Business Combinations at the First

Earnings Announcement Date

Kathleen Blackburn Norris

UNIVERSITY OFTENNESSEEFrances L. Ayres

UNIVERSITY OFOKLAHOMAAccounting for purchased goodwill in mergers and acquisitions has been its implications for the subsequent performance of the com-bined entity. Top management of firms seeking to acquire

a hotly debated issue for many years because of the increasingly large

other companies attempts to avoid purchase accounting when

impact of goodwill amortization on the reported earnings of acquiring

possible to avoid the hit to earnings associated with goodwill

firms and its implications for the subsequent performance of the combined

amortization (Lys and Vincent, 1995). However, since there

entity. There is evidence that top management of firms seeking to acquire

may be no economic cash flows associated with the goodwill

other companies attempts to avoid purchase accounting when possible to

amortization, it is not immediately apparent that the required

avoid the hit to earnings associated with goodwill amortization. However,

goodwill amortization has a negative effect on stock prices.1

since there may be no economic cash flows associated with the goodwill

On the other hand, there is substantial anecdotal evidence

amortization, it is not immediately apparent that the required goodwill

to suggest that managers believe that goodwill amortization

amortization has a negative effect on stock prices. This study examines

hurts their company’s performance and act to minimize its

the extent to which increases in purchased goodwill are negatively

associ-effect (e.g., Laderman, 1989; Wechsler, 1989a; Linden, 1990;

ated with the security prices of acquiring companies at the time of the

McGoldrick, 1990, 1997). A recent article by Beth McGoldrick

first earnings announcement following the completion of the merger. The

in theInstitutional Investordiscusses the efforts made by

man-results indicate that firms exhibit negative abnormal returns around the

agement of acquiring firms to structure business combinations

first quarterly earnings announcement date following a purchase business

as poolings of interest in order to avoid the negative earnings

combination and that the size of the reaction is negatively related to the

impact associated with goodwill amortization noting that,

amount of goodwill associated with the purchase. Thus, the results support

the concerns expressed by the financial press that reporting large amounts When Paramont Communications failed in its $11 billion of goodwill is bad news at the time of earnings announcements. These bid to purchase Time in 1989, one often cited reason results are not inconsistent with the findings of earlier work suggesting was that the deal would have included $9.2 billion of that goodwill is positively valued by the market. Rather, our results suggest accounting goodwill. This staggering load was expected to that while goodwill may be viewed positively as an asset, the earnings depress the earnings of the acquiring company—and its impact of the amortization of goodwill is bad news to the market. J BUSN stock price—for years to come (McGoldrick, 1997, p. 145). RES2000. 49.79–88. 2000 Elsevier Science Inc. All rights reserved

1The intangible asset goodwill can only arise when a business combination

is accounted for by the purchase method. If any cash is paid for the acquisition, the purchase method, rather than the pooling-of-interests method, combina-tion is required. U.S. accounting rules require that the goodwill be amortized

A

ccounting for purchased goodwill in mergers andacqui-over its useful life but not more than 40 years. However, prior to the Revenue

sitions has been a hotly debated issue for many years

Reconciliation Act of 1993 (OBRA 93), the Internal Revenue Code did not

because of the increasingly large impact of goodwill

allow for the amortization of goodwill for tax purposes. Consequently, the

amortization on the reported earnings of acquiring firms and required amortization of goodwill implemented in 1970 by APB Opinion

No. 17 penalized reported earnings but had no direct cash flow effects. Even now, not all goodwill can be amortized for tax purposes. Goodwill

Address correspondence to K.B. Norris, University of Tennessee, Department

amortization for tax purposes requires that the business combination be

of Accounting and Business Law, 603 Stokely Management Center, Knoxville,

TN 37996-0560 . taxable.

Journal of Business Research 49, 79–88 (2000)

2000 Elsevier Science Inc. All rights reserved ISSN 0148-2963/00/$–see front matter

In another example, Gillette Company acquired Duracell evidence that abnormal returns were negative for firms using International Inc. in a stock-swap intentionally structured as the purchase method during the period after the merger. a pooling-of-interests. A report of the deal emphasized how Using a sample of 97 poolings and 27 purchases, the authors accounting rules seemed to motivate management’s behavior: examined abnormal stock returns by using the market model and monthly returns for the period from 12 months before Gillette executives deliberately structured the deal to cater

the merger date until 11 months after the merger date. The to Wall Street’s simplistic emphasis on reported earnings

results indicated generally insignificant returns for firms using per share. They chose an accounting treatment that would

poolings and positive abnormal returns in the post-announce-appeal to the Street—even though it may cost shareholders

ment period for purchase acquisitions. Davis (1990) replicated more money. So important was the accounting strategy

Hong, Kaplan, and Mandelker over the 1971–1982 time pe-that one Gillette adviser says the company would have

riod by using weekly returns and found similar results. Both walked away had Duracell insisted on a cash deal

(Mare-of these studies focused on average market reactions (Mare-of pooling mont, 1996, p. 36).

