245 Duties and Responsibilities of the Board of Directors and Board of Commissioners of the Group Head. 288 Share ownership of Members of the Board of Directors amounting to 5% or more of the Paid-up Capital.

Quality Lending

Capital Adequacy

Liquidity

Customer

Satisfaction

Branch

Internet Banking

Mobile Banking

Corporate

Governance

To be the bank of choice and

Vision

Mission

Core Values

BCA developed its information technology capability by establishing an online system for its branch network and is launching new products and services, including the Tahapan BCA savings account product. BCA strengthens and develops its products and services, especially in electronic banking, by launching Debit BCA, Tunai BCA, KlikBCA internet bank, m-BCA mobile bank, EDCBIZZ, etc.

Business development

BCA aggressively expanded its branch network in line with the deregulation of the Indonesian banking sector. BCA Holds Short Film Competition BCA holds "BCA (Shovia) Short Film Awards 2015" under the theme "Indonesia Muda, Indonesia Kaya Budaya".

BCA Ultimate Shareholders

Shares issued pursuant to the MSOP program above have been taken into account for the effect of the share split.

BCA Dividends History *

Bonds Highlights

Subsidiaries Business

Subsidiary Ownership Structure

Letter to

Shareholders

Supervisory Report

Dear respected Shareholders,

Djohan Emir Setijoso President Commissioner

The Board of Commissioners recognizes that the continuous improvements in the scope and performance of the subsidiaries are in line with the Bank's strategic plan. In 2015, there were no changes to the composition of the membership of the Board of Commissioners.

Dear Stakeholders and valued Customers,

A slowdown in the pace of Indonesia's economic activity continued in 2015, influenced by the weakening global economy and various domestic macro challenges. The slow economic recovery of the US and the Eurozone remains suboptimal with continued slow growth leading to uncertainty in the global economy despite the implementation of various economic stimulus programs.

Report of the Board of Directors

Effective communication and coordination is maintained between the members of the Board of Directors in. We report that in 2015 there were no changes in the composition of the Board of Directors.

PT Bank Central Asia Tbk 2015 Annual Report

Management Discussion

Contents

Business Review

Branch Banking

Third Party Funds (in billion Rupiah)

Commercial and SME Loan Portfolio (in billion Rupiah)

BCA continues to develop cash management services to improve customer relationships and strengthen the Bank's core business in transaction banking. In the commercial and SME segment, the Bank will focus its lending to clients with strong business prospects and proven stability in uncertain economic conditions.

Corporate Banking

Corporate Loan by Facilities (in billion Rupiah)

Corporate Loan Portfolio by Industry Sectors

BCA's exposure to the sea and river transport sector is manageable, amounting to Rp 2.2 trillion or 1.6% of the bank's total corporate loan portfolio. Within the oil and gas segment, the bank continues to provide cash management services to the public service station business chain.

Individual Banking

Consumer Loan Portfolio (in billion Rupiah)

Total Consumer Loans (in billion Rupiah)

The bank continues to maintain its position as one of the leading mortgage credit providers in Indonesia. In 2015, the bank began collaborating with other banks on the issue of co-branded Flazz cards.

Treasury and International Banking

Treasury Portfolio (in billion Rupiah)

As part of the Bank's commitment to meet the needs of its customers, BCA Custodian provides custody of securities in foreign currencies. However, the Bank continues to maintain its position as one of the largest remittance service providers in Indonesia.

International Banking Business Volume (in USD billion)

BCA Treasury offers a wide range of foreign currency products and services along with bond sales and custody services to the bank's diverse customer base. Services are delivered to customers in all segments through collaboration with frontliners throughout the bank's branch network.

Business Support

Risk Management

Non-Performing Loans (NPL) ratio

To mitigate the various risks faced by the bank, BCA has implemented a “Comprehensive Risk Management Framework” consisting of strategy, organization, policies and procedures and a risk management infrastructure that ensures that all risks can be identified faced by the bank or its branches. measured, monitored, controlled and properly reported. In addition, to support the implementation of effective risk management, the bank continues to develop its risk management infrastructure in accordance with applicable regulations and international best practices.

FOCUS ON RISK MANAGEMENT 2015

BCA recognizes that there is inherent risk in the banking business and in general banking operations.

