April 2010

Consumer Confidence Index (CCI) in April 2010 moved higher

by 3.3 points over previous month to 110.7. Continuing

positive trend on economic condition was reckoned took

apart in upwarding CCI.

Pressures on prices for the next 3 months were predicted to

hardening as indicated by 3.5 points higher on price

expectation index over previous month. The government’s

plan on increasing basic electricity tariff in July 2010 was

deemed triggered the respondent’s expectation over the

prices in the next 3 months. Conversely, pressures on prices

in the next 6 months were believed to drop 1.8 points

considering seasonal factor due to the last of Eid-ul Fitr

celebration.

Consumer Confidence Index

Sustained strengthening trend since March 2010, the CCI in

April 2010 stepped up by 3.3 points.

Based on Bank Indonesia Consumer

Survey in April 2010, CCI elevated by 3.3 points to 110.7 over previous

month.

Graph 1. Consumer Confidence Index

60.0

70.0

80.0

90.0

100.0

110.0

120.0

130.0

140.0

1 2 3 4 5 6 7 8 9 10 11 12 1 2 3 4 5 6 7 8 9 10 11 12 1 2 3 4

2008 2009 2010

(Index)

Current Economic Condition Index

Consumer Expectation Index

Consumer Confidence Index

Optimistic

Pesimistic

CONSUMER SURVEY

Consumer Confidence Index

boosted up

Methodology

The improvement on Consumer’s confidence was endorsed by

favorable consumer’s perception over both current economic condition and

the expectation for the following 6 months. Sustained economic development

as shown by better economic indicators such as stable exchange rate,

moderate inflation, and terracing foreign exchange reserves have endorsed

the CCI to accelerate and eventually raised tendency on household

expenditures.

Consumers concluded that current economic condition is

surpassed the same period in the last year

, as CCI grew 8.2 points to

110.7. The rising CCI was due to respondent’s confidence over current

economic condition and the expectation for the next 6 months. The reading

added by 11.4 and 4.9 points respectively.

Current Economic Condition Index

Current economic condition rated more expansive compared

with the previous month.

Current Economic Condition Index (CECI) in April

2010 stayed at 99.6, or 3.2 points higher from prior period. Respondents

stated that the upwarding index was substantially driven by the increasing on

their income and more prospective on job availability. Respondents also

claimed that current time is appropriate to consume durable goods.

Similar condition also took place on annual Current Economic

Condition Index (CECI)

that

boosted up 11.4 points over last year. The

increasing CECI was related to respondents who become optimistic over the

wider job availability as shown by the index which mounted by 14.8 points.

In

line with improving job availabilities, respondents also stated that their income

rose accordingly the current time is proper to consume durable goods.

Graph 2. Current Economic Condition Index (CECI)

0.0 20.0 40.0 60.0 80.0 100.0 120.0 140.0

1 2 3 4 5 6 7 8 9 10 11 12 1 2 3 4 5 6 7 8 9 10 11 12 1 2 3 4

2008 2009 2010

Current Economic Conditions Index Buying Durable Goods Conditions Job Availability Current Incomes

(Index)

Current economic condition

Consumer Expectation Index

Consumer expectation index grew stronger.

The strengthening

optimism was reflected from 3.2 points of rising index over previous month.

Such advancing index was mainly supported by respondents’ expectations

that economic condition would be more expansive in the next 6 months as

proven by the index which rose 4.5 points. As the economic condition

convicted to more favorable, job prospects and income were also expected to

be higher. The indexes gained each by 3.9 and 1.4 points respectively.

Graph. 3

Consumer Expectation Index (CEI)

0.0 20.0 40.0 60.0 80.0 100.0 120.0 140.0 160.0

1 2 3 4 5 6 7 8 9 10 11 12 1 2 3 4 5 6 7 8 9 10 11 12 1 2 3 4

2008 2009 2010

Index

Consumer Expectation Index Incomes Expectation

Economic Expectation Job Availability Expectation

Compared to the same period over last year, respondents also

showed a brighter optimism.

The height expectations were seen from

better respondent’s appraisement over economic condition, job prospects,

and incomes expectation in the next 6 months. The index rose by 1.5; 7.6,

and 5.8 points respectively.

Income Expectations

Consumers believed that their income would hike in 6 months

ahead.

The expectation was seen from income expectation index which

advanced 1.4 points from previous month. Classified by expenditure,

respondents who spent Rp1 million – Rp3 million have the highest expectation

towards their income among others. In the meantime, based on ages, those

who classified between 20-40 years old have the strongest conviction on their

rising income in the next 6 months ahead.

Consumers are upbeated on

economic condition in the

next 6 months

Price Expectations

Pressure on prices in the next 3 months were predicted to be

moderately higher,

as the price expectation index bounced from 155.1 to

158.6. The government’s plan on hiking electricity tariff in July 2010 was

deemed to drive increasing respondents’ expectations. This period survey also

confirmed that the highest upward on price expectation for the next 3 months

mainly on housing, electricity, gas and fuels group which the index added by

7.2 points.

Conversely, pressures on prices for the next 6 months were

predicted to loose.

Price expectation index in the next 6 months

dropped 1.8

points from preceding month. Clothing group was envisaged will suffered the

most due to seasonal factor post Eid-ul Fitr celebration and the index was 2.8

points lower.

Graph 4.

Price Expectation Index for the next 3 and 6 months

‐1.00 0.00 1.00 2.00 3.00 4.00 5.00 6.00

130.0 140.0 150.0 160.0 170.0 180.0 190.0 200.0

1 2 3 4 5 6 7 8 9 10 11 12 1 2 3 4 5 6 7 8 9 10 11 12 1 2 3 4 5 6 7 8 9 10

2008 2009 2010

Price Expectation Index 3 months ahead Price Expectation Index 6 months ahead Cummulative Inflations in 3 months

Index

Notes

: Index = 100 indicates that consumer expect prices will still be stable, index > 100 indicates

consumer expect prices will increase, and index < 100 indicates consumer expect prices will decrease

Expectations of Savings and Interest Rates

Interest rates in the next 6 months were decelerated, however,

saving expectation index remained advanced.

This month’s survey

showed that interest rates index in the next 6 months laid at 0.8 point lower

than the last survey. On the contrary, saving index achieved 0.8 point against

previous month as the respondents were sanguine that economic condition in

the next 6 months would expand.

Pressure on prices in the

next 3 months will

moderately increase

Graph. 5

Expectation Indexes on Interest Rates and Total Savings in the next 6 months

0 5 10 15 20 25

90 100 110 120 130 140

1 2 3 4 5 6 7 8 9 10 11 12 1 2 3 4 5 6 7 8 9 10 11 12 1 2 3 4 5 6 7 8 9 10

2008 2009 2010

Savings Growth in 6 months

Interest Rates Expectation Index in 6 months ahead Savings Expectation Index in 6 months ahead

Index (%)

Notes

: Index = 100 indicates that consumer expect saving deposit and interest rate will still be

stable, index > 100 indicates consumer expect saving deposit and interest rate will increase, and

index < 100 indicates consumer expect saving deposit and interest rate will decrease

Expectations on Economic Conditions

Respondents were more confidence on better economic condition

in the next 6 months.

Respondent’s expectation on economic condition

persisted to get stronger since March 2010 as the index obtained 4.5 points to

122.2. The upward index was predominantly supported by expectation from

academy graduate.

Economic condition

Table 1. Consumer Confidence, Price Expectations, Consumption Plans, and Economic Indicators (Index)

2008

Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr

A Consumer Confidence Index (CCI) 90.6 92.8 96.4 98.6 102.5 105.9 109.1 115.4 114.3 110.8 110.0 111.0 108.7 110.5 105.3 107.4 110.7

Present Situation (CECI) 78.4 79.7 82.7 86.2 88.2 91.0 94.5 98.6 100.5 96.6 96.8 97.7 96.7 98.4 94.7 96.4 99.6

Expectations (CEI) 102.9 105.9 110.0 111.0 116.8 120.9 123.7 132.3 128.2 125.1 123.2 124.3 120.7 122.6 115.9 118.5 121.7

Appraisal of Present Situation

Current Incomes 110.8 112.0 114.6 117.6 121.1 123.2 124.2 129.5 127.5 124.0 124.9 124.1 123.1 125.5 118.6 121.7 126.1

Buying durable goods Conditions 64.3 64.8 68.7 73.8 73.0 74.5 78.0 83.7 87.6 81.3 82.2 84.9 81.1 85.2 87.3 85.3 87.5

Employment Conditions 60.2 62.4 64.8 67.2 70.5 75.3 81.2 82.5 86.3 84.5 83.2 84.1 85.8 84.5 78.0 82.1 85.3

(before Oct 2004: Unemployment Condition)

Expectations for 6 Months Hence of

Incomes 128.1 130.3 131.3 131.2 130.9 136.4 135.2 142.9 138.3 138.5 137.3 139.3 136.8 141.1 132.5 135.3 136.7

Economic Conditions 104.1 107.9 113.6 112.6 120.7 126.6 130.5 138.9 135.4 130.4 127.3 128.8 122.1 122.7 114.4 117.7 122.2

Employment Conditions 76.4 79.4 85.2 89.1 98.7 99.7 105.2 115.1 110.7 106.4 105.1 104.8 103.1 103.9 100.8 102.4 106.3

(before Oct 2004: Unemployment Expectation)

B Price Expectations for 3 Months Hence of

Prices 154.7 143.8 140.9 150.9 148.1 150.5 154.5 154.8 163.8 165.2 158.8 159.9 161.0 160.6 160.2 155.1 158.6

Foodstuff 154.3 145.3 144.3 153.1 148.1 152.0 156.5 158.2 168.2 167.0 160.8 160.6 163.0 163.5 163.4 156.0 159.6

Food, beverages, cigarettes and tobacco 151.6 144.4 141.5 150.3 144.3 147.8 151.8 151.3 161.0 161.0 154.9 155.8 157.2 156.4 155.0 149.9 153.5

Housing, electricity, gas and fuel 139.2 126.4 122.4 133.1 136.2 141.0 141.5 141.6 148.8 155.2 156.0 156.6 156.3 152.0 151.5 148.1 155.3

Clothing 136.8 127.7 125.8 132.3 130.7 134.2 139.5 142.5 152.7 150.2 138.6 139.3 138.0 135.5 136.4 131.2 133.7

Health 139.0 131.3 127.9 133.0 132.0 134.0 135.5 132.1 139.6 140.6 135.4 136.6 137.9 135.9 136.1 133.9 133.6

Transportations, communications and financial services 134.2 116.4 108.3 122.4 126.9 132.3 135.5 136.7 145.6 146.9 142.6 142.2 141.4 137.5 137.9 134.3 136.4

Education, recreation, and sports 139.2 133.7 128.6 136.1 133.3 134.8 138.4 135.3 141.1 141.3 137.3 139.0 140.0 138.0 137.2 138.2 141.4

C Price Expectations for 6 Months Hence of

Prices 156.8 147.5 146.7 153.7 152.6 154.0 154.5 152.2 156.5 156.9 156.2 157.9 158.8 161.2 164.3 161.1 159.3

Foodstuff 156.2 146.5 148.9 155.3 151.9 155.9 154.9 154.2 160.0 158.2 158.4 158.4 160.5 162.1 166.0 161.7 160.5

Food, beverages, cigarettes and tobacco 153.3 144.8 145.7 151.7 149.4 152.3 152.1 149.9 155.0 153.4 154.3 154.4 154.9 156.9 158.9 156.7 154.5

Housing, electricity, gas and fuel 142.8 131.8 132.2 140.2 143.0 144.1 144.5 142.0 148.5 150.8 154.3 155.7 155.4 153.2 153.1 148.6 154.1

Clothing 140.6 129.5 130.9 137.9 136.6 140.8 141.9 139.0 144.0 141.7 137.4 140.5 139.9 140.1 144.4 143.1 140.3

Health 141.9 133.9 130.7 136.2 135.4 137.7 136.6 132.5 139.0 140.2 136.7 138.1 138.9 140.0 140.8 136.7 137.2

Transportations, communications and financial services 138.6 123.4 117.9 130.5 133.7 138.0 138.9 136.9 143.2 143.4 143.9 142.6 143.9 142.8 145.5 143.6 144.9

Education, recreation, and sports 145.8 138.7 136.4 141.0 139.0 139.0 139.8 134.9 139.8 141.0 138.6 143.1 144.7 146.2 147.7 145.3 144.2

D Economic Indicator within 6 Months

Avaibility of Goods & Services 118.7 116.1 121.2 120.4 123.7 130.9 134.0 137.2 140.0 138.6 136.4 132.7 133.5 138.3 134.2 135.5 137.6

Interest Rate 114.8 111.5 111.0 113.4 112.3 110.6 114.2 115.8 117.7 115.2 113.3 115.4 116.3 117.9 114.9 117.0 116.2

Current savings 88.6 89.2 93.1 93.1 98.1 101.0 103.0 107.5 107.8 104.4 104.7 106.6 105.9 106.4 105.2 106.9 105.0

Savings for 6 months hence 110.3 112.7 114.4 115.7 118.8 121.0 121.6 129.9 127.6 125.0 125.9 128.2 126.7 129.8 125.6 126.2 127.0

2010

Descriptions 2009

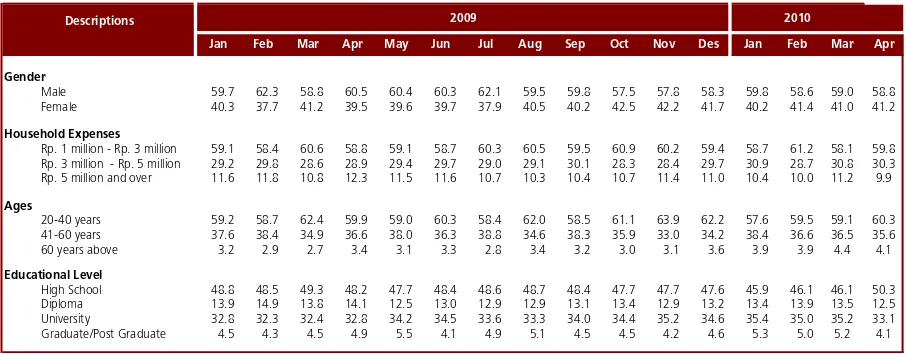

Table 2. Respondent Figures (percentages)

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Des Jan Feb Mar Apr

Gender

Male 59.7 62.3 58.8 60.5 60.4 60.3 62.1 59.5 59.8 57.5 57.8 58.3 59.8 58.6 59.0 58.8 Female 40.3 37.7 41.2 39.5 39.6 39.7 37.9 40.5 40.2 42.5 42.2 41.7 40.2 41.4 41.0 41.2

Household Expenses

Rp. 1 million - Rp. 3 million 59.1 58.4 60.6 58.8 59.1 58.7 60.3 60.5 59.5 60.9 60.2 59.4 58.7 61.2 58.1 59.8 Rp. 3 million - Rp. 5 million 29.2 29.8 28.6 28.9 29.4 29.7 29.0 29.1 30.1 28.3 28.4 29.7 30.9 28.7 30.8 30.3 Rp. 5 million and over 11.6 11.8 10.8 12.3 11.5 11.6 10.7 10.3 10.4 10.7 11.4 11.0 10.4 10.0 11.2 9.9

Ages

20-40 years 59.2 58.7 62.4 59.9 59.0 60.3 58.4 62.0 58.5 61.1 63.9 62.2 57.6 59.5 59.1 60.3 41-60 years 37.6 38.4 34.9 36.6 38.0 36.3 38.8 34.6 38.3 35.9 33.0 34.2 38.4 36.6 36.5 35.6 60 years above 3.2 2.9 2.7 3.4 3.1 3.3 2.8 3.4 3.2 3.0 3.1 3.6 3.9 3.9 4.4 4.1

Educational Level

High School 48.8 48.5 49.3 48.2 47.7 48.4 48.6 48.7 48.4 47.7 47.7 47.6 45.9 46.1 46.1 50.3 Diploma 13.9 14.9 13.8 14.1 12.5 13.0 12.9 12.9 13.1 13.4 12.9 13.2 13.4 13.9 13.5 12.5 University 32.8 32.3 32.4 32.8 34.2 34.5 33.6 33.3 34.0 34.4 35.2 34.6 35.4 35.0 35.2 33.1 Graduate/Post Graduate 4.5 4.3 4.5 4.9 5.5 4.1 4.9 5.1 4.5 4.5 4.2 4.6 5.3 5.0 5.2 4.1

2010

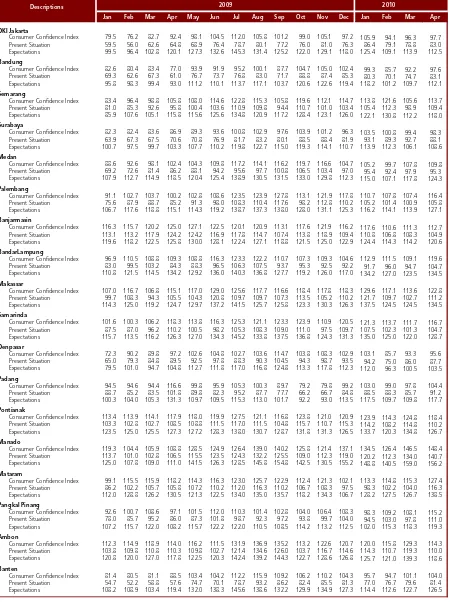

Table 3. Consumer Confidence by Region (Index)

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr

DKI Jakarta

Consumer Confidence Index 79.5 76.2 82.7 92.4 98.1 104.5 112.0 105.8 101.2 99.0 105.1 97.2 105.9 94.1 96.3 97.7 Present Situation 59.5 56.0 62.6 64.8 68.9 76.4 78.7 80.1 77.2 76.0 81.0 76.3 86.4 79.1 78.8 83.0 Expectations 99.5 96.4 102.8 120.1 127.3 132.6 145.3 131.4 125.2 122.0 129.1 118.0 125.4 109.1 113.9 112.5

Bandung

Consumer Confidence Index 82.6 80.4 83.4 77.0 93.9 91.9 95.2 100.1 87.7 104.7 105.0 102.4 99.3 85.7 92.2 97.6 Present Situation 69.3 62.6 67.3 61.0 76.7 73.7 76.8 83.0 71.7 88.8 87.4 85.3 80.3 70.1 74.7 83.1 Expectations 95.8 98.3 99.4 93.0 111.2 110.1 113.7 117.1 103.7 120.6 122.6 119.4 118.2 101.2 109.7 112.1

Semarang

Consumer Confidence Index 83.4 96.4 98.8 105.8 108.0 114.6 122.8 115.3 105.8 119.6 112.1 114.7 113.8 121.6 105.6 113.7 Present Situation 81.0 85.3 92.6 95.8 100.4 103.6 110.9 109.8 94.4 110.7 101.0 103.4 105.4 112.3 98.9 109.4 Expectations 85.9 107.6 105.1 115.8 115.6 125.6 134.8 120.9 117.2 128.4 123.1 126.0 122.1 130.8 112.2 118.0

Surabaya

Consumer Confidence Index 82.3 82.4 83.6 86.9 89.3 93.6 100.8 102.9 97.6 103.9 101.2 96.3 103.5 100.8 99.4 98.3 Present Situation 63.9 67.3 67.5 70.6 70.8 76.9 81.7 83.2 80.1 88.5 88.4 81.9 93.1 89.3 92.7 88.1 Expectations 100.7 97.5 99.7 103.3 107.7 110.2 119.8 122.7 115.0 119.3 114.1 110.7 113.9 112.3 106.1 108.6

Medan

Consumer Confidence Index 88.6 92.6 98.1 102.4 104.3 109.8 117.2 114.1 116.2 119.7 116.6 104.7 105.2 99.7 107.8 109.8 Present Situation 69.2 72.6 81.4 86.2 88.1 94.2 95.6 97.7 100.8 106.5 103.4 97.0 95.4 92.4 97.9 95.3 Expectations 107.9 112.7 114.9 118.5 120.4 125.4 138.9 130.5 131.5 133.0 129.8 112.3 115.0 107.1 117.8 124.3

Palembang

Consumer Confidence Index 91.1 102.7 103.7 100.2 102.8 108.6 123.5 123.9 127.8 113.1 121.9 117.8 110.7 107.8 107.4 116.4 Present Situation 75.6 87.9 88.7 85.2 91.3 98.0 108.3 110.4 117.6 98.2 112.8 110.2 105.2 101.4 100.9 105.8 Expectations 106.7 117.6 118.8 115.1 114.3 119.2 138.7 137.3 138.0 128.0 131.1 125.3 116.2 114.1 113.9 127.1

Banjarmasin

Consumer Confidence Index 116.3 115.7 120.2 125.0 127.1 122.5 120.1 120.9 113.1 117.6 121.9 116.2 117.6 110.6 111.3 112.7 Present Situation 113.1 113.2 117.9 124.2 124.2 116.9 117.8 114.7 107.4 113.8 118.9 109.4 110.8 106.8 108.3 104.9 Expectations 119.6 118.2 122.5 125.8 130.0 128.1 122.4 127.1 118.8 121.5 125.0 122.9 124.4 114.3 114.2 120.6

BandarLampung

Consumer Confidence Index 96.9 110.5 108.8 109.3 108.8 116.3 123.3 122.2 110.7 107.3 109.3 104.6 112.9 111.5 109.1 119.6 Present Situation 83.0 99.5 103.2 84.3 88.3 96.5 106.3 107.5 93.7 95.3 92.5 92.2 91.7 96.0 94.7 104.7 Expectations 110.8 121.5 114.5 134.2 129.2 136.0 140.3 136.8 127.7 119.2 126.0 117.0 134.2 127.0 123.5 134.5

Makassar

Consumer Confidence Index 107.0 116.7 106.8 115.1 117.0 129.0 125.6 117.7 116.6 118.4 117.8 118.3 129.6 117.1 113.6 122.8 Present Situation 99.7 108.3 94.3 105.5 104.3 120.8 109.7 109.7 107.3 113.5 105.2 110.2 121.7 109.7 102.7 111.2 Expectations 114.3 125.0 119.2 124.7 129.7 137.2 141.5 125.7 125.8 123.3 130.3 126.3 137.5 124.5 124.5 134.5

Samarinda

Consumer Confidence Index 101.6 100.3 106.2 118.3 113.8 116.3 125.3 121.1 123.3 123.9 110.9 120.5 121.3 113.7 111.7 116.7 Present Situation 87.5 87.0 96.2 110.2 100.5 98.2 105.3 108.3 109.0 111.0 97.5 109.7 107.5 102.3 101.3 104.7 Expectations 115.7 113.5 116.2 126.3 127.0 134.3 145.2 133.8 137.5 136.8 124.3 131.3 135.0 125.0 122.0 128.7

Denpasar

Consumer Confidence Index 72.3 90.2 89.8 97.2 102.6 104.8 102.7 103.6 114.7 103.8 108.3 102.9 103.1 85.7 93.3 95.6 Present Situation 65.0 79.3 84.8 89.5 92.5 97.8 88.3 90.3 104.5 94.3 98.7 93.5 94.2 75.0 86.0 87.7 Expectations 79.5 101.0 94.7 104.8 112.7 111.8 117.0 116.8 124.8 113.3 117.8 112.3 112.0 96.3 100.5 103.5

Padang

Consumer Confidence Index 94.5 94.6 94.4 116.6 99.8 95.9 105.3 100.3 89.7 79.2 79.8 99.2 103.0 99.0 97.8 104.4 Present Situation 88.7 85.2 83.5 101.8 89.8 82.3 95.2 87.7 77.7 66.2 66.7 84.8 88.5 88.3 85.7 91.2 Expectations 100.3 104.0 105.3 131.3 109.7 109.5 115.3 113.0 101.7 92.2 93.0 113.5 117.5 109.7 109.8 117.7

Pontianak

Consumer Confidence Index 113.4 113.9 114.1 117.9 118.0 119.9 127.5 121.1 116.8 123.8 121.0 120.9 123.9 114.3 124.8 118.4 Present Situation 103.3 102.8 102.7 108.5 108.8 111.5 117.0 111.5 104.8 115.7 110.7 115.3 114.2 108.2 114.8 110.2 Expectations 123.5 125.0 125.5 127.3 127.2 128.3 138.0 130.7 128.7 131.8 131.3 126.5 133.7 120.3 134.8 126.7

Manado

Consumer Confidence Index 119.3 104.4 105.9 108.8 128.5 124.9 126.4 139.0 140.2 125.8 121.4 137.1 134.5 126.4 146.5 148.4 Present Situation 113.7 101.0 102.8 106.5 115.5 123.5 124.3 132.2 125.5 109.0 112.3 119.0 120.2 112.3 134.0 140.7 Expectations 125.0 107.8 109.0 111.0 141.5 126.3 128.5 145.8 154.8 142.5 130.5 155.2 148.8 140.5 159.0 156.2

Mataram

Consumer Confidence Index 99.1 115.5 115.9 118.2 114.3 116.3 123.0 125.7 122.9 112.4 121.3 102.1 113.3 114.8 115.3 127.4 Present Situation 86.2 102.2 105.7 105.8 107.2 110.2 112.0 116.3 110.2 106.7 108.3 97.5 98.3 102.2 104.0 116.3 Expectations 112.0 128.8 126.2 130.5 121.3 122.5 134.0 135.0 135.7 118.2 134.3 106.7 128.2 127.5 126.7 138.5

Pangkal Pinang

Consumer Confidence Index 92.6 100.7 108.6 97.1 101.5 112.0 110.3 101.4 102.8 104.0 106.4 108.3 98.3 109.2 108.1 115.2 Present Situation 78.0 85.7 95.2 86.0 87.3 101.8 98.7 92.3 97.2 93.8 99.7 104.0 94.5 103.0 97.8 111.0 Expectations 107.2 115.7 122.0 108.2 115.7 122.2 122.0 110.5 108.5 114.2 113.2 112.5 102.0 115.3 118.3 119.3

Ambon

Consumer Confidence Index 112.3 114.9 118.9 114.0 116.2 111.5 131.9 136.9 135.2 113.2 122.6 120.7 120.0 115.8 129.3 114.3 Present Situation 103.8 109.8 110.8 110.3 109.8 102.7 121.4 134.6 126.0 103.7 116.7 114.6 114.3 110.7 119.3 110.0 Expectations 120.8 120.0 127.0 117.8 122.5 120.3 142.4 139.2 144.3 122.7 128.6 126.8 125.7 121.0 139.3 118.6

Banten

Consumer Confidence Index 81.4 80.5 81.1 88.5 103.4 104.2 112.2 115.9 109.2 106.2 110.2 104.3 95.7 94.7 101.1 104.0 Present Situation 54.7 52.2 58.8 57.6 74.7 70.1 78.7 93.2 86.2 82.4 85.5 81.3 77.0 76.7 79.6 81.4 Expectations 108.2 108.9 103.4 119.4 132.0 138.3 145.6 138.6 132.2 129.9 134.9 127.3 114.4 112.6 122.7 126.5

2010