www.elsevier.com / locate / econbase

Modelling the duration of firms in Chapter 11 bankruptcy using

a flexible model

*

˜

´

´

Jesus Orbe, Eva Ferreira, Vicente Nunez-Anton

´ ´ ´

Dpto. de Econometrıa y Estadıstica, Facultad de Ciencias Economicas y Empresariales, ´

Universidad del Paıs Vasco-Euskal Herriko Unibertsitatea, Bilbao, Spain

Received 20 March 2000; accepted 8 November 2000

Abstract

This paper analyzes the duration of firms in Chapter 11 bankruptcy using a flexible model without assuming any probability distribution. We use bootstrap techniques to make inference on the estimators, and propose a new bootstrap procedure for censored samples. 2001 Elsevier Science B.V. All rights reserved.

Keywords: Duration models; Censorship; Kaplan–Meier; Bootstrap

JEL classification: C41; C24; G33

1. Introduction

As a result of increased financial fragility in the 1980s, the number of bankruptcies has also been significantly on the rise. This paper analyzes the duration or time that a firm spends under Chapter 11. That is, the period from a firm filing for Chapter 11 until its exit from it. When a firm files for bankruptcy it has two possible decisions: the possibility of liquidating the firm under Chapter 7 or the possibility to restructure it under Chapter 11 (for the procedures of Chapter 7 and 11 see, e.g., White, 1989). The objective of this paper is to examine the effect of several factors on the duration of the firm under Chapter 11. These factors or covariables measure firm specific characteristics, sector specific characteristics, institutional decisions and evolution of the economy. The research is based on a sample of distressed original issue high yield bonds between 1982 and 1991, in which the issuers filed for Chapter 11.

There are several papers in the literature that deal with the duration of firms from default or from filing for Chapter 11. This work can be located in the same line of study carried out by Li (1999);

*Corresponding author. Tel.: 134-94-601-3749; fax:134-94-601-3754. ˜

´ ´

E-mail address: [email protected] (V. Nunez-Anton).

Helwege (1999) and Bandopadhyaya (1994). These authors study the effect of different factors on the duration of firms in default or under Chapter 11. Bandopadhyaya (1994) studies the duration of firms which filed for Chapter 11 between 1979 and 1990, assuming a Weibull distribution for the duration variable. Li (1999) investigates the effect of different covariates over the length of time in Chapter 11 for firms that had been in default from 1982 to 1991, using several probability distributions for the duration and, finally, choosing the Log–Logistic distribution as the most adequate to explain the data. Helwege (1999) analyzes the length of time spent in default for defaults occurring between 1980 and 1991. She does not assume any distribution for the duration variable and obtains the interest coefficients using ordinary least squares regressions. However, this is only possible if there are no censored observations in the sample. If the sample has censored observations, the ordinary least squares estimates are inconsistent.

In our dataset we have censored observations; that is, when the study has finished some firms still stay in Chapter 11. Thus, the method used by Helwege (1999) is not adequate for this case. Our approach is less restrictive in the sense that it is robust against deviations from the assumed distribution. We use a recent method (Stute, 1993) proposed to analyze censored variables without assuming any distribution for the duration. Therefore, we can compare the results obtained assuming some distributions, already carried out by other authors, with the flexible approximation proposed here. Inference of the estimators for this model will be carried out using bootstrap techniques. In order to do this, we propose a new procedure to generate bootstrap resamples, which is adequate for regression models in samples with censored observations.

2. Statistical model for the duration

Let T be a random variable measuring the time that one firm stays in Chapter 11. We want to explain the effect of the different covariables on this duration. Therefore, we need a heterogeneous duration model. Reviewing the extensive literature in survival or duration analysis, we find that the two most relevant regression models in duration data analysis are the proportional hazards model (Cox, 1972) and the accelerated failure time model.

The advantage of the Cox model is that the distribution of the duration variable does not need to be specified and this is the reason why this model is the most widely used in practice. However, it assumes a proportional hazard function for different individuals, a hypothesis not always supported by the data.

On the other hand, for the accelerated failure time model, we have a direct effect of the covariates on the duration, accelerating or decelerating the exit from Chapter 11. The usual estimation for these models requires the assumption of a specific distribution for the duration (for a review of the most common distributions, see, e.g., Lawless, 1982). In addition, if we use the usual functional form to introduce the effect of the covariables in the model (the exponential function), these models can be rewritten as log–linear models for the duration variable.

duration or the proportionality of the hazards functions and, in addition, the model specifies a direct relation between the duration and the regressors.

