THE EFECT OF CORPORATE SOCIAL RESPONSIBILITY

EXPENDITURES TOWARD FINANCIAL PERFORMANCE AND FIRM

VALUE

Aditya Satya Yudharma

1, Yeterina Widi Nugrahanti

2, Ari Budi Kristanto

3ABSTRACT

Corporate Social Responsibility is becoming increasingly important in Indonesia, many

companies get into trouble when they do not care about the environmental and social issues.

The purpose of this research is to analyze the influence of corporate social responsibility

expenditure on the financial performance and firm value. The samples of this study were 56

companies listed in Indonesia Stock Exchange in 2012 to 2013. The samples are chosen

using the purposive sampling method based on certain designated criterias. Corporate

social responsibility expenditure is measured by employee welfare cost and social

expenditure for community. The financial performance is measured by return on assets

(ROA) and firm value is measured by Tobin’s Q ratio. For hypothesis testing, this study used multiple regressions analysis. The result of this study showed that the employee welfare

cost had positive effect toward financial performance (ROA), and It had no effect toward firm

value (Tobins’Q). While, social expenditure for community had no effect toward financial

performance (ROA) and firm value (Tobin’s Q).

Keywords : corporate social responsibility expenditures,employee welfare cost, social

expenditure for community, financial performance, firm value

Conference Track: Accounting

1 Mr. Aditya Satya Yudharma, alumnus of Economics and Business Faculty, Satya Wacana Christian University 2 Mrs. Yeterina Widi Nugrahanti, faculty member of Economics and Business Faculty, Satya Wacana Christian University. Email: [email protected]

INTRODUCTION

Nowadays, the challenge faced by a company is not merely on how it can get profit as much

as possible. Social and environmental issues are the other challenge it has to deal with in order to survive in running the business. Corporate Social Responsibility (CSR) is the form of companies’ awareness toward the stakeholders’ interests, particularly, which is related to social and environmental issues (Kusumadilaga, 2010). Ambadar (2008) mentioned 4 benefits of CSR

implementation: (a) companies will be able to avoid bad reputation, (b) companies have an ethical

framework to deal with social and environmental issues, (c) companies will be respected by any group

needing for the companies existence, and (d) companies will be safe from environmental disruption,

so companies will run well. The CSR’s benefits for the companies can be seen from the companies’

financial performance. Aryani (2012) stated that every company will try to improve its financial performance, one of which is CSR implementation. Carrying out CSR activity will raise people’s reliance toward companies’ product, thus they will be more interested in buying those products. Dahlia and Veronica (2008), Dewa (2011), and Syahnaz (2013) found out that CSR measured with CSR disclosure positively influences the companies’ financial performance.

Studies about CSR influence toward firm value have been carried out before. Bird (2007) in

Sapta (2009) stated that high investation on social responsibility performed by a company will have

positif impact to the firm value. Global survey conducted by The Economist Intelligent Unit presented

that 88 percents of senior executives and investors from various organizations made CSR as their main consideration in decision making process. The higher the investors’ interest in investing in a company, the better firm value the company will acquire. Nurlela and Ishlahudin (2008), Gunawan

and Sri (2008), and Agustina (2013) found out that CSR disclosure positively influences firm value measured by Tobin’s Q ratio.

Indeed, the implementation of CSR is proven to be beneficial for the companies, but it does

not directly make them set aside their revenue easily for supporting CSR activities. Definitely, the

CSR implementation needs considerable expenses, whereas the benefit obtained has not yet been

measured reliably. The previous researchers have tried to clarify the structural condition of a company

which gains profit from the company social responsibility. However, Rowley and Berman (2000) in

Cahyono (2011) stated that there is no theoretical framework which can surely explain the results

acquired from CSR implementation.

According to Septiana and Nur (2012), generally, CSR expenditure includes employee

welfare cost, community cost, environmental development cost, and partnership cost. Some early

Rustiyaningsih (2013) suggested that employee welfare cost positively influences company’s return

of assets. In addition, Septiana and Nur (2012), and Januarti and Dini (2015) discovered that

employee welfare cost negatively influences company’s return of assets. Besides, Primawati (2010)

found out that community cost has positive impact to company’s retur of assets. On the other hand,

Mardiandari and Rustiyaningsih (2013), and Januari and Dini (2005) asserted that community cost

does not have any correlation with company’s return of assets.

