THE INFLUENCE OF EARNINGS MANAGEMENT ON THE COST OF DEBT

(An Empirical Study on Listed Consumer Goods Companies in Indonesia Stock Exchange)

A THESIS

Submitted in Partial Fulfillment of Requirements for Obtaining The Degree of Economy Bachelor

BY :

FRANSISCA WINNY MORANTA GULTOM Reg. No. 7103220027

FACULTY OF ECOMOMIC STATE UNIVERSITY OF MEDAN

ACKNOWLEDGEMENT

First and foremost, praise and thanks goes to my LORD Jesus Christ for

the many blessing undeservingly bestowed upon me. Because of His love and

faithfulness, the author finally able to complete this thesis with title “The Influence of Earnings Management on The Cost of Debt (An Empirical Study on Listed Consumer Goods Companies in Indonesia Stock Exchange)”. This thesis intended to fulfill the requirement for undergraduate program in Accounting

Major on Faculty of Economics, State University of Medan.

The writing of this thesis has been one of the most significant academic

challenges I have ever had to face. It has given me lots of learning. It was really

challenging and fun, also seasoned with stressful experiences sometimes. It helps

me to explore a wider horizon of behavioural science, which I enjoy the most.

It would not have been possible to write this thesis without the help,

support, guidance and advice of the kind people around me, to only some of

whom it is possible to give particular mention here.

1. Prof. Dr. Ibnu Hajar, M.Si. as The Rector of State University of Medan.

2. Drs. Kustoro Budiarta, M.E. as The Dean in Faculty of Economic.

3. Drs. La Ane, M.Si. as The Chief of Accounting Major.

4. Drs. Jihen Ginting, M.Si., Ak. as The Secretary of Accounting Major and as

The Examiner in examining and giving comments and suggestions for this

5. Chandra Situmeang S.E., M.S.M., Ak. as The Advisor and The Supervisor.

I’m deeply grateful for his guidance, patience and support. His wisdom,

knowledge and commitment to the highest standards inspired and motivated

me. Thank you for always been a good role model in accounting.

6. Muhammad Ishak, S.E., M.Si., Ak. as The Examiner in examining and giving

comments and suggestions for this thesis.

7. Khairunnisa Harahap, S.E., M.Si. as The Examiner in examining and giving

comments and suggestions for this thesis.

8. Lecturers and staffs on Accounting Major, Faculty of Economics, State

University of Medan.

9. My sweet family: Gultom Family. I extend my respect to my parents: J.

Gultom, Ph. D. and N. Samosir, B. A., for their unconditional support, both

financially and emotionally throughout my study. There is no way to express

how much it meant to me. Thank you Mom and Dad for showing faith in me

and giving me liberty to choose what I desired. I consider myself the luckiest

girl in the world to have such a supportive family, standing behind me with

their love and support. This thesis is dedicated to you.

10. My fellow brothers and sisters in Christ, for their continual support and

encouragement throughout these past years: Kak Marriane McLaine, Kak

Donna Havard, Kak Erin, Kak Winda, Kak Vita, Kak Tiwi, Bang Binsar,

Bang Echan, Ingrid, Ester, Bellina (my sweetest sister ever), Vero, Dian

11. My dear friends Kak Tiwi, Kak Rizka, Vivin and Ribka. Discussions with

you have been illuminating and always helpful.

12. All of my friends in Accounting Major 2010 A Class, my deepest

appreciation goes to you guys. Especially for Shanty and Lia for keep giving

strength and encouraging, also other fighting friends KD, Suci, Hermila, Putri

Rizky, Zizah, Aisyah, Tika, Eva, Rini, Dwinda, April, Mega, Linda, Ilham,

Kaisar, Josua, Hary, Benny, Maman and etc (I can’t mention all of you one

by one but we will always be great friends each other).

13. All of my friends in LCE, I owe my deepest gratitude to you. Although I

missed spending time with you these three past months but your spirit keep

me up.

14. All people who were contributed to this thesis completion. As always it is

impossible to mention everybody who had an impact to this thesis.