To describe this methodology let us assume that T , . . . ,T are independent observations from some1 n unknown distribution function F and, because of the censoring, not all of the T ’s are available. That is, rather than observing T , we observei

1; if Ti#Ci Yi5min(T ,C ),i i di5

H

,0; if Ti.Ci

where C , . . . ,C are the values of the censoring variable C, which is independent of the duration1 n variable T, and di is the indicator for the censoring variable. In addition, X represents thei

k-dimensional vector of covariates for the i-th individual. The relation between the covariates and the

duration (or some monotonous transformation of it) is given by

Ti5Xib1ei with E[eiux ]i 50. (1)

The estimator of b can be obtained by minimizing

n

are the Kaplan–Meier weights, F ( y) is a Kaplan–Meier estimator of F (Kaplan and Meier, 1958),n and Y(i ) indicates the i-th ordered value of the Y variable. The weights Win can also be obtained following the redistribute to the right algorithm introduced by Efron (1967).

T 21 T

ˆ

In this way, the estimation of the coefficients can be obtained as b5(X WX ) X WY where

T

Y5(Y , . . . ,Y ) , W is a diagonal matrix with the Kaplan–Meier weights on its main diagonal and( 1 ) (n)

T T T T

X5[X ,X , . . . ,X ]1 2 n is the covariate matrix.

To apply this model in a duration context, it would be more adequate to fit lnT rather than T then, we do not have to impose restrictions on b for guaranteeing the nonnegativity of T. Therefore, this model can be seen as an accelerated failure time model, but with the important advantage of not assuming any distribution for the duration variable. The theoretical properties for this model can be found in Stute (1993) and Stute (1996). The first provides the strong consistency of the estimator and the latter its asymptotic normality.

3. Inference using bootstrap techniques

If we review the literature on bootstrap with censored observations, we can only find two different methods to obtain the bootstrap samples: one proposed by Reid (1981) and another one proposed by Efron (1981). The procedure put forward by Efron (1981) proposes to estimate, using Kaplan–Meier,

ˆ ˆ

the distribution functions for the duration variable and for the censoring one, F and G . Then, usingn n

*

*

these estimated distribution functions, he generates one sample for the duration variable, t , . . . ,t ,1 n

*

*

and another one for the censoring variable, c , . . . ,c . Finally, he considers the following bootstrap1 n resample:

On the other hand, the procedure in Reid (1981) proposes to estimate the Kaplan–Meier estimator

ˆ

for the distribution function of the duration variable F and to use this to generate the bootstrapn resample. Akritas (1986) shows that the procedure proposed by Efron is better. However, both methods are proposed to be applied in homogeneous models; that is, for models without covariates. But as, in our case, we have covariates, these resample procedures are not adequate. The procedure by Efron could still be valid if we assume that the censoring variable follows the same regression model as the duration one. However, this assumption is very restrictive. In order to solve this problem, we proposed a new procedure to generate the bootstrap sample for these models. This procedure is a flexible one because we do not assume any model for the relationship between the censoring variable and the covariates. The complete procedure that allows us to obtain the bootstrap estimations is presented in the next steps

Step 1: Estimate model (1) for lnT.

ˆ

Step 4: Obtain the bootstrap sample of the variable of interest doing model-based bootstrap:

ˆ

*

*

lnTi 5Xib1ei ; for i51, . . . ,n.

Step 5: Obtain the bootstrap censored indicator generating a vector of Bernoulli variables d*,

2

*

*

*

*

where P(di 51uln Ti 5ln t ,Xi i5x )i 512G(ln ti ), for i51, . . . ,n.

Step 6: Estimate the model, in the bootstrap sample, using the same estimation procedure in Step

1. That is,

Step 7: Go back to Step 4 and repeat the process R times.

In Step 5, G denotes the cumulative distribution function of the censorship variable. Since it is

ˆ

values are sufficient. To read on more details about bootstrap procedures see, e.g., Davison and Hinkley (1997) or Efron and Tibshirani (1993).

