ANALYSIS

An empirical analysis of dematerialisation:

Application to metal policies in The Netherlands

Rob B. Dellink

a,b,*, Patricia P.A.A.H. Kandelaars

c,daEn6ironmental Economics,Wageningen Uni6ersity,Hollandseweg 1,6706 KN Wageningen, Netherlands bInstitute for En6ironmental Studies,Vrije Uni6ersiteit,Amsterdam, Netherlands

cDe6elopment Economics,Wageningen Uni6ersity,Hollandseweg 1,6706KN Wageningen, Netherlands dSpatial Economics,Vrije Uni

6ersiteit,Amsterdam, Netherlands

Received 16 December 1998; received in revised form 12 October 1999; accepted 13 October 1999

Abstract

This paper presents a first empirical step in filling the gap between physical and economic models, by combining a material flow model and an applied general equilibrium (AGE) model. The goal of this paper is threefold. Firstly, a new methodology is discussed for the integration of material and economic flow models. Secondly, the new methodology is tested for its empirical applicability by simulation of material policies. Finally, the analysis leads to the identification of major steps for filling the existing gap between physical and economic models further. Fiscal material policies are imposed to reduce the use of specific materials. The material levy and the accompanying labour tax reduction shift the tax burden from labour to the use of materials. The empirical illustration shows that the physical and economic flows can be made mutually compatible, and that the combined model can be used for empirical analysis of material policies. From this analysis of material policies in an economic model it may be concluded that the combination of an AGE model and a material flow model may produce an appropriate tool for analysing environmental, sectoral and distributional effects of dematerialisation policies. © 2000 Elsevier Science B.V. All rights reserved.

Keywords:Material use; ‘Green’ taxation; Material flow analysis; Applied general equilibrium (AGE)

www.elsevier.com/locate/ecolecon

1. Introduction

The extraction, production and waste treatment of materials cause problems that may call for government intervention. Several countries have imposed materials-related policies, mainly charges

* Corresponding author. Tel.:+31-317-483870; fax:+ 31-317-484933.

E-mail address:[email protected] (R.B. Dellink)

R.B.Dellink,P.P.A.A.H.Kandelaars/Ecological Economics33 (2000) 205 – 218

206

and deposit-refund systems on specific materials and products (OECD, 1994). In the Netherlands regulatory policies on the use of materials and products are not yet widespread, mainly because governmental policies focus on the self-regulatory capacity of the industry, based on covenants.

Flows of materials through the economy are mainly studied from a physical or environmental point of view, using, for example, material flow analysis and life cycle assessment. These methods generally do not take into account economic, behavioural or policy aspects. On the other hand, most economic models do not consider material aspects explicitly.

In the late 1960s and beginning of the 1970s, various analytical studies addressed material flows in economic models (Ayres and Kneese, 1969; Kneese et al., 1970). More recently the interac-tions between economy, material flows and the material balance principle have been studied theo-retically (Perrings, 1986; Van den Bergh and Ni-jkamp, 1994; Van den Bergh, 1999).

This study tries to set a first, empirical step in filling the gap between physical and economic models by combining a material flow model and an applied general equilibrium (AGE) model. The goal of this paper is threefold. First, a new methodology is discussed for the integration of material flow and economic models. In the cur-rent paper, the fact that the integration of both models is not yet perfect is accepted beforehand. Still, the new methodology is already useful for policy analysis. The second goal is that the new methodology must be empirically applicable. The third and final goal of the current research is that the analysis should lead to the identification of major steps that can fill the gap between physical and economic models even further. The overall aim is to provide a (more) appropriate tool to empirically assess the economy-wide and environ-mental effects of environenviron-mental policies. This new

tool should obey the material balance principle.1

The material flow model describes the physical flows of materials through the various sectors of an economy, so that a material balance is satisfied for each material in each sector in the model. To change the use of materials a material policy may be imposed on specific materials in certain sectors. With a disaggregated AGE model, the sectoral and distributional effects of policies can be analysed for various production sectors and household groups. Moreover, the effects of vari-ous policies on trade and employment may be examined.

In this study, a highly disaggregated empirical AGE model for the Netherlands is used. The AGE model is a model in monetary terms, while the material flow model is in physical terms. Con-sequently, the two models have to be made com-patible before they are combined.

Several (market-oriented) scenarios are de-signed to study the effects of a material policy on metals, in particular zinc and lead. These metals have been selected because of the environmental and health risks they may create (Gorter, 1994; Annema et al., 1995). The physical data are used together with the monetary flows to calculate the height of the levies that are imposed on the vari-ous sectors in the AGE model for the Nether-lands. Thus, the material flow model is used to determine policies in the AGE model. There is no endogenous feedback from the AGE model into the material flow model: the results of the AGE model are exogenously combined with the mate-rial flow model in order to provide the effects of the policy on the use of materials. This does not mean that all material flows remain constant, but it does imply that all direct material intensities of the production sectors are constant.

The organisation of this paper is as follows. Section 2 gives a short description of the AGE model, the material flow model and the way the latter is used in the AGE model. Section 3 dis-cusses various material and product policies that will be studied in the scenarios. Results of the scenario analysis are given in Section 4. The last section draws conclusions and presents sugges-tions for further research.