Several earlier studies had presented different studies’ results. The writer wanted to examine

the influence of CSR expenditure toward financial performance. This research is a replication study

of Mardiandari and Rustiyaningsih’s (2013) study which used manufactures company in BEI

(Indonesian Stock Exchange) from 2008-2010 as the sample. The CSR variable was proxied into 2

expenditures, the employee welfare cost (post-retirement costs) and community cost (donation).

Then, the financial performance variable was proxied by the return of assets ratio. The differences

between this study and the study conducted by Mardiandari and Rustiyaningsih (2013) is the period

used, which is from 2012-2013, and is using companies in all sectors or various industries. This

research used 2-year observation period by comparing CSR expenditure in the first year with financial

performance and firm value in the following year. Within 1 year interval of CSR implementation, it

is assumed that there will be responses acquired from the society and investors. It will also be

supported with advanced technology development therefore society and investors can receive

information faster. Besides, this study added firm value, measured by Tobin’s Q ratio, as 1 dependent

variable.

The aim of this study was to analyze how CSR expenditure influences financial performance

and firm value. This study is beneficial for the companies as additional information in the decision

making process related to CSR impelementation. On the other hand, for the investors, later on the

result of this study should be of considerable information in making an investment decision related

to companies’ future CSR implementation.

,

THEORETICAL FRAMEWORK

Corporate Social Responsibility and Corportate Social Responsibility Expenditure

According to the International Standard ISO 26000 (2010) CSR is an organization’s responsibility as the impact of a decision, social and environmental activities, through transparent and

Law No. 40 Year 2007 about Limited Companies Article 74 states that company social responsibility is companies’ responsibility which business related to natural resources. Principally, the implementation of company social responsibility is obligatory for a certain business field,

particularly companies related to natural resources. For the other companies, which are not related to

natural resources, CSR implementation is considered as voluntary activities.

Indeed, the CSR implementation needs expenses. Actually, the companies do not purposely

limit the amount of expense for CSR implementation. In this research, CSR expenditure was divided

into 2, based on the object of the CSR expenditure (internal and external). The internal CSR

expenditure used employee welfare cost measured from post-retirement costs. The Post-retirement

cost, according to PSAK 24 No. 24 on the 8th paragraph, is payable employee benefits after the

workers finish their working period (IAI 2002). Then, the external CSR expenditure used community

cost measured from donation cost. Community cost is an expense used for society or a group of

organism which often interacts with the company (Mardiandari and Rustiyaningsih, 2013).

Financial Performance

Financial performance can be defined as a description of companies’ financial condition in a certain period, which includes fund raising and its distribution aspects, which is measured using

indicator of capital adequacy, liquidity, and profitability (Jumingan, 2006). This research used Return of Assets (ROA) in measuring companies’ profitability. ROA is a measurement to assess how much returned assets from the asset owned by the companies (Riyanto, 1997). Utilizing a company’s total

assets in order to measure profitabitability is positively correlated with the CSR expenditure because basically expenditure is a reduction of assets’ value. According to Utomo (1999) in Nugrahanti (2009), the special qualities of ROA are as a comprehensive measurement tool, in which all the items

affecting financial statement can be seen in this ratio; it is easy to calculate and understand, and it is

considerably significant in absolute value; as an applicable denominator in every organizational unit

which is responsible to profitability and business units; as an the main measurement of operational

efficiency; it is the easiest ratio to be controlled by the managements.

FIRM VALUE

Firm value is investors’ perception toward public companies, and is often related to stock price (Sujoko and Soebiantoro, 2007). High stock price indicates high firm value. The high firm value

will make markets trust not only the current company performance but also the future prospect of the

company (Hardiyanti, 2012).

than those companies’ market value. It shows that markets less value those companies. Whereas if Tobin’s Q value of a company is high (more than 1), it means that firm value is higher than the recorded company assets. It indicated that there are several company assets which is not measured or recorded (Haosana, 2012). According to Sukamuja (2004), Tobin’s Q ration can provide meaningful information, because it includes all elements of company’s debt and capital stock. It includes not only

common stock and companies’ equity, but also all companies’ assets. By including all companies’

assets means that the company focuses on both stock investors and creditors.

