www.elsevier.com / locate / econbase

Factor bias and technical progress

a b ,

*

Ronald Findlay , Ronald Jones

a

Columbia University, New York, NY, 10027-6902 USA

b

Department of Economics, University of Rochester, 238 Harkness, Rochester, NY 14627, USA Received 15 October 1998; accepted 9 February 1999

Abstract

The role of factor bias in technical progress has been a bone of contention between labor economists and international trade theorists. By considering progress that results in finite changes in techniques these two views can be reconciled. For example, labor-saving technical progress can result in lowered real wages, even if it is concentrated in the more labor-intensive of two commodities initially produced. 2000 Elsevier Science S.A. All rights reserved.

Keywords: Factor bias; Technical progress

JEL classification: F11; O30

The fate of wage rates for unskilled workers in recent years has been the focus of analysis both of

1

labor economists and international trade theorists. Labor economists often favor partial equilibrium analysis and trade theorists frequently rely on the standard general equilibrium 232 model of Heckscher and Ohlin. These approaches sometimes lead to different conclusions, and such differences can prove to be contentious in the ongoing debate. Much of the disagreement concerns the role of factor bias in technical progress. Thus if Hicksian labor-saving progress (i.e. at initial factor prices the improvement in technology reduces the optimal labor–capital ratio utilized in production) takes place in some sector of the economy, labor economists would argue that there would be pressure on market wages to fall, and that such downward pressure would be greater than in the case of Hicksian neutral or capital-saving progress. By contrast, standard Heckscher–Ohlin trade theory suggests that factor bias would be unimportant for the issue, whereas wages would rise or fall depending completely on whether the improved sector is labor-intensive or capital-intensive. The trade theory result would be

*Corresponding author. Tel.: 11-716-275-2688; fax: 11-716-256-2309.

E-mail address: [email protected] (R. Jones)

1

See, for example, the recent work of Collins (1998).

illustrated using a model in which two traded commodities are produced, their world (and domestic)

2

prices remain unchanged, and production requires the use of two inputs.

This trade result shares company with much of trade theory in its assumption that the shocks to the equilibrium, such as technical progress, are small — with the general rationale being a desire to exclude second-order changes. In this note we examine what would happen to the trade argument about unskilled wages and biased technical progress if the change in technical progress is not small —

3

rather is of finite size. In such a case bias does indeed matter. The surprise is that bias may matter in a manner opposite to the supposed harm which a Hicksian saving in the use of unskilled labor would bring to the wage rate.

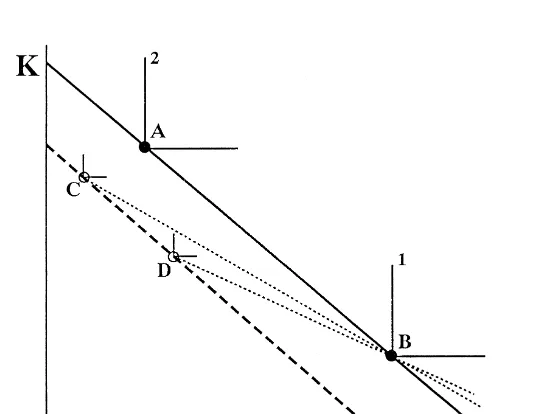

Our first two diagrams illustrate these possibilities. In both of these it is assumed that technical progress takes place in the capital-intensive sector (2) in a two-sector model. In Fig. 1 it is assumed for convenience that the possibilities for factor substitution are absent, so that unit-value isoquants are right-angled at initial points A and B. A parallel line, through points C and D, is drawn, and two alternative possibilities for technical progress in the capital-intensive sector are represented by points C and D. If commodity 2’s isoquant shifts to point C, at the initial wage–rent ratio the ratio of labor to capital has been reduced — a Hicksian labor-saving technical change. The same degree of technical progress is captured in the alternative possibility, that the new unit-value isoquant touches at point D, although in this case progress is Hicksian capital-saving. In either of these two cases the effect of technical progress in the capital-intensive sector is to lower wage / rental rates. Unlike the case of

Fig. 1. Technical progress in the capital-intensive sector. 2

The issues related to the impact of technological progress on the terms of trade and factor prices first arose in the ‘trade and growth’ literature of the 1950s and 1960s. Our own main contributions to this literature are in Findlay and Grubert (1959) and Jones (1965). The present article draws on the insight in both of these papers.

3

infinitessimal changes, bias does matter. But wages are driven down more in situation D than in situation C. That is, workers lose more in cases in which technical progress is labor-using.

In specific-factors models, a neutral degree of progress in either sector of the economy would tend to help labor, assuming labor is the mobile factor. If the technical progress is labor-using, wages are

4

driven up even more. In Fig. 1 the results are the opposite — the more labor-using the bias, the more are wages driven down. The reason?: such a bias in technical progress in the capital-intensive sector of the economy serves to bring closer together the factor intensities in the two sectors. And a standard result in Heckscher–Ohlin theory is that the magnification effects of commodity price changes (or changes in technologies) on factor prices are stronger the closer are the factor intensities (Jones, 1965). That is, when intensities do not differ as much between sectors, factor prices must change by more in order to accommodate any given change in commodity prices or technical progress. In Fig. 1 the same kind of result would emerge if technical progress took place in the labor-intensive sector instead. As can easily be verified, the more labor-saving the bias in technology among alternatives of the same degree, the greater will be the increase in relative wages.

