This document is an unofficial English translation of the Prospectus issued by the Company in Bahasa Indonesia on the initial public offering conducted in the Republic of Indonesia and is provided by the Company for information purposes only. The Prospectus has been prepared in accordance with the regulatory framework and disclosure practices in the Republic of Indonesia and neither the Company nor the Lead Underwriter makes any representation or warranty as to the accuracy or the completeness of this translation of the Prospectus. Each person receiving this document acknowledges that disclosure requirements and practices in the Republic of Indonesia, as in other emerging markets, differ significantly from disclosure requirements and practices in other jurisdictions. Accordingly, each person receiving this document acknowledges that this document does not provide the level or type of disclosure that a prospective investor may require in connection with making an investment decision with regards to the Offering. In the event that a prospective investor would like to obtain more information about the Company and/or the Offering before making an investment in the Company, it would be advisable for such potential investor to read the Prospectus in Bahasa Indonesia.

Effective Date June 18, 2010 Share Distribution Date June 25, 2010

Offering Period June 22-23, 2010 Refund Date June 28, 2010

Allotment Date June 24, 2010 Listing Date at IDX June 28, 2010

BAPEPAM-LK DOES NOT APPROVE NOR DISAPPROVE THIS OFFERING, NOR DOES IT PASS JUDGMENT UPON THE ACCURACY AND COMPLETENESS OF THIS PROSPECTUS. ANY CONTRADICTING REPRESENTATION THERETO IS ILLEGAL.

PT NIPPON INDOSARI CORPINDO TBK AND THE LEAD UNDERWRITER ARE FULLY RESPONSIBLE FOR THE ACCURACY OF INFORMATION OR MATERIAL FACTS AND OBJECTIVITY OF OPINIONS INCLUDED IN THIS PROSPECTUS.

PT NIPPON INDOSARI CORPINDO Tbk

Line of Business:Establish factory and produce various types of bread

Domiciled in Cikarang, Bekasi

Head Office

Jababeka Industrial Estate

Jl. Jababeka XII A, Block W No. 40-41, Cikarang, Bekasi Tel: (021) 8935088, Fax: (021) 8935286, 8935473

Website: www.sariroti.com Jl. Rembang Industri Raya No. 28

Pasuruan 67152 East Java Tel: (0343) 740388 Fax: (0343) 740387

OFFERING

151,854,000 new shares or 15% of issued and paid-up capital after the Offering, each with a nominal value of Rp 100, offered to the public at an Offer Price of Rp1,275 per share, to be paid in full upon submission of the Share Subscription Form. The aggregate value of the Offering amounts to Rp193,613,850,000.

THE NUMBER OF SHARES OFFERED IS RELATIVELY LIMITED AND AS SUCH THERE IS A POSSIBILITY THAT THIS WILL AFFECT THE TRADING OF AND CAUSE THE MARKET FOR THE COMPANY’S SHARES TO BE LESS LIQUID.

THE MAJOR RISK FACING THE COMPANY IS THE RISK RELATING TO PRODUCT CONTAMINATION, FROM RAW MATERIALS, DURING PRODUCTION AND AT DISTRIBUTION. THE COMPLETE BUSINESS RISKS OF THE COMPANY ARE SET OUT IN CHAPTER V OF THIS PROSPECTUS.

THE COMPANY WILL NOT ISSUE COLLECTIVE CERTIFICATES FOR THE SHARES OFFERED HEREIN. THE SHARES ARE TO BE DISTRIBUTED ELECTRONICALLY AND ADMINISTERED IN A COLLECTIVE CUSTODIAN WITH PT KUSTODIAN SENTRAL EFEK INDONESIA.

THE LISTING OF THE SHARES IS TO BE CONDUCTED ON THE INDONESIA STOCK EXCHANGE

LEAD UNDERWRITER

PT OSK NUSADANA SECURITIES INDONESIA UNDERWRITERS

PT Asia Kapitalindo Securities Tbk , PT BNI Securities, PT CIMB Securities Indonesia, PT Ciptadana Securities, PT Danasakti Securities, PT Danatama Makmur, PT Dhanawibawa Artha Cemerlang, PT Dinamika Usahajaya, PT e-Capital Securities, PT Erdikha Elit Sekuritas,

PT HD Capital Tbk, PT Kresna Graha Securindo Tbk, PT Madani Securities, PT Makinta Securities, PT Mega Capital Indonesia,

PT Panin Sekuritas Tbk, PT Phillip Securities Indonesia, PT Sinarmas Sekuritas, PT Sucorinvest Central Gani, PT Victoria Sekuritas, PT Yulie Sekurindo Tbk

PT Nippon Indosari Corpindo Tbk (”Company”) has submitted a statement of registration in relation to the Offering of its Shares to the Chairman of Bapepam-LK in Jakarta under letter No. 003/IV/LL/10 on April 5, 2010, according to the requirements stipulated in the Law of the Republic of Indonesia No. 8 of 1995 regarding Capital Market, as contained in the State Gazette of the Republic of Indonesia No. 64 of 1995, Supplement No. 3608/1995 and its implementing regulations and amendments (“Capital Market Law”).

The Shares offered are planned to be listed on the Indonesia Stock Exchange (”IDX”) in accordance with the Preliminary Listing Agreement entered into between the Company and IDX on April 1, 2010. In the event that the Company cannot satisfy the listing requirements as stipulated by IDX, the Offering will be cancelled and payments for subscriptions of the Shares will be refunded to the respective subscribers.

The Company, the Lead Underwriter, the Underwriters and the capital market supporting professionals and institutions involved in this Offering will be fully responsible for the accuracy of all data and objectivity of opinions, disclosure and reports presented in this Prospectus, based on their respective areas of duty and in accordance with the prevailing laws within the Republic of Indonesia, as well as their respective code of ethics, norms and the standards of their respective professions.

In relation to the Offering, no affiliated parties will be allowed to make any disclosure and/or statements regarding any matter whatsoever not otherwise disclosed in this Prospectus, unless prior written consent has been given by the Company and the Lead Underwriter.

The Underwriters hereby expressly declare that they are not in any way affiliated with the Company, whether directly or indirectly, as defined in the Capital Market Law. Explanations on affiliation are set out in Chapter XIII on Underwriting.

This Offering has not been registered in any jurisdiction outside the Republic of Indonesia. If a party outside the jurisdiction of the Republic of Indonesia receives this Prospectus, it is not meant to serve as an offer to purchase shares, unless any such offer and subsequent purchase of shares are not in contradiction nor a violation of any of the laws and regulations prevailing in such country.

TABLE OF CONTENTS

TABLE OF CONTENTS ... i

GLOSSARY ... ii

EXECUTIVE SUMMARY ... v

I. OFFERING ... 1

II. USE OF PROCEEDS ... 4

III. INDEBTEDNESS ... 5

IV. MANAGEMENT DISCUSSION AND ANALYSIS ... 9

V. BUSINESS RISKS ... 18

VI. MATERIAL EVENTS SINCE THE DATE OF THE INDEPENDENT AUDITOR’S REPORT ... 21

VII. INFORMATION ABOUT THE COMPANY ... 22

1. Brief history ... 22

2. Permits and licenses ... 23

3. Shareholding evolution ... 24

4. Management and supervision ... 27

5 . Human resources ... 30

6. Brief description of corporate shareholders ... 32

7. Ownership, management and supervision relationship between the Company and its corporate shareholders ... 35

8. Affiliated party transaction ... 36

9. Agreements with third parties ... 36

10. Assets ... 38

11. Legal proceedings faced by the Company ... 39

12. Insurance ... 39

VIII. BUSINESS AND PROSPECT ... 41

1. General ... 41

2. Operational activities ... 42

3. Prospects ... 51

4. Strategy and Business Plan ... 53

5. Environmental management and monitoring ... 53

6. Research and development ... 54

7. Corporate Social Responsibility ... 54

8. Good Corporate Governance ... 54

IX. SUMMARY OF IMPORTANT FINANCIAL INFORMATION ... 55

X. SHAREHOLDERS’ EQUITY ... 57

XI. DIVIDEND POLICY ... 58

XII. TAXATION ... 59

XIII. UNDERWRITING ... 61

XIV. CAPITAL MARKET SUPPORTING PROFESSIONALS ... 63

XV. LEGAL OPINION ... 65

XVI. INDEPENDENT AUDITOR’S REPORT AND THE COMPANY’S FINANCIAL STATEMENTS ... 66

XVII. APPRAISAL REPORT ... 67

XVIII. ARTICLES OF ASSOCIATION ... 68

XIX. TERMS OF SHARE SUBSCRIPTION ... 89

GLOSSARY

Affiliates : Parties referred to in Article 1 paragraph 1 of the Capital Market Law.

