e x e c u t i v e s u m m a r y

S

S

S

h

h

h

a

a

a

r

r

r

i

i

i

a

a

a

B

B

B

a

a

a

n

n

n

k

k

k

Potency

Preference &

Community’s Attitude

toward it in West Java

RESEARCH TEAM

Dr. Anny Ratnawati (Coordinator) Dr Asep Saefuddin – Dr Widiyanto Dwi Surya

Dr. Sumardjo – Ir. Hari Wijayanto, MS Ir. I Made Sumertajaya, MS – Sumedi, SP

I . I N T RODU CT I ON

1.1. BACKGROUN D

Two main reasons of interest-free commercial banking: (1) the fact that the interest in conventional bank is considered as riba, of which not only Islam but also the rest of samawi religion prohibit it; (2) from the economy point of view, the risk transfer only to one party is considered an act of injustice. Within the long run, the conventional banking system would get only few rich people with vast capital richer (Sjahdeini, S. Remy, 1999).

The developing of syaria banking system in Indonesia was driven by the demand in the society (especially of muslim) who accepts interest as a forbidden transaction. Actually, the interest-free system in has been long acknowledged both in Islamic and non-Islamic countries. This shows that such a system is in no relation with religion rituality (of Islam) but indeed an integrated concept of risk-profit sharing between the capital owner and capital user, which makes the bank management with such a feature also accessible and manageable to all society interested in it, although it is still a fact, that in Indonesia, this is just developing within the muslim society. This aspect proves such vast opportunity waiting to be further developed, especially here in Indonesia, since most of the citizen is Muslim.

From the legal point of view, the ground rule for syaria banking system is UU No 7 of year 1992, in which the syaria is vaguely mentioned as the interest-free banking system. A more concrete representation is in UU No 10 of year 1998. E ven so, the syaria development cannot depend only on legality aspect such as this regulation and virtue of moral values projected into syaria banking system, but further, it has to be hard-evidenced through a market-driven progress.

This system could be well expanding, just like any other line of product, if there is demand upon such a system and service. E ven though this syaria banking system is relatively new, its development is obviously not based upon infant industry argument with extra protection and other dispensation policies; and any differences in the operational aspect are strictly because of the system dissimilarity to the conventional banking system.

1.2. OBJE CT IVE

The study is to:

2) Come out with the information on the development strengths of syaria banking system over certain areas under study based on the ground of economy and attitude pattern/preference analysis of the economy stakeholders.

1.3. OUT PUT

The expected output of this study are:

1) Information on the characteristics and behavior of bank customers grouped as (a) the ones that interact only with interest-free system, (b) the ones that interact with both conventional and syaria banking system, (c) the ones that have no intention to join the syaria banking system.

2) Information on factors affecting community’s behavior toward choosing syaria banking system.

3) Information on aspects of the development of syaria banking system that include market segment, marketing strength, and community’s perception over syaria banking system.

1.4. WORK CON T E N T

I I . M E T H OD OF S T U DY

2.1. PURCH ASE DE CISION PROCE SS

In the process of purchasing, the consumer’s psychological and physical activities can be depicted as shown in the next figure.

F igure 2.1. Steps in Purchase Decision Process Source: E ngel, Black well, Miniard (1994)

The theory of “V eblen E ffects” states that the attractive consumption done by consumer is affected by elements of sociology and psychology that in turn could affect the demand function. Those elements are then to construct characteristics that a unit’s differentiation of an attractive commodity utility does not only depend on the quality but also on the price paid for such a unit. This Veblen effect divides the unit’s price into two categories: real price – the actual price paid by consumer, and attractive price (conspicuous price) – the level of price predicted by consumer to be paid. Both type of prices could intersect to a point when the commodity is in the organized market where the consumer could easily access the price info.

NE E D ASSE SSME NT

Benefit sought Motivation Involvement

INFO ASSE SSME NT Source of information

Media’s effect Focus of attention

ALTE RNATIVE E VALUATION

Prior consideration Quality indicator

PURCHASING PROCESS

Reason to choose certain item Place of purchase

E xpenditure

AFTER-PURCHASE BEHAVIOR

2.2. F RAME OF T H OUGH T

F igure 2.2. Decision Process over Syaria Bank ing System.

Discontinue:

• Change to other banking • Dissappointed

• Attitude toward banking changes • Education

• Age

• Sex

• Etc.

2. Social Characteristics • State of urbane (cosmopolite) • Social status

• Religion • Openness to ideas 3. Economic variable 4. Level of income • Occupation/bussiness

• Transportation and communication accessibility • Family expenditure

• Harapan terhadap perbankan • Value/attitude to bank • Behaviour

2. Tolerance toward irregularity • To conventional banking • To syaria banking • To private accountant 3. Communication

• Accessibility to mass media • Reliable info source

Level of knowledge

over syaria banking Self- persuasion Decision

Communication Source

PREFERENCE VARIABLES

Characteristics of syaria banking system innovation: 1. Relative advantages

2. Compatibility (appropriateness to living and social being) 3. Complexity (problem)

4. Triabilitas (sulit tidak menjangkaunya) 5. Observability (mudah tampak/tidak manfaatnya)

Late Adoption

2.3. ME T H OD OF ANALYSIS

Logistic Regression Modeling

Regression parameter estimation logistic regression model of the study use maximum lik elihood method. The method is consistent and efficient enough for large amount of samples (n> 10(S+ 1), s = number of parameters) (Cox, 1970).

Maximum likelihood method provides the value of parameter estimation of likelihood function. The likelihood function to be maximized is:

f (β;y) = π(xi ) yi [ 1- π(xi) ] 1-yi , and since it is an independent observation, then L(β) =

∏

The same result will be gained for the estimator by maximizing the logarithmic likelihood. L = log f (β;y)

To obtain maximum likelihood estimator for parameter b, Newton-Rapson iteration method or iterated least square method is used.

