Full Terms & Conditions of access and use can be found at

http://www.tandfonline.com/action/journalInformation?journalCode=vjeb20

Download by: [Universitas Maritim Raja Ali Haji], [UNIVERSITAS MARITIM RAJA ALI HAJI

TANJUNGPINANG, KEPULAUAN RIAU] Date: 13 January 2016, At: 17:31

Journal of Education for Business

ISSN: 0883-2323 (Print) 1940-3356 (Online) Journal homepage: http://www.tandfonline.com/loi/vjeb20

The 150-Hour Requirement and the Supply of

Graduate Accounting Programs

Joseph G. Donelan & Ronald O. Reed

To cite this article: Joseph G. Donelan & Ronald O. Reed (2000) The 150-Hour Requirement and the Supply of Graduate Accounting Programs, Journal of Education for Business, 76:2, 93-97, DOI: 10.1080/08832320009599959

To link to this article: http://dx.doi.org/10.1080/08832320009599959

Published online: 31 Mar 2010.

Submit your article to this journal

Article views: 16

View related articles

The 150-Hour Requirement and

the Supply

of

Graduate

Accounting Programs

JOSEPH G. DONELAN

zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

University of West Florida Pensacola, Florida

RONALD

0.

zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

REED

University

of Northern Colorado

Greeley, Coloradoo date, 36 states and three

zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

U.S.T

jurisdictions require CPA examcandidates to earn 150 hours of college credit. Ten more states will implement 150-hour requirements before the year 2010. Even though these 150-hour requirements do not mandate a graduate degree, universities that offer graduate accounting programs may have a com- petitive advantage. As a result, there is likely to be an increase in the number of graduate accounting programs in the coming years.

The purpose of our study was three- fold: (a) to examine the increase in the number of undergraduate and graduate accounting programs, (b) to test for a relationship between that increase and the adoption of the 150-hour require- ment, and (c) to project the likely increase in new graduate accounting programs over the next 10 years. The results of our study will help business programs anticipate the number of com- peting degrees that they will face as their states implement the 150-hour requirement.

Method

zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

Our

sample included the 834 univer-sities listed in either the

zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

Accounting Faculty Directory (Hasselback, 1988,1998) or the AACSB Membership Direc-

tory (1988, 1998). The primary source

ABSTRACT. During the past 10 years, many states and U.S. jurisdic-

tions have established 150-hour CPA

licensing requirements. Simultaneous- ly, the supply of graduate accounting programs in the United States has increased dramatically. This article (a) describes that recent increase in grad- uate programs, (b) provides evidence

of an association between the propor- tion of universities offering graduate accounting degrees and implementa- tion of the 150-hour requirement, and (c) projects the expected growth in graduate accounting programs over the next 10 years. Our results suggest that higher education is responding to state-mandated 150-hour requirements by increasing the supply of graduate accounting programs. Moreover, there is likely to be a growth of approxi- mately 17% in graduate accounting programs over the next 10 years.

of information about each university’s degree programs was the Accounting

Faculty Directory. In some cases, other sources were used to confirm or clarify information, such as the AACSB Mem-

bership Directory, Internet Web pages, university catalogues, and telephone interviews.

We used statistics to describe trends in undergraduate and graduate accounting programs over the past 10 years. The Chi-square test was used to test for an association between the proportion of universities offering graduate account- ing degrees and implementation of the

1

150-hour requirement. We used data from early-adoption states, combined with earlier survey literature results, to project the likely increase in graduate programs over the next 10 years.

