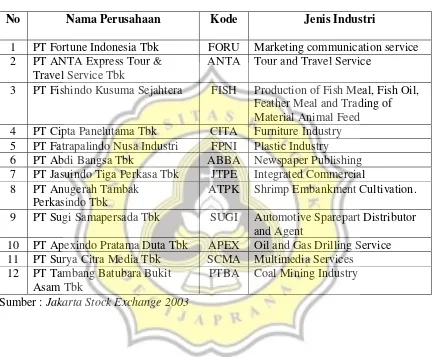

LAMPIRAN 1

Tabel Daftar Sampel

Tahun 2002

No

Nama Perusahaan

Kode

Jenis Industri

1

PT Fortune Indonesia Tbk

FORU

Marketing communication service

2

PT ANTA Express Tour &

Travel Service Tbk

ANTA Tour and Travel Service

3

PT Fishindo Kusuma Sejahtera

FISH

Production of Fish Meal, Fish Oil,

Feather Meal and Trading of

Material Animal Feed

4

PT Cipta Panelutama Tbk

CITA

Furniture Industry

5

PT Fatrapalindo Nusa Industri

FPNI

Plastic Industry

6

PT Abdi Bangsa Tbk

ABBA Newspaper Publishing

7

PT Jasuindo Tiga Perkasa Tbk

JTPE

Integrated Commercial

8

PT Anugerah Tambak

Perkasindo Tbk

ATPK

Shrimp Embankment Cultivation.

9

PT Sugi Samapersada Tbk

SUGI

Automotive Sparepart Distributor

and Agent

10 PT Apexindo Pratama Duta Tbk

APEX

Oil and Gas Drilling Service

11 PT Surya Citra Media Tbk

SCMA Multimedia Services

12 PT Tambang Batubara Bukit

Asam Tbk

PTBA

Coal Mining Industry

Sumber : Jakarta Stock Exchange 2003

Tahun 2003

No

Nama Perusahaan

Kode

Jenis Industri

1

PT Arona Binasejati Tbk

ARTI

Wooden Furniture

2

PT Pelayaran Tempuran Mas

Tbk

TMAS Shipping

Company

3

PT Perusahaan Gas Negara Tbk

PGAS

Planning Building, Managing and

Developing Downstream Business

of Natural Gas

Sumber : Jakarta Stock Exchange 2004

Tahun 2004

No

Nama Perusahaan

Kode

Jenis Industri

1

PT Bioteknologi Holtikultura

Tbk

BTEK

Development of Biotechnology

2

PT Energi Mega Persada Tbk

ENRG

Onshore and Offshore Exploration

and Production Petroleum and

Natural Gas.

3

PT Sanex Qianjiang Motor Tbk

SQMI Motorcycle

Assembly

Part

4

PT Aneka Kemasindo Utama

Tbk

AKKU Plastic Packaging Industry

5

PT Mitra Adiperkasa Tbk

MAPI

Retail Trade, Cafe, Restaurant,

Agent and / or Distributor

Sumber : Jakarta Stock Exchange 2005

Tahun 2005

No

Nama Perusahaan

Kode

Jenis Industri

1

PT Multistrada Arah Sarana Tbk

MASA Tire Manufacturing

2

PT Arpeni Pratama Ocean Line

Tbk

APOL

Dockhand and Shipping Company,

Domestic and International

3

PT Excelcomindo Pratama Tbk

EXCL

Telecommunication Service

4

PT Multi Indocitra Tbk

MICE

General trading and Distribution of

Beauty and Healthy Product, and

Products for Baby, Kids and

Pregnant

Sumber : Jakarta Stock Exchange 2006

Tahun 2006

No

Nama Perusahaan

Kode

Jenis Industri

1

PT Bakrie Telecom Tbk

BTEL

Telecommunication Infrastructure

and Service

2

PT Malindo Feedmill Tbk

MAIN

Production and Selling Feedmill,

Breeding and Distributions Day-old

Chicks, Investment on Subsidiaries.

3

PT Radiant Utama Interinsco

Tbk

RUIS

Offshore Eksploration and

production Oil and Gas, inspection

and Sertification

4

PT Indonesia Air Transport Tbk

IATA

Air Charter and Helicopter Services

5

PT Central Protein Prima

CPRO

Budidaya Udang Terintegrasi

meliputi Benur Udang, Pakan

Udang, Tambak Udang, Produk

Udang Beku, Pakan Ikan, Pakan

Ayam, Unggas DOC

6

PT Mobile-8 Telecom Tbk

FREN

Telecommunication Services

Sumber : Pusat Data Pasar Modal IBII

LAMPIRAN 2

Data Perusahaan IPO tahun 2002-2006

Dalam jutaan

No Nama Established Total Asset Sales Operating Net Cash Flows Share Offering Penerimaan

Emiten Date Income

(OI)