Allotment Date : The date when the Allotment Manager determines the allotment of the

Shares, which is at the latest two Business Days from the end of the Offering Period.

Allotment Manager : The party conducting the allocation in accordance with Bapepam

Regulation No. IX.A.7, Attachment to Bapepam Decree No. Kep-45/PM/2000 dated October 27, 2000, on Responsibilities of Allotment Manager in Subscription and Allotment of Securities in a Public Offering, which in this Offering is conducted by the Lead Underwriter.

Automatic sanding : Equipment to fill cream to sandroll bread automatically.

Band slicer : Equipment to slice toast bread in accordance with the required thickness.

Bapepam : Badan Pengawas Pasar Modal, the Capital Market Supervisory Board as

referred to in Article 3 paragraph (1) of the Capital Market Law.

Bapepam-LK : Badan Pengawas Pasar Modal dan Lembaga Keuangan, the Capital

Market and Financial Institutions Supervisory Board in accordance with Decree of the Minister of Finance of the Republic of Indonesia No. KMK/606/KMK.01/2005 dated December 30, 2005, on the Organization and Administration of the Capital Market and Financial Institutions Supervisory Board.

BKPM : Badan Koordinasi Penanaman Modal, the Investment Coordinating Board.

BPOM RI : Badan Pengawas Obat dan Makanan Republik Indonesia, the National

Agency of Drug and Food Control.

Business day : Mondays through Fridays, except for national holidays designated by the

Government of the Republic of Indonesia.

Capital Market Law : Law No. 8 Tahun 1995 dated November 10, 1995, on the Capital Market,

as published in the State Gazette of the Republic of Indonesia No. 64 of 1995, Supplement No. 3608, and its implementing regulations.

Company : PT Nippon Indosari Corpindo Tbk, a limited liability company incorporated

based on the laws of the Republic of Indonesia and is domiciled in Cikarang, Bekasi.

Company Law : Law No. 40 of 2007 dated August 16, 2007, on Limited Liability Company,

as published in the State Gazette of the Republic of Indonesia No. 106 of 2007, Supplement No. 4756, and its implementing regulations.

Depanner : Equipment to remove bread from the baking pan.

Divider : Equipment used to divide bread dough in accordance with the required

Effective : The fulfillment of all requirements for Registration Statement in accordance with Bapepam-LK Regulation No. IX.A.2.

Filler : Raw material in the form of bread filling.

Final proofing : The last stage of dough development process.

Flour Handling System : Equipment used to move and control flour usage from the flour silo to the

mixer.

Government : The Government of the Republic of Indonesia.

GSM : General Shareholders Meeting (Rapat Umum Pemegang Saham) as

defined in the Company Law and held in accordance with the provisions of the Company’s articles of association.

IDX or the Indonesian Stock : The stock exchange as defined in Article 1 paragraph 4 of the Capital

Exchange Market Law that is organized by PT Bursa Efek Indonesia, a limited liability

company incorporated and operating based in the laws of the Republic of Indonesia and domiciled in South Jakarta, which is the stock exchange where the Company’s shares will be listed.

KSEI : PT Kustodian Sentral Efek Indonesia (Indonesian Central Securities

Depository), a limited liability company incorporated and operating under the laws of the Republic of Indonesia and domiciled in South Jakarta, whose business activities are and is licensed as securities depository and settlement institution as defined in the Capital Market Law.

Kwik Lok : Toast bread plastic packaging bag closure device with printing of, amongst

others, the product expiry date.

Lead Underwriter : PT OSK Nusadana Securities Indonesia, a limited liability company which

is fully responsible for the administration and implementation of the Offering in accordance with the terms and conditions of the Underwriting Agreement and is subject to the provisions of the Capital Market Law.

Mixer : Dough mixing equipment.

Moulder : Equipment used to form bread dough.

Offer Price : The price of the Shares in the Offering.

Offering : The initial public offering of the Company’s Shares conducted in

accordance with and under the Capital Market Law.

Offering Period : A period of at a minimum one Business Day, where the public can submit

subscription for the Shares based on the procedures set out in the SSF and Chapter XIX on Terms of Share Subscription.

Overproof : Condition where the dough bread is overdeveloped.

PMA : Penanaman Modal Asing, a foreign investment company under the

auspices of BKPM.

Registration Statement : The documents that shall be submitted to Bapepam-LK by the Company in relation to the Offering in accordance with the Capital Market Law.

Rounder : Equipment used to shape bread dough into a round form with solid and

even pores.

Rp or Rupiah : The currency of the Republic of Indonesia.

Sandroll : Bread product with an oval shape.

Securities : Marketable securities, which include acknowledgement of indebtedness,

commercial paper, shares, bonds, proof of indebtedness, participation unit in a Collective Investment Contract, futures contract Securities and each derivatives of Securities.

Securities company : A party conducting the activities of Underwriter, Broker and/or Investment

Manager in accordance with the provisions of the Capital Market Law.

Share Registrar : A supporting professional in the Indonesian capital market as referred to

Article 48 of the Capital Market Law.

Shares : Shares issued by the Company, offered and sold in this Offering in

accordance with the Underwriting Agreement.

SSF or Share Subscription Form : Formulir Pemesanan Pembelian Saham, the form to be used to order or

subscribe to the Shares which can be obtained from the Underwriters.

Underproof : Condition where the bread dough is underdeveloped.

Underwriters : The Lead Underwriter and other parties forming the syndicate of the

Company’s Underwriters based on notarial Deed of Underwriting, who shall take up all of the remaining Shares in the Offering.

Underwriting Agreement : The agreement between the Company and the Lead Underwriter in

accordance with the Deed of Underwriting Agreement for the Initial Public Offering of PT Nippon Indosari Corpindo Tbk, including its amendments and/or additions and/or renewals, which contains the terms of the underwriting of the Offering.

USD : United States Dollar, the currency of the United States of America.

EXECUTIVE SUMMARY

This executive summary forms an integral part of this Prospectus and must be read in conjunction with the more detailed information in the Company’s financial statements and the notes thereto which is set out in Chapter XVI of this Prospectus. All financial information of the Company is stated in Rupiah and is prepared in accordance with the accounting principles generally applicable in Indonesia.

1. Brief history

The Company was incorporated under the name PT Nippon Indosari Corporation by Deed of Establishment No. 11 dated March 8, 1995, as amended by Deed of Amendment of Articles of Association No. 274 dated April 29, 1995, both drawn up before Benny Kristianto, SH, Notary in Jakarta, which have been ratified by the Minister of Law and Human Rights (formerly Minister of Justice) pursuant to Decree No. C2-6209 HT.01.01.Th.95 dated March 18, 1995, registered in the District Court of Bekasi No 264 and 265 dated September 14, 1995, and published in the State Gazette of the Republic of Indonesia No. 94 dated November 24, 1995, Supplement No. 9729/1995.