Credit Risk

In the face of uncertainty on the currency market, the bank continued with the precautionary principle of managing currency exposure by maintaining a conservative net open position. As of December 2015, the bank recorded a net open position of 0.4%, well below the regulator's ceiling of 20%, which has sufficiently mitigated market risk associated with foreign currency.

Liquidity Risk

To reduce exchange rate risk, the Bank has strictly monitored foreign currency transactions to ensure that these transactions comply with the Bank's internal policies and Bank Indonesia's Net Open Position (NOP) regulations. The management of foreign currency transactions is centralized within the treasury department, with transactions made at the branch level monitored, recorded and reported to the central treasury department.

Operational Risk

In a year of extreme exchange rate volatility, the Bank maintained discipline in managing foreign currency exposure with a limit on overall USD loans and in compliance with Bank policy to issue USD loans only to clients whose main business income is in USD. In 2015, BCA was exposed to increased exchange rate risk due to the Rupiah's volatility against the USD.

INTEGRATED RISK MANAGEMENT

Supervision of the Board of Commissioners and the Board of Directors of the Main Entity

24 hours a day without interruption, BCA runs two redundant data centers that are designed to ensure business continuity in the event of a system failure at one of the two data center locations.

Adequacy of policies and procedures, and

Adequacy of identification, measurement, monitoring, and control of integrated risks, as well as the

INTERNAL CONTROL

BCA AND SUBSIDIARIES RISK SELF- ASSESSMENT RESULTS

DISCLOSURE OF RISK MANAGEMENT

BCA’s Application of Risk Management

A. Active Supervision by the Board of Commissioners and the Board of Directors

- In carrying out the risk management function, the Board of Directors has defined

- Active supervision by the Board of Commissioners and the Board of Directors

Enrolling all employees/officers in the Risk Management Certification Program in accordance with their respective positions. The Audit Committee, the Risk Oversight Committee, the Remuneration and Nomination Committee and Integrated Corporate Governance assist in the supervisory tasks of the Supervisory Board.

Committee, established to provide recommendations to

B. Adequacy of Risk Management Policies and Procedures, and Determination of Risk

- The Bank’s organizational structure adequately supports the implementation

- Policies and procedures, and determination of risk management limits, have been fully

- In conducting its business activities, the Bank has developed a Bank Business

- Risk exposure is monitored regularly by the Risk Management Unit by comparing the

- Reports on risk trends, including among others Risk Profile Reports, Credit Portfolio

- The internal control systems are linked to each business or operational unit, and are

- All management and employees of the Bank have a role and responsibility in

A risk control committee established to ensure that the risk management framework provides adequate protection against the risks faced by the bank. The effectiveness of risk management is also assessed through regular reports to the Board of Directors and the Board of Directors.

EFFECTIVENESS OF BANK RISK MANAGEMENT SYSTEMS

In order to maintain compliance with regulations and taking operational conditions into account, the bank continuously evaluates and updates policies, procedures and risk management methods. These reports include Risk Management Policy Reports; Risk Profile Reports; and risk update reports.

Risk Appetite

Stress Test

BCA capital Capital Policy

Adequacy of Capital and Dividend Policy

The dividend distribution is equivalent to a dividend payout ratio of 22.1% and was paid out of the net profit from 2014. The Bank has a portion of the 2015 net profit in the form of an interim dividend of Rp 55 per share paid on December 9 is paid out. 2015.