Income Offered Price Kotor

1 FORU 5-May-1970 47053.000 25554.000 3483.000 2006.000 -190.163 205 130 26650

2 ANTA 10-May-1972 184279.900 543994.400 7365.730 10398.300 -22830.595 80 125 10000

3 FISH 27-Jun-1992 42101.975 21820.710 1295.430 884.260 1657.619 80 125 10000

4 CITA 27-Jun-1992 35324.320 18515.210 1558.590 1240.700 -1243.601 60 200 12000

5 FPNI 9-Dec-1987 208508.000 136495.015 29078.000 18887.000 26185.371 67 450 30150

6 ABBA 28-Nov-1992 48750.105 35418.208 -8693.487 -2869.424 -7195.792 400 105 42000

7 JTPE 10-Nov-1992 39365.109 28183.110 2872.740 894.217 -10270.738 100 225 22500

8 ATPK 12-Jan-1988 63759.320 7241.850 2933.350 994.811 -2050.345 135.45 300 40635

9 SUGI 26-Mar-1990 52617.670 60753.260 600.777 781.838 -16741.718 100 120 12000

10 APEX 20-Jun-1984 1324287.530 590376.070 74759.470 38667.380 29353.500 200 550 110000

11 SCMA 29-Jan-1999 932.728 728.950 243586.000 7803.000 7294.252 375 1100 412500

12 PT BA 2-Mar-1981 1919954.000 2219687.000 363998.000 272222.000 256061.000 346.5 575 199238

13 ARTI 31-Mar-1993 99952.094 43600.780 5829.220 826.829 -6184.904 95 650 61750

14 TMAS 17-Sep-1987 159129.778 83129.270 16051.377 18397.157 24340.176 55 550 30250

15 PGAS 1-Feb-1985 5770088.390 3151811.670 813933.798 1115714.395 314555.163 1685.185 1500 2527778

16 BTEK 6-Jun-2001 80184.770 5926.340 760.881 446.483 -4223.737 120 125 15000

17 ENRG 16-Oct-2001 258508.955 195223.415 18805.978 11236.750 56382.369 2847.4335 160 455589

18 SQMI 21-Mar-2000 92730.400 35486.778 2079.785 1892.858 2079.369 120 250 30000

19 AKKU 5-Apr-2001 16141.974 7774.934 411830.000 848.904 -133.833 80 220 17600

20 MAPI 23-Jan-1995 1244984.000 2014108.413 122910.038 74171.222 108.472 500 625 312500

21 MASA 20-Jun-1988 794257.026 222405.205 1583.428 2015564.935 -6842.574 1000 170 170000

22 APOL 4-Oct-1975 1513768.472 845866.695 181111.513 77316.707 194562.268 500 625 312500

23 EXCL 6-Oct-1989 6474459.432 2590703.653 662401.018 -45302.622 1583167.257 1427.5 2000 2855000

24 MICE 11-Jan-1990 124488.369 159616.054 36081.083 17506.282 18296.306 100 490 49000

25 BTEL 13-Aug-1993 1526986.558 164300.474 -67511.538 -111957.710 -58300.084 5500 110 605000

26 MAIN 10-Jun-1997 293970.210 498862.320 61571.359 32914.596 21922.580 61 880 53680

27 RUIS 22-Aug-1984 193855.808 545697.778 27953.223 14201.288 4455.612 170 250 42500

28 IATA 15-Apr-1969 405435.139 231052.980 51554.908 15120.989 48454.493 432 130 56160

29 FREN 16-Dec-2002 2365416.999 350708.835 -179211.410 -286700.181 23849.404 3900 225 877500 30 CPRO 30-Apr-1980 2498007.000 5004875.000 335297.000 232943.000 234521.000 3000 110 330000

Cat : untuk Offering price, data dalam rupiah

Sumber : Prospektus Perusahaan

LAMPIRAN 3

Data Perusahaan IPO untuk Uji Pertumbuhan Tahun 2002

(Dalam juta Rupiah)

No Nama Sales T Sales T-1 Sales T-2 Sales T / Sales T-1 Sales T-1 / Sales T-2

1 FORU 25554.000 51325.000 35990.000 0.49788602 1.426090581 2 ANTA 543994.400 908898.410 795716.910 0.598520576 1.1422384 3 FISH 21820.710 21761.470 4775.000 1.002722243 4.557375916 4 CITA 18515.210 27339.311 24108.987 0.677237623 1.133988375 5 FPNI 136495.015 193738.802 132713.386 0.704531119 1.459828642 6 ABBA 35418.208 32968.507 32385.062 1.074304275 1.018015868 7 JTPE 28183.110 25978.072 29233.006 1.084880741 0.888655515 8 ATPK 7241.850 18199.925 11289.612 0.397905486 1.612094818 9 SUGI 60753.260 61599.540 8668.640 0.986261586 7.106021244 10 APEX 590376.070 364909.130 343479.130 1.617871468 1.062390981 11 SCMA 728.950 553845.000 269466.000 0.001316162 2.055342789 12 PT BA 2219687.000 1708847.000 1797063.000 1.298938407 0.950911014

Sumber : Prospektus perusahaan

Data Perusahaan IPO untuk Uji Pertumbuhan Tahun 2002

(Dalam juta Rupiah)