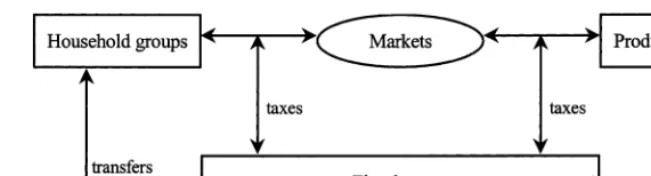

Fig. 1. Schematic working of the AGE model.

2. Description of the combination of the models

This section first describes the AGE model ‘Taxinc’ and then the material flow model ‘Flux’. Then, a general methodology of the way these two models can be combined is analysed.

2.1. Taxinc-model

Applied general equilibrium (AGE) models are general equilibrium models that are empirically calibrated. This type of model consists of a set of economic agents, e.g. households and production sectors. These agents demand and supply ‘goods’, which are either consumption goods or produc-tion factors. The demand and supply equaproduc-tions of production sectors and household groups are derived from standard neo-classical economic the-ory, implying that all agents behave rationally, firms maximise their profits given prices and ca-pacity, and households their utility given prices and transfers. The price of a product paid by buyers equals the market price plus taxes levied on the demand side of the market. Suppliers face a price equal to the market price minus supply-side taxes. The central mechanism of AGE models is that (market) prices are flexible and will adjust such that equilibrium is achieved on each market. The structural characteristics of the model, such as household preferences, production structure and technology are exogenous.

The AGE model used in this study is the Tax-inc-model, which was originally developed to analyse the effects of changes in the tax structure in the Netherlands (Keller, 1980; Cornielje, 1990; Statistics Netherlands, 1991) and has since then been adapted and applied to study the effects of

energy levies (Dellink and Jansen, 1995). Fig. 1 shows the general model structure graphically.

The comparative-static model includes 61 pro-duction sectors and 44 household groups, allow-ing the analysis of sectoral and distributional consequences of policies. The tax structure is equally disaggregated: for each economic

transac-tion the accompanying tax payments are

recorded, using different empirical estimates for the tax rates. This relatively high level of disaggre-gation (at least from a macro-economic point of view) is one of the main strengths of the model. The interactions between all agents in the model are so complex (indirect and non-linear) that cal-culation of the results for individual production sectors or household groups requires numerical simulation. Each production sector is assumed to produce a single, unique good; individual firms within a sector are assumed identical. Each hold group represents several individual house-holds with assumed identical marginal behaviour. The utility functions of the household groups and the production function of the production sectors are of a nested CES-type (Keller, 1980; Cornielje,

1990)2, with several branches and sector-specific

substitution elasticities for each knot in the CES ‘tree’.

2An example of a nested utility function is as follows: aggregate consumption is divided into necessities and luxuries, the necessities are divided among food and clothes, food is divided into vegetables, milk and bread (Keller, 1980). Thus, a nested function has a tree-structure. A CES production func-tion with output (Q) and three inputs (Kis capital,Lis labour, R is resources) has the following structure Q=A(aK−?+

R.B.Dellink,P.P.A.A.H.Kandelaars/Ecological Economics33 (2000) 205 – 218

208

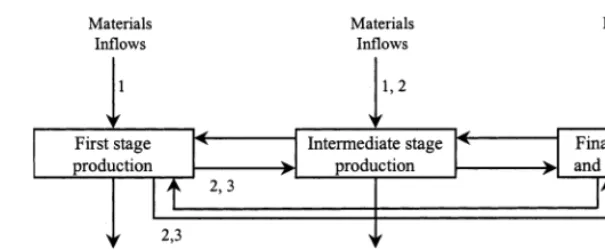

Fig. 2. Stages in production and consumption where material policies may be imposed. Arrows indicate material and product flows; numbers are explained in the text.

The ‘small open economy assumption’ is used which implies that world market prices are exoge-nous. This assumption results in a strong reaction by the foreign sector to changes in prices. The Taxinc-model includes the ‘Armington assump-tion’ that distinguishes import and domestic pro-duction of a good as two different goods, with imperfect substitutability. The trade formulation is especially suited for a country like the Nether-lands which has a small domestic market and important links with foreign markets.

2.2. The material flow model ‘Flux’

A material flow analysis (MFA) describes the flow of one or more specific materials in a geo-graphic area during a certain period of time (Kan-delaars, 1999). The basis of an MFA is a database on stocks and flows of materials through the economic processes. The material flow model ‘Flux’ consists of a database that describes the physical flows of materials and products through the Dutch economy in 1990 (Boelens and Ol-sthoorn, 1998). It is an input – output type of model in physical units, which consists of 167 distinguished domestic economic processes, a ‘for-eign sector’ (that constitutes imports and exports) and the environment (divided into the compart-ments of atmosphere, soil and water). The inflow of materials into the domestic economic system originates from both the foreign economic sector (i.e. imports) and the environment (i.e. extraction of new materials). The throughput of materials

through the economic system is made up of all flows of material between the different economic processes. The outflow of materials from the do-mestic economic system consists of exports (flow to the foreign sector) and the disposal of materials (flow to the environment).

