0

BUSINESS ADMINISTRATION, MANAGEMENT &

COMMERCIAL SCIENCES

BUSINESS MANAGEMENT 512

1

BUSINESS ADMINISTRATION, MANAGEMENT &

COMMERCIAL SCIENCES

LEARNER GUIDE

MODULE: BUSINESS MANAGEMENT 512

(2

ndSEMESTER)

Copyright © 2016

Richfield Graduate Institute of Technology (Pty) Ltd (Pty) Ltd Registration Number: 2000/000757/07

2

Copyright © 2016 RGI (Pty) Ltd

Registration Number: 2000/000757/07

All rights reserved; no part of this publication may be reproduced in any form or by any means, including photocopying machines, without the written permission of the Institution

TOPIC PAGE NO.

SECTION A :PREFACE

1. Welcome 5

2. Title of Modules 6

3. Purpose of Module 6

4. Learning Outcomes 7

5. Method of Study 7

6. Lectures and Tutorials 7

7. Prescribed & Recommended Material 7

8. Assessment & Key Concepts in Assignments and Examinations 9

9. Specimen Assignment Cover Sheet 12

10. Work Readiness Programme 14

11. Work Integrated Learning 15

SECTION B: BUSINESS MANAGEMENT 512 (2ND SEMESTER)