The Company’s articles of association has been amended several times and in the last amendment, in relation to the Offering, the Company amended its articles of association in compliance with articles of association for listed companies and changed the name of the Company to PT Nippon Indosari Corpindo Tbk by Deed No. 86 dated February 24, 2010, drawn up before FX Budi Santoso Isbandi, SH, Notary in Jakarta, which has been ratified by the Minister of Law and Human Rights pursuant to Decree No. AHU.12936.AH.01.02.Tahun 2010 dated March 12, 2010, and registered in the Company Register No. AHU-0019036.AH.01.09.Tahun 2010 dated March 12, 2010.

Based on Article 3 of the Company’s Articles of Association as set forth in the Deed of Meeting Resolution No. 86 dated February 24, 2010, drawn up before FX Budi Santoso Isbandi, SH, Notary in Jakarta, the Company’s purpose and objective are:

1. To conduct business activities in the bread, cakes and other foodstuff

2. To achieve the above purpose and objective, the Company may perform the following busines activities: a. Main business activities:

To establish factories and produce all types of bread, including but not limited to toast bread, sandwiches and

other types of cakes

b. Supporting business activities:

To market and sell all types of bread, including but not limited to toast bread, sandwiches and other types of cakes.

2. Financial summary

The following table summarizes the Company’s financial statements for the years ending December 31, 2009, 2008, 2007, 2006 and 2005, which have been audited by the Public Accounting Firm Purwantono, Suherman & Surja (previously Purwantono, Sarwoko & Sandjaja), a member of Ernst & Young Global Limited, with unqualified opinion.

Balance sheet

(in millions of Rupiah)

Description December 31

2009 2008 2007 2006 2005 ASSETS

CURRENT ASSETS

Cash and cash equivalents 57,945 52,878 8,249 9,299 6,567

Trade payables – third parties 53,135 42,717 28,222 18,305 16,514

Inventories 9,075 7,280 5,225 3,237 2,733

Restricted time deposits 13,018 - - 1,758 2,028

Prepaid expenses and other current assets 4,412 1,326 1,327 5,618 1,028

Total current assets 137,585 104,200 43,023 38,217 28,870

NON-CURRENT ASSETS

Fixed assets – net of accumulated depreciation 204,681 201,431 123,499 113,441 116,206

Guarantee deposits 4,346 2,600 2,148 1,517 791

Claims for tax refund 43 43 689 43 43

Other non-current assets 323 339 109 119 136

Total non-current assets 209,393 204,413 126,445 115,120 117,176

TOTAL ASSETS 346,978 308,613 169,468 153,337 146,046

LIABILITIES

CURRENT LIABILITIES

Bank loans - - - 6,827 -

Trade payables – third parties 37,635 24,975 17,757 12,354 9,616

Other payables 13,108 34,423 3,676 5,806 13,480

Taxes payable 12,162 11,857 4,599 2,202 1,296

Accrued expenses 7,543 5,597 5,499 6,566 4,537

Current maturities of long-term loans:

Bank loans 25,000 14,588 5,000 12,506 13,685

Other loans - - 169 458 403

Total current liabilities 95,448 91,439 36,700 46,720 43,017 NON-CURRENT LIABILITIES

Customers’ deposits 4,420 2,979 2,436 1,851 1,209

Long-term bank loans – net of current maturities 68,750 75,465 35,000 28,669 35,338

Convertible bonds - - - 22,929 22,929

Deferred tax liability – net 6,590 5,195 5,049 3,956 3,153

Estimated liability for employee benefits 3,929 2,810 1,969 1,604 1,156

Total non-current liabilities 83,690 86,449 44,454 59,011 63,784

TOTAL LIABILITIES 179,138 177,888 81,154 105,731 106,802

SHAREHOLDERS’ EQUITY

Authorized, issued and fully paid 86,051 86,051 17,349 17,349 17,349

Additional paid-in capital 350 350 30,123 30,123 30,123

Advances for future stock subsription - - 38,928 16,000 16,000

Retained earnings 81,440 44,325 1,913 (15,865) (24,227)

TOTAL SHAREHOLDERS’ EQUITY 167,840 130,725 88,313 47,606 39,244

Profit and loss statement

(in millions of Rupiah)

Description 12 months

2009 2008 2007 2006 2005

Net sales 485,920 383,553 250,513 193,027 143,203

Cost of goods sold 263,821 222,360 145,660 111,579 83,924

Gross profit 222,099 161,193 104,853 81,448 59,280

Operating expenses:

Selling 113,068 83,360 62,190 49,608 35,578

General and administrative 20,735 16,166 12,703 11,550 10,305

Total operating expenses 133,803 99,526 74,894 61,158 45,883

Income from operations 88,295 61,667 29,959 20,290 13,397

Other income (expenses)

Sales of scrap 5,517 3,981 2,875 1,928 1,731

Interest income 1,328 661 170 281 252

Gain (loss) on sale of fixed assets – net 51 (21) 3 96 (17)

Interest expense (12,356) (5,268) (6,741) (9,562) (6,124)

Gain (loss) on foreign exchange – net (1,932) (414) 16 (61) 649

Others – net (412) (180) (83) (124) (469)

Other expenses – net (7,804) (1,242) (3,760) (7,440) (3,978)

Income before income tax 80,491 60,425 26,199 12,849 9,419

Income tax expense:

Current 21,981 17,867 7,328 3,684 3,008

Deferred 1,396 146 1,092 804 737

Total 23,376 18,013 8,421 4,487 3,745

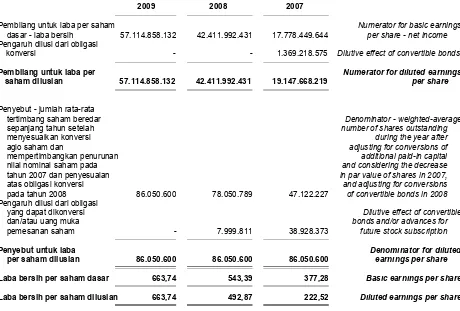

Net income 57,115 42,412 17,778 8,362 5,674

3. Business risks

Any industry is subject to various risks that can affect a company’s operations, which also applies to the Company. In conducting its business activities, the Company faces the following business risks :

Risks relating to operational activities

(i) Product contamination in pre-production, during production and at distribution (ii) Short shelf life of the products

(iii) Availability of wheat as raw material of flour (iv) Availability of energy supply

(v) Risk of labor strikes

(vi) Risk relating to availability of spare parts

Risks relating to market conditions and sales

(i) Foreign exchange fluctuations (ii) Competition

Risks relating to government policies and social environment

(i) Increase of regional/provincial minimum wage (ii) Economic, political and social stability (iii) Preservative and halal issues (iv) Natural disaster.

4. Initial public offering

The Company is conducting an initial public offering of 151,854,000 shares with a nominal value of Rp100 per share, at an offering price of Rp1,275 per share, which must be paid in full upon submission of SSF.

The shares offered in the Offering are new shares from shares under portfolio. These shares shall provide their holders equal and similar rights in all respects with the Company’s issued and fully paid up shares, including the rights to dividend distributions.

The capital structure of the Company prior to and after the Offering will be as follows :

Description Authorized capital 3,440,000,000 344,000,000,000 3,440,000,000 344.000.000.000 Subscribed and fully paid up capital:

- Bonlight Investments Limited - Treasure East Investments Limited - Sojitz Corporation Shares under portfolio 2,579,494,000 257,949,400,000 2,427,640,000 242,764,000,000

A more detailed explanation of the Offering is presented in Chapter I of this Prospectus.

5. Prospects and strategy

There are ample business opportunities in food and drinks in Indonesia. The Indonesian population, purchasing power and economic growth are significant factors in the food business. During an economic crisis the food industry can still grow. Increase of purchasing power and change of eating pattern, particularly in the cities where practical eating pattern is desired, will increase demand for bread.]