2.4. SAMPL IN G T E CH N IQUE S AN D DATA COL L E CT IN G

District selection is based on number of pondok pesantren, number of praying sites, length of road, number of populati based on occupation, trading activities, banking activities, and researcher consoderation. From each district, 2 to 3 sub districts are selected according the same criteria for districts (especially sub-districts with quite developed state of economy, with Bank Umum Syariah, Bank Perk reditan Rak yat Syariah (BPRS), or Baitul Maal wa Tamwil (BMT).

The sampling of respondents generally will cover a number of respondents familiar with syaria banking principles (a portion of the respondents are expected to actually practice syaria principles), and other respondents knowing the principles of syaria and conventional banking, as well as those not using banking services at all.. Other primary data will be colected through Focus Group Discusssion

I I I . PE RF ORM A N CE OF S Y A RI A BA N K I N G

3.1. F UN D RAISIN G

There is a steady positive growth of fund-source raised from mudharabah saving from year to yaer natinally. The largest increase is on 1998 where the growth of the year achieved 53.4 percent or nominal value of mudharabah saving for national data increased from Rp 14.9 billion in 1997 to Rp 22.9 billion in 1998. The national average value of growth/year for mudharabah saving product is 26.7 percent.

Table 3.1. Growth of Syaria F und-source (Mudharabah Saving) per A rea of Work Year 1996-2000 (in thousand of rupiah)

Year Nominal Value of KBI Bandung*

Nominal Value of KBI Tasikmalaya

Nominal Value of l KBI Cirebon

Nominal Value of KBI Jakarta

National Nominal Value

1996 12.286.064 563.801 177.492 6.547.000 14.034.000 1997 16.150.866 1.147.778 119.402 6.819.000 14.964.000 1998 14.029.112 659.705 123.771 7.060.000 22.954.000 1999 24.255.500 673.963 104.036 8.525.000 28.117.000 2000 29.269.201 1.151.283 164.316 10.745.000 34.919.000

R (%)/year 26,6 33,5 3,2 13,6 26,7

Source : KBI Bandung ; KBI Tasikmalaya ; KBI Cirebon ; KBI Jakarta (2000) * : including general syaria bank

For the development of mudharabah deposit product experienced negatif growth in 1997 and 1998 in area of work of Bandung’s Bank Indonesia as much as –10.9 percents and –2.8 percents. The same thing happende in area of work of Cirebon’s BI where there was a negative growth in 1998 as much as –11 percents and –53 percents in 1999. Such was the case in area of work of Jakarta’s BI where a negative growth of –2.2 percents occurred in 1997 and –37.4 percents in 1998. Negative growth in 1997 and 1998 in almost all area of work of Bank Indonesia in West Java contributed a very small effect on the percentage of growth in that year nationally.

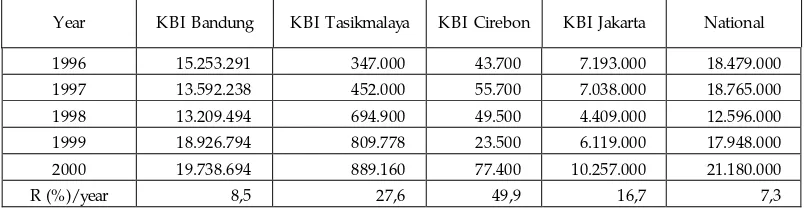

Table 3.2. Growth of Syaria F und-source (Mudharabah Deposit) per A rea of Work Year 1996-2000 (in thousand of rupiah)

Year KBI Bandung KBI Tasikmalaya KBI Cirebon KBI Jakarta National

1996 15.253.291 347.000 43.700 7.193.000 18.479.000 1997 13.592.238 452.000 55.700 7.038.000 18.765.000 1998 13.209.494 694.900 49.500 4.409.000 12.596.000 1999 18.926.794 809.778 23.500 6.119.000 17.948.000 2000 19.738.694 889.160 77.400 10.257.000 21.180.000

R (%)/year 8,5 27,6 49,9 16,7 7,3

3.2. F UN D DIST RIBUT ION

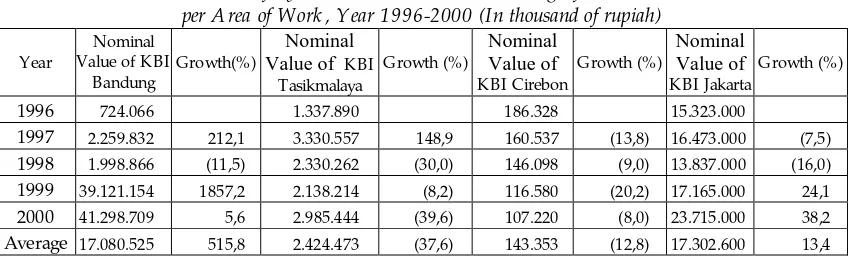

Mudharabah funding in area of work of Cirebon’s Bank Indonesia experienced negative average growth per year as much as –12.8 percents with decreasing nominal value of fund distribution each year. While area of work of Bandung’s Bank Indonesia Bandung had the largest average of growth per year as much as 515.8 percents. In the area of work of Tasikmalaya’s Bank Indonesia there was a negative growth in 1998 as much as –30 percents and –8.2 percents in 1999, however the growth increased to 39.6 percents up to July 2000 with the number of average growth per year was 37.6 percents.. While in area of work of Jakarta’s BI negative growth only happened in 1998, that is –16 percents. Or nominal value in 1997 as much as Rp 16.5 billion decreased to Rp 13.8 billion in 1998.

