Judgement-Proof Injurers, and

Asymmetric Information

ROBERTINNES

University of Arizona, Tucson, Arizona, USA E-mail: [email protected]

This paper studies the use ofex postliability to regulate unilateral accidents when injurers have (1) different probability distributions for accident damages and, as a result, different optimal levels of accident prevention effort, (2) private information about their damage distributions, and (3) liability that is limited to the injurer’s available assets. When the asset bound on liability is in a plausible range, an optimal damage-contingent legal rule is shown to take a threshold form, assessing maximal liability whenex postdamages are above a given threshold and zero liability otherwise. © 1999 by Elsevier Science Inc.

I. Introduction

In many cases, parties who potentially cause injuries have better information than others about the risks and consequences of accidents that they may cause. Often, they also have financial resources that are insufficient to cover victims’ damages from particularly harmful accidents. Examples include medical product failures (e.g., , Tha-lidamide and the Dalcon Shield), industrial disasters (e.g., chemical releases such as the one that occurred at the Union Carbide plant in Bhopal, India), and hazardous substance releases of the sort covered by the U.S. Comprehensive Environmental Response, Compensation and Liability Act (CERCLA) (e.g., leakages from under-ground petroleum storage tanks or mine tailing ponds). In practice, such problems are regulated by bothex antesafety standards [e.g., citing and technology standards for the production and disposal of toxic wastes, as specified in the U.S. Resource Conservation and Recovery Act (1982)] and ex-post liability [e.g., as assessed under tort law and CERCLA (1980, 1986, 1990)].

I want to thank an anonymous reviewer and Rohan Pitchford for inspired comments on this paper. I am also indebted to Dennis Cory, Edna Loehman, John Antle, and seminar participants at Brigham Young University, the University of Arizona, and American Association of Agricultural Economics meetings in San Diego for valuable encouragement and comments on earlier versions. The usual disclaimer applies.

International Review of Law and Economics 19:181–203, 1999

This paper studies these types of accident situations. In the analysis, injurers/firms reduce accident risks by taking “care” and have different optimal levels of care because they have different accident damage distributions. The injurers have private informa-tion about their damage distribuinforma-tions and liability that is limited to their available assets. Because firms’ assets are sometimes exceeded by accident damages, the government cannot implement a liability rule under which injurers pay exactly the damages that they cause and which thereby elicits the care choices that most efficiently mitigate accident risks.1 Moreover, asymmetric information rules out heterogeneous govern-ment standards on care that would be required to prompt efficient behavior by the different firms.

In an important paper, Shavell (1984) argued that asymmetric information and limited liability may together motivate joint use of liability regulation and government “safety” standards on permissable levels of care. In doing so, he fixes the liability rule in a model with nonstochastic damages. The present paper, in contrast, positsstochastic

damages, whether because of imperfections in the damage assessment process, inherent randomness in damage creation, or both. Moreover, the liability rule is endogenized to address the following key question: Given that asymmetric information and limited liability rule out simple resolutions to the problem of optimal accident regulation, what is the most efficient design— or form— of a liability rule?

Despite a rich literature on liability rules in tort law, these design questions have not yet been studied.2Recent work, for example, has focused on the problem of providing appropriate incentives for a plaintiff (victim) suit when there is both a costly court process and a desire to achieve agiven level of injurer precautionincentive. Suchplaintiff

incentive considerations lead to optimal award levels [Polinsky and Rubinfeld (1988)], optimal decoupling of plaintiff and defendant liability [Polinsky and Che (1991)], and optimal penalties to losing plaintiffs [Polinsky and Rubinfeld (1996)]. Other work has been concerned with injurer precaution incentives, but not with their implications for the design of liability rules [e.g., Png (1987)]. An interesting paper by Spier (1994) studies how to design a liability rule that balances the benefits of efficient precaution and the benefits of cost-saving settlements, but it does not consider the problem of heterogeneous injurers.3In sum, despite recent strides in the analysis of legal games, there remains the unanswered question posed for this paper: How, in view of liability limits, can liability be tied to stochastic damage realizations in a way that confronts

different injurerswithoptimalprecautionary incentives?

An injurer’s liability may depend on realized (measured) damages and, in principle, his care level. Because care choices are often complex combinations of precautionary measures that are difficult to observe and measure ex post [e.g., see Rose-Ackerman (1991) and Viscusi (1989)], this paper focuses on non-care-contingent liability rules that can take any functional form consistent with limited liability.4

1The implications of limited liability for accident regulation are studied in a number of illuminating papers,

including Summers (1983), Shavell (1986), Schwartz (1985), Beard (1990), and Boyd and Ingberman (1992). However, to my knowledge, only Shavell (1984) analyzes accident regulation under both limited liability and asym-metric information.

2This literature dates back to the classic papers by Brown (1973), Diamond (1974), and Green (1976), among

others. Thorough surveys of the field can be found in Shavell (1987) and Landes and Posner (1987).

3The papers cited here are only a few of the many excellent studies on settlement and trial games, the few that are

most closely related to the arguments made in this paper.

4In an expanded version of this paper (available from the author on request), optimal care-contingent liability rules

Under conditions that often hold for the industrial and environmental accidents that are of interest here, this setting gives rise to the following optimal liability rule: If damages are above a given threshold, injurers are assessed maximal liability; otherwise, when damages are below the threshold, injurers have zero liability. For example, suppose that firms each have assets of $100,000 and that the threshold is $40,000. Then, if damages are below $40,000, a firm will pay nothing; and if damages are $40,000 or more, a firm will pay $100,000.5,6

The presence of stochastic damages is crucial to the optimality of thisdamage threshold liabilityrule. For example, consider a world with nonstochastic damages, in which the accidents of different firms cause different levels of harm, but the harm caused by each firm is deterministic once an accident has occurred. In this case, it will be optimal to fine firms for the actual damage they have caused. Low-damage firms will be able to pay their fines, and high-damage firms—those with damages above their assets—will only be able to pay their assets. This strict liability rule is efficient because it induces the lower damage firms to exert the optimal amount of care, and it prompts the higher damage firms to take as much care as they can be induced to take, even though it is too little. Moreover, the damage threshold rule described above will elicit too little care by firms with damages below the liability threshold (e.g., $40,000) because these firms pay nothing for their accidents; in contrast, firms with damages between the threshold (e.g., $40,000) and the asset limit (e.g., $100,000) will be prompted to exert excessive care. With stochastic damages, these arguments no longer hold. For instance, suppose that the harm from a firm’s accident is continuously distributed in the interval from $1 to $150,000 according to a positive density, with the distribution of harm being “higher” for some firms (high-damage) than for others (low-damage). In this situation, strict liability always prompts too little care by sometimes assessing too little liability (when damages are above the $100,000 asset limit) and never assessing too much. A damage threshold liability (DTL) rule helps to cure the problem of too little care by sometimes imposing liability that is higher than harm. For some firms, however, the above-harm liability—if unmatched by a relaxation of liability for other levels of harm—will prompt excessive levels of care. The DTL rule mitigates this problem by requiring no payment for harms below the threshold. Although low-damage firms gain most from the zero-liability portion of the DTL rule (because they are more likely to cause damages below the threshold), they also pay their assets when the realized harm is above the threshold; indeed, because they are more likely to have harms between the threshold (e.g., $40,000) and the asset level (e.g., $100,000)—whereas high-damage firms are more likely to have harms above the asset level, when accidents are necessarily underpenal-ized—low-damage firms are often more subject to the overdeterrence problem created by the above-harm liability than are high-damage firms. In sum, although a DTL rule will clearly underpenalize low-damage firms when damages are deterministic, it often

resembles a rule ofcomparative negligence, wherein a firm’s proportionate liability declines with its care level. These results build upon the important insights of Rubinfeld (1987).

