CHAPTER IV

RESULT AND DISCUSSION

In this chapter, descriptive analyses were used

to identify the respondents’ big five personality.

Frequencies were computed for the independent as

well as the dependent variables, the two stock

categories, value stock and growth stock. It also

provided the results of the hypothesis tests. The

results from regression analyses were used to identify

the investors’ stock preference.

A. RESULT

1. Descriptive Statistics

Respondents’ Big Five Personality Types

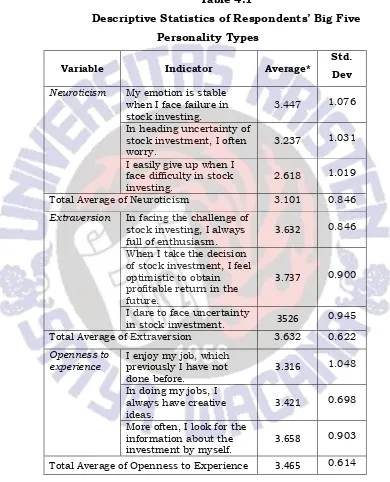

The big five personality types consisted of

neuroticism, extravert, openness to experience,

conscientiousness, and agreeableness. However,

among five personalities, agreeableness would not be

investigated in this study since the previous research

found that agreeableness did not influence the

tendency to prefer certain stocks. There were about

of big five personality types. The result of investors’

big five personality types could be seen in table 4.1.

Among twelve statements, the total average was

3.39. It meant that most of the investors are in the

medium of all personality types. For the neuroticism,

there were 58.7% investors at the level of low

neuroticism. Thus, most of investors did not really

worry about their investment, which would influence

their decision making process. In addition there were

61.9% of the investors were in the high level of

extraversion. Individual in this level indicated that

they are highly motivated and risk takers. While for

openness to experience, there were a slightly different

percentage of low and high openness, 49.2% of low

openness and 50.7% for high openness. With this

result, it could be stated that the investors did not

have any tendency to be low or high openness.

Furthermore, 41.3% high level of openness, which

meant that only a few of the investors had creative

idea and enjoy new experience. Finally, 53.9% were in

the low level of conscientiousness, which meant that

most of the investors had a mature planning of their

investment and also good management of their own

Table 4.1

Descriptive Statistics of Respondents’ Big Five

Personality Types

Variable Indicator Average*

Std. Dev Neuroticism My emotion is stable

when I face failure in stock investing.

3.447 1.076

In heading uncertainty of stock investment, I often worry.

3.237 1.031

I easily give up when I face difficulty in stock investing.

2.618 1.019

Total Average of Neuroticism 3.101 0.846

Extraversion In facing the challenge of stock investing, I always full of enthusiasm.

3.632 0.846

When I take the decision of stock investment, I feel optimistic to obtain profitable return in the future.

3.737 0.900

I dare to face uncertainty

in stock investment. 3526 0.945

Total Average of Extraversion 3.632 0.622

Openness to experience

I enjoy my job, which previously I have not done before.

3.316 1.048

In doing my jobs, I always have creative ideas.

3.421 0.698

More often, I look for the information about the investment by myself.

3.658 0.903

Variable Indicator Average*

Std. Dev

Agreeable-ness

I tend to easily trust someone when he/she offers me the stock investment.

2.803 1.071

The excessive money I have will be better to be invested than to help others.

3.408 1.009

Before deciding to invest, I

often argue with others. 3.289 1.017 Total Average of Agreeableness 3.167 0.685

Conscien-tiousness

I always examine the risk as well as the profit of stock investment I will take.

3.671 0.900

Before deciding to invest in stocks, I do not need a lot of time to think of.

3.303 0.994

I have well-done planning

in stock investment 3.724 0.826

Total Average of Conscientiousness 3.566 0.566 Source: Primary Data, 2013

Note: * The answers’ interval categories: 1.00-1.80 (very low); 1.81-2.60 (low); 2.61-3.40 (medium); 3.41-4.20 (high); 4.21-5.00 (very high).

The data above explained that mostly investors

were at the medium level of neuroticism, openness to

experience and agreeableness. It was explained by the

average result, which was around the interval

2.61-3.40. While for extraversion and Conscientiousness,

the investors were at the level of high

Stock Preferences

Stock preference itself were divided into two

categories, value and growth stocks. There were six

statements, which represented the indicators of both

stocks. The distribution of the answer could be seen

in the following table.

