoring and review, particularly as

regard the possibility of competition over the same target

market between commercial banks and BPRs.

This possible competition would create problems for

BPRs, although these will still be within the context of free

competition, considering that protection for common

people has become a sensitive issue, which if not handled

Box 2.1

Potential Pressures on Several Industries due to Oil Price Hikes

World oil price development that has been

trending upward and reached US$47.86 per barrel

on 23 August 2004 warrants cautious attention. In

addition to its potential to bring pressures on the state

budget, world oil price hikes also have the potential

to put pressures on the real sector performance,

particularly the airline industry. Although credits

extended to this industry has only reached 0.09% of

total credits extended by the banking industry as of

end of June 2004, the industry»s NPLs have reached

6.8%. If this situation is not well anticipated, this

trend would bring pressures on financial system

stability.

World crude oil price hike that reaches US$50/

barrel would trigger transportation cost hike, which

in turn has the potential to put pressures on

performance of businesses, which raw materials are

based on imports. The textile and plastic industries

have the potential to come under pressure due to

soaring world oil prices because almost 90% of their

raw materials still depend on imports. Although direct

impacts of oil price hikes have not materialized yet,

several companies in the plastic industry have already

slowed down their factory performance and

undertaken efficiency efforts in several areas. In

addition, companies in the plastic industry plan to raise

their selling prices by 25%.

The airline industry will be the first to feel the

impact of world oil price hikes because these hikes

would trigger avtur price hikes, where avtur price

constitutes one of the components that determine

tariffs (35% up to 40% of the cost of an airline

company comes from avtur cost). This condition has

the potential to prompt operational cost to rise, while

on the other hand airline companies are facing price

war, which in the end would influence revenue.

There is a worry that this upward trend in world

crude oil prices that is predicted to continue until

end-2004, prompted by among others rising world demand

as several developing countries such as China and India

are advancing, upcoming summer season on the other

hemisphere, as well as sensitivity towards news of

violence in Iraq, would disrupt world oil supply.

Data as of end of July 2004 show that

non-performing loans of credits that have been extended

to the airline industry have reached Rp29,985 million

or 6,8% of total credits that have been extended to

this industry. Of these NPLs, 83% is owned by Bank

Danamon and 11% is owned by Bank Mandiri.

Although credits channeled to the airline industry have

only reached 0.09% of total credits channeled by the

banking industry as of end of June 2004, this industry»s

relatively high NPLs need to be closely watched,

Chart Box 2.1 Loan Classification of Airline Industry - July 2004

Source : Bank Indonesia,BPS

Current Special Mention Doubtful Loss

7 % 0 % 23 %

price hikes such as the airline companies or related

companies. In addition, Bank Indonesia and the

government (fiscal authority) need to intensify

coordination, among others in maintaining

assumptions on inflation rate and SBI interest rates in

line with market needs. considering that the uptrend of oil prices would

probably continue until end of 2004 and heavy tariff

war is still on going among airline companies.

In view of above development, banks are

expected to continuously increase their monitoring of

Chapter 3

1. STRUCTURE OF BANKING INDUSTRY

Indonesia»s financial system was yet dominated by

the banking industry (representing 90% of the financial

system»s total assets). The condition of the banking industry

itself was very much marked by the conditions of 15 large

banks (major banks), considering these banks dominated

the banking industry»s total assets (72.5%). Ten of these

large banks were recap banks.

Up to June 2004, number of banks was lower than

in previous report»s period. Due to the closure of two

small banks, it came to 137 banks with total assets

amounting to Rp1,185.7 trillion.

Indonesia»s banking industry still relied on credit

channeling and accumulation of public deposits and as

such the largest potential for instability would come from

these two sources. However, in terms of earning assets,

the share of credit itself was only 47.5% and the rest

comprised marketable securities (recap bonds and SBIs),

which had zero risk. Meanwhile, deposits were yet

dominated by short-term and corporate deposits, which

were extremely sensitive to interest rates.

Ten banks among the above-mentioned 15 large

banks were recap banks that were yet undergoing

consolidation. Therefore, the operational risks faced by

those banks were yet quite significant, considering that

there have been additions of new owners and

management, which could result in rising operational risks.

2. GENERAL PICTURE OF BANKING INDUSTRY

Stability of the financial system during semester I/

2004 was quite maintained with the support of the banks

as major players in controlling risks being faced, coming

both from internal as well as from external factors.