Table 3.3. Growth of Syaria F und Distribution (F unding) of Mudharabah Investment per A rea of Work , Year 1996-2000 (In thousand of rupiah)

Year

Nominal Value of KBI

Bandung

Growth(%)

Nominal Value of KBI

Tasikmalaya

Growth (%)

Nominal Value of

KBI Cirebon

Growth (%)

Nominal Value of

KBI Jakarta

Growth (%)

1996 724.066 1.337.890 186.328 15.323.000

1997 2.259.832 212,1 3.330.557 148,9 160.537 (13,8) 16.473.000 (7,5)

1998 1.998.866 (11,5) 2.330.262 (30,0) 146.098 (9,0) 13.837.000 (16,0)

1999 39.121.154 1857,2 2.138.214 (8,2) 116.580 (20,2) 17.165.000 24,1

2000 41.298.709 5,6 2.985.444 (39,6) 107.220 (8,0) 23.715.000 38,2

Average 17.080.525 515,8 2.424.473 (37,6) 143.353 (12,8) 17.302.600 13,4

I V. RE S PON DE N T ’ S B E H A V I OR T OW A RD S Y A RI A BA N K

4.1. RE SPON DE N T ’S CH ARACT E RIST ICS

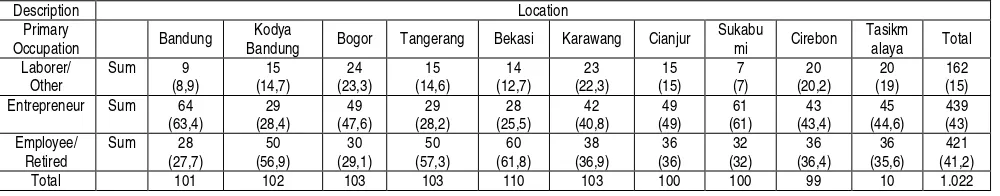

Based on primary occupation variable, most of the respondents, that is around 42.95 percents, are entrepreneurs (traders, small, medium and large scale businessmen), followed by employee/retired as much as 41.19 percents, laborer and others (including farmers, religious teacher) around 15.5 percents. Highest percentage for employee/retired is in the area of municipality of Bandung, Tangerang, and Bekasi. Respondents whose occupations are entrepreneurs are mostly (> 43%) in the area of district of Bandung (63,4%), Sukabumi (61%), Cianjur (49%), Tasikmalaya (44,6%), and Cirebon (43,4 %). Generally, those areas are small/household scale industry areas.

Table 4.1. Occupations of Respondents in A rea of Research

Description Location Primary

Occupation Bandung

Kodya

Bandung Bogor Tangerang Bekasi Karawang Cianjur

Sukabu Entrepreneur Sum 64

(63,4)

Information : ( Percentage in each area

According to average monthly income of the respondents, most of them (50%) are from low-income average, that is < Rp 750.000 per month. Where as those from medium average monthly income (Rp 750.000 - Rp 2 million) is 36.6 percents, the rest (13.4 percents) are high-income respondents (above Rp 2 million). The area of Bogor, Karawang, and Sukabumi are the areas with the most low-income respondents (> 50%). The areas of municipality of Bogor and Tangerang are areas with the most medium-income respondents (45%). While those with high income yielded relatively small percentage, which is below 20 percents, except in District of Bandung and Cianjur.. Some of the low-income respondents are laborers.

Table 4.2. Monthly A verage Income of Respondents in A rea of Research

Description Location Monthly

Average Income

Bandung Kodya

Suka-4.2. PE RCE PT ION TOWARD SYARIA BAN K

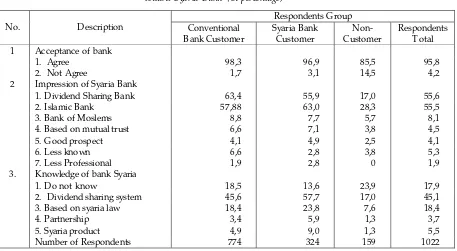

Table 4.3 shows that most of the respondents (95,8 percents) accepted and agrees with the existence of banking institutions in economics. Among the reasons were that banking institution is very important to enhance economics performance. Without bank, economy will not grow. The dominant impression prevailing is the community are: (1) syaria bank is a bank using dividend sharing system, mentioned by 55.6 percents of respondents (2) syaria bank is an Islamic bank, expressed by 55.5 percents of respondents, and (3) syaria bank is a special bank for Moslems only revealed from 8.1 percents of the respondents. There are 18 percents of respondents without any knowledge about syaria banking operational system. From respondents’ groupings point of view, there are 18.5 percents of conventional bank customers who have no knowledge about syaria banking operational system.

Table 4.3. Community Perception toward Bank ing and Community Knowledge toward Syaria Bank (in percentage)

Respondents Group No. Description Conventional

Bank Customer

2 Impression of Syaria Bank

1. Dividend Sharing Bank 63,4 55,9 17,0 55,6

3. Knowledge of bank Syaria

1. Do not know 18,5 13,6 23,9 17,9

Table 4.4. Community Behavior toward Implementation of Interest System in Conventional Bank s and Dividend Sharing System in Syaria Bank s (in percentage)

No Description Non-customer of Syaria

Banks (n = 698)

Total Respondents (n = 1022) 1. Behavior toward interest system

a. agree 58 55

b. disagree 42 45

2. Behavior toward dividend sharing system

a. agree 92 94

b. disagree 8 6

3. Opinion that interest system is against religious law

a. agree 60 62

b. disagree 23 22

c. do not know 17 16

The considerable potency for syaria bank market is also apparent from the attitude and acceptance of respondents toward dividend sharing system. As much as 92 percents of non-customer of syaria bank’s group and 94 percents of total respondents are acceptable to implementing sharing system in banking. The reasons stated are (1) because dividend-sharing system is more suitable with religious syaria law, (2) dividend dividend-sharing system is more equitable/fair and mutually benefiting. Respondents unacceptable to dividend sharing system are mostly because of lack of understanding concerning its practices, considered less profitable, still unproven and difficult calculation.

Information possesses important role in supporting banking developments. Source of information mostly accessed by the respondents in obtaining banking information are as follows: 1) friends, colleagues, relatives, or workplace (54,7%); 2) direct information direct from the bank (26%); 3) electronic media (23,3 %); 4) printing media (20,8 %), and 5) brochure, advertisement and banners (13,3 %). About 39,2 percents of respondents obtain their information from more than one sources. According to the result of the research, conventional method is still mostly practiced (friends and colleagues) compared to other methods capable of reaching a much wider audience such as printing and electronic media. This fact should be well appreciated in formulating the strategy for syaria bank development.