5This liability rule has a simple negligence interpretation. When liability does not depend explicitly onex antecare

levels, negligence may be thought to have occurred when damage realizations are sufficiently high; in this event, a court or government may conclude that the prospective damages from an accident were sufficiently large that the injurer was negligent in allowing the accident to have occurred. Such negligence calls for the assessment of liability, while the absence of negligence exempts a firm from liability.

6In a model with legal error and costs of court care, Rasmusen (1995) shows that optimal liability may sometimes

overpenalizes these firms when damages are stochastic. It is precisely when this occurs— when the damage threshold rule tends to overpenalize low-damage firms and under-penalize high-damage firms—that this rule will be optimal.

In general terms, a DTL rule is distinguished from other liability functions by the property that it maximizes liability when damages are high and minimizes liability when damages are low. Among liability rules that deliver a common level of precautionary incentive to some low-damage firm, DTL penalizes higher damage firms—those firms that have higher probabilities of creating high damages—as much as possible. More-over, limited liability often precludes the assessment of sufficient accident penalties on the high-damage injurers—those that have higher probabilities of creating accident damages above the asset bound. In such cases, care-exertion incentives can be enhanced by the use of a DTL rule that, although providing a requisite precaution incentive to low-damage firms, gets the high-damage injurers expected liability as high as possible and, hence, as close as possible to their expected damages.

In practice, there are many examples of liability rules akin to that characterized in this paper. For instance, in the United States, both federal and state environmental laws require firms to report their own violations, providing liability protections when they do and imposing nonreporting penalties when they do not. In general, however, the liability protections areonlyavailable when the violations do not involve serious harm to public health or to the environment; in essence, the self-reporting laws exempt “small damage” violations from liability and do not exempt “large damage” violations.7 Simi-larly, CERCLA distinguishes between “major” and “minor” accidents when it assesses liability for hazardous substance releases. Major accidents are subject to more onerous damage assessments that include lost passive use values; minor accidents are exempted from both exhaustive damage assessments and from liability for passive-use damages that often represent the bulk of environmental harm.8 In regulating agricultural pol-lution, Arizona laws also distinguish between “egregious violations” that are subject to asset-liquidating penalties and nonegregious violations that are exempted from the penalties, with an “egregious violation” judged by the extent of harm that it causes [Cory (1997)]. In all of these cases, liability assessments exhibit the central qualitative attribute of this paper’s damage threshold rule, subjecting violators with damages above a threshold to large liability, while treating violators with damages below the threshold to much lower, and often negligible, penalties.

The balance of the paper is organized as follows. Section II develops the model framework and is followed by derivations of the paper’s main results in Section III. Section IV discusses a variety of extensions and implications of the analysis, including the scope forex antesafety standards to improve on liability regulation alone.

II. The Model

Consider a set of risk-neutral firms/agents that engage in activities that can lead to damaging accidents. Firms are distinguished by their type, t, with higher t levels associated with higher accident damages in a sense made precise below. In the

popu-7For example, see von Oppenfeld (1996) for discussion of Federal law, and Anderson (1996) and ADEQ (1996) for

relevant discussions of State law.

8In the Exxon-Valdez case, for example, economists estimated lost active use values to be approximately $4 million

lation of firms,thas the relative frequency (density)q(t), which has positive support on [t,#t]. Firms have private information about their type.

A typetfirm either engages in the accident-related activity or does not operate. If a firm operates, it can exercise care that reduces the probability that an accident will occur. The level of care will be denoted by x, which has the nonempty and compact feasible set,X5[0,x#]. The probability that a typetfirm has an accident isp(x,t), where

px( ) ,0 andpxx( ). 0 (care reduces accident risk at a decreasing rate). Excluding

accident-related costs, a type t firm obtains a net expected benefit of p(x,t), where

px( ),0 andpxx( )¶0 for allx.0 (care is increasingly costly).9

p( ) andp( ) are both twice continuously differentiable, with an arbitrary dependence on the firm type parametert.10

When an accident occurs, damages to other parties ared, wheredis the realization of a random variable that has the positive and twice continuously differentiable density functionh(d;t) on the support [d,d#]. Higherttypes have “higher” damage distribu-tions in the sense of the monotone likelihood ratio property (MLRP) [see Milgrom (1981)]11:

]

]d

S

ht~d;t!h~d;t!

D

.0 ; ~d,t!. (1)Condition (1) implies that expected damages,E(d;t), are increasing int.

When an accident occurs, the courts will assign liability to the injurer that is assumed to depend only upon ex-post damages,l(d). A typetfirm’s expected accident liability thus equals p(x, t) E(l(d); t), whereE( ) is the expectation operator over damages. Given the liability rulel(d), each firm chooses its care level to maximize its net benefits:

max

x[X

$p~x,t!2p~x,t!E~l~d!; t!% (2)

The solution to (2) will be denoted byx(l,t). For simplicity, it will be assumed that

x(l,t) is in the interior ofX, the feasible care-choice set, for all firm types and all feasible nonzero liability functions l(d).12 A firm will operate if and only if its net expected benefit from operation—the maximal net profit in equation (2)—is non-negative.

Under “pure” strict liability,l(d) equalsdand, hence, each firm will pay the trueex postdamages; optimal (first-best) care choices and operation decisions will thus ensue. The main purpose of this analysis is to study implications of limited firm liability for the

9Any victim precaution measures are assumed to be fixed at their optimal levels to focus attention on injurer

incentives for accident prevention. For the same reason, I abstract from multimarket effects and potential efficiency costs of imperfect competition [e.g., see Sunding and Zilberman (1996)].

10When turning to entry and entry-deterrence effects of optimal liability in the third part of Section IV below, I will

consider possible restrictions on the nature of the dependence ofp( ) andp( ) ont.

11The MLRP condition (1) holds for a wide class of distributional specifications and is a somewhat stronger

condition than first-order stochastic dominance (FOSD) of highert(versus lowert) damage distributions [Milgrom (1981)]. The MLRP is closely related to FOSD in the following sense: The MLRP holds if and only if FOSD holds for any possible conditional distribution ford[see Whitt (1980)]. The MLRP also implies that the outcome variabledcan serve as a signal of firm type in that higher realizations ofdimply a higher damage type [Milgrom (1981)].

