2014 2015 2016F 2017F 2018F

Revenue (IDR bn) 1413 1148 1409 1577 1770

Operating Profit (IDR bn) 371 213 349 397 435

Net Profit (IDR bn) 177 77 187 215 240

Earnings Per Share (IDR) 404 159 390 447 501

EPS Growth (%) 23.6 -60.7 145.2 14.7 12.0 OPM (%) 26.2 18.6 24.8 25.1 24.6 NPM (%) 20.5 11.3 18.9 18.7 18.1 ROE (%) 35.3 14.7 27.6 26.3 24.9 ROA (%) 10.2 4.6 9.0 9.5 9.7 ROIC (%) 23.5 0.0 17.5 22.1 27.2 P/E (x) 23.8 60.4 24.6 21.5 19.2 P/B (x) 5.1 4.7 3.6 3.1 2.6

Source: Company, Sucorinvest estimates

Share Performance (%)

Month Absolute Relative

3m 3.0 1.4

6m 5.2 0.8

12m 15.1 28.3

BUY

Impack Pratama

Alderon – The Next Big Thing

We recently met up with the marketing director of IMPC along with their top roofing distributor in Indonesia to discuss the current roofing market and the acceptance of Alderon, IMPC’s new uPVC roofing.

Alderon penetrating the retail alternative roofing market

Our talks with IMPC’s top distributor showed that the thick uPVC Alderon is hot in demand from the retail market as an alternative to polycarbonate roofing. Although stock was not available yet because two new Alderon production machines came this May, orders have been placed by mom-and-pop stores as consumers like the product and want to use it as an alternative to polycarbonate roof for car canopies.

High demand for Alderon in the warehousing and factory market

This year, IMPC has signed with BaoZhen for their Nike and Converse factory around 140.000 sqm or 25% of total capacity for Alderon. Potentially, deals with this one company can reach up to 300.000 sqm for this year only, emphasizing the high demand for Alderon. Other clients include large sportswear producers and textile manufacturers among others.

1Q16 Results: Better at second sight

At first glance, results seemed disappointing as topline is down 17%. However, this is caused by an absence in real estate sales. Excluding Altira, revenue went up 4% YoY to Rp255bn and gross profits increased by 36% to Rp88bn. Bottomline, NPAT to parents increased by 27% to Rp27bn.

Investing for the long haul

IMPC’s story has just begun, and we believe that their tale is one that will play out these next coming few years. By introducing new products such as Alderon and ACP, IMPC will soon dominate the basic industries market in Indonesia.

INDONESIA

BASIC INDUSTRY

Share Price Performance

Company Update

Alexander Budiman alexander.budiman@sucorinvest.com +62 21 8067 3134 23 May 2016 Stock DataBloomberg Ticker IMPC IJ Equity Outs. Share (bn) 483.35 Mkt Cap (USD mn) 0.34 52 Week Range (RP) 8025-9650 6M Avg Val (RP bn) 2 YTD Returns (%) 3.2 Beta (x) n.a Current price Rp9,575 Price target Rp10,950 Upside/Downside +14.3%

2

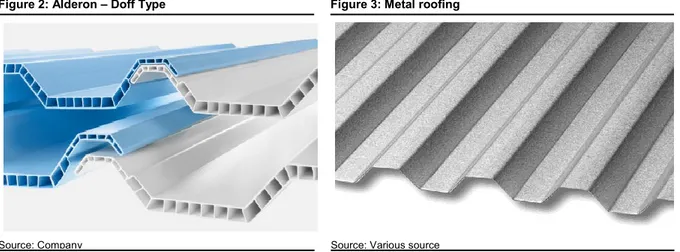

Source: CompanyFigure 2: Alderon – Doff Type

Source: Various source

Figure 3: Metal roofing

Trumping the uPVC competition

Competition wise, Rooftop is the only close competitor in the corrugated roofing space. Price per square meter for Rooftop and Alderon is currently comparable. Alderon’s products are 8% more expensive but also 8% more in length.