Dividend Payout Ratio

Capital Needs Of Subsidiaries

BCA Capital Position

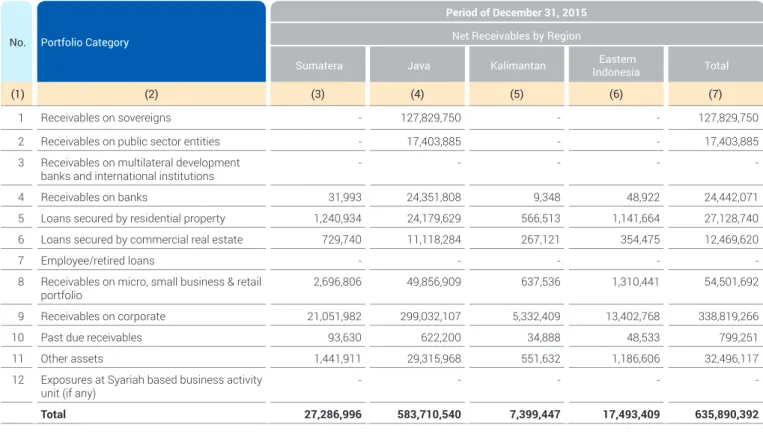

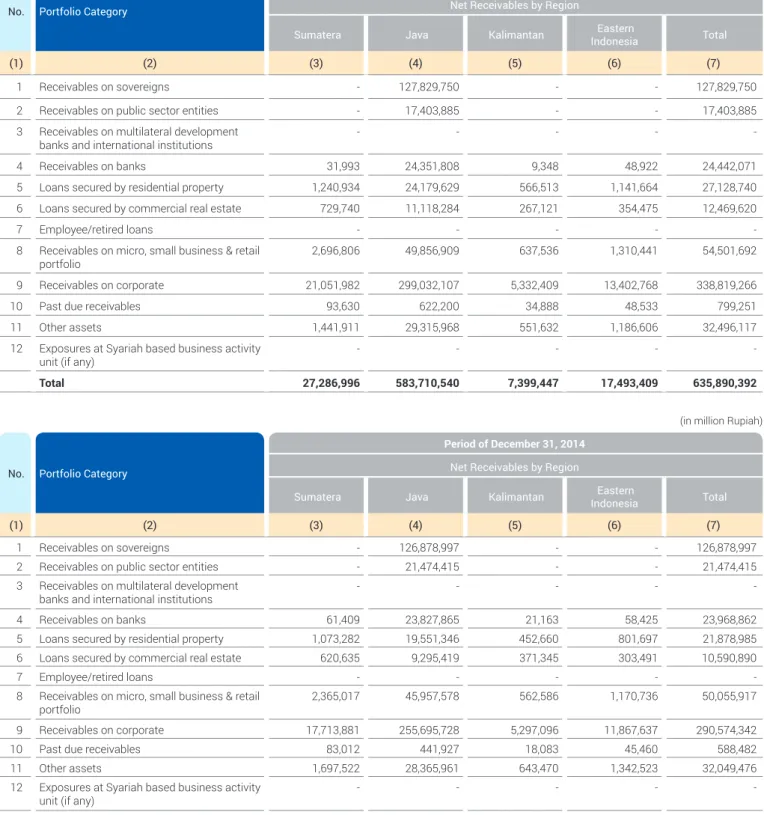

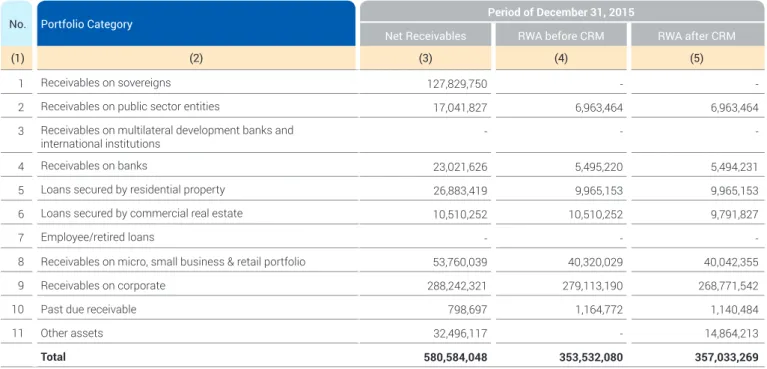

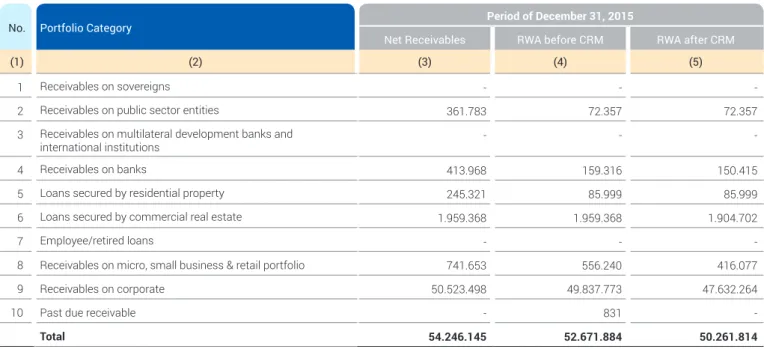

Disclosure of Risk Exposures and Implementation of Risk Management

Implementation Of Credit Risk Management Organization of Credit Risk Management

The Board of Commissioners approves the Bank’s credit plans and oversees their

The Board of Directors is responsible for the preparation of credit plans and the