Chapter 3

Indonesia’s Banking Industry

During the said period, the banking industry faced

heavier pressures relative to the previous year due to yet

inconducive economic condition, exchange rate

weakening, world oil price hikes, and the general election.

In addition, during the same period, two small banks have

been closed and incidents of fraud have occurred in several

banks.

These pressures did not disturb financial system

stability because the related institutions were able to handle

the situation well. Bank Indonesia consistently continued

its efforts in maintaining the banking industry»s stability

by issuance of new regulations to strengthen the banking

system, which included among others reformulation of

the minimum reserve requirement (MRR) and net foreign

currency position, as well as planned implementation of

the Indonesian Banking Architecture.

Credit risk was quite under control and there were

no risk fluctuations that could significantly affect the

financial system»s stability. This is reflected by improving

credit quality marked by decreasing NPL ratio. In addition,

at the end of semester one recorded a quite large jump in

new credits and a decline in the rise of undisbursed loan

relative to the previous month.

Banking sector»s excess liquidity that was quite large

was gradually reduced by a new formulation in the MRR,

which could reduce potential for speculations. In addition,

the plan for phasing out the blanket guarantee needs to

be approached carefully because of its potential in reducing

public confidence in the banking industry.

On the other hand, market risk was quite moderate

despite exchange rate weakening and interest rate rise

by The Fed. Banking industry»s profile, particularly that of

report. It was yet at short position for the short-term

and as such was extremely susceptible to market risk as

well as liquidity risk. Meanwhile, opeational risk was yet

relatively high due to yet ineffective risk management

and good governance implementations, which have

allowed a few cases of fraud to occur. However, banking

industry profitability rose in line with rising credits. On

the other hand, capital declined due to a rise in

risk-weighted assets (RWA) resulting from rising credits.

However, this capital decline did not stir problems in the

banking sector because aggregate CAR was yet relatively

high, namely above 20%.

However, there were a few factors that needed close

attention, particularly credit risk and operational risk, which

had the potential for disturbing banking industry stability.

In the light of developments during the previous year

and economic prospects of semester II/2004, the banking

industry is projected to face heavier pressures. Stage 3 of

the general election is not expected to be a factor of

concern for businesses or the banking industry, considering

that stages 1 and 2 of the general election that has been

held during semester I/2004 has not caused fluctuations

in the banking sector. However, economic and banking

industry»s growths would be much influenced by

developments of world oil prices, rupiah stability, and

interest rates.

The rise in oil prices would raise production costs,

including transportation cost for businesses, which in the

end would raise prices. Should such a situation occurs in

a condition where there is no rise in public income,

business people would experience difficulty in paying off

their debts to banks, which in the end would rise banking

industry NPL.

3. CREDIT RISK

In the period of end December 2003 up to semester

I/2004, Indonesia»s bank credit risk was relatively under

control. This was marked by improving bank credit quality

as reflected by declining trend of NPL ratio. However,

starting semester II/2004 onwards, credit risk would again

rise due to high level of uncertainty coming from external

factor, namely yet inconducive domestic economic

condition, and pressures from international factor, namely

oil price hikes. In addition, the business and banking

sectors would be waiting for policy directions of the newly

elected government, which are expected to be announced

at the start of 2005.

In general, several main challenges, which would face

the banking industry in improving its credit quality in the

future, cover :

i. National economic condition that is not yet conducive

and rising world oil prices. In the long-run, these

would have an impact in raising production cost.

Currently, sea transportation tariffs for goods have

experienced a rise of 20%, both domestic as well as

international.

ii. Existence of a potential rising in credit interest rates

due to interest rate hikes by The Fed and several other

world central banks, which would indirectly influence

global economy, including Indonesia.

iii. Weakening of rupiah value, which would disturb the

performances of exports as well as domestic

businesses that use imported raw materials.

iv. Absorption capability of the real sector, particularly

the corporation sector, is still relatively low because

in general their restructuring process has not been

fully completed. Therefore, it is difficult to

significantly raise new credits. As an impact, new

credit channeling is dominated by small credits and

consumption credits, which cannot accelerate

growths of bank credit portfolio as well as the

economy.

v. There is a potential for a rise in NPLs in the future,

0 10 20 30 40 50 60 70 80 90 0 5 10 15 20 25

Des Dec Dec Dec Dec Dec Dec Jun Dec Jun

1996 1997 1998 1999 2000 2001 2002 2003 2003 2004

Loan (left) Interbank (right) Securities (left) SBI (left)

Percentage Percentage

In the short-term, the impact of oil price hikes would

not yet be realized by the business sector. However, the

size and duration of oil price hikes cannot be predicted

yet, including by APEC, because they are very much related

to issues of wars/terrorism and political instability in several

countries that are world largest oil suppliers.