Signaling Theory

Signaling theory (Leland and Plye (1977) in Scott, 2012: 475) defines that the company

eccecutives who have better information of their companies will be motivated to deliver the

information to investor candidates where the companies can improve the firm value through their

financial statements by sending a signal from their annual financial statements. In simple, this theory

explains that the wider the company reveals its information, the easier the information receiver in

making the decision to invest.

According to Nezz et al. (2005) in Ghozali and Chariri (2007), if a company reveals

environmental information positively, it will reduce the risk of decreasing welfare that might be

occured in the future. Actually, by revealing how much the Corporate Social Responsibility

expenditure, a company delivers information to the information users or the investors about the

company’s good prospect since it has funded the CSR expenditure. One example of a good prospect

is a company which has a good relation with the people and environment around the company because

they have funded the CSR expenditure. The company hopes that the information can influence the

information users or the investors in their decision making process, particulary related to investation.

Hypothesis Development

The influence of CSR expenditure toward Return of Assets (ROA) ratio

Principally, expenditure has negative correlation with return of assets (ROA) ratio. The higher

expenditure spent, the less profit gained, thus ROA is getting lower, and vice versa. However, CSR

expenditure actually is potential to positively influence ROA.

By expending employee welfare cost, such as employee allowance, companies will gain

employees’s loyality toward the companies. Employees will be more productive since they feel that

the companies care of them well. The increasing productivity will also increase the selling, therefore

it influences the rising of profit earned. Researchs conducted by Nathania (2013), and Mardiandari

Then, spending some expenses for communities, such as donation for construction, makes the

companies be more attractive for the society, and the society will be more symphatetic toward the

companies. The society will assume that the company not only gains more profits, but also cares of

its surrounding environment. The company will have a good image, which increases the chance for

its products to be liked by the consumers, and implicates to the increasing profit. Primawati (2010)

found out that the community cost positively influence ROA.

Indeed, CSR expenditure decreases the companies’ profit, but actually the CSR expenditure

is potential to increase the revenue valuewhich might be more than company’s expenses for CSR

expenditure so that it increases the profit. Thereby, it can be stated that company’s expenses for CSR

expenditure positively influences financial performance (profitability).

H1 : employee welfare cost positively influences financial performance

H2 : community cost positively influences fianancial performance

The influence of CSR expenditure toward Tobin’s Q ratio

The influence of CSR toward firm value can be explained based on the signaling theory, as

when the company reveals its expenses for CSR, it means that the company will inform the information receiver, particularly the investors, about the company’s valuable prospect. The positively perceived information will influence investation rate of the investors. It can affect the company’s stock value as well as firm value. Nurlela and Ishlahudin (2008), Gunawan and Sri (2008) and Agustina (2013) confirmed that CSR disclosure has positive correlation with the firm value measured with Tobin’s Q ratio.

The amount of employee welfare cost and community cost spent by the company can be one

of the terms in discovering how the CSR performance has been implemented by the company. Nurlela

and Islahudin (2008) in Sutopoyudo (2009) stated that a good CSR performance makes thr investors

rate the firm value well. A good CSR practice will make the investors be more interested to the

company because they assume that the company has a good prospect.

The expenses for employee welfare cost and community cost, indeed, reduce the profit,

however the investors consider that a good prospect or benefit acquired are more important than the

expenses. The good prospect is related to the continuity and growth of the company, thus the investors are interested to invest or buy the company’s stock, and consequently the firm value will also increase. Companies which spend some money for CSR activities will have more opportunity in

increasing firm value than the companies that do not. From the explanation above, the proposed

hypotheses were:

H4: community cost positively influences firm value

RESEARCH METHODOLOGY

Source and Kind of Data

Secondary data which was obtained from companies’ annual financial statements from

Indonesian Stock Exchange Office in Semarang were used in this study. Data related to financial

performance, firm value, and corporate social responsibility expenditure were used in this study.

Population and Sampling Method

The population of this study was all companies registered in Indonesian Stock Exchange from

2012 to 2013. The sampling method applied was the purposive sampling method with several criteria:

(a) Companies provided their annual financial statements in consective 2 years, and included

employee welfare cost and community cost during the observation period, and (2) The financial

statements were presented in Rupiahs currency.