No Nama Asset T Asset T-1 Asset T-2 Asset T / Asset T-1 Asset T-1 / Asset T-2

1 FORU 47053.000 46117.000 28725.000 1.020296203 1.605465622 2 ANTA 184279.900 211236.970 127172.090 0.872384697 1.661032464 3 FISH 42101.975 43150.710 12455.840 0.975695997 3.464295463 4 CITA 35324.320 20608.903 16341.641 1.714032038 1.26112812 5 FPNI 208508.000 224728.760 168686.590 0.92782072 1.332226587 6 ABBA 48750.105 44727.392 44578.214 1.089938465 1.003346433 7 JTPE 39365.109 20995.675 12625.889 1.874915143 1.662906667 8 ATPK 63759.320 58323.497 59152.771 1.093201253 0.985980809 9 SUGI 52617.670 55568.310 26437.320 0.946900671 2.101888921 10 APEX 1324287.530 580009.290 532847.930 2.283217791 1.088508104 11 SCMA 932.728 759127.000 560212.000 0.001228685 1.355070937 12 PT BA 1919954.000 1658696.000 1648149.000 1.157508067 1.0063993

Sumber : Prospektus perusahaan

Data Perusahaan IPO untuk Uji Pertumbuhan Tahun 2003

(Dalam juta Rupiah)

No Nama Sales T Sales T-1 Sales T-2 Sales T / Sales T-1 Sales T-1 / Sales T-2

1 ARTI 43600.780 55352.694 57089.449 0.787690297 0.969578354 2 TMAS 83129.270 50489.759 30287.883 1.646458047 1.666995313 3 PGAS 3151811.670 2780268.935 2181788.046 1.133635538 1.27430753

Sumber : Prospektus perusahaan

Data Perusahaan IPO untuk Uji Pertumbuhan Tahun 2003

(Dalam juta Rupiah)

No Nama Asset T Asset T-1 Asset T-2 Asset T / Asset T-1 Asset T-1 / Asset T-2

1 ARTI 99952.094 62232.373 37842.655 1.606110922 1.644503352 2 TMAS 159129.778 93127.410 82647.172 1.708731919 1.126806977 3 PGAS 5770088.390 4314175.388 3334307.845 1.337471909 1.293874348

Sumber : Prospektus perusahaan

Data Perusahaan IPO untuk Uji Pertumbuhan Tahun 2004

(Dalam juta Rupiah)

No Nama Sales T Sales T-1 Sales T-2 Sales T / Sales T-1 Sales T-1 / Sales T-2

1 BTEK 5926.340 1034.158 84.922 5.730594358 12.17773957 2 ENRG 195223.415 171541.688 203847.188 1.138052314 0.841520993 3 SQMI 35486.778 40374.406 19601.565 0.878942417 2.059754208 4 AKKU 7774.934 5344.041 1043.384 1.454879182 5.121835297 5 MAPI 2014108.413 1807435.277 1505418.615 1.114346078 1.200619721

Sumber : Prospektus perusahaan

Data Perusahaan IPO untuk Uji Pertumbuhan Tahun 2004

(Dalam juta Rupiah)

No Nama Asset T Asset T-1 Asset T-2 Asset T / Asset T-1 Asset T-1 / Asset T-2

1 BTEK 80184.770 1770.249 1825.309 45.29575783 0.969835244 2 ENRG 258508.955 437559.935 409010.455 0.590796676 1.069801345 3 SQMI 92730.400 92824.811 71509.159 0.998982912 1.298082823 4 AKKU 16141.974 12022.321 11410.973 1.342667027 1.053575449 5 MAPI 1244984.000 994342.465 920449.253 1.252067616 1.080279507

Sumber : Prospektus perusahaan

Data Perusahaan IPO untuk Uji Pertumbuhan Tahun 2005

(Dalam juta Rupiah)

No Nama Sales T Sales T-1 Sales T-2 Sales T / Sales T-1 Sales T-1 / Sales T-2

1 MASA 222405.205 143276.432 108191.045 1.552280455 1.324291045 2 APOL 845866.695 594146.572 579879.673 1.423666709 1.024603206 3 EXCL 2590703.653 2228723.078 2138772.839 1.162416129 1.042056939 4 MICE 159616.054 138499.212 115424.265 1.152469041 1.199914177

Sumber : Prospektus perusahaan

Data Perusahaan IPO untuk Uji Pertumbuhan Tahun 2005

(Dalam juta Rupiah)

No Nama Asset T Asset T-1 Asset T-2 Asset T / Asset T-1 Asset T-1 / Asset T-2

1 MASA 794257.026 473174.965 490329.440 1.678569419 0.965014389 2 APOL 1513768.472 1362788.275 1174644.634 1.110787714 1.16017069 3 EXCL 6474459.432 5514138.849 4746574.511 1.174156039 1.16170911 4 MICE 124488.369 113056.775 98557.015 1.101113746 1.147120527

Sumber : Prospektus perusahaan

Data Perusahaan IPO untuk Uji Pertumbuhan Tahun 2006

(Dalam juta Rupiah)

No Nama Sales T Sales T-1 Sales T-2 Sales T / Sales T-1 Sales T-1 / Sales T-2

1 BTEL 164300.474 161701.443 168658.996 1.016073023 0.95874781 2 MAIN 498862.320 437493.767 326780.070 1.140272977 1.338801865 3 RUIS 545697.778 340056.496 271256.618 1.604726816 1.253633915 4 IATA 231052.980 203798.110 155961.431 1.133734655 1.306721211 5 FREN 350708.835 76061.237 27219.433 4.610874722 2.794372572 6 CPRO 5004875.000 4179832.000 2991877.000 1.197386641 1.397060106