On one hand, new credit1 rise and undisbursed loan2

decline, which have occurred in the last months of semester

I/2004, are sufficient to prompt bank credit as well as

economic growths. On the other hand, these will also

raise credit risk, which could reduce capitals, if a prudential

approach is not adopted. It is hoped that this credit rise

will not be temporary but will continue.

However, improving economies of Indonesia»s major

trading partners, such as the US, on the one hand and

China»s overheating economy on the other hand give an

opportunity for Indonesia to expand its exports, which in

turn would raise demand for investment and working

capital credits.

3.1. Development of Credits

Bank credit growth was yet influenced by sectors

and types that did not prompt economic growth, which

in nominal terms did not dominate. New credit

withdrawals were smaller than in the pevious year although

the last two months showed quite encouraging

development, which has prompted the share of credit to

surpass that of marketable securities and caused bank LDR

to rise.

Indonesia»s bank post-crisis earning asset composition

is marked by quite large share of recap bonds that has

zero risk as a result of the recapitalization program in 1998.

As of June 2004, bank earning assets rose by Rp29.7 trillion

(2.7%) from December 2003 position, particularly credits

and SBIs, which rose by 11.6% and 9.1%, respectively.

As of above position, credit rise reached Rp50.9

trillion, which particularly came from public funds mobilized

by the banking sector amounting to Rp24.2 trillion, a

decline in recap bonds (Rp19.6 trillion) and interbank

placements (Rp12.0 trillion). This growth prompted a rise

in the share of credit in produtive assets from 42.5% to

46.1%. This share of credit is the largest compared to the

shares of other types of earning assets in the post-crisis

period, which two months previously was yet dominated

by marketable securities (government bonds and SBIs).

The rise in credits resulted from the banking sector»s

efforts to continuously promote its intermediary function,

which prompted banking LDR to also rose to 46.4%.

This is reflected by the credit growth (y-to-y) of foreign

bank group, which was recorded as being negative in the

Chart 3.1 Earning Assets

1 New credits are credits withdrawn by debtors in the same months as the dates of the credit agreements.

2 Credit facilities made available by banks but not yet utilized by debtors.

Chart 3.2 Loans by Group Trillion Rp

State-owned Bank Private Bank

Foreign and Joint Venture Bank Regional Development Bank

1996 1997 1998 1999 2000 2001 2002 2003 2004

Chart 3.5

New Disbursed Loan 2002, 2003, 2004 0.0 0.2 0.4 0.6 0.8 1.0 1.2 1.4 1.6 1.8 2.0

Jan May Sep Jan May Sep Jan May Sep Jan May Sep Jan May

2000 2001 2002 2003 2004

Substandard Doubtful Loss

Trillion Rp.

previous report but started to show positive growth in

this reporting period. However, bank credit growth during

this period was yet supported by the domestic bank group.

Therefore, it can still be stated that marketable

securities still provide a safe and quite large source of

income for the banking sector because their risk do not

weigh as much as that of credits.

3.1.1 Consumption Credits

Despite its small share (9.7%), the quality of

consumption credits need to get special attention,

considering the growth of this type of credit has been

recorded to be the highest with a trend of rising NPLs.

Since the start of 2002 up to May 2004, consumption

credit NPLs have been recorded as being on the rise

although it has started to experience a decline, where as

of June 2004 it came to 2.4% with similar nominal value

as its December 2003 position of Rp2.9 trillion.

This high consumption credit growth relative to public

income growth requires a close attention in a situation of

yet inconducive economic condition. Economic condition

very much influences the performance of this type of credit,

particularly in a situation where there are occurrences of

company closures and employee discharges, considering

that the payoff for this type of credit relies on individual

income.

3.1.2 New Credits and Undisbursed Loans

Withdrawals of new credits were lower relative to

the previous year, however, the last two months showed

quite a significant rise. In addition, undisbursed loans (Uls)

was quite large relative to the previous year. However,

the large number of new credit withdrawals have caused

a decline in the rise of Uls. It is hoped that this positive

development would continue in order to support economic

growth.

