THE JOINT DETERMINATION OF AUDIT DELAY AND AUDITOR CHANGES

Cherrya Dhia Wenny STIE MDP [email protected]

ABSTRACT

The purpose of this research is to determine the effect of auditor changes, firm size, Debt Equity Ratio, Audit Complexity, Auditor’s Opinion, and KAP’s Reputation on Audit Delay. Furthermore, The purpose of this research is to determine the effect of audit delay, firm size, growth, Management Changes, and ROA on Auditor Changes. The method of analysis used is quantitative analysis, with the two stage least square models.

The research shows that auditor changes, firm size, Debt Equity Ratio, Audit Complexity, Auditor’s Opinion, and KAP’s Reputation has impact on audit delay simultaneously. However, partially, only auditor changes, firm size, Debt Equity Ratio, Audit Complexity and KAP’s Reputation have a dominant influence on audit delay, while Auditor’s Opinion is not dominant affect on audit delay. Furthermore, the research shows that audit delay, firm size, growth, Management Changes, and ROA has impact on Auditor Changes simultaneously. However, partially, only audit delay and firm size have a dominant influence on audit delay, while growth, Management Changes, and ROA is not dominant affect on auditor changes.

Keyword: Audit Delay, Auditor Changes

1. INTRODUCTION

PSAK No. 1 (2009, par 07) states that the financial statements are a structured representation of the financial position and financial performance of an entity that has a purpose to provide information about the financial position, financial performance, and cash flow of the entity that will benefit the majority of the report users in economic decision-making, and show the management accountability for the use of the resources entrusted to them.

Bapepam Regulation No. XK2 attachment decisions of the Chairman of

on timeliness in completing the work of the Auditors (Kartika, 2009).

Based on the information released by the Indonesia Stock Exchange (IDX), that until April 1, 2013, there were 52 companies have not submitted audited financial statements ended December 31, 2012. The same thing happened in the first, II, and III quarter in 2013 . On April 30, 2013 there are 81 companies that have not submitted interim financial statements ended December 31, 2013, BEI announced as many as 34 companies have not submitted financial statements as of June 30, 2013, and 52 companies until October 31, 2013 have not submitted financial statements per 30 September 2013. The data shows the fact that there are many companies who have not submitted their financial statements in a timely manner. Research about determination of audit delay has been carried out, in which one of the factors causing the delay according Rustiarini and Sugiarti (2013) is the auditor changes.

Auditor changes caused by several factors, one of which is the regulation of the government under the Minister of Finance Decree No. 17 / PMK 01/2008. Minister of Finance Decree No. No. 17 / PMK 01/2008 Article 3 paragraph (1) stated that:

"Provision of services of general audit of the financial statements of an entity

referred to in Article 2 paragraph (1) is executed by the firm for a maximum of 6 (six) consecutive years and by a Public Accountant for a maximum of 3 (three) years books in a row. "

In addition, the auditor changes can also occur due to factors outside of it. This study restricts the auditor changes caused by factors outside of regulation. One of the factors that are outside the regulation is audit delay, as expressed Srimindarti (2007). Seeing the simultaneous relationship between the audit delay and auditor changes, the researcher is interested in knowing the simultaneous relationship between audit delay and auditor changes. In addition, this study aimed to examine (1) Effect of Auditor Changes, Company Size, Debt Equity Ratio, Complexity Audit, Auditor's Opinion, and the Audit Firm Reputation on Audit Delay, 2) Effect of Audit Delay, company size, growth, management turnover, and Percentage Change in ROA on Auditor Changes

2. Literature Review

2.1 Agency Theory

Jensen and Meckling (1976) define an agency relationship as follows:

When management as an agent and shareholder as a principle, then a conflict of interest may occur. The conflict would be the trigger of management changes, in which the new management will apply a new accounting method and expect more to work with new KAP (Sinarwati, 2010).

In addition, the conflict of interest between the agent (the management) and the principal (owner) could have occurred because of the information asymmetry.