and purchase firms relative to the merger announcement date. Proponents of the perception that the required amortization In contrast, in this study we focus on returns during the of goodwill is detrimental to company valuation also have period surrounding the first earnings announcement following asserted that it is affecting the international competitive ability the merger and its relation to goodwill amortization. of U.S. firms bidding against foreign firms (An Edge to Foreign Davis (1990), Robinson and Shane (1990), and Vincent Buyers?, 1988; Dieter, 1989; Wechsler, 1989b; Davis, 1992). (1997) provided evidence that merger premia are greater for However, despite the concerns voiced by the financial poolings than purchases. These findings are consistent with press, no empirical evidence has substantiated that the non- the reluctance of acquiring firms to book large amounts of cash write-off to earnings caused by goodwill amortization goodwill. That is, in cases where it is likely that goodwill negatively impacts stock prices. Davis (1996, p. 58) reviews is greatest, it appears that efforts are made to structure the extant literature and concludes that, “There is thus no reason combination as a pooling of interest. Vincent concluded that for firms to hide goodwill and, as yet, no conclusive evidence there is support for the concern that purchase method ac-that the non-cash reduction in reported income caused by counting has negative valuation implications.

goodwill amortization harms stock prices.” Several studies provide evidence that goodwill values are This study examines this issue. Specifically, we examine the viewed as assets by the market (e.g., Vincent, 1997; Wang, extent to which increases in purchased goodwill are negatively 1993; McCarthy and Schneider, 1995; Jennings, Robinson, associated with the security prices of acquiring companies at Thompson, and Duvall, 1996). Jennings, Robinson, Thomp-the time of Thomp-the first earnings announcement following Thomp-the son, and Duvall examined the relation between equity values completion of the merger. The results indicate that firms ex- and reported goodwill for the period 1982–1988. They found hibit negative abnormal returns around the first quarterly that when goodwill was regressed against the market value of earnings announcement date following a purchase business equity, a strong positive relation was found for each of seven combination and that the size of the reaction is negatively years after the acquisition. The size of the coefficient decreased related to the amount of goodwill associated with the pur- each year consistent with goodwill being a wasting asset. chase. Thus, the results support the concerns expressed by Jennings, Robinson, Thompson, and Duvall also examined the financial press that reporting large amounts of goodwill the relation between market values and goodwill amortization is bad news at the time of earnings announcements. These in the seven post-merger years. The results are mixed de-results are not inconsistent with the findings of earlier work pending upon the form of the model but provide some evi-suggesting that goodwill is positively valued by the market. dence that goodwill amortization is negatively associated with Rather, our results suggest that while goodwill may be viewed market value.

positively as an asset, the earnings impact of the amortization Summarizing the status of current research findings, it of goodwill is bad news to the market. appears that reported goodwill is viewed as an economic The remainder of this article is structured as follows. In resource by market participants, but at the same time, there the next section, previous literature examining the market is evidence that the unreported goodwill associated with pool-response to goodwill disclosures is examined. Then, the re- ing-of-interest accounting is even higher. This is consistent search hypotheses are developed. The fourth section discusses with the hypothesis that managers concerned with the negative the methodology and presents the results. The final section hit to earnings associated with goodwill amortization will summarizes the results and presents conclusions. expend resources to avoid this cost. While the above studies provide indirect evidence that the goodwill amortization would be expected to be associated negatively with returns,

Prior Literature

they do not directly test this conjecture.From a policy perspective, it is important to determine if Hong, Kaplan, and Mandelker (1978) compared tax-free

amortiza-tion is associated with a negative stock market reacamortiza-tion. If it

Methodology

is not, then managers may be spending resources to structureEvent Date

transactions as poolings of interest for reasons not related to

The first time at which the results of the acquisition and its the impact on shareholders.2

effect on earnings is reported in the financial statements of the company is the first quarterly earnings report after the

Hypotheses

acquisition becomes effective.3 At this date, the effects from the purchase combination accounting method are known with Valuation of acquiring firms involved in merger has beencertainty, and the reported earnings figure reflects the impact investigated in finance and accounting research. Jensen and

of the required accounting for goodwill.4 Prior to that time, Ruback (1983) reviewed over 40 studies in the merger and

even if the amount of goodwill has been reported, its impact acquisition literature. In the majority of these studies,

success-on earnings is uncertain. ful bidding firms experienced negative abnormal returns

around the date the merger was finalized (Langetieg, 1978;

Data

Dodd, 1980; Asquith, 1983; Malatesta, 1983). Although

good-A list of acquisitions was compiled from Accounting Trends will amortization alone most likely does not fully explain the

and Techniques(1987–1991) and from the delistings of stocks price declines to bidding firms, the required amortization may

from the Daily CRSP Stock file, for the years 1984–1990. This be a partial factor in explaining those declines.

seven-year sample period covers a range of years in which the The first research hypothesis tests the assertion that the

income-statement impact of goodwill amortization had become release of information related to the earnings impact of

good-more significant (Davis, 1992, exhibit 4), and the sample con-will is associated with a decrease in firm valuation:

trols for the post-1970 and pre-1993 regulation time periods. Acquisitions were limited to those which were paid with all H1A: Acquiring firms recording a business combination

cash5or with a mixture of cash and less than 50% common by the purchase method that results in an increase

stock, to control for tax status and method of payment.6 in goodwill will exhibit negative unexpected returns