4.3. UT IL IZE D SE RVICE S AN D MOT IVAT ION F OR BAN KIN G SE RVICE S UT IL IZAT ION

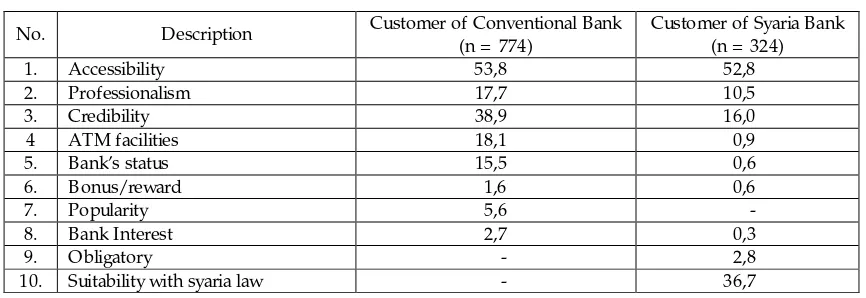

Table 4.5. Percentage of Respondents in Selecting Bank ing Institutions Year 2000

No. Description Customer of Conventional Bank

(n = 774)

Customer of Syaria Bank (n = 324)

1. Accessibility 53,8 52,8

2. Professionalism 17,7 10,5

3. Credibility 38,9 16,0

About 61 % of respondents choose to save their money in conventional bank for security motive. A similar reason also expressed by respondents who are also customers of syaria bank (41,4%). Most respondents choose conventional bank for lending/loan services, mainly based on fast service motive (17,3%). For customers of conventional bank, low interest rate likewise is a good motivation in getting a loan from conventional bank.

Table 4.6. Motivations of Respondents in Selecting/ Utilizing Services of Saving, L ending or other Services Offered by Conventional Bank Year 2000

No. Motivation Frequency Percentage

(n = 774) A. Saving services

1. High interest rate 45 5,8

B. Lending Services

1. Low interest rate 89 11,5

4. Variability of banking services 80 10,3

Table 4.7. Type of Products/ Services of Syaria Bank Utilized by Respondents

Customers of syaria bank No. Description

Frequency Percentage A. Saving Services/ Fund Raising

1. Clearing account/wadiah 15 4,6

2. Saving/wadiah yad dhamanah 208 64,2

3. Saving /wadiah mudharabah 83 25,6

4. Deposit (special saving) 5 1,5

5. Deposit (mudharabah mutlaqah) 19 5,9

6. Haj saving 15 4,6

B. Lending Service / Funding or fund distrivutions

1. Murabahah transaction 32 9,9

2. Salam transaction 1 0,3

3. Istisha 11 3,4

4. dividend sharing (syirkah musyarakah) 2 0,6

5. Syirkah mudharabah mutlaqah 86 26,5

6. Syirkah mudharabah muqayadah 4 1,2

7. Qardh 1 0,3

C. Other services

1. Wakalah 2 0,6

2. Ijarah 2 0,6

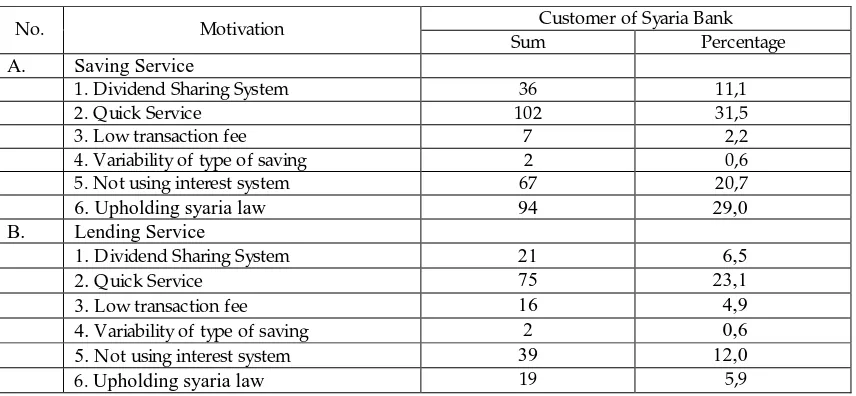

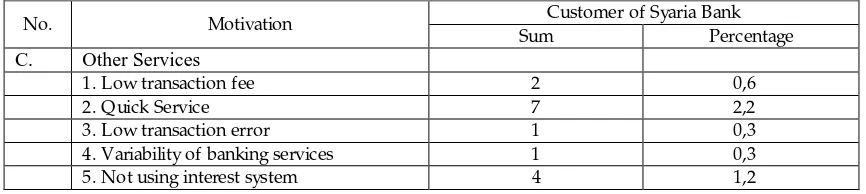

For customers of syaria bank, the motivations to save their money in the bank with syaria system mostly because of quick services (31,5%), upholding syaria law (29,0%) and not using interest system (20,7%). Customers of syaria bank like BPRS, who are mostly traditional market traders, expressed that they use lending services in the bank also mostly due to its quick and easy service. The bank’s employees collect their money directly, daily or weekly. Therefore they don’t have to spend more time and expences for trasportations to reach the bank. In some cases in area of reasearch there were customers of syaria bank who considered the bank required them to utilize their syaria system when they save their money. However when the customers was getting a loan from the bank, the syaia system nolonger in effect. Sometimes when calculated, its “interest” rate were even higher then that of conventional banks.