The author realizes this thesis is far away from perfect. Therefore if there

are any errors in this thesis as well as shortcomings, the author accept criticism

and constructive suggestions to perfect this research. Finally, the author hope this

thesis may be useful for related society, institution and other researchers.

Medan , March 2014

ABSTRACT

Fransisca Winny Moranta Gultom. Reg. No. 7103220027. The Influence of Earnings Management on The Cost of Debt. Thesis, Accounting Study Program, Faculty of Economic, State University of Medan, 2014.

The problem in this research is whether earnings management has influence on cost of debt. This research is aimed to find out the empirical evidence of the influence of earnings management on the cost of debt on consumer goods companies listed in Indonesian Stock Exchange (IDX) in year 2012.

The population in this research are all consumer goods companies listed in Indonesia Stock Exchange in 2012. From 36 listed companies, 35 companies were selected as the samples. Judgment sampling is used as a method of sample selection. The data used in this research is secondary data, by collecting and downloading the financial statements from Indonesian Stock Exchange site http://www.idx.co.id. Data analysis technique used was simple regression.

The results obtained with significance level α = 5%, indicates that earnings management has no effect on the cost of debt. In this research the hypothesis testing of the second and third are ignored because it moderates first hypothesis. The second and third hypotheses as moderating will not strengthen or weaken the relationship between earnings management and the cost of debt, because of the remaining first hypothesis showed no influence between earnings management and cost of debt.

The conclusion of the research hypothesis states that the first hypothesis is rejected. This means that earnings management has no influence on the cost of debt on consumer goods companies listed in Indonesian Stock Exchanges.

ABSTRAK

Fransisca Winny Moranta Gultom. NIM 7103220027. Pengaruh Manajemen Laba Terhadap Biaya Utang. Skripsi, Program Studi Akuntansi, Fakultas Ekonomi, Universitas Negeri Medan 2014.

Permasalahan yang dibahas dalam penelitian ini yaitu apakah manajemen laba berpengaruh terhadap biaya utang. Penelitian ini ditujukan untuk mengetahui bukti empiris dari pengaruh manajemen laba terhadap biaya utang di perusahaan barang konsumsi yang terdaftar di Bursa Efek Indonesia pada tahun 2012.

Populasi dalam penelitian ini adalah seluruh perusahaan barang konsumsi yang terdaftar di Bursa Efek Indonesia pada tahun 2012. Dari 36 perusahaan yang terdaftar, dipilih 35 perusahaan sebagai sampel dengan menggunakan metode judgement sampling. Data yang digunakan dalam penelitian ini adalah data sekunder, dengan cara mengumpulkan laporan keuangan dari situs Bursa Efek Indonesia pada situs internet. Teknik analisis data yang digunakan adalah analisis regresi sederhana.

Hasil yang diperoleh dengan taraf signifikansi α = 5%, menunjukkan

bahwa manajemen laba tidak berpengaruh terhadap biaya utang. Dalam penelitian ini pengujian terhadap hipotesis kedua dan ketiga diabaikan karena berfungsi untuk memoderasi hipotesis pertama. Hipotesis kedua dan ketiga tidak akan memperkuat atau memperlemah hubungan antara manajemen laba dan biaya utang karena dari hipotesis pertama yang tersisa tidak menujukkan pengaruh manajemen laba terhadap biaya utang.

Kesimpulan dari hasil penelitian menyatakan bahwa hipotesis pertama ditolak. Hal ini berarti bahwa manajemen laba tidak berpengaruh terhadap biaya utang pada perusahaan barang konsumsi yang terdaftar di Bursa Efek Indonesia.