The Company implements the following strategy in its business development:

- Implementing supply chain management;

- Using SAP as enterprise resources planning software;

- Opening factories in other areas in Indonesia to meet the needs for quality, halal, clean and hygienic products;

- Producing new products, be it bread and bread-based snacks;

- Selecting appropriate distribution channels that can distribute the Company’s products quickly and accurately.

- Maintaining a mutually beneficial relationship with its customers;

- Showing its consumer the cleanliness of the Company’s production facilities and the Company’s efforts to

implement good manufacturing practice and sanitation;

- Expanding by opening factories in locations near its consumer.

6. Dividend policy

All of the Company’s issued and paid-up shares, including the Shares offered in this Offering, have the same rights and entitlements and are equal in all respects, including with respect to rights to dividend distributions.

The Company plans to distribute cash dividends at least once a year. Without prejudice to the Company’s financial condition and the right of an annual shareholders’ meeting to otherwise determine based on the Company’s articles of association, the amount of cash dividend to be distributed is related to the Company’s profits in the relevant fiscal year. The Company’s management plans to propose an annual dividend distribution of a maximum of 30% of the Company’s net profit in the relevant fiscal year.

7. Use of proceeds

The proceeds of the Offering, less expenses connected with the Offering, shall be used based on the following priorities :

1. Approximately 75% for development of new factories;

2. Approximately 25% for repayment of bank loans.

I. OFFERING

The Company is conducting an initial public offering of 151,854,000 shares with a nominal value of Rp100 per share, at an offering price of Rp1,275 per share, which must be paid in full upon submission of SSF. The total value of the Offering is Rp193,613,850,000.

The shares offered in the Offering are new shares from shares under portfolio. These shares shall provide their holders equal and similar rights in all respects with the Company’s issued and fully paid up shares, including the rights to dividend distributions.

PT NIPPON INDOSARI CORPINDO Tbk.

Line of Business:

Establish factory and produce various types of bread

Domiciled in Cikarang, Bekasi

Head Office: Jababeka Industrial Estate

Jl. Jababeka XII A, Block W No. 40-41, Cikarang, Bekasi Tel (021) 8935088, Fax: (021) 8935286, 8935473

Website : www.sariroti.com

Factories:

Cikarang :

Jababeka Industrial Estate Jl. Jababeka XII A Block W No. 40-41 Cikarang, Bekasi Tel: (021) 8935088 Fax: (021) 8935286, 8935473

Cikarang :

Jababeka Industrial Estate Jl. Jababeka XVII B

Block U No. 33

Cikarang, Bekasi

Pasuruan :

PIER Industrial Estate Jl. Rembang Industri Raya No. 28

Pasuruan 67152 East Java Tel: (0343) 740388 Fax: (0343) 740387

THE MAJOR RISK FACING THE COMPANY IS THE RISK RELATING TO PRODUCT CONTAMINATION, FROM RAW MATERIALS, DURING PRODUCTION AND AT DISTRIBUTION. THE COMPLETE BUSINESS RISKS OF THE COMPANY ARE SET OUT IN CHAPTER V OF THIS PROSPECTUS.

The Deed of Establishment, which contains the Company’s articles of association, have been amended by the following deeds:

1. Deed of Amendment of Articles of Association No. 23 dated July 7, 1997, drawn up before Benny Kristianto, SH,

Notary in Jakarta, which has been ratified by and reported to the Minister of Law and Human Rights (formerly Minister of Justice) pursuant to Decree No. C2-8.943 HT.01.04 TH.97 dated September 2, 1997, registered in the Company Register at the Office of Company Register of the District of Bekasi under agenda No. 37/BH.10.07/X/1997 dated October 31, 1997, and published in the State Gazette of the Republic of Indonesia No. 4 dated January 13, 1998, Supplement No. 268/1998, that has been revised by the State Gazette of the Republic of Indonesia No. 11 dated February 6, 2001, Supplement No. 268a/2001. This deed approves the amendments to Articles 2, 3 and 4 of the Company’s articles of association.

2. Deed of Meeting Resolution No. 5 dated July 23, 2003, drawn up before Ukon Krisnajaya, SH, Notary in Jakarta,

which has been ratified by the Minister of Law and Human Rights (formerly Minister of Justice and Human Rights) pursuant to Decree No. C-19350.HT.01.04.TH.2003 dated August 14, 2003, registered in the Company Register at the Office of Company Register of the District of Bekasi under agenda No. 418/BH.10.07/X/2003 dated October 9, 2003, and published in the State Gazette of the Republic of Indonesia No. 85 dated October 24, 2003, Supplement No. 10575/2003. This deed approves the increase of the Company’s authorized capital, confirmation of the Company’s boards and change of the Company’s name from PT Nippon Indosari Corporation to PT Nippon Indosari Corpindo. Notice of change of the name of the Company has been received and registered by BKPM pursuant to BKPM letter No. 228/B2/A6/2003 dated September 4, 2003, regarding the Change of the Name of the Company.

3. Deed of Meeting Resolution No. 3 dated June 7, 2005, drawn up before Ukon Krisnajaya, SH, Notary in Jakarta,

which has been ratified by the Minister of Law and Human Rights pursuant to Decree No. C-19324 HT.01.04.TH.2005 dated July 13, 2005, registered in the Company Register at the Office of Company Register of the District of Bekasi No. 546/BH.10.07/XI/2005 dated September 21, 2005, and published in the State Gazette of the Republic of Indonesia No. 104 dated December 30, 2005, Supplement No. 1234/2005. This deed approves the amendments to Articles 11.3(a), 11.3(b) and 11.6(b) on the Responsibility and Authority of the Board of Directors.

4. Deed of Meeting Resolution No. 1 dated July 1, 2008, drawn up before Ukon Krisnajaya, SH, Notary in Jakarta,

which has been ratified by the Minister of Law and Human Rights pursuant to Decree No. AHU-65556.AH.01.02.Tahun 2008 dated September 18, 2008, registered in the Company Register No. AHU 0087323.AH.01.09.Tahun 2008 dated September 18, 2008, and published in the State Gazette of the Republic of Indonesia No. 92, Supplement No. 23590/2008, on increase of capital and amendment to entire articles of association in accordance with Law No. 40/2007 on Limited Liability Company.

5. Deed of Meeting Resolution No. 17 dated December 30, 2009, drawn up before Ukon Krisnajaya, SH, Notary in

Jakarta, which has been reported to the Minister of Law and Human Rights by Receipt of Notice of Change of Company Data No. AHU-AH.01.10-03769 dated February 12, 2010, and registered in the Company Register No. AHU-0011453.AH.01.09.Tahun 2010 dated February 12, 2010. This deed approves the cancellation of Deed of Meeting Resolution No. 10 dated November 16, 2009, the change of the Company’s Board of Directors and Board of Commissioner and the sale of shares belonging to Bonlight Investments Limited to Treasure East Investments Limited.

As of the date of this Prospectus, the Company’s capital structure and shareholding are as follows:

Assuming all shares offered in this Offering are subscribedm the Company’s proforma capital structure and shareholders shall become as follows:

Description Par value Rp100 per share

No. of shares Par value (Rp) Percentage

Authorized capital 3,440,000,000 344,000,000,000

Issued and paid-up capital: - Bonlight Investments Limited - Treasure East Investments Limited - Sojitz Corporation

Shares in portfolio 2,427,640,000 242,764,000,000

Simulatenously with the listing of Shares from the Offering of 151,854,000 shares or 15% of the Company’s issued and paid-up capital after the Offering, the Company shall also list all shares that have been issued prior to the Offering of 860,506,000 shares or 85% of the Company’s issued and paid-up capital after the Offering. As such, the total number of the Company’s shares in IDX is 1,012,360,000 shares or 100% of the issued and paid-up capital after the Offering.