The rise in credit portfolio was prompted by a rise in

withdrawals of new credits that have been approved and

withdrawn during 2004, which up to June have reached

Rp31.9 trillion, smaller compared to the same position in

2003 of Rp41.8 trillion.

Chart 3.4 NPL of Consumer Loan

Chart 3.3 Loan to Deposit Ratio

Trillion Rp Percent

Loan (left axis) Deposits (left axis) LDR (right axis)

0 10 20 30 40 50 60 70 80 90 100

1996 1997 1998 1999 2000 2001 2002 2003 2004

0 100,000 200,000 300,000 400,000 500,000 600,000 700,000 800,000 900,000 1,000,000 0 5,000 10,000 15,000 20,000 25,000

Jan Feb Mar Apr May Jun

2002

2003

Based on type of use, the largest extension of new

credits occurred in working capital credit (amounting

to 52.3%), while based on sector, it occurred in the

business services, trade, and industry sector. Meanwhile,

46.5% of new credits extended during 2004 was

channeled to small-to-medium size businesses.

However, the number of Uls for this type of credit and

this sector was also the highest. The percentage shares

of Uls by type of use and by sector are presented in the

following two Charts.

Most (91.6%) of bank Uls belonged to 25 banks

(13 large banks, including 3 state banks, 7 foreign banks,

4 foreign joint venture banks, and 1 other private bank).

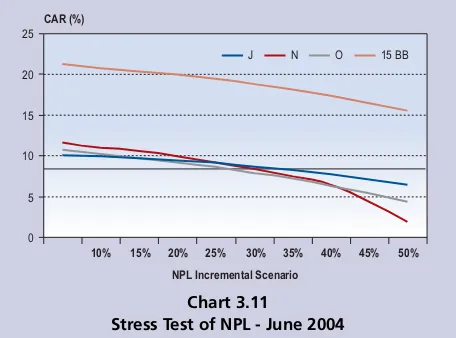

3.3.1 Non Performing Loans

Improvement of non-performing loans (NPLs) has

reached a saturation point where bank NPLs declined with

a much lower magniture although credits continuously

rose. In addition, there is a concern that NPLs that has

reached a saturation point might reverse.

Credit quality is a reflection of bank credit risk. This

is indicated by developments of NPL ratios, both gross and

net. Position of bank NPLs at the reporting period was

quite high. This was due to economic condition that has

not fully recovered, which was tackled by the banking

sector through quite cautious implementation of its

intermediary function as well as through formation of quite

large reserve in anticipation of possible risk.

During the period of December 2003 up to June

2004, Indonesia»s bank credit quality improved as reflected

by a decline in gross and net NPL ratios. Gross NPL ratio

dropped from 8.21% to 7.54%, the smallest ratio since

the 1997/1998 banking crisis. Net NPL ratio also dropped

from 3.04% to 2.09% (Chart 3.8).

Chart III.7

Undisbursed Loan by Usage Chart 3.6

Undisbursed Loan by Sector

Chart 3.8 NPL Gross & Net

However, in nominal terms, NPLs also rose as the

result of yet inconducive economy. However, this rise was

relatively small compared to the rise in total credits. Bank

credits rose by 10.8%, while the rise of NPLs was only

1.8% (Table 3.1). Agriculture Electricity Transportation Others

Mining Construction Business Services Manufacture Trading Social Services

5% 2%

1% 4% 24%

33%

3%

15% 1%

12%

73.3% 14.7%

12.0%

Working Capital Loan Investment Loan Consumer Loan

Dec Jun Dec Jun Dec Jun Dec Jun Dec Jun Dec Jun Dec Jun

1997 1998 1999 2000 2001 2002 2003 2004

0 10 20 30 40 50 60

NPLs Gross NPLs Net

In the short-term, it is estimated that bank CAR

would not be influenced by the rise in credit risk,

considering that in general banks have formed reserves

that exceed requirements. A more conservative ratios are

NPLs to Equity and NPLs to Core Equity. As of June 2004,

these ratios came to 24.1% and 30.5%, which dropped

from their positions at December 2003 of 26.6% and

35.8%, respectively.

The largest NPLs yet belonged to the state bank

group, foreign bank group, foreign joint venture bank

group with ratios above that of the industry, a condition

that did not much change from the previous condition.

NPLs of the foreign bank group and foreign joint

venture bank group experienced a slight improvement