4. Data

The data, which were kindly provided by Kai Li of the University of British Columbia, consist of a dataset presenting a sample of original issue high yield bonds that went into default between 1982 and 1991, in which the issuers filed for Chapter 11. For each issue, we have the date in which the firm files Chapter 11 and the date in which the firm emerges from it. Therefore, we can obtain the duration (in months). There are several firms that remain in Chapter 11 when the study is finished. Those durations must be treated as censored observations. Otherwise, we would obtain downward biased estimates of the duration or upward biased estimates of the hazard function.

In addition, there are several covariates showing the special characteristics of each firm: variables such as Prepack, Prech11, Complexity, Hlt, Hy / Tl, Dispute, Ebitda / Sales, TL; about the characteristics of the sector to which the firm belongs: Iebitda / Sales; and variables about institutional decisions and the economical situation: Post90 and Termprem.

Briefly, Prech11 measures the duration of firm spent in out-of-court negotiations before filing for Chapter11. Hy / Tl captures the relative importance of the high yield debt in relation with the firm total liabilities. Ebitda / Sales measures the profitability of the firm dividing the earnings before interest, taxes, depreciation and amortization by its sales. Iebitda / Sales is the previous variable but evaluated in average terms for a particular industry. TL measures the firm size before the financial problems.

Termprem is a business cycle indicator measuring the difference between the 30-years US

government bond interest rate and the 3-month Treasury bill rate. The rest of covariables are indicators. Prepack indicates if firms filed for prepackaged Chapter 11, Complexity points out if the firm has more than one layer of subordination among its high yield bonds, Hlt if the firm has realized a highly leveraged transaction, Dispute if the firm is involved in different disputes as underfunded pensions, environmental liabilities, subordination lawsuits among its creditors, etc, and Post90 if the firm goes into default after 1990. These indicator variables take value one if the mentioned event happens, and zero otherwise, (see Li, 1998, for a detailed description of the variables).

5. Results

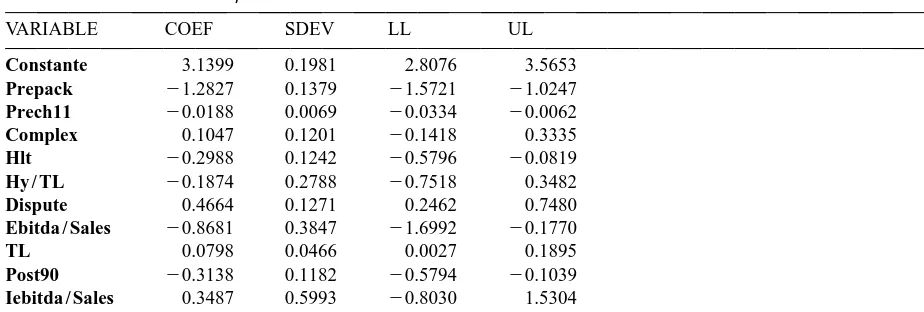

The objective is to study the effect of the covariables described above on the duration, but, unlike previous research, we do not assume any distribution for the duration variable. We fit model (1) for lnT, minimizing (2), and obtaining the estimated coefficients shown in Table 1.

After generating all the bootstrap resamples, we can obtain the bootstrap distribution, standard deviation (SDEV) and confidence intervals (LL and UL). Using these confidence intervals we can study the significance of the effect of the covariables, (if zero belongs to the interval, the correspondent covariable is not significant to explain the duration).