Dyer and McHugh (1975) in Utami (2006) defines audit delay as follows:

“Auditors’ report lag is the open interval of number of days from the year end to the date recorded as the opinion signature date in the public accountant registered (Prayogi, 2012). Obligation of submission of periodic financial statements is set out in the regulations of Bapepam Number X.K. 2 attachments of Bapepam Chairman Decree number: KEP-36/PM/2003.

2.3 Auditor Changes

Substitution Public Accounting Firm (KAP) conducted by a company known as the Auditor Changes. Susan and Trisnawati (2011) states that the change of the firm can be divided into the turn compulsory and voluntary turnover. Substitution compulsory occur because of government regulations that restrict the provision of audit services is set out in a regulation of the Minister of finance number: 17/FMD. 01/2008 about public accounting services. While voluntary turnover is done when clients change auditors, when there are no rules that require it to make the turn auditor.

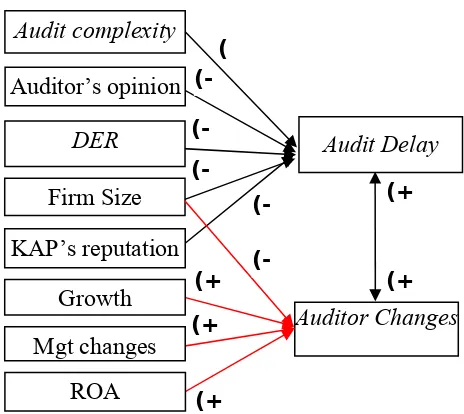

2.4 Framework and Hypotheses

Figure 2.1 Framework and Hypotheses

Dyer and Mc Hugh (1975) in Utami (2006) said that a large-scale company tend to report the results of audited financial statements in a timely manner because the companies are closely monitored by investors, employees, creditors, and the government, so they have more pressure to announce the audit report earlier. The same thing is expressed by Mantik and Sujana (2013) that the large company will report the results of audited financial statements more quickly because the company has a lot of system resources and has a good internal control so as to reduce the level of error in the preparation of the financial report. It can be concluded that the possibility of the Company may affect the size of the audit completion time.

H1: Company Size has negative effect on audit delay

2.4.2 Relations of Audit Opinion and Audit Delay

Hilmi and Ali (2008) in Margaretta and Soepriyanto (2012) stated that the longer audit delay experienced by companies that receive a qualified opinion. This occurs because the process of giving that opinion involves negotiating with clients, consulting with more senior audit partner or technical staff, and expansion of the scope of the audit.

H2 : Audit Opinion has negative effect on audit delay

2.4.3 Relations of KAP’s Reputation and Audit Delay

Francis (2004) in Palmer (2008) states that international auditors (KAP the big-four) who has had the reputation of the brand name will tend to protect their reputation by providing high-quality audits.

This reason is also expressed by Prabandari and Rustiana (2007) in Mary (2012) stated that the international public accounting firm, or better known as the big four need a shorter time to complete the audit, because the firm is considered to perform the audit more efficiently and have a degree of flexibility is higher timeline to complete the audit in a timely manner.

H3 : KAP’s Reputation has negative effect on audit delay

2.4.4 Relations of Debt Equity Ratio and Audit Delay

Yunita, et al (2013) states that companies with large liabilities tend to urge auditors to audit start and finish faster because large companies are supervised and monitored by creditors that will put pressure on companies to publish audited financial statements more quickly to reassure the owners capital, so that the greater the level of DER, the shorter anyway Audit Delay.

H4 : DER has negative effect on audit delay

2.4.5 Relations of Audit Complexity and Audit Delay

and the risk of unintentional errors also increased (Bustamam and Kamal, 2010).

H5: Audit complexity has positive effect on audit delay

2.4.6 Relations of Company Size and Auditor Changes

Stocken (2000) in Srimindarti (2006) states that the bigger company is considered less at risk, so that the larger companies are less likely to change auditors. Wijayani and Januarti (2011) stated quality KAP is needed to enhance the credibility of the company, so that large companies have a lower tendency to switch auditors than small clients.

H6: Firm size has positive effect on auditor changes.