Chief Risk Officer, a member of the BCA Board of Directors, has signing authority for credit

Work Units that perform functions related to credit risk management, the Business Unit and

Credit Policy Committee has the principal function of assisting the Board of Directors

Credit Committee has the principal function of providing guidance for credit analysis, providing

Risk Management Committee has the main function of developing policies, strategies

Risk Management Strategy for Activities with Significant Credit Risk Exposure

Credit Concentration Risk Management Policy Portfolio management manages credit risk by

Credit Risk Measurement and Control

Impaired

Approach Used for the Formulation of Allowances for Impairment

Risk Measurement

Credit Risk Mitigation

Responsible for maintaining foreign exchange Net Open Position (NOP) and interest on the trading book and ensuring the bank complies with Bank Indonesia regulations regarding NOP. Regional Offices and Branches Responsible for managing foreign exchange transactions in the respective regional offices/branches in accordance with predetermined limits.

Trading Book and Banking Book Portfolio Management

Responsible for managing marketable securities trading and foreign currency transactions in accordance with client needs and/or income considerations. The calculation of market risk to determine the Bank's capital requirements uses standardized methods as defined by Bank Indonesia.

Market Risk Measurement

The Risk Management Unit supports ALCO in monitoring and measuring foreign exchange and interest rate risks.

Scope of Trading and Banking Portfolios Accounted for by Capital Adequacy Ratio

Anticipation of Market Risk on Foreign Currency Transactions

C. Disclosure of Operational Risk Exposure and Implementation of Operational Risk

Organization of Operational Risk Management Bank-wide implementation of Operational Risk

The Board of Commissioners and the Board of Directors ensure adequate risk management

The Risk Management Committee ensures that the risk management framework provides

The Risk Management Unit (SKMR) ensures that the risks faced by the Bank are identified,

The Enterprise Security Work Unit protects and secures information and physical assets

The Internal Audit Division assures that business risks are managed properly and

The Operation Strategy and Development Division assists SKMR in implementing

The Work Units (business units and support units) are risk owners responsible for risk

Measurement and Identification of Operational Risk Implemented in 2002, BCA applies a Risk Self-

The RCSA, LED and KRI application is supported by the Operational Risk Management Information System (ORMIS). Currently, all branches and main units use ORMIS in the implementation of RCSA, LED and KRI.

Operational Risk Mitigation

The purpose of the LED is to identify the source and reduce the possible risk of operating losses. LED is also a means of operational loss risk data collection used by the Bank to determine the allocation of capital costs and for monitoring events that may lead to further operational losses.

Risk Management of New Products and Activities As the largest private bank in Indonesia, BCA focuses

Responsible for monitoring statutory reserves and ensuring the Bank's compliance with Bank Indonesia regulations regarding Statutory Reserves. Regional Offices and Branches Responsible for liquidity risk management at the respective regional offices and branches.

Measurement and Control of Liquidity Risk and Early Warning Indicators for Liquidity Problems

Organization of Legal Risk Management

Legal Risk Control

Organization of Strategic Risk Management In an effort to limit the occurrence of strategic risks,

Policies to Identify and Respond to Changes in the Business Environment

G. Disclosure of Reputation Risk Exposure and Implementation of Reputation Risk

Reputational risk can occur as a result of reduced levels of stakeholder trust caused by negative perceptions of the Bank.

Organization of Reputation Risk Management BCA has a strong commitment to managing

Policies and Mechanism of Reputation Risk Control In order to manage reputation risk, the Bank

Reputation Risk Management at Times of Crisis To manage reputation risk in times of crisis, the Bank

- Implementation of Crisis Management, which includes

- Development of a business continuity plan and a disaster recovery plan, designed to speed up

- Installation of backup systems to prevent high risk business failure

- H. DISCLOSURE OF COMPLIANCE RISK EXPOSURE AND IMPLEMENTATION OF

The Board of Commissioners is responsible for approving risk management policies and advising on compliance risk. The management, with the help of the audit committee and the risk control committee, supervises the implementation of compliance risk management.

Risk Management Strategies Associated with Compliance Risk

To minimize compliance risks, all organizational lines must be responsible for compliance risk management in all bank activities. The Compliance Director, assisted by the Compliance Unit, is responsible for ensuring compliance and mitigating compliance risk by establishing compliance risk management policies and procedures and monitoring their implementation.