The Company does not plan to issue or list other shares and/or other securities that can be converted into shares within twelve months from the Effective date of this Offering. Should the Company decide to do so in the future, the Company shall follow the provisions of the prevailing regulations.

Employee Stock Allocation (ESA)

The ESA program shall be implemented in accordance with Bapepam Regulation No. IX.A.7, Attachment to Decree of the Chairman of Bapepam No. KEP-45/PM/2000 dated October 27, 2000, on Responsibilities of Allotment Manager in Subscription and Allotment of Securities in a Public Offering, which allows up to 10% of the Shares offered to the public to be owned by employees. The Company has decided to implement the ESA program to all of the Company’s employees, which shall be administered in the Offering through special orders with the following conditions:

1. The number of shares allocated is up to 15,185,500 shares;

2. Payment for shares ordered by employees shall be made in cash.

Shares offered in the ESA program shall originate from the fixed allocation portion. Should the order under the ESA program is less than 15,185,500 shares, the remaining shares shall be offered to the public.

Description Par value Rp100 per share

No. of shares Par value (Rp) Percentage

Authorized capital 3,440,000,000 344,000,000,000

Issued and paid-up capital:

Bonlight Investments Limited 344,202,400 34,420,240,000 40 Treasure East Investments Limited 344,202,400 34,420,240,000 40

Sojitz Corporation 86,050,600 8,605,060,000 10

II. USE OF PROCEEDS

The proceeds of the Offering, less expenses connected with the Offering, will be used based on the following priorities:

1. Approximately 75% for development of new factories.

The Company expands its business by opening new factories to increase capacity and penetrate other regions in Indonesia. The new factories to be opened are located in Semarang and Medan. If the funds required to develop these factories are not met by the proceeds of the Offering, the Company will use bank financing to complete the expansion.

2. Approximately 25% for repayment of bank loans.

Lender: PT Bank Central Asia Tbk

Outstanding: Rp65,000,000,000

Interest rate: 1% below prime rate

Maturity date: July 21, 2014

Note: Terms and conditions of the loan can be seen in Chapter III on Indebtedness

In accordance with Bapepam-LK’s Circular No. SE-05/BL/2006 dated September 29, 2006, on Disclosure of Expenses in a Public Offering, the total expenses incurred by the Company in the Offering is approximately 3% of the total proceeds of the Offering, consisting of:

- Underwriting fee: 0.75%

- Management fee: 0.75%

- Selling fee: 0.50%

- Capital market supporting entities and professionalsL 0.48% consisting of

• Legal counsel: 0.10%

• Auditor: 0.28%

• Appraiser: 0.05%

• Registrar: 0.02%

• Notary: 0.03%

- Others: 0.52% .

According to Bapepam’s Regulation No. X.K.4, Attachment to the Decree of the Chairman of Bapepam No. Kep-27/PM/2003 dated July 17, 2003, on Report of the Realization of the Use of Proceeds from a Public Offering, the Company shall periodically report the realization of the use of proceeds from the Offering to Bapepam-LK and shall account for the same to the Company’s shareholders in a general meeting of shareholders.

Should at any time in the future the Company intend to amend its plan for the use of proceeds from the Offering, the Company shall first report such intention to Bapepam-LK by stating the grounds and considerations for such amendment and shall obtain prior approval for the amendment of the use of proceeds from the Company’s shareholders in a general meeting of shareholders.

III. INDEBTEDNESS

Based on the Company’s financial statements for the year ending December 31, 2009, which has been audited by the Public Accounting Firm Purwantono, Suherman & Surja (previously Purwantono, Sarwoko & Sandjaja), a member of Ernst & Young Global Limited, with an unqualified opinion, the Company has a total indebtedness of Rp179,138 million with the following details:

(in millions of Rupiah)

Description Balance as of December 31, 2009

CURRENT LIABILITIES

Trade payables – third parties 37,635

Other payables 13,108

Taxes payable 12,162

Accrued expenses 7,543

Current maturities of long-term loans 25,000

Total current liabilities 95,448

NON-CURRENT LIABILITIES

Customers’ deposits 4,420

Long-term bank loans – net of current maturities 68,750

Deferred tax liability – net 6,590

Estimated liability for employee benefits 3,929

Total non-current liabilities 83,690

TOTAL LIABILITIES 179,138

1. Trade payables – third parties

Trade payables to third parties arising from purchases of raw materials and packaging materials amounted to Rp37,635 million as of December 31, 2009.

2. Other payables

Other payables arising from transportation and distribution services, construction of a new plant and purchases of machinery and equipment amounted to Rp13,108 million as of December 31, 2009.

3. Taxes payable

Taxes payable as of December 31, 2009, amounted to Rp12,162 million, with the following details:

(in millions of Rupiah)

Description Balance as of December 31, 2009

Income taxes:

Article 21 233

Article 23 156

Article 25 962

Article 26 67

Article 29 10,744

Total 12,162

4. Accrued expenses

Accrued expenses as of December 31, 2009, amounted to Rp7,543 million, with the following details:

(in millions of Rupiah)

Description Balance as of December 31, 2009

Promotion expenses 2,502

Transportation and distribution 1,884

Royalty fees 1,591

5. Customers’ deposits

Customers’ deposits amounted to Rp4,420 million as of December 31, 2009.

6. Bank loans

The following are details of the bank loans:

(in millions of Rupiah)

Description Balance as of December 31, 2009

PT Bank Central Asia Tbk 68,750

PT Bank Resona Perdania 25,000

Total 93,750

Less: current maturities 25,000

Long-term portion 68,750

PT Bank Central Asia Tbk (”BCA”)

Based on notarial deed No. 40 dated July 21, 2008, of Veronica Sandra Irawaty Purnadi, SH, BCA agreed to grant investment credit facility to finance the Company’s expansion in Cikarang. The facilility has a maximum amount of Rp75,000 million, a certain portion of which has been used to issue Letter of Credit. The loan was available for withdrawal until June 2009 and is payable in monthly installments from August 2009 through July 2014 and carried an interest rate ranging from 11.75% to 14% pa in 2009.

The loan is secured by land at Block U-33, Jababeka Industrial Estate, Cikarang, Bekasi, together with the manufacturing plant, machinery and equipment as well as production supporting facilities thereon with net book value amounting to Rp86,696 million as of December 31, 2009.

Under the terms of the loan agreement, the Company is required to obtain prior written approval from BCA with respect to, among others:

a. Obtaining new loan and/or acting as guarantor in whatever form and/or pledging the Company’s assets while the

Company is in violation of its financial covenants;

b. Lending money, including but not limited to its affiliated companies, other than in the normal course of business;

c. Entering into transactions with another party, including but not limited with its affiliated companies, on a

non-arms length basis;

d. Submitting application for bankruptcy or deferral of payments to the relevant authority (court of law);

e. Making investments in or opening new businesses other than the Company’s existing business activities;

f. Divesting the Company’s fixed assets or major assets that constitute more than 20% of the Company’s equity or

10% of the Company’s revenues, whichever is lower, unless in the normal course of business;

g. Conducting merger, consolidation, takeover or dissolution of the Company;

h. Amending the status of the Company and the articles of association on objectives of the Company and reduction

of capital.

The Company is also required to maintain the following financial ratios:

1. Debt to equity ratio of not more than 2x

2. EBITDA (earnings before interest, taxes, depreciation and amortization) to interest and monthly principal

repayment ratio of not less than 1.25x

3. Current ratio of not less than 1x.

PT Bank Resona Perdania (”BRP”)

On June 15, 2007, the Company obtained a loan amounting to Rp40,000 million from BRP to finance the Company’s expansion. This non-revolving loan is payable in quarterly installments of Rp2,500 million starting on September 18, 2008, through June 18, 2012, and is secured by a fiduciary transfer of ownership on certain machinery and equipment of the Company with net book value amounting to Rp23,840 million as of December 31, 2009. The loan carried an interest rate ranging from 8.81% to 12.43% in 2009.