TOPIC 1: THE FINANCIAL FUNCTION AND FINANCIAL MANAGEMENT

1.1 Introduction to Financial Function 20

1.2 The Financial Function and Financial Management 20

1.3 Concepts In Financial Management 21

1.4 Cost-Volume-Profit Relationship 23

1.5 The Time Value of Money 24

1.6 Future Value and Present Value 25

1.7 Financial Analysis, Planning and Control 25

Assessment questions 28

TOPIC 2: ASSEST MANAGEMENT: THE INVESTMENT DECISION

2.1 Introduction 30

2.2 The Management of Current Assets 30

2.3 The Management Long-Term Investment Decisions and Capital Budgeting 32

Assessment questions 33

TOPIC 3: FINANCING DECISIONS

3.1 Introduction 34

3.2 Financial Markets 34

3.3 Short-Term Financing 35

3.4 Long-Term Financing 35

3 TOPIC 4: THE OPERATIONS FUNCTION

4.1 The Nature and Definition of Operations Management 39

4.2 The Importance of Operation Management 39

4.3 The Transformation Model 41

4.4 The Classification of Operations Processes for Manufacturers And Service Providers

42

Assessment questions 43

TOPIC 5: OPERATIONS MANAGEMENT: ACTIVITIES, TECHNIQUES AND METHODS

5.1 Introduction 44

5.2 Operations Design 44

5.3 The Stages In The Design Of Products And Services 44

5.4 Planning And Control of the Operations Process 46

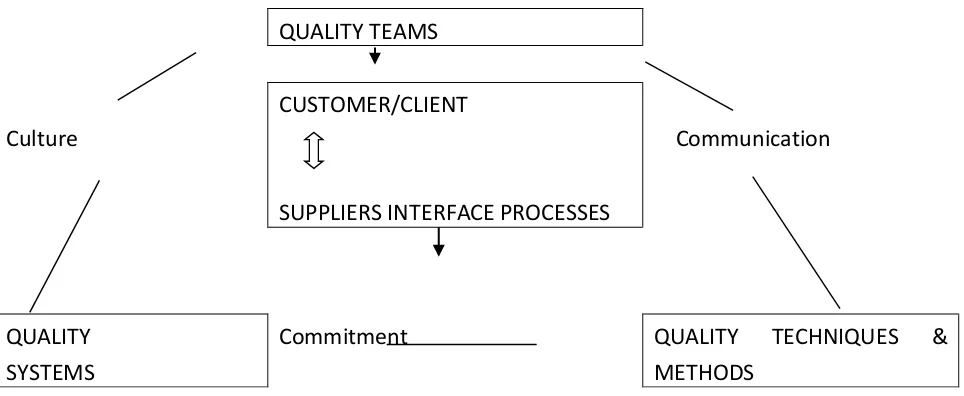

5.5 Operations Improvement 48

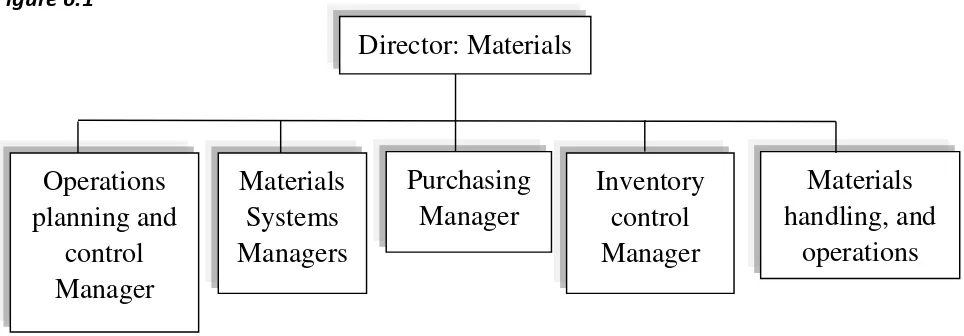

TOPIC 6: THE PURCHASING FUNCTION

6.1 Purchasing In Perspective 52

6.2 Broadening the Provision Function 52

6.3 The Importance of Purchasing Function to the Business 53

6.4 The Management Task of the Purchasing Manager 53

6.5 The Purchasing Cycle 56

6.6 Quality Decisions as a Purchasing Activity 57

6.7 Deciding On Purchasing Quantities 57

6.8 The Selection of Suppliers 58

6.9 Pricing Decisions 58

6.10 Negotiations In Purchasing 59

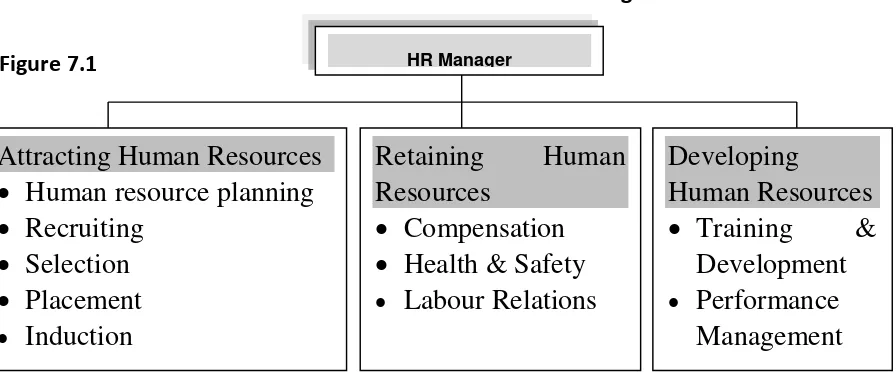

TOPIC 7: THE HUMAN RESOURCE FUNCTION: ATTRACTING HUMAN RESOURCES

7.1 Introduction to Human Resource Management 60

7.2 What Is The Task Of The Human Resource Manager? 60

7.3 Attracting Human Resources 61

7.4 Recruitment 63

7.5 Selection 63

7.6 Placement and Induction 64

7.7 The Development Of Human Resources 64

7.8 Performance Management 65

7.9 Remunerating Employees 65

7.10 Health and Safety 66

7.11 Labour Relations 67

Assessment questions 69

4

8.1 The Problem of Productivity In South Africa 70

8.2 The Importance of Productivity Improvement and Level of Productivity in South Africa

70

8.3 Productivity Improvement in South Africa 71

8.4 Management in the International Environment 72

Assessment questions 72

TOPIC 9 MANANGING BUSINESS STRATEGY

9.1 Introduction 73

9.2 Strategic planning and it characteristic 73

9.3. Concept of strategic management 74

9.4 The strategic management process 76

Assessment Questions 84

TOPIC 10: BUSINESS ORGANISATION AND THEIR ESTABLISHMENT

10.1 Types of business enterprises 85

Assessment Questions 93

Topic 11:Addendum 512 (A): Case Study for Tutorial Discussion 95

Topic 12:Addendum 512 (B): Revision Questions 97

Topic 13: Addendum 512 Typical Examination Question paper and marking

guidelines

5 SECTION A: PREFACE

1.

WELCOMEWelcome to the Department of Business Administration, Management & Commercial Sciences at Richfield Graduate Institute of Technology (Pty) Ltd. We trust you will find the contents and learning outcomes of this module both interesting and insightful as you begin your academic journey and eventually your career in the business world.

This section of the study guide is intended to orientate you to the module before the commencement of formal lectures.

The following lectures will focus on the study units described.

SECTION A: WELCOME & ORIENTATION

Study unit 1: Orientation Programme

Introducing academic staff to the learners by academic head. Introduction of institution policies.

Lecture 1

Study unit 2: Orientation of Learners to Library and Students Facilities

Introducing learners to physical structures

Issuing of foundation learner guides and necessary learning material

Lecture 2

Study unit 3: Distribution and Orientation of Business Management 512

Learner Guides, Textbooks and Prescribed Materials Lecture 3

Study unit 4: Discussion on the Objectives and Outcomes of Business

Management 512 Lecture 4

Study unit 5: Orientation and guidelines to completing Assignments

Review and Recap of Study units 1-4

6

2.

TITLE OF MODULES, COURSE, CODE, NQF LEVEL, CREDITS & MODE OF DELIVERY3.

PURPOSE OF THE MODULE3.1 Business management 512

The purpose of this module is to give learners an overview of the business world and how business entities and other non-business entities should be managed to achieve the desired results. The module is an introduction to what management is all about, but we trust that learners will gain sufficient knowledge about the various business functions to enable them to choose possible areas of work preference and further study and or articulation.

3.2 Business Management 512 (2nd Semester)

This module, Business Management 512, forms an integral part of the P C Training & Business College qualification and serves to introduce the student to the fundamentals of management. In so doing, the module explores the evolution of management theory, the management environment, and the management process.

3.3 Business Management 512 (2nd Semester)

This module is to take the broad subject area of Business Management further and to allow the learner to explore the concepts of entrepreneurship and small business management, managing technology and innovation as well as explore the concept of managing change.

4.

LEARNING OUTCOMESOn completion of these modules the student will be able: To define the concepts of Business Management To be able to develop a Business Plan.

To understand the principals of general management

To understand the functional management of the organisation 2nd Semester Business Administration

Title of Module:

Code:

NQF Credits:

Mode of Delivery:

Business Management 512

BMN_512

NQF 5 10

7

5.

METHOD OF STUDYThe sections that have to be studied are indicated under each topic. These form the basis for tests, assignments and examination. To be able to do the activities and assignments for this module, and to achieve the learning outcomes and ultimately to be successful in the tests and examination, you will need an in-depth understanding of the content of these sections in the learning guide and prescribed book. In order to master the learning material, you must accept responsibility for your own studies. Learning is not the same as memorizing. You are expected to show that you understand and are able to apply the information. Use will also be made of lectures, tutorials, case studies and group discussions to present this module.

6.

LECTURES AND TUTORIALSLearners must refer to the notice boards at their respective campuses for details of the lecture and tutorial time tables. The lecturer assigned to the module will also inform you of the number of lecture periods and tutorials allocated to a particular module. Prior preparation is required for each lecture and tutorial. Learners are encouraged to actively participate in lectures and tutorials in order to ensure success in tests, assignments and examinations.

Notices

All Business Management 1(A) notices (e.g. change of test dates, tutorials, meetings etc) will be displayed on the notice board located at your campus. Learners are advised to check the notice board on a daily basis.

7.

PRESCRIBED & RECOMMENDED MATERIAL7.1 Prescribed Material-Diploma in Business Administration

Erasmus, B., J. Strydom, J., W. and Rudensky-Kloppers, S. 2013: Introduction to Business

Management. 3rd ed. Cape Town. Oxford University Press.

Business Management 511 has a well balanced approach in that it is structured such that it not only

informs and educates you about the theoretical back-ground required in the business world, but

also has a powerful practical element / component. Our practical syllabus follows strongly in line

with that of strong management principles and standards currently employed by many enterprises

today.

7.2 Recommended Material

Du Toit G., S. Erasmus B. J. and Strydom J., S. 2010. Introduction to Business Management. 8th

8 Neiman G. Bennett. A. 2011. Business Management: A value chain approach. 2nd ed. Van Schaik.

Pietermaritzburg.

7.3. Independent Research:

The student is encouraged to undertake independent research with emphasis on the value of strategic thinking in companies and the formulation of a proper business management.

7.4. Library Infrastructure

The following services are available to you:

Each campus keeps a limited quantity of the recommended reading titles and a larger variety of similar titles which you may borrow. Please note that learners are required to purchase the prescribed materials.

Arrangements have been made with municipal, state and other libraries to stock our recommended reading and similar titles. You may use these on their premises or borrow them if available. It is your responsibilities to safe keep all library books.

PCT&BC has also allocated one library period per week as to assist you with your formal research under professional supervision.

PCT&BC has dedicated electronic libraries for use by its learners. The computers laboratories, when not in use for academic purposes, maybe used for research purposes. Booking electronic library usage.8. ASSESSMENT

Assessment for this module will comprise two CA tests, an assignment and an examination. Your lecturer will inform you of the dates, times and the venues for each of these. You may also refer to the notice board on your campus or the Academic Calendar which is displayed in all lecture rooms.

8.1Continues Assessment Tests

There are two compulsory tests for each module (in each semester).

8.2Assignment

There is one compulsory assignment for each module in each semester. Your lecturer will inform you of the Assignment questions at the commencement of this module.

8.3Examination

There is one two - hour examination for each module. Make sure that you diarize the correct date, time and venue. The examinations department will notify you of your results once all administrative matters are cleared and fees are paid up.

9 examinable in both your tests and the examinations.