2.4.7 Relations of Growth and Auditor Changes

When the client is expanding its business, then there is a vast increase of activity, broad geographic spread, and the volume of activity also increased, the quantity of transactions within the company will be higher, requiring auditors can better meet the increasing needs of the client (Srimindarti 2006 ).

H7: The growth has positive effect on auditor changes.

2.4.8 Relations of Management Changes and Auditor Changes

Sinarwati (2010) revealed that the new management hopes that the new KAP can be invited to collaborate more and more

able to provide an opinion as expected by the management, along with their own preferences on auditors to be used, turn of the KAP can occur within the company.

H8: Management Changes has positive effect on auditor changes.

2.4.9 Relations of Percentage change of ROA and Auditor Changes

Wijayanti and Januarti (2011) states that companies that have a lower ROA tend to replace their auditors as decreased performance so that its business prospects decline. When the company's financial condition declines, management tends to look for a new auditor who can hide the circumstances of the company.

H9 : Percentage change of ROA positive effect on auditor changes

2.4.10 Simultaneous Relation Between Auditor Changes and Audit Delay

In performing its duties, the auditor takes considerable time, under an agreement has been signed to complete the audit. If the time required auditors to complete the audit for too long, causing the company is late in submitting financial statements to the capital markets can affect the change of auditors. The length of time required to complete the audit, the auditor will be more likely to change auditors (Stocken in Srimindarti, 2006).

lead to delays in the submission of audited financial statements. Looking at the relationship between the delay of delivering simultaneous audited financial statements and auditors changes, then the hypothesis can be formulated as follows:

H10a: Audit Delay has positive effect on auditor changes

H10b: Auditor changes has positive effect on audit delay

3. RESEARCH METHODS 3.1 Data

The data used are the financial statement of listed companies in BEI from 2012-2013

3.2 Population and Sample

The population in this study are manufacturing companies as many as 52 companies. Of the population, then the researchers draw samples using non-probability sampling technique by purposive sampling, with the following criteria:

1. Companies that are late in submitting

the audited Financial Statements of 2012

2. The company has been audited and accompanied by independent auditor’s report in 2012 and 2013

3. The report uses rupiah.

Based on these criteria, there are 31 firms as samples in this research.

3.3 Methods of Data Analysis

Systematically, the equation of audit delay and auditor changes can be formulated as follows:

The two equations above reflect that the audit delay and auditor changes have simultaneously influence. To test the hypotheses that have been developed, this study will use two stage least squares (2SLS) model. Before estimating the simultaneous equation model, we need to know whether an equation in the model can be identified. There are two methods that can be used, the order condition and the rank condition.

1. Order Condition

Table 3.1

Identification of Simultaneous Equation

Source: Data processed author, 2014 Model K k m Identification

Audit

delay 8 4 3

Over identified

Auditor

Changes 8 3 3

2. Rank Condition

Since the determinant of the matrix R is not equal to zero, then the first and second equations can be identified

4. RESULT

4. 1 Hausman Test

Table 4.1 Hausman Test

t-statistic Prob

Unstandardized Residual

229,531

(2,927) 0,005

Source: Data processing with SPSS 20 n = 62 α = 0.05

Value of t-statistics for the variables unstandardized residual is 2.927 and significant at the 5% significance level (0.005 <0.05) so that the equation above can be summarized as simultaneous equations.

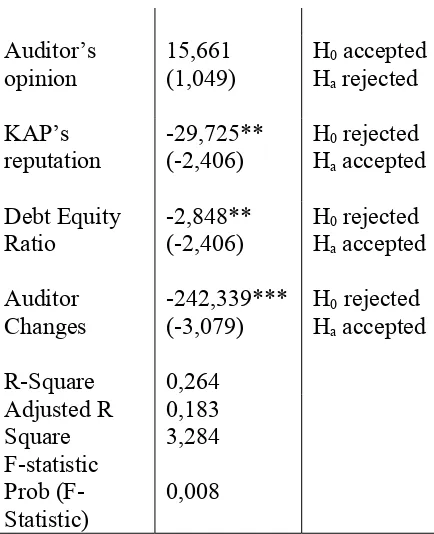

4.2 Estimation of Audit Delay Model

The results of hypothesis test for audit delay model are as follows:

Tabel 4.4

Hypothesis of Audit Delay equations

Hipotesis

Size -54,876***

(-3,397) H0 rejectedHa accepted

Audit Complexity

146,560** (2,490)

H0 rejected Ha accepted

Auditor’s

opinion 15,661(1,049) H0 acceptedHa rejected

KAP’s

reputation -29,725**(-2,406) H0 rejectedHa accepted

Debt Equity

Ratio -2,848**(-2,406) H0 rejectedHa accepted

Auditor Changes

-242,339*** (-3,079)

H0rejected Ha accepted

R-Square 0,264 Adjusted R

Square F-statistic

0,183 3,284

Prob

(F-Statistic) 0,008

Source: Data processing with SPSS 20 n = 62 α = 0.05

The table above shows the F test from the audit delay equation is 3.284 with a significance of 0.008. Based on these results it can be concluded that the variables of firm size, debt equity ratio, audit complexity, the auditor's opinion, the reputation of the firm, and auditor changes has impact on audit delay simultaneously 26.4%, while 73.6% is explained by variables outside the independent variable.

4.3 Estimation of Auditor Changes Model

From the results of hypothesis test for equality Auditor Changes, then the results are as follows:

Hypothesis of Auditor Changes

Tests were also conducted on auditors changes equation. The table above shows the F test is 3.844, while the F table is 2.38 with a significance of 0.05. Based on these results it can be concluded that the variables company size, growth, management changes, the percentage change in ROA, and audit delay has a significant impact on auditor changes simultaneously 25.5%, while 74.5% is explained by variables outside variables

4.4 Discussion

Results showed that the alternative hypothesis in the first equation is proven. Company Size, Debt Equity Ratio, Audit Complexity, Auditor's Opinion, and Firm Reputation have a significant impact on audit delay simultaneously.

KAP reputation variables proved negative and significant effect on audit delay. Accordingly, Wijaya (2013) states that the large-sized of KAP tend to have credibility and a high level of expertise while small sized of KAP has the lower quality. Bangun and Subagyo (2012) said that the big four KAP usually more timely on financial reporting, compared to non big four KAP.

Then, this study also tested the variable debt equity ratio (DER). The higher of DER, the time to produce financial statements will be getting shorter. This is supported by the statement Yunita, et al (2013) that firms with large obligations tend urged auditors to audit start and finish faster because large companies are supervised and monitored by creditors that will put pressure on companies to publish audited financial statements more quickly to reassure the owners of capital, so that the greater the level of DER, the shorter the Audit Delay anyway.

The test results of the audit complexity also proved that partially, audit complexity have significant positive effect on audit delay. The more complex a task of audit, the risk of errors also increases so that the auditor requires a longer time to complete the audit task.

Variable auditor changes have a significant impact on audit delay. But the effect of this variable is indicated by negative influences. Negative effect demonstrated in this study because of several companies in the sample change the auditor which has a good reputation, even some company change the old KAP to the new that has a better reputation than before. That is, the new auditor will provide audit results faster than the previous auditor, where these results are consistent with the previous hypothesis that the reputation of KAP has the effect on audit delay. This is contrary to the results of the research study conducted by Maria (2012) which states that the number of procedures taken by the new auditor in the audit process require a longer time than if the auditors continued acceptance of the assignment. This could lead to delays in the submission of audited financial statements.

Results showed that the alternative hypothesis in the second equation is proven. The size of the company, the firm's reputation, growth, management changes, and the percentage change in ROA have a significant impact on auditor changes simultaneously.

the smaller their tendency to change auditors because the new auditor would need more time to understand the company's procedures so that the impact on the late submission of audited financial statements. So the large companies tend to retain their auditors. Wijayani and Januarti (2011) have the same argue that the KAP which has the good quality will enhance the credibility of the company, so that large companies have a lower tendency to switch auditors than small clients.