Table 4.8. Respondents’ Motivation in Selecting/ Utilizing Services of Saving, L ending or other Services Offered by Syaria Bank Year 2000

Customer of Syaria Bank No. Motivation

Sum Percentage

A. Saving Service

1. Dividend Sharing System 36 11,1

2. Quick Service 102 31,5

3. Low transaction fee 7 2,2

4. Variability of type of saving 2 0,6

5. Not using interest system 67 20,7

6. Upholding syaria law 94 29,0

B. Lending Service

1. Dividend Sharing System 21 6,5

2. Quick Service 75 23,1

3. Low transaction fee 16 4,9

4. Variability of type of saving 2 0,6

5. Not using interest system 39 12,0

Customer of Syaria Bank

4. Variability of banking services 1 0,3

5. Not using interest system 4 1,2

4.2. ADVAN TAGE AN D WE AKN E SS OF BAN KIN G SYST E M

Conventional bank’s primary excellence seems to be its professionalism in its services. Both conventional bank’s customer and syaria bank’s customer admit this fact. The four indicators described in the table are actually correlated to each other. In short, professional service will obviously supported by wide accessibility because of well-developed facilities. A faster and easier transaction is also an important criterion for the respondents to determine bank’s level of professionalism. One conventional bank’s excellence still unsurpassed by syaria bank is the widespread of service offices, on-line facilities and ATMs.

Table 4.9. Respondents’ Perception toward the E xcellence of Conventional Bank ing based on Customer Groupings (Percents)

1. Services’ Professionalism 62,3 40,1 47,2

2. Accessibility 48,2 33,3 36,5

3. Facilities 29,8 24,4 22,6

4. Transactions System 28,9 18,2 21,9

Average 42,3 29,0 32,1

The group of customers from conventional bank has more positive perception than the group of customers from syaria bank. This is apparent from average value of perception toward the four factors, that is 42,3 percents compared to 29 percents. However the perception of total respondents without differing groupings of customers is 32,1 percents. The meaning of the information is that in every respect the level of satisfaction of respondents toward the condition of conventional banking services is still low, that s only one-third of possible maximum satisfaction.

Table 4.10. Perception of Respondents toward E xcellence and Weak ness of Syaria Bank based on groupings of Customers (in percentage)

Description

Customer of conventional and syaria bank

(n = 235)

The large percentage for excellence and weakness at a glance show inconsistency of behavior. However both groups of answers seems to have its own logic. We can say that the respondents found the excellence and weakness sides at the same time and openly give opinions.

Table 4.11. Several Primary A nswers of Respondents for the E xcellence and Weak ness of Syaria bank

Aspect Excellence Weakness

A. Syaria principles related

a. Using dividend sharing system, free of riba, no burden b. Appropriate with syaria law

a. Unclear transaction b. High Lending service

c. The dividend sharing s just the same with common interest

B. Product type related

a. More variability (there is haj saving, loan with transaction system, dividend sharing credits, etc.)

b. The conditions are straight and without guaranty

a. Lack of Information and socialiszation.

b. Limited maximum amount of loan c. Less variability of products

C. Service comfort related

a. Nice employee, employee comes to the customers and open on holidays (Saturday and Sunday) b. Friendly employee with modest

clothing

c. Quick services

d. There is bargaining in dividend sharing

a. Employee not thoroughly understand the syaria system

b. Lack of facilities (no ATM, etc), lack of human resource

c. Difficulties in withdrawing saving/deposit

V. COM M U N I T Y PRE F E RE N CE T OW A RD S Y A RI A BA N K

5.1. FACTORS IN F L UE N CIN G T H E COMMUN IT Y IN USIN G SYARIA BAN K SE RVICE S

Factors influencing the community in using syaria bank services are studied through logit modeling. In the logit model, the case is the whole respondents, and the response variables are customers of syaria bank (1) or non-customer of bank syaria (0). The independent variables were chosen from variables considered relevant in influencing decision in adopting syaria bank or not. The factors influencing the community in using syaria bank are as follows:

1. Primary occupation, entrepreneurs vs. non-entrepreneurs: customers of syaria bank tend to originate mostly from entrepreneurs compared to non-entrepreneurs. The tendency of entrepreneurs to become customer of syaria bank is 5.4 times more than that of non-entrepreneurs.

2. Income, low vs. non-low: customers of syaria bank tend to originate from community with medium and higher income (more than Rp. 750.000 monthly income) than low-income community.

3. Accessibility: accessibility turned out to have a negative influence toward syaria bank’s potency. This is probably due to excellent accessibility areas where there are high information access and many alternative banks, resulting in high expectation for banking services.

4. Information openness: information openness also has a negative influence toward syaria bank’s potency. This is probably due to the community’s exposure to information provides more information about other alternative banks, resulting in high expectation for banking services. In such community, syaria bank is not a primary alternative because generally syaria bank’s service is considered less professional compared to conventional banks.

5. Acceptance of conventional bank: acceptance of conventional bank gave a positive impact to syaria bank’s potency. People who accept conventional bank for their daily activities are more willing to adopt syaria bank compared to people who do not accept conventional banking system.

6. Consideration of choosing bank by location/access: location/accessibility of the bank turned out to contribute a considerable effect on syaria bank’s potency. E asily accessed bank will encourage the community to become its customers.

8. Consideration of choosing bank by credibility: people choosing a bank for credibility consideration tend to not use syaria bank. This is caused by syaria bank’s credibility is considered less clear and still left far behind compared to that of conventional banks. 9. Consideration of choosing bank by facilities: people choosing a bank for facilities

consideration tend to not use syaria bank. This is caused by syaria bank’s facilities are considered still far behind compared to that of large conventional banks:

10. Consideration of choosing bank by status: people choosing a bank for status consideration tend to not use syaria bank. This is caused by syaria bank’s credibility is considered less clear compared to that of conventional banks.

11. User of conventional bank services – loan: people already acquired a loan (credit) from conventional bank tend to not use syaria bank.

12. User of conventional bank services – services: people already used services from conventional bank tend to adopt syaria bank

13. Knowledge of syaria bank: people already familiar with syaria bank tend to be willing to become customers of syaria bank. The tendency of people with good knowledge about syaria bank to become customers of syaria bank is 2.4 times more than those who do not know.