12A nonzero liability function assesses strictly positive liability on a nondegenerate interval of the damage support,

structure and effects of an optimal legal rule in the presence of asymmetric information. Therefore, it is assumed that strict liability cannot always be assessed because ex post

damages sometimes exceed the firm assets that are available for damage payment:

y5level of firm assets,d#. (3)

Although (3) defines a nonstochastic asset level,y can be interpreted as the mean level ofex postassets. With this interpretation, the following analysis constrains assets to be stochastically independent of damages. In a related vein, it is assumed that y is invariant to the firm’s typet. This assumption is made to focus the analysis on a legal rule that depends only on the damage assessmentdand not on firm assets,y, except to the extent thatylimits the firm’s liability.13,14If the firm’s monetary profits are included in its assets, this specification requires that net firm benefitsp(x,t) equal the difference between an exogenous profit/asset measure and a nonmonetary effort costc(x,t).15

Given the asset levely, limited liability constrains the legal rule to satisfy:l(d)¶y@ d. Hence, by the assumed inequality in (3), pure strict liability is infeasible. It is also assumed that l(d) must be everywhere non-negative (so that injurers cannot be re-warded for accidents) and piecewise continuous (to ensure existence of the expecta-tion,E(l(d);t)).16The feasible set for

l(d) is thus defined asL5{1:0¶1(d)¶yand

l( ) is piecewise continuous over the domain, [d,d#]}. III. The Optimal Legal Rule

An optimal legal rule elicits care choices and operation decisions that maximize the sum total difference between firms’ expected profits and the expected costs of accidents:

max 1

E

T~l!@p~x~l,t!,t!2p~x~l,t!,t!E~d;t!#q~t!dt s.t. 1[L~lis feasible! (4)

wherex(l,t) is thet-firm care choice underl(d), as described in (2), and

T~l!5$t[@t,t##:p~x~l,t!,t!2p~x~l,t!,t!E~l;t!>0%5set of operating firms. Under circumstances that are often likely to hold, this section will show that a solution to problem (4) must take the following DTL form:

13Beard (1990) analyzes an interesting model in which a firm’sex antecare costs are deducted from a firm’s “no-care

assets” to obtain theex postassets available for damage payment. In the context of the present model, such a specification would yieldt-specific assets (or asset distributions) unless firms have common care levels. To avoid conditioning liability on assets as a mechanism to condition liability on the firm’st-type, this paper abstracts from the issues addressed in Beard (1990).

14For a variety of reasons, there may be liability limits other than asset bounds. For example, a tighter (lower)

liability limit may be motivated by firm costs of financial distress or a prohibition on confiscatory judgements (which may limit liability to a multiple of damages). For simplicity, I appeal to the simplest possible upper liability bound here, although the paper’s qualitative results are robust to other bounds.

15Alternately, this specification can be motivated by an ability of firms to pay out profit flows to their owners (as

dividends, for example), leaving the asset level to be driven by operation requirements rather than profits. (I am indebted to the referee for these observations.)

l~d!5lT~d;do!5

ywhend.do

0 whend<do

(5)

for some critical do [ [d, d#]. The DTL rule lT(d; do) assigns maximal liability when

damages are above a given threshold and zero liability otherwise.

Optimality of the DTL rule can be established using the following five-step argument. (A more formal development of the argument can be found in the Appendix.)

First Step

Loosely speaking, the objective of problem (4) can be met by a legal rule that confronts each firm with an expectedex postliability,E(l(d);t), that is as close as possible to the true expectedex postdamages caused by the firm’s accident, E(d; t). Firms will then choose care levels that are as close as possible to their first-best levels,

x*~t!5argmax$p~x,t!2p~x,t!E~d;t!%.

In addition, a firm’s net benefit from operation,p( )2p( )E(l( );t), will be as close as possible to the net social benefit from its operation, p( ) 2 p( )E(d; t), thus minimizing the extent to which firms operate or do not operate when it is socially inefficient for them to do so.

Given this logic, a necessary condition for optimality is that there be no other feasible legal rulel(d) that yields expected liability levels which are closer to expected damage levels for all firm types. The object of the following arguments is to show that only a DTL rule can satisfy this necessary condition. For example, suppose thaty¶E(d;t), that is, the asset level is so small that no injurer can be assessed liability amounts that, on average, cover the actual damages from an accident. Then liability should always be set as high as possible to make firms’ expected liabilities as close as possible to their expected damages. The optimal liability rule thus takes an extreme DTL form,l(d)5 y @d.

A more interesting case arises wheny.E(d;t); that is, some firms have assets that are sufficient to cover their expected accident damages, whether because expected dam-ages are sufficiently modest or because asset bounds are not exceedingly tight. Even though accident damages may sometimes be very large, so that limited liability is a constraint in the sense of equation (3), this second case is likely to hold in most of the industrial accident situations that are of interest in this paper. Because this case provides the analytical challenge here, it is assumed to hold in what follows.

Second Step

Under an optimal legal rule, some firm type to pays exactly its expected damage when an accident occurs. If this werenottrue, then because the expected liability function,E(l( );

t), is continuous in the firm typet, either all firms would pay more than their expected damages or all would pay less. As a result, all firms’ expected liabilities could be set closer to their expected damages by either a proportionate reduction in liability or a feasible increase in liability.17By the “first-step” arguments above, such changes would increase efficiency.

17This argument implicitly relies upon my premise thaty.E(d;t). Liability increases are then possible with any rule

Third Step

Consider two possible candidates for an optimal liability rule, both of which satisfy the “second step” necessary condition for optimality— confronting a given to firm with

expected liability equal to its expected damages. The first is a DTL rule, which I will denote bylTo(d). The second is an arbitrary nonthreshold rule,lAo(d) (Afor

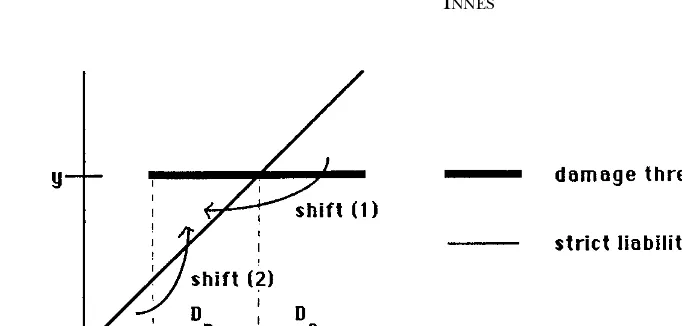

“alterna-tive”). As depicted in Figure 1, it can be shown that the threshold rule lTo(d) yields

higher expected liability forttypes abovetoand lower expected liability forttypes below to. The reason is as follows: As shown in Figure 2, a move to the threshold rule reduces

damage payments in low-damage states, wherein low t firms have relatively more probability weight, and increases these payments in high-damage states, wherein hight

firms have relatively more probability weight. When these shifts are chosen to preserve the expected liability to a typetofirm, they will thus increase (decrease) the expected

liability to higher (lower)tfirms.18,19

18The MLRP equation (1) is crucial to this argument. Under the MLRP, if a highertlevel implies a greater

probability weight on some damage levels belowdo, it must also imply a proportionally larger increase in probability weight on damage levels abovedo. Hence, when one shifts liability from low- to high-damage realizations so as to preserve thetofirm’s expected liability, the expected liability to highertfirms,t.to, rises. By concentrating liability

FIG. 2. Feasible liability rules.

Fourth Step

Suppose that the threshold rulelTo(d) yields hightfirms (t.to) an expected liability

that is less than their expected accident damages and, conversely, yields lowtfirms (t, to) an expected liability that is higher than their expected damages (see Figure 1). Then

a move from lAo(d) tolTo(d) will uniformly reduce the divergence between expected

liability and expected damage. By the preceding three-step argument, the DTL rule will then be optimal because, among all feasible legal rules that preserve firmto’s expected

liability, DTL yields the highest expected liability for firms witht .to and the lowest

expected liability for firms witht,to.