Additionally, asides from the solid blue and white Alderon (Doff Type) IMPC has released a new translucent Alderon (Semi-TR type) which allows light to pass through.

Alderon uPVC roofing is on average twice as expensive in comparison to metal. However, the range of advantages Alderon brings such as heat resistance, sound reduction and rust resistance more than compensates the difference in price.

Alderon penetrating the retail alternative roofing market

Polycarbonate roofing has long since been the only alternative roofing for houses, but our discussion came to the conclusion that a storm is brewing. IMPC’s main distributor said that the thick uPVC Alderon is hot in demand from the retail market though it is not for sale yet at the time of interview. On a price per sqm scale, Alderon is around 20% more expensive than Twinlite although it is twice as thick.

Although stock was not available yet because two new Alderon production machines came this May, orders have been placed by mom-and-pop stores as consumers like the product and want to use it as an alternative to polycarbonate roof for car canopies.

3

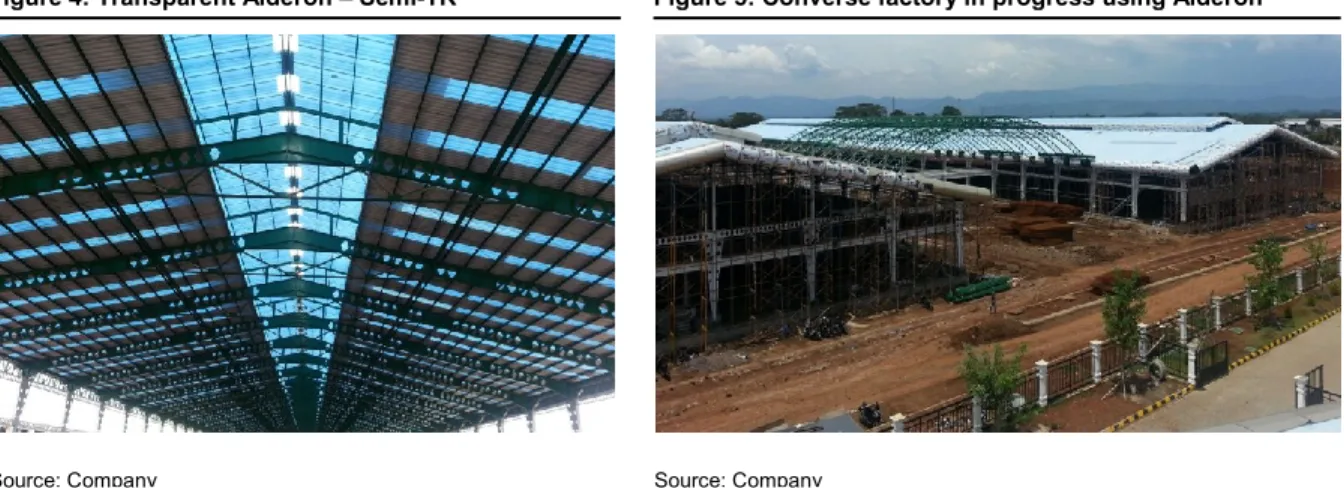

Source: CompanyFigure 4: Transparent Alderon – Semi-TR

Source: Company

Figure 5: Converse factory in progress using Alderon

High demand for Alderon in the warehousing and factory market

This year, IMPC has signed with BaoZhen for their Nike and Converse at Ciranjang factory around 140.000 sqm or 25% of total capacity for Alderon. Potentially, deals with this one company can reach up to 300.000 sqm for this year only, filling up more than 50% of machine capacity for the year and emphasizing the high demand for Alderon. Other clients include large sportswear producers and textile manufacturers among others.

1Q16 Results: Core business revenue still in line

At first glance, results seemed disappointing as topline is down 17%. However, this is caused by an absence in real estate (Altira) sales. However, NPAT to parents still increased by 27% YoY.