The examination department will make available the details of the examination (date, time and venue) in due course. You must be seated in the examination room 15 minutes before the commencement of the examination. If you arrive late, you will not be allowed any extra time. Your learner registration card must be in your possession at all times.

8.4Final Assessment

The final assessment for this module will be weighted as follows:

CA Test 1

8.5Key Concepts in Assignments and Examinations

In assignment and examination questions you will notice certain key concepts (i.e. words/verbs) which tell you what is expected of you. For example, you may be asked in a question to list, describe, illustrate, demonstrate, compare, construct, relate, criticize, recommend or design particular information / aspects / factors /situations. To help you to know exactly what these key concepts or verbs mean so that you will know exactly what is expected of you, we present the following taxonomy by Bloom, explaining the concepts and stating the level of cognitive thinking that theses refer to.

Key Content S Explanation

Knowledge

observation and recall of information knowledge of dates, events, places knowledge of major ideas

mastery of subject matter Question

Cues

list, define, tell, describe, identify, show, label, collect, examine, tabulate, quote, name, who, when, where, etc.

Comprehension

understanding information grasp meaning

10 interpret facts, compare, contrast

order, group, infer causes predict consequences Question

Cues

summarize, describe, interpret, contrast, predict, associate, distinguish, estimate, differentiate, discuss, extend

Application

use information

use methods, concepts, theories in new situations solve problems using required skills or knowledge Questions

Cues

apply, demonstrate, calculate, complete, illustrate, show, solve, examine, modify, relate, change, classify, experiment, discover

Analysis

seeing patterns organization of parts

recognition of hidden meanings identification of components Question

Cues

analyze, separate, order, explain, connect, classify, arrange, divide, compare, select, explain, infer

Synthesis

use old ideas to create new ones generalize from given facts

relate knowledge from several areas predict, draw conclusions

Question

Cues

combine, integrate, modify, rearrange, substitute, plan, create, design, invent, what if?, compose, formulate, prepare, generalize, rewrite

Evaluation

compare and discriminate between ideas assess value of theories, presentations make choices based on reasoned argument verify value of evidence recognize subjectivity Question

Cues

11 10. WORK READINESS PROGRAMME (WRP)

In order to prepare learners for the world of work, a series of interventions over and above the formal curriculum, are concurrently implemented to prepare learners. These include:

Soft skills

Employment skills Life skills

End –User Computing (if not included in your curriculum)

The illustration below outlines some of the key concepts for Work Readiness that will be included in your timetable.

It is in your interest to attend these workshops, complete the Work Readiness Log Book and prepare for the Working World.

Attitude & Goal Setting

Etiquettes & Ethics

Employer / Employee Relationship

12 12.WORK INTEGRATED LEARNING (WIL)

Work Integrated Learning forms a core component of the curriculum for the completion of this programme. All modules making of the Diploma in Business Administration will be assessed in an integrated manner towards the end of the programme or after completion of all other modules.

Prerequisites for placement with employers will include: Completion of all tests & assignment

Success in examination Payment of all arrear fees Return of library books, etc.

Completion of the Work Readiness Programme.

Learners will be fully inducted on the Work Integrated Learning Module, the Workbooks & assessment requirements before placement with employee

The partners in Work Readiness Programme (WRP) include:

13

Registered with the Department of Higher Education as a Private Higher Education Institution under the Higher Education Act,

1997. Registration Certificate No. 2000/HE07/008

BUSINESS ADMINSITRATION, MANAGEMENT & COMMERCIAL SCIENCES

LEARNER GUIDE

MODULES: BUSINESS MANAGEMENT 512 (2nd SEMESTER)

TOPIC 1 : ASSEST MANAGEMENT: THEINVESTMENT DECISION

TOPIC 2 : FINANCING DECISIONS

TOPIC 3 : THE OPERATIONS FUNCTION

TOPIC 4 : OPERATIONS MANAGEMENT: ACTIVITIES, TECHNIQUES AND METHODS

TOPIC 5 : THE PURCHASING FUNCTION

TOPIC 6 : THE HUMAN RESOURCE FUNCTION: ATTRACTING HUMAN RESOURCES

TOPIC 7 : CONTEMPORARY ISSUES IN BUSINESS MANAGEMENT

TOPIC 8 : THE MARKETING PROCESS

TOPIC 9 : MANANGING BUSINESS STRATEGY

14 SECTION B: BUSINESS MANAGEMENT 512 (2ND SEMESTER)

TOPIC 1: THE FINANCIAL FUNCTION AND FINANCIAL MANAGEMENT

1.1 Introduction to Financial Function Week 1

1.2 The Financial Function and Financial Management 1.3 Concepts In Financial Management

1.4 Cost-Volume-Profit Relationship

1.5 The Time Value of Money Week 2

1.6 Future Value and Present Value

1.7 Financial Analysis, Planning and Control Assessment questions

TOPIC 2: ASSEST MANAGEMENT: THE INVESTMENT DECISION

2.1 Introduction Week 3

2.2 The Management of Current Assets

2.3 The Management Long-Term Investment Decisions and Capital Budgeting

Assessment questions

TOPIC 3: FINANCING DECISIONS

3.1 Introduction Week 4

3.2 Financial Markets 3.3 Short-Term Financing 3.4 Long-Term Financing 3.5 Long-Term Debt

TOPIC 4: THE OPERATIONS FUNCTION

4.1 The Nature and Definition of Operations Management Week 5 4.2 The Importance of Operation Management

4.3 The Transformation Model

4.4 The Classification of Operations Processes for Manufacturers And Service Providers

Week 6

Assessment questions

TOPIC 5: OPERATIONS MANAGEMENT: ACTIVITIES, TECHNIQUES AND METHODS

5.1 Introduction Week 7

5.2 Operations Design

5.3 The Stages In The Design Of Products And Services 5.4 Planning And Control of the Operations Process 5.5 Operations Improvement

TOPIC 6: THE PURCHASING FUNCTION

6.1 Purchasing In Perspective Week 8

15 6.3 The Importance of Purchasing Function to the Business

6.4 The Management Task of the Purchasing Manager 6.5 The Purchasing Cycle

6.6 Quality Decisions as a Purchasing Activity Week 9

6.7 Deciding On Purchasing Quantities 6.8 The Selection of Suppliers

6.9 Pricing Decisions

6.10 Negotiations In Purchasing

TOPIC 7: THE HUMAN RESOURCE FUNCTION: ATTRACTING HUMAN RESOURCES

7.1 Introduction to Human Resource Management Week 10

7.2 What Is The Task Of The Human Resource Manager? 7.3 Attracting Human Resources

7.4 Recruitment 7.5 Selection

7.6 Placement and Induction

7.7 The Development Of Human Resources

7.8 Performance Management Week 11

7.9 Remunerating Employees 7.10 Health and Safety 7.11 Labour Relations Assessment questions

TOPIC 8: CONTEMPORARY ISSUES IN BUSINESS MANAGEMENT

8.1 The Problem of Productivity In South Africa Week 12

8.2 The Importance of Productivity Improvement and Level of Productivity in South Africa

8.3 Productivity Improvement in South Africa 8.4 Management in the International Environment Assessment questions

TOPIC 9 MANANGING BUSINESS STRATEGY

9.1 Introduction Week 13

9.2 Strategic planning and it characteristic 9.3. Concept of strategic management 9.4 The strategic management process Assessment Questions