Fifth Step

The key premise underpinning this argument—and the resulting optimality of a DTL rule—is that DTL overpenalizes low-damage firms and underpenalizes the high-damage firms, as depicted in Figure 1. The fifth and final step in the argument is to describe conditions under which this premise is valid.

To this end, Figure 3 compares a DTL rule to a strict liability rule that, if feasible, would confront all firms with exactly their average damages. Three differences between these rules determine the extent to which firms are overpenalized or underpenalized by the DTL rule: (1)limited liabilityfor high levels of harm (in RegionDA) underpenalizes

(underdeters) accidents; (2) above-harm liability for intermediate levels of harm (in Region DB) overpenalizes accidents; and (3) zero liability for low levels of harm (in

RegionDC) underpenalizes accidents. By the design of the DTL rule, these three effects

will exactly balance out for thetofirm, thus confronting the firm with exactly its average

damages. However, for lower damage (t ,to) and higher damage (t .to) firms, the

as much as possible in the high damage states, as is done by a damage threshold rule, the highertfirms’ expected liability is thus maximized.

19The proof of this observation draws from arguments developed in Innes (1990). There, “live-or-die” financial

contracts concentrate the borrower’s rewards as much as possible in high-profit states and thereby maximize the borrower’s reward from higher (profit-improving) effort choices. Similarly, I show in the present paper that a liability function which concentrates payments as much as possible in high-damage states maximizes the firm’s cost of having a “higher” damage distribution.

DTL rule’s incentive impacts are more complicated. To understand them, let us suppose that the underdeterrence effect of zero liability, effect 3, is either relatively small or approximately the same for all firm types; then we only need to consider the other two impacts of threshold liability.

Turning first to the low-damage (t , to) firms, note that they have relatively more

probability weight on the lower damage RegionDB, and less weight on the high-damage

Region DA, than does a to firm. Therefore, the overdeterrence effect of above-harm liabilitywill be stronger than for thetofirm, the underdeterrence effect oflimited liability

will be weaker, and because the DTL rule charges thetofirmexactlyits average damages,

it will overpenalize (overdeter) accidents by the low-damage (t,to) types. Conversely,

higher damage firms have relatively less probability weight on the lower damage Region

DB, and more weight on the high-damage RegionDA; hence, the DTL rule will

under-penalize (underdeter) accidents for these firms. In sum, when the underdeterrence effect of zero liability is sufficiently small, firms’ expected threshold liability and average damages are related in the presumed way (Figure 1).20

The final question thus becomes: when is the zero liability effect “small” or constant across firms? There are three related answers to this question. First, if a highertlevel implies a change in probability weight primarily from intermediate damage states (those in regionDB) to high-damage states (those inDA), then the underdeterrence

effect of zero liability in the lowest damage DCstates will be approximately constant

across firms. Second, if the asset boundyis sufficiently small, then for the DTL rule to confront theto firm with its true expected damages, there must be a correspondingly

lowdothreshold above which the DTL rule assesses (maximal) liability; as a result, the DCregion in Figure 3—and the attendant zero liability effect—will be correspondingly

small. Third, the same logic applies when there is a greater preponderance of higher damage firms, those with expected damages that are relatively close to the asset bound

y. In this case, an optimal DTL rule will again set thedothreshold at a relatively low level

to confront the preponderance of firms with expected liabilities that are closer to their true average damages.21

What follows is a sufficient condition for the foregoing circumstances to imply the desired (Figure 1) premise—that the DTL rule overdeters low-damage firms, underde-ters high damage firms, and is, therefore, optimal:

CONDITION1: Because of their higher expected damage levels, higherttypes must be found liable in more(lower)damage states for the equation(5)DTL rule to cover their expected damages.22

20If the underdeterrence effect of zero liability is not small or approximately constant across firms, then it will be

stronger for low damage firms who have more probability weight in the lowest damageDCregion. As a result, the low damage (t,to) firms need not be overpenalized by the DTL rule and, hence, the Figure 1 relationship between expected threshold liability and expected damages need not hold.

21The appendix verifies that these circumstances imply the desired (Figure 1) relationship between expected

threshold liability and damages (see Lemma 5).

22Stated more precisely, Condition 1 has “weak” (less onerous) and “strong” forms, either of which is sufficient for

our desired (Figure 1) premise to hold. Formally, lett1denote the maximumtlevel such that firm assets can cover

the firm’s expected damages,t15max{t

[[t,t#]:yÄE(d;t)}. Fortlevels no greater thant1, letd

Condition 1 implies that our candidate DTL rulelTo(d), by confronting theto firm

with its actual expected damages, assesses liability less frequently than is needed to confront a higher damage (t.to) firm with its higher average damages; the hightfirms

are thus underpenalized. Conversely, low-damage firms are overpenalized. Thus, we have:

PROPOSITION1: If Condition 1 is satisfied, an optimal legal rule will take the damage threshold form of equation (5).

Although Section IV below discusses cases in which Condition 1 is violated, the follow-ing example illustrates circumstances under which this key condition will hold, verifyfollow-ing some of our earlier intuition.

Example

Suppose damages are exponentially distributed with mean parameterat:

h~d;t!5~at!21exp~2d/at!N H~d;t!

512exp~2d/at! ; d>0, wherea .0. Then the following is the threshold leveldosuch that the associated DTL

rule confronts thettype firm with exactly its average damages

do~t,y!5@ln~y!2ln~at!#at5do: E~lT~d;do!2d;t!50. (6)

Differentiating (6) gives the following statement of Condition 1 (in a strong form):

y<exp~1!~at!52.718E~d;t!N ]do~t,y!/]t,0 ;t[~t,t##. (7) Roughly speaking, if the liability limit is less than treble the expected damages of the least-damaging firm, a DTL rule will be optimal.

Condition 1, in a weaker form, imposes two less onerous requirements (see note 22): (1)]do(t,y)/]t¶0 at t5to,

y<exp~1!~ato!; (8)

and (2) under the optimal DTL rule, the lowest damage firm type,t, has an expected liability that is no lower than its expected damages,

E~d2lT~d; do~to, y!; t!5at2yexp@~ln~ato!2lny!~to/t!#<0.

23 (9)

For instance, suppose that (1)t51 and#t55, so that the highest damage type has five times the expected damages of the lowest damage type, and (2) att54,E(d;t)5y, so that only the very highest firm types,t.4, have expected damages above their assets. Then both equations (8) and (9) will be satisfied if the optimaltoequals at least two.24

A DTL rule will thus be optimal provided there is a sufficient preponderance of firms in the interval,t [[2, 5], rather than the interval [1, 2). Ifto is less than 4 (because

there is a sufficient preponderance of profitable firms in the intervalt [[1, 4]), the

23Equations (8) and (9) are clearly necessary for the “weak form” of Condition 1 to hold (see note 22). An expanded

version of this paper (available on request) shows that they are also sufficient.

24Witht51,E(d;t54)5y(so thaty54a), andt

optimal DTL rule also exempts firms from liability in some low-damage states (setting

do.d).