Table 4.2

Descriptive Statistics of Respondents’ The Stock

Preference

Variable Indicator Average* Std.

dev Stock

Preferen-ce

I tend to purchase the

undervalued stocks. 3.263 1.147

I tend to choose the stocks

with low price earnings ratio. 3.224 1.138 I tend to choose the stocks

with negative media coverage but the prospects are good.

3.145 0.962

I tend to purchase the stocks with high sales growth and high earnings.

2.513 0.986

I tend to purchase the

popular stocks. 2.737 0.971

I tend to purchase the stocks with the profit per share, which continually increase consistently.

2.474 0.901

Total Average of Stock Preference 2.839 0.541 Source: Primary Data, 2013

The above data showed that most of the

investors were at the level of neutral. In other world,

there were slightly similarities in stock preference,

because the average of both growth stocks and value

stocks were in the level of neutral criteria.

Previously, stock preferences as dependent

variables could be divided into two categories, in

particular: value stocks and growth stocks. Out of

seventy-six investors, there were 39.47% preferred

value stocks to growth stocks. Mostly investors,

60.53% preferred growth stocks to value stocks.

Chart 4.3 showed the investors’ tendencies whether

prefer value stocks, growth stocks and combination of

both and growth stocks.

Table 4.3

The Stock Preference Distribution

Stock Preference Frequency Percentage

Value Stock 29 39.47

Growth Stock 47 60.53

Total 76 100

Source: Primary data, 2013

2. Goodness of Fit

Prior the hypotheses testing, the regression

model’s goodness of fit should be measured. There

measured, in particular: normality, absence of

multicollinearity, and the absence of autocorrelation.

Normality was a test to see whether there was

normal distribution or not. The result of

Kolmogorov-Smirnov test showed that the score was 0.676 and

significant at the level of 0.750. It meant that the

Kolmogorov-Smirnov Z was less than the significance,

which meant that the data normally distributed.

The absence of multicollinearity test used to

test the model whether any correlation

inter-independent variables. The coefficient correlation

showed that the variable extraversion had the highest

correlation above all -.430 or 43%. This correlation

was under 95%, so the multicollinearity was not

serious. From the coefficient table (see appendix 8)

the tolerance score was under 0.10 and the Variance

Inflation Factor (VIF) was under 95%. Thus this

model was adequate to see the influence of the

independent variables towards the dependent

variable.

Then, to see the absence of autocorrelation,

this study would see the Durbin-Watson score. The

score was 1.992. This score was greater than 1.227

from the Durbin-Watson table. Thus, there was no

However, since the result of some goodness of

fit did not show the good result, in the following

subchapter provided three kinds of analyses. The

analyses consisted of numerical, logs, and binary

analyses.

3. Hypotheses Testing

To test the hypotheses, regression was used.

