6 6 2 3 -T a u fi q u r R a ch m a n h t t p : / / t a u f i q u r r a c h m a n . w e b l o g . e s a u n g g u l . a c . i d

TIN205 – EKONOMI TEKNIK Materi #10 h t t p : / / t a u f i q u r r a c h m a n . w e b l o g . e s a u n g g u l . a c . i d 6 6 2 3 -T a u fi q u r R a ch m a n

Pendahuluan … (1)

2

Seandainya

anda

menginvestasikan

senilai

($1.650) dalam rekening tabungan 6% per tahun.

Kemudian anda hanya memperoleh $9.477 pada

Januari tahun 2000.

Apa arti dari 6%

interest

disini?

Ini adalah

opportunity cost

jika menyimpan uang

pada rekening tabungan, dan merupakan suatu

tindakan yang terbaik yang dapat dilakukan saat

itu.

h t t p : / / t a u f i q u r r a c h m a n . w e b l o g . e s a u n g g u l . a c . i d 6 6 2 3 -T a u fi q u r R a ch m a n

Pendahuluan … (2)

Materi #10 Genap 2014/2015 TIN2005 - Ekonomi Teknik3

Kemudian, pada tahun 1970, anda memperoleh

tawaran untuk investasi lain dengan

interest

lebihdari 6% untuk investasi lain, anda akan mengambil investasi tersebut?

Dalam hal ini, 6% dipandang sebagai

minimum

attractive rate of return

/MARR (rate of return

yang dibutuhkan). Maka, anda dapat menetapkan aturan keputusan

berikut untuk memperoleh investasi yang diusulkan yang terbaik jika:

ROR > MARR h t t p : / / t a u f i q u r r a c h m a n . w e b l o g . e s a u n g g u l . a c . i d 6 6 2 3 -T a u fi q u r R a ch m a n

Definisi #1 ROR

4

Rate of return

(ROR) merupakan interest

rate yang diperoleh pada unpaid balance

dari angsuran suatu pinjaman.

Contoh:

Sebuah

bank

meminjamkan

$10.000

dan

menerima

pembayaran

pertahun sebesar $4.021 selama 3 tahun.

Dalam hal ini, bank dikatakan memperoleh

penghasilan kembali

(return of)

10% dari

h t t p : / / t a u f i q u r r a c h m a n . w e b l o g . e s a u n g g u l . a c . i d 6 6 2 3 -T a u fi q u r R a ch m a n

Loan Balance Calculation

A = $10.000 (A/P, 10%, 3) = $4.021

Year Unpaidbalance at beginning of year Return on unpaidbalance (10%) Payment received Unpaid balance at the end of year 0 –$10.000 –$10.000 1 –$10.000 –$1.000 +$4.021 –$6.979 2 –$6.979 –$698 +$4.021 –$3.656 3 –$3.656 –$366 +$4.021 0 Materi #10 Genap 2014/2015 5

TIN2005 - Ekonomi Teknik

A return of 10% on the amount still outstanding

at the beginning of each year

h t t p : / / t a u f i q u r r a c h m a n . w e b l o g . e s a u n g g u l . a c . i d 6 6 2 3 -T a u fi q u r R a ch m a n

Contoh #1 (ROR)

6

John membeli barang seni seharga $80.000

dan menjual kembali seharga $53,9 juta

pada 40 tahun kemudian.

Berapa

rate of return

dari investasi John ?

$80.000

$53,9juta

0

h t t p : / / t a u f i q u r r a c h m a n . w e b l o g . e s a u n g g u l . a c . i d 6 6 2 3 -T a u fi q u r R a ch m a n

Solusi Contoh #1 (ROR)

Materi #10 Genap 2014/2015 TIN2005 - Ekonomi Teknik

7

Diketahui:

P

= $80.000 ;

F

= $53,9juta ;

n

= 40 tahun

Ditanya:

i

Jawab:

1

i

40$80.000

$53,9juta

17,69%

i

1

i

nP

F

h t t p : / / t a u f i q u r r a c h m a n . w e b l o g . e s a u n g g u l . a c . i d 6 6 2 3 -T a u fi q u r R a ch m a nContoh #2 (ROR)

8

Pada awal 1985, suatu investasi dari 100 saham

seharga $1.650 menjadikan sebuah perusahaan

terbuka (

go public

). Investasi tersebut akan

menjadi $13.312.000 pada 31 Januari 2015.