5.2. FACTORS IN F L UE N CIN G COMMUN IT Y TO KE E P ADOPT IN G SYARIA BAN K

These factors are run through logit model that consist of respondents of syaria bank customers with respond variable of being a customer to syaria bank (1) or quit to be a syaria bank customer (0). As for the independent variable, some relevant variables influencing the decision to adopt syaria system are chosen. The factors are as follow:

1. Accessibility: this factor puts negative effect on the development potency of syaria system. This may due to the fact that in areas with high accessibility, the access to other banks is also high that cause people to expect high performance of banking service. 2. Position of key person, highly regarded key person vs. ordinary people: this also affect

negatively to the development potency of syaria system. This could be caused by the accessibility to information for key person is higher than for ordinary people, which makes the key person possess better knowledge on the alternative system.

3. Knowledge on syaria system: people who knows about syaria system tends to keep adopting syaria system. This tendency is is 2.4 times higher than the people with less knowledge on syaria system.

4. The opinion that syaria system is profitable: people with this opinion in mind tend to keep adopting the system.

(i.e. the bank officer does the service not at the bank, but at the customer’s site) is appreciated by customers of BPRS.

6. User of syaria bank’s services – fund distribution: people already acquired a loan from the syaria banks tend to stop adopting syaria bank. There are several reasons that cause this, among them are: (1) many syaria bank does not practice syaria principles purely, (2) for customers with already thriving business, syaria system is considered less benefiting compared to interest system, (3) lack of knowledge in the customers about syaria bank/system resulting in the opinion that syaria bank is unclear and difficult for the customers, (4) there are disappointed customers because of lack of good service from the bank

5.3. FACTORS IN F L UE N CIN G COMMUN IT Y IN ADOPT IN G SYARIA BAN K

These factors are the results of the logit model. Within such a model, the primary case is the respondent who is not a customer to syaria bank and its responding variable is the willingness to become a customer (1) or rejection to become one (0). The independent variables are the ones that affect the willingness to adopt syaria bank. The factors affecting community to keep the syaria bank are as follow:

1) Main occupation, permanent employee vs. non-permanent employee: permanent employees show lack of enthusiasm in adopting syaria bank rather than the more enthusiastic non-permanent employees. This tendency of permanent employees to become the customer of syaria bank is only 0.6 times higher than of non-permanent employees.

2) Level of income: the community with mid to low level of income have greater willingness to adopt syaria bank over the community with higher level of income. This tendency (of the community with mid to low level of income to become syaria bank customer) is 1.5 times higher that the ones with higher level of income.

3) Accessibility: this factor has negative effect to the development of syaria bank. This is probably because of the area with high accessibility, the access to information on other alternative banks is also high that causes the community’s demand on the better service is inevitable.

4) Openness to information: this factor has negative effect on the development potential of syaria bank. This is probably due to the openness of the community over the information on other bank that the demand on better service is high.

5) Position of key person, highly regarded key person vs. ordinary people: the member of community who is also a key person (either of religious or formal key person) tends to adopt the syaria system rather than the rest ordinary member of community.

likely to adopt syaria system rather than the community who refuses to accept conventional system.

7) Site/accessibility consideration: the location/accessibility of a bank actually gives a great deal of positive effect on the development potency. The easiness to access the bank encourages people to become its customer. Therefore, a bank should position itself in a site that is accessible to its (future) customer.

8) Service consideration: people using the bank for its general service tends to refuse to adopt syaria system. This is because of the low quality of service provided by syaria banks, while the professional service of established conventional banks is available to adopt.

9) Obligation consideration: people using the syaria system as a duty-bound tends to refuse to adopt syaria system.

10) Knowledge on syaria banking system: people with better knowledge on syaria system tend to adopt it. This tendency is as high as 1.3 times higher than people with inadequate knowledge on syaria system.

11) The opinion that syaria is profitable: such an opinion also affects the respondent in adopting or leaving syaria alternative. People who thinks that syaria system is profitable tends to adopt the system.

12) The opinion that syaria system is according to religion: people with such an opinion in mind tends to adopt the syaria alternative. This shows that the development potency of syaria system is quite high in areas with community that possesses adequate comprehension over syaria system.

13) The opinion that syaria system offers practical services: people with such an opinion tends to adopt syaria system. The practical side is mostly experienced by customers who are directly assisted by the bank officers.

14) The attitude toward interest system: people who agrees with the conventional interest system tends to refuse to adopt syaria system, while the people who disagrees to it shows otherwise. This is to prove that interest system is truly prohibited in religion that people with strong religion influence will likely adopt syaria alternative.

15) The confidence over the possibility of interest-free system: people who are convinced that this interest-free system would be applicable in the existing banking system tend to adopt syaria system.

16) Attitude toward interest-free system: people who believes that the interest-free is going to be successful tends to adopt syaria system.

17) Attitude toward syaria system being more desirable: the pattern goes as well for people with the belief that syaria system is more desirable tend to adopt the system.

Bandung. However, this kind of analysis could be misleading and bias for: 1) in reality, the potency is not only measured over the community’s willingness to adopt, but also depend on the existing infrastructure in the respective area; 2) data gathered in this study is not specifically designed to represent each district, but rather to represent West Java, so that the potency analysis on each district in this study could be bias.

5.4. GE N E RAL CON CL USION S F ROM L OGIT MODE L ANALYSIS

In general, the performance of syaria bank, in the present time, is far behind compared to its older brother of conventional bank. This is proved by several facts that:

1. People prefer a bank system for its better service in general, facilities provided, credibility, and bank status, while on the other hand people tend to avoid syaria bank for their underestimation over its limited services and facilities, faint status, and low credibility. 2. People who are open to information and have extensive access to it tend to discontinue

(as customer) in being a syaria bank customer or refuse (not yet as customer) to adopt such a system. This shows that syaria bank performance is considered inferior to the conventional banks, that the level of one’s openness to information of syaria bank is the reason to drop that alternative.

Nevertheless, some aspects are worth further developing in order to improve syaria bank, they are:

1. Syaria bank is preferable around the community with mid to low level of income, yet the fact shows that most of the existing customers are community that is of mid to high level of income.