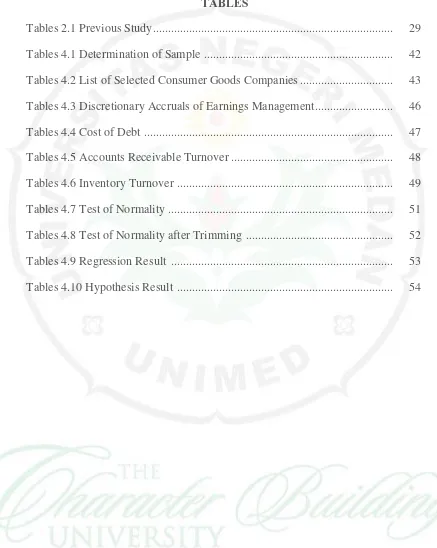

TABLES

Tables 2.1 Previous Study ... 29

Tables 4.1 Determination of Sample ... 42

Tables 4.2 List of Selected Consumer Goods Companies ... 43

Tables 4.3 Discretionary Accruals of Earnings Management ... 46

Tables 4.4 Cost of Debt ... 47

Tables 4.5 Accounts Receivable Turnover ... 48

Tables 4.6 Inventory Turnover ... 49

Tables 4.7 Test of Normality ... 51

Tables 4.8 Test of Normality after Trimming ... 52

Tables 4.9 Regression Result ... 53

FIGURES

APPENDIX A

RESULT OF

DATA

LIST OF SELECTED CONSUMER GOODS COMPANIES

No. Code Company

1 ADES PT Akasha Wira International Tbk 2 AISA PT Tiga Pilar Sejahtera Food Tbk 3 ALTO PT Tri Banyan Tirta Tbk

4 CEKA PT Cahaya Kalbar Tbk 5 DAVO PT Davomas Abadi Tbk 6 DLTA PT Delta Djakarta Tbk

7 DVLA PT Darya-Varia Laboratoria Tbk 8 GGRM PT Gudang Garam Tbk

9 HMSP PT HM Sampoerna Tbk

10 ICBP PT Indofood CBP Sukses Makmur Tbk 11 INAF PT Indofarma (Persero) Tbk

12 INDF PT Indofood Sukses Makmur Tbk 13 KAEF PT Kimia Farma (Persero) Tbk 14 KDSI PT Kedawung Setia Industrial Tbk 15 KICI PT Kedaung Indah Can Tbk 16 KLBF PT Kalbe Farma Tbk

17 LMPI PT Langgeng Makmur Industry Tbk 18 MBTO PT Martina Berto Tbk

24 RMBA PT Bentoel International Investama Tbk 25 ROTI PT Nippon Indosari Corpindo Tbk 26 SCPI PT Schering-Plough Indonesia Tbk 27 SKBM PT Sekar Bumi Tbk.

28 SKLT PT Sekar Laut Tbk

29 SQBB PT Taisho Pharmaceutical Indonesia Tbk 30 STTP PT Siantar Top Tbk

DATA TABULATION

No. Code DA COD ART ITO

1 ADES -0,406427903 0,08165 126,2617219 8,39469

2 AISA -0,205596162 0,07477 31,8424694 5,88010

3 ALTO -0,094118681 0,08080 3,947165784 3,37346

4 CEKA -0,146036367 0,02578 217,6052828 3,19995

5 DAVO -1,113232308 0,05521 3,375965698 4,19866

6 DLTA -0,346882648 0,05521 -66,81174983 18,05365

7 DVLA -0,109560346 0,00342 13,85617648 8,65520

8 GGRM -0,17502437 0,03363 106,8123751 1,79363

9 HMSP 2,810799085 0,00186 270,3093666 5,42045

10 ICBP -0,211296344 0,01044 -676,1985833 12,53339

11 INAF 0,026083783 0,03252 13,48181428 6,51692

12 INDF -0,48231005 0,03961 493,8970263 6,99206

13 KAEF -0,151129706 0,00939 50,03282269 7,57079 14 KDSI -0,208746212 0,03561 57,77762686 7,91767 15 KICI -0,060483421 0,01947 38,69467683 2,35446

16 KLBF -0,193633759 0,00248 49,54309 7,13822

17 LMPI -0,226346555 0,06674 16,78908621 3,35387 18 MBTO 25,77654568 0,01824 6,314259711 13,55259 19 MERK -0,004768179 0,00315 -23,66089999 15,02272 20 MRAT -0,041786133 0,01684 9,098665247 7,25950