Fig. 2 illustrates graphically the stages in pro-duction and consumption where material or product policies may be imposed. Three stages are identified. In the first production stage, raw mate-rials are converted into (intermediate) products. Between the first and final production stages there may be one or more intermediate stages of pro-duction. All production sectors require inputs from, and supply products to, other economic sectors so all stages are connected through product flows as well as material flows. Moreover, the production stages require ‘inflows’ of materi-als from and have ‘outflows’ of materimateri-als to the environment and foreign economies.

2.3. Combining the material flow model‘Flux’

with the AGE model ‘Taxinc’

The data on the material flows in the material flow model Flux are used to implement material policies in the economic model Taxinc. The phys-ical data on the material flows between economic sectors (including extraction) are connected to the data in monetary units in the Taxinc-model. A levy on an economic sector is determined by its use of materials in kg and its output in guilders. After the levy is imposed, the Taxinc-model calcu-lates a new equilibrium. The results of the Taxinc-model are imported into Flux to assess the effects on the material flows. Thus, the combination of Flux and the Taxinc-model allows for the con-struction of various fiscal policy scenarios to ex-amine the economic and physical (environmental) effects of these policies.

The height of the material levy imposed on a production sector depends on the material inten-sity of the sector. In this study, two different types of material intensities are distinguished. First, the direct material intensity of a production sector is defined as the material inflow (in kg) in the sector, coming from outside the domestic economy (i.e. coming from imports or from the environmental sector) per guilder of production output. The second material intensity that is identified is the so-called compounded material intensity that measures the total embodied material content of the product produced in the sector. This com-pounded material intensity consists of the direct inflow of material in the sector (from imports or the environment), but also encompasses the mate-rials that entered the economic system in earlier

production stages.3 In this way, the compounded

material intensity depends also on the throughput of the materials through the economic system. The material flow model makes the calculation of these compounded material intensities possible, and it is these compounded intensities that are relevant for material policies.

For practical reasons, it is assumed that the direct material intensity does not change when a

levy is imposed. Changes in the output levels can then be translated into changes in material use. Clearly, this effect on materials will differ from the ‘true’ effects, primarily because changes in the material contents of inputs cannot be accounted for, and because substitution within a sector is not taken into account. However, substitution of one material by another is considered if the supplying production sector is different for both materials. Consequently, the compounded material intensi-ties are non-constant. The assumption of constant direct material intensities limits the interpretation of the results, but cannot be voided in the current framework (see concluding section below for a discussion on how to improve the methodology in this respect).

3. Material and product policies

A material policy may be imposed to reduce the use of specific materials and products. The poli-cies used in this study are regulatory polipoli-cies, where the revenues are redistributed to the tax-payers. Therefore, a scenario for a policy imple-mentation consists of two parts: (1) the material or product policy; and (2) the destination of the revenues generated by the policy. In practice, policy makers need to make choices about both of these issues. The scenario analyses are not per-formed for forecasting, but for illustrating the mechanisms in the combined empirical model.

For the material policies, the relative tax weight of the material levy depends on the material inten-sity of the production sector. Different policy alternatives are formulated to show the differ-ences between using the direct or compounded material intensities (see Section 2). The overall tax rate of the levy, which essentially serves as a scaling parameter, is chosen such that the total tax revenue will be 0.1% of national income. The total ex post tax payments by a production sector or household group also depend on the indirect economic effects of the policy. These indirect ef-fects are governed by all the price, tax and income elasticities.

The revenues are redistributed by reducing the labour taxes paid by the production sectors,

R.B.Dellink,P.P.A.A.H.Kandelaars/Ecological Economics33 (2000) 205 – 218

210

which may be interpreted as a reduction in the employers’ contributions to social security. How-ever, as the labour supply is rather inelastic, the labour effects of the policies are expected to be limited in the general equilibrium context.

The material levy and the reduction of the labour tax result in a shift in the tax burden from labour to material use. The current tax system discourages work and investment, and it encour-ages pollution and material use. Therefore, a tax shift from labour to material use is attractive because it taxes more what we want less of, i.e. material use, and less what we want more of, i.e.

labour (Hamond et al., 1997).4

This regulatory levy can be seen as a ‘green tax reform’ or ‘eco-tax’. Though the explicit objective is to reduce the use of specific materials, stimulating employment may be an implicit goal.

Exports are exempt from levies, as the competi-tive position of the exporting sector would be too severely affected. Implicitly, the material content of the imported products is assumed to be equal to those of domestic substitutes.5

This results in a single tax rate for both types of inflows of materi-als (extraction and imports).

The regulatory levy will not only affect the sectors that are subjected to the levy, but (indi-rectly) also other production sectors and house-hold groups. The levied sectors will react to the changes in relative prices, which triggers a reac-tion of other agents. In total, all relative prices will change, and consequently all production sec-tors and household groups are affected by the levy. As a result, part of the tax burden is shifted from the taxed sectors to the rest of the economy. The magnitude of this burden-shift depends on the price and income elasticities.

3.1. A regulatory le6y on primary material input:

the ‘inflow le6y’

A regulatory levy on primary material input is imposed on the inflow of materials into the Dutch economy, either through imports from foreign economic sectors or through extraction from the environment (see arrows labelled 1 in Fig. 2). This means that the production sectors are levied ac-cording to the direct material intensity of the sector (i.e. the materials added during the produc-tion stage and not the material contents of in-puts). To avoid double counting, the intermediate flows of materials between sectors are not levied.