TOPIC 10: BUSINESS ORGANISATION AND THEIR ESTABLISHMENT

10.1 Types of business enterprises Week 14

16 TOPIC 1

1. THE FINANCIAL FUNCTION AND FINANCIAL MANAGEMENT

LEARNING OUTCOMES:

After you have read this topic you should be able to:

Understand the nature and meaning of the financial function and financial management Understand the basic concepts and techniques that are used in financial management

1.1 INTRODUCTION TO THE FINANCIAL FUNCTION

Managerial finance is identified as one aspect of the functional management areas of, business. The financial function and its management is identified and analyzed. Relationships between financial management, and other functional management areas, related subject disciplines and the environment are outlined. This followed by an introduction to basic concepts and techniques used in financial management. Goals and basic principles of financial management are discussed. Finally, one of the tasks of financial management involves financial analysis, planning and control, which are examined

1.2 THE FINANCIAL FUNCTION AND FINANCIAL MANAGEMENT

A business must have necessary assets, such as land, building, machinery, vehicles, equipment, raw materials and trade inventories, at its disposal if it is to function efficiently. Businesses also need resources such as management acumen, labour and services such as power supply and communication facilities. Funds (capital) are needed to obtain these assets, resources and services. Owners or institutions that make funds available to a business may not use the funds in the short or long term and run the risk of losing some or all of the funds, if the business fails.

Financial Function: is concerned with the flow of funds, and in particular with the following: The acquisition of funds, which is known as financing

The application of funds for the acquisition of assets, which is known as investment The administration of and reporting on, financial matters.

1.3 CONCEPTS IN FINANCIAL MANAGEMENT

Asset side: reflects all the possessions of the business

Balance Sheet: is an ‘instantaneous photograph’ of the financial position of a business.

Fixed assets: comprise of land, buildings, machinery, vehicles and equipment

17 converted into cash within one year during the normal course of business such as inventories and debtors

Liability (or claim side): This side displays the financing or capital structure of the business as at the balance sheet date. The liability side is subdivided on the basis of 2 criteria.

1) The term for which the funds have been made available

2) The source from which the funds have been obtained.

The liability side contains the following details:

Long-term funds: these comprise of shareholders interest and long-term debt

Shareholders Interest: made up of ordinary share capital, reserves and undistributed, or retained, profit

Long-term debt: is usually made up of debentures, mortgage loan, secured loans, and long-term credit

Short-term funds: represent all debt or credit normally repayable within one-year e.g. bank overdrafts, trade creditors

Capital referred to as the monetary value of assets that the business possesses. It is needed for investment in fixed assets (fixed capital) and the investments in current assets (working capital). The need for fixed capital is permanent in any business. Similarly, working capital is required in the same light e.g. seasonal

Costs monetary value sacrificed in production of goods or services produced for resale.

Fixed Cost is the portion of total costs that remains unchanged within the boundaries of a fixed production capacity regardless of an increase or decrease in the quantity of goods or services produced.

Variable Costs are that portion of the total costs that changes according to the volume produced. Such variable cost items are manufacturing material costs.

Semi-variable cost there is not a pure linear relationship between these variable cost items and the volume produced

Variable cost per unit producing cost of a unit remains more or less constant irrespective of the quantity produced

18 Profit- difference between income earned and the cost incurred. A loss results when costs are

greater than income.

e.g. Profit/loss = income –costs = 100 –30

Profit = 70

Loss =income – costs = 70-100 = 30

Profit or loss = income – costs Or

Profit or loss = (selling price * sales quantity) – costs

Income Statement indicates the profit/loss for a specified period and the way it has been distributed.

The objective and fundamental principles of financial management

The long-term objective should be to increase the value of the business. This may be accomplished by:

Investing in assets that add value to the business

Keeping the cost of capital of the business as low as possible.

The short-term financial objective should be to ensure the profitability, liquidity and solvency of the business. Profitability is the ability of a business to generate income that will exceed cost. Liquidity is the ability of the business to satisfy its short –term dates. Solvency is the extent to which the assets of a business exceed its liability. Solvency differs from liquidity in that liquidity pertains to the settlement of short-term liabilities such as debentures and mortgage loans.

Financial Management is based on three principles:

The risk –return principle is a trade –off between risk and return. The higher the risk, the greater the required rate of return will be.

The cost-benefit principle: Decision-making based on the cost of resources only does not necessarily lead to the most economic utilization of resources. Sound financial decision-making requires an analysis of the total cost and total benefits, and ensuring that the benefits always exceed the cost.

19 1.4 COST – VOLUME – PROFIT RELATIONSHIP

The profitability of a business is determined by the unit-selling price of its product, the costs (fixed and variable) of the product, and the level of activity of the business (the volume of production and sales). A change in any one of the three components will results in a change in the total profit made by the business. The components therefore have to be reviewed in conjunction with one another and not in isolation. Consider the example below:

Example:

Selling price (SP) = R12 per unit Variable cost (V) = R8 per unit

Total fixed cost (F) = R100 000 per year Number of units manufactured and sold:

N = 30 000 (case 1)

N = 40 000 (case 2)

Profit = P

From P = Income – Cost

It follows that P = (N x SP) – [(N x V) + F]

Where N = 30 000

P is = (30 000 x R12) – [(30 000 x R8) + R100 000] = R360 000 – R340 000

= R20 000

Where N = 40 000

= (40 000 x R12) – [(40 000 x R8) +R100 000] = R480 000 – R420 000

= R60 000

The example refers to a break-even analysis. (Where a break-even point is reached, there is no profit or loss realised).

The following formula can be used:

N=__F____ (SP – V)

N – number of units (volume) at which no profit or loss is made (SP – V) – Marginal income or variable profit

20 Time value of money refers to the combined effect of both interest and time in the context of

financial decision-making.

Capital is vital for all businesses to operate. Interest must be paid on loans. Capital used for short or long periods. Time value of money combines the effect of both interest and time in financial decision-making. The principle is directly linked to the opportunity of earning interest in an investment.

Two perspectives are of importance:

Present value –present value or amount Future value – expected future amount

Applying the concept: The time value of money principle

If you had to choose between receiving a cash gift of R100 today or in a year’s time, what would you

be your choice? Naturally the R100 today. Why?

R100 received today is worth more than R100 will be in one year from now, because it can be invested now to earn interest. This is pure time value of money.

There is the possibility that the person who wishes to make the gift will no longer wish to do so

in a year’s time, or may only give part of the money – there is therefore risk and uncertainty involved in waiting.