Below was provided the result of the regression for

numerical, logs and binary analyses. The log data

was used to examine the model, which were not

normally distributed. Whereas, binary data was used

to examine the model in which this analysis was used

to see equates numbers of respondents of each

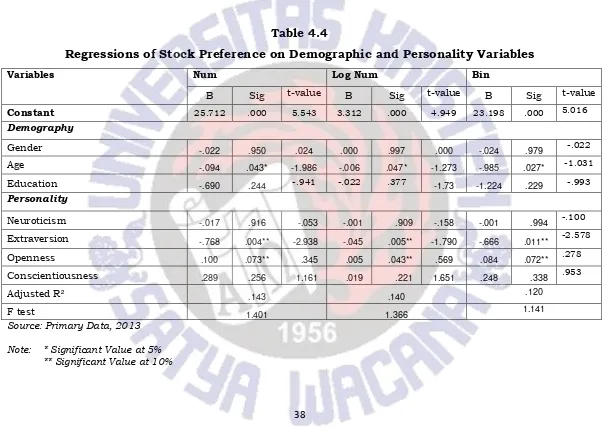

Table 4.4

Regressions of Stock Preference on Demographic and Personality Variables

Variables Num Log Num Bin

B Sig t-value B Sig t-value B Sig t-value

Constant 25.712 .000 5.543 3.312 .000 4.949 23.198 .000 5.016

Demography

Gender -.022 .950 .024 .000 .997 .000 -.024 .979 -.022

Age -.094 .043* -1.986 -.006 .047* -1.273 -.985 .027* -1.031

Education -.690 .244 -.941 -.022 .377 -1.73 -1.224 .229 -.993

Personality

Neuroticism -.017 .916 -.053 -.001 .909 -.158 -.001 .994 -.100

Extraversion -.768 .004** -2.938 -.045 .005** -1.790 -.666 .011** -2.578

Openness .100 .073** .345 .005 .043** .569 .084 .072** .278

Conscientiousness .289 .256 1.161 .019 .221 1.651 .248 .338 .953

Adjusted R² .143 .140 .120

F test 1.401 1.366 1.141

Source: Primary Data, 2013

The table above showed the result of the

regression with three analyses in particular:

numerical, log and binary. The adjusted R² was in the

range of 12% up to 14.3%, meant that the variability

of dependent variable could be explained 12%-14.3%

by the variability of independent variables. While,

85.7 % of the variability would be explained by other

variables outside the demographic factors and

personality traits, in particular the excessive cash

flow the investors owned and the emotion stability.

Although the R² value was relatively small, the F test

for this model showed the result 1.401 up to 1.366

and significant at .000. That meant that the

independent variable simultaneously influence the

income. Furthermore, the result of F-test showed the

linearity of the model, where the F-test were bigger

than F-table (1.27), meant that this model was linear.

Among three demographic factors, which

consisted og age, gender and education, only age was

significantly influence the stocks preference. With the

significant value expected was less than 5%, the

numeric analysis’ result showed that age was

significant towards the stock preference, with the

significant value 0.043. Both numeric and logs

stock preference. Even though it was significant, the

coefficient was negative, which meant that the elder

investors tend to prefer growth stocks instead of

value stocks. Thus, the hypothesis H1a that the elder investors tend to prefer value stocks was not

acceptable. In addition, gender and education did not

significantly influence to stock preference because

gender had significant value at 0.950 and Education

0.244, which more than 5%.

Furthermore, the personality types, which were

tested, consisted of neuroticism, extraversion,

openness, and conscientiousness. With the

significant value expected was less than 10%. Among

five personality being tested, extraversion and

openness was significantly influence the stock

preference. Extraversions had significant value at

0.004. The expected significant value was 10%. It

meant that extraversions were significant toward

stock preferences. The coefficient was -0.768. The

negative coefficient showed that the extraversions

tend to prefer growth stocks. Thus, the hypothesis

H3: Investors with extraversions tend to prefer

growth stocks, was acceptable. Openness had

significant value at 0.073. The coefficient was

prefer value stocks. Therefore, H4: Investors with openness tend to prefer value stocks, was acceptable.

B. Discussion

In making a choice such as stock preference,

investors were led by some aspects. One of them was

demographic features. Mayfield, Perdue and Wooten

(2008) stated that demographic features provide the

explanation of investment management decisions.

This study explored the influence of demographic

features, for instance: age, gender, and education

toward the investors’ stock preference, whether they

prefer value or growth stocks.

Age described their actual number of age as

well as how long the investors experiencing stock

investment, level of certainty and emotional stability

the investors possessed. However, this study only

focused on the actual number of investors’ age.

Normally, the elder investors would prefer the value

stocks. Moreover, Deaves and Bhandari (2006) stated

that the investors who closely to the retirement will

hold the long-term investment. It meant that the

elder investors supposed to prefer value stocks. The

result of this study showed that age was significantly

positive impact towards growth stocks. This could

happen because their experience was not adequate to

predict the value stock prospects. Their lack of

experience might be influenced by how long they were

engaged in stock investment, which mostly not more

than two years. Most of the investors involved in this

study were beginners. Those investors started the

investment after 2012 (27%).

Moreover, in this study, gender and education

were not significantly influence the stock preference.

Though in previous studies such as Bhandari &

Deaves (2006) who stated that women had less

certainty, but men were more overconfident than

women, proved that men supposed to hold growth

stocks. However, according to Mayfield, Perdue, and

Wooten (2008), men tend to prefer both short-term

and long-term investment. In other words, men were

likely to engage in either value or growth stocks.