The restrictions described in this example, equations (8) to (9), are rather mild in view of the paper’s premise that liability limits are a problem for the regulation of accidents. This premise is supported by the work of Ringleb and Wiggins (1990), who have documented U.S. firms’ exploitation of bankruptcy laws to reduce their exposure to potential damage assessments. This exploitation has been manifested in the organi-zation of smaller corporate entities that have smaller maximal liability. Beyond observed efforts to reduce y, there are potential constitutional and economic motivations for liability limits that are serious bounds in the sense of Condition 1. On the constitutional side, it can be argued that exceedingly large liability assessments would be confiscatory; particularly in view of imperfections in the damage assessment process (with well-respected economists, for example, deriving quite different damage estimates), this argument may favor a liability limit linked to a measure of expected damages, much as suggested in the above example.25,26On the economic side, deadweight costs of bank-ruptcy, costs that are incurred when firms face financial distress, may motivate liability limits that are tighter than a restriction to available assets.

In sum, Condition 1 describes cases in which the liability limit is not exceedingly lax and the equation (5) damage threshold rule is uniquely optimal. If a sufficiently large proportion of firms have expected damages above the asset bound,E(d;t).y, this rule will set liability uniformily equal to assets; however, if most firms’average damagesdo not exceed their assets— even though their damage realizations may often do so—zero liability will be assessed when damages are sufficiently low.

IV. Extensions and Implications

This paper has characterized an optimal liability rule for injuring firms/agents that (1) can have unilateral accidents that cause stochastic damages to victims, (2) can reduce the likelihood of an accident by taking ex antecare measures, (3) have private infor-mation about their damage distributions, and (4) have liability that is limited to their available assets. When the liability rule cannot depend on care choices and the liability limit is in a plausible range—neither too tight nor too loose relative to expected accident damages—an optimal legal rule is shown to take a damage threshold form, assessing maximal liability when ex post damages are above a given threshold and assessing zero liability otherwise.

In closing, let me comment on several extensions and implications of this analysis.

Ex Ante Safety Standards

Many scholars have been interested in whether or not economic efficiency can be enhanced by the joint use ofex postliability regulation andex antesafety standards that

25It is also worth noting that imperfections in the damage assessment process give rise to an added economy of the

equation (5) DTL rule. When damages are hard to measure, DTL economizes on the extent to which this measurement needs to be made in assessing liability; rather than requiring that the specific damage level be identified, implemen-tation of DTL only requires that the damage level be identified as lying in one of two ranges.

26Suppose that liability limits are linked toex postdamage levels, such asl(d)¶min(g(d),y), whereg(d) is some

directly require all firms to exercise care at or above a minimum level. Shavell (1984) studies the desirability of using safety standards in an accident regulation model that also features limited liability and asymmetric information.27In doing so, Shavell posits both an exogenous postprosecution legal rule (strict liability) and an exogenous prob-ability of prosecution that is less than 1. In this setting, each firm is confronted with an expected accident penalty that is no greater than the prosecution probability times the true expected damage and, hence, is strictly less than the expected accident damage. Because liability underpenalizes all firms, all firms also exert too little care. By raising some firms’ care levels,ex antesafety standards can increase efficiency.

Here, however, the legal rule is endogenous and, although not explicitly modeled, permits a nonunity probability of prosecution,r [(0, 1]. Specifically, if lP(d) is the

postprosecution liability rule, then the preprosecution liability rule characterized here isl(d)5lP(d)r. Implicitly, therefore, this analysis permits the legal rule to compensate

for imperfect prosecution. For example, a strict liability rule in this paper, l(d) 5d, compensates for imperfect prosecution by assessing “super-strict” postprosecution lia-bilitylP(d)5d/r, rather than settinglP(d)5das in Shavell (1984). In Shavell’s model, “super-strict” liability would elicit first-best care choices from all lower damage firms, thus removing the inadequate liability motivation for imposing care standards on these firms.

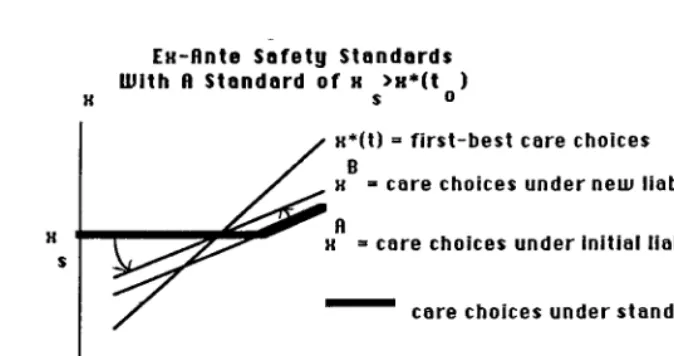

More generally in this paper’s model, Condition 1 implies that low-care firms are the lowttypes that are assessed excessive liability and, hence, that exert too much care.28 Anex antestandard can make matters worse by compelling these firms to exert yet more care. If the care standard were set sufficiently high—namely, above the first-best care level for thetofirm that receives an expected liability assessment equal to its expected

damage—then the standard can also have the beneficial effect of compelling some highertfirms to exert more care. However, the same end can often be met at lower cost by revising the liability rule and having noex ante safety regulation. This argument is illustrated in Figure 4, where an initial liability rule setsto5toAand yields care choices xA. Together with the care standardx

s, the initial liability rule yields the care choices

depicted in bold. Now consider replacing this liability-cum-standard policy with a liability-only policy that, relative to the initial liability rule, raises to from toA totoBas

indicated. The newtoBis selected so that the first-best care level of thetoBfirm equals

the standard, xs. This change in liability would be achieved by lowering the critical

damage level below which no liability is assessed, do; liability would thus be assessed

more frequently, leading to the higher care choices, xB, as depicted in the figure.

Comparing the new care choices,xB, with those under the liability-cum-standard policy, one sees thatcare falls for the low-damage firmsthat exert excessive care and thatcare rises for the high damage firmsthat exert too little care. The new liability-alone policy is, hence, more efficient that the standard-cum-liability policy.

This last argument hinges on an implicit assumption that the threshold damage level,

27See also Kolstad et al. (1990), Calfee and Craswell (1984), and Craswell and Calfee (1986). Like Shavell (1984),

these papers posit a fixed liability rule (i.e., negligence), but unlike Shavell (1984), motivate their analysis with uncertainty in the legal process [as in Edlin (1994)]. For other important work on the relative merits and potential joint use ofex anteregulation andex postliability, see Wittman (1977), White and Wittman (1983), Viscusi (1989), and Rose-Ackerman (1991).

28In this discussion, I am implicitly ruling out implausible cases in which care choices decrease with increases in

do, can be lowered. In other words, it is presumed that the legal rule does not set liability

uniformly equal to the asset bound. However, if a sufficiently large proportion of firms have expected damages above the asset bound,E(d;t).y, an optimal policy will assess maximum possible liability and care standards may sometimes enhance efficiency by requiring higher care exertion by the plentiful high-damage firms that are assessed too little liability, even under the “maximum liability” rule. In sum, the conclusion thatex antesafety standards are necessarily welfare decreasing is limited to the cases of most interest in this paper, those that lead to optimality of a nondegenerate damage thresh-old rule, one that sometimes assesses zero liability because there is not a sufficient preponderance of firms with expected damages above the asset bound.