Under the terms of the loan agreement, the Company is required to obtain prior written approval from BRP with respect to, among others:

a. Obtaining new loan and/or acting as guarantor in whatever form and/or pledging the Company’s assets;

b. Lending money, including but not limited to its affiliated companies, other than in the normal course of business;

c. Conducting consolidation, takeover, investment, dissolution or declaring bankruptcy in the Commercial Court;

d. Amending the status of the Company

e. Entering into transactions with another party, including but not limited with its affiliated companies or

shareholders, on a non-arms length basis.

As of December 31, 2009, the Company has met all the loan requirements. In relation to the Offering, the Company has obtained approval from BRP to amend the terms of loan by letter No. 29/CRD/II/2010 dated February 11, 2010. There are no negative covenants that put the public shareholders at a disadvantage.

7. Deferred tax liability – net

The following are details of the deferred tax liability of Rp6,590 million as of December 31, 2009:

(in millions of Rupiah)

Description Balance as of December 31, 2009

Deferred tax asset

Estimated liability for employee benefits (982)

Deferred tax liability

Fixed assets 7,573

Total 6,590

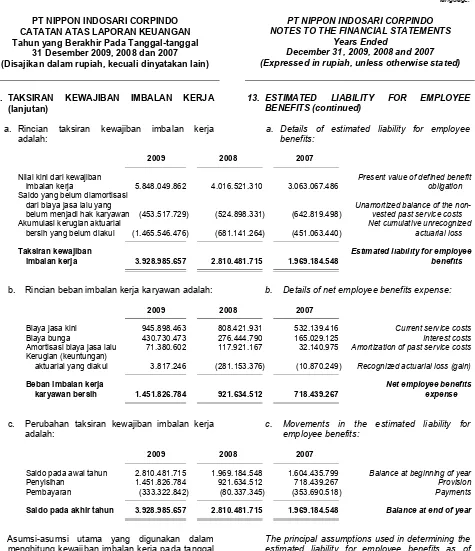

8. Estimated liability for employee benefits

The following are details of the deferred tax liability of Rp3,929 million as of December 31, 2009:

(in millions of Rupiah)

Description Balance as of December 31, 2009

Present value of defined benefit obligation 5,848

Unamortized balance of the non-vested past service costs (454)

Net cumulative unrecognized actuarial loss (1,466)

Total 3,929

The components of the net defined benefit costs recognized in the profit and loss statement and the amount of defined benefits in the balance sheet has been calculated by independent actuaries PT Bumi Dharma Aktuaria with projected-unit-credit method in its report dated January 12, 2010, based on the following principal assumptions:

Normal retirement age: 55 years

2009 discount rate: 10.5% pa

Salary increment rate: 8% pa

As of the date of this Prospectus, the Company has no overdue liabilities.

The Company’s management hereby states that as of December 31, 2009, the Company has no other liabilities and commitments other than what has been disclosed in this Prospectus and in the Company’s consolidated financial statements as attached to this Prospectus.

Between December 31, 2009, and the date of the independent auditor’s report and between the date of the independent auditor’s report and the effective date of the Registration Statement, the Company has no material new liabilities, other than trade payables and other liabilities arising out of the normal course of the business.

IV. MANAGEMENT DISCUSSION AND ANALYSIS

The following discussion and analysis of the Company’s financial condition and results of the operations should be read in conjunction with the Company’s audited financial statements and the notes thereto as set out in Chapter XVI of this Prospectus on Independent Auditor’s Report and the Company’s Financial Statements. The Company’s financial statements for the years ending December 31, 2009, 2008 and 2007, have been audited by the Public Accounting Firm Purwantono, Suherman & Surja (previously Purwantono, Sarwoko & Sandjaja), a member of Ernst & Young Global Limited, with unqualified opinions.

1. Overview

The Company was incorporated in 1995 and is currently headquartered in Jababeka Industrial Estate, Cikarang, Bekasi. It is a company engaged in the business of bread, cake and other food manufacturing. The Company carries out its business activities by establishing bread factory, producing, marketing and selling toast bread and other types of bread.

At its incorporation, the Company had two production lines, one for production of toast bread and one for production of sweet bread. In 2001, in line with the growth of sales, the Company doubled its production capacity by adding two production lines namely for toast bread and sweet bread.

In November 2005, the Company opened its second factory in Pasuruan, East Java, by installing two production lines. Production output of this factory is marketed in East Java, Central Java and Bali. In 2009, the Company added one production line of sweet bread in Pasuruan.

In December 2008, the Company opened its third factory with two production lines in Block U, Jababeka Industrial Estate, Cikarang, Bekasi, West Java, one for production of toast bread and one for production of sweet bread. In addition, the Company built an auditorium in Block U factory for consumer visit so they can directly view the Company’s production process that incorporates hygienic and halal (prepared in the manner prescribed by Islamic law) methods.

2. Financials

The following table shows the Company’s financial position based on the financial statements for the years ending December 31, 2009, 2008 and 2007, that have been audited by the Public Accounting Firm Purwantono, Suherman & Surja (previously Purwantono, Sarwoko & Sandjaja), a member of Ernst & Young Global Limited, with unqualified opinions.

Balance sheet

(in millions of Rupiah)

Description December 31

2009 2008 2007 Assets

Current assets 137,585 104,200 43,023

Non-current assets 209,393 204,413 126,445

Total assets 346,978 308,613 169,468

Liabilities and shareholders’ equity

Current liabilities 95,448 91,439 36,700

Non-current liabilities 83,690 86,449 44,454

Total liabilities 179,138 177,888 81,154

Total shareholders’ equity 167,840 130,725 88,313

Statements of income

The following chart shows the Company’s sales and profits over the years:

Sales and Profits

For the 12-month periods ending December 31, 2007, 2008 and 2009 (in millions of Rupiah)

Sales Gross Profit Operating Profit Net Income

2.1.1. Net sales

The following is the breakdown of the Company’s net sales based on products:

(in millions of Rupiah)

Description 12 months

2009 2008 2007

Sweet bread - Sari Roti 287,326 210,063 129,633

Toast bread - Sari Roti 230,932 193,725 133,097

Sweet bread - Boti 8,527 10,291 9,888

Toast bread - Boti 4,965 5,019 4,387

Sari Cake 2,614 2,726 -

Others 1,863 673 427

Gross sales 536,227 422,496 277,432

Sales returns (50,307) (38,943) (26,919)

Sales comparison for the years 2009 and 2008

The Company’s gross sales for 2009 was Rp536,227 million, of which 53.6% came from Sari Roti sweet bread and 43.1% came from Sari Roti toast bread.

Gross sales increased by 26.9% in 2009 from Rp422,496 million in 2008 due to the increase in sales volume as a result of the Company’s promotional activities.

Net sales for 2009 was Rp485,920 million, a 26.7% increase from Rp383,553 million in 2008. Sales returns for 2009 was Rp50,307 million or 9.4% from gross sales, similar to the 2008 level of 9.2% or Rp38,943 million. The Company has been able to maintain the balance between production volume and market demand such that the rate of product returns have been stable.

Sales comparison for the years 2008 and 2007

The Company’s gross sales for 2008 was Rp422,496 million, of which Sari Roti sweet bread contributed 49.7% or Rp210,063 million and Sari Roti toast bread contributed 45.9% or Rp193,725 million.

Gross sales for 2008 increased 52.3% from Rp277,432 million in 2007 as a result of the Company’s decision to increase selling price due to the increase of raw material prices.