Sumber : Prospektus perusahaan

Data Perusahaan IPO untuk Uji Pertumbuhan Tahun 2006

(Dalam juta Rupiah)

No Nama Asset T Asset T-1 Asset T-2 Asset T / Asset T-1 Asset T-1 / Asset T-2

1 BTEL 1526986.558 1051585.812 1107347.630 1.45207984 0.949643801 2 MAIN 293970.210 239342.330 192720.86 1.228241615 1.241911903 3 RUIS 193855.808 179967.284 131226.005 1.077172493 1.37143003 4 IATA 405435.139 436272.557 385059.955 0.929316164 1.132999034 5 FREN 2365416.999 2035812.497 1573058.470 1.161903173 1.294174715 6 CPRO 2498007.000 2370497.000 2098944.000 1.053790408 1.12937601

Sumber : Prospektus perusahaan

LAMPIRAN 4

Nilai Operating Earning

Periode T dan T-1

No Nama earning (OI) earning (OI) Sales Nilai emiten periode t periode t-1 periode t Earning

1 FORU 3483.000 2381.000 25554.000 0.043124364 2 ANTA 7365.730 11047.420 543994.400 -0.006767882 3 FISH 1295.430 735.040 21820.710 0.025681566 4 CITA 1558.590 1455.593 18515.210 0.005562832 5 FPNI 29078.000 45783.816 136495.015 -0.1223914 6 ABBA -8693.487 -7845.103 35418.208 -0.023953329 7 JTPE 2872.740 2271.106 28183.110 0.021347325 8 ATPK 2933.350 4798.728 7241.850 -0.257583076 9 SUGI 600.777 -515.532 60753.260 0.018374471 10 APEX 74759.470 -20918.070 590376.070 0.162062023 11 SCMA 243586.000 203278.000 728.950 55.29597366 12 PT BA 363998.000 184330.000 2219687.000 0.080942944 13 ARTI 5829.220 6681.623 43600.780 -0.019550178 14 TMAS 16051.377 14991.062 83129.270 0.012755014 15 PGAS 813933.798 724779.954 3151811.670 0.028286539 16 BTEK 760.881 -455.142 5926.340 0.205189544 17 ENRG 18805.978 6889.693 195223.415 0.06103922 18 SQMI 2079.785 -626.199 35486.778 0.076253302 19 AKKU 411830.000 -1958.631 7774.934 53.22085448 20 MAPI 122910.038 21216.401 2014108.413 0.050490647 21 MASA 1583.428 -14373.532 222405.205 0.071747242 22 APOL 181111.513 89490.793 845866.695 0.108315791 23 EXCL 662401.018 574777.568 2590703.653 0.033822259 24 MICE 36081.083 26776.810 159616.054 0.058291586

25 BTEL -67511.538 -67527.090 164300.474 9.46558E-05 26 MAIN 61571.359 22454.021 498862.320 0.078413094 27 RUIS 27953.223 21741.652 545697.778 0.011382804 28 IATA 51554.908 29442.408 231052.980 0.095703159 29 FREN -179211.410 -385714.281 350708.835 0.588815708 30 CPRO 335297.000 142158.000 5004875.000 0.038590175

Sumber : Prospektus perusahaan

Cat

:

Nilai variabel dihitung dengan rumus : (variabel

t- variabel

t-1) / penjualan

tVariabel yang dimaksud adalah earnings, total accrual, dan cash flow. Data diambil dari masing-masing prospektus perusahaan

Nilai Total Accrual

Periode T dan T-1

No Nama Total Accruals Total Accrual Sales Nilai TAC emiten periode t periode t-1 periode t

1 FORU 3673.163 9421.979 25554.000 -0.224967363 2 ANTA 30196.325 -30923.978 543994.400 0.112354655 3 FISH -362.189 3682.596 21820.710 -0.1853645 4 CITA 2802.191 2127.432 18515.210 0.036443497 5 FPNI 2892.629 3769.547 136495.015 -0.006424542 6 ABBA -1497.695 -2880.281 35418.208 0.039036024 7 JTPE 13143.478 4292.145 28183.110 0.314065162 8 ATPK 4983.695 -269.681 7241.850 0.725419057 9 SUGI 17342.495 -4297.234 60753.260 0.356190417