Results and Discussion

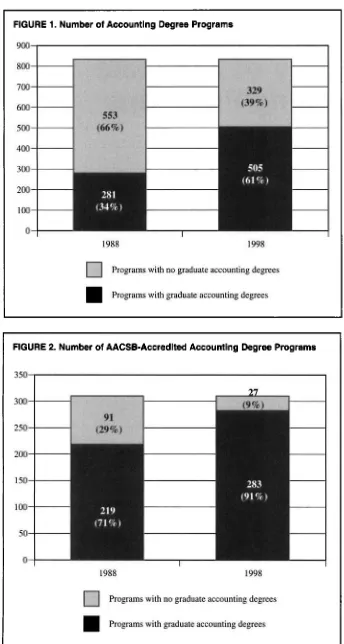

Increase in Graduate Programs

There has been a sizable increase in the supply of graduate accounting degree programs over the past 10 years, as illustrated in Figure 1. In 1988, 34% of business schools had graduate accounting programs. By 1998, the pro- portion had risen to 61%. In Figure 2, we show that the increase for AACSB-

accredited universities was from 7 1 %

zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

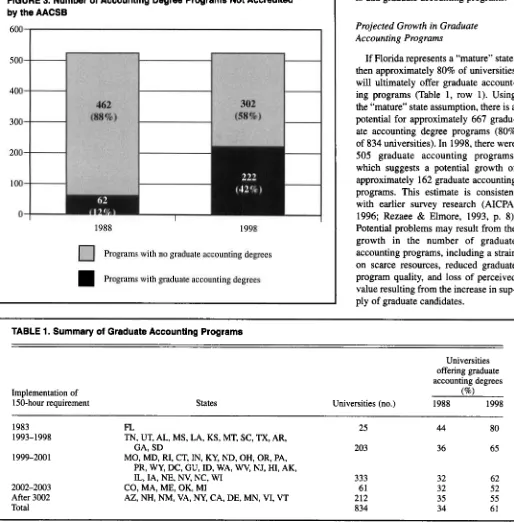

to 91%. And in Figure 3, we show anincrease of 12% to 42% for non- AACSB-accredited universities for the same period.

In Table 1, we summarize the gradu- ate program offerings for the 834 uni- versities based on the year that their respective states adopted a 150-hour requirement. For each year, the table shows (a) the number of universities in those states implementing the require- ment, (b) the percentage of those uni-

versities offering graduate accounting degrees in 1988, and (c) the percentage of those universities offering graduate accounting degrees in 1998. Overall,

NovemberDecember 2000 93

there was a substantial increase in grad-

uate accounting degrees between

zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

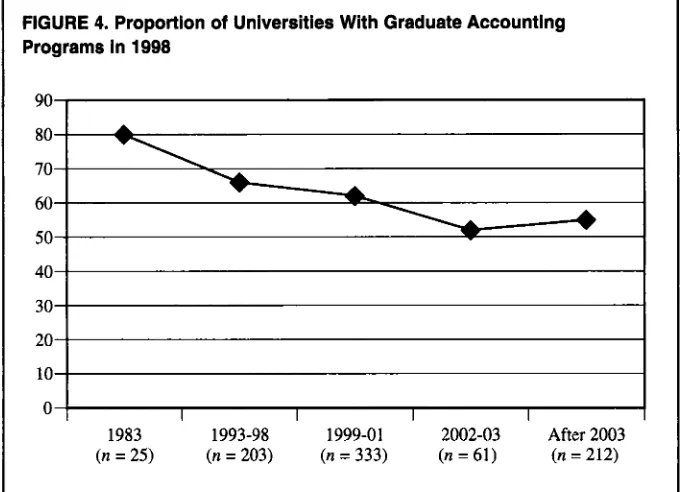

1988and 1998. Moreover, the percentage of

universities offering graduate account-

ing degrees in 1998 appears to be high-

er in states that adopted the 150-hour requirement earlier. In Figure 4, we

depict this trend graphically. Next we

examine the trend to determine if there is a relationship between the implemen- tation date and the proportion of gradu-

ate accounting programs.

zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

[image:3.612.44.388.93.737.2]~~ ~ zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

FIGURE 1. Number of Accounting Degree Programs

Programs with no graduate accounting degrees Programs with graduate accounting degrees

FIGURE 2. Number of AACSB-Accredited Accounting Degree Programs

1988 1998 Programs with no graduate accounting degrees

Programs with graduate accounting degrees

zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

Tests of Relationships Between Implementation Date and Proportion of

Graduate Programs

To test for a relationship between implementation of 150-hour require- ments and the proportion of universities offering graduate accounting degrees, the 834 universities were divided into

five groups based on the year in which each university’s state implemented the 150-hour requirement. The five groups were (a) 1983, (b) 1993-1998,

(c) 1999-2001, (d) 2002-2003, and

(e) after 2003. The first group, 1983,

represented Florida universities, and was treated separately because of the extended period in which the 150-hour requirement has been in effect there.

No other states implemented 150-hour requirements until 1993, so the second group spanned the period from 1993 to 1998. A cutoff year of 1998 was select-

ed because it represents the year that we began our study, and it is likely that any changes in curriculum would be reflected in the data sources used in our study. The third group represented uni- versities in the 26 states with imple-

mentation dates ranging from 1999 to 2001. The fourth group represented the

universities in the five states with implementation dates ranging from

2002 through 2003. The “after 2003”

group comprised the universities in the final 10 states. Although these five

groupings are somewhat arbitrary, the tests of independents presented below are relatively insensitive to alternative grouping schemes.

In Table 2, Panel A, we summarize

the graduate accounting degree infor- mation, by group, for all 834 universi-

ties. Because the 834 universities may

not represent the entire population of accounting programs, the Chi-square

test was used to determine if the propor-

zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

tion of 834 universities offering gradu-

ate accounting degrees was independent of the grouping. The results support rejecting the null hypothesis of equal

proportions

zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

(x2

= 9.67; p = .05). This test result suggests that there was a rela-94 Journal of Education for Business

[image:3.612.49.386.99.420.2]tionship between the implementation date of the 150-hour requirement and the proportion of universities offering graduate accounting degrees in 1998. Although the Chi-square test is not directional, it appears from the data that the longer the 150-hour requirement was in effect, the higher the proportion of universities in those states that offered graduate accounting degrees.

To provide further detail of the rela- tionship between the 150-hour require- ment and the proportion of graduate

accounting programs, we examined the AACSB-accredited universities (Table 2, Panel B) and the non-AACSB- accredited universities (Table 2, Panel C). For the AACSB-accredited universities, the proportion of universi- ties offering graduate degrees appeared to be independent of when the state

adopted a 150-hour requirement

zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

(x2

=zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

4 . 1 4 ; ~ = .38).* For the universitiesnot accredited by the AACSB (Table 2, Panel C), the Chi-square test results

[image:4.612.49.563.220.742.2]were significant at the .10 level

zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

FIGURE 3. Number of Accounting Degree Programs Not Accredited

by the AACSB

zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

1988 1998

Programs with no graduate accounting degrees Programs with graduate accounting degrees

(x2

= 7.79), suggesting a relationship between the implementation date of the 150-hour requirement and the propor- tion of non-AACSB-accredited univer- sities offering graduate accounting degrees. There are several possible explanations for such a relationship: (a) As states adopt 150-hour requirements, there may be greater competitive pres- sure for universities not accredited by the AACSB to add graduate accounting programs, and (b) there may be lower resource requirements for non-AACSB- accredited institutions, making it easier to add graduate accounting programs.Projected Growth in Graduate Accounting Programs

If Florida represents a “mature” state, then approximately 80% of universities will ultimately offer graduate account- ing programs (Table 1, row 1). Using the “mature” state assumption, there is a potential for approximately 667 gradu- ate accounting degree programs (80% of 834 universities). In 1998, there were

505 graduate accounting programs, which suggests a potential growth of approximately 162 graduate accounting programs. This estimate is consistent with earlier survey research (AICPA, 1996; Rezaee & Elmore, 1993, p. 8). Potential problems may result from the growth in the number of graduate accounting programs, including a strain on scarce resources, reduced graduate program quality, and loss of perceived value resulting from the increase in sup- ply of graduate candidates.