Berapa

rate of return

pada investasi tersebut?

$1.650

$13.312.000

0

h t t p : / / t a u f i q u r r a c h m a n . w e b l o g . e s a u n g g u l . a c . i d 6 6 2 3 -T a u fi q u r R a ch m a n

Solusi Contoh #2 (ROR)

Materi #10 Genap 2014/2015 TIN2005 - Ekonomi Teknik

9

Diketahui:

P

= $1.650 ;

F

= $13.312.000 ;

n

= 30 tahun

Ditanya:

i

Jawab:

1

i

30$1.650

0

$13.312.00

34,97%

i

1

i

nP

F

h t t p : / / t a u f i q u r r a c h m a n . w e b l o g . e s a u n g g u l . a c . i d 6 6 2 3 -T a u fi q u r R a ch m a nDefinisi #2 ROR

10

Rate of return (ROR) is defined as

break-even interest rate (i*), which equates the

present worth of a project’s cash outflows

to the present worth of its cash inflows.

h t t p : / / t a u f i q u r r a c h m a n . w e b l o g . e s a u n g g u l . a c . i d 6 6 2 3 -T a u fi q u r R a ch m a n

Definisi #3 ROR (Return on Invested Capital)

Materi #10 Genap 2014/2015 TIN2005 - Ekonomi Teknik

11

Return on invested capital is defined as the

interest rate earned on the

unrecovered project

balance

of an investment project. It is commonly

known as

internal rate of return (IRR)

.

Contoh: A company invests $10.000 in a

computer and results in equivalent annual labor

savings of $4.021 over 3 years. The company is

said to earn a return of 10% on its investment of

$10.000.

h t t p : / / t a u f i q u r r a c h m a n . w e b l o g . e s a u n g g u l . a c . i d 6 6 2 3 -T a u fi q u r R a ch m a nProject Balance Calculation

12

0 1 2 3

Beginning project balance –$10.000 –$6.979 –$3.656 Return on invested capital –$10.000 –$6.979 –$3.656 Payment received –$10.000 +$4.021 +$4.021 +$4.021 Ending project balance –$10.000 –$6.979 –$3.656 0

The firm earns a 10% rate of return on funds that remain internally invested in the project. Since the return is internalto the project, we

h t t p : / / t a u f i q u r r a c h m a n . w e b l o g . e s a u n g g u l . a c . i d 6 6 2 3 -T a u fi q u r R a ch m a n

Metode Perhitungan ROR

Materi #10 Genap 2014/2015 TIN2005 - Ekonomi Teknik

13 Metode Solusi Langsung (Log) Metode Solusi Langsung (Quadratic) MetodeTrial & Error Metode Solusi Grafik Komputer n Proyek A Proyek B Proyek C Proyek D 0 –$1,000 –$2,000 –$75,000 –$10,000 1 0 1,300 24,400 20,000 2 0 1,500 27,340 20,000 3 0 55,760 25,000 4 1,500 h t t p : / / t a u f i q u r r a c h m a n . w e b l o g . e s a u n g g u l . a c . i d 6 6 2 3 -T a u fi q u r R a ch m a n

Metode Solusi Langsung (Log) Proyek A

14$1,000 = $1,500(P/F, i, 4)

$1,000 = $1,500(1 + i)

–40.6667 = (1 + i)

–4ln 0.6667/–4 = ln (1 + i)

0.101365 = ln (1 + i)

ℯ

–4= (1 + i)

i = ℯ

0.101365– 1

i = 10.67%

h t t p : / / t a u f i q u r r a c h m a n . w e b l o g . e s a u n g g u l . a c . i d 6 6 2 3 -T a u fi q u r R a ch m a n

Metode Solusi Langsung (Quadratic)

Proyek B

Materi #10 Genap 2014/2015 TIN2005 - Ekonomi Teknik

15 h t t p : / / t a u f i q u r r a c h m a n . w e b l o g . e s a u n g g u l . a c . i d 6 6 2 3 -T a u fi q u r R a ch m a n

Metode Trial & Error Proyek C

… (1)

16

Langkah 1: Guess an interest rate, say, i = 15%

Langkah 2: Compute PW(i) at the guessed i value.

PW (15%) = $3,553

Langkah 3: If PW(i) > 0, then increase i. If PW(i)

< 0, then decrease i.

PW(18%) = –$749

Langkah 4: If you bracket the solution, you use a

h t t p : / / t a u f i q u r r a c h m a n . w e b l o g . e s a u n g g u l . a c . i d 6 6 2 3 -T a u fi q u r R a ch m a n

Metode Trial & Error Proyek C

… (2)

Materi #10 Genap 2014/2015 TIN2005 - Ekonomi Teknik

17 3,553 0 -749 15% i 18% 749 3,553 3,553 3% 15% i 17.45% i h t t p : / / t a u f i q u r r a c h m a n . w e b l o g . e s a u n g g u l . a c . i d 6 6 2 3 -T a u fi q u r R a ch m a n

Metode Solusi Grafik Komputer Proyek D

Langkah (a): Create a NPWplot using Excel.

Langkah (b): Identify the

point at which the curve crosses the horizontal axis closely approximates the i*.

Catatan: This method is

particularly useful for projects with multiple rates of return, as most financial softwares would fail to find all the multiple i*s.

h t t p : / / t a u f i q u r r a c h m a n . w e b l o g . e s a u n g g u l . a c . i d 6 6 2 3 -T a u fi q u r R a ch m a n

Situasi

Multiple Rates of Return

Materi #10 Genap 2014/2015 TIN2005 - Ekonomi Teknik

19

Aturan keputusan dasar, jika ROR > MARR, maka terima

proyek.

Aturan ini tidak berlaku untuk situasi dimana investasi

mempunyai“multiple rates of return”.

Contoh: Cari rate(s) of return dari CF diagram berikut.

$1,000 $2,300 $1,320 0 1 2 PW i( ) $1, i i $2, $1, ( ) 000 300 1 320 1 0 2 h t t p : / / t a u f i q u r r a c h m a n . w e b l o g . e s a u n g g u l . a c . i d 6 6 2 3 -T a u fi q u r R a ch m a n

Solusi Contoh

Multiple ROR

20

Let Then,

Solving for yields,

or

Solving for yields or 20% x i PW i i i x x x x x i i 1 1 000 300 1 320 1 000 300 320 0 10 11 10 12 10% 2 2 . ( ) $1, $2, ( ) $1, ( ) $1, $2, $1, / /

h t t p : / / t a u f i q u r r a c h m a n . w e b l o g . e s a u n g g u l . a c . i d 6 6 2 3 -T a u fi q u r R a ch m a n

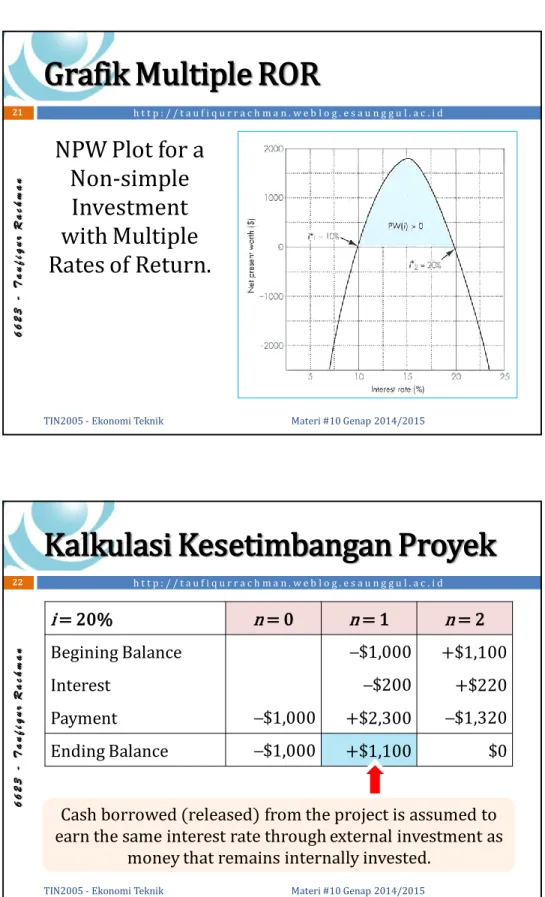

Grafik Multiple ROR

Materi #10 Genap 2014/2015 TIN2005 - Ekonomi Teknik

21

NPW Plot for a

Non-simple

Investment

with Multiple

Rates of Return.

h t t p : / / t a u f i q u r r a c h m a n . w e b l o g . e s a u n g g u l . a c . i d 6 6 2 3 -T a u fi q u r R a ch m a nKalkulasi Kesetimbangan Proyek

i = 20% n = 0 n = 1 n = 2 Begining Balance –$1,000 +$1,100 Interest –$200 +$220 Payment –$1,000 +$2,300 –$1,320 Ending Balance –$1,000 +$1,100 $0 22

Cash borrowed (released) from the project is assumed to earn the same interest rate through external investment as

h t t p : / / t a u f i q u r r a c h m a n . w e b l o g . e s a u n g g u l . a c . i d 6 6 2 3 -T a u fi q u r R a ch m a n

Critical Issue Kesetimbangan Proyek

Materi #10 Genap 2014/2015 TIN2005 - Ekonomi Teknik

23

Can the company be able to invest the money

released from the project at 20% externally in

period 1?

If your MARR is exactly 20%, the answer is

“yes”

, because it represents the rate at which the

firm can always invest the money in its investment

pool. Then, the 20% is also true IRR for the project.

Suppose your MARR is 15% instead of 20%. The

assumption used in calculating i* is no longer valid.

Therefore, neither 10% nor 20% is a true IRR.

h t t p : / / t a u f i q u r r a c h m a n . w e b l o g . e s a u n g g u l . a c . i d 6 6 2 3 -T a u fi q u r R a ch m a n

How to Proceed Kesetimbangan Proyek

24

If you encounter multiple rates of return, abandon

the IRR analysis and use the NPW criterion.

If NPW criterion is used at MARR = 15%.

PW(15%) = –$1,000 + $2,300 (P/F, 15%, 1)

– $1,320 (P/F, 15%, 2 )

= $1.89 > 0

h t t p : / / t a u f i q u r r a c h m a n . w e b l o g . e s a u n g g u l . a c . i d 6 6 2 3 -T a u fi q u r R a ch m a n

Aturan Keputusan Non-Simple Investment

Materi #10 Genap 2014/2015 TIN2005 - Ekonomi Teknik

25

Kemungkinan multiple ROR

Jika PW(i) seperti Gambar

1, maka IRR = ROR.

Maka jika IRR >

MARR, terima proyek.

Jika PW(i) seperti Gambar

2, maka, IRRROR (i*).

Dapatkan IRR sebenarnya, atau Gunakan method PW. i* i i i* i* PW (i) h t t p : / / t a u f i q u r r a c h m a n . w e b l o g . e s a u n g g u l . a c . i d 6 6 2 3 -T a u fi q u r R a ch m a n

Aturan Keputusan Non-Simple Investment

26h t t p : / / t a u f i q u r r a c h m a n . w e b l o g . e s a u n g g u l . a c . i d 6 6 2 3 -T a u fi q u r R a ch m a n

Incremental Investment

n Proyek A1 Proyek A2 Incremental Investment (A2 – A1)

0 –$1,000 –$5,000 –$4,000

1 $2,000 $7,000 $5,000

ROR 100% 40% 25%

PW(10%) $818 $1,364 $546

Assuming MARR of 10%, you can always earn that rate from other

investment source, i.e., $4,400 at the end of one year for $4,000 investment.

By investing the additional $4,000 in A2, you would make additional

$5,000, which is equivalent to earning at the rate of 25%. Therefore, the incremental investment in A2 is justified.

Materi #10 Genap 2014/2015

27

TIN2005 - Ekonomi Teknik

h t t p : / / t a u f i q u r r a c h m a n . w e b l o g . e s a u n g g u l . a c . i d 6 6 2 3 -T a u fi q u r R a ch m a n

Incremental Analysis (Procedure)

28

• Compute the cash flows for the

difference between the projects

(A,B) by subtracting the cash flows

for the lower investment cost

project (A) from those of the higher

investment cost project (B).

Langkah 1:

• Compute

the

IRR

on

this

incremental investment (IRR).

Langkah 2:

• Accept the investment B if and only

if IRR B-A > MARR.

h t t p : / / t a u f i q u r r a c h m a n . w e b l o g . e s a u n g g u l . a c . i d 6 6 2 3 -T a u fi q u r R a ch m a n

Contoh Incremental ROR

Diketahui MARR = 10%, proyek mana yang menjadi pilihan terbaik?

n B1 B2 B2 – B1 0 1 2 3 –$3,000 1,350 1,800 1,500 –$12,000 4,200 6,225 6,330 –$9,000 2,850 4,425 4,830 IRR 25% 17.43% 15% Materi #10 Genap 2014/2015 29

TIN2005 - Ekonomi Teknik

Karena IRRB2-B1=15% > 10%, dan juga IRRB2 > 10%, pilih B2.

h t t p : / / t a u f i q u r r a c h m a n . w e b l o g . e s a u n g g u l . a c . i d 6 6 2 3 -T a u fi q u r R a ch m a n

IRR Increment Investment 3 Alternatif

n D1 D2 D3 0 –$2,000 –$1,000 –$3,000 1 1,500 800 1,500 2 1,000 500 2,000 3 800 500 1,000 IRR 34.37% 40.76% 24.81%

1. Langkah 1: Tetapkan IRR untuk tiap proyek untuk mngeliminasi tiap project yang gagal memenuhi MARR.

2. Langkah 2: Bandingkan D1 dan D2 berpasangan.

30

IRRD1–D2=27.61% > 15%, pilih D1.

3. Langkah 3: Bandingkan D1 dan D3. IRRD3–D1= 8.8% < 15%, pilih D1.

h t t p : / / t a u f i q u r r a c h m a n . w e b l o g . e s a u n g g u l . a c . i d 6 6 2 3 -T a u fi q u r R a ch m a n

Incremental Borrowing Analysis

If the difference in flow (B-A)represents an increment of investment, then (A-B) is an increment of borrowing.

When considering an

increment of borrowing, the rate i*A-B is the rate we paid to borrow money from the increment.

If BRR B-A <

MARR, select B.

If BRR B-A =

MARR, select either one.

If BRR B-A >

MARR, select A.

Materi #10 Genap 2014/2015

31

TIN2005 - Ekonomi Teknik

Principle: Decision Rule:

h t t p : / / t a u f i q u r r a c h m a n . w e b l o g . e s a u n g g u l . a c . i d 6 6 2 3 -T a u fi q u r R a ch m a n

Borrowing Rate of Return

32 n B1 B2 B1–B2 0 –$3,000 –$12,000 +$9,000 1 1,350 4,200 –2,850 2 1,800 6,225 –4,425 3 1,500 6,330 –4,830

h t t p : / / t a u f i q u r r a c h m a n . w e b l o g . e s a u n g g u l . a c . i d 6 6 2 3 -T a u fi q u r R a ch m a n

Incremental Analysis for Cost-Only Projects

Materi #10 Genap 2014/2015 TIN2005 - Ekonomi Teknik

33

Items CMS Option FMS Option

Annual O&M costs:

Annual labor cost $1,169,600 $707,200

Annual material cost 832,320 598,400

Annual overhead cost 3,150,000 1,950,000

Annual tooling cost 470,000 300,000

Annual inventory cost 141,000 31,500

Annual income taxes 1,650,000 1,917,000

Total annual costs $7,412,920 $5,504,100

Investment $4,500,000 $12,500,000

Net salvage value $500,000 $1,000,000

h t t p : / / t a u f i q u r r a c h m a n . w e b l o g . e s a u n g g u l . a c . i d 6 6 2 3 -T a u fi q u r R a ch m a n

Incremental Cash Flow (FMS – CMS)

34

n CMS Option FMS Option Incremental(FMS–CMS) 0 –$4,500,000 –$12,500,000 –$8,000,000 1 –7,412,920 –5,504,100 1,908,820 2 –7,412,920 –5,504,100 1,908,820 3 –7,412,920 –5,504,100 1,908,820 4 –7,412,920 –5,504,100 1,908,820 5 –7,412,920 –5,504,100 1,908,820 6 –7,412,920 –5,504,100 $2,408,820 Salvage + $500,000 + $1,000,000

h t t p : / / t a u f i q u r r a c h m a n . w e b l o g . e s a u n g g u l . a c . i d 6 6 2 3 -T a u fi q u r R a ch m a n

Solusi (FMS – CMS)

PW(i)FMS–CMS= –$8,000,000 + $1,908,820(P/A, i, 5) + $2,408,820(P/A, i, 6) = 0 IRRFMS–CMS = 12.43% < 15%, pilih CMS Materi #10 Genap 2014/2015 35TIN2005 - Ekonomi Teknik

h t t p : / / t a u f i q u r r a c h m a n . w e b l o g . e s a u n g g u l . a c . i d 6 6 2 3 -T a u fi q u r R a ch m a n

Predicting Multiple RORs

36

–100% < i* < infinity

Net Cash Flow Rule of Signs:

No. of real

h t t p : / / t a u f i q u r r a c h m a n . w e b l o g . e s a u n g g u l . a c . i d 6 6 2 3 -T a u fi q u r R a ch m a n

Contoh

n Net Cash flow ChangeSign

0 –$100 1 –$20 2 $50 1 3 0 4 $60 5 –$30 1 6 $100 1

No. of real i*s = 3.

This implies that the

project could have

(0, 1, 2, or 3) i*s but

NOT more than 3.

Materi #10 Genap 2014/2015

37

TIN2005 - Ekonomi Teknik

h t t p : / / t a u f i q u r r a c h m a n . w e b l o g . e s a u n g g u l . a c . i d 6 6 2 3 -T a u fi q u r R a ch m a n

Accumulated Cash Flow Sign Test

Find the accounting sum of net cash flows at the

end of each period over the life of the project.

Period (n) Cash Flow (An) Sum (Sn)

0 A0 S0= A0

1 A1 S1= S0+ A1 2 A2 S2= S1+ A2

n An Sn= Sn–1+ An

38

If the series

S

starts

negatively

and changes sign

h t t p : / / t a u f i q u r r a c h m a n . w e b l o g . e s a u n g g u l . a c . i d 6 6 2 3 -T a u fi q u r R a ch m a n

Contoh

n An Sn Perubanhantanda 0 –$100 –$100 1 –$20 –$120 2 $50 –$70 3 0 –$70 4 $60 –$10 5 –$30 –$40 6 $100 $60 1Jumlah tanda

berubah =

1, indicating

a unique i*.

i* = 10.46%

Materi #10 Genap 2014/2015 39TIN2005 - Ekonomi Teknik

h t t p : / / t a u f i q u r r a c h m a n . w e b l o g . e s a u n g g u l . a c . i d 6 6 2 3 -T a u fi q u r R a ch m a n

Contoh Incremental B/C Ratios

40

A1

A2

A3

I

$5,000

$20,000

$14,000

B

12,000

35,000

21,000

C’

4,000

8,000

1,000

PW(i)

$3,000

$7,000

$6,000

h t t p : / / t a u f i q u r r a c h m a n . w e b l o g . e s a u n g g u l . a c . i d 6 6 2 3 -T a u fi q u r R a ch m a n

Solusi

Materi #10 Genap 2014/2015 41TIN2005 - Ekonomi Teknik A1 A2 A3 BC(i) 1.33 1.25 1.40 Ranking Base A1 A3 A2 I +C’ $9,000 $15,000 $28,000 h t t p : / / t a u f i q u r r a c h m a n . w e b l o g . e s a u n g g u l . a c . i d 6 6 2 3 -T a u fi q u r R a ch m a n

Cost-Effectiveness Studies

… (1)

42General Procedure

Step 1: Establish the goals to be achieved by the analysis.

Step 2: Identify the imposed restrictions on achieving the goals, such as budget or weight.

Step 3: Identify all the feasible alternatives to achieve the goals. Step 4: Identify the social interest rate to use in the analysis. Step 5: Determine the equivalent life-cycle cost of each

alternative, including research and development, testing, capital investment, annual operating and maintenance costs, and salvage value.

h t t p : / / t a u f i q u r r a c h m a n . w e b l o g . e s a u n g g u l . a c . i d 6 6 2 3 -T a u fi q u r R a ch m a n

Cost-Effectiveness Studies

… (2)

Materi #10 Genap 2014/2015 TIN2005 - Ekonomi Teknik43

Step 6: Determine the basis for developing the cost-effectiveness index. Two approaches may be used;

(1) the fixed-cost approach and (2) the fixed-effectiveness approach.

If the fixed-cost approach is used, determine the amount of

effectiveness obtained at a given cost.

If the fixed-effectiveness approach is used, determine the cost

to obtain the predetermined level of effectiveness.

Step 7: Compute the cost-effectiveness ratio for each alternative based on the selected criterion in Step 6.

Step 8: Select the alternative with the maximum cost-effective index. h t t p : / / t a u f i q u r r a c h m a n . w e b l o g . e s a u n g g u l . a c . i d 6 6 2 3 -T a u fi q u r R a ch m a n

Cost-Effectiveness Decision Criterion

44

Fixed Cost Approach

Maximize Effectiveness

Subject to:

Budget Constraint

Fixed Effectiveness

Approach

Minimize Cost

Subject to:

Must meet the

minimum effectiveness

h t t p : / / t a u f i q u r r a c h m a n . w e b l o g . e s a u n g g u l . a c . i d 6 6 2 3 -T a u fi q u r R a ch m a n

Case Study – Selecting An Weapon System

Materi #10 Genap 2014/2015 TIN2005 - Ekonomi Teknik

45 h t t p : / / t a u f i q u r r a c h m a n . w e b l o g . e s a u n g g u l . a c . i d 6 6 2 3 -T a u fi q u r R a ch m a n

Weapon System Alternatives

46

Alternative Aj Advantage Disadvantage Probability of Kill A1: Inertial navigation

system Low cost, mature technology. Accuracy, target recognition 0.33 A2: Inertial navigation

system (Global positioning system)

Moderate cost,

nature technology Target recognition 0.70 A3: Imaging infrared

(I2R)

Accurate, target recognition

High cost, bunkered

target detection 0.90

A4: Synthetic aperture radar

Accurate, target

recognition High cost 0.99

A5: Laser detection / ranging

Accurate, target recognition

High cost, technical

maturity 0.99

A6: Millimeter wave

h t t p : / / t a u f i q u r r a c h m a n . w e b l o g . e s a u n g g u l . a c . i d 6 6 2 3 -T a u fi q u r R a ch m a n

Life-Cycle Costs for Weapon

Development Alternative

Materi #10 Genap 2014/2015 TIN2005 - Ekonomi Teknik

47

Expenditures in Million Dollars

Phase Year A1* A2 A3 A4 A5 A6 FSD 0 15 19 50 40 75 28 1 18 23 65 45 75 32 2 19 22 65 45 75 33 3 15 17 50 40 75 27 4 90 140 200 200 300 150 5 95 150 270 250 360 180 IOC 6 95 160 280 275 370 200 7 90 150 250 275 340 200 8 80 140 200 200 330 170 PW(10%) 315.92 492.22 884.27 829.64 1,227.23 612.70 h t t p : / / t a u f i q u r r a c h m a n . w e b l o g . e s a u n g g u l . a c . i d 6 6 2 3 -T a u fi q u r R a ch m a n

Cost-Effectiveness Index

48Type Cost/Unit Probability of Kill Cost/Kill Kill/Cost

A1 $31,592 0.33 $95,733 0.0000104 A2 49,220 0.70 70,314 0.0000142 A3 88,427 0.90 98,252 0.0000102 A4 82,964 0.90 83,802 0.0000119 A5 122,723 0.99 123,963 0.0000081 A6 61,370 0.80 76,713 0.0000130

h t t p : / / t a u f i q u r r a c h m a n . w e b l o g . e s a u n g g u l . a c . i d 6 6 2 3 -T a u fi q u r R a ch m a n A1 A2 A3 A4 A5 A6 60.000 70.000 80.000 90.000 100.000 110.000 120.000 130.000 300 400 500 600 700 800 900 1.000 1.100 1.200 1.300 Co st /k ill

Present value of life cycle cost ($ million)

Cost-Effectiveness Graph

Materi #10 Genap 2014/2015 TIN2005 - Ekonomi Teknik

49 Maximize Effectiveness Fixed Cost Unacceptable Region 66 23 -T au fiq ur R ac hm an h t t p : / / t a u f i q u r r a c h m a n . w e b l o g . e s a u n g g u l . a c . i d