10 APEX 45405.970 -48118.970 590376.070 0.158415872 11 SCMA 236291.748 278592.000 728.950 -58.02901708 12 PT BA 107937.000 -75642.000 2219687.000 0.082704904 13 ARTI 12014.124 2173.339 43600.780 0.22570204 14 TMAS -8288.799 -10222.306 83129.270 0.02325904 15 PGAS 499378.635 47753.902 3151811.670 0.14329052 16 BTEK 4984.618 299.601 5926.340 0.79054138 17 ENRG -37576.391 -58814.853 195223.415 0.108790546 18 SQMI 0.416 -986.352 35486.778 0.027806638 19 AKKU 411963.833 -2930.486 7774.934 53.36306636 20 MAPI 122801.566 9476.073 2014108.413 0.056265836 21 MASA 8426.002 -20843.649 222405.205 0.131605063 22 APOL -13450.755 -2014.958 845866.695 -0.013519621 23 EXCL -920766.239 -600178.265 2590703.653 -0.123745521 24 MICE 17784.777 22264.281 159616.054 -0.028064245 25 BTEL -9211.454 -85756.547 164300.474 0.465884797 26 MAIN 39648.779 33362.144 498862.320 0.012601944 27 RUIS 23497.611 11635.809 545697.778 0.021736944 28 IATA 3100.415 18388.751 231052.980 -0.066168097 29 FREN -203060.814 -105670.538 350708.835 -0.277695531 30 CPRO 100776.000 -46863.000 5004875.000 0.029499038

Sumber : Prospektus perusahaan

Cat :

Total accrual merupakan selisih antara earnings (operating income) dan cash flow.

Nilai Cash Flow

Periode T dan T-1

No Nama Cash Flow Cash Flow Sales Nilai emiten periode t periode t-1 periode t Cash Flow

1 FORU -190.163 -7040.979 25554.000 0.268091727 2 ANTA -22830.595 41971.398 543994.400 -0.11912254 3 FISH 1657.619 -2947.556 21820.710 0.211046066 4 CITA -1243.601 -671.839 18515.210 -0.03088067 5 FPNI 26185.371 42014.269 136495.015 -0.11596686 6 ABBA -7195.792 -4964.822 35418.208 -0.06298935 7 JTPE -10270.738 -2021.039 28183.110 -0.29271784 8 ATPK -2050.345 5068.409 7241.850 -0.98300213 9 SUGI -16741.718 3781.702 60753.260 -0.33781595 10 APEX 29353.500 27200.900 590376.070 0.00364615 11 SCMA 7294.252 -75314.000 728.950 113.3249907 12 PT BA 256061.000 259972.000 2219687.000 -0.00176196 13 ARTI -6184.904 4508.284 43600.780 -0.24525222 14 TMAS 24340.176 25213.368 83129.270 -0.01050403 15 PGAS 314555.163 677026.052 3151811.670 -0.11500398 16 BTEK -4223.737 -754.743 5926.340 -0.58535184 17 ENRG 56382.369 65704.546 195223.415 -0.04775133 18 SQMI 2079.369 360.153 35486.778 0.048446664 19 AKKU -133.833 971.855 7774.934 -0.14221188 20 MAPI 108.472 11740.328 2014108.413 -0.00577519 21 MASA -6842.574 6470.117 222405.205 -0.05985782

22 APOL 194562.268 91505.751 845866.695 0.121835412 23 EXCL 1583167.257 1174955.833 2590703.653 0.15756778 24 MICE 18296.306 4512.529 159616.054 0.086355831 25 BTEL -58300.084 18229.457 164300.474 -0.46579014 26 MAIN 21922.580 -10908.123 498862.320 0.06581115 27 RUIS 4455.612 10105.843 545697.778 -0.01035414 28 IATA 48454.493 11053.657 231052.980 0.161871256 29 FREN 23849.404 -280043.743 350708.835 0.866511239 30 CPRO 234521.000 189021.000 5004875.000 0.009091136

Sumber : Prospektus perusahaan

Nilai Discretionary Accrual

Periode T dan T-1

No Nama

Total

Accruals Total Accrual Sales Sales Discretionary emiten periode t periode t-1 periode t periode t-1 Accruals

1 FORU 3673.163 9421.979 25554.000 51325.000 -0.039833632 2 ANTA 30196.325 -30923.978 543994.400 908898.410 0.089532102 3 FISH -362.189 3682.596 21820.710 21761.470 -0.185823922

4 CITA 2802.191 2127.432 18515.210 27339.311 0.073529493 5 FPNI 2892.629 3769.547 136495.015 193738.802 0.001735344 6 ABBA -1497.695 -2880.281 35418.208 32968.507 0.045078599 7 JTPE 13143.478 4292.145 28183.110 25978.072 0.301138255 8 ATPK 4983.695 -269.681 7241.850 18199.925 0.702997514 9 SUGI 17342.495 -4297.234 60753.260 61599.540 0.355218663 10 APEX 45405.970 -48118.970 590376.070 364909.130 0.208775872 11 SCMA 236291.748 278592.000 728.950 553845.000 323.6505599 12 PT BA 107937.000 -75642.000 2219687.000 1708847.000 0.09289206 13 ARTI 12014.124 2173.339 43600.780 55352.694 0.2362849 14 TMAS -8288.799 -10222.306 83129.270 50489.759 0.102753206 15 PGAS 499378.635 47753.902 3151811.670 2780268.935 0.141265774 16 BTEK 4984.618 299.601 5926.340 1034.158 0.551390268 17 ENRG -37576.391 -58814.853 195223.415 171541.688 0.150381493 18 SQMI 0.416 -986.352 35486.778 40374.406 0.024441853 19 AKKU 411963.833 -2930.486 7774.934 5344.041 53.53451696 20 MAPI 122801.566 9476.073 2014108.413 1807435.277 0.055727855 21 MASA 8426.002 -20843.649 222405.205 143276.432 0.183364373 22 APOL -13450.755 -2014.958 845866.695 594146.572 -0.012510395 23 EXCL -920766.239 -600178.265 2590703.653 2228723.078 -0.086119207 24 MICE 17784.777 22264.281 159616.054 138499.212 -0.049331614 25 BTEL -9211.454 -85756.547 164300.474 161701.443 0.474274103 26 MAIN 39648.779 33362.144 498862.320 437493.767 0.003220984 27 RUIS 23497.611 11635.809 545697.778 340056.496 0.00884247 28 IATA 3100.415 18388.751 231052.980 203798.110 -0.076811601 29 FREN -203060.814 -105670.538 350708.835 76061.237 0.810281265 30 CPRO 100776.000 -46863.000 5004875.000 4179832.000 0.031347262

Sumber : Prospektus perusahaan

Cat :

Nilai discretionary accrual diukur dengan rumus :

DAC

pt= (TAC

pt/ Sales

pt) - (TAC

pd/ Sales

pd)

LAMPIRAN 5

Nilai Operating Earning

Periode T-1 dan T-2

No Nama earning (OI) earning (OI) Sales Nilai emiten periode t-1 periode t-2 periode t-1 Earning

1 FORU 2381.000 1628.000 51325.000 0.014671213 2 ANTA 11047.420 3452.270 908898.410 0.008356434 3 FISH 735.040 -232.440 21761.470 0.044458394 4 CITA 1455.593 2337.505 27339.311 -0.032258018 5 FPNI 45783.816 24661.661 193738.802 0.109023875 6 ABBA -7845.103 451.314 32968.507 -0.251646731 7 JTPE 2271.106 1780.610 25978.072 0.018881155 8 ATPK 4798.728 1123.991 18199.925 0.201909458 9 SUGI -515.532 434.324 61599.540 -0.015419855 10 APEX -20918.070 80919.190 364909.130 -0.27907567 11 SCMA 203278.000 90701.000 553845.000 0.203264451 12 PT BA 184330.000 400088.000 1708847.000 -0.126259402 13 ARTI 6681.623 4999.710 55352.694 0.030385386

14 TMAS 14991.062 9390.955 50489.759 0.110915701 15 PGAS 724779.954 597363.853 2780268.935 0.045828696 16 BTEK -455.142 -319.636 1034.158 -0.131030268 17 ENRG 6889.693 49866.087 171541.688 -0.25053032 18 SQMI -626.199 -3545.463 40374.406 0.072304816 19 AKKU -1958.631 -459.299 5344.041 -0.28056147 20 MAPI 21216.401 57484.631 1807435.277 -0.020066129 21 MASA -14373.532 -19446.340 143276.432 0.035405739 22 APOL 89490.793 100644.610 594146.572 -0.018772837 23 EXCL 574777.568 749294.024 2228723.078 -0.078303338 24 MICE 26776.810 15698.068 138499.212 0.079991372 25 BTEL -67527.090 2910.412 161701.443 -0.435602186 26 MAIN 22454.021 12544.740 437493.767 0.022650108 27 RUIS 21741.652 26523.211 340056.496 -0.014061072 28 IATA 29442.408 18730.064 203798.110 0.05256351 29 FREN -385714.281 -207695.812 76061.237 -2.340462449 30 CPRO 142158.000 -30399.000 4179832.000 0.041283238

Sumber : Prospektus perusahaan

Cat

:

Nilai variabel dihitung dengan rumus : (variabel

t- variabel

t-1) / penjualan

tVariabel yang dimaksud adalah earnings, total accrual, dan cash flow. Data diambil dari masing-masing prospektus perusahaan

Nilai Total Accrual

Periode T-1 dan T-2

No Nama Total Accruals Total Accrual Sales Nilai emiten periode t-1 periode t-2 periode t-1 TAC

1 FORU 9421.979 2286.689 51325.000 0.139021724 2 ANTA -30923.978 -17602.510 908898.410 -0.014656718 3 FISH 3682.596 -526779.100 21761.470 24.37618856 4 CITA 2127.432 -2647.416 27339.311 0.174651366 5 FPNI 3769.547 -613.704 193738.802 0.022624539 6 ABBA -2880.281 451.314 32968.507 -0.101053863 7 JTPE 4292.145 299.630 25978.072 0.153687887 8 ATPK -269.681 1842.620 18199.925 -0.116060973 9 SUGI -4297.234 -826.169 61599.540 -0.056348879 10 APEX -48118.970 -24254.950 364909.130 -0.065397158 11 SCMA 278592.000 90701.000 553845.000 0.339248346 12 PT BA -75642.000 129244.000 1708847.000 -0.119897217 13 ARTI 2173.339 542.974 55352.694 0.029454122 14 TMAS -10222.306 -3566.710 50489.759 -0.131820712 15 PGAS 47753.902 -4914.653 2780268.935 0.018943691 16 BTEK 299.601 258.306 1034.158 0.039931036 17 ENRG -58814.853 62989.893 171541.688 -0.710059155 18 SQMI -986.352 -1846.182 40374.406 0.021296412 19 AKKU -2930.486 667.357 5344.041 -0.673243899 20 MAPI 9476.073 -12054.552 1807435.277 0.011912252 21 MASA -20843.649 -13710.705 143276.432 -0.049784489 22 APOL -2014.958 38838.619 594146.572 -0.068760099 23 EXCL -600178.265 -658516.525 2228723.078 0.026175643 24 MICE 22264.281 16424.802 138499.212 0.042162543 25 BTEL -85756.547 53442.650 161701.443 -0.860840784 26 MAIN 33362.144 -34695.273 437493.767 0.155562027 27 RUIS 11635.809 14185.817 340056.496 -0.007498777 28 IATA 18388.751 -11536.430 203798.110 0.146837382 29 FREN -105670.538 -64376.797 76061.237 -0.542901255 30 CPRO -46863.000 -85259.000 4179832.000 0.009186015

Sumber : Prospektus perusahaan

Cat :

Total accrual merupakan selisih antara earnings (operating income) dan cash flow.

Nilai Cash Flow

Periode T-1 dan T-2

No Nama Cash Flow Cash Flow Sales Nilai

emiten periode t-1 periode t-2 periode t-1 Cash Flow

1 FORU -7040.979 -658.689 51325.000 -0.124350511 2 ANTA 41971.398 21054.780 908898.410 0.023013153 3 FISH -2947.556 526546.660 21761.470 -24.33173016 4 CITA -671.839 4984.921 27339.311 -0.206909384 5 FPNI 42014.269 25275.365 193738.802 0.086399337 6 ABBA -4964.822 0.000 32968.507 -0.150592867 7 JTPE -2021.039 1480.980 25978.072 -0.134806732 8 ATPK 5068.409 -718.629 18199.925 0.317970431 9 SUGI 3781.702 1260.493 61599.540 0.040929023 10 APEX 27200.900 105174.140 364909.130 -0.213678512 11 SCMA -75314.000 0.000 553845.000 -0.135983894 12 PT BA 259972.000 270844.000 1708847.000 -0.006362185

13 ARTI 4508.284 4456.736 55352.694 0.000931265 14 TMAS 25213.368 12957.665 50489.759 0.242736413 15 PGAS 677026.052 602278.506 2780268.935 0.026885006 16 BTEK -754.743 -577.942 1034.158 -0.170961304 17 ENRG 65704.546 -13123.806 171541.688 0.459528835 18 SQMI 360.153 -1699.281 40374.406 0.051008404 19 AKKU 971.855 -1126.656 5344.041 0.392682429 20 MAPI 11740.328 69539.183 1807435.277 -0.031978382 21 MASA 6470.117 -5735.635 143276.432 0.085190229 22 APOL 91505.751 61805.991 594146.572 0.049987261 23 EXCL 1174955.833 1407810.549 2228723.078 -0.104478981 24 MICE 4512.529 -726.734 138499.212 0.037828829 25 BTEL 18229.457 -50532.238 161701.443 0.425238599 26 MAIN -10908.123 47240.013 437493.767 -0.132911919 27 RUIS 10105.843 12337.394 340056.496 -0.006562295 28 IATA 11053.657 30266.494 203798.110 -0.094273872 29 FREN -280043.743 -143319.015 76061.237 -1.797561194 30 CPRO 189021.000 54860.000 4179832.000 0.032097223

Sumber : Prospektus perusahaan

Nilai Discretionary Accrual

Periode T-1 dan T-2

No Nama

Total

Accruals Total Accrual Sales Sales Discretionary emiten periode t-1 periode t-2 periode t-1 periode t-2 Accruals

1 FORU 9421.979 2286.689 51325.000 35990.000 0.120038059 2 ANTA -30923.978 -17602.510 908898.410 795716.910 -0.011902007 3 FISH 3682.596 -526779.100 21761.470 4775.000 110.4894559 4 CITA 2127.432 -2647.416 27339.311 24108.987 0.187626198 5 FPNI 3769.547 -613.704 193738.802 132713.386 0.024081132 6 ABBA -2880.281 451.314 32968.507 32385.062 -0.101300487 7 JTPE 4292.145 299.630 25978.072 29233.006 0.15497213 8 ATPK -269.681 1842.620 18199.925 11289.612 -0.178031456 9 SUGI -4297.234 -826.169 61599.540 8668.640 0.025544679 10 APEX -48118.970 -24254.950 364909.130 343479.130 -0.061250125 11 SCMA 278592.000 90701.000 553845.000 269466.000 0.166419041 12 PT BA -75642.000 129244.000 1708847.000 1797063.000 -0.116184505 13 ARTI 2173.339 542.974 55352.694 57089.449 0.029752539 14 TMAS -10222.306 -3566.710 50489.759 30287.883 -0.084702665 15 PGAS 47753.902 -4914.653 2780268.935 2181788.046 0.019428581 16 BTEK 299.601 258.306 1034.158 84.922 -2.751980063 17 ENRG -58814.853 62989.893 171541.688 203847.188 -0.651865862 18 SQMI -986.352 -1846.182 40374.406 19601.565 0.069755308 19 AKKU -2930.486 667.357 5344.041 1043.384 -1.187973415 20 MAPI 9476.073 -12054.552 1807435.277 1505418.615 0.01325027 21 MASA -20843.649 -13710.705 143276.432 108191.045 -0.018751759 22 APOL -2014.958 38838.619 594146.572 579879.673 -0.07036838 23 EXCL -600178.265 -658516.525 2228723.078 2138772.839 0.038602126 24 MICE 22264.281 16424.802 138499.212 115424.265 0.01845446 25 BTEL -85756.547 53442.650 161701.443 168658.996 -0.847206853 26 MAIN 33362.144 -34695.273 437493.767 326780.070 0.182430577

27 RUIS 11635.809 14185.817 340056.496 271256.618 -0.018079385 28 IATA 18388.751 -11536.430 203798.110 155961.431 0.164199996 29 FREN -105670.538 -64376.797 76061.237 27219.433 0.975821861 30 CPRO -46863.000 -85259.000 4179832.000 2991877.000 0.017285132

Sumber : Prospektus perusahaan

Cat :

Nilai discretionary accrual diukur dengan rumus :

DAC

pt= (TAC

pt/ Sales

pt) - (TAC

pd/ Sales

pd)

LAMPIRAN 6

Data perbandingan Discretionary Accrual

No Nama

Total Accruals

Total

Accrual Sales Sales DAC

Total

Accrual Sales DAC emiten periode t periode t-1 periode t periode t-1 T vs T-1 periode t-2 periode t-2 T-1 vs T-2

1 FORU 3673.163 9421.979 25554 51325 -0.03983363 2286.689 35990 0.120038059

2 ANTA 30196.325 -30923.978 543994.4 908898.41 0.089532102 -17602.51 795716.91 -0.01190201

3 FISH -362.189 3682.596 21820.71 21761.47 -0.18582392 -526779.1 4775 110.4894559

4 CITA 2802.191 2127.432 18515.21 27339.311 0.073529493 -2647.416 24108.987 0.187626198 5 FPNI 2892.629 3769.547 136495.015 193738.802 0.001735344 -613.704 132713.386 0.024081132 6 ABBA -1497.695 -2880.281 35418.208 32968.507 0.045078599 451.314 32385.062 -0.10130049 7 JTPE 13143.478 4292.145 28183.11 25978.072 0.301138255 299.63 29233.006 0.15497213

8 ATPK 4983.695 -269.681 7241.85 18199.925 0.702997514 1842.62 11289.612 -0.17803146 9 SUGI 17342.495 -4297.234 60753.26 61599.54 0.355218663 -826.169 8668.64 0.025544679 10 APEX 45405.97 -48118.97 590376.07 364909.13 0.208775872 -24254.95 343479.13 -0.06125013

11 SCMA 236291.748 278592 728.95 553845 323.6505599 90701 269466 0.166419041

12 PT BA 107937 -75642 2219687 1708847 0.09289206 129244 1797063 -0.11618451

13 ARTI 12014.124 2173.339 43600.78 55352.694 0.2362849 542.974 57089.449 0.029752539 14 TMAS -8288.799 -10222.306 83129.27 50489.759 0.102753206 -3566.71 30287.883 -0.08470267 15 PGAS 499378.635 47753.902 3151811.67 2780268.94 0.141265774 -4914.653 2181788.046 0.019428581

16 BTEK 4984.618 299.601 5926.34 1034.158 0.551390268 258.306 84.922 -2.75198006

17 ENRG -37576.391 -58814.853 195223.415 171541.688 0.150381493 62989.893 203847.188 -0.65186586 18 SQMI 0.416 -986.352 35486.778 40374.406 0.024441853 -1846.182 19601.565 0.069755308 19 AKKU 411963.833 -2930.486 7774.934 5344.041 53.53451696 667.357 1043.384 -1.18797342 20 MAPI 122801.566 9476.073 2014108.41 1807435.28 0.055727855 -12054.552 1505418.615 0.01325027 21 MASA 8426.002 -20843.649 222405.205 143276.432 0.183364373 -13710.705 108191.045 -0.01875176 22 APOL -13450.755 -2014.958 845866.695 594146.572 -0.0125104 38838.619 579879.673 -0.07036838

23 EXCL

-920766.239 -600178.27 2590703.65 2228723.08 -0.08611921 -658516.525 2138772.839 0.038602126 24 MICE 17784.777 22264.281 159616.054 138499.212 -0.04933161 16424.802 115424.265 0.01845446 25 BTEL -9211.454 -85756.547 164300.474 161701.443 0.474274103 53442.65 168658.996 -0.84720685 26 MAIN 39648.779 33362.144 498862.32 437493.767 0.003220984 -34695.273 326780.07 0.182430577 27 RUIS 23497.611 11635.809 545697.778 340056.496 0.00884247 14185.817 271256.618 -0.01807939 28 IATA 3100.415 18388.751 231052.98 203798.11 -0.0768116 -11536.43 155961.431 0.164199996

29 FREN

-203060.814 -105670.54 350708.835 76061.237 0.810281265 -64376.797 27219.433 0.975821861

30 CPRO 100776 -46863 5004875 4179832 0.031347262 -85259 2991877 0.017285132