This was consistent with the Bank's initiatives to strengthen the capabilities of these two digital channels. The expansion of the Bank's ATM network focuses on investments in CRMs, which facilitate both cash withdrawals and deposits.

Future Development Plans

The bank was one of the first to use API Programming Interface (Application Programming Interface) technology to build connectivity through a payment system for e-commerce and fintech players. BCA will continue to build partnerships and collaborate with e-commerce and fintech players to support their business growth in.

CORPORATE BANKING

Business Review

Throughout 2019, corporate banking was one of main drivers

Corporate Lending

CORPORATE BANKING

Syndicated Loans

Total Solutions for Customers

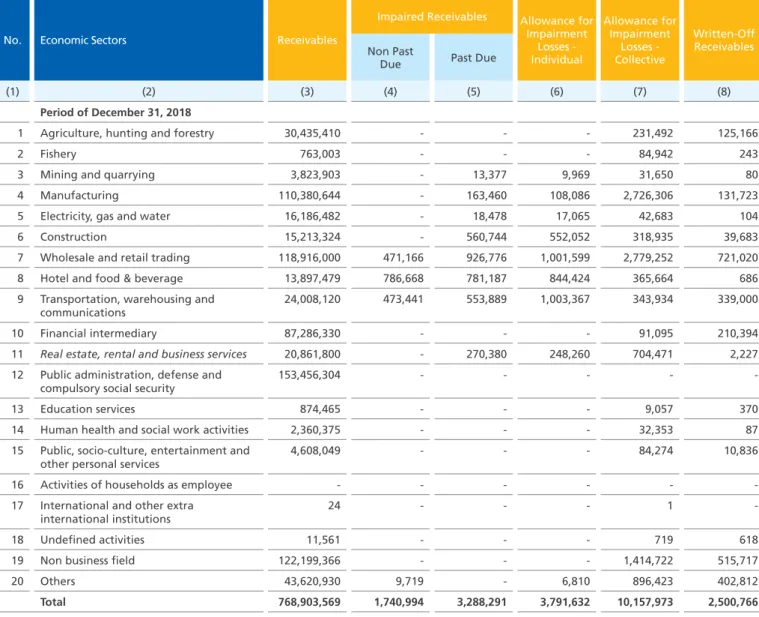

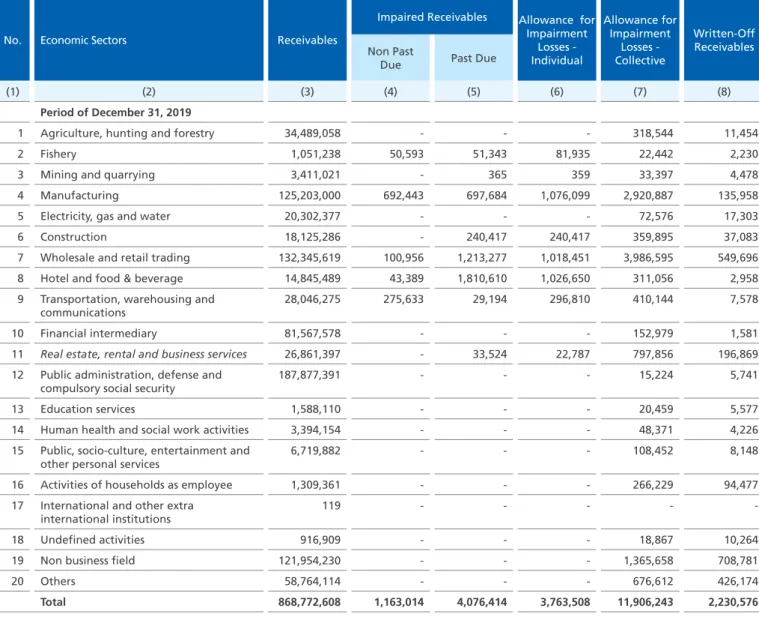

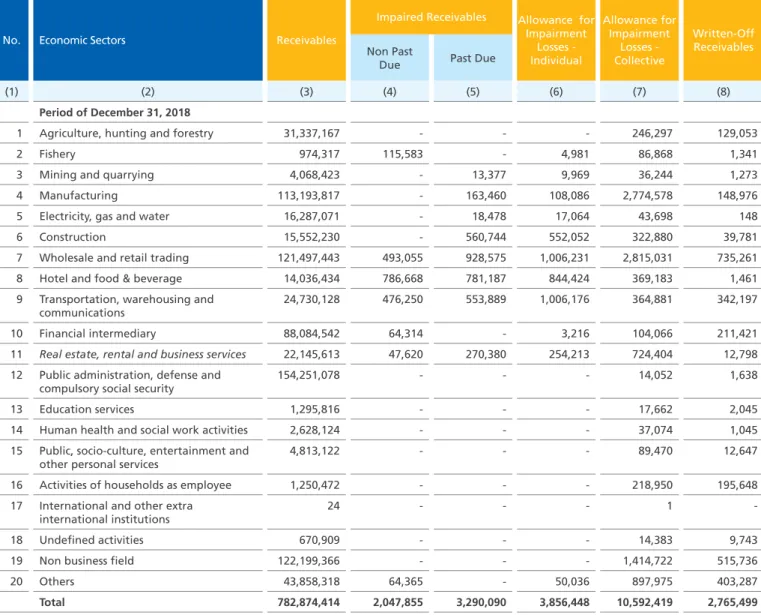

Corporate Loan Portfolios by Industry Sectors (based on the Bank’s internal classification)

Corporate banking will continue to be one of the main pillars of BCA's lending growth in the future. BCA will continue to encourage the development of API technology to provide convenience for corporate partners using our banking facilities and strengthen our payments ecosystem.

COMMERCIAL AND SME BANKING

The commercial and SME segment achieved solid loan growth of 12.8%

Through the provision of cash management services, the bank connects business customers with its payment ecosystem. As competition for third-party funds intensifies, we believe the role of cash management services is increasingly important in supporting the growth of CASA funds beyond fee-based income.

Commercial and SME Lending

COMMERCIAL AND SME BANKING

Integrated Cash Management Service

Cash management services are essential to support the Bank's comprehensive banking transaction services, especially in the commercial and SME segments. Particularly in the commercial and SME segment, the Bank is increasing the synergy between lending and cash management services.

INDIVIDUAL BANKING

Supported by a large customer base, BCA is well-positioned to

Quality Individual Banking Solutions and Services