The following general conclusion is suggested: If there is imperfect prosecution and a strict liability legal rule in which multiple damages cannot compensate for imperfect prosecution, then ex ante safety standards will be an optimal complement to ex post

liability in the regulation of accidents [Shavell (1984)]. Safety regulation will also be desirable if there is a preponderance of potential injurers whose average accident damages are so large that they substantially exceed their available assets. However, if the legal rule can be adjusted to achieve efficiency objectives and, in addition, most firms’

average damagesdo not exceed their assets— even though damage realizations may often do so—thenex antesafety standards are unlikely to be justified by limited liability.

Linking Liability to Wealth

There has been recent debate about the relative merits of tying damage awards to available injurer assets. Citing principles of justice and an absence of economic logic, Abraham and Jeffries (1989) argue against such ties when injurers have heterogeneous asset/wealth endowments. However, this analysis provides a possible economic motiva-tion for linking damage awards to assets. In particular, suppose there are different asset/y classes of firms, with firms’ asset levels uncorrelated with theirt-types (so as to avoid the most obvious argument for linking liability to assets). Then, for eachylevel, the foregoing arguments apply and a DTL rule is optimal under the conditions

scribed above. In moving from a loweryclass of firms,y5yo, to a higheryclass of firms, y5y1.yo, and by increasing the liability assessment for the higheryfirms fromyoto y1 (fixing to), the expected DTL liability function in Figure 1 will pivot closer to the

expected damage function; hence, by tying liability to the higheryfirms’ asset/ylevel, welfare gains will be achieved.29

On the other side of the coin, however, are prospective bankruptcy costs from asset-linked liability and the potentially greater incentives created by asset-linked liabil-ity for adoption of costly measures to limit corporate assets. If these costs are sufficiently large, they may offset the gains from asset-linked damage awards, thus favoring liability limits that are decoupled from—and are below—the asset level. It is important to note, however, that below-asset liability bounds do not affect the logic of this paper’s analysis; under appropriate generalizations of Condition 1, a damage threshold rule that assesses maximal liability in high-damage states and zero liability in low-damage states remains optimal.30

Entry and Exit

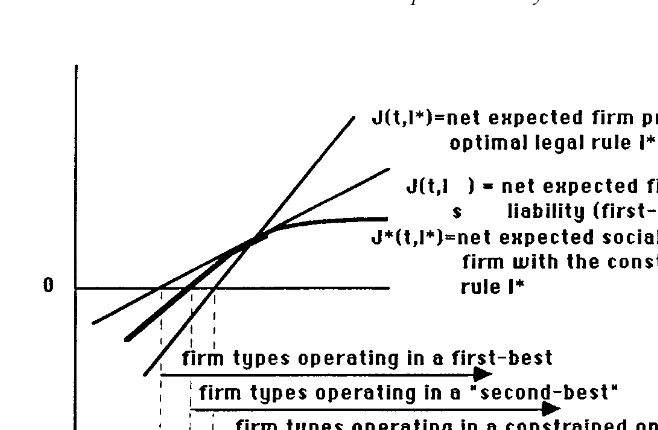

In this paper’s model, the optimal liability rule may prompt either fewer operating firms or a greater number of operating firms than is efficient. A damage threshold rule optimally mitigates the “excessive entry” or “excessive entry-deterrence” problem by confronting firms with expected accident penalties that are as close as possible to the expected accident damages from their activities. For example, let us suppose that the higher damage firms are also more profitable overall, with pt( ) positive and large

relative to firm type effects on both the probability of an accident,p( ), and expected liability.31When Condition 1 holds in this case, the optimal liability rule entails exces-sive damage assessments on low-damage firms that are also the marginal operators in the accident-creating activity. As a result, there is less entry in the limited-liability constrained optimum than in either a first-best or a “second-best” in which a semi-omnicient government tells which firms to operate but cannot direct care choices; in this sense, too few firms operate. By minimizing the extent to which expected liability assessments exceed expected damages for low-damage firms, a damage threshold rule minimizes this excessive entry deterrence.

Figure 5 illustrates these conclusions using three curves: (1) net expected firm profits under the constrained optimal legal rule 1*,J(t, 1*); (2) net expected firm profits in a first-best,J(t,ls) (wherelsdenotes a strict liability rule,l(d)5d); and (3) net expected

social surplus from firm operation when firms choose their privately optimal care levels under the constrained optimal legal rule,J*(t,l*)5 p(x(l*,t),t)2p(x(l*,t),t)E(d;t). To determine whether there are firms that do not operate even though their operation would increase social welfare, we can compare the “second-best” set of operating firms— those for whichJ*(t,l*) is positive—with the set of firms that actually operate under the

29Arlen (1992) develops another argument for asset-linked liability, one driven by injurer risk aversion. 30In fact, to the extent that modified liability limits tighten the upper bound on liability, they also increase the

likelihood that an appropriate analog to Condition 1 will hold and, hence, that damage threshold rules will be optimal.

31Alternately, the low-damage firms will be more profitable if the firm type parameter t affects mainly the damage

constrained optimal legal rule—those for which J(t, l*) is positive. Because J(t, 1*) intersects the zero-profit axis to the right of both the first-best profit curve,J(t,ls), and the

second-best surplus curve, J*(t,l*), the constrained optimum is characterized by fewer firms—and more entry deterrence—than in either a first-best or a second-best world.32 Notably, the possibility of too few operating firms conforms with a public debate on entry/exit effects of liability rules that is often concerned with the likelihood of deterring too many “good” firms from operating [e.g., see Huber (1988)].33

Violation of Condition 1

Condition 1 requires moderately tight liability limits, which are arguably plausible in many situations. In the context of the foregoing model, violation of this condition may permit nonthreshold, non-care-contingent legal rules that reduce the divergence

be-32Three features of Figure 5 imply excessive entry deterrence: (1) Whentis above (below) the optimalt olevel,to

5t*o, Condition 1 implies that first-best expected firm profitsJ(t,ls) are below (above)J(t,l*), the corresponding profit levels under the optimal legal rule l*. (2) By revealed preference (i.e., optimality of the first-bestxchoice, whenE(l; t)5E(d;t)),J*(t,l*) is everywhere belowJ(t,ls) except whent5to(whereJ*(t,l*)5J(t,ls)). Furthermore, when tis less thanto(so thatE(d;t),E(l*;t) by Condition 1),J*(t,l*) is aboveJ(t,l*) (sinceJ*(t,l*)2J(t,l*)5p(x(l*, t),t) (E(l*;t)2E(d;t))). (3) Thetofirm that pays exactly its expected damages when an accident occurs is interior to the set of firm types that operate in a constrained optimum. The reason is that a change intofrom outside or on one of the bounds of this set into its interior increases efficiency for all firms in the interior by reducing the divergence between expected liability and expected damages for these firms. (This argument assumes that there is some minimal ability to chooseto. That is, it requiresy.E(d;t*), wheret* is the lowestttype that operates in a first-best. Without this premise, assets would be less than expected accident damages for all relevant firms; as a result, the optimal liability rule would take the degenerate form,l(d)5y@d, and entry would nonetheless remain under-deterred.) A complete derivation of these conclusions is available in the expanded version of this paper.