The Company’s net sales for 2008 was Rp383,553 million, a 53.1% increase from Rp250,513 million in 2007. While the nominal amount of sales returns increased by 44.7% in 2008 to Rp38,493 million from Rp26,919 million in 2007, the ratio of sales returns to gross sales actually decreased from 9.7% in 2007 to 9.2% in 2008, resulting in a higher rate of growth in net sales compared to the rate of growth of gross sales.

2.1.2. Cost of goods sold

The following is the breakdown of the Company’s cost of goods sold:

(in millions of Rupiah)

Description 12 months

2009 2008 2007 Raw materials and packaging materials 201,686 176,632 110,517

Direct labor 11,162 9,090 6,688

Manufacturing overhead:

Depreciation 13,663 8,276 7,690

Utilities 11,190 8,157 6,366

Professional fees 8,247 6,453 4,603

Repairs and maintenance 7,124 4,804 4,815

Royalty fees 6,317 4,986 3,257

Others 4,483 4,113 1,841

Total manufacturing overhead 51,024 36,788 28,572

Total manufacturing costs 263,872 222,510 145,776

Finished goods inventory:

Balance, beginning of year 444 294 177

Balance, end of year (494) (444) (294)

Cost of goods sold 263,821 222,360 145,660

Cost of goods sold comparison for the years 2009 and 2008

The biggest contributor to cost of goods sold are raw materials and packaging materials, which constituted 76.4% of cost of goods sold or Rp201,686 million. This represented an increase of 14.2% from Rp 176,632 million in 2008.

Cost of goods sold comparison for the years 2008 and 2007

Cost of goods sold for 2008 was Rp222,360 million with raw materials and packaging materials representing the largest contributor of 79.4% or Rp176,632 million.

Total cost of goods sold experienced a significant increase in 2008 by 56.2% from Rp145,660 million in 2007 as a result of raw materials and packaging materials cost increase from Rp110,517 million to Rp176,632 million or by 59.8% due to the limited supply of raw materials in 2008. In addition, direct labor also increased quite significantly by 35.9% from Rp6,688 million in 2007 to Rp9,090 million in 2008 due to the significant increase of the regional minimum wage in 2008 in accordance with the inflation rate.

2.1.3. Gross profit

Gross profit comparison for the years 2009 and 2008

Gross profit for 2009 was Rp222,099 million, a 37.8% increase from Rp161,193 million in 2008. This came as a result of a 26.7% growth in net sales, which is higher than the increase in cost of goods sold of 18.6%, improving gross margin from 42.0% in 2008 to 45.7% in 2009.

Gross profit comparison for the years 2008 and 2007

Gross profit for 2008 was Rp161,193 million, a 53.7% increase from Rp104,853 million in 2007. This came as a result of a 53.1% growth in net sales, which is higher than the increase of cost of goods sold of 52.6%, improving gross margin slightly from 41.9% in 2007 to 42.0% in 2008.

2.1.4. Operating expenses and operating profit

The following is the breakdown of the Company’s operating expenses:

(in millions of Rupiah)

Description 12 months

2009 2008 2007

Selling expenses 113,068 83,360 62,190

General and administrative expenses 20,735 16,166 12,703

Total operating expenses 133,803 99,526 74,894

Operating profit 88,295 61,667 29,959

Operating expenses and operating profit comparison for the years 2009 and 2008

Operating expenses for 2009 was Rp133,803 million, of which the biggest contributor was selling expenses of Rp113,068 million or 84.5% of total operating expenses.

In 2009 operating expenses increased by 34.4% from Rp99,526 million in 2008, as a result of the increase in advertising and promotion expenses by 57.8% from Rp24,933 million in 2008 to Rp39,337 million in 2009. General and administrative expenses increased by 28.3% from Rp16,166 million in 2008 to Rp20,735 million in 2009, driven by the increase of salaries and benefits by 35.7% from Rp8,581 million in 2008 to Rp11,645 million in 2009.

Operating expenses and operating profit comparison for the years 2008 and 2007

Operating expenses for 2008 was Rp99,526 million, of which the biggest contributor was selling expenses of Rp83,360 million or 83.8% from total operating expenses.

In 2008 operating expenses increased by 32.9% from Rp74,894 million in 2007, as a result of the increase in selling expenses, particularly from expired products inventory expenses by 56.5% from Rp13,615 million in 2007 to Rp21,304 million in 2008 due to raw material price increase that affected the cost of goods sold for expired products. The increase of selling expenses was also driven by the increase of advertising and promotion expenses by 37.9% from Rp18,074 million in 2007 to Rp24,933 million in 2008.

Operating profit for 2008 was Rp61,667 million, a 105.8% increase from Rp29,959 million in 2007 due to the significant sales growth that was higher than the increase in expenses. Operating margin was 16.1% in 2008, an improvement from 12.0% in 2007.

2.1.5. Net profit

Net profit comparison for the years 2009 and 2008

Net profit for 2009 was Rp57,115 million, a 34.7% increase from Rp42,412 million in 2008. Net margin in 2009 was 11.8%, an improvement from 11.1% in 2008.

Other expenses increased by 528.3% in 2009 from Rp1,242 million in 2008 to Rp7,804 million, due to the significant increase of interest expense by 134.5% from Rp5,268 million in 2008 to Rp12,356 million in 2009, even though the Company had an increase in sales from expired products by 38.6% to Rp5,517 million from Rp3,981 million, which came as a result of the increase in sales returns.

The increase in net profit was attributable to the sales growth that is not accompanied by the same rate of growth in expenses, therefore net margin also improved.

Net profit comparison for the years 2008 and 2007

Net profit for 2008 was Rp42,412 million, a 138.6% from Rp17,778 million in 2007. Net margin improved to 11.1% in 2008 from 7.1% in 2007.

Other expenses decreased by 67.0% from Rp3,760 million in 2007 to Rp1,242 million in 2008, as a result of the increase in sales of expired products by 38.5% from Rp2,875 million in 2007 to Rp3,981 million in 2008 due to the increase in the volume of expired products. In addition, interest expense declined by 21.9% from Rp6,741 million in 2007 to Rp5,268 million in 2008.

2.2. Assets, liabilities and equity

The following chart shows the Company’s assets, liabilities and equity over the years:

Assets, Liabilities and Equity As of December 31, 2007, 2008 and 2009

(in millions of Rupiah)

169,468

308,613

346,978

81,154

177,888 179,138

88,313

130,725

167,840

2007 2008 2009

Assets Liabilities Equity

2.2.1. Assets

The following are the details of the Company’s assets:

(in millions of Rupiah)

Description December 31

2009 2008 2007

Current assets :

Cash and cash equivalents 57,945 52,878 8,249

Trade receivables – third parties 53,135 42,717 28,222

Inventories 9,075 7,280 5,225

Restricted time deposits 13,018 - -

Prepaid expenses and other current assets 4,412 1,326 1,327

Total current assets 137,585 104,200 43,023

Non-current assets:

Fixed assets – net of accumulated depreciation 204,681 201,431 123,499

Guarantee deposits 4,346 2,600 2,148

Claims for tax refund 43 43 689

Other non-current assets 323 339 109

Total non-current assets 209,393 204,413 126,445

Total assets 346,978 308,613 169,468

Assets comparison as of December 31, 2009, and December 31, 2008

Total assets as of December 31, 2009, was Rp346,978 million, a 12.4% increase from Rp308,613 million as of December 31, 2008, which came as a result of the increase of trade receivables due to the higher sales. In addition, the Company opened a restricted time deposit for the purpose of letter of credit opening in 2009.

Assets comparison as of December 31, 2008, and December 31, 2007

Total assets as of December 31, 2008, was Rp308,613 million, an 82.1% increase from Rp169,468 million as of December 31, 2007, which came as a result of a significant increase in cash and cash equivalents as well as increases in trade receivables and fixed assets. The increase of cash and cash equivalents was due to a new long-term loan and the increase of cash receipts from buyers as the Company’s sales increased. The Company made capital expenditure in 2008 for the construction of Block U factory in Jababeka Industrial Estate, Cikarang, and the purchase of the machinery and equipment for the factory.