The Bank maintains a reliable and convenient payment platform for individual customers BY OFFERING DIGITAL CHANNELS SUCH AS +LIK "#!. In addition, the Bank has developed a customer relationship management system to improve its understanding of the dynamic needs of our loyal customers.

Priority and Solitaire Banking

BCA focuses on improving its product offerings for individual customers, including but not limited to: mortgages, car loans, credit cards, savings accounts and wealth management products such as bancassurance and investments. The bank maintains a reliable and convenient payment platform for individual customers BY PROVIDING DIGITAL CHANNELS LIKE +LIK "#! )NDIVIDU (internet banking) and BCA Mobile (mobile banking) as well as through the branch network.

INDIVIDUAL BANKING

Quality Consumer Credit Financing

By the end of the year, the bank's credit for four-wheelers TOTAL PORTFOLIO FINANCING "#. The credit card business supported the growth of the middle-income segment in Indonesia.

Wealth Management Products and Services

One of its famous credit card products is the BCA Card, which is the only proprietary card or local private brand in Indonesia that is not affiliated with other local or international networks. BCA continues to focus on maintaining current relationships and expanding the portfolio of individual banking products of its existing clients.

TREASURY AND

INTERNATIONAL BANKING

BCA Treasury manages liquidity prudently by always maintaining a

BCA provides international banking services, covering cross border

Prudent Liquidity Management

The Ministry of Finance regularly reviews appropriate pricing for the term deposit portfolio, taking into account the growth rate of CASA's core funds. BCA gradually reduced interest rates on term deposits, in response to an ample internal liquidity position and the latest interest rate environment.

TREASURY AND INTERNATIONAL BANKING

Investments managed by BCA Treasury reached Rp 189.3 trillion at the end of 2019, an increase of 28.7%. compared to Rp 147.1 trillion last year, a substantial portfolio which accounted for 20.6% of BCA's total assets. This investment deal was taken on the basis of the Bank's solid rupee liquidity position and in line with the growing demand in the foreign exchange hedging market.