33In contrast, standard care-contingent negligence rules—rules that confront an injurer with zero liability if a

requisite standard of care is met and a large positive liability if this standard is not met— elicit excessive entry into an accident-creating industry [Polinsky (1980); Shavell (1980)].

tween expected liability and expected damage for some firms. For example, suppose that there are two injurer types,tH.tL, with Condition 1 violated. Then a nonthreshold

legal rule with less severe penalties in higher damage states can support first-best outcomes by confronting both firms with expected liabilities that equal their expected damages; one such rule (among many possibilities) is modified strict liability,l(d)5d

for alld¶d1andl(d)5k[(d1,y) for alld.d1, withd1andkchosen to solveE(l(d)

2d;tL)5E(l(d) 2d;tH) 50.

This observation, however, exagerates the importance of Condition 1 for the opti-mality of the damage threshold liability rule characterized in this paper. Generically, a DTL rule maximally punishes the most damaging injurers and minimally punishes the least damaging injurers. This property of the threshold rule makes it useful in more involved models ofex postliability assessment and litigation, even when Condition 1 is violated. For example, consider a game between a government regulator and a set of injuring firms, wherein damage realizations can only be uncovered in a costly court proceeding that can be avoided if an injuring firm agrees to pay a fine set by the regulator. The court-level liability rule and the fine should be designed to elicit the most efficient precautionary behavior possible, although in doing so it minimizes the extent to which the costly court process is invoked. A DTL rule may achieve these ends by minimizing the incentive for high-damage firms to appeal to the court process, thereby enabling the court appeal process to serve as a screening mechanism with fewer government prosecutions of low-damage firm appeals and correspondingly lower ex-penditures on the legal process. Similar logic is likely to apply in suit, settlement, and trial games [e.g., see Bebchuk (1984); Grossman and Katz (1983); and Png (1987)]. Although these ideas merit further development, they suggest a rather general scope for DTL rules to increase economic efficiency.

Appendix: Proof of the DTL Rule’s Optimality

In this appendix, I present the rigorous analog to the five-step argument developed in Section III. In making the argument, it is necessary first to rule out degenerate cases in which (1) no firms operate and the issue of liability design is moot, and (2) the extreme DTL rule,l(d) 5yfor alld, is trivially optimal:

ASSUMPTION1: T(l*)is of positive measure. ASSUMPTION2: y.E(d; t).

Under Assumptions 1 and 2, the formal analogs to the results developed in Section III are as follows:

LEMMA1 (FIRSTSTEP): Ifl*(d)solves problem(4),then there is nol[Lsuch that: (I)for allt[[t, t#],either(a) E(l*(d); t)¶E(l(d); t),E(d; t),or(b) E(l*(d); t)ÄE(l(d); t)

ÄE(d; t);and(II)for some t[T(l*),the first inequality in(a) or(b)is strict. LEMMA2 (SECONDSTEP): An optimal liability rule has the following property:

E~l*~d!;to!5E~d;to!, someto[@t,t##. (A1)

LEMMA 3 (THIRD STEP): If an equation (5) negligence rule, lTo(d), and a feasible non

E~lTo~d!;t!,E~lAo~d!;t!;t,to, and (A2a) E~lTo~d!;t!.E~l

A

o~d!;t!;t.t

o. (A2b)

Finally, given Condition (1)’s “weak” ((C1(a)) and “strong” ((C1)(b)) forms, as described in note 22, we have:

LEMMA4 (FOUTH ANDFIFTHSTEPS): If (C1)(a) holds, then the DTL rulelTo(d) (as defined in

Lemma 3)satisfies:

E~lTo~d!;t!,E~d;t!fort[~to,t##, (A3a) E~lTo~d!;t!.E~d;t!fort

[@t,to!. (A3b)

If (C1)(b) holds, thenlTo(d)satisfies equation(A3)for any possibleto[[t, t1].

LEMMA5 (FIFTHSTEP): (1) If the asset boundyis sufficiently small,then(C1)(b)will hold. (2)Suppose that some firms have assets that are insufficient to cover their expected damages, t15max{t[[t, t#] : yÄE(d; t)},#t.Then there exists at*,witht*,t1,t#,such that

(C1)(a)holds for alltoÄt*.Hence,if there are sufficiently many firms withtÄt*that the

optimaltois no lower thant*, then Lemma4’s equation(A3)will hold at the optimal to. If Lemma 4’s equation (A3) holds, then Lemma 3 implies that DTL rules minimize the difference between expected liability and expected accident damage for all firms. Thus, by Lemma 1, an optimal legal rule must take the DTL form whenever Condition 1 holds, whether in its “weak” or its “strong” form.

Proof of Lemma 1: Preliminaries

Define:

J~t,f,D!5p~x1~f,t!,t!2p~x1~f,t!,t!D,

wherex1(f, t) 5 argmax {p(x, t) 2 p(x, t)f} (5x(l,t) for l5 f). With expected liability of f, social surplus from a firm’s operation is J(t, f, E(d; t)) and the corre-sponding firm benefit from operation is J(t,f,f). Further define the social surplus produced by firmtwith liability rule 1 as:

J*~t,l!5J~t,E~l; t!,E~d;t!!. Some useful properties of J( ) are:

(P1) ]J(t,f,D)/]D5 2p( ),0 (higher damages lead to lower surplus)

(P2) d

df~J~t,f,f!! 5 2p~ ! , 0 (firm benefits fall when liability is raised)

(P3) ]J(t,f,D)/]f 5 2px( )[f 2D]xf1(f,t)x0 whenfcD (surplus rises when

liability approaches damage)

(P1) follows from the envelope theorem (and the definition ofx1(f,t)). (P2) follows from simple differentiation. To establish (P3), differentiate J( ), substitute from the first-order condition forx1(f,t) and note thatxf1(f,t)5px( )/[pxx( )2pxx( )f].

0.

E

T~l!J*~t, l!q~t!dt.

E

T~l*!

J*~t,l*!q~t!dt. (A4)

Now suppose that the following conditions hold:

(A) l does not reduce social surplus: For all t [ T(l*), J*(t, l) ÄJ*(t, l*), with strict inequality for some t9[T(l*).

(B) ldoes not subtract positive benefit firms:Ift[T(l*)andJ*(t, l*)Ä0,thent[T(1). (C) l does not add negative benefit firms:If t¸T(l*)andJ*(t, l),0, thent¸T(l). Conditions (A) to (C) directly imply that l achieves at least the same social surplus as does l*. If t9[T(l) (for t9as defined in A), then l strictly raises social surplus for a t9

firm that continues to operate. And if t9 ¸ T(l), then by condition (B), the t9 firm generates negative surplus under l*, J*(t9, l*),0; hence, the exclusion of t9under 1 raises surplus. (A4) will thus follow if conditions (A) to (C) can be shown to hold under conditions (I) and (II) in the lemma.

CONDITION(A): Condition (I) and property (P3) imply condition (A).

CONDITION (B): Suppose the contrary, t ¸ T(1). Then, because t ¸T(l*), firm t benefits must be higher under liability rule l*:

J~t,f1,f1!,J~t, f1*, f1*!, (A5a)

wherefl5E(l; t) andfl*5E(l*; t).

By property (P1), (A5a) implies thatf1. fl*and hence, by condition (I),f1¶E(d; t). Together with (P3), these inequalities imply:

J~t,f1,E~d;t!!.J~t,f1*,E~d;t!!5J*~t,l*!>0, (A5b) with the last inequality holding by hypothesis. Finally, withfl¶E(d; t), property (P2) implies

J~t,f1,E~d;t!!<J~t,f1,f1!. (A5c) Together, (A5b) and (A5c) contradict the initial supposition, t¸T(l) (because J(t,f1,

f1),0) and thus establish condition (B).