The real purchasing power of R100 may decline in the course of the time under inflationary conditions

1.6 FUTURE AND PRESENT VALUE

1.6.1 The future value of a single amount

The future value of an initial investment or principal is determined by means of compounding, which means that the amount of interest earned in each successive period is added to the amount of the investments at the end of the preceding period.

FVn = PV (1+I) n Where:

PV is the original investment or present value of the investment FVn is the future value of the investment after n periods

i is the interest rate per period expressed as a decimal number

n is the number of discrete periods over which the investment extends

21 of a single amount.

Example

What is the future value of an investment of R100 for the one-year at an interest rate of 5% per annum?

FV1 = R100 (1+0, 05)1

= R100 (1, 05) = R105

And if the investment is for three years?

FV3 = R100 (1+0, 05) 3

= R100 (1, 1576) = R115.76

1.7 FINANCIAL ANALYSIS, PLANNING AND CONTROL

1.7.1. Financial Analysis – monitor financial position of a business and limit the risk of financial failure. Financial analysis reveals strengths and weaknesses of the business, so that corrective measures can be taken. The following financial statements assist in the financial analysis:

Income statement Balance sheet

Flow of funds in a business – continuous flow of funds to and from the business. Increased sale values boost profits. Profits (after tax) are utilized in the distribution of ordinary and preference share (dividends). The balance is reinvested into the business increasing available funds.

Funds-flow statement- drawn up from other statements (balance sheet, income statement etc). Reflects cash utilization and purposes for use, in a specific period.

Advantages:

It gives an indication of whether the cash dividends are justified in terms of the cash generated by business activities (profit)

It gives an indication of how growth in fixed assets has been financed It gives an indication of possible imbalances in the application of funds

It helps financial management to analyse and evaluate the financing methods of the business

Ratios

Ratios give the relationship between two items (group of items) in the financial statements. It serves as a measure to identify strengths and weaknesses of the business.

22 Financial Management – view to internal control, planning and decision-making

Suppliers of borrowed capital – evaluate the ability of the business to pay its debts and interests Potential owners- to determine the feasibility of the business as well as it being an investment

opportunity

Financial ratios must be viewed against norms and standards to be useful. Three types of comparison exist:

Current financial ratios with past and future ratios With other similar businesses

With norms of the industry as a whole. There is a large variety of financial ratios

A) Liquidity ratio – provide indication of the ability of the business to meet short-term obligations, without interference in its normal activities. Made up of the current ratio and acid test ratio.

Current ratio – reflects the relationship between the value of current assets and the extent of Current liabilities of a business

Current ratio = Current Assets

Current Liabilities

Acid test ratio – shows that for each R1 worth of current liabilities, the business has a certain amount of current assets, excluding inventory.

Acid Test ratio = Current Assets - inventory Current Liabilities

B). Solvency ratios- These are an indication whether a business is able to repay its debts from the sale of its assets on termination of its activities. Made up of the debt ratio and gearing ratio

Debt ratio: means that a certain percentage of the assets were financed by debt

Debt Ratio = debt X 100

Assets 1

Gearing ratio: indicates that for each R1 of debt the business has a certain amount of owner’s equity Gearing ratio = owners equity

Debt

C) Profitability, rate of returns or yield ratios

23 Total capital 1

b) Rate on return on capital (after tax) =Operating Profit -tax x 100

Total Capital 1

c) Return on shareholders’ interest

=Net profit after tax x 100 Shareholders interest 1

d) Return on owners equity =Net profit after tax

Owner’s Equity

e) Return on owners equity (no shareholders)

= Profit attributable to ordinary shareholders x100

Owners’ Equity 1

Financial budgets

Used by financial management

Consists of capital expenditure, cash, financing and balance sheet budget. Financial budgets serve 3 major purposes:

Verify the viability of operational planning

Give pointers to financial actions that the business must take to make operations budgets possible

Indicate how operating plans of the business affects future financial actions and conditions

Capital expenditure budgets: indicates the expected future capital investment in physical facilities

Financing budgets: ensure the availability of funds to meet budgeted shortfalls-receipts to payments. Provides the business with funds it needs at times it needs them.

Balance sheet budget: enables management to examine its activities and priorities annually. Less used because of large amounts of paperwork

ASSESSMENT QUESTION

24 PRACTICE QUESTIONS

Current Ratio: It is the relationship between the current assets and current liabilities of a concern. Current Ratio = Current Assets/Current Liabilities

If the Current Assets and Current Liabilities of a concern are R4,00,000 and R2,00,000 respectively, then the Current Ratio will be : R4,00,000/R2,00,000 = 2: 1

Current Assets: Raw Material, Stores, Spares, Work-in Progress. Finished Goods, Debtors, Bills Receivables, Cash.

Current Liabilities : Sundry Creditors, Installments of Term Loan, payable within one year and other liabilities payable within one year.

Current Ratio measures short term liquidity of the concern and its ability to meet its short term obligations within a time span of a year.

It shows the liquidity position of the enterprise and its ability to meet current obligations in time.

Higher ratio may be good from the point of view of creditors. In the long run very high current ratio may affect profitability ( e.g. high inventory carrying cost)

Shows the liquidity at a particular point of time. The position can change immediately after that date. So trend of the current ratio over the years to be analyzed.

ACID TEST or QUICK RATIO: It is the ratio between Quick Current Assets and Current Liabilities. The should be at least equal to 1.

Quick Current Assets: Cash/Bank Balances + Receivables up to 6 months + Quickly realizable securities such as Govt. Securities or quickly marketable/quoted shares and Bank Fixed Deposits Acid Test or Quick Ratio = Quick Current Assets/Current Liabilities

Example:

Cash 50,000 Debtors 1, 00,000

Inventories 1, 50,000 Current Liabilities 1,00,000 Total Current Assets 3, 00,000

Current Ratio = > 3, 00,000/1, and 00,000 = 3: 1 Quick Ratio = > 1, 50,000/1, 00,000 = 1.5: 1

GearingRatio

• Gearing Ratio is the proportion of the capital employed of the firm which come from outside of the business finance, e.g. by taking a short term loan etc

Debtratio

25 Debtratio

• The higher the ratio, the greater risk will be associated with the firm's operation.

26 TOPIC 2

2. ASSET MANAGEMENT: THE INVESTMENT DECISIONS

LEARNING OUTCOMES

After you have read this topic you should be able to: To explain the management of current assets

To explain the principles and the implementation of capital budgeting techniques in the management of fixed assets

2.1 INTRODUCTION

Management of the assets requires that decisions regarding investments in current and fixed assets be taken effectively as possible. It has a direct influence on a scope of the investment in current

assets and acquisition of fixed assets that will maximize stakeholder’s wealth.