21 MYOR -0,21764719 0,04747 29,02674524 7,41428

22 PSDN -0,267812178 0,05922 565,304875 6,71071

Description:

DA : Discretionary Accruals (Proxy of Earnings Management)

COD : Cost of Debt

ART : Accounts Receivable Turnover

1. NORMALITY TEST I

NPar Tests

Notes

Output Created 05-Mar-2014 13:24:56

Comments

Input Data D:\SPSS SISCA\SPSS XY.sav

Active Dataset DataSet1

Filter <none>

Weight <none>

Split File <none>

N of Rows in Working Data File 35

Missing Value Handling Definition of Missing User-defined missing values are treated as

missing.

Resources Processor Time 00 00:00:00,032

Elapsed Time 00 00:00:00,031

Number of Cases Alloweda 157286

a. Based on availability of workspace memory.

One-Sample Kolmogorov-Smirnov Test

Cost of debt

Earnings

management

N 35 35

Normal Parametersa,b Mean ,0365631428571

43

Most Extreme Differences Absolute ,136 ,492

Positive ,136 ,492

Negative -,100 -,359

Kolmogorov-Smirnov Z ,807 2,911

Notes

Output Created 05-Mar-2014 13:24:56

Comments

Input Data D:\SPSS SISCA\SPSS XY.sav

Active Dataset DataSet1

Filter <none>

Weight <none>

Split File <none>

N of Rows in Working Data File 35

Missing Value Handling Definition of Missing User-defined missing values are treated as

missing.

Resources Processor Time 00 00:00:00,032

Elapsed Time 00 00:00:00,031

Number of Cases Alloweda 157286

a. Test distribution is Normal.

b. Calculated from data.

2. NORMALITY TEST II

NPar Tests

Notes

Output Created 05-Mar-2014 13:26:52

Comments

Input Data D:\SPSS SISCA\SPSS XY.sav

Active Dataset DataSet1

Filter <none>

Weight <none>

Split File <none>

N of Rows in Working Data File 32

Missing Value Handling Definition of Missing User-defined missing values are treated

Cases Used Statistics for each test are based on all

Resources Processor Time 00 00:00:00,016

Elapsed Time 00 00:00:00,015

Number of Cases Alloweda 157286

a. Based on availability of workspace memory.

One-Sample Kolmogorov-Smirnov Test

Cost of debt

Earnings

management

N 32 32

Normal Parametersa,b Mean ,0376375000000

00

Most Extreme Differences Absolute ,123 ,113

Positive ,123 ,061

Negative -,098 -,113

Kolmogorov-Smirnov Z ,695 ,641

Asymp. Sig. (2-tailed) ,719 ,806

a. Test distribution is Normal.

b. Calculated from data.

Notes

Output Created 05-Mar-2014 13:31:05

Comments

Input Data D:\SPSS SISCA\SPSS XY.sav

Active Dataset DataSet1

Filter <none>

Weight <none>

Split File <none>

Syntax GRAPH

/HISTOGRAM=cod.

Resources Processor Time 00 00:00:04,508

Elapsed Time 00 00:00:03,979

3. SIMPLE LINEAR REGRESSION Regression

Notes

Output Created 17-Mar-2014 05:11:57

Comments

Input Data D:\SPSS SISCA\SPSS XY.sav

Active Dataset DataSet1

Filter <none>

Weight <none>

Split File <none>

N of Rows in Working Data File 32

Missing Value Handling Definition of Missing User-defined missing values are treated

as missing.

Cases Used Statistics are based on cases with no

missing values for any variable used.

Syntax REGRESSION

Resources Processor Time 00 00:00:00,015

Elapsed Time 00 00:00:00,038

Memory Required 1436 bytes

Additional Memory Required for

Residual Plots

Variables Entered/Removedb

a. All requested variables entered.

b. Dependent Variable: cost of debt

Model Summary

a. Predictors: (Constant), earnings management

ANOVAb

Model Sum of Squares df Mean Square F Sig.