Treasury Banking Solutions

Trade Finance Services

Remittance Service

To manage these risks, BCA applies an integrated risk management system that covers the risks to which BCA and its subsidiaries are exposed. BCA also promotes risk awareness among its employees through risk management training for all work units.

RISK MANAGEMENT FOCUS IN 2019

BCA has implemented an Integrated Risk Management Framework that includes a strategy, organizational structure, a set of policies and procedures and all relevant infrastructure to ensure that potential risks are properly identified, measured, monitored, controlled, reported and resolved. In response to organizational development, regulatory changes and the business environment, BCA adjusts its internal risk management policies to comply with regulations and international best practice.

Business Support

RISK

MANAGEMENT

BCA continues to promote discipline in risk management

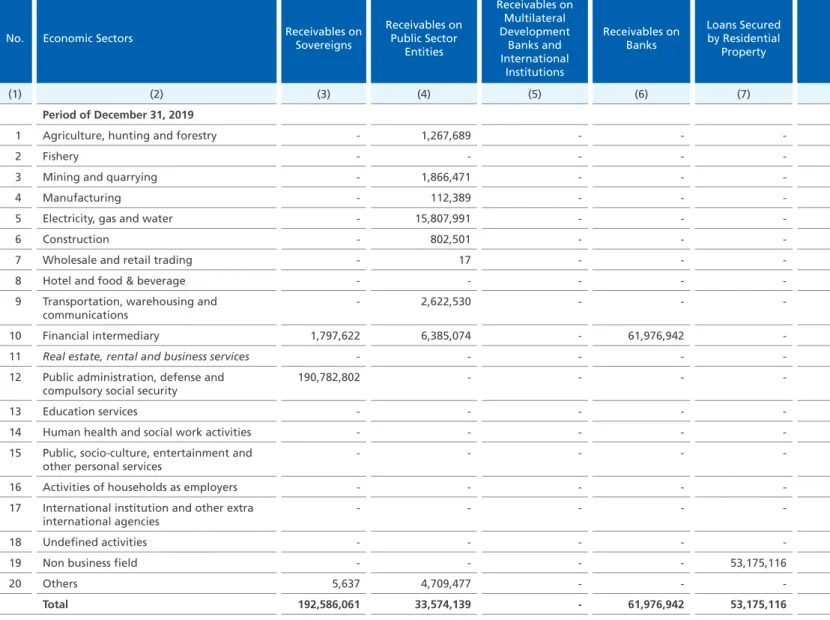

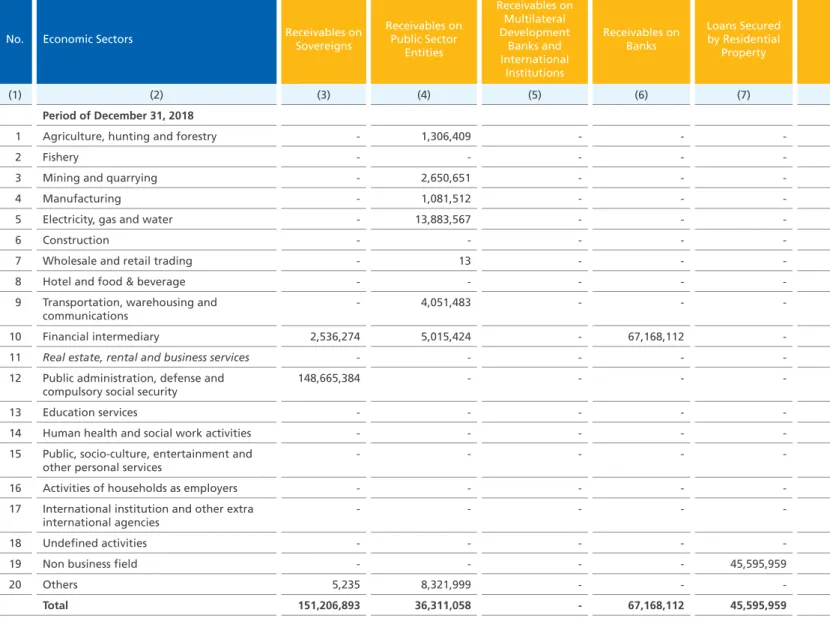

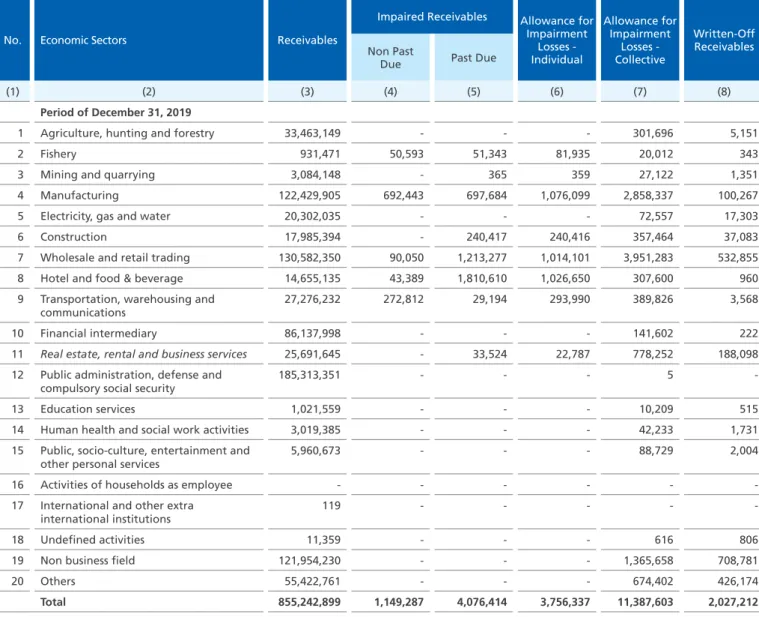

Industry Sectors in Corporate, Commercial and SME Segment (based on the Bank’s internal classification)*

With transaction banking as the bank's core business, operational risk becomes a crucial part of risk management. The bank carries out socialization of the implementation of operational risk management to employees across all work units to promote a risk management culture.

INTEGRATED RISK MANAGEMENT

A. Active Supervision by the Board of Commissioners and the Board of Directors

The Board's responsibility to ensure the effective management of BCA's activities and risks and to ensure that the Board regularly provides guidance to improve the implementation of risk management policies. After obtaining the approval of the Board of Commissioners, the Board of Directors establishes the policy, strategy and framework for risk management.

INTERNAL CONTROL