3.2. A regulatory le6y on material throughput: the

‘throughput le6y’

With a regulatory levy on primary material input the first stage production sectors will be severely affected. Therefore, an alternative mate-rial policy may be imposed on the throughput of materials in the economy. This is simulated by levying the inflow of materials into all sectors, except for first stage production sectors (see ar-rows labelled 2 in Fig. 2) plus the material flows from the first stage production sectors to their respective clients. The throughput levy thus de-pends on the compounded material intensity. The total material flow on which the policy is imposed is smaller than in the base scenario as the outflow from the first stage production sectors are not taxed. This is compensated by a higher overall tax rate.

A firm in the first stage production sector is taxed to the extent that it is a buyer of goods made by another firm in this sector (the buying firm then acts as a second stage production sec-tor). This can be interpreted as intra-industry trade between two firms in the first stage produc-tion sector. For instance, the basic zinc industry will provide some zinc products to the other basic metal industries.

3.3. A regulatory le6y on products: the ‘product

le6y’

The product policy is directed at products that

4Other possibilities to redistribute the revenues to the tax-payers include a subsidy on the use of an environmentally less-damaging input, introduce a subsidy on R&D, or a lump-sum transfer to the production sectors or households.

contain certain materials. The consumers of these products, which may be either production sectors or household groups, are subjected to the levy (see arrows labelled 3 in Fig. 2). The goal of this policy is to encourage consumers to switch to other products with a lower metal content. The main difference with the regulatory material levies is that the products themselves are levied, not their material content. In this scenario the relative tax weights are equal across all sectors. The total tax paid by a sector depends on the value of the products bought from the first stage production sectors.

3.4. Application to hea6y metals

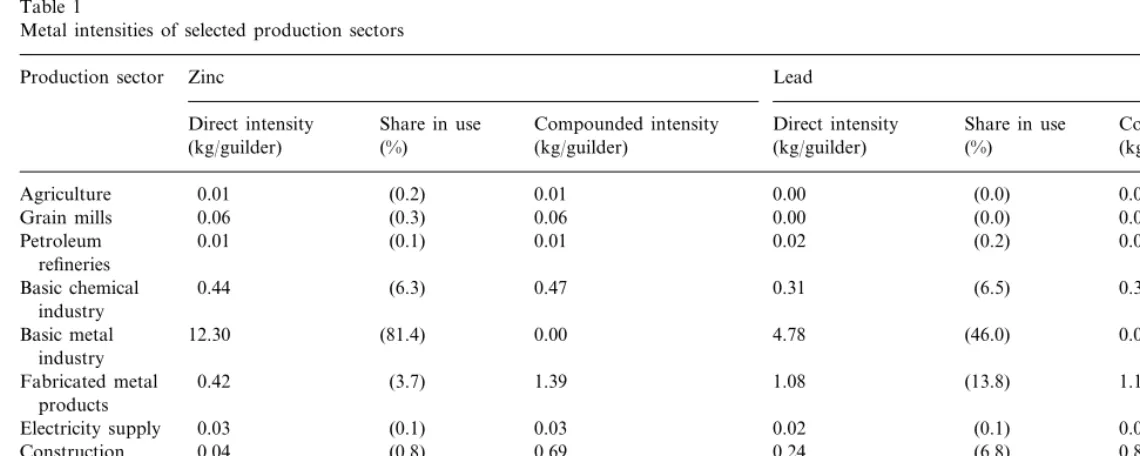

In the scenario analysis the material policies will be simulated for two specific heavy metals: zinc and lead. Table 1 presents the direct and compounded zinc and lead intensities for selected production sectors. The compounded material in-tensity is calculated for a ‘first-stage compound’, i.e. the first-stage production sectors are excluded and the implicit material content of the products from these first stage production sectors are taken into account in the material intensities of the other sectors. For illustrative purposes, the share in the total inflow of a particular metal is pre-sented (measured as a percentage of the use in kilograms).

Table 1 shows that the share of the basic metal industry in the total inflow of zinc is more than 80% of the total zinc use. Other large users of zinc are the basic chemical industry, metal products manufacturing and wholesale and retail trade (through imports). The lead use of the basic metal industry is 46% of total lead use. Among the sectors with high lead intensity is the construction sector. At first glance, the large zinc and lead intensity of the other services sector may seem surprising. However, this sector encom-passes the waste-handling firms that account for a large use of metals (Boelens and Olsthoorn, 1998).

A high (low) direct metal input of a production sector does not necessarily imply a high (low) compounded metal intensity of the goods and services produced in the sector. The reported

di-rect intensities are based on where the metals enter the economic process. For example, a final stage production sector may produce goods and services with a high compounded metal content, but add a little more metal in the production process itself. The materials included in the eco-nomic inputs are already accounted for in other production stages. The differences between the compounded and direct material intensities indi-cate where most of the materials from the basic metal industry goes (the throughput from this sector).