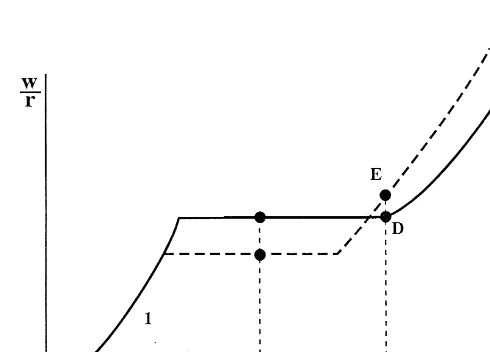

Finite changes in technology do not always lead to this ranking of biases on factor prices. Consider Fig. 2. The relationship shown there between relative factor prices and factor endowments reflects both technology and world commodity prices (as did Fig. 1). The original three-part heavy curve shows that, at low capital–labor endowment ratios, the country is specialized in producing the first commodity and, since factor substitution is now allowed, relative wages rise with increases in endowment capital–labor ratios. Such a monotonic relationship also holds for high capital–labor endowment ratios when the economy is specialized in the second commodity. For endowments in between, the country produces both commodities and, since world prices for these commodities are given, factor prices are determined — the middle section of the locus is flat.

Consider, now, technical progress in the capital-intensive good, progress that is capital-saving. That is, if the second commodity is the only commodity produced, at any given factor–price ratio the

Fig. 2. Capital-saving technical progress. 4

techniques of producing commodity 2 would be adjusted to show higher labor–capital ratios; at initial factor prices more labor would be demanded per unit of capital. The existence of technical progress in the second commodity (of any bias) causes the new middle ‘flat’ portion in Fig. 2 to shift downwards; the wage–rental ratio would be reduced by this progress in the capital-intensive commodity (of the two being produced). Therefore, if the endowment ratio is given by point A, wages suffer. But if the endowment point is at B, finite technical progress that has a capital-saving bias causes the wage rate to rise (from level D to E), in conformity with the expectations put forth in the labor economics literature. A finite degree of technological progress has encouraged the economy to devote all its resources to producing the favored commodity, thus altering the specialization pattern and, with it, the consequences of progress for the distribution of income.

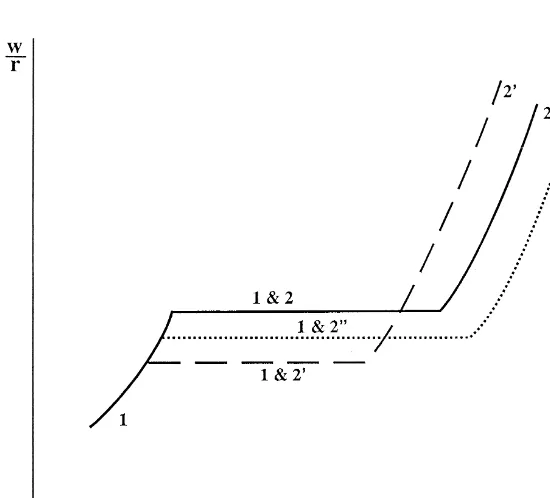

These two possible results on the effect of biased progress on relative (and real) wage rates are brought together in Fig. 3. The solid broken line illustrates the factor price–factor endowment relationship initially. Also illustrated is the dashed locus and the dotted locus. The dashed locus reflects the effect of labor-using (or capital-saving) technical progress in the second sector (all at constant commodity prices); the dotted locus reflects labor-saving technological progress of the same Hicksian extent. If both commodities are produced before and after the technological change, the drop in wages is more severe in the case of labor-using progress — the same result as shown in Fig. 1. At the other extreme, if only the second commodity is produced before and after the change, the wage rate falls if and only if technical progress is biased in a labor-saving direction — a result consistent

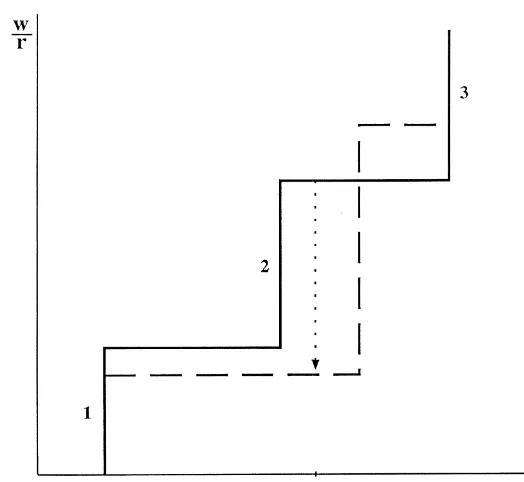

Fig. 4. Progress in the labor-intensive sector leading to fall in wage rate.

with partial equilibrium analysis. And, as Fig. 2 reveals, if technical progress is capital-saving instead and if, initially, both commodities are produced, the wage rate could nonetheless rise if the country is driven to specialize completely in the second commodity.

In the final diagram, Fig. 4, we illustrate a case that perhaps serves to crystallize the different points of view held by trade economists and labor economists. We return to the fixed-coefficient technology illustrated in Fig. 1, but now consider a three-commodity case using the kind of diagram illustrated in Figs. 2 and 3. Along the three solid vertical sections the country has an endowment ratio that allows it to achieve full employment by producing a single commodity. For other endowment proportions it must split its resources to produce two goods — commodities 1 and 2 in the lower horizontal section and commodities 2 and 3 for a more capital-rich endowment proportion. Now suppose that a

labor-saving technical progress takes place in commodity 2, and that the country’s endowment

References

Collins, S.M. (Ed.), 1998. Imports, Exports and the American Worker. Brookings, Washington, DC.

Findlay, R., Grubert, H., 1959. Factor intensities, technological progress, and the terms of trade. Oxford Economic Papers 11, 111–121.

Jones, R.W., 1965. The structure of simple general equilibrium models. Journal of Political Economy 73, 557–572. Jones, R.W., 1996. International trade, real wages and technical progress: the specific factors model. International Review of