2.2 THE MANAGEMENT OF CURRENT ASSETS

2.2.1 The cost and Risk of Investing in Current Assets

Current assets include cash, marketable securities, debtors and inventory. They are vital to ensure the continuous functioning of the business. Raw material sustains the manufacturing process. Sales influenced by credit allowed by the businesses. Management of the current assets involves cost and risk

3 reasons why a business should have cash available

The transaction motive The precaution motive The speculative motive

2.2.2.1. The cash budget: cash needs of a business, an important part of Management unused cash surpluses on cash shortages result in cost and risk of cash flows for a specific period and composed of 3 elements:

Cash receipt- cash sales etc

Cash disbursements cash paid for purchases of merchandises

Net changes in cash- difference between cash receipts and cash disbursements

27 2.2.2.2 Cash cycle

Also known as the Cash Conversion Cycle (CCC) measures how long a firm will be deprived of cash if it increases its investment in resources in order to expand customer sales.

2.2.2.3. The cash cycle: comprises the following Investigating cash in raw material

Converting raw material to finished products Selling finished products on credit

Ending the cycle by collecting cash

The cash cycle is a continuous process and if the cycle is speed up, the demand for cash will decrease. This can be achieved by cash collections and efficient management of debtors and stock (inventory)

2.2.3. The management of debtors

Debtors arise when a business sells on credit

Four C’s of credit

Character Capacity Capital Conditions

2.2.4. The management of stock (inventory)

The concept stock includes raw and auxiliary materials, work in progress; semi finished products, trading stock, and so forth, and like debtors, represents a considerable portion of the investment in working capital. In inventory management there is once again a conflict between the profit objective (to keep the lowest possible supply of stock, and to keep stock turnover as high as possible, to minimize the investment in stock, as well as attendant cash needs) and the operating objective (to keep as much stock As possible to ensure that the business is never without, and to ensure that production interruptions and therefore loss of sales never occur).

It is once again the task of financial management to optimally combine the relevant variables in the framework of a sound purchasing and inventory policy, in order to increase profitability without subjecting the business to unnecessary risks.

2.3 LONG TERM INVESTMENT DECISIONS & CAPITAL BUDGETING

Nature of capital investments

Capital investment –use of business funds to acquire fixed assets. (Land, buildings, equipment etc) the benefits accrue over a period longer than one year.

28 must be 3 factors

Relative magnitude of the amounts

Long term nature of capital investment decisions The strategic nature of capital investment project

2.3.1. The Evaluation of Investment Projects

The basic principle underlying is cost-benefit analysis where the cost of each project is compared to its benefits. Time value of money and cash flow are important factors to examine when evaluation investments

2.3.2.1. Cash flow concepts- represent each transaction

Cash revenues (source cash) and cash expenses (use of cash) is the net cash flow Net cash flow=cash revenues-cash expenses

Important cash flow components are distinguished for capital budgeting purposes

Initial investment money paid at the beginning of a project for equipment or purchases exceeds cash disbursement positive net cash flow insufficient to meet expenses (negative)

The expected terminal cash flow related to the termination of the project usually positive Annual cash flows are calculated as the profit after interest and tax.

Initial investment net cash flows are net cash outflow at the beginning of the project The life project economic life of the project

The terminal cash flow after tax

2.3.2.2. Net Present Value Method

Decisions criteria take the time value of money into account and based on cash flow are called discounted cash flow (DCF) methods. This involves discounting estimated future cash flows to their present values and takes the amount and timing of cash flows into account.

Net Present Value – NPV

NPV compares the value of a dollar today to the value of that same dollar in the future, taking inflation and returns into account. If the NPV of a prospective project is positive, it should be accepted. However, if NPV is negative, the project should probably be rejected because cash flows will also be negative.

29 therefore, reduce the overall value of the clothing company.

The initial investment in a pollution prevention project is R10, 000. The projected savings is R4, 000 for the first year, R4, 000 for the second year, R2, 500 for the third year, R2, 000 in the fourth year, and R2,000 for the fifth year. The payback would be at 2.8 years.

Example of Payback With

Unequal Annual Cash Flow

Year

Annual

Cash Flow

Cumulative

Cash Balance

0 (today) (R10,000) (R10,000)

1 R 4,000 (R6,000)

2 R4,000 (R2,000)

2.8 = Payback R2,000 R0

3 R2,500 R500

4 R2,000 R2,500

2.4 ASSESSMENT QUESTIONS:

1. Differentiate between over investment and under investment. Determine the level of risk in each

2. What options are available for a company to improve its poor liquidity

3. The most common reasons for enterprises to have cash in hand is a:

a) Transaction motive

b) Precautionary motive

30 TOPIC 3

3. FINANCING DECISIONS

LEARNING OUTCOMES:

After you have read this topic you should be able to:

To explain the types of short-term financing decision (the financing of current assets) To describe the forms and sources of long-term financing

To explain the cost of capital

To explain the long-term financing decision and the establishment of an optimal capital structure To describe the money and capital markets as providers of finance

3.1. INTRODUCTION

This involves making decisions about the types of finance and suppliers of finance, to minimize cost and risk to the business.

3.2. FINANCIAL MARKETS

Financial markets and financial institutions play an important role in the financing of businesses. An economic system comprises of individuals and institutions with surplus funds (the savers) and those with shortage of funds.

Financial Markets - are the channels through which holders of surplus funds (the savers) make their funds available to those who require additional finance.

Financial Institutions act as intermediaries on financial markets between the savers and those with the shortage of funds. This financial service is referred to as financial intermediation.

3.2.1. Primary and secondary markets

New issues of financial claims are referred to as issues on the primary market. Secondary markets are types of financial claims that are negotiable and traded on financial markets. The JSE is an example of a financial institution that operates within the financial market.

3.2.2. Money and capital markets

Money market is the market for financial instruments with a short-term maturity: funds are borrowed and lent in the money market for periods of one day (i.e. overnight) or for months. Has no central physical location and transactions are conducted from the premises of the various

participants, for example, banks using telephones or on-line computer terminals.

Capital Market is where funds required for long-term investment are raised and traded by investors.

In South Africa much of this trading takes place on the Johannesburg Stock Exchange. Long-term investment transaction is also done privately.

31 without channeling the transaction through a stock exchange.

3.3. THE SHORT –TERM FINANCING DECISION (FINANCING OF CURRENT ASSETS)

Cost of short-term funds is lower than long-term funds. The reason is that trade credit does not involve a cost.

Profit is advantageous to use short–term funds. It can become a risk if the business is dependent on such a method of finance. The business can lose its liquidity and the financial position deteriorates.

The opposite applies to long-term funds. It is costly; long-term funds are more expensive than short-term funds. A less risk factor is guaranteed.

The following are the most common forms of short-term financing:

Trade credit: Important form of finance for businesses, and is mainly in the form of suppliers’ credit. This means that a supplier does not take payment from the business when goods or services are purchased. The business is expected to pay only after 30, 60 or 90 days, depending on the credit terms.

Accruals: Represent liabilities for services provided to the business, which has not yet been paid for. The most common expenses accrued are wages and taxes.

Bank overdraft: An overdraft facility is an arrangement with a bank that allows a business to make payments from a cheque account in excess of the balance in the account. The purpose of an overdraft is to bridge the gap between cash income and cash expenses.

Factoring: Factoring is similar to invoice discounting but goes one-step further. With factoring the financier also undertakes to administer and control the collection of debt.

