Refer to Important disclosures in the last page of this report

Premier Insight

16 October 2018

Cement Sector Update

Challenging condition

Cement sales grew 4.9% in 9M18, due to by Outer-Java growth.

SMGR market share relatively stable compared to INTP.

Rising transportation cost will burden earnings going forward.

Maintain sector Underweight with SMGR as our preferred exposure.

Solid sales volume recovery in 3Q18. National cement sales volume recorded solid growth in September 2018, grew 7.4% yoy to 6.8mn ton and brought 9M18 demand up 4.9% yoy, in line with our expectation (~70.5% of 2018F target). This solid numbers was mainly supported by outer-Java demand which increased by 6.5% yoy (Sumatera and Kalimantan recorded the highest growth stood at 7% and 9.1% yoy, respectively), while Java grew by a mere 3.8% yoy (Banten and Central Java grew by 8.4% and 10.3%, respectively, while Jakarta decreased by 2.8% yoy). Utilization rate in 3Q18 increased significantly to 72% vs 52% in 2Q18 (due to short working days in the period).

SMGR market share relatively stable compared to peers. Among the Tier 1 cement players, SMGR able to maintain their market share of some 39.4% in 9M18 (vs. 39.3% in 6M18) due to least aggressive in raising ASP in the period. While, INTP market shares declined by 30bps to 25.8% in 9M18 (vs. 26.1% in 6M18) as the company raised ASP by 5% during the period. Additionally, INTP’s market share in Sep 18 dropped to the lowest level ytd at only 24.6% despite demand growth in its home base market, Java, outperforming national growth. On the other hand, SMBR hold stable market share in its home base by around 3 % in 9M18.

Oil price and Rupiah will burden performance. Albeit domestic cement appetite will continue to exhibit steady momentum in 4Q18F driven by completion phase of infrastructure projects in Java and outer-Java. We forecast that national cement sales volume this year will only stood at 5.8% yoy slightly lower compared to last year figure of 7% yoy. Also, we suspect that oversupply condition will remain persist going forward as current cement oversupply already stood at 36.7mn ton. If we forecast demand growth at some 7%/p.a. this condition will be diminished roughly at 2022. On top of that, higher oil price and depreciating Rupiah will also continue to burden cement players performance as transportation cost is a big chunk (>70%) of selling expenses.

Maintain Underweight. We are maintaining our underweight stance on the sector while waiting for the 9M18 results which will be released at the end of this month. The upcoming results will give a clearer picture on how cement players deal with the weakening Rupiah, higher petrol prices and the impact of the recent ASP hike. SMGR is remain our top pick due to the company’s 2018F PE trades at deep discount to the sector’s and stable profitability outlook.

Stock Ticker Rating Price TP

Index Closing 1 day 1 year YTD

JCI 5,727 - 0.5% -3.7% -9.9%

Commodities Last price Ret 1 day Ret 1 year

PremierInsight

2 Refer to Important disclosures in the last page of this report

Economic Update

The start of an encouraging episode

First trade surplus of US$0.23bn registered in 3Q18.

Overall trade improved, countering previous deficit trends.

Recovery also seen in OG trade, partially explained by B20 policy.

3Q18 CAD expected to be at 2.95% of GDP.

First surplus in the quarter. Trade in Sep18 came with US$0.23bn surplus and should be a positive update and point to a better outlook for Indonesian goods trade, which has posted US$-2.3bn deficit in 3Q18. The Sep18’s update is uplifting on few notable fronts, namely: (1) Improvement of overall trade position from deficit to surplus, and (2) Recovery in all but notably the OG trade, in both nominal and real terms, which likely and partly is due to B20 implementation. Trade had recorded US-2.95bn for the first two months of 3Q18 (a revision of US$-3.03bn earlier) and increased wariness against further deterioration of the current account deficit (CAD), as 2Q18’s CAD breeched the central bank’s comfortable level mainly due to the ebbing trade position. We believe the recent trade update may cushion the impact and build on better trades going forward, if the trends underlining it sustain.

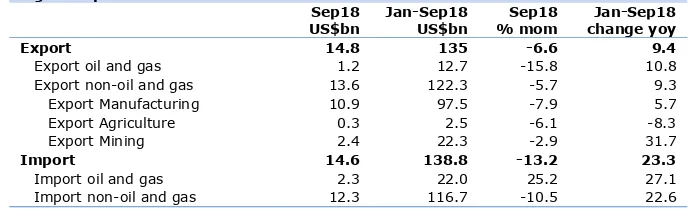

Overall trade improvement. Overall trade position gained 124% and managed to counter previous deficit trends in 3Q, which is constructive in our view, despite falling short of amount to reverse the deficit in the 3Q balance. The occurrence took place after exports declined by 6.6% mom (+1.7% yoy) and imports -13.2% mom (+13.5% yoy), with NOG trade improvement explaining at least 54% of total trade position. Against the current backdrop, where EM countries are assessed on how they manage domestic policies, this is positive, as it should signal the government’s ability to curb demand for imported goods. We observe at least three-fourth import reduction could be explained by decline in demand of raw materials (-13.5% mom).

OG trade recovery partially supported by B20 policy. On the other hand, the case of improving OG trade (+34% mom) is also supportive, notably as market had earlier been cautious against previously widening OG trade deficits, amid situation where domestic subsidised-fuel price was left unadjusted. We believe partly the improvement could be explained by the B20 policy implementation, which has taken effect starting on September 1st, as OG imports in nominal value declined by

25% mom, in line with real OG imports of -27% mom. While the development should look encouraging and shape future downward trend in OG imports if persists continually, the non-positive impact it would bring is further reluctance to adjust subsidised-fuel price more to its market price. This widening price disparity between subsidised and non-subsidised fuel price should not, in the future, incentivise behaviour to use the non-subsidised fuel.