The total price paid for the acquisition, the goodwill at the time period surrounding the first earnings

amount, the amortization period, and the effective date of the release after the merger.

acquisition for accounting purposes were obtained from the We also examine the relation between the change in good- footnotes of the acquiring company’s annual report. TheWall will and abnormal returns by using a cross-sectional regression Street Journal Index (WSJI)was examined to obtain the date of model. If the amount of goodwill recognized is associated the first quarterly earnings announcement after the acquisition with the stock returns of the acquiring firm, then differing was complete. A further review of the historical sequence impacts might be observed among firms depending on the of announcements in the WSJI eliminated dates with other size of each firm’s goodwill change. The second hypothesis significant announcements during the test period. Both the

tested in this study is: annual reports and theWSJIprovided data on whether the

acquisition was initiated as a tender offer or a merger/acquisi-H2A: For acquiring firms recording a business

combina-tion of company assets or stock. tion by the purchase method, those with a

propor-Finally, complete firm data for computing regression model tionately larger change in goodwill experience a

variables had to be available from the COMPUSTAT Industrial greater decrease in returns around the earnings

an-or Industrial Research databases and complete monthly an-or nouncement period.

daily security returns for the estimation and test periods had to be available from the CRSP Stock files. At the end of these Rejection of the null hypothesis in this case would be

processes, 157 acquisitions out of an original 1,004 remained an indication of a negative association between the goodwill

in the sample. change and the market valuation of the firm and provide

additional support for the contention in the popular press that the required amortization of goodwill in the United States 3

The SEC requires that the results of the acquisition be reflected in the Form

has negative valuation consequences. From a policy

perspec-10-Q for the quarter in which the transaction was consummated.

tive, support for H2A suggests that U.S. firms may be disad- 4Bernard (1989) suggests that capital market studies involving accounting vantaged in international capital markets relative to countries policy choices focus on earnings announcement days when method choices that do not require goodwill amortization. have their impact.

5If the consideration paid for the acquisition included debt instruments,

the acquisition was not included in the sample in order to restrict the method of payment for the acquisition.

2One possibility is that managers are reluctant to express that their true

concern is with the impact on earnings-based compensation plans and assess- 6Prior research has classified samples with acquisitions paid for with less

than 50% stock as taxable, cash acquisitions. This classification is the same ments of their performance and that they use allegations of negative market

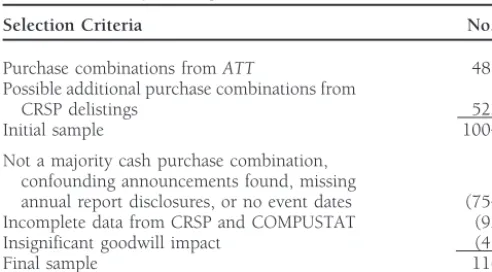

Table 1. Summary of Sample Selection

Cross-Sectional Regression Analysis

Selection Criteria No. Cross-sectional regression using weighted least squares was

employed to obtain additional insights into the price effects Purchase combinations fromATT 481 associated with the goodwill change by using the individual Possible additional purchase combinations from

firm CAART1,T2 as the dependent variable. The independent

CRSP delistings 523

variable investigated in this study is the change in goodwill

Initial sample 1004

(DGW). It was measured as the total amount of goodwill Not a majority cash purchase combination,

recorded from the specific business combination of interest confounding announcements found, missing

annual report disclosures, or no event dates (754) and was obtained from the footnote disclosures of the firm’s Incomplete data from CRSP and COMPUSTAT (93) annual report. Control variables included those for which Insignificant goodwill impact (41) evidence of a significant relation to abnormal returns around

Final sample 116

merger dates was found in previous studies, change in depreci-ation (Hayn, 1989), relative size of the acquisition (Asquith, Bruner, and Mullins, 1983), and type of acquisition (Jensen and Ruback, 1983).

The sample was further reduced to those acquisitions where

A control variable was included for the tax benefit from a GW/NI was at least 1% by computing the ratio of the new

change in the depreciable asset base after merger. The assets amount of goodwill to be amortized in the year after the

of the target firm are valued at fair market value in a purchase merger to the net income of the firm in the year before the

combination. The depreciable asset base of the acquiring firm merger (GW/NI). The final sample consisted of 116

acquisi-is often increased, providing a tax advantage. Even though, tions. Table 1 describes the sample selection.

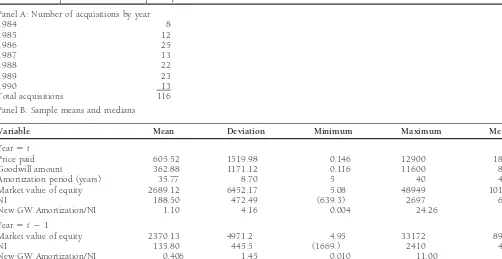

like goodwill amortization expense, the increased depreciation Table 2 reports descriptive statistics for the total sample.