Compliance Risk Monitoring and Control

Application of Integrated Risk Management

- Active supervision of FC BCA by the Board of Directors and the Board of Commissioners of

- Adequacy of identification, measurement, monitoring, and mitigation of integrated

- Comprehensive internal control system

- Appointing the Director in charge of risk management at BCA as the Director in charge

- Forming an Integrated Risk Management Committee to ensure that the risk management

- Adjusting the organizational structure of the Risk Management Unit to ensure that

- Identifying the Main Entity and Subsidiaries included in the Financial Conglomerate for

- Compiling and submitting Integrated Risk Profile Reports

- Finalizing the compilation of Basic Integrated Risk Management Policies for

Completion of the compilation of basic integrated risk management policies for integrated risk management policies for the implementation of integrated risk management. The risk management unit is responsible for establishing guidelines and monitoring the implementation of risk management in the bank and its subsidiaries within FC BCA.

Inter-group Transaction Risk

Adequacy of identification, measurement, monitoring and mitigation of integrated monitoring and mitigation of integrated risk and information systems for integrated risk management; Formation of an Integrated Risk Management Committee to ensure that the Risk Management Committee ensures that the risk management framework provides adequate integrated protection against all risks faced by the bank and its subsidiaries.

Insurance Risk

BALANCE SHEET A. Asset

OFF BALANCE SHEET A. Off Balance Sheet Receivables

Off Balance Sheet Liabilities

Administrative Account Payable

- BALANCE SHEET A. Assets

Liabilities

Human Resources

Number of Employees

Training and Development

In order to maximize managers' commitment to their teams, improving staff quality is one of the key performance indicators for measuring BCA division and group general managers. This gallery is designed to tell the story of the Bank's journey and to introduce BCA's vision, mission and values as part of the orientation of new Bank employees.

Recruitment and Career Building

This training centre, the BCA Learning Institute, is designed to meet BCA's overall training needs and equipped with over 70 modern classrooms, accommodation and group conference rooms. The modern design, the use of the latest technology and virtual classrooms are considered essential for BCA to continue to improve human resources.

Learning Organization

At headquarters, more specific enrichment programs cater directly to the needs of individual units. For example, the Treasury Products and Services Enrichment Program ensures that Corporate Business Group officers understand the business relationship between Corporate Banking and Treasury.

Work-Life Balance

These exchange programs are the loan-related enrichment program for the heads of branch operations who do not yet have the necessary expertise or experience in lending and the operational enrichment program for the heads of branch business development who do not yet have sufficient experience in the operational field. . Since 2012, a portion of employees' annual bonuses have been paid in the form of BCA shares acquired through the Indonesian Stock Exchange.

Looking Forward

Network and Operations

Number of ATMs

The Bank has developed a multi-channel network strategy consisting of the traditional physical branch network and increasingly through a wide range of electronic banking channels that provide customers with flexibility in their transaction activities. This trend is expected to accelerate and will require the Bank to remain innovative in developing and expanding digital banking channels to remain one of the leading banks in Indonesia and improve the efficiency and quality of its services.

Integrated Network Infrastructure

To ensure the smooth functioning of the Bank's networks, the delivery channels are supported by two data centers, each of which has the capacity and capability to handle the entire process of the Bank's customers' transactions. In addition to the two data centers, the Bank has set up a Disaster Recovery Center (DRC) in Surabaya, specifically designed to keep basic banking operations running in the event of force majeure and limit the Bank's operational risk.

Digital Technology, Internet and Social Media

PT Bank Central Asia Tbk Annual Report 2015 and is a pioneer in providing reliable mobile banking. Laku' and 'Duitt' are in the early stages of development and are now only available in selected areas.

Focus on Customer Service

Quality of service will be the differentiator as competition in the Indonesian banking sector continues to grow. We continuously work to improve the organizational structure and key performance indicators (KPI) of frontliners to deepen customer relationships as a foundation for sustainable business growth in the future.

Information Technology

Internet Banking Transaction Value

16 Rp Trillion/Day

BCA continues to strengthen its information technology infrastructure to ensure that the Bank has the capacity and capability to meet the growing demand for banking services through both branch and electronic networks. In 2015, BCA invested in a number of information technology developments designed to take the Bank's digital services to the next level by utilizing the latest technology to deliver the best possible products and services.