1 Regression ,000 1 ,000 ,370 ,547a

Residual ,023 30 ,001

Total ,023 31

a. Predictors: (Constant), earnings management

b. Dependent Variable: cost of debt

Coefficientsa

APPENDIX C

DAFTAR RIWAYAT HIDUP

DATA PRIBADI PENELITI

Nama : Fransisca Winny Moranta Gultom Tempat/Tanggal Lahir : Medan/30 Juli 1991

Jenis kelamin : Perempuan

Agama : Kristen Protestan

Alamat : Jalan Notes Lrg. Gereja No. 53, Medan

Telepon/HP : 081260463521

1 CHAPTER I INTRODUCTION 1.1 Background of The Study

A company needs funds to finance its operations. One of them is by the

debt. Debt can come from bank loans or corporate bonds. Cost of debt is the rate

of return that must be repaid to the company's debts. The return rate is the

expected yield for the willingness of investors and creditors bear the risk. This is

what makes company urgently needs to consider the cost of corporate debt. If the

company's cost of debt is high, then the selling costs of company's products will

also increase due to increased production costs. This condition will be hard to

compete with other companies. Company will also be difficult to accept projects

due to high cost of debt. The company will be difficult to accept the project if the

estimated cash flows of the company is not as profitable (counting based on the

present value of future cash flows).

World Bank site reveals a comparison between inflation and interest rates

to borrow. In ASEAN comparison between inflation and borrowing interest rates

have varied differences. World Bank data shows that interest rate to borrow as one

proxy for measuring cost of debt, in Indonesia, in 2012 at a rate ranging from

12.4% to 5.4% of inflation which is higher than some other ASEAN countries

such as Malaysia from 4.9% to 3.2% of inflation, Singapore from 5.4% to 5.3% of

inflation, and Thailand from 6.9% to 3.8% of inflation. Cost of debt in Indonesia

is quite high. The interest rate is also higher than China which is in the range from

by taking into account the inflation rate is still quite high which indicates a high

cost of corporate debt in Indonesia.

An interest rate is the rate at which interest is paid by a borrower for the

use of money that they borrow from a lender (creditor). Interest rate set by the

central bank of country as a reference to relative interest rate to each country. In

Indonesia, the interest rate set by Bank Indonesia become the basis for calculating

interest rates. When the interest rate set by Bank Indonesia increased, then at the

same time interest rate set by the company when issuing bonds will also increase,

so the interest rate that can be borrowed or proxied by cost of debt will increase as

well.

High cost of debt is also due on each business risks. When the government

raises the interest rate, the increase is also borne by the investor. Business risk is

the potential change in the level of return on an investment. Business risk is the

uncertainty in projections of the company for return or profit in the future. Keown

et al. (2010) suggested that cost of debt is the rate of return expected by investors

over the debt, which is the return that is required when giving a loan to the

company. In order to understand the business risks of a company, stakeholders

(internal or external parties) need sufficient information about a company. The

required information was obtained from financial statements of company. In terms

of financial reporting, managers can perform earnings management to mislead

stakeholders of the company's economic performance. Earnings management is

accounting policy choice by manager in order to achieve his own goals.

management efforts to maximize or minimize income, including income

smoothing in accordance with the desire of management.

Manager knows more about the company's internal information and

prospects in the future than the owner. This privilege is used by managers as an

opportunistic behavior in disclosing information about the company. Supposedly

the manager shall provide a signal about the state of the company to the owner

through disclosure of accounting information in the financial statements.

However, most of the times the information submitted is not acceptable according

to the actual condition of the company. This condition is known as asymmetric

information that received by investors as a bad signal. Bad signal derived from

earnings management practices in company. When the information is not real at

the same time the quality of financial reporting is in doubt. The doubtful of

financial reporting leads to lower earnings quality. It means investors are aware

that they have to bear high risk over uncertainty. This uncertainty will lead to high

cost of debt.