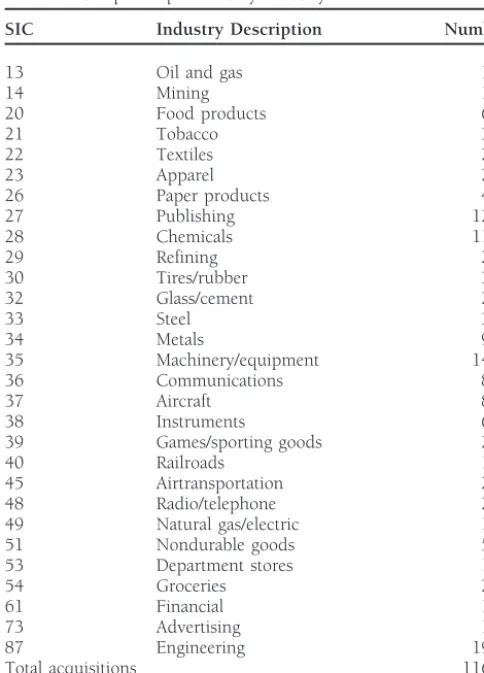

The average purchased goodwill amount is more than half of expense has a negative impact on net income, depreciation the average price paid. Goodwill increases substantially as a expense increases cash flows to the acquiring firm in the form percentage of net income during the year of the acquisition. of tax savings.8To derive the tax benefit (cost) associated with On average, this percentage increased from 41% in the year the increased (decreased) asset base, we computed change prior to the acquisition to 110% in the year of the acquisition. in depreciation, DDEPR, as the change in depreciation and The 36-year average amortization period indicates that firms amortization from periodt-1totmultiplied by the statutory tend to maximize the amortization period. Table 3 illustrates corporate tax rate for the year of the merger event.

that there is a wide range of industries represented in the The relative size of the acquisition was included to allow sample with the largest number of acquisitions occurring in for the impact the acquisition has on the acquiring firm and publishing, chemicals, machinery/equipment, and engineering. to account for differences in abnormal returns due to the size of targets relative to bidders reported by Asquith, Bruner, and

Event Study Analysis

Mullins (1983). Evidence from that study demonstrated that the larger the target firm in relation to the bidding firm, the To evaluate the performance of the stock prices associatedlarger the price response of the bidding firm. Size of the acqui-with the merger period, we employed standard event date

sition, SAQ, was measured by the ratio of the price paid for methodology. Using the single-index market model, we

esti-mated abnormal returns per firm (AR). Then average abnormal the acquisition to the corresponding market value of the bidding returns per test sample (AAR) and cumulative average abnor- firm’s common equity at the beginning of the event period. mal returns per test sample (CAAR) were computed.7 The Finally, since there is some evidence that in acquisitions statistical significance of the return metrics was determined initiated as tender offers returns to bidding firms have gener-using a parametric mean test. The test statistic Z for the average ally been higher than those in merger bids (Jensen and Ruback, abnormal returns and for the cumulative average abnormal 1983), a dichotomous variable was employed to allow for returns was computed following the procedures of Dodd and

Warner (1983).

8Hayn (1989) found a significant positive relation between the increase in

assets and the cumulative abnormal returns of acquiring firms involved in taxable mergers at the acquisition announcement. However, Hayn’s

step-7The monthly estimation period used in this study is 60 months, ending 13

months prior to each event date. The daily estimation period is 255 trading up in asset base variable included an estimate of accumulated accelerated depreciation since accelerated methods are usually used for tax reporting days, ending six weeks before the announcement date of the impending

acquisition in order to exclude announcement period returns from the estima- rather than the straight-line methods typically found in financial statements. While the depreciation expense reported in COMPUSTAT is computed for tion periods for the later two dates. For acquisitions with no published

announcement date, eight months before the effective date (which is present financial statements, there is noex antereason to believe a systematic difference in depreciation expense occurs among firms selected in the random sample for for every observation) is computed as the end of the estimation period. This

Table 2. Descriptive Statistics for Sample Acquisitions

Panel A: Number of acquisitions by year

1984 8

1985 12

1986 25

1987 13

1988 22

1989 23

1990 13

Total acquisitions 116

Panel B: Sample means and medians

Variable Mean Deviation Minimum Maximum Median

Year5t

Price paid 605.52 1519.98 0.146 12900 182.30

Goodwill amount 362.88 1171.12 0.116 11600 86.55

Amortization period (years) 35.77 8.70 5 40 40

Market value of equity 2689.12 6452.17 5.08 48949 1016.02

NI 188.50 472.49 (639.3) 2697 65.39

New GW Amortization/NI 1.10 4.16 0.004 24.26 0.034

Year5t21

Market value of equity 2370.13 4971.2 4.95 33172 890.38

NI 135.80 445.5 (1669.) 2410 45.44

New GW Amortization/NI 0.406 1.45 0.010 11.00 0.043

N5116; t5effective year of acquisition. NI5net income.

these differences. Type of acquisition is scaled TYPE5 0 for interest expense changes that could have been a result of the merger and are captured in other variables.10The change in merger proposals and TYPE51 for tender offers.