Information Technology Infrastructure

PT Bank Central Asia Tbk 2015 Annual Report The implementation of a reliable Information Technology. IT) system is key to providing payment settlement services and financial solutions that meet the diverse financial needs of BCA's customers. Leveraging the latest developments in information technology, the Bank provides up-to-date solutions for customers with specific focus on enhancing online transactions as the new lifestyle standard among the middle class in urban areas.

Solutions for Customers

The strategy to support e-commerce payment transactions as adopted by the Bank's information technology team is realized through various technical initiatives including the development of e-Commerce Gateway, Application Programming Interface (API) Gateway and Server-Based e-Money . In support of the Government's efforts to promote branchless banking, in 2015 BCA introduced the new

Strengthening IT Security Systems

Based on this analysis, the bank can minimize possible downtime for these operations in the event of a disaster and mitigate potential losses. As one of the most important factors supporting the bank's business, information technology will continue to be an integral part of the development of the bank's products and services in the coming years.

Financial Review

OVERVIEW OF INDONESIA’S MACRO ECONOMY IN 2015

Also, the uncertainty of the direction of the Fed funds rate in 2015 significantly increased the volatility of the local currency. To maintain the stability of the rupiah while steering the current account deficit to a healthier level, Bank Indonesia kept the BI base rate at 7.5% from February 2015.

OVERVIEW OF INDONESIAN BANKING SECTOR PERFORMANCE IN 2015

2015 is the first time in the last 5 years that the national banking sector experienced a decline in net income. Changes in the inclusion of current year net income in the calculation of CAR have fueled the growth of the CAR ratio.

SUMMARY OF INCOME

BCA's capital position has been maintained at a healthy level with a Capital Adequacy Ratio (CAR) of 18.7% as of 31 December 2015. Transaction banking remains the Bank's core business, with transaction accounts, current accounts and savings accounts (CASA) as a main funding source providing 76.1 % of BCA's total third party funds contribute.

Interest Income

Interest Expense

Interest expenses on savings accounts decreased by 7.8% to Rp 2.3 trillion from Rp 2.5 trillion last year. Other interest expenses increased by 7.9% to Rp 1.6 trillion in 2015, driven by an increase in government guarantee premiums and Shariah expenses.

Net Interest Income and Net Interest Margin

Time deposit interest expense decreased by 6.8% to Rp 6.2 trillion in 2015 in line with the 200 bps drop in the Bank's average time deposit interest rate over the course of the year. The deposits from customers' accounts, which mostly consist of monthly administration fees from savings accounts, grew by 8.9% to Rp 2.6 trillion in 2015 in line with the increase in the number of customer accounts.

Operating Expenses

BCA Insurance, BCA Finance and BCA Sekuritas respectively contributed 7.3% to total other operating income in 2015. Legislation for impairment losses of financial assets In 2015, BCA allocated net provisions for impairment losses.

Allowance for Impairment Losses on Financial Assets In 2015, BCA allocated net Allowance for Impairment Losses

PT Bank Central Asia Tbk Annual Report 2015 A collective review is being conducted of loans that have. Based on these criteria, the collective assessment is carried out on: (a) loans to small and medium-sized enterprises (SMEs) and consumer loans including credit cards, and (b) loans to corporate and commercial segments classified as current loans and loans with special mentions .

Income Before Tax

The collective assessment of impairment allowances covers credit losses inherent in portfolios of debtors with similar economic characteristics when there is objective evidence for this. For the calculation of the collective impairment, BCA applies the following formula: Probability of default x loss given default x amortized cost1.

Income Before Tax and ROA

BCA Net Income attributable to shareholders of the parent entity in 2015 was Rp 18.0 trillion, an increase of 9.3% from the previous year's Rp 16.5 trillion. The Total Comprehensive Income Attributable to Shareholders of the Parent Entity grew by 8.2% to Rp 17.7 trillion in 2015 from Rp 16.3 trillion in 2014.

BALANCE SHEET

ASSETS

In addition to lending, earning assets also consist of government bonds and funds placed in liquid and low-risk short-term instruments in the form of placements with other banks and placements with Bank Indonesia, including Bank.

CASH AND CURRENT ACCOUNTS WITH BANK INDONESIA

In addition to lending, earning assets also consist of government bonds and funds placed in liquid and low-risk short-term instruments in the form of placements with others.

PLACEMENTS WITH BANK INDONESIA AND OTHER BANKS

SECURITIES PURCHASED UNDER AGREEMENT TO RESELL

INVESTMENT SECURITIES