Companies with good conditions indicated by the effectiveness of the

company to utilize its resources. The utilization of resources is characterized by

the ability of the company to be able to generate profits from its activities. In this

study, researcher prefer to use account receivable turnover and inventory turnover

to analyze how company’s activities in making profit. Measurements with that ratios were chosen to do in the consumer goods company. The consumer goods

company must have a high activity of the company. This company has the

identity indicates a good signal to be able to assess the activity of the company,

especially in generating profits. Moreover, if company really has good activity,

surely, the tendency to perform earnings management is not required. Similarly

with debt. If both corporate activity and profit target is achieved, then the

company does not have to pay the high cost of debt, as funding from the

company's borrowing will also be smaller.

In line with this, Rao and Rao Madhusudhana Prahlada (2009) stated that

the activity of the company is important to establish a chain of company

performance. Effectiveness of the company indicating the best time to utilize the

company's activities in generating profits. The company must be able to adapt to

the appropriate time in order to move well so that continuity of the company is

also guaranteed. As a form of improvising its business, as well as the company

should maintain its effectiveness.

Empirical research that support high cost of debt due to earnings

management practices supported by research Valipour and Moradbeygi (2011).

They observed that the low quality of earnings, will result in a higher cost of debt.

The low earnings quality due to earnings manipulation detected by investors as a

form of earnings management. It can be concluded that firms aggressively use

accruals to manage earnings to avoid covenant violations and reduce the cost of

financing, including cost of debt.

This result is in contrast to Gray, Koh and Tong (2009) which states that

there is no relationship between earnings management in the accrual process with

quality of accruals that are not associated with the cost of debt. The quality of

accruals considered only affects cost of equity in the equity market, but had no

effect on cost of debt in debt market.

Previous studies have shown inconsistent results. Therefore, researcher

will examine the effect of earnings management on the cost of debt. In this

research efectiveness of the company is used to examine whether effectiveness of

the company will strengthen or weaken the relation between earnings

management and the cost of debt. In accordance with this background, the

researcher is interested to research “The Influence of Earnings Management on The Cost of Debt (An Empirical Study on Listed Consumer Goods Companies in Indonesia Stock Exchange).”

1.2 Identification of The Problem

As related to the background, the identification problem are as follows:

1. What is the reason of company in considering its cost of debt?

2. Do company’s efectiveness describe earnings management practice? 3. Do earnings management influence on the cost of debt?

4. Does company’s efectiveness moderate on the relation of earnings management and cost of debt?

1.3 Limitation of Problem

The problem of this research is limited to the influence of earnings

management on the cost of debt that moderates by company’s efectiveness which are accounts receivable turnover and inventory turnover on listed consumer goods

1.4 Research Question

From the background of the problem, the research questions are formulated

as follows :

1. Do earnings management influence on the cost of debt?

2. Does company’s accounts receivable turnover moderate the relation of earnings management and cost of debt?

3. Does company’s inventory turnover moderate the relation of earnings management and cost of debt?

1.5 Research Objective

According to the problem, research objectives are as follows:

1. To analyze the influence of earnings management on the cost of debt

2. To analyze the influence of accounts receivable turnover to the relation of

earnings management and cost of debt

3. To analyze the influence of inventory turnover to the relation of earnings

management and cost of debt

1.6 Research Contributions

The contributions of the study are as follows:

1. For researcher, to prove empirically the influence of earnings management on

the cost of debt

2. For academics, the results of this research are expected to contribute

additional information that available for students in studying similar material

3. For next researchers, as reference material and resources to conduct further

CHAPTER V

CONCLUSION AND SUGGESTION 5.1 Conclusion

From research analysis and discussion which has been elaborated before

and based on data obtained from research as which has been discussed in this

research, the conclusion is based on the regression test, hypothesis test rejects H1

(0.547 > 0.05). It means earnings management has no influence on cost of debt.

5.2 Suggestion

Based on conclusions explained before and research findings, hence

submitted suggestions as follows.