Excluding Altira, revenue went up 4% YoY to Rp255bn and gross profits increased by 36% to Rp88bn. Bottomline, NPAT to parents increased by 27% to Rp27bn. For the main business line, realization is in line with our expectations.

Figure 6: 1Q16 Results (Rp bn) 1Q16 1Q15 % YoY 2016F % to FY Revenue 264 317 -17% 1409 19% EBIT 47 66 -28% 349 13% NPAT 27 45 -40% 267 10% NPAT to Parents 27 21 27% 187 14% (Rp bn) 1Q16 1Q15 % YoY 2016F % to FY Revenue 255 244 4% 1119 23% Gross Profit 89 65 37% 358 25% NPAT to Parents 27 21 27% 107 25%

Source: Company, Sucorinvest estimates

IMPC including Altira (Real Estate)

4

Financial Summary

Figure 7: Income Statement Highlights

(Rp bn) 2014 2015 2016F 2017F 2018F Core Business 1,062 964 1,119 1,287 1,480 Altira 352 184 290 290 290 COGS 885 777 877 991 1,123 Gross Profit 529 371 532 586 648 Operating Expenses 158 158 183 189 212 EBIT 371 213 349 397 435 D&A 49 46 64 68 71 EBITDA 371 259 413 465 506 Pre-tax Income 355 147 310 354 388

Income tax exp 66 17 43 59 68

Minority Interest 113 53 80 80 80

Net Profit 177 77 187 215 240

Source: Company, Sucorinvest estimates Figure 8: Balance Sheet (Rp bn) 2014 2015 2016F 2017F 2018F Cash 392 122 349 541 786

Accounts Receivables 166 152 193 216 242

Goods Inventories 241 170 237 268 303

Real Estate Inventory 294 300 320 320 320

Advance Payments 94 109 116 65 48 Others 21 45 50 50 50 Current Assets 1,209 898 1,265 1,459 1,750 PPE - Net 398 466 479 453 382 Goodwill - Net 21 21 21 21 21 Intangibles - Net 67 97 97 97 97 Others 42 193 220 220 220 Non-Current Assets 528 777 817 791 720 Total Assets 1,737 1,675 2,082 2,251 2,470 ST Borrowing 287 206 250 150 150 Accounts Payable 114 81 154 173 194 Advance Payments 100 35 50 50 50 Current Maturities 31 33 30 50 50 Others 49 40 50 50 50 Current Liabilities 582 395 534 473 494 LT Borrowing 94 98 200 200 150 Others 76 85 85 85 85 Non-Current Liabilities 170 183 285 285 235 Total Liabilities 752 578 819 758 729 Common Shares 217 217 217 217 217 Minority Interests 163 215 295 375 454 Retained Earnings 561 620 751 901 1,069 Others 44 45 - - -Total Equity 985 1,097 1,263 1,493 1,741

5

Figure 9: Statement of Cash Flows(Rp bn) 2014 2015 2016F 2017F 2018F

Cash Flows from Operating Activities

Net Income 371 213 349 397 435

Depreciation Expense 49 46 64 68 71

NWC (63) (61) (21) 16 (24)

Total 163 62 229 298 287

Cash Flows from Investing Activities Capex (130) (164) (141) (110) (71)

Others (56) (137) 17 68 71

Total (186) (301) (124) (42) 0

Free Cash Flows 33 (102) 88 188 216

Cash Flows from Financing Activities Change in Equity 194 1 (45) -

-Dividend (274) - (56) (64) (72)

Others 39 (18) - -

-Change in Other Long-Term Liabilities (27) 9 - -

-Change in Short-Term Debt 9 (80) 41 (80)

-Change in Long-Term Debt 11 4 102 - (50)

Change in minority interest 93 52 80 80 80

Total 46 (31) 122 (65) (42)