CONDITION(C): Suppose the contrary, t[T(1) because J(t,f1,f1)Ä0. By hypothesis, we have J*(t, l)5J(t,f1, E(d; t)),0. Together with (P2), these two inequalities imply thatf1,E(d; t), and hence (by condition (I)),f1Ä f1*. By (P1), we thus have

J~t,f1,f1!<J~t,f1*,f1*!,0,

where the second inequality follows from the premise that t ¸T(l*). This inequality contradicts the initial supposition that t [T(1), and thus establishes condition (C). QED.

Proof of Lemma 2

either (1)E(l(d)2d;t).0@tor (2)E(l(d)2d;t),0@t. Suppose first thatE(l(d) 2d;t).0@t. In this case, one can replacel(d) with (12 e)l(d) (withepositive and

arbitrarily small), thus reducing the difference between expected liability and expected damages, E(l(d); t) 2 E(d; t), for all t; hence, by Lemma 1 and Assumption 1, l(d) cannot be optimal. Conversely, suppose that E(l(d) 2 d; t) , 0 @ t. In this case,

Assumption 2 implies thatl(d) ,y on some nondegenerate subset of the support for

d,D. Thus, one can replacel(d) with

lA~d!5

l~d!ford [ Dc l~d!~11e! ford [ D,

whereDcis the complement ofDon [d,d#]. This change will reduce the absolute value

of the difference between expected liability and damages, for allt, again contradicting optimality ofl(d). QED.

Proof of Lemma 3

Consider the following claim:

CLAIM: ]E(lAo(d); t)/]t, ]E(lT(d; do); t)/]twheneverE(lAo(d); t)5E(lT(d; do); t). PROOF: Given the liability bounds, 0¶l(d)¶y, and the definition of negligence, the following inequalities hold:

1Ao~d!>lT~d;do!;d<do, (A6a)

1Ao~d!<lT~d;do!;d.do, (A6b)

with both inequalities strict on sets of positive measure (recall Figure 2). Now, following Innes (1990), define

f~d!5lAo~d!2lT~d;do!

H

>0 ; d<do

<0 ; d.do

, (A7)

and note that, by construction (i.e., E(lAo(d); t)5E(lT(d; do); t)),

E

ddof~d!h~d;t!dd1

E

do

d

f~d!h~d; t! dd50. (A8)

The claim will follow if the derivative,

]E~f~d!; t!/]t5

E

d d

f~d!ht~d;t!dd, (A9)

is negative. To evaluate this derivative, define

d~dL!5 f~dL!h~dL;t!

E

ddof~d! h~d;t!dd

5 f~dL!h~dL;t! 2

E

do

d

f~d!h~d;t!dd

fordL [ @d, do!, (A10)

E

ddwheredHdenotes the variable of integration over the interval [do, d#] and dLdenotes the variable of integration over [d,do]. The inequality in (A11) follows fromd(dL)Ä0@dL Because equation (A14) contradicts equation (A13), condition (A2b) must hold. Sym-metric logic applies to inequality (A2a). QED. 2 d;t)/]t . 0. However, these last two relations contradict Condition 1. Inequality (A3b) follows from a symmetric contradiction. QED.

Proof of Proposition 1

Suppose the contrary, that there is an alternative liability rule that solves problem (4),

l*(d)5lAo(d). By Lemma 2, there is ato[[t,t#] such thatE(lAo(d);to)5E(d;to). Now

consider the DTL analog to lAo(d) (as defined in Lemma 3), namely, l(d) 5 lTo(d): E(lTo(d);to)5E(lAo(d);to). Given Assumption 1 and Condition 1, Lemmas 3 and 4 imply

that, with l*(d) 5 lAo(d) and l(d) 5 lTo(d), conditions (I) and (II) of Lemma 1 are

Proof of Lemma 5

1. Differentiatingdo(t,y) (as defined in note 22) gives:

]do~t, y!/]t5@]E~d;t!/]t1yHt~do;t!#/~2yh~do;t!!. (A15)

By the MLRP [equation (1)], there is, for eacht, a criticald*(t) such thatht(d;t),0

for alld,d*(t) andht(d;t).0 for alld .d*(t). If

y<2@]E~d;t!/]t#/Ht~d*~t!;t!, (A16)

then]do(t,y)/]tin (A15) will be nonpositive and strictly negative if eitherdoÞd*(t)

or the inequality in (A16) is strict. Therefore, ify satisfies (A16) for allt[[t,t1], so that

y<mint[@t,t1#$2@]E~d;t!/]t#/Ht~d*~t!;t!%, then (C1)(b) will hold.

2. Withy,E(d;#t) andy.E(d;t) (by Assumption 2), there is at1[(t,#t):E(d;t1)

5y and, hence,do(t1,y) 5d. Now, for a givendo, define:

Q~do,t,y!5]E~d2lT~d;do!; t!/]t5]E~d;t!/]t1yHt~do;t!. (A17)

For (C1)(a) to hold, it suffices to show thatQ( ) is non-negative for alltatdo5do(to,y).

Ifto5t1and, hence,do5d, thenHt(do;t)50 andQ( ).0 for allt. Therefore, there

exists ad1(y)5maxd[(d,d#]:Q( )Ä0 for alldo¶d 1(

y) and allt. We can thus define

t*5mint[@t,t1!:do~z,y!<d 1~y!

;z>t. Noting thatd1(y).d5do(t

1

,y) (becauseQ(d,t1,y).0), we have thatt*,t1and, by construction,Q( )Ä0 @tatd

o5do(to,y) for anyto Ät*. QED. References

ABRAHAM, K.,ANDJ. JEFFRIES. (1989). “Punitive Damages and the Rule of Law: The Role of Defendant’s Wealth.”Journal of Legal Studies18:415– 425.

ANDERSON, M. (1996). “The State Voluntary Cleanup Program Alternative.”Natural Resources and Envi-ronmental LawWinter:22–26.

Arizona Department of Environmental Quality (ADEQ). (1996).Arizona Environmental Compliance Update. ARLEN, J. (1992). “Should Defendants’ Wealth Matter?”Journal of Legal Studies21:413– 429.

BEARD, R. (1990). “Bankruptcy and Care Choice.”Rand Journal of Economics21:626 – 634.

BEBCHUK, L. (1984). “Litigation and Settlement Under Imperfect Information.”Rand Journal of Economics

15:404 – 415.

BOYD, J.,ANDD. INGBERMAN. (1992). “Insolvency, Product and Environmental Risk, and Rule Choice.” Working paper, Resources for the Future.

BROWN, J. (1973). “Toward an Economic Theory of Liability.”Journal of Legal Studies2:323–350. CALFEE, J.,ANDR. CRASWELL. (1984). “Some Effects of Uncertainty on Compliance with Legal Standards.”

Virginia Law Review70:965–1003.

CORY, D. (1997). “Potentially Polluting Activities and the Control of Environmental Risk: The Arizona Approach to Aquifer Protection.”Initiative8:115–119.

CRASWELL, R., AND J. CALFEE. (1986). “Deterrence and Uncertain Legal Standards.” Journal of Law, Economics and Organization2:279 –303.

DIAMOND, P. (1974). “Single Activity Accidents.”Journal of Legal Studies3:107– 64.