3 Refer to Important disclosures in the last page of this report

News & Analysis

Corporates

CTRA: Ciputra Development (CTRA IJ; Rp810; Buy) will launch a new township in Sentul, with total area of 1,000ha. The development will be integrated with International Sentul Circuit and Plam Hill Golf Course, which will be developed through a partnership with the land owner, Cendana family. In the first phase CTRA will launch 400 landed house with ticket price of Rp700mn-Rp1bn. In the remaining CTRA targets marketing contribution of Rp200-300bn from the project. (Kontan).

Comment: We continue to like CTRA given its aggressive launching through JV and JO with land owners. We believe the partnership will limit CTRA’s risk if the projects take up rate is not successful. Maintain Buy on CTRA with TP of Rp1,355.

INCO: Vale Indonesia (INCO IJ; Rp3,250; Buy) reported 3Q18 nickel matte production of 18,193 tons, down 4% qoq and 10% yoy due to unplanned maintenance activities. Thus, the company revised its FY18F production volumes target to 75k tons from 77k tons. Production volumes in 9M18 decreased 6% yoy to 54,227 tons. (Company).

Comment: We will review our forecast for INCO pending to 9M18 result announcement as FY18F production volumes would likely came in around 3% lower than our current estimate. Nonetheless, we maintain our positive view on INCO as YTD18 nickel price average of US$13,675 per ton remained 5% higher than our price forecast of US$13,000 per ton for FY18F.

LPKR: Lippo Karawaci (LPKR IJ; Rp290; Not Rated) The Corruption Eradication

RALS: Ramayana Lestari (RALS IJ; Rp1,210; Hold) is planning to open two more stores in 4Q18, which will be located outside of Greater Jakarta. So far this year the company had already opened 3 new stores, 2 Ramayana stores and 1 Ramayana Prime, totaling to 119 stores under operation. (Kontan).

TOWR: Sarana Menara Nusantara (TOWR IJ; Rp474; Not Rated)’s subsidiary, Protelindo, raised loan facility amount by 50% to Rp300bn. Protelindo (PT Profesional Telekomunikasi Indonesia) is 99.99% owned by TOWR. Based on TOWR’s disclosure on 15 Oct, Protelindo signed agreement with JPMorgan (JOMorgan Chase Bank, N.A., Jakarta) to change loan facility amount to Rp300bn from prev. Rp200bn. TOWR said there is no material impact to operational and financial of TOWR from this change. (Company, Investor Daily).

WSKT: Waskita Karya (WSKT IJ; Rp1,570; Buy) create a partnership with provincial government of East Kalimantan with 60:40 portion as a initiator for Balikpapan-Penajam toll road. The toll road will have the length of 7.6km (elevated) with total investment of Rp16.5tn. The pre-qualification process is scheduled in October with toll road concession agreement is scheduled on January 2019. WSKT is eager to make the investment as the toll road will become the alternative lane for Balikpapan-Penajam Paser Utara with shorter time travel and cheaper fee. The toll road will shorten the trip to only 10 minutes (from 30minutes-2 hours) with fee around Rp25,000 for motorcycle, which is better than crossing with kelotok of Rp35,000. (Bisnis Indonesia).

PremierInsight

4 Refer to Important disclosures in the last page of this report

Markets & Sector

Automotive Sector: 9M18 wholesales recorded +7% yoy to 856k unit while Astra 9M18 market share recorded 49%. Solid September sales are coming from surging commercial car sales that contributes to 10% of total 9M18 sales. (Gaikindo, Kontan).

Cars September MoM YoY 9M18 YoY

• Toyota 28,860 -8% 6% 257,400 -11%

• Daihatsu 17,110 -2.3% 10% 147,513 5%

• Isuzu 2,762 6% 31% 18,480 35%

Subtotal Astra 48,732 -5% 9% 423,476 -5%

• Mitsubishi 16,156 -6% 48% 152,758 87%

• Honda 10,960 -26% -27% 117,742 -15%

• Suzuki 8,880 -18% -3% 91,077 12%

• Nissan 158 86% -87% 5,392 -57%

• Others 8,217 3% 28% 66,066 43%

Total Domestic Car Sales 93,103 -9% 6% 856,511 7%

Astra Market Share 52% 2% 1% 49% -6%

Poultry sector: General Secretary of Indonesian Poultry Community (Pinsar) stated that currently poultry farmers are booking net-loss as egg and broiler prices went down by around 10%-20% while corn price increased by around 20%. Soybean meal price in international market went down by approximatelly 10% but this was offset by Rupiah depreciation. (Detik).

Head Office

PT INDO PREMIER SEKURITAS Wisma GKBI 7/F Suite 718 Jl. Jend. Sudirman No.28 Jakarta 10210 - Indonesia p +62.21.5793.1168 f +62.21.5793.1167

INVESTMENT RATINGS

BUY : Expected total return of 10% or more within a 12-month period HOLD : Expected total return between -10% and 10% within a 12-month period SELL : Expected total return of -10% or worse within a 12-month period

ANALYSTS CERTIFICATION.

The views expressed in this research report accurately reflect the analyst;s personal views about any and all of the subject securities or issuers; and no part of the research analyst's compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in the report.

DISCLAIMERS