4. Results of the scenario analysis

The results of the policies in the various scenar-ios are discussed for the production sectors, the household groups, employment and trade. The following policies as described in Section 3 are simulated:

1. A regulatory levy on the primary use of zinc (zinc inflow levy).

2. A regulatory levy on the throughput of zinc (zinc throughput levy).

3. A regulatory levy on products that contain zinc (zinc product levy).

4. A regulatory levy on the primary use of lead (lead inflow levy).

5. A regulatory levy on the primary use of both zinc and lead (zinc and lead inflow levy). In each of the first three scenarios, a levy is imposed on the use of zinc at different phases in order to analyse the difference between the effects of an input, a throughput or a product levy. The last two scenarios are simulated to examine the differences in results for different materials.

The results of the scenario analyses are pre-sented as percentage changes from the initial equi-librium (real quantity changes). Tables 2 – 4 give the main results of the scenarios for selected pro-duction sectors, household groups, employment and trade.6

R

.

B

.

Dellink

,

P

.

P

.

A

.

A

.

H

.

Kandelaars

/

Ecological

Economics

33

(2000)

205

–

218

212

Table 1

Metal intensities of selected production sectors

Zinc

Production sector Lead

Direct intensity Share in use Compounded intensity Direct intensity Share in use Compounded intensity

(%) (kg/guilder) (%) (kg/guilder)

(kg/guilder) (kg/guilder)

0.00 (0.0) 0.00

Agriculture 0.01 (0.2) 0.01

0.00

(0.3) 0.06 0.00 (0.0)

0.06 Grain mills

0.02

0.01 (0.1) 0.01 (0.2) 0.02

Petroleum refineries

0.47 0.31 (6.5) 0.31

Basic chemical 0.44 (6.3) industry

0.00 4.78 (46.0) 0.00

Basic metal 12.30 (81.4)

industry

(13.8) 1.12

1.08 1.39

Fabricated metal 0.42 (3.7) products

0.03 (0.1) 0.03 (0.1) 0.02

Electricity supply 0.02

0.04 (0.8) 0.69 (6.8) 0.82

Construction 0.24

(24.1) 0.60

0.60 0.20

Wholesale and 0.20 (5.7)

retail trade

0.03 (0.4) 0.56

Other transport 0.00 (0.0) 0.00

0.00

Civil government 0.00 (0.0) 0.00 0.00 (0.1)

Table 2

Model results for selected production sectors; real output change (%)

Production sector Zinc inflow Zinc through Zinc product Lead inflow Zinc and lead inflow levy

levy levy

levy levy

0.08 0.02 0.04 0.02

Agriculture 0.01

1.17 0.49

0.43 0.42

Tobacco industry 0.42

0.18

Petroleum refineries 0.32 0.25 0.12 0.16

−0.09

Basic chemical industry −0.79 0.46 −0.13 −0.10

−5.31 −13.15

−10.51 −7.01

Basic metal industry −9.24

Fabricated metal products −0.56 −2.28 −0.54 −0.95 −0.71

−0.47 −0.55

−0.46 −0.37

Electricity supply −0.43

−1.81 −0.01

Construction −0.01 −0.33 −0.13

−0.09 −0.07

−0.10 −0.29

Wholesale and retail trade −0.17

0.09 0.07 0.05 0.05

Insurance 0.06

0.29 0.13 0.15 0.13

0.12 Civil government

4.1. Scenario 1:zinc inflow le6y

For most production sectors the effects of the regulatory metal levy are small, because most products and services have only a small direct metal intensity (see Table 1) and the off-setting

reduction in labour taxes has no major impact on the competitive position of the sectors. However, the regulatory levy on the primary use of zinc has a considerable impact on the basic metal industry: Table 2 shows that the real output level of this sector decreases with 10.5%. This is not

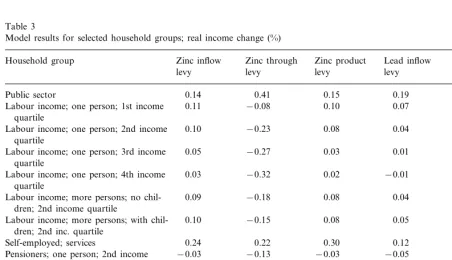

surpris-Table 3

Model results for selected household groups; real income change (%)

Lead inflow Zinc inflow

Household group Zinc through Zinc product Zinc and lead

levy inflow levy

Labour income; one person; 1st income quartile

0.08

0.10 −0.23 0.08 0.04

Labour income; one person; 2nd income quartile

0.01 0.04

0.05

Labour income; one person; 3rd income −0.27 0.03 quartile

0.02

0.03 −0.32 0.02 −0.01

Labour income; one person; 4th income quartile

Labour income; more persons; no chil- 0.09 −0.18 0.08 0.04 0.07 dren; 2nd income quartile