When valuing firms are involved in acquisitions, market operating income (DOPINC) is the change in earnings before the depreciation, tax, and interest expenses measured as a participants may have additional considerations. Some

acquir-ing firms borrow to finance acquisitions for which the consid- percentage change. It was calculated as operating income at periodt, minus operating income at period t-1, divided by eration is paid in cash. Previous capital structure research in

finance has found that leverage-increasing events have positive the operating income at periodt-1.

To achieve comparability between firms, DGW, DDEPR, announcement effects owing to the increased cash flow from

the added tax shield (e.g., Miller and Modigliani, 1966; Ma- andDLEV were deflated by the market value of equity (MVE) of the acquiring firm at the beginning of the period. MVE, sulis, 1980; and Bradley, Jarrell, and Kim, 1984). A variable

for the tax benefit (cost) of increased (decreased) leverage common shares outstanding times price at close of the period, was computed from data at the end of the year previous to (DLEV) was computed as the change in long-term debt from

periodt-1tot, multiplied by the statutory corporate tax rate the business combination event date (t-1).

This resulted in the regression model for individual firm for the year of the merger event.9

A second relation, operating income change, proxies for stock returns shown in the following equation: differences in firm operating economies from pre- to

post-CAART1,T25b01b1DGW1b2DDEPR1b3SAQ1b4TYPE1b5DLEV1b6DOPINC acquisition, since traditional merger theory assumes

acquisi-(2) (1) (1) (1) (1)

tions are undertaken expecting synergistic gains from the

com-bination. Operating income change, rather than net income The subscriptiis omitted for each individual firm observa-change, was considered a less encumbered measurement since tion. A negative and significant coefficient b1 of the DGW it does not contain gains and losses from other sources, variable supports the hypothesis that the increase in goodwill changes in sales and cost of goods sold, and depreciation and is negatively related to the stock price of the acquiring firm.

9Change in long-term debt, rather than change in interest expense, is em- 10Under purchase accounting, the income of the target company would not

be included for the entire merger year. Depending on the time of year, much ployed because it measures the total change in debt at the end of the accounting

period. The change in interest may be affected by how long the debt was of the target’s earnings might not be included in the measurement for operating income. However, reducing the impact of the target’s income on the combined held. If the debt was increased substantially toward the end of the year, the

interest expense for the year might not fully capture the impact of the increased company’s income would bias against the hypothesis of a positive relation between increased operating efficiencies and returns.

Table 3. Sample Acquisitions by Industry Panel B of Table 4 shows the results of the regressions for the quarterly earnings report date. Collinearity diagnostics

SIC Industry Description Number

were run for the regressions following the procedures of

Bel-13 Oil and gas 1 sley, Kuh, and Welsch (1980, p. 112). The daily abnormal

14 Mining 1 return regression demonstrates no significant coefficients. In

20 Food products 6 the regression of monthly abnormal returns, the coefficient

21 Tobacco 3

of DGW is significantly negative at the 0.05 level. This is

22 Textiles 2

consistent with H2A and indicative of the investors responding

23 Apparel 2

26 Paper products 4 negatively to the amortization of goodwill.DLEV is positive

27 Publishing 12 and significantly related to abnormal returns, consistent with

28 Chemicals 11 investors increasing the market valuation of the firm due to

29 Refining 2

the increased tax shields provided by the increased debt.

30 Tires/rubber 3

DOPINC is marginally significant and positive lending some

32 Glass/cement 2

33 Steel 3 support to the hypothesis that increased operating efficiencies

34 Metals 9 were viewed positively by the market.11,12The insignificance

35 Machinery/equipment 14 of the results in the daily cross-sectional regression is an area

36 Communications 8

of concern. One explanation may be that the information

37 Aircraft 8

about goodwill amortization may become available to market

38 Instruments 6

39 Games/sporting goods 2 participants throughout the earnings announcement month

40 Railroads 1 and not just on the day of the earnings release. This is

consis-45 Airtransportation 2 tent with the finding that the CAAR is greater in absolute

48 Radio/telephone 2

terms when the monthly abnormal returns are used. The

49 Natural gas/electric 1

monthly CAAR is21.19% compared with only2.60% for

51 Nondurable goods 5

53 Department stores 1 the two-day return on the earnings release date.

54 Groceries 2 If the earnings impact of goodwill amortization is driving

61 Financial 1 the negative abnormal returns, we would expect the result to

73 Advertising 1

be most pronounced for firms most affected, that is, those

87 Engineering 19

with the greatest amount of new goodwill as a result of the

Total acquisitions 116

acquisition. In order to determine if the relation between

SIC5Standard Industrial Classification. goodwill and abnormal returns was greatest for firms with the

largest amounts of reported goodwill, we ranked the sample on the basis of the impact of the newly acquired goodwill Hayn (1989) found a positive relation between the increase

amortization on earnings, and the monthly regressions were in asset base and abnormal returns to bidding firms, thus b2

run by using only firms in the highest and lowest quintile was predicted to be positive. The coefficient b3was predicted