TABLE 1. Summary of Graduate Accounting Programs

Implementation of

150-hour requirement States

Universities

offering graduate

accounting degrees

(”/.I

Universities (no.) 1988 1998 19831993-1998 1999-200 1

2002-2003

After 3002

Total

zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

FL 25

TN, UT, AL, MS, LA, KS, MT, SC, TX,

zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

AR,GA, SD 203

MO, MD, RI, CT, IN, KY, ND, OH, OR, PA, PR, WY, DC, GU, ID, WA, WV, NJ, HI, AK,

IL, IA, NE, NV, NC, WI 333 61 212 834

CO, MA, ME, OK, MI

zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

AZ, NH, NM, VA, NY, CA, DE, MN, VI, VT

44 80

36 65 32 62 32 52 35 55 34 61 November/December 2000 95

Implications f o r Accounting Programs

zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

marc! that Over 90% of their AACSBcompetitors also offer graduate pro- grams, and they should strive to develop a strategic competitive advantage for their program. Non-AACSB schools should be aware that the dominant Sound strategic planning calls for

assessment of the accounting program's competitive position in the market.

Accordingly, AACSB schools should be

zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

FIGURE 4. Proportion of Universities With Graduate Accounting

Programs In 1998

zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

J"

1

zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

-tu I I

J u

zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

I

I

&"

I

I

x"x

0zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

1983 1993-98 1999-01 2002-03 After 2003

( n = 25) ( n = 203) ( n = 333) ( n = 61) ( n = 212) Percentage of universities offering graduate accounting degrees in 1998

response to the 150-hour requirement is a graduate degree program. Therefore, institutions with no graduate business programs face a significant challenge as their states implement 150-hour require- ments. If they do not offer a graduate degree, they face competition from schools that do. Yet adding a graduate degree is costly, especially for schools with small enrollments. Nelson, Bailey, and Nelson (1998, p. 307) suggested that

smaller institutions should take a strate- gic view of their market. In doing so, they may decide that the best use of scarce resources would be to remain an undergraduate-only program, preparing their graduates for entry into other uni- versities' graduate programs, or prepar- ing their students for accounting careers other than public accounting.

Limitations

[image:5.612.45.385.127.373.2]Our study had two scope limitations. First, the review of accounting degree programs did not attempt to assess the content of the graduate accounting pro- grams. For readers interested in greater details about curriculum content, Schmidt (1993) provided a detailed review of the content of 150-hour pro-

TABLE 2.1998 Graduate Accounting Degrees by Effective Data of 150-Hour Requirement Status

Universities by date that respective state@) adopt

zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

150-hour requirement 1983 1993-1998 1999-2001 2002-2003 After 2003 TotalNo. % No. % No. % No. % No. % No. %

Panel A. All 834 universities

Graduate accounting degree in 1998 20 80 131 65 205 62 32 52 117

zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

55 505 61 Nograduateaccounting degreein 1998 5 20 72 35 128 38 29 48 95 45 329 39Total 25 100 203 100 333 100 61 100 212 100 834 100

x2

= 9.67; p = .05Panel B. AACSB-accredited universities

Graduate accounting degree in 1998 10 100 73 89 117 94 19 90 64 88 283 91 Total 10 100 82 100 124 100 21 100 73 100 310 100

x2

= 4.14; p = .38No graduate accounting degree in 1998

-

0 9 11 7 6 2 10 9 12 27 9Panel C. Non-AA CSB-accredited universities

Graduate accounting degree in 1998 10 67 58 48 88 42 13 32 53 38 222 42

Nograduateaccountingdegreein 1998 5 33 63 52 121 58 27 68 86 62 302 52 Total 15 100 121 100 209 100 40 100 139 100 524 100

x 2 = 7.79; p = .10

96 Journal of Education f o r Business

[image:5.612.43.568.423.732.2]grams. Second, we made no attempt to assess the overall value of the 150-hour requirement. However, research addressing this issue abounds. For example, Riordan and Sullivan (1998) provided a moral perspective of the 150- hour requirement, and Novin, Fetyki, and Tucker (1997) reviewed prior empirical studies and provided survey evidence about educator and practition- er views of 150-hour programs.