Definition of Variable Operations

1. Independent variable for CSR expenditure was proxied by:

1. The employee welfare cost was proxied by post-retirement costs. According to the

PSAK 24 year 2013, the post-retirement cost is a payable working allowance (other

than severance and short-term employee benefits) after the employee finished the

contract of emplyement. In the financial statement, the company includes it on the

Employee Benefits Liability account.

2. Community cost is expenses used for the society or an organizational groups

interacting with the companies (Mardiandari and Rustiyaningsih, 2013). The

community cost was proxied by donation account. In the financial statement, the

company includes donation account into administration and general cost classification.

2. Independent variable for financial performance variable was proxied by profitability ratio

measured by return of assets (ROA) ratio.

ROA = P o i a Tax

3. Whereas, dependent variable for firm value variable was proxied by Tobin’s Q ratio. Tobin’s

Q was calculated using a formula according to Darmawati, et al. (2005):

Tobin’s Q = � � � � � + � � � �

�� �

Data Analysis

Multiple regressions analysis was used in the hypothesis testing of this study. A classical

assumption test was conducted before performing multiple regression analysis. The classical

assumption test consisted of multicollinerity test (by looking at VIF and tolerance value),

autocorrelation test (Durbin Watson testing), normality test (Kolmogorov-Smirnov (K-S)

non-parametric test), and heteroscedasticity test (Glejser test) (Ghozali, 2011:103).

Multi-Regression Analysis

Multi-regression analysis was used in order to determine CSR expenditures’ influence toward

the financial performance and firm value variables. The first regression model was illustrated as

follow:

ROA = α+β1WELF+β 2COMM

Here is the regression analysis for the second model:

Tobin’s Q = α+β1WELF+β 2COMM

Y 1 = ROA

Y2 = Tobin’s Q

a = Constanta

β 1,β 2 = Regression Coefficient

WELF = Employee Welfare Cost

COMM = Community Cost

ANALYSIS AND DISCUSSION

Research Sampling

Population used in this study was all companies registered in Indonesian Stock Exchange from

Table 4.1 Research Sampling

Table 4.1 shows the research sampling process during 2 years observation period. The total

number of the samples collected during 2012 to 2013 period is 56 samples.

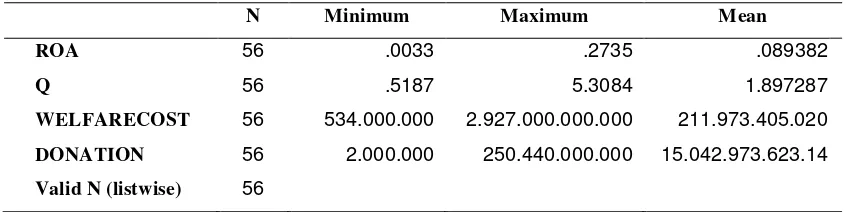

Descriptive Statistics

The table below presents the descriptive statistics results from 56 companies which includes

minimum, maximum and average scores from each variable.

Tabel 4.2 Descriptive Statistics

N Minimum Maximum Mean

ROA 56 .0033 .2735 .089382

Q 56 .5187 5.3084 1.897287

WELFARECOST 56 534.000.000 2.927.000.000.000 211.973.405.020

DONATION 56 2.000.000 250.440.000.000 15.042.973.623.14

Valid N (listwise) 56

Source : Processed Secondary Data, 2015

Table 4.2 presents that the average of profitability or return of assets was 8,93 percents, which

means that every 1 Rupiah assets could earn 0,0893 Rupiahs of ROA rate. Firm value measured using Tobin’s Q showed the average value was 1, 8972. If Tobin’s Q rate’s value is more than 1, it shows the companies’ growth based on companies’ stock market value. This value also showed that the firm value was rated higher than the book value by the markets. Therefore, the company’s stock value in

stock market tended to increase.

The mean of statistical result of employee welfare cost was Rp 211.973.405.020. Analyzed

from both the minimum value, Rp 534.000.000, and maximum value, Rp 2.927.000.000.000, welfare

Information 2012 2013

Number of companies in BEI 472 498

Companies which did not report data

related to employee welfare cost and

community cost on annual financial

statements

(415) (440)

Financial statements presented in foreign

currency

(29) (30)

cost had a considerable range. The community cost measured by donation’s mean value was Rp

15.042.973.623.14. If it was seen from both the minimum value, Rp 2.000.000, and maximum value,

Rp 250.440.000.000, it also had a considerable range.