These results are presented in Table 5. Panel A shows monthly to be positive, since previous research has shown that the

average abnormal returns for the high and low goodwill sam-larger the target in relation to the bidder, the greater the impact

ple. None were significantly different from zero.13However, in on the bidding firm. A change in debt was hypothesized to

the cross-sectional regression of the relation between goodwill be positively related to returns, indicating a positive coefficient

change and abnormal returns in the announcement month for b5. A positive b6 was hypothesized because traditional

(panel B), the results indicate that for firms in the high goodwill merger theory assumes acquisitions are undertaken expecting

quintile there is a strong negative relation between the change synergistic gains from the combination of two firms resulting

in a positive relation between the change in efficiency due to operating economies and firm returns. No prediction was 11

In the case that the variableDOPINC was not measuring enough of the

made about the intercept term. change in operating efficiencies, the monthly regression was replicated using

the change in net income (DNI5(NIt2NIt-1)/MVE) rather than the change in operating income (DOPINC). The test results were qualitatively similar in

Empirical Results

the month of the earnings report.12A post-event date estimation period also was used in the examination Average daily and monthly abnormal returns for the quarterly

of daily abnormal returns. The estimation period is 255 trading days long

earnings report date are reported in Table 4, panel A. Both

and begins six weeks after the quarterly earnings report date. Results for the

the daily and monthly abnormal returns are negative and

two-day returns were still negative like in the preevent date beta analysis but

significant atp50.01 andp50.10, respectively. The reaction insignificant. In the regression analysis, all results were qualitatively the same. at the earnings announcement date supports H1A and is con- 13For daily returns, we also examined a variety of different cumulation sistent with the hypothesis that investors respond negatively windows including (21,0), (26,0), (24,0), and (210,11). These average

residuals also were not significantly different from zero.

85

Reaction

to

Purchase

Business

Combinations

J

Busn

Res

2000:49:79–88

Table 4. Quarterly Earnings Report Date Abnormal Returns and Cross-Sectional Regression of Individual Abnormal Returns for Purchase Combinations in 1984–1990a

Abnormal Returns around the Event Date Period

Panel A: Abnormal Returns Period CAAR Z

Dailyb(n5114) (21, 0) 20.60 22.47c

Monthlyd(n5108) (0) 21.19 21.4e

Panel B: Cross-Sectional Regression of Individual CAARSfCAAR5b

01b1DGW1b2DDEPR1b3SAQ1b4TYPE1b5DLEV1b6DOPINC Coefficients for Independent Variables

Abnormal Dependent

Returns Variable Intercept DGW DDEPR SAQ TYPE DLEV DOPINC F-value Adj R2

Expected sign 2 1 1 1 1

Daily CAAR (21, 0) 0.005 20.001 0.024 20.003 20.014 0.041 0.001 0.318 20.040

(n5109) (20.83) (20.02) (0.03) (20.18) (21.10) (0.61) (0.24) (0.93)

Monthly AR (0) 20.010 20.095 20.286 0.010 20.024 0.201 0.009 2.156 0.064

(n5103) (21.10) (21.73)g (20.30) (0.41) (21.30) (2.27)c (1.56)e (0.05)

aSample size may vary slightly in each test due to missing returns in the estimation period or missing data for measuring the independent variables. b255-day estimation period ending 6 weeks before the announcement date.

cp,0.010.

d60-month estimation period ending 13 months before the quarterly earnings date. ep,0.1.

ft-tests are in parentheses;t-tests for significance of TYPE coefficient are two-tailed; for other coefficients,t-tests are one-tailed. gp,0.05.

DGW, GW/MVE;DDEPR, ((DEPRt2DEPRt21)3TAXRATEt)/MVE; SAQ, ACQPRICE/MVE; TYPE, 15tender offer, 05merger/acquisition;DLEV, ((LTDEBTt2LTDEBTt21)3TAXRATEt)/MVE;DOPINC, (OPINCt2OPINCt21)/

OPINCt21, where, GW5total goodwill from new acquisition; ACQPRICE5price paid for the acquisition; MVE5market value of common equity; LTDEBT5long-term debt; DEPR5annual depreciation; OPINC5operating

J

Busn

Res

K.

B.

Norris

and

F.

L.

Ayres

2000:49:79–88

Table 5. Monthly Abnormal Returns and Cross-Sectional Regression of Individual Abnormal Returnsafor High and Low Goodwill Purchase Combinations in 1984–1990bat the

Quarterly Earnings Report Date

Panel A: Abnormal Returns around the Event Date

Abnormal Returns Period CAAR Z

Low goodwill (n522) (0) 0.16 0.0

High goodwill (n523) (0) 1.64 1.3

Panel B: Cross-Sectional Regression of Individual CAARScCAAR5b

01b1DGW1b2DDEPR1b3SAQ1b4TYPE1b5DLEV1b6DOPINC Coefficients for Independent Variables

Abnormal Dependent

Returns Variable Intercept DGW DDEPR SAQ TYPE DLEV DOPINC F-value Adj R2

Expected sign 2 1 1 1 1

Low goodwill AR (0) 20.011 0.343 1.334 20.195 20.029 0.885 20.107 0.317 20.295

(n519) (20.17) (0.23) (0.21) (20.90) (20.30) (1.29) (0.83) (0.92)

High goodwill AR (0) 20.017 20.240 21.877 0.053 20.003 0.328 0.005 4.445 0.496

(n522) (1.01) (24.36)d (21.56e) (1.54e) (20.09) (3.53)d (0.93) (0.01)

a60-month estimation period ending 13 months before the quarterly earnings date. AR, abnormal returns.

bSample size may vary slightly in each test due to missing returns in the estimation period or missing data for measuring the independent variables. ct-tests are in parentheses;t-tests for significance of TYPE coefficient are two-tailed; for other coefficientst-tests are one-tailed.

dp,0.001. ep,0.10.