Table 1

Estimates of the coefficientsb and 95% confidence intervals

VARIABLE COEF SDEV LL UL

Constante 3.1399 0.1981 2.8076 3.5653

Prepack 21.2827 0.1379 21.5721 21.0247

Prech11 20.0188 0.0069 20.0334 20.0062

Complex 0.1047 0.1201 20.1418 0.3335

Hlt 20.2988 0.1242 20.5796 20.0819

Hy / TL 20.1874 0.2788 20.7518 0.3482

Dispute 0.4664 0.1271 0.2462 0.7480

Ebitda / Sales 20.8681 0.3847 21.6992 20.1770

TL 0.0798 0.0466 0.0027 0.1895

Post90 20.3138 0.1182 20.5794 20.1039

Iebitda / Sales 0.3487 0.5993 20.8030 1.5304

Termprem 20.0031 0.0497 20.1059 0.0882

indicator result not significant to explain the length of time spent in Chapter 11. The rest of the covariables seem important or influential to explain the duration. Thus, the firms which have filed for prepackaged (Prepack) spend less time in Chapter 11, because Chapter 11 and the restructuring plan are filed at the same time. We can see that, if a firm remains in negotiation during a large period between the date of default and the date of filing the formal Bankruptcy (Prech11), this firm emerges faster from it. The firms that have realized highly leveraged transaction (Hlt) in the past leave the bankruptcy before others. If the firm is involved in different disputes (Disputes), as pointed before in the description of this variable, it has more difficulties to leave Chapter 11. The size of the firm (TL), used as a proxy variable to measure the complexity of the firm’s total debt structure, is important to analyze the duration. In addition, the more profitable (Ebitda / Sales) the firm is the shorter the time it stays in Chapter 11. Finally, the variable that divides the sample in two parts, in relation to time, after and before 1990 (Post90), trying to capture several institutional changes, reveals a smaller duration for firms that go into default after 1990.

6. Conclusions

In this paper we use a flexible duration model, without assuming any probability distribution, and without assuming proportional hazard functions which, sometimes, is very restrictive. This model can be useful to check the distribution assumed in other studies as, for example, Li (1999), and, what is more important, it could be applied to the case of unknown distribution, as it is the usual case. In addition, we propose a new bootstrap procedure to make inference. This procedure is very general because, in order to generate the bootstrap resamples, it does not assume any relationship between the censoring variable and the covariables. The economic interpretation of our results allows us to propose this methodology as a good alternative to previous analysis for this type of data. Moreover, the differences with the results in Li (1999) can be due to the fact that Li’s assumption of a Weibull distribution for the duration is too restrictive and this can explain the non significance of the variables

Hlt and Ebitda / Sales, variables considered relevant by Jensen (1991).

Acknowledgements

´

This work was partially supported by Universidad del Paıs Vasco / Euskal Herriko Unibertsitatea, ˜

´

Direccion General de Ensenanza Superior del MEC and Gobierno Vasco under research grants UPV 038.321-HA129 / 99, PB98-0149, PI-1999-70 and PI-1999-46. The authors thank a referee for providing thoughtful comments and suggestions which led to substantial improvement in the presentation of the material in this paper.

References

Akritas, M.G., 1986. Bootstrapping the Kaplan–Meier estimator. Journal of the American Statistical Association 81, 1032–1038.

Bandopadhyaya, A., 1994. An estimation of the hazard rate of firms under Chapter 11 protection. The Review of Economics and Statistics 76 (2), 346–350.

Cox, D.R., 1972. Regression models and life-tables. Journal of the Royal Statistical Society-Series B 34, 187–220. Davison, D.R., Hinkley, D.V., 1997. In: Bootstrap Methods and Their Application. Cambridge University Press, Cambridge. Efron, B., 1967. The two sample problem with censored data. Proceedings of the Fifth Berkeley Symposium on

Mathematical Statistics and Probability 4, 831–853.

Efron, B., 1981. Censored data and bootstrap. Journal of the American Statistical Association 76, 312–319. Efron, B., Tibshirani, R.J., 1993. In: An Introduction To the Bootstrap. Chapman and Hall, New York.

Kaplan, E.L., Meier, P., 1958. Nonparametric estimation from incomplete observations. Journal of the American Statistical Association 53, 457–481.

Helwege, J., 1999. How long do junk bonds spend in default? The Journal of Finance 44, 341–357.

Jensen, M., 1991. Corporate control and the politics of finance. Journal of Applied Corporate Finance 4, 13–33. Lawless, J.F., 1982. In: Statistical Models and Methods For Lifetime Data. John Wiley and Sons, New York.

Li, K., 1998. An empirical examination of U.S. firms in Chapter 11 bankruptcy. In: University of British Columbia Working Paper, Vol. UBCFIN 97–7. The University of British Columbia, Vancouver, Canada.

Li, K., 1999. Bayesian analysis of duration models: an application to Chapter 11 bankruptcy. Economics Letters 63, 305–312.

Stute, W., 1993. Consistent estimation under random censorship when covariables are present. Journal of Multivariate Analysis 45, 89–103.

Stute, W., 1996. Distributional convergence under random censorship when covariables are present. Scandinavian Journal of Statistics 23, 461–471.

White, M.J., 1989. The corporate bankruptcy decision. Journal of Economic Perspectives 3, 129–151.