Classical Assumption Testing

From the result of the first multicolinearity test, tolerance rate and variance inflation factors

or VIF for employee welfare cost showed that there was multicolinearity. Therefore, the data were

improved by transforming the semilog research model with a natural logarithm in welfare cost

variable (Ghozali, 2007). After it was corrected, the tolerance rate from multicolinearity test result,

of financial performance equation, and firm value showed the same results, they were 0,634. On the

other hand, the variance inflation factor or VIF was 1,576. It proved that there was no multicolinearity

because the tolerance rate was more than 0,1 and the variance inflaction factor rate was less than 10. The result of Durbin Watson’s autocorrelation test showed the financial performance and firm value were 2, 186 and 1, 698, consequently. The dU value was 1, 681 ( sig=0,5 dan k’=2, ), both of

those value from Durbin Watson test showed that there was no autocorrelation as the value was more

than dU and less than 4 deducted by dU (2, 319).

Then, on Kolmogorov-Smirnov (K-S) non-parametric normality test of financial performance’s and firm value’s equation showed that the data were distributed normally. The value of financial performance proxied by return of assets’ equation using the Asymp.Sig. (2-tailed) was 0,101. Besides, the firm value measured using Tobin’s Q ratio got Asymp.Sig. (2-tailed) 0,072. Both

of those values showed that residual was distributed normally since the Asymp.Sig. (2-tailed) scores

were more than the significant rate 0, 05.

The Glejser test was used to determine the heteroscedasticity by regressing its residual

absolute value. The significant value as the result of Glejser test of financial performance equation

was ranged from 0, 133 to 0, 350. Besides, for the firm value equation, the result of significant value

was ranged from 0, 393 to 0, 728. Those results showed that the data have different variants or there

was no heteroscedasticity occurred because the significant value was more than 0, 05.

Discussion and Hypothesis Testing

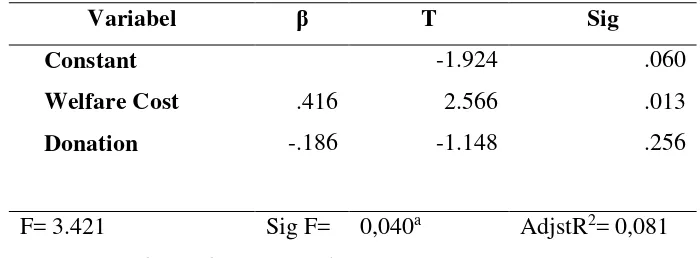

Corporate Social Responsibility Expenditure and Financial Performance

Table 4.4 below shows the results of multi regressions test for the equation of welfare cost,

Table 4.4 Summary of Financial Performance Regression Test

Variabel β T Sig

Constant -1.924 .060

Welfare Cost .416 2.566 .013

Donation -.186 -1.148 .256

F= 3.421 Sig F= 0,040a AdjstR2= 0,081

Source : Processed Secondary Data, 2015

Table 4.4 shows that the Adjusted R2 value was 0,081 which means that the dependent

variable, the employee welfare and community costs, could only explain 8,1 percents of financial

performance. While the other 91,9 percents were explained by factors other than independent

variables.

Employee Welfare Cost and Financial Performance

The regressions test result for the first hypothesis, the employee welfare cost, was β 0,416

with significancy 0, 013 indicting that the hypothesis was accepted. It could be inferred that welfare

cost positively influenced financial performances because the significant value was less than 0, 05.

Therefore, it could be inferred that welfare cost positively influenced financial performance

since the significant value was less than 0,05. This accepted hypothesis explained that a company

spending more welfare cost was able to increase company’s financial performance. By maximizing

employee welfare cost, employees would feel that the company cared of them. Consequently, the

employees would be more loyal to the company and worked harder in increasing company’s selling,

which would also increase company’s profit. The employee welfare cost did have negatif influence toward company’s profit, but the benefits acquired, which was the selling improvement, had higher value than employee welfare cost, therefore it positively influenced company’s financial performance. This result is in line with Primawati’s (2010) and Nathania’s (2013) researchs which show that the employee welfare cost positively influences return of assets.