DGW, GW/MVE;DDEPR, ((DEPRt2DEPRt21)3TAXRATEt)/MVE; SAQ, ACQPRICE/MVE; TYPE, 15tender offer, 05merger/acquisition;DLEV, ((LTDEBTt2LTDEBTt21)3TAXRATEt)/MVE;DOPINC, (OPINCt2OPINCt21)/

OPINCt21, where, GW5total goodwill from new acquisition; ACQPRICE5price paid for the acquisition; MVE5market value of common equity; LTDEBT5long-term debt; DEPR5annual depreciation; OPINC5operating

in goodwill and abnormal returns in the announcement month. The results from this study support the contentions of In contrast, for firms in the low quintile, the cross-sectional managers and the financial press that stock prices are adversely regressions were insignificant. Regressions of the daily abnormal impacted by the earnings impact of goodwill amortization returns by using the high and low goodwill sample also were following a purchase combination with large amounts of good-not significant and are good-not reported here. Overall the findings will. Consistent with the results of Hand (1990) and Shleifer are consistent with the hypothesis that goodwill amortization and Summers (1990), it appears that market participants re-is viewed negatively by the market as information about its sponded to the earnings impact of the goodwill amortization impact is released. It is also consistent with the hypothesis rather than to its direct cash flow impact suggesting that that this information becomes available to market participants in business combinations form may be as important as the gradually during the month leading up to the first quarterly substance of the transaction.

earnings announcement following the merger.14

The authors would like to thank the editor and the anonymous reviewers for their helpful comments. Any remaining errors belong solely to the authors.

Summary

Employing a sample of 116 acquisitions occurring during the

References

years 1984–1990, we found a negative association between

Accounting Trends and Techniques.41-45 Editions. American Institute increased goodwill from a purchase combination and

abnor-of CPAs, 1987–1991. New York. 1987–1991. mal returns of acquiring firms. Owing to the nature of the

An Edge to Foreign Buyers?Mergers and Acquisitions22 (March–April dispersion of goodwill information into the market across time

1988): 7–8. rather than on one day, the negative association is reflected

Asquith, P.: Merger Bids. Uncertainty, and Stockholder Returns. in monthly abnormal returns, rather than daily abnormal

re-Journal of Financial Economics11 (April 1983): 51–83. turns. At the first quarterly earnings announcement after the

Asquith, P., Bruner, R. F.m and Mullins D. W. Jr.: The Gains to acquisition effective date, the market responds negatively, and

Bidding Firms from Merger. Journal of Financial Economics 11 this time there is a negative association between abnormal

(April 1983): 121–139. returns and the change in goodwill. Consequently, it appears

Belsley, D. A., Kuh, E., and Welsch, R. E.:Regression Diagnostics:

that a negative reaction occurs on the first earnings announce- Identifying Influential Data and Sources of Collinearity.John Wiley ment date in response to the book reduction in reported and Sons, New York. 1980.

earnings from the goodwill amortization. Taken together, this Bernard, V. L. Capital Markets Research in Accounting During the evidence supports the hypothesis that the market considers the 1980’s: A Critical Review, inThe State of Accounting Research As increase in goodwill when valuing firms involved in purchase We Enter the 1990’s.Thomas J. Frecka, ed., University of Illinois,

Urbana. 1989, 72–120. combinations and responds negatively to the earnings impact

of goodwill amortization.15 Bradley, M. G., Jarrell, G., and Kim, E. H.: On the Existence of an Optimal Capital Structure: Theory and Evidence.Journal of Fi-nance(July 1984): 857–878.

14We reviewed Lexis-Nexis for information disclosures during periods sur- Brown, D. T., and Ryngaert, M. D.: The Mode of Acquisition in

rounding the merger announcement and the first earnings announcement Takeovers: Taxes and Asymetric Information.The Journal of Fi-following the merger. We found a tremendous variance in the amount of nance46 (June 1991): 653–669.

disclosure about the impact of goodwill and its earnings impact. Most

typi-Davis, M. L.: Differential Market Reaction to Pooling and Purchase

cally, however, earnings releases reported operating income before goodwill

Methods.The Accounting Review65 (July 1990): 696–709.

amortization if an advance earnings announcement was made. In these cases,

the impact of the merger-related amortization of earnings would not be known Davis, M. L.: Goodwill Accounting: Time for an Overhaul.Journal until the issuance of the quarterly financial statements. The wide variation of Accountancy173 (June 1992): 75–83.