Beginning Cash 370 392 122 349 541

Change in Cash 22 (270) 227 191 245

Ending Cash 392 122 349 541 786

Source: Company, Sucorinvest estimates

Figure 10: Key Ratios

% 2014 2015 2016F 2017F 2018F

Gross Profit Margin 37.4 32.3 37.8 37.1 36.6 Operating Profit Margin 26.2 18.6 24.8 25.1 24.6 Net Profit Margin 20.5 11.3 18.9 18.7 18.1 ROIC 23.5 15.2 17.5 22.1 27.2 ROE 35.3 14.7 27.6 26.3 24.9 Net Debt/EBITDA 5.4 56.5 31.6 Net Cash Net Cash Source: Company, Sucorinvest estimates

6

Sucorinvest rating definition, analysts’ certification, and important disclosure

Ratings for Sectors

Overweight : We expect the industry to perform better than the primary market index (JCI) over the next 12 months. Neutral : We expect the industry to perform in line with the primary market index (JCI) over the next 12 months. Underweight : We expect the industry to underperform the primary market index (JCI) over the next 12 months

Ratings for Stocks

Buy : We expect this stock to give return (excluding dividend) of above 10% over the next 12 months. Hold : We expect this stock to give return of between -10% and 10% over the next 12 months.

Sell : We expect this stock to give return of -10% or lower over the next 12 months

Analyst Certification

The research analyst(s) primarily responsible for the preparation of this research report hereby certi20 that all of the views expressed in this research report accurately reflect their personal views about any and all of the subject securities or issuers. The research analyst(s) also certi20 that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in this research report.

Disclaimers

This document has been prepared for general circulation based on information obtained from sources believed to be reliable but we do not make any representations as to its accuracy or completeness. PT Sucorinvest Central Gani accepts no liability whatsoever for any direct or consequential loss arising from any use of this document or any solicitations of an offer to buy or sell any securities. PT Sucorinvest Central Gani and its directors, officials and/or employees may have positions in, and may affect transactions in securities mentioned herein from time to time in the open market or otherwise, and may receive brokerage fees or act as principal or agent in dealings with respect to these companies. PT Sucorinvest Central Gani may also seek investment banking business with companies covered in its research reports. As a result investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision.

7

Sales Office & Research

PT. Sucorinvest Central Gani

Research

1. Inav Haria Chandra Equity Analyst inav.chandra@sucorinvest.com 2. Alexander Budiman Equity Analyst alexander.budiman@sucorinvest.com 3. Sharon Anastasia Tjahjadi Equity Analyst sharon.tjahjadi@sucorinvest.com 4. Felicia Putri Equity Analyst felicia.putri@sucorinvest.com 5. Sandy Ham Equity Analyst sandy.ham@sucorinvest.com 6. Adityo Mahendra Yogiswara Equity Analyst adityo.yogiswara@sucorinvest.com 7. Emily Bonosusatya Equity Analyst emily.bonosusatya@sucorinvest.com 8. Ahmad Hapiz Research Support ahmad.hapiz@sucorinvest.com

HEAD OFFICE

PT. Sucorinvest Central Gani Equity Tower, 31st Floor Jl. Jend Sudirman Kav. 52-53 Jakarta 12190 – Indonesia Ph : (+62-21) 2996 0999 Fax : (+62-21) 5797 3938

JAKARTA

Equity Tower, 31st Floor Jl. Jend Sudirman Kav. 52-53 Jakarta 12190 – Indonesia Ph : (+62-21) 2996 0999 Fax : (+62-21) 5797 3938 Ruko Pluit Village (Mega Mall Pluit) no. 30

Jl. Pluit Indah Raya, Jakarta Utara 14450

Ph: (+62-21) 6660 7599 (+62-21) 6660 7607 Fax: (+62-21) 6660 7610 Ruko Mangga Dua Square Blok F no. 39

