Assessment of Host Country

Financial System

in Managing Foreign Grant

by:

Drajad Sulistyana

Azrin Rasuwin

Assessment of Host Country Financial System in Managing Foreign Grant

by

Drajad Sulistyana Azrin Rasuwin

Editors:

Pahala Nainggolan Rony Megawanto Handoko Adi Susanto

TABLE OF CONTENTS

FOREWORD 5 GLOSSARY 6

EXECUTIVE SUMMARY 9

CHAPTER I: INTRODUCTION 13

A. Scope of Work 15

B. Methodology 16

C. Relevant Regulations 17

CHAPTER II: PLANNING 21

A. Planned grants 17

B. Direct Grants 19

C. Conclusions 20

CHAPTER III: BUDGETING 27

A. Planned Grants 30

B. Direct Grants 31

C. Conclusions 31

CHAPTER IV: IMPLEMENTATION/FUNDS DISBURSEMENT 33

CHAPTER V: ACCOUNTING AND REPORTING 39

CHAPTER VI: AUDITING 43

CHAPTER VII: FRAMEWORK FOR THE RECEIPT OF FOREIGN GRANTS USING THE

GOVERNMENT SYSTEM 45

A. Receipt of Foreign Grants by Local Governments through the MMAF 46

B. Receipt of Foreign Grants by Local Governments through a Trust Fund 50

C. Receipt of Foreign Grants by NGOs through the MMAF under the Direct Grant

Mechanism 52

D. Receipt of Foreign Grants by NGOs through a Trust Fund under the Direct

Grant Mechanism 54

Host Country System (HCS) concerns the government’s inancial system in the management of foreign grants speciically directed to marine conservation activities and constitutes a component of Marine Protected Areas Governance (MPAG) program year one. This component includes three main activities namely, assessment, design development, and training / workshops on HCS.

HCS Assessment attempts to see how inancial system in the Ministry of Marine Affairs and Fisheries (MMAF) works in channeling foreign grants for local governments, NGOs, community groups, etc. This study is important because on the one hand at the national level the government has issued Presidential Regulation No. 80 Year 2011 concerning the Trust Fund, and at the regional level an initiation has commenced to develop the inancial management system of Regional Public Service Agencies (Badan Layanan Umum Daerah - BLUD). On the other hand, however, there is yet any such operational institution as Trustees and BLUD which can be used as a model.

This study reviews regulations related to ways of grant funds distribution, including through the mechanism of Trustees. A series of consultation with relevant parties, particularly with the Ministry of Finance and Bappenas, has been exercised. Founded on the results of this study, a design of grant chanelling is developed and subsequently disseminated through training / workshops attended by MMAF staff representing different directorates, such as KKJI (Conservation for Areas and Fish Species), Legal Bureau, Secretariat of Directorate General of KP3K (Marine, Coastal and Small Islands), Inspectorate General, Research and Development Agency, and Finance Bureau.

We hope anyone involved in marine conservation can beneit form this study.

Author

GLOSSARY

APBD Anggaran Pendapatan dan Belanja Daerah - Local Government Budget APBN Anggaran Pendapatan dan Belanja Negara - State Budget

Bappenas Badan Perencanaan Pembangunan Nasional - National Development Planning Agency

BAST Berita Acara Serah Terima - Minutes of Handover

BLN Bantuan Luar Negeri - Foreign Aid

BPK Badan Pemeriksa Keuangan - Supreme Audit Agency

BPKP Badan Pengawasan Keuangan dan Pembangunan - Finance and Development Controller

BUMD Badan Usaha Milik Daerah - Local Government-Owned Enterprise BUMN Badan Usaha Milik Negara - State-Owned Enterprise

BUN Bendahara Umum Negara - State General Treasurer

CALK Catatan atas Laporan Keuangan - Financial Report Notes COREMAP Coral Reef Rehabilitation and Management Program CTI Coral Triangle Initiative

CTSP Coral Triangle Support Partnership

DIPA Daftar Isian Pelaksanaan Anggaran - Budget Implementation Registration Form

Dit EAS Direktorat Evaluasi Akuntansi dan Setelmen, Direktorat Jenderal Pengelolaan Utang, Kementerian Keuangan - Directorate of Accounting, Evaluation and Settlement, Directorate General of Loan Management, Ministry of Finance Dit PA Direktorat Pelaksanaan Anggaran, Direktorat Jenderal Perbendaharaan,

Kementerian Keuangan - Directorate of Budget Implementation, DG of Treasury (DJPb)

Dit PKN Direktorat Pengelolaan Kas Negara, Direktorat Jenderal Perbendaharaan, Kementerian Keuangan - Directorate of State Treasury Management, DG of Treasury (DGPb)

DJPb Direktorat Jenderal Perbendaharaan, Kementerian Keuangan - Directorate General of Treasury, Ministry of Finance

DJPK Direktur Jenderal Perimbangan Keuangan, Kementerian Keuangan - Director General of Fiscal Balance, Ministry of Finance

DJPU Direktorat Jenderal Pengelolaan Utang, Kementerian Keuangan - Directorate General of Debt Management, Ministry of Finance

DKP Dinas Kelautan dan Perikanan - Marine Affairs and Fisheries Ofice

DPA Daftar Pelaksanaan Anggaran - Budget Utilization List

DPR Dewan Perwakilan Rakyat - House of Representatives

DRKH Daftar Rencana Kegiatan Hibah - Planned Activities for Grant Funding List DRPPHLN Daftar Rencana Prioritas Pinjaman dan/atau Hibah Luar Negeri - List of Planned

Planning Green Book)

DRPHLN-JM Daftar Rencana Pinjaman dan/atau Hibah Luar Negeri Jangka Menengah - List of Medium-Term Planned External Loans and Grants (Ministry of Planning Blue Book)

GOI Government of Indonesia

K/L Kementerian/Lembaga - Ministry/Government Agency

Keppres Presidential Decree

KKJI Konservasi Kawasan dan Jenis Ikan - Directorate of Marine Areas and Fish Species Conservation

KKLD Kawasan Konservasi Laut Daerah - District Marine Protected Area KKP 1) Kawasan Konservasi Perairan - Marine Protected Area

2) Kementrian Kelautan dan Perikanan - Ministry of Marine Affairs and

Fisheries

KKP3K Kawasan Konservasi Perairan dan Pulau-pulau Kecil - Marine Protected Areas and Small Islands

KKPN Kawasan Konservasi Perairan Nasional - National Marine Protected Area

KPA Kuasa Pengguna Anggaran - Proxy Budget User

KP3K Direktorat Jendral Kelautan, Pesisir dan Pulau Pulau Kecil - Directorate General of Marine, Coastal and Small Islands Affairs, Ministry of Marine Affairs and Fisheries

KPPN Kantor Pelayanan Perbendaharaan Negara - State Treasury Service Ofice

KUN Kas Umum Negara - State General Treasury

LKPP Laporan Keuangan Pemerintah Pusat - National Government Financial Report

LRA Laporan Realisasi Anggaran - Budget Realization Report

LSM Lembaga Swadaya Masyarakat - Non-Government Organization

LWA Lembaga Wali Amanat - Trustee Institution

MPAG Marine Protected Areas Governance program

MPHL-BJS Memo Pencatatan Hibah Langsung Bentuk Barang/Jasa/Surat Berharga - Record of Direct Grant in the Form of Goods/Services/Securities

MRP Marine Resources Program

MWA Majelis Wali Amanat - Board of Trustees

NGO Non-Government Organization

NTT Nusa Tenggara Timur - East Nusa Tenggara

PA Pengguna Anggaran - Budget User

PDA Pengelola Dana Amanat - Trust Fund Manager

PP Peraturan Pemerintah - Government Regulation

PPN Perencanaan Pembangunan Nasional - National Development Planning

RAPBD Rencana Anggaran Pendapatan dan Belanja Daerah - Draft Local Government Budget