1. Researcher suggest next researcher to expand the sample where the sample

is not limited at consumer goods companies but also expanding the

sample all of manufacturing companies that listed in Indonesia Stock

Exchange.

2. Researcher suggest next researcher to use other variables that have not

been included in this research such as cost of equity or cost of capital or

other ratios that can be affected by earnings management and a range of

data time series so it can explain the overall effects of earnings

REFERENCES

Arya, A., J. Glover, and S. Sunder. 2003. Are Unmanaged Earnings always Better for Shareholders?. Accounting Horizons (supplement), pp.111-116.

Bhattacharya et al. 2012. Direct and Mediated Association among Earnings Quality, Information Asymmetry, and the Cost of Equity. The Accounting Review. Vol. 87, No. 2:449-482.

DeAngelo, L., 1986. Accounting numbers as market valuation substitutes: A study of management buyouts of public stockholders. The Accounting Review, 61. 400-420.

DeAngelo, L. E. 1988. Managerial Competition, Information Costs, and Corporate Governance: The Use of Accounting Performance Measures in Proxy Contests. Journal of Accounting and Economics, Vol. 10, pp. 3-36.

Dechow, Patricia M. and Richard G. Sloan. 1991. Executive Incentives and The Horizon Problem: An Empirical Investigation. Journal of Accounting and Economics, Vol. 14, pp. 51-89.

Dechow, P. M., R. G. Sloan and A.P. Sweeney. 1995. Detecting Earnings Management, The Accounting Review. Vol. 70.

Frankel, Micah, and Trezervant. 1994. The Year End LIFO Inventory Purchasing Decision : An Empirical Test. Accounting Review, April, 382-398.

Ghozali, Imam, 2011. Aplikasi Analisis Multivariate dengan Program SPSS. Edisi Ketiga. Semarang: Badan Penerbit Universitas Diponegoro.

Graham, J.R 2003. Taxes and Corporate Finance: A Review. Review of Financial Studies 16, 1075-1129.

Gray, P. Koh, P-S., and Tong, Yen H. 2009. Accruals Quality, Information Risk and Cost of Capital : Evidence from Australia. Journal of Business, Finance & Accounting. Vol. 36, No. (1) & (2): 51-72.

Haugen, R.A., and L.W. Senbet. 1978. The Insignificance of Bankruptcy Costs to The Theory of Optimal Capital Structure. Journal of Finance 33, 383-393.

Healy, P. M. and K. G. Palepu. 1993. The Effect of Firms’ Financial Disclosure Policies on Stock Prices. Accounting Horizons, Vol. 7, pp. 1-11.

Holthausen, R. W. 1990. Accounting Method Choice: Opportunistic Behavior, Efficient Contracting and Information Perspectives. Journal of Accounting and Economics, Vol. 12, pp. 207-218.

Holtahusen, R. W., D. Larker, and R. Sloan. 1995. Annual Bonus Schemes znd The Manipulation of Earnings. Journal of Accounting and Economics, Vol. 19, pp. 29-74.

Horngren, Charles T., Walter T. Harrison Jr., Michael A. Robinson., Thomas H. Secokusumo. 1997. Akuntansi di Indonesia. Jakarta: Salemba Empat.

Husnan, Suad. 1996. Manajemen Keuangan Teori dan Penerapan (Keputusan Jangka Panjang). Edisi Keempat. Yogyakarta: BPFE

Jensen, M., and Meckling, W. 1976. Theory of The Firm: Managerial Behavior, Agency Costs, and Ownership Structure. Journal of Financial Economics, Vol. 3: 305-360.

Jones, J. J. 1991. Earnings Management During Import Relief Investigations. Journal of Accounting Research. Vol. 29, No.2 : 193-228.

Kuncoro, Mudrajad. 2009. Metode Riset untuk Bisnis dan Ekonomi. Edisi Ketiga. Jakarta: Erlangga.