Jl. Gunung Sahari Raya, Jakarta Utara 14420 Ph: (+62-21) 2961 8899 Fax: (+62-21) 2938 3525 Wisma 77 Lt.17 Jl. Letjend S. Parman Jakarta Barat 11410 Ph: (+62-21) 536 3033 Fax: (+62-21) 5366 2966 Ruko Inkopal Block A No. 23 A Jl. Boulevard Barat Raya Jakarta Utara 14240 Ph: (+62-21) 4585 9114 Fax: (+62-21) 4585 9227 Ruko Puri Niaga 1 Blok K7 / 3T Jl. Puri Kencana Jakarta Barat 14240 Ph: (+62-21) 582 3117 Fax: (+62-21) 582 3118 GALERI INVESTASI Universitas PANCASILA Jl. Srengseng Sawah, Lenteng Agung, Jakarta Selatan 12640 Ph: (+62-21) 787 3711 GALERI INVESTASI Universitas Krisnadwipayana Jl. Raya Jatiwaringin, Pondok Gede Jakarta Timur 13620 Kiosk Mall Ambassador Lantai Dasar Blok H No.3A Jl. Professor Doktor Satrio Jakarta Selatan 12940

GALERI INVESTASI Univesitas Islam 45 Bekasi Jl. Cut Meutia NO.83, Bekasi 17113

TANGERANG

Ruko PDA No.9

Jl.Raya Boulevard Gading Serpong

Tangerang 15810. Ph : (+62-21) 54210990 GALERI INVESTASI Surya University

Gedung 01 Scientia Business Park

Jl. Boulevard Gading Serpong Blok O/1 Summarecon Serpong Tangerang 15810

BOGOR

Komplek Ruko V Point Jl. Pajajaran Blok ZG, Bogor 16144

Ph: (+62-251) 835 8036 Fax: (+62-251) 835 8037 GALERI INVESTASI STIE Kesatuan Bogor Jl. Ranggagading No.1 Bogor 16123

Ph : (+62-251) 835 8036

BANDUNG

Ruko Paskal Hyper Square Blok B No.47

Jl. Pasir Kaliki No. 25 - 27 Bandung 40181 Ph: (+62-22) 8778 6206 Fax: (+62-22) 8606 0653 JL.Hegarmanah No.57 Bandung 40141 Ph: (+62-22)-203 3065 Fax: (+62-22) 203 2809 YOGYAKARTA Jl. Poncowinatan No. 94 Yogyakarta 55231 Ph: (+62-274) 580 111 Fax: (+62-274) 580 111 GALERY INVESTASI Universitas Ahmad Dahlan Lab kompt FE Lt-2 kampus 1 Universitas Ahmad Dahlan Jl. Kapas no 9, Semaki, Umbulhardjo, Yogyakarta 55166 Ph: (+62-274) 71 700 48

MALANG

Jl. Jaksa Agung Suprapto No.40 Kav. B4, Malang 68416 Ph: (+62-341) 346 900 Fax: (+62-341) 346 928 GALERI INVESTASI UNIVERSITAS MERDEKA Jl. Terusan Dieng No.59, Malang 65146 Ph: (+62-341) 580 900 KEDIRI GALERI INVESTASI UNIVERSITAS NUSANTARA PGRI Jl. KH Ahmad Dahlan 76, Kediri 64112 Ph : (+62-354) 7417352 SURABAYA Jl. Trunojoyo no.67 Surabaya 60264 Ph: (+62-31) 563 3720 Fax: (+62-31) 563 3710 Jl. Slamet no. 37 Surabaya 60272 Ph : (+62-31) 547 9252 Fax : (+62-31) 547 0598 Ruko Pakuwon Town Square AA2-50

Jl. Kejawen Putih Mutiara, Surabaya 60112 Ph: (+62-31) 5825 3448 Fax: (+62-31) 5825 3449

GALERI INVESTASI Universitas Negeri Surabaya PIC : Wahyudi Maksum Kampus ketintang

Gedung bisnis centre fakultas ekonomi Jl. Ketintang, Surabaya 60231 Ph: (+62-31) 8297123 GALERI INVESTASI Universitas 17 Agustus 1945 Jl. Semolowaru 45 Surabaya 60118 BALI

Jl. Raya Puputan Renon No.60C, Denpasar 80226

Ph : (+62-361) 261 131 Fax: (+62-361) 261 132