2. The fetching system (i.e. the bank officer does the service not at the bank, but at the customer’s site) still becomes the prime service, especially on BPRS. Such a system really facilitate the customers and the appreciation shows in the customer’s intention to keep adopting the syaria bank system.

3. Community’s knowledge on the syaria banking system is still low that causes the community’s willingness to adopt the system to drop. This fact must be counterbalanced by major campaign on the system of syaria bank. While on the other hand, it is necessary to avoid the practices of conventional bank system in the name of syaria system.(interest system) that could be misleading and induces negative impact to the syaria banking system itself.

4. The syaria bank has high potential in area with strong Islamic influence and areas with small and medium enterprises (home industries) that have not been covered by conventional bank.

6. Parties, such as BI (Central Bank) and MUI (Majelis Ulama Indonesia) need to hold major campaing to assure the status as well as the credibility of syaria bank to the community, for there are still people who doubt such matters.

V I . DE V E L OPM E N T POT E N CY OF S Y A RI A BA N K

6.1. DE VE L OPME N T POT E N CY BY L OCAL IT Y

The result of logistic analysis shows that variables influencing the community to adopt syaria banking system are occupation (businessperson), level of income (of mid to low class of community with the level of income as much as less than two million rupiah/month), level of accessibility of the area, and the bank market coverage itself. As for the non-economic variables are the position of key person in community, number of Muslim, and the number of religious (of Islam) facilities in the area, such as Islamic boarding school (pesantren)and venerable scholar/teacher of Islam(k yai). According to those variables, with more weight on the economy variable than religious variable, then the eleven districts become three classifications for development potency. First classification will be regions with the best development potency of syaria bank, i.e. Bandung municipal, Bogor district, and Tangerang district; second classification with moderate potency, i.e. Bekasi district, Bandung district, and Tasikmalaya district. Regions with less potency are Bogor municipal, Cirebon district, Cianjur district, and Tasikmalaya district, while the region with low potency is Karawang district.

Table 6.1. Syaria Bank Development Potency Classification by L ocality

District/ Municipal Weighed Score

Bandung municipal 51

Bogor district 47

Tangerang district 47

Bekasi district 45

Bandung district 42

Tasikmalaya district 37

Bogor municipal 31

Cirebon district 29

Cianjur district 26

Sukabumi district 24

Karawang district 24

Source: BPS (1998); Statistika Bank Indonesia (2000)

6.2. DE VE L OPME N T POT E N CY OF SYARIA BAN KIN G SYST E M BASE D ON T H E COMMUN IT Y’S CH ARACT E RIST ICS

This analysis is based on variability and distribution of respondents from customers of syaria bank or intending to adopt syaria bank’s products. The analysis method is by giving descriptive analysis of dominant variables produced by logit analysis on factors influencing the community in selecting banking institutions and the intention of the community to adopt syaria bank’s products, which will be explained in the following two examples of variables.

as the indicator of the potency of syaria bank development, then the district with high potency will be Bandung, Sukabumi, Tasikmalaya, and Cirebon.

V I I . CON CL U S I ON A N D RE COM M E N DA T I ON

7.1. CON CL USION

Since implementation of UU no.7/1992 about banking system , syaria banking system become widely accepted. The result of comparative analysis of syaria bank and conventional bank in West Java in general assets, fund raising, periodical saving, savings and credits, shows that syaria banks’ market share compared to general conventional banks nearly all are below 1 percent. Beside that professionalism and type of services are also still below conventional bank, where it is shown that syaria system still cannot be implemented thoroughly. This fact shows that syaria banking in West Java have not been able to properly exploit the potential market share.

The result of logit model analysis shows that syaria banking system is preferred by the mid to low class of the community. The study finds that syaria bank has not well informed to the community. The accessibility of community to syaria bank also become an important factor that influence community preference to adopt syaria banking system.

Dominant variables that are produced from primary data processing with logit analysis were later cross-analyzed with relevant variables found in area of research. Selected relevant economic variables are amount of man-power, amount of small and medium scale trade, the number of bank offices and finance institutions, road accessibility, fund raised from banking, and credit distribution. While relevant social variables are the number of Moslems, number of religious figures, which show social position in the community, number of pondok pesantren and number of religious places. Based on those variables, analysis with weighted-score shows that the area of research can be grouped into three classifications of development potency. The first classification shows that areas with the best potency in development potency of syaria banking are municipality of Bandung, district of Bogor, and district of Tangerang. Districts with quite good potency are district of Bekasi, district of Bandung and district of Tasikmalaya. Districts included in not so well potency category are municipality of Bogor, district of Cirebon, district of Cianjur, and district of Tasikmalaya, whereas the area with the lowest potency is district of Karawang.

To complete the result of area potency analysis and determining marketing target group for syaria bank, an analysis based on primary data is conducted on data diversity of respondents from customers of syaria bank or intending to adopt syaria bank. From the respondents’ primary occupation, the potential groups to become customers of syaria bank are those whose primary occupations are entrepreneurs/traders. If the type of occupation as entrepreneurs/traders can be used as indicators of development potency of syaria bank, then districts with good development potency of syaria bank are district of Bandung, Sukabumi, Tasikmalaya and Cirebon.

and Kabupaten Bogor have potency based on role of local leader in socialization of syaria banking system. And based on accessibility, the location with high potency are Kabupaten Tangerang, Kabupaten Cirebon, Kabupaten Tasikmalaya.

7.2. RE COMME N DAT ION

E ffort to develop and to widespread syaria banking system need to be supported by:

1) Information concerning syaria bank should be presented completely and properly to the community (target market), especially syaria system related, types of products/services, facilities, and other supporting services. Syaria bank’s main weakness so far is that the community’s lack of awareness toward syaria bank, therefore considering unnecessary to voluntarily seek for information about syaria bank.

a. BI clarifies the legal aspect (dual bank ing system) to guarantee the existence of the system to the community.

b. Syaria bank should take the initiative to promote through mass media and prominent community figures.

c. MUI explains the system of syaria in accordance with fiqih muamalah

d. National Syaria Council, an institution subsidiary to MUI responsible in issuing fatwa

(binding rules/guidance in Islam) to issue a fatwa that products and services of syaria bank are religiously legal/allowed (halal)

e. The presence of Syaria Supervising Council in syaria bank ensure that syaria system will uphold properly.

f. Syaria bank should emphasize to educate the customers that syaria bank is a long-term investment. For this purpose syaria banks can establish an association so the promotion can be more focus and in harmony as well as wider scope of work. g. The existing Syariah Financial Club should be developed toward efforts to improve

human resources in bank officer level concerning good comprehension in syaria system and improving promotion efforts.

2) Professionalism of syaria bank in term of public services, type of product/services, and supporting facilities need to be improved. This is related to community expectation that they need to be serviced by credible banking system. Implementation of syaria system need to be emphasized and to be done well, it is to differentiate syaria banking system and the conventional one.

3) Development of syaria banking system need to determine marketing target, so the type of product can fulfill community needs. The mid to low class of community as the dominant existing customer is very potential because revolving fund in the class is considerable.

to note that in areas with good accessibility already flourish conventional banks, resulting in tight competition. Combination of accessibility, utilization of prominent community figures (pesantren, k yai) and professionalism improvement of syaria bank are absolute conditions for the development of syaria bank.

5) So far the syaria bank already established in the community is the BPRS, therefore the development of general syaria bank should not against the BPRS (not treating BPRS as competitor). Development of general syaria bank should :

a. Co-operate with BPRS by binding partnership with BPRS in fund raising and distributing, catching a potential market and establishing network to achieve.

b. Create partnerships with local BPRS in managing fund to circulate the community’s fund in its corresponding area (assisting in local economical development in accordance with local autonomy).

6) The result of this study, among others, is indicators to determine the potency of an area for syaria bank’s development/establishment. Those indicators are best to be compared with existing indicators already in use before.

RE F E RE N CE S

Anonim. 2000. Perkembangan E konomi-Keuangan Daerah tahun 1999 Propinsi Jawa Barat. Bank Indonesia. Bandung.

Anonim. 2000. Keynote Speech : Deputi Gubernur Bank Indonesia Pada Seminar Nasional : “Pengembangan Hukum Perbankan Syariah di Indonesia dalam Menyikapi Otonomi Daerah dan Perdagangan Bebas” , Bandung, 14 Oktober 2000

Anonim. 1998. Jawa Barat Dalam Angka. Biro Pusat Statistika. Jakarta

Anonim. 1999. Petunjuk Pelaksanaan Pembukaan Kantor Bank Syariah. Bank Indonesia. Jakarta Al-Omar, Fuad , M.Abdel Haq. 1996. Islamic Banking : Theory, Practice and Challenges. Oxford

University Press. USA.

Aunuddin. 1989. Analisis Data. PAU Ilmu Hayat IPB. Bogor.

Antonio, M. Syafi’i. 1999. Bank Syariah : Wacana Ulama dan Cendekiawan. Tazkia Institute. Jakarta

Arifin, Zainul. Memahami Bank Syariah : Lingkup, Peluang, Tantangan dan Prospek. AlvaBet. Jakarta

Basri, Ikwan Abidin, MA. 2000. Perkembangan Umat Islam di Indonesia. Artikel. www.tazkia.com. Jakarta.

____________________. 2000. Kendala Sosialisasi Perbankan Syariah di Indonesia. Artikel. www.tazkia.com. Jakarta.

Caragata, Warren. July 21, 2000. Shariah Lenders Make Headway in Indonesia. Article. Asiaweek. Chapra, M. Umer. 1999. Why Has Islam Prohibited Interest ? (Rationale behind The Prohibition

of Interest). Pakistan.

Clark, C.T. dan L.L. Sckade. 1983. Statistical Analysis for Administrative Decisions. South Western Publishing Co., Ohio.

E ngel, James F., Roger D. Blackwell & Paul W. Miniard. 1994. Perilaku Konsumen. Jilid I. E disi Keenam. Binarupa Aksara. Jakarta.

______________________________________________. 1995. Perilaku Konsumen. Jilid II. E disi Keenam. Binarupa Aksara. Jakarta.

E rol, Cengiz and Radi E l-Bdour. 1989. Attitudes, Behaviour and Patronage Factors of Bank Customers Towards Islamic Banks. International Journal Banking.

E ryanto, Dian E ka Hendralesmana. 2000. Identifikasi Kepentingan Nasabah dalam Memilih Bank. Jurusan Statistika. Fakultas Matematika dan Ilmu Pengetahuan Alam IPB. Bogor.

Hosmer, D.W. dan S. Lemeshow. 1989. Applied Logistic Regression. John Wiley & Sons, New York.

Kotler, Philip & Gary Armstrong. 1993. Manajemen Pemasaran : Analisis, Perencanaan, Implementasi & Pengendalian. Volume Satu & Dua. E disi Ketujuh. Lembaga Penerbit Fakultas E konomi Universitas Indonesia. Jakarta.

__________________________. 1994. Dasar-dasar Pemasaran. Jilid I. E disi V. Intermedia. Jakarta.

McCullagh, P. and J.A. Nelder. 1983. Generalized Linear Models. Chapman, London.

Mirakhor, Abbas. 1995. Theory of an Islamic Financial System. E ncyclopedia of Islamic Banking and Insurance. London.

Siregar, Mulya. 2000. Makalah “Kajian Pengembangan Perbankan Syariah di Indonesia. Jakarta Sjahdeini, S. Remy. 1999. Perbankan Islam: Kedudukan dan Peranannya Dalam Tata Hukum

Perbankan Indonesia. Grafiti. Jakarta..

Walpole, R. E . 1995. Pengantar Statistika, E d.-3. Terjemahan Bambang Sumantri. Gramedia Pustaka Utama, Jakarta.