RAPBN Rencana Anggaran Pendapatan dan Belanja Negara - Draft State Budget Renja-K/L Rencana Kerja-Kementerian/Lembaga - Ministry/Government Agency Work

Renstra Rencana Strategis - Strategic Plan

RKA-K/L Rencana Kerja dan Anggaran Kementerian/Lembaga - Ministry/Government Agency Work and Budget Plan

RKA-SKPD Rencana Kerja dan Anggaran Satuan Kerja Perangkat Daerah - Local Government Ofice Work and Budget Plan

RKP Rencana Kerja Pemerintah - Government Work Plan

RKUD Rekening Kas Umum Daerah - Local Government General Treasury Account RKUN Rekening Kas Umum Negara - State General Treasury Account

RPH Rencana Pemanfaatan Hibah - Grant Utilization Plan

RPJM (N) Rencana Pembangunan Jangka Menengah (Nasional) - (National) Mid-Term Development Plan

RPJP Rencana Pembangunan Jangka Panjang - Long-Term Development Plan SA-BUN Sistem Akuntansi Bendahara Umum Negara - State General Treasurer

Accounting System

SAI Sistem Akuntansi Instansi - Government Agency Accounting System

Satker Satuan Kerja - Work Unit

SKPD Satuan Kerja Perangkat Daerah - Local Government Work Unit SP2D Surat Perintah Pencairan Dana - Funds Disbursement Order

SP2HL Surat Perintah Pengesahan Hibah-Langsung - Direct Grant Validation Order SP3HL-BJS Surat Perintah Pengesahan Pendapatan Hibah Langsung Bentuk Barang/Jasa/Surat

Berharga - Direct Grant in the Form of Goods/Services/Securities Validation Order

SPHL Surat Pengesahan Hibah-Langsung - Direct Grant Validation Letter

SPM Surat Perintah Membayar - Payment Order

SPTJM Surat Pernyataan Tanggung Jawab Mutlak - Statement of Absolute Responsibility

SSME Sulu-Sulawesi Marine Ecoregion

TNP Taman Nasional Perairan - Marine National Park

UAKPA-BUN Unit Akuntansi Kuasa Pengguna Anggaran Bendahara Umum Negara - Proxy Budget User Accounting Unit - State General Treasurer

UAP-BUN Unit Akuntansi Pembantu Bendahara Umum Negara - Supporting Accounting Unit - State General Treasurer

UAPPA/B-E1 Unit Akuntansi Pembantu Pengguna Anggaran/Barang tingkat Eselon-1 - Echelon 1 Budget/Goods User Supporting Accounting Unit

UAPPA/B-W Unit Akuntansi Pembantu Pengguna Anggaran/Barang tingkat Wilayah - Regional Level Budget/Goods User Supporting Accounting Unit

Marine Protected Areas Governance (MPAG) program is a USAID-funded program that aims to support the Government of Indonesia (GOI) to achieve its commitment of developing 20 million hectares of Marine Protected Areas (MPAs) by 2020, along with the effective and sustainable management of these MPAs.

The Jakarta Commitment, launched in 2009 by the National Development Planning Agency (Bappenas), has been endorsed by representatives from 22 agencies/donor countries, including the US Government. This commits USAID and the Government of Indonesia to implementing the spirit of this agreement through the enhancement of Host Country Systems (HCS) for effective grant management.

MPAG is required to conduct an assessment of the HCS with regard to grant management, with a particular focus on the marine conservation sector. This assessment was conducted within relevant work units at the Ministry of Marine Affairs and Fisheries (MMAF) as the government institution responsible for marine conservation activities in Indonesia.

The objectives of this assessment are threefold: (1) provide an overview of the various inancial regulations that are currently in place, including the most recent of these that relate to foreign grants; (2) provide an overview of the implementation of these regulations in relevant work units; and (3) provide conclusions on these regulations and the implementation of grant management.

The conclusions provided on the reliability of the HCS with regard to grants are made with reference to the cycle of planning, budgeting, fund disbursement, program implementation, inancial reporting, and auditing. This assessment is expected to serve as an input to USAID in making of decisions on the use of the HCS in the management of grants provided to Indonesia.

This assessment will also look at the management of foreign grants within the marine conservation sector in the form of: (1) planned grants; (2) direct grants; and (3) direct grants in goods/services. It will also examine how these are managed within each of the following phases of the government inancial cycle listed below.

PLANNING PHASE

With regard to planned grants, there are existing regulations that stipulate procedures for foreign grants in the planning phase of activities/programs. However, the implementation of these

regulations in the marine conservation sector still requires improvement, as planning processes still do not adequately refer to annual baseline data and progress made against performance indicators.

With regard to direct grants, including those in the form of goods/services, although referred to in some regulations, they were found to have not been included in government inancial system planning processes within the marine conservation sector. This is due to the fact that direct grants are mainly implemented outside the government inancial system.

BUDGETING PHASE

The budgeting phase follows on from the planning phase. With planned grants there are regulations in place in relation to budgeting processes that are also currently implemented, including within the marine conservation sector.

In the case of direct grants, as they are not included in the planning phase they are thus implemented outside of the government system. In the marine conservation sector such grants are are often termed ‘off-budget, off-treasury’. However, according to government regulations, direct grants can actually be incorporated into the government system through a revision of the government’s Budget Implementation Registration Form (DIPA).

IMPLEMENTATION/FUNDS DISBURSEMENT PHASE

For planned grants, as is the case with the planning and budgeting phases, the mechanism with regards to implementation/funds disbursement is also clearly regulated. One problem that has been identiied in regards to this relates to activity implementation falling behind schedule.

The funds disbursement process for direct grants cannot be discussed here, as such grants generally sit outside of the government system, except for those that are accommodated through a revision of the DIPA. Any disbursement outside of the state treasury can still be accounted for in the government system as long as the relevant bank accounts and grants are registered, and the disbursement records are reported to the state treasury.

REPORTING PHASE

A inancial reporting/accounting mechanism and procedures for its implementation have been prepared for both planned and direct grants. One problem that has been identiied in connection to this is a lack of human resources capacity in regards to reporting, including insuficient understanding of new regulations issued by the Ministry of Finance/Bappenas. A problem identiied in relation to direct grants is that if the actual use of a grant is not reported, then neither will it be recorded in the Ministry of Finance’s inancial reports.

AUDITING

The Inspectorate General of MMAF normally conducts audits with regard to foreign grants outside of speciic work programs. One problem that has been identiied here is that auditors’ understanding of the accounting system, including with regard to the reporting of foreign grants, still needs improvement in order to ensure that reviews of the MMAF’s inancial reports are more effective.

Through the Marine Protected Areas Governance program (MPAG), USAID provides grants to consortium-member NGOs via a mechanism that can be classiied as ‘off-budget, off-treasury’. The term ‘off-budget’ describes the mechanism whereby a grant received by an organization in Indonesia is not recorded in the government inancial system nor mentioned in the budget of any ministry/government agency. The term ‘off-treasury’ refers to the mangement of grants outside the state treasury, including with regard to grant revenue and expenditure. In this case, grants are provided to the recipient through a private bank account that has no oficial government connection.

In general, grants are awarded by USAID to the Government of Indonesia through contractors: either companies, or non-proit organizations such as universities and NGOs, among others. They are furthermore distributed to agencies for implementation according to approved work plans at the ministerial, district/city, or even community level.

The grants are not recorded in the government inancial system from the planning to the auditing phase, although some attempts have been made to synchronize grant-funded activities with government programs during the implementation phase. However, this so-called synchronization process is only ever informal and performed on an ad hoc basis. Similarly, the management of funds, including with regard to both revenue and expenditure, is not conducted through the government treasury system as coordinated by the Directorate General of Treasury, Ministry of Finance (DJPb).