3.4. LONG-TERM FINANCING DECISIONS

Shareholders Interest comprises of:

Owners Equity – funds made available by legal owners in the form of share capital and indirect contributions such as undistributed profits.

ORDINARY SHARES

Gives right of ownership. Receive share. Certificates in exchange for money made available to the business. Consists of 2 types—par value shares (have some value) and non-par value (shares differ).

The liability of ordinary shareholders is limited to the amount of share capital they contribute to the business.

Shareholders have no certainty that the money paid for the shares will be recouped, for this depends on the success of the business.

Ordinary shares in a listed company are tradable on the stock exchange.

32 they can vote at a general meeting to appoint directors of the company.

Disadvantages

The earnings per share (the profit attributable to ordinary shareholders divided by the number of shares issued) of existing shareholders may decrease.

Existing shareholders may lose control, because voting rights are linked to shareholdings, and people other than existing shareholders may take up new shares and become majority shareholders.

The cost of issuing new ordinary shares and the riskiness of an investment in ordinary shares may result in the cost of ordinary shares being higher than that of other forms of financing.

Advantages

There is no risk involved for the business, because payment of dividends and redemption of capital are not compulsory.

Additional ordinary shares serve as security for attracting additional borrowed capital, which provides greater flexibility for capital structure decisions.

Retained Profit-Consists of reserves and undistributed profit

Advantages

Capital is immediately available for use

It lends flexibility to the capital structure, because it serves as security for attracting additional borrowed capital.

In contrast to the issue of new shares, there are no control implications for existing shareholders It serves as an alternative form of financing, if conditions are unfavourable in the capital market

as a result of, for example, high interest rates It entails no interest or redemption obligations

Because no issue cost involved, it is cheaper than the issuing of additional ordinary shares

Disadvantages

It has a serious short-term disadvantage, because the retention of profit means the forfeiting of dividends.

Preference Shareholders Capital

Fall somewhere between debentures and ordinary shares in terms of risks.

If a business is doing poorly, it will first pay debenture holders their required interest and then pay dividends to preference shareholders.

Anything left goes to ordinary shareholders.

There are two types:

33 following year

Ordinary preference share- shareholders forfeit a dividend if directors decide not to declare one in the current year.

Characteristics of Preference shares

It has a preferential claim over an ordinary share on profit after tax.

It has a preferential claim over ordinary shares on the assets of the business in the case of liquidation.

The term of availability is unlimited

Authority can vary between full voting rights and no voting rights at all, but usually an ordinary preference share provides no voting rights.

3.5. LONG-TERM DEBT

Debt that will mature (repaid) in a year or more; can be obtained in two ways: 1) Through a loan

2) Through credit

Loan is a contract between the borrower and lender. The borrower makes interest payments at specific times to the supplier (lender) so that the total principle sum in payments is settled over an agreed period and specific due date.

Credit refers to an agreement between the supplier of capital and the receiver of capital to supply a principle sum and interest with the power of disposal over assets.

Types of Loans

Debentures: A certificate is issued to the lender indicating the conditions of the loans. Has a fixed interest charge and available to the business over a specified term

Bonds: Secured loans and issued with fixed assets (fixed property) as security (mortgage bonds). Rose on value of property.

Financing Leasing: This is a form of credit that gives the lessee the opportunity of owning the asset at the end of the lease.

Two types:

Direct Leasing- For example, motor vehicles and computers. Direct leasing is repayable in regular installments. The end of the lease pays up the value of the asset and interest.

34 TOPIC 4

4. THE OPERATIONS MANAGEMENT FUNCTION

LEARNING OUTCOMES:

After you have read this topic you should be able to:

Explain the nature of, and define, operations management Identify and explain the components of an operations model Depict a classification system for different operations processes

4.1THE NATURE AND DEFINITION OF OPERATIONS MANAGEMENT

Operations function is that function of the business aimed at executing the transformation process. Operations function and management are connected with creating products and providing services to realize the objectives of the business.

4.2THE IMPORTANCE OF THE OPERATIONS MANAGEMENT

The following three reasons are important.

Improves productivity- serves as a yardstick, measured as the ratio of output to input and converts the scarce resources of a business into products and services. Higher productivity is

directly related to an increase in a business’s profitability.

Helps the business to satisfy the needs of the customers / clients more effectively: The customer /client are an important focal point in operations management, thus the manager should ensure quality products/services are provided to the customer at a reasonable price. Satisfied customers are crucial to a business and its success and existence

It is vital to the general reputation of the business: Businesses have accomplished outstanding

reputations for high quality products/services. Low costs or plain and simple ‘good value for money’ e.g. Woolworth’s and Panasonic. Quality can be used as a competitive weapon and be

used to protect and expand their market position.

OPERATIONS MANAGEMENT STRATEGIES AND OBJECTIVES

Objectives are necessary for the business and in order to survive Long-term, the satisfied customer is the most important objective.

35 To obtain the advantages the following guidelines must be followed.

Do things right the first time– by providing defect free products and services, the business will gain a quality advantage. Higher quality means improved competitive position that could lead to

higher prices and a greater market shares e.g. Woolworth’s

Do things cost effectively– products and services must be placed on the markets that will ensure a cost advantage. Cost effectiveness prevents large-scale retrenchments, subsidies by the government etc, which all takes place at the expense of the taxpayer.

Do things fast – lead-time shortened. It will increase availability and give the business a speed advantage. Maintain a sound reputation in the market.

Change things quickly– able to change or adapt activities if unforeseen circumstances arise. This will enable the business to have an adaptability advantage.

Do things right every time- producing error free products at all times give the business high reliability or variability advantage? This meets the customer /client requirement for high quality. It allows the business to meet long-term requirements.

Do things better – provide a better total package compared to its competitors – service advantage. This is closely linked

Positive Results obtained by the Application of Operations Management Guidelines

Operation management Guidelines Positive Result Doing things right the first time

Doing things cost effectively Doing things fast

Changing things quickly Doing things right every time Doing things better

Positive results obtained by the application of operation management guidelines

Source: Adapted for slack, N Chambers, Sharland, A ASHNSON R, Operations Management, 1995 p54

36 Material: a wide variety (processed and unprocessed) can be used as inputs in the transformation process. E.g. skill, glass, plastic (processed), gold ore (unprocessed)

Customers / clients: they serve as inputs when they are the subject to the transformed / processed e.g. a visit to the dentist / salon.

Information: can be primary input processed e.g. news (converted information) or secondary input e.g. customer preferences (colour of motor vehicle).

Aids include:

Human resources– workers physically involved in supervision, manufacturing capacities etc. Some are more labour intensive than others e.g. gold mine labours intensive than a motor vehicle manufacturer that makes use of automated machinery.

Equipment and facilities – assume many different forms e.g. manufacturer uses factories, machinery and equipment. Hospitals – wards, theatres (operations). Banks and attorneys – offices.

Technology – enables the transformation process to take place better. Automation in manufacturing plants and satellite communication assists in these areas at rendering a

“better” transformation process.