−0.15

0.10 0.08 0.08

Labour income; more persons; with chil- 0.05

dren; 2nd inc. quartile

0.19

0.22 0.30

Self-employed; services 0.24 0.12

−0.03 −0.05

−0.13 −0.04

Pensioners; one person; 2nd income −0.03 quartile

−0.01 −0.02 −0.02

Pensioners; more persons; 2nd income −0.07 −0.01 quartile

0.02

−0.03 0.01

0.02 0.01

Transfer recipients; one person; 2nd in-come quartile

R.B.Dellink,P.P.A.A.H.Kandelaars/Ecological Economics33 (2000) 205 – 218

214

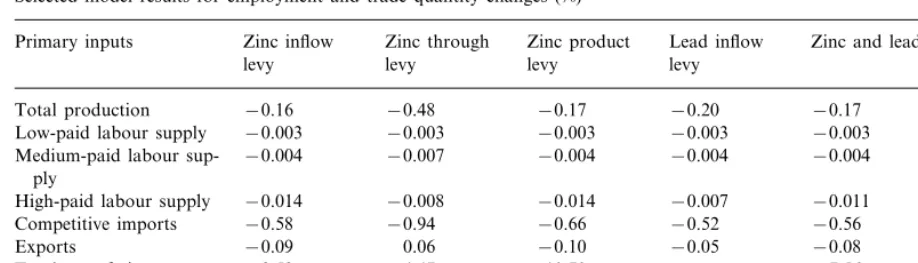

Table 4

Selected model results for employment and trade quantity changes (%)a

Lead inflow Zinc through

Primary inputs Zinc inflow Zinc product Zinc and lead inflow levy levy

levy levy

levy

−0.48 −0.17

Total production −0.16 −0.20 −0.17

Low-paid labour supply −0.003 −0.003 −0.003 −0.003 −0.003 Medium-paid labour sup- −0.004 −0.007 −0.004 −0.004 −0.004

ply

−0.008 −0.014

High-paid labour supply −0.014 −0.007 −0.011

Competitive imports −0.58 −0.94 −0.66 −0.52 −0.56

Exports −0.09 0.06 −0.10 −0.05 −0.08

−4.47 −10.70

−8.58

Total use of zinc −7.56

Total use of lead −3.46 −4.41

aThe competitive imports do not include the import of crude petroleum and natural gas. Exports are the demand by the ‘rest of the World’.

ing, as the basic metal industry accounts for over 80% of the total primary use of zinc (see Table 1). If the basic metal industry could transfer part of the tax burden to other sectors (through a higher price for its products), the impact may be mitigated. This tax burden transfer depends on the price elasticities, especially for basic metal industry goods. A small value for these elasticities would imply that these sectors would still demand the metal goods, even if the price of these goods rises. In the model, these price elasticities are calculated within the model from the nesting structure of the production functions and the substitution elasticities. It may be concluded that the basic metal industry has only limited opportu-nities to transfer the tax to its buyers. This is consistent with the empirical observation that in-ternational competition in this sector is severe.

In general, the effects of the zinc inflow levy on real household income are small (see Table 3), mostly less than one-tenth of a percent. The posi-tive impact is only significant (around 0.25% of their net income) for the self-employed: both the partial effects of the metal tax and the labour subsidy are positive for these groups. For most households the effects of the metal tax and the labour subsidy roughly balance each other. Given the redistribution of the tax revenues as a labour subsidy the labour income households and the self-employed can improve more on their real

income than the ‘non-workers’, i.e. the pensioners and the transfer recipients.

Total production decreases, indicating that the zinc inflow levy is not without economic costs.

However, these costs are small: −0.16% (see

Table 4). This decrease can entirely be contributed to the decrease in output of the basic metal industry.

Table 4 shows that the demand for labour decreases very slightly in the zinc inflow levy, indicating that there is no double dividend. One can also conclude that the material policy does not negatively affect employment. This is in line with other empirical observations that the em-ployment effects of environmental policy are in general negligable, at least within an applied gen-eral equilibrium framework (see, for example, Dellink and Jansen, 1995).

The labour tax reform has a positive effect on the import of primary inputs, but the zinc levy off-sets this. Imports decrease, while exports (the demand by the ‘Rest of the world’) are affected slightly negatively (see Table 4). Thus, the effects on the trade balance are small and inconclusive.

Using the ‘rough’ measure for the effects on materials (see Section 2), the total use of zinc will decrease from 270 to 247 kilotons (a decrease of 8.6%, see Table 4). Compared to the overall

de-crease in output (−0.16%), the policy induces a

4.2. Scenario 2:zinc throughput le6y

A levy on the throughput of zinc negatively influences the output of most production sectors. The associated labour tax cut has a slightly posi-tive effect, while the total effect is negaposi-tive for these sectors. Table 2 shows that this scenario has a negative effect of more than 1% on the output of some sectors, for instance, the metal products, construction, and the wood and furniture indus-tries. Compared with the zinc inflow levy the main differences are that the basic metal industry is less damaged, and that most other production sectors are affected more severely than in the first scenario.

Here, the tax burden is spread more evenly over the production sectors. The macro-economic

ef-fect on production of −0.48% (see Table 4) is

more than twice as large compared to the zinc inflow levy. This indicates that the economic costs of exempting the basic metal industry from the zinc levy are substantial. Furthermore, the impact of the zinc levy on the basic metal industry cannot be totally mitigated: the decrease in production of this sector still accounts for 0.1% of the total production loss.

For households with a labour income, the ef-fects are more negative than in the base scenario. A reason is that now more labour intensive sec-tors carry the tax burden, instead of the more capital intensive basic metal industry. Moreover, other sectors may be better capable of transferring the burden to their clients (and eventually to consumers). For the other household groups there is only a small, negative change, except for the self-employed.