Meanwhile, the 2005 Paris Declaration has created strong momentum to change the way developing countries and their development partners interact with each other to maximize the beneits derived from foreign aid in the achievement of the host country’s national development goals. Indonesia has a long history as a recipient of foreign aid, in the form of both loans and grants. In the Government’s 2012 annual budget, foreign aid contributed to less than ive percent of the total, and foreign grants as a part of that made up less than one percent. Foreign grants are used mainly to facilitate the exchange of information and lessons learned in the strengthening of national capacity. In the spirit of the principles of the Paris Declaration, such as host country ownership and alignment, Indonesia announced the introduction of the Jakarta Commitment on January 12, 2009. Signed by 26 development partner representatives, it aims to guide the implementation of the objectives of the aforementioned declaration. This announcement was then followed by the establishment of the Aid for Development Effectiveness Secretariat

(A4DES) by Bappenas, aimed at facilitating and monitoring the implementation of the Jakarta Commitment road map, at the same time as including Civil Society Organizations (CSOs) in national development processes.

The 2010 USAID FORWARD initiative is set to change the way the Agency does business, with new partnerships, an emphasis on innovations and a relentless focus on results. It therefore gives USAID the opportunity to transform its institution and unleash its full potential to achieve high-impact development.

One of the USAID FORWARD key areas is the Implementation and Procurement Reform: USAID will change its business processes--contracting with and providing grants to more and varied local partners, and creating true partnerships to create the conditions where aid is no longer necessary given to the countries where the Agency works. To achieve this, USAID is streamlining its processes, increasing the use of small businesses, building metrics into its implementation agreements to achieve capacity building objectives and using host country systems where it makes sense.”

The ideal Host Country System (HCS) allows foreign grants to be ‘On Plan, On Budget, On Treasury, and On Audit’. ‘On Plan’ means that foreign grants should be included in either the MMAF and/or local government mid-term and annual plans. They should be accompanied by clearly identiied targets and structured to support the achievement of national program outcomes. ‘On Plan’ also means that foreign grants have been anticipated and accommodated in institutions’ strategic plans and annual operating plans. ‘On Budget’ means that foreign grants are included in MMAF and/or local government inancial reports, which relect all resources available to the government in achieving its program targets. ‘On Treasury’ means that foreign grants are channeled via the government treasury system. Lastly, ‘On Audit’ requires foreign grant-funded activities to be covered by the government audit system.

The Government of Indonesia (GOI) has demonstrated its commitment to achieving these requirements through a series of efforts such as the implementation of regulatory improvements, the enforcement of current regulations and the development of tools to assist in moving closer to the ideal conditions outlined above. A series of public inancial regulations issued in early 2000 led to changes in the structure of the GOI’s inancial system. Of note was the segregation of national government unit (ministry) budgets and local government budgets, as part of the implementation of decentralization. Also of note was the introduction of new funding channels called grants or social aid. These can be awarded to NGOs that submit successful project proposals that work towards the achievement of ministry or local government performance indicators, as part of efforts to improve public engagement. The allocation of this funding is the discretionary authority of ministers or heads of local government. However, this approach has proven problematic due to its lack of transparency and accountability, which has led to misuse.

with regard to the receipt and management of foreign grants that is used by the government in general, and more speciically within the marine sector or marine conservation sector.

A. SCOPE OF WORK

The assessment includes the ‘upstream stage’, which refers to the process of developing Indonesian marine conservation strategic plans and their derived annual work plans. This aims to determine government and other stakeholders’ roles in the achievement of targets or performance indicators, in the lead-up to the allocation of funding. The assessment also includes the ‘downstream stage’, which consists of the annual government budgeting process. This aims to ensure that annual government budgets relect their annual plans, which in turn derive from the medium-term development framework. This process may identify inconsistencies between planning and resource allocation for programs or activities. It is also expected to identify gaps in the funding provided by national and local governments that need to be illed, and that should be available for the marine conservation sector in Indonesia.

The planning stage is key to the subsequent stages in the inancial process, especially when foreign grants are not recorded in planning activities, which is then relected in government budget and implementation documents. The process of budgeting, funds disbursement, and inancial reporting depends heavily on the planning process, as any grant that goes unrecorded in government planning will not be able to be identiied at the later stages.

The assessment of the budgeting process will include the channeling of funds to other parties, such as NGOs, local governments, and communities. This covers the mechanism used to distribute funds to ultimate recipients, the inancial management of the funds, and the procurement of goods/services using these funds. Budget effectiveness is a critical point for assessment here, to ensure that proposed budgets are suficient to enable the achievement of performance indicators, which is a priority of government programs.

Government processes in relation to the procurement of goods and services will also be visited to provide information on transparency and accountability. Monitoring and control of the utilization of goods and services will also be assessed. This aims to ensure the reliability and integrity of processes as well as the suficiency of regulations with regard to foreign grants.

The funds disbursement process in the government system will also be examined, starting with requests for payment, up to the disbursement of funds to third parties. Government units have

1. Source: USAID Factsheet: 2010, USAID Announces USAID FORWARD Reform Agenda, USAID

website: http://transition.usaid.gov/press/factsheets/2010/fs101118.html

2. Source: Lister: 2008, Risks and Rewards in Using Country Systems, Mokoro Seminar, Oxford as

actually managed this process for years and revisiting it is considered necessary to assess the associated timeframes and any accompanying complications.

The inancial reporting mechanism used at the lowest units of government or non-government organizations will be assessed, and comparison made between the existing relevant regulations and actual performance. This aims to determine the exact timeframe required to complete, and contents of, reports produced as part of the government periodic reporting system. Samples will be taken to ensure that the quality of information submitted is suficient.

Monitoring and evaluation activities with regard to government-funded programs will be assessed for effectiveness through an examination of available reports and documents, this will include related follow-up activities. Monitoring and evaluation methodologies and tools will also be assessed to see whether any additional approaches can be adopted.

Auditing and oversight processes include both the internal and external auditing of government-funded activities, including those implemented at the district level. The inancial auditing system will be visited to evaluate the adequacy of its technical aspects. This will include an analysis of audit report samples, along with an assessment of auditor competency and supervisory mechanisms.

Performance auditing is conducted with regard to activities funded by the annual government budget. This component of the auditing program along with related reports will be analyzed to assess the suficiency of technical aspects. Follow-up of results will also be focused on as a critical element in the auditing process. Finally, conclusions will be made on the adequacy of existing government inancial and performance auditing practices and whether additional auditing is needed.

B. METHODOLOGY

In the initial stages, this assessment was conducted as a desktop study, which was then followed by interviews with related oficials. Afterwards, a series of structured interviews were undertaken with oficials related to the topics in question, followed up by further research with reference to relevant written material.

C. RELEVANT REGULATIONS

There are a variety of regulations relevant to the government inancial system and grants. They are as follows:

1. Law No. 25 of 2004 on the National Development Planning System. This law sets out development planning procedures, including the production of long-term, mid-term, and annual development plans for implementation by national and local levels of government with the involvement of the community.

2. Law No. 17 of 2003 on State Finance. This contains the deinition of state inance, and asserts the President’s authority over the management of state inancial matters, including the preparation and decreeing of the state/local government budgets. It also provides direction on the inancial relationship between national and local levels of government, the implementation of the state/local government budget, and accountability with regard to state inancial management.

3. Government Regulation No. 10 of 2011 on Procedures for the Procurement of Foreign Loans and Receipt of Grants. This sets out, among other matters, the receipt of grants through two alternatives (planned and direct), through trust funds and through foreign grants that can be lent or forwarded on to local governments, or lent to State-Owned Enterprises (BUMN).

4. Government Regulation No. 2 of 2012 on Grants to Local Governments. This emphasizes, among other matters, that foreign grants to local government should be chanelled through the national government via a grant-forwarding mechanism.

5. Government Regulation No. 90 of 2010 on the Preparation of Ministry/Government Agency Work and Budgets Plans (RKA-K/L). This sets out the processes and timeframes for the preparation of RKA-K/Ls within the framework for the development of the Draft State Budget (RAPBN).

6. Presidential Decree No. 80 of 2011 on Trust Funds. This regulates the mechanism for the chaneling of grants through trust funds established by a ministry through a ministerial work unit.

8. Minister of Finance Regulation No. 191/PMK.05/2011 on Grant Management Mechanisms. This regulates the procedures for verifying direct grants received by the government, both in the form of cash and goods/services.

9. Minister of Finance Regulation No. 230/PMK.05/2011 on the Grant Accounting System. This sets out accounting procedures with regard to grant income and expenditure. It appoints: the Directorate General of Debt Management (DJPU) as the supporting accounting unit for the State General Treasurer for managing grants; the Directorate of Accounting Evaluation and Settlement as the accounting unit for the Proxy Budget User - State General Treasurer (KPA-BUN) for grant income and expense transactions; and the Directorate General of Fiscal Balance as the Proxy Budget User Accounting Unit - State General Treasurer (UAKPA-BUN) for grant expenditure transactions to local governments.

10. Minister of Finance Regulation No. 151/PMK.05/2011 on the Procedures for Foreign Loan and/or Grant Withdrawal. This sets out the ive methods for withdrawing foreign grants (planned grants).

11. Minister of Finance Regulation No. 169/PMK.05/2011 on the Procedures for Forwarding Grants to Local Governments. This appoints the Director General of Fiscal Balance as the Proxy Budget User (KPA) for the provision of grants to local governments, the preparation and validation of the Annual Budget Allocation Document (DIPA), and the channeling of grants to local governments.

12. Director General of Treasury Regulation No. 81/Pb/2011 on the Procedures for Validating Direct Grants in the Form of Cash and for the Submission of Records on Direct Grants in the Form of Goods/Services/Securities. This regulates the forms used for direct grants of cash, goods, services and/or securities.

Based on the above list of laws and regulations, a grant is deined as government income in the form of cash, goods, services and/or securities provided by a donor that does not need to be repaid, and that can derive from a domestic or foreign source. The government can directly beneit from such grants through their allocation as support for the basic tasks and functions of ministries/government agencies, or can forward them on to local governments, State-Owned Enterprises (BUMN), and Local Government-Owned Enterprises (BUMD).

In brief, grants can be classiied into two major types: 1. Planned grants

2. Direct grants

State Treasury Service Ofice (KPPN) (as the Local State General Treasurer (BUN)), and inally reporting on the funded activities.

Planned grants include (according to Article 48, Paragraph 2 of Regulation No. 10 of 2011): 1. A grant provided as a precursor and/or a counterpart to a loan

2. A grant that has been listed in a planning document mutually agreed upon by the government and the donor

3. A grant requiring a counterpart fund

4. A grant implemented by non-government organizations through the government

5. A grant provided under a cooperation scheme between agencies and foreign donors, such as a sister city

From the explanation provided above, it is clear that planned grants are accommodated in the government inancial system. However, USAID cannot provide these types of grants directly to the Government of Indonesia, therefore it assigns contractors, either companies or non-proit organizations, for implementation purposes.

The marine conservation project the Coral Reef Rehabiliation and Management Program (COREMAP) is one example of a planned grant that was part of the government inancial system, including its procurement of goods and services activities.

In contrast, a direct grant is a grant that is received directly and does not pass through the planning cycle, nor does it follow the state budget cycle. These grants can be provided by a donor to ministries/government agencies any time and their funds are not disbursed via the State Treasury Service Ofice (KPPN). A grant that is included in the planning process, but is not disbursed via the KPPN, is also categorized as a direct grant. In order for the process of grant receipt and use by a ministry/government agency to align with the State Budget (APBN) mechanism, the ministry/government agency is required to register the grant, request permission to open an account, revise the Annual Budget Allocation Document (DIPA), and then validate it.

Direct grants include (according to Article 48, Paragraph 3, Government Regulation No. 10 of 2011):

1. A grant for the management of natural disasters, non-natural disasters, and social disasters 2. A grant under technical cooperation between a ministry/government agency and foreign

donors for such things as workshops, training and seminars

3. A grant submitted directly to a ministry/government agency on the request of the donor

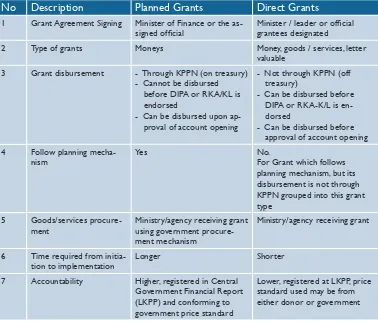

No Description Planned Grants Direct Grants

1 Grant Agreement Signing Minister of Finance or the

as-signed oficial Minister / leader or oficial grantees designated

2 Type of grants Moneys Money, goods / services, letter

valuable 3 Grant disbursement - Through KPPN (on treasury)

- Cannot be disbursed before DIPA or RKA/KL is endorsed DIPA or RKA-K/L is en-dorsed

For Grant which follows planning mechanism, but its disbursement is not through KPPN grouped into this grant type

6 Time required from initia-tion to implementainitia-tion

Longer Shorter

7 Accountability Higher, registered in Central

Government Financial Report (LKPP) and conforming to government price standard

Lower, registered at LKPP, price standard used may be from either donor or government

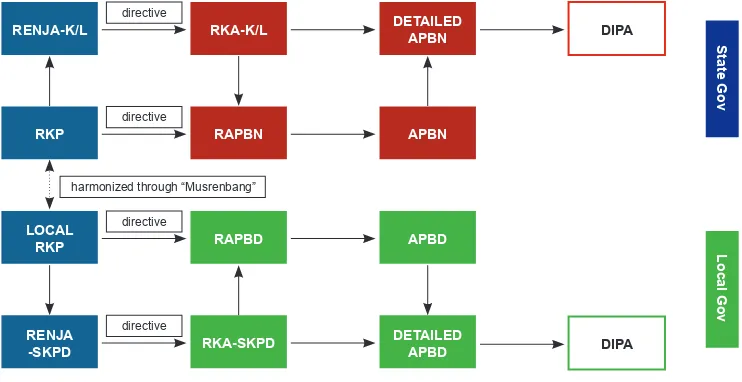

Development planning is mandated by Law No. 25 of 2004 on the National Development Planning System. National development plans consist of Long-Term Development Plans (RPJP) (20 years), Mid-Term Development Plans (RPJM) (5 years), and Annual Development Plans or Government Work Plans (RKP). These consist of an integrated development plan prepared by ministries/government agencies and local governments.

The RPJM and RKP will be referred to in the preparation of ministry/government agency strategic plans and work plans. Likewise, local government will also refer to both documents for activities performed through Local Government Work Units (SKPD).

The ‘RPJM II’ aims to stabilize the restructuring of Indonesia in all ields through emphasizing efforts to improve the quality of human resources, including providing capacity building in the ields of science and technology, and through the strengthening of economic competitiveness.

CHAPTER II

There are 11 national priorities laid out in the RPJM II, namely: 1) Bureaucratic and Governance Reform; 2) Education; 3) Health; 4) Poverty Reduction; 5) Food Security; 6) Infrastructure; 7) Investment and Business Climate; 8) Energy; 9) Environment and Disasters; 10) Remote, Frontier, Outer, and Post-Conlict Areas; and 11) Culture, Creativity, and Technological Innovation.

The MMAF itself has ive identiied priorities: 1) Bureaucratic and Governance Reform; 2) Poverty Reduction; 3) Food Security; 4) Environment and Disasters; 5) Remote, Frontier, Outer, and Post-Conlict Areas.

The work program of the Directorate of Marine Areas and Fish Species Conservation (Directorate of KKJI) falls under the ninth priority, and is thus an environment and disaster action program with a particular focus on the management and development of marine areas and ish species.

The irst performance indicator within this work program relates to the effective management of 20 percent of coral reef, seagrass, mangrove areas, and 15 species of endangered aquatic biota. Also required is the sustainable management of a total of 4.5 million hectares of marine protected areas, and freshwater and brackishwater conservation areas.

This area of 4.5 million hectares has been planned for gradual allocation over a period of ive years. The cumulative allocations per year (in hectares) are as follows: 900,000 (2010), 2.5 million (2011), 3.2 million (2012), 3.7 million (2013), and 4.5 million (2014).

The second performance indicator relates to the accurate identiication and mapping of marine protected areas and protected aquatic biota species. The size of these conservation areas is to measure 2 million hectares in total. Once again, these areas will be distributed progressively, with the non-cumulative allocations per year (in hectares) as follows: 700,000 (2011), 500,000 (2012), 500,000 (2013), and 300,000 (2014). The number of protected species of aquatic biota (after revision) is three species, increasing by three species each year from 2010 to 2014.

The number of marine protected areas as of June 2012 was 108, spanning a total of 15.7 million hectares. The government’s target is to establish 20 million hectares by 2020. Of this total area, 30% is currently managed by the Ministry of Forestry, 35% by the MMAF, and the remaining 35% by local government.

The indicator relating to the sustainable management of marine conservation areas refers to the management strategies found in Marine Conservation Area Management Plans which are required to be prepared by area management organizational units in accordance with the Minister of Marine Affairs and Fisheries Regulation No. PER.30/MEN/2010 dated December 30, 2010 on the Management and Zoning Plans for Marine Protected Areas.

A. PLANNED GRANTS

The planning process starts with the submission of the proposed activities to be inanced by a grant to the Minister of National Development Planning (hereinafter called the ‘Minister of Planning’), who then assesses the proposed activities, paying particular attention to the aspects of technical feasibility and compatibility with overall government planning. Based on the results of this, the Minister of Planning inalizes the Planned Activities for Grant Funding List (DRKH). This is an annual list of planned activities eligible for funding via grants and/or that prospective donors have alrady expresssed an interest in funding. The DRKH is prepared with reference to the National Mid-Term Development Plan (RPJM{N}) and the Grant Utilization Plan (RPH). The RPH is a document containing policy directions and strategies relating to the utilization of grants in the mid-term (ive-year) in accordance with national development priorities. The RPH is prepared with reference to the RPJM(N).

Furthermore, the DRKH is also submitted to the Minister of Finance for use as a document for presentation to prospective donors outlining potential projects suitable for funding via grants. It is also conveyed to the ministries/government agencies that have submitted project proposals as an input to the preparation of ministry, government agency, local government and/or state-owned enterprise work plans. The above planning process is in accordance with the Minister of Planning Regulation No. 4 of 2011 dated October 24, 2011.

Minister Planning Minister Finance Minister

Propose activities

inanced by grants

a. Assess the proposed activities refrerred to RPJM and Grant Use Plan (RPH)

b. Assessement result is

determined by DRKH c. Submit DRKH to the

Ministry and Minister of

Finance

a. Propose activities funded

by Grants to Prospective Donors

b. Negotiate and sign off agreement

c. Submit agreement to K/L

START

Figure 2. Planned-grants

Planned grants for conservation activities to be implemented by the Directorate of KKJI are required to meet the following criteria:

1. A planned grant should fulill the six principles guiding the receipt of grants, namely: transparent, accountable, eficient and effective, prudent, without political ties, and free from content that has the capacity to threaten state security (Article 2, Government Regulation No. 10 of 2011).

2. Any grant for conservation activities shall align with the Mid-Term Development Plan (RPJM) and/or MMAF Strategic Plan, and the Five-Year Grant Utilization Plan, particularly that of the Directorate of KKJI.

Grants are directed toward the achievement of the Directorate of KKJI performance indicators, namely the sustainable management of 21 selected areas by 2014, to be measured by the achievement of a management level of ‘green’ and ‘blue’ in 12 areas, and of at least ‘yellow’ in the other nine remaining areas.

The adequacy of funds for conservation management and development can be assessed by comparing the overall budget of the Directorate of KKJI- the funds that it manages directly, local government funds, Deconcentration funds, and Assignment Tasks as well as other existing grants with potential funds identiied in the MMAF Strategic Plan.

According to the Strategic Plan, the total funds required for the management and development of marine conservation areas and ish species in 2013 was IDR 190.2 billion, and in 2014 IDR 220.7 billion. Funding has increased since 2010 in line with the increasing size of the conservation areas.

In 2010, the total managed conservation area in hectares was 900,000, increasing to 2.5 million in 2011, 3.2 million in 2012, 3.7 million in 2013 and 4.5 million in 2014. In 2011, the budget allocated to the Directorate of KKJI was IDR 136 billion.

The Directorate of KKJI was the recipient of a planned grant through the Coral Reef Rehabilitation and Management Program (COREMAP) Work Unit for COREMAP II activities from 2005 to 2011. This program was irst listed in the Ministry of Planning Blue Book (List of Medium-Term Planned External Loans and Grants - DRPHLN-JM) and then the 2011 Green Book (List of Planned Priority Activities for Funding by Foreign Loans and Grants - DRPPHLN).

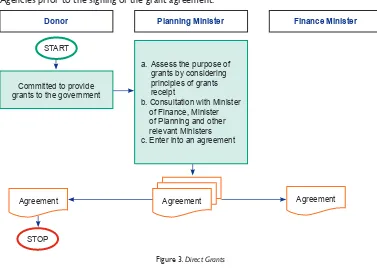

B. DIRECT GRANTS

Direct grants do not pass through the planning phase and can be received at any time during the iscal year. Ministries/government agencies assess the purpose of these grants are responsible for them upon receipt, and will consult the most recent Direct Grant Utilization Plan along with the Minister of Finance, Minister of Planning, and other related Ministers/Heads of Government Agencies prior to the signing of the grant agreement.

Donor Planning Minister Finance Minister

Committed to provide

grants to the government

a. Assess the purpose of

grants by considering principles of grants

receipt

b. Consultation with Minister of Finance, Minister

of Planning and other

relevant Ministers

c. Enter into an agreement

START

STOP

Agreement Agreement

Figure 3. Direct Grants

Agreement

The Directorate General of KP3K received a direct grant in 2011 through the Directorate of Coastal and Marine Affairs work unit (Satker) of IDR 435,600,000.

The Coral Triangle Support Partnership (CTSP)/Marine Protected Areas Governance program (MPAG) is one example of a program funded by a grant that is not channeled through the government inancial mechanism, and that is thus also not included in the mechanisms of planning, budgeting, implementation/funds disbursement, and recording (‘off-budget, off-treasury’).

C. CONCLUSIONS

• The planning processes within government work units are yet to be integrated with the results of monitoring from previous years or of program progress. This has been caused by a lack of available baseline data for each program that would allow progress in each iscal year to be monitored and then used as an input for planning in subsequent periods.

• The decentralization of authority to the district/city level has complicated the planning process with regard to the achievement of conservation targets. The MMAF cannot instruct any district/city to establish marine protected areas or to encourage more effective management. Subsequently, as some activities are located within districts/cities and thus fall under separate authorities, this poses a challenge for the planning mechanism and the achievement of national targets. In some cases, district/city- and ministry-level planning activities are not synchronized, with efforts to acutally achieve this further complicated by the issue of local autonomy.

• Planned grants accorded with the government planning mechanism, because such grants are already in the government inancial system and are generally associated with the receipt of foreign loans.

• Planned grants relating to these loans lowed along the loan period. Following this, at the closing of the loan/grant, activities were either not continued or the government assumed responsibility for funding, however now with a much lower budget than before, which negatively affected the achievement of activity targets.

CHAPTER III

BUDGETING

The completion of annual planning activities is followed by the budgeting process. The relevant regulations relating to this are: Government Regulation No. 90 of 2010 on the Preparation of State Ministry/Government Agency Work Plans and Budgets; and the Minister of Home Affairs Regulation No. 13 of 2006 on Guidelines for Local Government Financial Management for local governments.

Based on the Ministry/Government Agency Work Plan (Renja-K/L) and the Government Work Plan (RKP), the Ministry/Government Agency prepares a Ministry/Government Agency Work and Budget Plan (RKA-K/L). Before being inalized, the RKA-K/L is irst discussed in Parliament and then reviewed by the Ministry of Finance. Based on the RKA-K/L, the Draft State Budget (RAPBN) can be prepared. If the RAPBN is approved, in accordance with regulations it then becomes the State Budget (APBN). The APBN consists of a revenue budget, an expenditure budget, and a inancing budget. Details of the APBN then provided through its ratiication as a Presidential Decree.

Preparing the proposed budget for activities or programs starts with the planning process. An activity or program will not be allocated a budget if it is not irst included in the planning of activities. As a result, if it is not budgeted, it will also not be included in the subsequent processes of funds disbursement, inancial reporting and auditing.

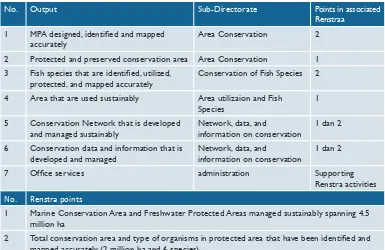

The Directorate of Marine Areas and Fish Species Conservation (Directorate of KKJI) work unit (Satker) (Satker code: 465167) prepares an RKA-K/L document annually. There are two activities linked to the performance indicators in the MMAF Strategic Plan with a budget of IDR 11.8 billion, namely:

1. The sustainable management of 4.5 million hectares of marine protected areas, and freshwater and brackishwater conservation areas

2. The accurate identiication and mapping of protected areas and species of aquatic biota (2 million hectares and six species)

Furthermore, there are seven outputs to be implemented by ive Sub-Directorates that sit under the Directorate of KKJI. These outputs and their relation with the Strategic Plan are as follows:

The above table shows that two points in the Strategic Plan fall under the responsibility of four Sub-Directorates, namely: Area Conservation; Fish Species Conservation; Area and Fish Species Utilization; and Conservation Network, Data and Information. In addition, the Administration Sub-Division supports the activities of the other four Sub-Directorates as well as performing its own basic tasks and functions.

Six outputs are generated to support the achievement of the above two points in the Strategic Plan, namely: marine protected areas that are designed, identiied, and mapped accurately; the protection and preservation of conservation areas; the sustainable utilization of conservation areas; ish species that are identiied, utilized, protected, and mapped accurately; the development

No. Output Sub-Directorate Points in associated Renstraa

1 MPA designed, identiied and mapped

accurately

Area Conservation 2

2 Protected and preserved conservation area Area Conservation 1

3 Fish species that are identiied, utilized, protected, and mapped accurately

Conservation of Fish Species 2

4 Area that are used sustainably Area utilizaion and Fish Species

1

5 Conservation Network that is developed and managed sustainably

Network, data, and information on conservation

1 dan 2

6 Conservation data and information that is developed and managed

Network, data, and information on conservation

1 dan 2

7 Ofice services administration Supporting

Renstra activities

No. Renstra points

1 Marine Conservation Area and Freshwater Protected Areas managed sustainably spanning 4.5 million ha

2 Total conservation area and type of organisms in protected area that have been identiied and

mapped accurately (2 million ha and 6 species)

and sustainable management of conservation networks; and the development and management of conservation data and information.

1. The output entitled ‘marine protected areas that are designed, identiied, and mapped accurately’ includes such activities as: identifying prospective MPAs, facilitating the strengthening of prospective MPAs, and facilitating the evaluation of established MPAs. This output also relates with the plan to extend conservations areas by 700,000 hectares in 2011.

2. The output entitled ‘the protection and preservation of conservation areas’ covers such activities as: organizing workshops and providing consultation services; providing simulations of MPA management models; and facilitating coaching with regard to turtle-based MPAs. This output also relates to the sustainable management of marine conservation areas.

3. The output entitled ‘the sustainable utilization of areas’ covers such activities as: facilitating coaching with regard to MPAs; preparing standard operating procedures on MPA utilization, MPA utilization pilot projects, trainings, and workshops; and the management of turtle habitats. This output is also related to the sustainable management of marine conservation areas.

4. The output entitled ‘the development and sustainable management of conservation networks’ covers such activities as: supporting the Sulu-Sulawesi Marine Ecoregion (SSME) and the Coral Triangle Initiative (CTI); organizing an international convention to support area and ish species conservation management networks; and facilitating Komnasko meetings. This output is related to points 1 and 2 in the Strategic Plan.

5. The output entitled ‘the development and management of conservation data and information’ covers such activities as updating data and information on conservation. This output is also related to points 1 and 2 of the Strategic Plan.

In order to improve the eficiency and effectiveness of government administration, and to develop the capacities of management and the local marine affairs and isheries public service, programs and activities in the marine affairs and isheries sector have been implemented based on the principles of ‘Deconcentration’ and ‘Assignment Tasks’. The Minister of Marine Affairs and Fisheries Regulation No. PER.25/MEN/2010 dated December 31, 2010 stipulates that as of 2011 the responsibility for the administration of marine affairs and isheries is to be delegated to Governors as the government representatives in charge of Deconcentration and to the provincial or district/city level as those in charge of Assignment Tasks. Deconcentration funds are non-physical while Assignment Tasks are physical. This Regulation applies to the Directorate General of KP3K as a whole, and not to speciic directorates.

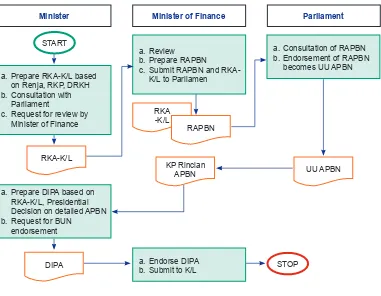

A. PLANNED GRANTS

Based on the Ministry/Government Agency Work Plan (Renja-K/L) and the Government Work Plan (RKP), Ministry/Government Agencies then prepare a Ministry/Government Agency Work and Budget Plan (RKA-K/L). The Planned Activities for Grant Funding List (DRKH) is one of the documents required for its preparation. Before being inalized, the RKA-K/L is discussed in Parliament and subsequently reviewed by the Ministry of Finance. The RKA-K/L is then used as a basis for the preparation of the Draft State Budget (RAPBN).

The Government is required to submit the RAPBN and RKA-K/L to the Parliament no later than mid-August. If approved, the RAPBN must then be legalized as an APBN before the end of October. The APBN will subsequently be provided with more detail through its ratiication via Presidential Decree. Hereinafter, a budget utilization document, called the Annual Budget Allocation Document (DIPA), is prepared by the Budget User/Proxy Budget User (PA/KPA) with reference to the already approved RKA-K/L and the APBN Presidential Decree. It will then be validated by the Minister of Finance as State General Treasurer (BUN) no later than December 31 prior to the next iscal year.

A grant for incompleted activities is accommodated in the budget utilization document that is carried over to the budget ceiling in the subsequent year. The grant ceiling for the Coral Reef

Minister Minister of Finance Parliament

a. Review b. Prepare RAPBN

c. Submit RAPBN and RKA-K/L to Parliamen

a. Endorse DIPA b. Submit to K/L

a. Consultation of RAPBN b. Endorsement of RAPBN

becomes UU APBN

a. Prepare RKA-K/L based on Renja, RKP, DRKH

Rehabilitation and Management Program (COREMAP II) according to the Ministry’s inancial statement was IDR 21.6 billion in 2011. This igure is part of the COREMAP II total budget of IDR 83.8 billion. The difference between these two igures constitutes the amount of the loan for COREMAP II.

B. DIRECT GRANTS

A direct grant that does not pass through the planning process will then not be included government budgeting processes. To be recorded in the government inancial system, a direct grant needs to be recorded in the DIPA, through a revision of the most current DIPA. Such revisions can be made up to the deadline for disbursement in a Funds Disbursement Order (SP2D). Without this, the grant will remain unrecorded in the government inancial system (‘off-budget, off-treasury’), as with the grants for the CTSP/MPAG and JFPR.

C. CONCLUSIONS

Government budgeting processes relect planning processes. Activities or programs funded by planned grants are already included in the planning process and are thus also incorporated into the budgeting process. The budget for a planned grant is decided in accordance with a planned-grant agreement that is usually an integral part of the foreign loan ceiling. Such budgeting is bound to the grant/loan agreement relating to the activities or programs to be implemented.

Budget utilization or funds disbursement is the next step following on from the activity/program planning and the budgeting stages. Once budget documents have been inalized and approved for the iscal year, activities/programs are then implemented with reference to these and to the allocated funding levels. The mechanism for funds disbursement is based on the activities and their budgets as set out in the Annual Budget Allocation Document (DIPA).

CHAPTER IV

IMPLEMENTATION/FUNDS

DISBURSEMENT

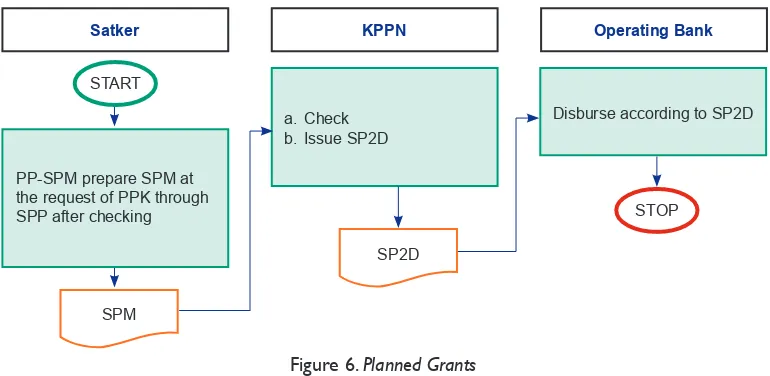

As planned grants are included in the planning process, the mechanism for their disbursement is the same as that for activities/programs funded by the government in the APBN.

Disbursement is conducted through the submission of a Payment Order (SPM) by the Proxy Budget User (KPA) to the State Treasury Service Ofice (KPPN), which the KPPN then follows-up with the issuance of a Funds Disbursement Order (SP2D). Both the KPA and KPPN issue SPMs and SP2Ds respectively after running substantive and formal checks. This is done to conirm the availability of funds for activities/sub-activities in the DIPA and relevant documentation for invoicing purposes (e.g. Summary of Contract).

There are ive methods for the disbursement of grants, namely: • Transfer to the State General Treasury (KUN) account • Direct Payments

Satker KPPN Operating Bank

a. Check

b. Issue SP2D

Disburse according to SP2D

PP-SPM prepare SPM at the request of PPK through SPP after checking

START

STOP

SPM

Figure 6. Planned Grants

• Special Account • Letter of Credit • Advanced Payment

The COREMAP project disbursed grants in 2011 of IDR 21,522,181,512, out of a total budget of IDR 21,658,150,000, or 99.37%.

A GEF grant (TF053350-IND, reg. no. 70528801) managed by the World Bank that was provided from January 28, 2005 to December 31, 2011.

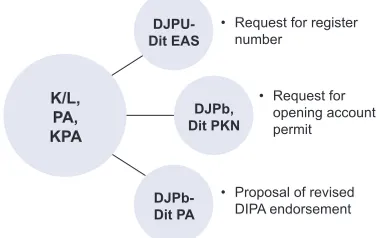

A Direct Grant that is ‘Off-Budget, Off-Treasury’.

For a direct grant that is ‘off-budget, off-treasury’, there is no way to verify payments for activity implementation. Thus, there will be no record of this in ministry/government agency inancial reports.

K/L, PA, KPA

DJPb, Dit PKN DJPU-Dit EAS

• Request for register

number

• Request for

opening account

permit

• Proposal of revised

DIPA endorsement

DJPb-Dit PA

Figure 7. Direct-Grants

Figure 8. Direct-Grants

Donor of Ministry

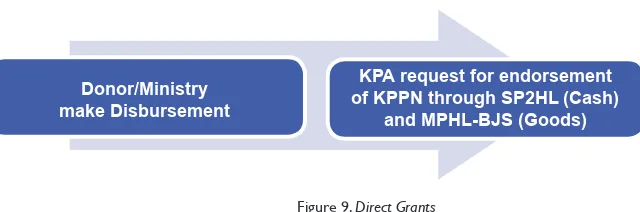

A Direct Grant that is ‘On-Budget, Off-Treasury’.

Direct grant disbursement can be managed directly by the donor or an appointed contractor, or by the relevant ministry/government agency. Furthermore, the KPA shall request validation from the KPPN by using a Direct Grant Validation Order (SP2HL) and a Record of Direct Grant in the Form of Goods/Services/Securities (MPHL-BJS).

Prior to disbursement, there is a procedure in place with regard to direct grants in cash that are received directly by a ministry/government agency, which is as follows:

• Register the grant with the Directorate General of Debt Management (DJPU)

• Request a permit to open an account from the Directorate General of Treasury (DJPb) or the Directorate of State Treasury Management (Dit PKN)

The procedure for a direct grant in the form of goods/services/securities received directly by a ministry/government agency is as follows:

• The Satker/KPA and the donor prepare Minutes of Handover (BAST) with regard to the goods/services/securities

• The PA/KPA (Budget User/Proxy Budget User) applies for grant registration to the DJPU with reference to a grant agreement or equivalent document

• The Satker/KPA requests validation from the DJPU or Directorate of Accounting Evaluation and Settlement through the use of a Direct Grant in the Form of Goods/Services/Securities Receipt Validation Order (SP3HL-BJS)

Figure 10. Direct Grants

Figure 9. Direct Grants

Donor/Ministry make Disbursement

KPA request for endorsement of KPPN through SP2HL (Cash)

The ministry/government agency may spend grant funds before a DIPA revision is inalized or before receiving approval to open an account.

Direct grants can be received by the KPPN disbursement deadline in the current iscal year.

The Directorate of Coastal and Marine Affairs Satker received a direct grant in the form of cash in 2011 of IDR 435 million out of a total budget of IDR 1.4 billion. It then proceeded to register the grant with the DJPU, request a permit to open an account, and revise the DIPA. The donor money was then credited into the account that had already been approved by the Directorate of State Treasury Management, Directorate General of Treasury (Dit PKN). After this, the Satker implemented its activities and disbursed its funds. Finally, it requested a validation from the KPPN.

Currently, a direct grant can be provided through a Trust Fund in accordance with Presidential Decree No. 80 of 2011 as an elaboration on the provision in Article 47, Paragraph 2 of Government Regulation No. 10 of 2011 on the Procedures for the Procurement of Foreign Loans and Receipt of Grants. The deinition of a ‘trust fund’ is donor funding that is managed by a trustee for a speciic purpose. A trustee institution is established by the revelant minister after receiving approval from the Minister of Planning and Minister of Finance, and is led by a board of trustees and a trust fund manager. The board of trustees constitutes a work unit (Satker).

All funds are recorded in accordance with the APBN mechanism. The board of trustees is responsible for appointing both the program and trust fund management, authorizing payments, and disbursing funds. The trust fund management is responsible for handling all relevant administrative and inancial matters and for making payments as directed by the board of trustees. Members of the board of trustees can be selected from personnel from the ministry/agency establishing the board, other related ministries/government agencies, other parties relating to the use of trust funds, or can be appointed by the donors. The board of trustees may appoint certain parties in accordance with the grant agreement to support the conduct of its duties. The trust fund management may come from a ministry/government agency, a multilateral institution, a non-government organization, a state-owned enterprise and/or a foreign inancial institution.

PA, KPA

DJPU-Dit EAS Pemberi

Hibah

• Prepare BAST

• Request for

register number

• Endorsement of

revenue through SP2HL-BJS

DJPU-Dit EAS

CONCLUSIONS

The funds disbursement mechanism that is currently in place accommodates planned grants through its provision of clear implementation procedures. One problem that was identiied was related to the management of activities, where implementors were found to not be providing adequate support for the meeting of deadlines and targets.