Another limitation is the potential for missing variables. In addition to state- mandated 150-hour requirements, there may be other forces driving changes in accounting degree offerings. Such forces include the rapidly changing nature of the accounting profession, changing student demographics, and declining undergraduate enrollments. Therefore, the Chi-square test results do not show causality, nor do they isolate the potential impact of other forces. Rather, the results merely suggest a relationship between the implementa- tion date of the 150-hour requirement and the proportion of universities offer-

ing graduate accounting programs.

zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

Conclusion

Fifty states and

zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

U.S. jurisdictionshave passed legislation requiring 150 hours of college credit before a person can sit for the CPA exam. A likely result of this change is an increase in the num-

ber of graduate accounting programs. Most of the new programs will be at institutions not accredited by the AACSB. With this increase in the num- ber of graduate accounting programs, accounting program administrators must closely monitor the competitive position of their existing degree offer- ings. Moreover, business schools should assess the potential demand for new graduate programs prior to committing to them. Finally, the profession has a responsibility to monitor the overall quality of graduate accounting pro- grams to prevent reduced quality and loss of prestige for the profession.

ACKNOWLEDGMENTS

We wish to thank the Colorado Society of CPAs for funding this research project. We also grateful- ly acknowledge the assistance of Dr. John Freese, Dr. James Reardon, and Dr. Kirk Philipich.

NOTES

1. The

zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

Accounting Faculty Directory reportsgraduate business degrees “with emphasis or con- centration in accounting.” Our research adopted the same definition, using the term graduate

accounting to describe either a master’s degree in accounting or a master’s degree in business with B concentration or emphasis in accounting.

2. In a large contingency table, if more than 20% of the expected cell values are less than 5.0, the p value approximation may be poor (Conover, 1980, p. 156). Although the contingency table test- ed here did not violate this criterion, there were several small expected value cells. Accordingly, several alternative procedures were performed. First, there is reason to believe that log-linear models for analysis of contingency tables are less affected by small sample sizes (Howell, 1982, p.

109). Thus, the likelihood ratio statistic was used in addition to the Chi-square test (likelihood ratio

p

zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

= .30). Second, the universities were collapsedinto three groups instead of five, and another Chi-

square test was performed (%* = 2.69 p = .44).

zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

REFERENCES

American Assembly of Collegiate Schools of Business (AACSB). (1988). 1988AACSE mem-

bership directory. Saint Louis, MO: Author. American Assembly of Collegiate Schools of

Business (AACSB). (1998). 1998AACSE mem-

bership directory. Saint Louis, M0:Author. American Institute of Certified Public Accoun-

tants (AICPA). (1996). AICPA 150-hour imple-

mentation survey results. New York: Author. Conover, W. J. (1980). Practical nonparametric

statistics. New York: John Wiley & Sons. Hasselback, J. R. (1988). 1988 accounting faculty

directory. Upper Saddle River, NJ: Prentice Hall.

Hasselback, J. R. (1998).1998 accounting faculty

directory. Upper Saddle River, NJ: Prentice Hall.

Howell, D. C. (1982). Statistics for psychology. Boston, MA: Duxbury Press.

Nelson, I. T., Bailey, J. A., & Nelson, A. T. (1998, February). Changing accounting education with purpose: Market-based strategic planning for departments of accounting. Issues in Account-

ing Education, 13(1), 301-326.

Novin, A. M., Fetyki, D. F., & Tucker, J. M.

(1997, Fall). Perceptions of accounting educa- tors and public accounting practitioners on the composition of the 150-hour accounting pro- grams: A comparison. Issues in Accounting

Education, 12(2), 331-352.

Rezaee, Z., & Elmore, R. C. (1993). Issues, chal- lenges, and opportunities of the 150-hour accounting program: A survey of administrators.

Accounting Educators’Journal, 5(

zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

I), 1-20.Riordan, D. A., & Sullivan, M. C. (1998). A moral perspective of the 150-hour requirement. Jour-

nal

zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

of Accounting Education, 16( l), 53-64.Schmidt, R. J. (1993). Accounting curriculum responses to the 150-hour requirement. Journal

of Accounting Education, 11(1), 1541.

NovembedDecember 2000

97