The sectoral and distributional effects differ considerably between the inflow and throughput levies. This is largely related to the demand for inputs from the basic metal industry. In the inflow scenario, the basic metal industry is levied severely, and subsequently a part of the levy is transferred to the purchasers of its products. In this way, the ‘down-stream’ producers are levied indirectly. In the throughput levy scenario, the down-stream producers are levied directly on ba-sis of their metal intensity. Consequently, the metal-intensive sectors (generally the industrial

sectors) are negatively affected, while the less metal-intensive sectors (e.g. basic industries and services) can increase their output. This substanti-ates the conclusion that the basic metal industry is not very capable of transferring its imposed extra costs to the other sectors.

The total reduction in the use of materials is smaller than in the base scenario (−4.5 instead of

−8.6%). Given the larger decrease in economic

activity, the dematerialisation of the economy is less significant. The dominant reason is that the basic metal industry is less affected, and hence its use of materials is less reduced. Moreover, in this scenario the intra-sectoral substitution effects that are not accounted for will presumably be larger (note that inter-sectoral substitution is taken into account). Finally, the relatively large outflow from the basic metal industry to foreign economic sectors or outside the economic system is not taxed in the throughput scenario, and hence there are no incentives to reduce this outflow.

4.3. Scenario 3: zinc product le6y

The results of a product levy on the production sectors in Table 2 show that the basic metal industry is strongly affected, with an output re-duction of 13% (somewhat larger than in the inflow levy case). Here, only the production from the basic metal industry is levied. The buyers of the products of the basic metal industry may switch to other products, affecting the basic metal industry negatively. The metal products and the electricity supply sectors are also negatively af-fected, as their possibilities of using alternative materials or products is limited. The basic chemi-cal industry is positively affected, partially be-cause the intermediate production sectors are substituting zinc for other materials like plastics. The reduction in total economic activity is very similar to that in the zinc inflow levy scenario

(−0.17 vs. −0.16%; see Table 4), indicating no

di-R.B.Dellink,P.P.A.A.H.Kandelaars/Ecological Economics33 (2000) 205 – 218

216

rectly, in contrast to the zinc inflow scenario. Table 4 shows that the trade balance and employ-ment effects are similar to the zinc inflow scenario.

The large decrease in the output of the basic metal industry is reflected in a relatively large

decrease in the total use of materials (−10.7%,

see Table 4). However, the crude assumption that there is no substitution from the taxed metal to other metals within the same production sector is of importance here. After all, if the use of zinc itself is taxed, the producers may substitute other metals for zinc, inducing a reduction of zinc use at a constant input from the basic metal industry. If the input from the basic metal industry itself is taxed, regardless of the zinc content of that input, the producers have no incentive to switch to other metals.

4.4. Scenario 4:lead inflow le6y

In this scenario the lead inflow is taxed (similar to the zinc inflow levy). The results for the pro-duction sectors show that the output of the basic metal industry will be reduced by 7%, which is less than in the corresponding zinc scenario (see Table 2). The impact of the levy on lead on various other sectors is around 0.3 – 0.4%. The spread of the lead intensities over the production sectors is larger than the zinc intensities (see Table 1), making the tax burden more evenly distributed over the various production sectors. This implies that the policy affects more production sectors negatively. The macro-economic decrease in

pro-duction is−0.20% (compared to −0.16% for the

zinc inflow levy; see Table 4). The share of the production loss in the basic metal industry sector in total reduction of output is just over 50%. The impact of a levy on lead on household groups is roughly the same as in the corresponding zinc scenario (see Table 3). The effects on imports are negative (see Table 4). The employment effects are similar to those in the corresponding zinc sce-nario. The total use of lead decreases with 3.5%.

4.5. Scenario 5:zinc and lead inflow le6y

This scenario studies the combined effect of

levies on zinc and lead. This can give an insight into the economic effects of a ‘more complete’ metal policy. Policy makers may want to impose a levy on several materials simultaneously, for ex-ample, a levy on a number of harmful materials. Changes in the production processes to reduce tax payments are likely to have impacts on the use of other metals as well. This correlation between two metals can be positive (change to less metal-intensive production) or negative (change from one metal to another). If in the zinc (lead) inflow levy scenario zinc (lead) was substituted by lead (zinc), it would be expected that in a scenario where both metals are levied the costs of substitu-tion and the output effects would be higher, as some of these substitution possibilities are no longer available. This latter effect does not occur, and therefore it may be concluded that there is not much substitution between zinc and lead. For most production sectors, household groups, em-ployment, trade and total use of materials, the effects of this scenario are between those of the corresponding zinc and lead scenarios (see Tables 3 and 4). An exception is the decrease in lead use, which is somewhat larger than if the levy is only placed on lead use. This at first sight surprising result can easily be explained: the economic re-structuring that is induced by the levy on zinc will also result in a reduction of lead use.