For direct grants in cash, there is no funds disbursement mechanism in place, aside from the possibility of obtaining formal validation of the grant implementation. If a direct grant is then not followed by a DIPA revision, there is the possibility that it will not be recorded in the government inancial system or will be classiied as ‘off-budget, off-treasury’, as is the case with CTSP/MPAG and JFPR.

Accounting and reporting with regard to funds disbursement refers to Law No. 1 of 2004 on the State Treasury. This law is detailed in Government Regulation No. 8 of 2006 on the Financial and Performance Reporting of Government Agencies. It is given more detail in Minister of Finance Regulation No. 171/PMK.05/2007 on the National Government Accounting and Financial Reporting System.

The national government accounting and inancial reporting system consists of two sub-systems, namely the State General Treasurer Accounting System (SA-BUN) and Government Agency Accounting System (SAI). The SA-BUN is used by the Ministry of Finance as the State General Treasurer while the SAI is used by ministries/government agencies.

CHAPTER V

ACCOUNTING AND REPORTING

MINISTRY/BODY as THE BUDGET/ASSET USER

MINISTER OF FINANCE AS GENERAL TREASURER OF STATE INSTITUTE ACCOUNTING SYSTEM (SAI)

STATE GENERAL TREASURER ACCOUNTING SYSTEM

WORKING

A work unit (Satker) is an accounting entity that is required to manage its own accounting activities and prepare inancial reports as a consolidated reporting entity. Some of the documents used for record keeping include Payment Orders (SPMs) and Fund Disbursement Orders (SP2Ds), among others relating to the funds disbursement process. The resulting inancial reports consist of a Budget Realization Report (LRA), a Balance Sheet, and Financial Report Notes (CALK). Satkers send their reports to the Regional Level Budget/Goods User Supporting Accounting Unit (UAPPA/B-W). The UAPPA/B-W compiles reports from all Satkers and submits them to the Echelon 1 Budget/Goods User Supporting Accounting Unit at (UAPPA/B-E1), which are then forwarded onto the Budget/Goods User Accounting Unit in the ministry/government agency.

The consolidation of SA-BUN and SAI reports produces a National Government Financial Report (LKPP). This LKPP consists of a Budget Realization Report (LRA), a Balance Sheet, a Cash Flow Statement, and Financial Report Notes (CALK). Special software is used as a recording tool from the Satker-level up the LKPP stage.

Both planned grants and direct grants are recorded in the inancial reports of ministry/ government agency Satkers and the national government respectively, via different means or source documents. A planned grant uses Payment Orders (SPMs) from the Proxy Budget User (KPA) and Fund Disbursement Orders (SP2Ds) from the State Treasury Service Ofice (KPPN), while a direct grant uses a Validation Letter of Direct Grant (SPHL) for grants in cash and a Record of Direct Grant in the Form of Goods/Services/Securities (MPHL-BJS) for grants in the form of goods/services/securities from the KPPN.

The ministry/government agency as an accounting entity records any grant in the SAI that is reported in the Budget Realization Report (LRA) for the realization of goods expenditure (account 52), capital expenditure (account 53) and/or social aid expenditure (account 57). The Balance Sheet also records inventory, ixed assets, and other produced assets. The Satker records grant expenditures following completion of the reconciliation process with the KPPN. The ministry/government agency reconciles quarterly expenditures from direct grants in the form of cash, goods, and services with the grants recorded as received by the Directorate General of Debt Management, Ministry of Finance (DJPU).

Received grants are recorded by the Minister of Finance as the State General Treasurer (BUN). The DJPU consolidates all transactions relating to grant income and expenditure (national government spending in the form of cash/goods/services/securities to local governments or local state-owned enterprises) for each Proxy Budget User Accounting Unit - State General Treasurer (UAKPA-BUN). The inancial reports of the Supporting Accounting Unit - State General Treasurer (UAP-BUN) managing grants are further consolidated with those from other UAP-BUNs by an accounting unit of the BUN that sits under the Directorate General of Treasury (DJPb).

while for a grant in the form of services the ministry/government agency reports it in an LRA and a CALK.

The following accounting and reporting practices at the Bureau of Finance should be highlighted: 1. The Bureau of Finance does not record grants in the form of goods/services but records

only cash transactions. In fact, the MMAF received grants in the form of goods/services equivalent to IDR 16 billion in 2011, however this was only recorded in the Financial Report Notes (CALK). Detail of the sources are as follows:

a. Donor: Wageningen UR, IDR 1.3 billion - MMAF (Secretariat General) b. Donor: UNDP, IDR 2.8 billion - MMAF (Secretariat General)

c. Donor: JICA, DG of P2HP

2. The recorded amount of direct grants in cash in the LRA does not match with its detailed breakdown. The difference in totals is IDR 823 million out of a total IDR 13 billion.

The reason for this difference is that the Satker and the Bureau of Finance never reconciled grants individually. As a result, the grant details according to the SAI (entered by the Satker) and the details according to the donor cannot be compared with one another. Actually, grant details by donor can be known from grant management records from the Directorate General of Debt Management (DJPU) as a UAKPA-BUN.

The monitoring and evaluation of activity performance and inancial implementation is conducted by the ministry/government agency and reported quarterly to the Minister of Planning and Minister of Finance. Monitoring and evaluation activities include tracking the progress of actual funds disbursement, physical achievements, goods and services procurement, problems encountered, and the necessary monitoring and evaluation follow-up. Based on the results of this, the Minister of Planning publishes a report on the performance of activities funded by foreign loans and/or grants.

CONCLUSIONS

For both planned grants and direct grants, an accounting/reporting mechanism is in place with implementation procedures that have been stipulated by The Minister of Finance. One of the main constraints identiied is a lack of capacity amongst personnel in the Bureau of Finance and the relevant Satker with regard to accounting/reporting processes, especially in connection with newly issued regulations.

The Inspectorate General of MMAF (Inspectorate General) does not conduct audits speciically with regard to grants, either directly or indirectly. Nevertheless, it does review the Ministry’s inancial reports internally prior to auditing by an external auditor (the Supreme Audit Agency - BPK). This review does not assess the recording of grants or the most recent Government Accounting System (SAI). In addition to reviews of inancial and performance audit reports, the Inspectorate General also conducts other activities, namely: speciic-purpose audits, monitoring of post-audit follow-up actions, strengthening inancial and state asset management, strengthening internal control systems, evaluating partners’ program planning activities, evaluating government agency partners’ performance reports, monitoring and evaluating marine affairs and isheries programs, handling public complaints, providing mentoring for marine and isheries development programs, implementing continuous control over the procurement of goods/service, and providing technical guidance in the performance of supervisory activities.

The Inspectorate General has 217 staff with a variety of educational qualiications, including: one Ph.D.; 53 Master degrees; 109 Bachelor degrees; 14 staff with Diploma-4 qualiications; 17 staff Diploma-3 qualiications; and 23 with either high school or elementary school certiicates. Out of the total number of staff (217), 97 are auditors spread across ive inspectorates. Of this, there are two senior auditors (daltu), 21 middle-level auditors (dalnis), 21 junior auditors (team leaders), and 52 prospective auditors/supervisors (team members).

From the information gathered on educational levels in the Inspectorate General, it has been concluded that they are adequate.

The current number of work units (Satker) in the MMAF is 743, with 56 at the ministry level (Satker Pusat), 127 at the local government level (Satker Daerah), 198 Deconcentration work units (Satker Dekonsentrasi), and 362 Assignment Task work units (Satker Tugas Pembantuan). With a strategic target of 100% oversight coverage and 21 auditing teams that can be formed from available Inspectorate General staff, each team conducts audits at more than 35 Satkers per year with auditing period of ive to seven days each. This auditing period is quite short given the targeted coverage.

Recommendations upon the results of oversight are aimed at improving performance and control systems, with the target of 70% realized at 48% (69% of the target). In addition, follow-up actions on inancial indings exceeded its goal, with the target of 70% realized at 89% (127%