Keown, J.A., & Martin, J.D., & Petty, J.W., & Scott, D.F., 2010. Manajemen Keuangan, Edisi 11. Jakarta: PT Indeks.

Kraus, A., and R.H. Litzenberger. 1973. A State-Preference Model of Optimal Financial Leverage. Journal of Finance 33, 911-922.

Lambert, R.A. 2001. Contracting Theory and Accounting. Journal of Accounting & Economics, Vol. 32, No.2 : 3 – 87.

Leary, M. and M.R. Roberts. 2004b. Do Firms Rebalance Their Capital Structures?. Journal of Finance, forthcoming.

Maydew, Edward L. 1997. Tax - Induced Earnings Management by Firms with Net Operating Losses. Journal of Accounting Research, Spring. Page 83-86. Myers, S.C. 1984. The Capital Structure Puzzle. Journal of Finance 39,

575-592.

Rao Madhusudhana C. And Rao Prahlada K. 2009. Inventory Turnover Ratio as a Supply Chain Performance Measure. Serbian Journal of Management, Vol. 4, No. 1: 41-50.

Schipper, K. 1989. Commentary on Earnings Management. Accounting Horizons 3: 91-102.

Scott, William R. 2003. Financial Accounting Theory. Third Edition, University of Waterloo.

Sentosa, Agnes Andriyani. 2009. Pengaruh Good Corporate Gorvenance dan Tingkat Voluntary Disclosure terhadap Cost of Debt. Surabaya: Skripsi S-1, Program Studi Akuntansi Universitas Kristen Petra.

Situmorang dan Lufti, M. 2012. Analisis Data untuk Riset Manajemen dan Bisnis. Medan : USU Press

Subramanyam, K. R. 1996. The Pricing of Discretionary Accruals. Journal of Accounting and Economics, Vol. 22, pp. 249-281.

Sudjito, Dwi Apriani. 2006. Analisis Praktek Manajemen Laba Pada Perusahaan Manufaktur yang Melakukan Initial Public Offering dan Listed di BEJ Periode 1997-2004. Universitas Diponegoro, Semarang. Accessed at November 15th, 2012.

Sulistyanto, Sri. 2008. Manajemen Laba: Teori dan Model Empiris. Jakarta: Grasindo.

Sutopo, Bambang, 2009. Manajemen Laba dan Manfaat Kualitas Laba Dalam Keputusan Investasi. Jurnal Akuntansi. Solo. Universitas Negeri Sebelas Maret.

Suwardjono. 2005. Teori Akuntansi : Perekayasaan Pelaporan Keuangan (Edisi III). Yogyakarta : BPFE.

Tariverdi, Y., Moradzadehfard, M., and Rostami, M. 2012. The Effect of Earnings Management on The Quality of Financial Reporting. African Journal of Business Management, Vol. 6, N0. 12: 4603-4611.

Teoh, Siew Hong, Ivo Welch, and T. J. Wong. 1998 a. Earnings Management and The Long-Run Market Performance of Initial Public Offerings. Journal of Finance, Vol. 53, pp. 1935-1975.

Utami, Wahyuni Dewi. 2005. Analisis Variabel yang Mempengaruhi Struktur Pendanaan pada Industri Perdagangan Besar Barang Produksi dan Eceran yang terdaftar di BEJ. Universitas Brawijaya. Malang.

Valipour, H. and Moradbeygi, M. 2011. Corporate Debt and Financing Quality. Journal of Applied Finance and Banking, Vol. 1, No. 3: 139-157.

Watts, RL. Dan J.L. Zimmerman. 1986. Positive Accounting Theory. Prentice Hall, NJ.

Weston, J.F dan Copeland. 2008. Dasar–Dasar Manajemen Keuangan Jilid II. Jakarta: Erlangga.

Wolk, Harry I., and Michael G. Tearney. 1997. Accounting Theory: A Conceptual and Institutional Approach 4th edition. Cincinnati: South Western College Publishing.

Worthy, F.S. 1984. Manipulating profits: How it's done. Fortune (June 25): 50-54.