5. Concluding remarks

In this paper, an empirical model is introduced in which economic and environmental aspects are (partially) integrated. The basic building blocks of the new model are a material flow model and an applied general equilibrium model. The model is applied in order to study the impact of policies to reduce the use of zinc and lead in the Nether-lands. From the scenario results the following conclusions may be drawn.

negligi-ble, provided that the proceeds of the levy are used to reduce existing (labour) taxes. The major economic effects are the output losses of those production sectors where most materials enter the domestic economy. On the other hand, the environmental benefits are clear: total use of the levied materials will decrease signifi-cantly.

Second, the adverse effects on the major mate-rial-using production sectors can be reduced, but only at the cost of larger impacts on other pro-duction sectors (and consequently larger macro-economic costs) and a smaller environmental gain. In other words, when the sectors where the materials enter the domestic economy are exempt from the levy, the economic effects will be larger and more dispersed, as the policy is less focussed.

Third, at least within the current model set-up, the economic effects of a product levy (irrespec-tive of the intensity in the use of materials) will be similar to those of a material levy. However, this crucially depends on the lack of endogenous feed-back between the material flow model and the applied general equilibrium model, which implies that substitution possibilities between different materials are underestimated.

Finally, from the current analysis it becomes clear that, although the current methodology is

not yet capable of capturing all relevant

mechanisms, the material flow data and the eco-nomic flow data can be made compatible and

applied in empirical analyses. Consistent

analysis of the interactions of these effects is important to inform environmental – economic policy makers.

More research is needed to more accurately assess the material and economic impacts of poli-cies in an integrated physical and economic model. Two further steps towards this integration could be the inclusion of a direct feedback from the AGE model to the material flow model and the modelling of dynamic effects.

In the current analysis the feedback between the AGE model and the material flow model is exoge-nous. Moreover, the material intensities are as-sumed not to change when a levy is imposed. These weaknesses, which limit the empirical

anal-ysis, may be overcome by integrating the feedback between the AGE model and the material flow model. This endogenous feedback might be imple-mented by using a new economic sector that supplies the materials to the production sectors. In this way, the material flow model will essen-tially become a part of the AGE model. This provides many new possibilities, as other environ-mental themes, like emissions, can be included in the same manner.

With a dynamic model the impacts over time and the role of technological development may be analysed. Technological development may be a major source for reducing the use of materials. For instance, material policies may induce en-dogenous changes in technology, as well as in recycling, more material-efficient production tech-niques and new substitution possibilities. The for-mulation and validation of a dynamic integrated model, that captures the major dynamic pro-cesses, will prove to be a challenging task, espe-cially in an empirical setting.

Acknowledgements

The authors would like to thank Paul Mensink, Erik Schmieman and two anonymous referees for their valuable comments.

References

Annema, J.A., Booij, H., Paardekoper, L., van Oers, L., van der Voet, E., Mulder, P., 1995. Stofstroomanalyse van zes zware metalen-gevolgen van autonome ontwikkelingen en maatregelen. RIVM, Bilthoven, The Netherlands Report No. 601 014 010.

Ayres, R.U., Kneese, A.V., 1969. Production, consumption and externalities. Am. Econ. Rev. 59, 282 – 297.

Boelens, J., Olsthoorn, X., 1998. Flux. In: Proceedings of SAMBA II workshop, Wuppertal, p. 1998.

Cornielje, O., 1990. Rationing and Capital Mobility in Ap-plied General Equilibrium Models. VU University Press, Amsterdam.

Dellink, R.B., Jansen, H.M.A., 1995. Socio-economic aspects of the greenhouse effect: applied general equilibrium model. Global Change. NRP, Bilthoven Report 410.100.113.

R.B.Dellink,P.P.A.A.H.Kandelaars/Ecological Economics33 (2000) 205 – 218

218

Hamond, M.J., DeCano, S.J., Dusbury, P., Sanstad, A.H., Stinson, C.H., 1997. Tax Waste, Not Work. Redefining Progress, San Francisco.

Kandelaars, P.P.A.A.H., Dellink, R.B., 1997. Economic ef-fects of materials policies: combining an applied equi-librium model with materials flows. Tinbergen Institute, Amsterdam discussion paper 97-118/3.

Kandelaars, P.P.A.A.H., 1999. Economic Models of Mate-rial – Product Chains for Environmental Policy Analysis. Kluwer, Dordrecht.

Keller, W.J., 1980. Tax Incidence: a General Equilibrium Approach. North-Holland, Amsterdam.

Kneese, A.V., Ayres, R.U., d’Arge, R.C., 1970. Economics and the Environment: a Materials Balance Approach. Johns Hopkins Press, Baltimore, MD.

OECD, 1994. Applying Economic Instruments to Environ-mental Policies in OECD and Dynamic Non-Member Economies. OECD, Paris.

Perrings, C., 1986. Conservation of mass and instability in a dynamic economy – environment system. J. Environ. Econ. Manage. 13, 199 – 201.

Statistics Netherlands, 1991. Tax incidence in the Netherlands: accounting and simulations. SDU, The Hague CBS statis-tische onderzoekingen M42.

Van den Bergh, J.C.J.M., Nijkamp, P., 1994. Dynamic macro modelling and materials balance: economic – environmental integration for sustainable development. Econ. Model. 11, 283 – 307.

Van den Bergh, J.C.J.M., 1999. Materials, capital, direct/ indi-rect substitution and mass balance production functions, Land Econ., in press.