The study of variable growth have proved to be a significant influence on the auditor changes. This result is supported by research Wijayanti (2010) which states that the ratio of positive sales growth could not guarantee the company to accept the auditor's confidence in the ability of the client to maintain its viability. So the company will consider to continue using the old KAP KAP than make the turn.

The same results were shown by the variable change of management. Variable management changes can not prove the eighth hypothesis. These results are same with research Sudarma and Damayanti (2007) which states that a change of management is not always followed by a change of policy in using the services of a KAP because of the accounting and reporting policies the oldest KAP can still aligned with new management policy.

The ninth hypothesis which states that the percentage change of ROA have a positive effect on auditor changes is not proven. ROA is the ability of management to generate revenue from asset management. High or low ROA percentage has no effect on the auditor changes in the company. The results showed the phenomenon, the management of the firm will maintain the oldest KAP because they worry if replacing with a new auditor, the new auditor will examine the system of bookkeeping and accounting standards to undervalue them. These results support the research Mukodim and Riskilah (2012).

in the submitting of financial statements, they still have consideration for retaining the old KAP in order to maintain their reputation. This result is contrary to that expressed in Srimindarti Stocken (2006) that if the time required auditors to complete the audit for too long, causing the company late in submitting financial statements to the capital markets can affect the change of auditors. The longer the time required Auditors to complete the audit would be the more likely companies to change Auditors.

5. CONCLUSION

Complexity audit, the auditor's opinion, the debt-equity ratio, firm size, the firm's reputation, and the auditor changes have affect on audit delay simultaneously 26.4%. While partially the size of the company, debt equity ratio, firm size, reputation, and auditor changes affect the audit delay. While the auditor's opinion does not significantly influence the auditor changes

In addition, this study also saw the factors that influence the auditor changes. Of the five factors were used, namely the size of the company, the growth of the company, management turnover, ROA, and audit delay was only the size of the company and the audit delay that significantly affect the auditor changes. However, these five factors (company size,

growth, management turnover, ROA, and audit delay) simultaneously affect the auditor changes 25.5%.

DAFTAR PUSTAKA

Afif, Faisal. 2013. Tren Perilaku Organisasi dalam Bisnis (diakses tanggal 19 Maret 2014)

Agoes, Sukrisno.2011. Auditing Petunjuk Praktis Pemeriksaan Akuntan Oleh Akuntan Publik. Salemba Empat, Jakarta, Indonesia.

Ardana, Komang, dll. 2008. Perilaku Keorganisasian. Yogyakarta: Graha Ilmu.

Arief, Anggyansyah. 2013. Teori Keagenan (Agency Theory). (diakses tanggal 20 Maret 2014).

Banimahd, Bahman, dkk. 2012. Audit Report Lag and Auditor Change: Evidence from Iran. Journal of Basic and Applied Scientific Research. (diakses tanggal 31 Desember 2013)

Bangun, Primsa dan Subagyo. 2012. Faktor-Faktor yang Mempengaruhi Audit Report Lag pada Perusahaan yang Listed di Bursa Efek Indonesia. Proceeding for Call Paper Pekan Ilmiah Dosen FEB-UKSW (diakses tanggal 31 Desember 2013)

Bustamam dan Maulana Kamal. 2010. Pengaruh Leverage, Subsidiaries Dan Audit Complexity terhadap Audit Delay (Studi Empiris Pada Perusahaan Manufaktur Di Bursa Efek Indonesia). Jurnal Telaah & Riset Akuntansi Vol. 3. No. 2 Juli 2010 Hal. 110-122 (diakses tanggal 23 Mei 2013)

Mempengaruhi Perusahaan Berpindah Kantor Akuntan Publik. Tesis. Malang: Universitas Brawijaya

Dopuch, Nicholas. 1980. "The Nature of Competition in the Auditing Profession, A Descriptive and Normative View," Regulation and the Accounting Profession

Eisenhardt, Kathleen M. 1989. Agency Theory: An Assessment and Review. Academy of Management Review Vol 14 No 1 57-74 (diakses tanggal 20 Maret 2014).