2.2.2. Liabilities

The following are the details of the Company’s liabilities:

(in millions of Rupiah)

Description December 31

2009 2008 2007 Current liabilities:

Trade payables – third parties 37,635 24,975 17,757

Other payables 13,108 34,423 3,676

Taxes payable 12,162 11,857 4,599

Accrued expenses 7,543 5,597 5,499

Current maturities of long-term loans:

Bank loans 25,000 14,588 5,000

Other loans - - 169

Total current liabilities 95,448 91,439 36,700

Non-current liabilities:

Customers’ deposits 4,420 2,979 2,436

Long-term bank loans – net of current maturities 68,750 75,465 35,000

Deferred tax liability – net 6,590 5,195 5,049

Estimated liability for employee benefits 3,929 2,810 1,969

Total non-current liabilities 83,690 86,449 44,454

Total liabilities 179,138 177,888 81,154

Liabilities comparison as of December 31, 2009, and December 31, 2008

Total liabilities as of December 31, 2009, were Rp179,138 million, a slight increase of 0.7% from Rp177,888 million as of December 31, 2008. Even though trade payables increased quite significantly in 2009 by 50.7% from Rp24,975 million in 2008 to Rp37,635 million in 2009 as a result of the higher operational activities, other payables decreased significantly by 61.9% from Rp34,423 million to Rp13,108 million due to the payables relating to the Block U factory construction and equipment purchase in 2008 that were recorded as other payables.

Liabilities comparison as of December 31, 2008, and December 31, 2007

2.2.3. Equity

The following are the details of the Company’s equity account:

(in millions of Rupiah)

Description December 31

2009 2008 2007

Issued and paid-up capital 86,051 86,051 17,349

Additional paid-in capital 350 350 30,123

Advances for future stock subscription - - 38,928

Retained earnings 81,440 44,325 1,913

Total equity 167,840 130,725 88,313

Equity comparison as of December 31, 2009, and December 31, 2008

Total equity as of December 31, 2009, was Rp167,840 million, a 28.4% increase from Rp130,725 million, which came as a result of an 83.7% increase of retained earnings from Rp44,325 million in 2008 to Rp81,440 million in 2009.

Equity comparison as of December 31, 2008, and December 31, 2007

Total equity as of December 31, 2008, was Rp130,725 million, a 48.0% increase from Rp88,313 million, which came as a result of a significant increase in retained earnings by 2,217.0% due to the additional capital from conversion of convertible bond and advances for future stock subscription and additional up capital that increased total paid-up capital of the Company to Rp86,051 million.

2.3. Solvency and profitability

2.3.1. Solvency

Solvency is the ability to meet all obligations using all assets or equity. Solvency is measured by comparing total liabilities to total equity (equity solvency ratio) and total liabilities to total assets (asset solvency ratio). The Company’s equity solvency ratios as of December 31, 2009, 2008 and 2007 were 1.07x, 1.36x and 0.92x, respectively, while asset solvency ratios as of December 31, 2009, 2008 and 2007 were 0.52x, 0.58x and 0.48x, respectively.

2.3.2. Profitability

Profitability is measured, amongst others, by net margin, return on average assets and return on average equity. These ratios show the Company’s ability to generate profit during a certain period of time:

- Net margin is the ratio of net profit to revenues

- Return on average assets is the ratio of asset turnover in generating profit

- Return on average equity is the ratio of net profit to average equity.

Description 12 months

2009 2008 2007

Net margin 11.8% 11.1% 7.1%

Return on average assets 17.4% 17.7% 11.0%

2.4. Liquidity

The Company’s liquidity is reflected in cash flows as detailed in the following table:

(in millions of Rupiah)

Description 12 months

2009 2008 2007 Net cash provided by operating activities 56,084 83,854 20,416 Net cash used in investing activities (32,782) (88,694) (13,190) Net cash provided by (used in) financing activities (16,302) 49,883 (8,292) Net increase (decrease) in cash and cash equivalents 5,068 44,629 (1,050) Cash and cash equivalents at beginning of year 52,878 8,249 9,299 Cash and cash equivalents at end of year 57,945 52,878 8,249

3. Risk management

In facing the risks described in Chapter V – Business Risks, the Company applies the following risk management policies:

- The Company continues to find suppliers for all types of raw materials. The Research and Development division

conducts quality tests with the objective of having an alternative supply should there be a delivery disruption from the main suppliers while ensuring that the product quality is maintained.

- The Company anticipates risk of competition by continuously increasing brand awareness for the Company’s

products so that they continue to be demanded by the consumer. In addition, the Company continues to upgrade the quality of its products and create new products that meet the consumer taste.

- To reduce the risk of foreign exchange fluctuations relating to the purchase of machinery, the Company sets

aside reserves in the currency needed for this purpose.

- Should there be a shortage in energy supply, the Company uses a modified oven with burner that can use

liquified petroleum gas (LPG). In addition, the Company has power generator facilities for temporary electricty outages.

- The Company recognizes that labor is a key component to the Company’s success, therefore the Company

continues to attend to its employees’ needs. The Company has met all relevant Government labor regulations and provides sufficient facilities to its employees to minimize the risk of labor strikes.

- The Company’s Research and Development division continues to find alternative equipment from other suppliers

to minimize dependency to the current machinery supplier.

- The Company conducts quality control in each step of its production process to minimize contamination risks.

The quality contol process is described in Chapter VIII on Business and Prospect.

- To address issues relating to the Company’s products, the Company provides explanations to the public through

V. BUSINESS RISKS

Investment in the Shares contain significant risks. Prior to investing in the Shares, prospective investors should be aware the the Company, and therefore its business activities, are subject to the laws, regulations and investment climate in Indonesia. The Company’s business is affected by a number of factors, some of them are outside the control of the Company. Prior to making investment decision, prospective investors shall review the following risks and shall make its own investment analysis. Other risks that are currently unknown to the Company or that are considered immaterial by the Company may have an impact on the Company’s business activities. The following risks have been presented in accordance with its potential impacts on the Company’s performance based on the Company’s judgment. The Company has disclosed all material risks relating to its business.

Risks relating to operational activities

(i) Product contamination in pre-production, during production and at distribution

The Company faces the risks of product contamination from the raw material stage, during production process and at distribution to the outlets and end consumer. Product contamination will result in the loss of consumer trust in the Company and in turn in the decline of the Company’s sales.

(ii) Short shelf life of the products

As the Company’s products are products with limited shelf life, delay in the collection of expired products will result in the display in the shelves of products that are stale and not consumable, that will result in loss of consumer trust in the Company and in turn in the decline of the Company’s sales.

(iii) Availability of wheat as raw material of flour

The Company uses flour which is processed from wheat that is imported and purchased based on international market price. As an agricultural product, wheat is produced seasonally and may not always be available. In addition, should there be a fluctuation in world demand, wheat availability may be limited. If there is a shortage that results in the Company’s suppliers not being able to produce flour, the Company would not be able to conduct its operational activities.

Shortage of wheat in the international market will also result in the increase of flour price that may not be able to be passed on to the Company’s selling price due to the sensitivity of demand for the products to price. Therefore a significant increase in wheat price would result in the increase of the Company’s raw material cost and in turn the decline in the Company’s profitability.

(iv) Availability of energy supply

One of the essential raw materials for the Company’s production is energy. Currently the Company utilizes liquefied natural gas and electricity as source of energy, which are supplied by the industrial estates where the Company’s factories are located. Shortage of energy supply will result in disruption in the Company’s production and in lower production output, which in turn will impact the Company’s sales.

(v) Risk of labor strikes