The transformation process

Inputs are converted to outputs. 3 types exist.

Transformation of materials- processing materials by changing their physical appearance / characteristics. E.g. motor vehicle. Service providers are a part of this process. E.g. changing ownership

Transformation of information – information changes from its primary source and changes its shape and composition e.g. an auditor report to a market publication and is stored in the library.

Transformation of customers/ clients- changing physical characteristics (hairdressing) to the physiological condition (medical treatment)

Outputs

Manufacturers produce products e.g. motor vehicles, office furniture etc. Service providers provide services e.g. hairdressing.

4.4. THE CLASSIFICATION OF OPERATION PROCESSES FOR MANUFACTURERS AND SERVICE PROVIDERS

37 The classification of operations process for manufacturing:

Project systems: Project systems are operations processes that are highly individual, unique and normally tackled on a large scale. It takes the project team months or even years to complete such projects. Examples of such projects systems are construction projects (the building of an airport, bridge, highway etc.) a development programme for a new motorcar or the upgrading of an assembly line.

Jobbing systems: Jobbing systems normally comprise operations processes conducted on a small scale with low volume output. The nature of the work is the same throughout, but the specific requirements differ from one task to the next. Examples are a goldsmith who manufactures jewellery (each jewellery is unique and takes the design preference of each customer into consideration and the printing of wedding invitations).

Continuous or repetitive systems: Continuous or repetitive systems are operations systems in which the output volume is high. They provide the same product on the continuous basis and the variety is far less than in jobbing systems. Examples are a vehicle manufacturer.

Multiple-unit project systems: The first combination system (hybrid system) to be identified is the multiple-unit project system, a combination of a repetitive and a project system. The scope of the project is still large, but multiple units of the end product are produced. Examples are found in aircraft and missile manufacture.

Job-lot systems: A job-lot system is the second type of combination system (hybrid) and is a combination of a repetitive and a jobbing system. It is also known as a lot production system. A limited range of products is manufactured by the business and production occurs in lots or batches. Examples are the manufacture of domestic appliances and sound equipment

Classification of Operations Procedures for Service Providers

Professional Services - operation processors provided on a high-client-contact basis, where the

client is present in the services process for a considerable time.

The services are more people oriented e.g. dentist, attorneys etc.

Service Shops – operation processes that fall between professional services and mass services. Client contact adapted to accommodate the unique needs of clients e.g. banks, hotels, retail stores

Mass Services- processes that take place with limited client contact, with services that are standardised e.g. air and rail transport and TV broadcasts.

ASSESSMENT QUESTION

38 TOPIC 5

5. OPERATIONS MANAGEMENT: ACTIVITIES, TECHNIQUES AND METHODS

LEARNING OUTCOMES

After you have read this topic you should be able to: Explain the activity “operation design”

Explain the activity “ planning and control of the operation processes”

Discuss the activity “ operation improvement”

5.1INTRODUCTION

Operation Management model comprises operation management strategies and objective as well as the activities that influence the transformation process that provides output. Techniques and methods that operations managers use to perform these activities with greater efficiency and effectiveness are discussed.

5.2 OPERATION DESIGN

Nature – entail two independent aspects, the desire of products and services and the design of processes to manufacture these products and services. Operations management and other

functional managers are actively involved in the design of the business’s products or services.

The primary aim of operations design is to establish products/services and corresponding processes to ensure customer satisfaction. The operations activities include cost, lead-time, adaptability, variability and service. The design must be free of errors. Services are expected to be designed in a similar manner with customer expectations/ satisfaction being the main priority.

Service shops – operation processes that fall between professional services and mass services client contact adapted to accommodate the unique needs of clients e.g. bank, hotels, retail stores Mass services- processes that take place with limited client contact, with services that are

standardized e.g. air and rail transport and TV broadcast.

5.3 THE STAGES IN THE DESIGN OF PRODUCTS AND SERVICES

1. Concept generation

New ideas for products/services come from with the business or from customers for a new product.

2. The screening process

Concepts are screened for the design criteria of feasibility, acceptability and risk to determine whether a significant product/service will be designed. Other important management areas include finance and marketing.

39 The next step is to design the product/service once the concepts are accepted

4. Evaluation and improvement

Evaluate the product/service, with a view to improvement. Various techniques can be used.

5. Prototype and final design

Provide a sample for the customer to test. If positive, the final design can be compiled.

The design of operations processes

The design of operations processes to manufacture products or provide services is just as important as the design of the products and services themselves. Without both, it is impossible to develop, manufacture or provide a successful product or service.

The design of the operations network

No operations process exists in isolation – it is part of a greater integrated operations network. Besides the specific operations process, the operations network also includes suppliers of materials, intermediaries and final customers/clients.

Layout and flow of the manufacturing or service provision facility

The layout of a facility entails the three steps below: Selecting the process type

This involves selecting the appropriate process type.

Selecting the basic layout type

This involves selecting a basic layout type. There are four basic layout types:

Fixed position layout – the product cannot be shifted because of its size, shape or location Process layout – similar processes are grouped together into sections.

Product layout- different processes or operations required to manufacture specific product are arranged in consecutive order.

Cellular layout – processes are placed in a cell and the particular cell then arranged accor

ding to either a process or a product layout.

Detailed design of the layout

Involves the selection of a basic layout type merely provides an indication of the broad layout of the operations facility.

The application of process technology

40 Job design and work organization

Operations management not only focuses on the technologies, systems, procedures and facilities in

a business but decisively also on people’s involvement in the operations activity itself.

The way in which human resources are managed in a business has a fundamental effect on the effectiveness of the operations function.

5.4 PLANNING AND CONTROL OF THE OPERATIONS PROCESS

The nature of planning and control of the operations process

Planning and control is aimed at reconciling the provision ability of operations facility with the demand for specific products and services. This occurs in 3 dimensions viz. volume (quantity), timing and quality.

The following tasks are involved:

Loading of tasks- this refers to the volume or quantity of work allocated to a particular work centre

Sequencing of tasks – this refers to the sequence in which tasks are performed. Sequence of tasks can be determined beforehand by the use of priority rules.

Scheduling tasks- this refers to the use of detailed roster which indicates when a specific task should start and when it should be completed.

Capacity planning and control

This focuses on the provision of manufacturing/services capacity of an operations process. When a balance between available capacity and expected demand is reached, the business will have a satisfied customers/clients and acceptable profits.

The nature of capacity planning and control

Long-term capacity is determining during design the design of the operations process (medium and long-term) and is possible to adapt the capacity of the operations process to changes in demand for particular products/services. Certain machinery/equipment can be used for longer periods daily and overtime can be worked, over peak periods 3 steps must be applied to satisfy the expected demand.

The required capacity to satisfy the expected demand must be obtained by applying the following three steps:

Determine the total demand and required capacity Identify alternative capacity plans

Choice of a particular capacity planning and control approach

Techniques and methods that can be used in capacity and planning control

Techniques and methods can be applied in capacity planning. The methods are: