www.elsevier.com / locate / econbase

On the superiority of the multiple round ascending bid auction

*

Fernando Branco

´

Universidade Catolica Portuguesa, FCEE, Palma de Cima, 1649-023 Lisboa, Portugal

Abstract

I compare the equilibria of standard auctions for two objects when there are unit and bundle bidders. In the example considered, the multiple round ascending bid auction performs better than the other mechanisms in both revenue and efficiency. 2001 Elsevier Science B.V. All rights reserved.

Keywords: FCC auctions

JEL classification: D44

1. Introduction

In the mid-nineties, the FCC decided to award the communication licenses through auctions. A new auction format, the multiple round ascending bid auction, was then used for the first time. The astonishing success of these auctions generated a new wave of interest for auction theory. The study of multiple unit auctions has received great attention in the last five years. In particular, the analysis has focused on frameworks where the bidders have complementarities in their preferences over the objects.

Branco (1995) considered an environment in which some bidders derive utility from a specific object only (unit bidders), while some others value the bundle of two objects only (bundle bidders). Revenue maximizing and efficient mechanisms were identified. The Vickrey-Clarke-Groves mecha-nism is optimum under a regularity condition.

Krishna and Rosenthal (1996) proposed an alternative model with unit bidders and bundle bidders. A bundle bidder values the individual objects but he has a superadditive valuation for the bundle of two objects. The authors characterized an equilibrium of the simultaneous second price auctions. The design of revenue maximizing and efficient mechanisms was addressed in Branco (1996). An

*Tel.:1351-217-214-241; fax: 1351-217-270-252. E-mail address: [email protected] (F. Branco).

equilibrium in the sequential English auctions was constructed in Branco (1997). More recently, within this framework, Albano et al. (1999) concluded for the superiority of the multiple round ascending bid auction over other standard auctions.

A mechanism design approach when there are general preference structures has been followed by Levin (1997) and Monteiro (1997).

In this note I get back to the analysis of simple mechanisms. In particular, I compare the properties of the multiple round ascending bid auction with some other simple mechanisms, within the model proposed by Branco (1995). The main conclusion of the analysis is that, among the simple mechanisms considered, the multiple round ascending bid auction lets the seller extract the highest revenue while distorting the least the ex-post allocation.

The paper is organized as follows. In Section 2 I briefly describe the assumptions of the model and the optimal mechanism. In Section 3 I describe and compare the properties of symmetric equilibria of the simultaneous second price auctions, the sequential second price auctions, and the multiple round ascending bid auction. Section 4 concludes.

2. The model

I consider a parameterized version of the model developed in Branco (1995). To keep the analysis simple, I assume that there are two objects to be sold. There are three bidders, each one endowed with a private signal about his value of the objects. Bidders U and U , the unit bidders, have a positive1 2 utility from getting object 1 and 2, respectively. Bidder U ’s utility is equal to v , which is uniformly

i Ui

distributed in [1,2]. The bundle bidder, bidder B, has a positive utility from getting both objects only, given by v and uniformly distributed in [2,4]. All signals are independently drawn. The seller does

B

not value the objects. All agents are risk neutral.

Using the results in Branco (1995) one concludes that, in this case, the Vickrey-Clarke-Groves mechanism is optimal (in terms of revenue and efficiency): the objects are allocated to the bundle bidder if and only his valuation exceeds the sum of the unit bidders’ valuations. The seller’s expected revenue is 31 / 12.

3. Standard auctions

3.1. Simultaneous second-price auctions

Suppose that the two objects are auctioned through simultaneous second price auctions: the bidders

1

would have to simultaneously submit separated sealed bids for each object.

1

The unit bidders have a (weakly) dominant strategy and bid according to b (v )5v . The bundle

U Ui Ui

i 2

bidder will chose the bids b (iB [h1,2j) to maximize his objective function:

1 2 1 2

(i[h1,2j). In a symmetric equilibrium the bundle bidder will use the same bid for each unit, and

3

therefore his equilibrium bids will be given by:

1 ifv [[2, 3)

So, in this mechanism, the bundle bidder follows a bang-bang strategy: he looses both auctions for sure if his valuation is less than average, and he wins both auctions for sure otherwise. So, the bundle

4

bidder may find it in his interest to (strategically) not participate in the auctions. The expected revenue of the seller, under this mechanism, is:

5

]

2Probhv ,3j13Probhv $3j5 .

B B 2

So, this mechanism yields 6 / 7 of the excess revenue provided by an optimal mechanism.

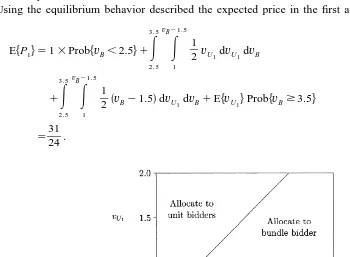

A major drawback of this mechanism is its low performance in terms of efficiency, which can be seen from Fig. 1. The reason for the inefficiency is clear: the final allocation depends only on the valuation of the bundle bidder.

3.2. Sequential second-price auctions

5

Suppose now that the seller organizes sequential second price auctions. We start by the second

6

auction, which I will assume to be for object 2. The unit bidder has a (weakly) dominant strategy and bids according to b (v )5v . The bundle bidder will also have a (weakly) dominant strategy given

U2 U2 U2

by:

v if he has won the first auction,

2 B

b (v )5

H

B B 1 otherwise.

Given the assumptions about the distributions of the bidders’ valuations, the outcome of the second auction is simple: the bundle bidder will win if and only if he has also won the first auction.

2 i

I am here supposing that the bids bB (i[h1,2j) are in [1,2]. 3

Note that the solution of equating the first order conditions to zero leads to a minimum. 4

Here I assume that non-participation implies submitting a bid of 1. Otherwise, the seller would have to use reserve prices. 5

In this model, the sequential second price auctions are equivalent to the sequential English auctions, in the sense that they lead to exactly the same prices, allocations and utilities.

6

Fig. 1. Allocations in the simultaneous second price auctions.

The equilibrium behavior of the unit bidder in the first auction is again to bid his valuation. The bundle bidder will decide his bid to solve the following problem:

1 bB 2

max

E E

s

v 2v 2vd

dv dv ,B U1 U2 U2 U1

1 bB

1 1

1

with the restriction that bB[[1,2]. The first order condition for an interior solution is:

2

1

E

S

v 2b 2vD

dv 50.B B U2 U2

1

Therefore, the equilibrium bidding function of the bundle bidder in the first auction is:

1 ifv [[2, 2.5)

B

3

1

b (B vB)5 v 2] ifv [[2.5, 3.5)

B 2 B

5

2 ifv [[3.5, 4]B

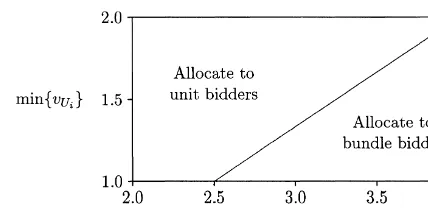

Once again we note that the bundle bidder will prefer not to participate if his valuation is lower than 2.5. On the other extreme, he will win for sure (and hence he will win both units) if his valuation exceeds 3.5.

2 2.5 3.5 2

So, this mechanism yields to the seller 13 / 14 of the expected excess revenue provided by an optimal mechanism.

The behavior of the bundle bidder induces inefficiencies in this mechanism, which are illustrated in Fig. 2. The inefficiencies arise from two sources: first, the bidding behavior of the bundle bidder, which may ensure himself a probability of zero or one of winning the objects; second, the fact that the valuation of the second unit bidder is irrelevant for the final allocation.

It also worth to note that the expected price declines from the first to the second auction. In the equilibrium constructed the bundle bidder wins the second auction if and only if he has also won the first auction. Hence the expected price in the second auction can be computed as:

EhP j5 Ehv uBidder B won the first auctionjProbhBidder B wins the first auctionj

2 U2

1Eh1uBidder B lost the first auctionjProbhBidder B loses the first auctionj

which is equal to 1.25.

Using the equilibrium behavior described the expected price in the first auction will be given by:

v 21.5

7

Hence, in expectation there will be a decreasing price anomaly: the expected price in the second auction is lower than the expected price in the first auction. Even though the model is different, this result is in line with that in Branco (1997).

3.3. Multiple round ascending bid auction

The multiple round ascending bid auction was used by the FCC. Here, I model it as simultaneous English (clock) auctions, where the current highest bid for each object cannot be withdrawn.

Each unit bidder has as a dominant strategy to actively bid for its object until the price reaches his valuation: b (v )5v (i[h1, 2j).

U Ui Ui

The behavior of the bundle bidder is more complex. Suppose that he has entered the highest bid for one object at price p; then he will keep bidding for the other object until its price reachesv . Given

B

the distributional assumptions of the example, this means that as soon as the bundle bidder has won one object, he will win the second object, regardless of the valuation of the last active unit bidder. Now, suppose that there is still active bidding for both objects. Given the structure of the valuation of the bundle bidder, if he decides to stop bidding for one object, he will also stop bidding for the

1

other. Let b be the price at which he will stop bidding for both objects. In equilibrium, if this price isB

in [1, 2] it will satisfy the following condition:

2

Therefore, the bundle bidder will stay active bidding for both objects until the price reaches:

1 ifv [[2, 2.5)

Like in the case of the sequential second price auctions, the bundle bidder will prefer not to participate if his valuation is lower than 2.5. However, in this mechanism, there are no valuations for which he will outbid both unit bidders for sure.

The expected revenue of the seller is:

2 2.5 4 4

Fig. 3. Allocations in the multiple round ascending bid auction.

This mechanism is still inefficient, as illustrated in Fig. 3. As in the sequential second price auctions, the inefficiencies arise from two sources: first, the bidding behavior of the bundle bidder, which may ensure himself a probability of zero of winning the objects; second, the fact that the final allocation is just determined by the valuation of the bundle bidder and the lowest valuation of the unit bidders.

4. Conclusion

In this short paper I constructed symmetric equilibria in standard auctions in a model of two units with unit bidders and bundle bidders. All auctions may produce inefficient outcomes. The inefficiencies arise, with varying degrees in the different mechanisms, from the fact that the bundle bidder may have incentives to strategically not participate in the auctions, and from the fact that, in equilibrium, the outcome is fully determined from the comparison of the valuation of the bundle bidder and, at most, the valuation of a single unit bidder (the one bidding for the first unit or the minimum of the two).

Among the mechanisms considered, the multiple round ascending bid auction is the one that ranks highest in both efficiency and revenue. This conclusion is analogous to that in Albano et al. (1999), who conducted a similar analysis within the model introduced by Krishna and Rosenthal (1996).

These are models of independent private signals. Given the superiority of the English auction in single unit models with affiliated types, we may conjecture that the multiple round ascending bid auction will in general be superior to the other simple mechanisms.

References

Albano, G.-L., F. Germano, S. Lovo, 1999, A Comparison of Standard Multi-unit Auctions with Synergies. Mimeo, CORE, Louvain-la-Neuve, Belgium.

Branco, F., 1995, Multi-object auctions: on the use of combinational bids. Working Paper 2-95, Banco de Portugal, Lisbon, Portugal.

´

Branco, F., 1997. Sequential auctions with synergies: an example. Economics Letters 54, 159–163.

Krishna, V., Rosenthal, R.W., 1996. Simulaneous auctions with synergies. Games and Economic Behavior 17, 1–31. Levin, J., 1997. An optimal auction for complements. Games and Economic Behavior 18, 176–192.