in disclosures about the impact of goodwill is consistent with that reported

Davis, M. L.: The Purchase Vs. Pooling Controversy: How the Stock

by Duvall, Jennings, Robinson, and Thompson (1992). They examined a large

sample of firms and reported that despite requirements that disclosures be Market Responds to Goodwill.Journal of Applied Corporate Finance made about the impact of goodwill on earnings, that in fact disclosures about 9 (Spring 1996): 50–59.

goodwill and its amortization varied widely in the degree of disclosure about

Dieter, R.: Is Now the Time to Revisit Accounting for Business

Combi-goodwill and the amortization periods used.

nations?The CPA Journal59 (July 1989): 4448. 15A possible alternate explanation for the observed relation is that the

Dodd, P.: Merger Proposals. Managerial Discretion and Stockholder

negative relation between goodwill and returns on the earnings announcement

Wealth.Journal of Financial Economics8 (June 1980): 105–138.

date signals the extent of overpayment for the acquisition. However, there

is no reason to expect that this effect would be observed on the earnings Dodd, P., and Warner, J. B.: On Corporate Governance—A Study announcement date following the merger. Rather, we would expect that if of Proxy Contests.Journal of Financial Economics11 (April 1983): the market perceived that there had been an overpayment for the acquisition,

401–438.

the negative impact on returns to the acquiring firm would be observed at

the time of the merger announcement. We examined average daily and Duvall, L., Jennings, R., Robinson, J., and Thompson, R. B. II: Can

monthly abnormal returns at the merger announcement date and found the Investors Unravel the Effects of Goodwill Accounting?Accounting daily returns (CAAR(21,0)5 21.26) to be significantly negative at less than Horizons6 (June 1992): 1–14.

the 0.001 level. We also ran cross-sectional regressions by using both daily

Hand, J. R. M.: A Test of the Extended Functional Fixation

Hypothe-and monthly returns on the merger announcement date Hypothe-and the results were

sis.The Accounting Review65 (October 1990): 740–763.

Hayn, C.: Tax Attributes as Determinants of Shareholder Gains in Prices: A Study of Exchange Offers.Journal of Financial Economics

(June 1980): 139–178. Corporate Acquisitions.Journal of Financial Economics23 (June

1989): 121–153. McCarthy, M., and Schneider, D. K.: Market Perceptions of Goodwill: Some Empirical Evidence.Accounting and Business Research 26

Hong, H., Kaplan, R. S., and Mandelker, G.: Pooling vs. Purchase: The

(Winter 1995): 69–81. Effects of Accounting for Mergers on Stock Prices.The Accounting

Review53 (January 1978): 31–47. McGoldrick, B.: The Quashing of Dow’s Merger Experiment.

Institu-tional Investor24 (October 1990): 299–300. Jennings, R., Robinson, J., Thompson, R. B., and Duvall, L.: The

Relation Between Accounting Goodwill Numbers and Equity Val- McGoldrick, B.: Goodwill Games. Institutional Investor 30 (March ues.Journal of Business, Finance and Accounting23 (June 1996): 1997): 145–149.

513–533. Miller, M., and Modigliani, F.: Some Estimates of the Cost of Capital

to the Electric Utility Industry.American Economic Review(June Jensen, M. C., and Ruback, R. S.: The Market for Corporate Control.

1966): 333–391.

Journal of Financial Economics11 (April 1983): 5–50.

Robinson, J. R., and Shane, P. B.: Acquisition Accounting Method Laderman, J. M.: Goodwill is Making a Lot of People Angry.Business

and Bid Premia for Target Firms.The Accounting Review65

(Janu-Week.(July 31, 1989): 73–76.

ary 1990): 25–48. Langetieg, T. C.: An Application of a Three-Factor Performance Index

Shleifer, A., and Summers, L. H.: The Noise Trader Approach to to Measure Stockholder Gains From Merger.Journal of Financial

Finance.Journal of Economic Perspectives4 (Spring 1990): 19–33.

Economics6 (December 1978): 365–383.

Travlos, N. G.: Corporate Takeover Bids, Methods of Payment, and Linden, D. W.: The Accountants Versus the Dealmakers.Forbes146

Bidding Firms’ Stock Returns.The Journal of Finance42 (Septem-(August 20, 1990): 84.

ber 1987): 943–963.

Lys, T., and Vincent, L.: An Analysis of Value Destruction in AT& Vincent, L.: The Equity Valuation Implications of Purchase vs. Pool-T’s Acquisition of NCR.Journal of Financial Economics39 (Octo- ing Accounting.Journal of Financial Statement Analysis3 (Summer

ber–November 1995) 353–378. 1997): 5–19.

Malatesta, P. H.: The Wealth Effect of Merger Activity and the Objec- Wang, Z.: An Empirical Evaluation of Goodwill Accounting.Journal tive Functions of Merging Firms.Journal of Financial Economics of Applied Business Research9 (Fall 1993): 127–133.

11 (April 1983): 155–181.

Wechsler, D.: A Peculiar Beauty Contest.Forbes144 (July 10, 1989a): Maremont, M.: How Gillette Wowed Wall Street.Business Week(Sep- 43–46.

tember 30, 1996): 36–37. Wechsler, D.: Britain’s Goodwill Games. Forbes 144 (October 2, 1989b): 65–68.