Community Cost and Financial Performance

The result of the second hypothesis testing which was community cost proxied by donation

was β -0.186 with significancy 0, 256, thus it showed that the hypothesis was rejected. Community

value. Societies consider other factors, such as company products’ price and quality, than the company’s good image. Therefore, community cost did not affect company’s financial performance. This finding is in agreement with the studies conducted by Mardiandari and Rustiyaningsih (2013)

and Januarti and Dini (2005).

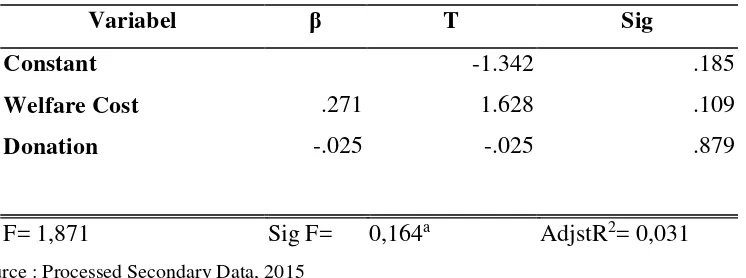

Corporate Social Responsibility Expenditure and Firm Value

The result of multi regressions test for the equation of independent variables, welfare cost and

community cost (donation) toward firm value (Tobin’s Q) is presented in the following table:

Table 4.5 Summary of Firm Value Regressions Test Result

Variabel β T Sig

Constant -1.342 .185

Welfare Cost .271 1.628 .109

Donation -.025 -.025 .879

F= 1,871 Sig F= 0,164a AdjstR2= 0,031

Source : Processed Secondary Data, 2015

Referring to table 4.5, it is presented that the Adjuster R2 value was 0,031, which means that

the independent variables, which were employee welfare cost and community cost, were only able to explain 3,1 percents of the firm value (Tobin’s Q). While the other 96,9 percents were explained by factors other than the independent variables.

Employee Welfare Cost and Firm Value

The result of regressions test for the third hypothesis, which was employee welfare cost,

showed β 0,271 with significancy 0, 109, which showed that the third hypothesis was rejected. It

indicated that employee welfare cost had no effect toward firm value as its significant value was

higher than 0,05. This hypothesis showed that employee welfare cost expended by the company did not affect company’s firm value. The high employee welfare cost might be potential in increasing the number of selling, but the high expenses on employee welfare cost would also reduce company’s

net profit if the selling did not increase higher than the expenses. Investors tended to not use employee

welfare cost as the major consideration as they invested because its financial benefit had not been

Community Cost and Firm Value

The result of the fourth hypothesis testing, which was community cost proxied by donation,

was β -0.118 with significancy 0,468 which indicated that the hypothesis was rejected. Community

cost had no influence over firm value as its significancy was higher than 0, 05. A company’s expenses

on community cost did not affect company’s stock selling level. According to the investors, the

expenses for community cost in a form of donation in order to show company’s good prospect had

not been confirmend yet. Community cost might be potential in establishing a good company image

which in the future would provide a good prospect related to the company’s continuity and growth.

However, high community cost was also not ideal for both the companies and investors as those

expenses deducted company’s nett profit. Community cost had not been able to provide specific

financial benefits for both the company and investors. Therefore the investors tended to not consider

the number of company’s community cost when they were interested to buy company’s stocks. In

conclusion, the community cost had no effect toward firm value.

CONCLUSION AND SUGGESTION

Conclusion

Based on the hypotheses testing, it could be concluded that employee welfare cost proxied by

post-retirement costs had positive influence over financial performance. Community expenditure was

proxied by donation cost had no influence over financial performance. Besides, the employee welfare

cost as well as community cost had no effect toward firm value.

Implications

From the result of the study, it was found that employee welfare positively influenced

financial performance. The companies are expected to pay attention to employee welfare cost because

it is proven increasing financial performance, particularly companies’ profit. On the other hand, the

investors may consider the corporate social responsibility expenditure in making an investment

decision, particularly the employee welfare cost since it positively influence company profitability

performance.

Limitation and Suggestion

This research only used 2 years observation period, from 2012 to 2013. Thus, it still less

represents the benefits of corporate social responsibility implementation. There were only a few

to report the donation expenses to the account of other expenses which is included in the classification

of administrative and general expenses. Based on those limitations, the future study should be able to

further analyze the detail related to donation cost which is included in the other expensess under

administrative and general cost classification. Besides, the future research may also extend the

observation period in order to obtain more samples.