Ferdianto, Rio. 2011. Pengaruh Ukuran Perusahaan, Profitabilitas, Solvabilitas, Opini Auditor Dan Reputasi Kap Terhadap Audit Delay Pada Perusahaan Sektor Barang Konsumsi Yang Terdaftar Di Bursa Efek Indonesia. Tesis. Universitas Gunadarma Bekasi (diakses tanggal 23 Mei 2013)

Forddanta, Dityasa H. 2013. Lagi-lagi, BORN telat sampaikan laporan keuangan. Artikel Online (www.kontan.co.id, diakses tanggal 6 Januari 2014)

Freeman, R. Edward dan Rober A. Phillips. 2002. Stakeholder Theory: A Libertarian Defense. Business Ethics Quarterly Volume 12 Issue 3 pp 331-349 (diakses tanggal 19 Maret 2014)

Gujarati, Damodar N. 2007. Dasar-darsar Ekonometrika Edisi Ketiga Jilid 2. Pernyataan Standar Akuntansi Keuangan. Salemba Empat, Jakarta, Indonesia.

Jensen, Michael C dan William H. Meckling. 1976. Theory of the Firm: Managerial Behavior, Agency Costs and Ownership Structure. Journal of Financial Economics V.3 No.4 pp. 305-360 (diakses tanggal 28 Februari 2014).

Kartika, Andi. 2009. Faktor-Faktor yang Mempengaruhi Audit Delay di Indonesia (Studi Empiris pada Perusahaan-Perusahaan LQ45 yang Terdaftar di Bursa Efek Indonesia). Jurnal Bisnis dan Ekonomi (JBE)

Kewajiban Penyampaian Laporan Keuangan Berkala Ketua Badan pengawas Pasar Modal, Jakarta, Indonesia.

Ketua Badan Pengawas Pasar Modal. 1997. Keputusan Ketua Badan Pengawas Pasar Modal Nomor: Kep. 11/PM/1997 tentang Pedoman Mengenai Bentuk dan Isi Pernyataan Pendaftaran dalam Rangka Penawaran Umum Oleh Perusahaan Menengah atau kecil, Jakarta, Indonesia.

Kusumawardhani, Fitria. 2013. Faktor-Faktor Yang Mempengaruhi Audit Delay Pada Perusahaan Manufaktur. Accounting Analysis Journal (diakses tanggal 24 Mei 2013)

Mantik, I Md Ngr Sudewa dan Edy Sujana. 2013. Analisis Faktor yang Mempengaruhi Audit Delay pada Perusahaan Food and Beverages Tercatat di BEI 2009-2011 (diakses tanggal 18 Desember 2013)

Margaretta, Stepvanny dan Gatot Soepriyanto. 2012. Penerapan IFRS dan Pengaruhnya Terhadap Keterlambatan Penyampaian Laporan Keuangan: Studi Empiris Perusahaan Manufaktur di Bursa Efek Indonesia Periode Tahun 2008-2010 (diakses tanggal 1 Januari 2014)

Maria, Anna. 2012. Analisis Faktor-Faktor yang Berpengaruh Terhadap Audit Delay pada Perusahaan Consumer Goods di Bursa Efek Indonesia. Tesis. Universitas Gunadarma (diakses tanggal 7 Januari 2013)

Menteri Keuangan. 2008. Peraturan Nigerian Companies: Empirical Evidence. Research Journal of Finance and Accounting Vol 3, No 6, 2012 (diakses tanggal 24 Mei 2009-2011). Tesis. Universitas Gunadarma Bekasi (diakses tanggal 25 Mei 2013)

Rahayu, Siti Kurnia dan Ely Suhayati. 2013. Auditing Konsep Dasar dan Pedoman Pemeriksaan Akuntan Publik. Graha Ilmu, Bandung, Indonesia.

Rheza. 2013. Ini Alasan BORN Terlambat Serahkan Laporan Keuangan 2012. diakses tanggal 12 Juli 2014)

Riskilah dan Didin Mukodim. 2012. Faktor – Faktor Yang Berpengaruh Terhadap Auditor Switching Pada Perusahaan Perbankan Di Indonesia. Universitas Gunadarma (diakses tanggal 2 Maret 2014)

Robbins, Stephen P dan Timothy A. Judge. 2009. Perilaku Organisasi. Salemba Empat, Jakarta, Indonesia.