The result of this study showed that gender did

not influence the stock preference, which might

happen because of their investors’ marital status,

which 44% of them were men and married. The

hypothesis that men tend to prefer growth stocks

were not proven because married men tended to

explained that the amount of both gender were not

balance. Women investors, who preferred value

stocks were 9.2%, while for men investors 30.2%.

Women investors, who preferred growth stocks were

13.1%, while men investors 47.4%.

The third one of demographic features involved

in this study was education. Education also played

important role in decision-making process. According

to Bhandari & Deaves (2006), higher education levels

were associates with certainty. The more highly

educated the investors, the more certain they are, the

more risk takers they are. Unfortunately, this study

showed that education did not significantly influence

the stock preference. The cross tabulation data

showed that most of the investors were in the group

of bachelor degree, which were 51.3%. While, the

group of investors not included in the group of

bachelor degree were in the small percentage. Thus,

the result did not significant. Another factor of

education, which might play important role to prove

that education was not significant, was that the

investors came from various background of the study.

Their background of education was probably not

sufficient to support the investors’ ability in stock

The other aspects, which might influence stock

preference, were the investors’ personality, which was

measured by using the big five personality traits. The

big five personality traits was a viable approach for

examining economic behavior (Mayfield, Perdue, and

Wooten, 2008). This study only used four of them to

determine whether the personality traits influence the

stock preference or not.

Two personalities, neuroticism and

conscientiousness did not significantly influence the

stock preference, though it had positive impact

towards growth stock preference. Mayfield, Perdue,

and Wooten (2008), and Jamhidinavid, Chavoshani,

and Amiri (2012) stated that investors with

neuroticism were indicated by having anxiety,

unstable emotion, moodiness, and tenseness.

Investors in this type surely would avoid risk as well

short-term investment in order to avoid nervous and

tenseness. Thus, investors with neuroticism would

probably tend to prefer value stock. However, the

result of this study did not prove the previous

studies. It might be influenced by the unstable

emotion triggered the feeling of avoid loss.

In addition, conscientiousness was indicated by

and strong willed (Mayfield, Perdue and Wooten,

2008). Furthermore, Jamhidinavid, Chavoshani, and

Amiri (2012) stated that investors in this type

believed that their own performance in investments

were better than the other investors. Thus, the

investors with conscientiousness supposed to prefer

growth stocks. The analysis of this study proved

conversely, where the investors prefer value stocks to

growth stocks. It might happen because the investors

in this type were seeking for excellence, so they could

predict the undervalue stocks and its potential to rise

up.

The rests personality, extraversions and

openness to experience clearly gave significant

influence towards stock preference. Extraversion,

according to Mayfield, Perdue, and Wooten (2008)

and Peterson (2011), agreed that extraversion was

people who had characteristics as enthusiasm,

optimistic, seeking excitement, social and emotional

ability to achieve positive feelings. Investors in this

type were more likely to be risk averse. In addition,

Larson (2005) found that investors with extraversions

engaged to long-term investing. While,

Jamshidinavid Chavoshani, and Amiri (2012) stated

excitement tend to be very confidence to take risk.

Thus, investors in this type tend to prefer growth

stocks. This study’s result showed the same premise

with previous studies that extravert investors prefer

growth stocks.

At the final was openness to experience is

characterized by both imagination and intellectual

expression (John and Srivastava, 1999).

Furthermore, Mayfield, Perdue, and Wooten (2008)

stated that investors who are categorized in openness

were likely engaged in long-term investing. While,

Jamshidinavid, Chavoshani, and Amiri (2012) stated

that the investors with openness meant that

individuals interested in novelty and new

experiences, action-oriented, and curious about

others’ ideas buy and sell their shares because of

their high confidence. Investors in this type of

personality trait might engage in long-term

investment, which referred to value stocks. Thus, the

hypothesis that investors with openness tend to

prefer value stock was proven.

Some of demographic factors and personality

traits did not adequately prove the hypotheses. It was

probably because most of the investors were

most of investors were getting information from their

friends or colleagues. It meant that the social

interaction may influence the investors stock

preference. Nofsinger and Hirschey (2008)

emphasized that people often leant by interacting

with others. When investors learn what others think,

herding happened. Consequently, when herding

movement happened, most of investors took decision

based on what happen in their group. The

demographic factors and investors’ personality

seemed not play important role in decision-making