Rustiarini, Ni Wayan dan Sugiarti. 2013. Pengaruh Karakteristik Auditor, Opini Auditor, Audit Tenure, Pergantian Auditr pada Audit Delay. Jurnal Ilmiah Akuntansi dan Humanika JINAH Volume 2 Nomor 2 Singaraja. (diakses tanggal 31 Desember 2013)

Sarwono, Jonathan. 2013. Jurus Ampuh SPSS Untuk Riset Skripsi. PT.Elex Media Komputindo, Jakarta, Indonesia.

Setyorini, Andini Ika dan Totok Dewayanto. 2011. Pengaruh Kompleksitas Audit, Tekanan Anggaran Waktu, Dan Pengalaman Auditor Terhadap Kualitas Audit Dengan Variabel Moderating Pemahaman Terhadap Sistem Informasi (diakses tanggal 17 Juli 2014).

Tahun 2007-2008). Jurnal Akuntansi dan Ekonomi Bisnis Vol. 1 No. 1 Tahun 2012 (diakses tanggal 24 Mei 2013)

Sinarwati,, Ni Kadek. 2010. Mengapa Perusahaan Manufaktur yang Terdaftar di BEI Melakukan Pergantian Kantor Akuntan Publik. Simposium Nasional Akuntansi XIII Purwokerto 2010 (diakses tanggal 4 Januari 2014)

Srimindarti, Ceacilia. 2006. Opini Auditr dan Pergantian Auditor: Kajian Berdasarkan Resiko, Kemampuan Perusahaan dan Kinerja Auditor. Fokus Ekonomi Vol.5 No. 1 (diakses tanggal 31 Desember 2013)

Sugiyono. 2007. Metode Penelitian Bisnis. Alfabeta, Bandung, Indonesia.

Sulistyawati, Ardiani Ika. 2009. Praktek Audit Delay oleh Auditor dan Kaitannya dengan Timelines. Jurnal Solusi Vol. 8 No 2 April 2009 1-10 (diakses tanggal 25 Mei 2013)

Sulistiyono, Seno Tri. 2013. Berkabung, Laporan Keuangan Zebra Jadi Terlambat. Artikel Online. (www.pasarmodal.inilah.com,

diakses tanggal 6 Januari 2014)

Sumodiningrat, Gunawan. 2002. Ekonometrika Pengantar. BPFE Yogyakarta, Yogyakarta, Indonesia.

Tida, Renny Pratama. 2011. Analisis Hubungan Auditor-Klien:

Faktor-Faktor yang Mempengaruhi Perpindahan KAP Pada Perusahaan Manufaktur di Indonesia (diakses tanggal 1 Maret 2014)

Utami, Wiwik. 2006. Analisis Determinan Audit Delay Kajian Empiris di Bursa Efek Jakarta. (diakses tanggal 1 Maret 2014)

Wijaya, R.M Aloysius Pangky. 2013. Faktor-Faktor yang Mempengaruhi Pergantian Auditor Oleh Klien. Universitas Brawijaya (diakses tangggal 4 Januari 2014)

Wijayani, Evi Dwi dan Indira Januarti. 2011. Analisis Faktor-Faktor yang Mempengaruhi Perusahaan di Indonesia melakukan Auditor Switching. Simposium Nasional Akuntansi XIV Aceh 2011 (diakses tanggal 4 Januari 2014)

Mas’ud Machfoedz. 1994. Financial Ratio Characteristic Analysis and The Prediction of Earnings Changes in Indonesia, Kelola No. 7:114-133.

Yunita, Desi Asmada, dkk. 2011. Analisa Faktor-Faktor Yang Mempengaruhi Audit Delay Pada Perusahaan Industri Kimia Dan Dasar Yang Terdaftar Di Bursa Efek Indonesia. Tesis. Universitas Riau (diakses tanggal 24 Mei 2013)