Risk management policies and strategies at least once a year, or on more frequent occasions if there are significant changes in factors affecting BCA's business activities. Requests from the Board relating to transactions require the approval of Commissioners and the making of decisions on such requests.

RISK ASSESSMENT OF BCA RISK PROFILE AND SUBSIDIARIES

DISCLOSURE OF RISK MANAGEMENT

BCA’s Application of Risk Management

All material risks and impacts from these risks are followed and regularly submitted to the Board of Commissioners, including reports on progress and issues related to material risks, related to corrective actions that have been, are and will be carried out. IT IS IN A STATE OF EMERGENCY and, if necessary, the Board of Directors may seek the opinion of the risk management committee (KMR), the asset and liability committee (ALCO) or other related committee.

B. Adequacy of Risk Management Policies and Procedures and Determination of Risk Limits

D. Comprehensive Internal Control System

To support the implementation of the internal control system, BCA has a fully documented risk management policy (organizational structure, division of tasks, risk limits, etc.). Oversee the internal audit/risk management/compliance function of the subsidiaries in conjunction with the integrated corporate governance and integrated risk management application.

GENERAL MEETING OF SHAREHOLDERS

The assessment and evaluation of the adequacy and effectiveness of the internal control system is periodically reviewed by the Internal Audit Division, which is the third line of risk management defense, to ensure that internal controls have been implemented adequately. The Compliance, Legal & Risk Management Director oversees subsidiary risks as part of integrated risk management.

BOARD OF DIRECTORS

BCA strongly encourages a culture of risk and a culture of compliance with respect to the applicable regulations implemented and monitored by the Risk-ANAGEMENT 5NIT AND #OMPLIANCE 5NIT, WHICH TOGETHER form THE SECOND line of defense for risk management. All BCA managers and employees have the role and responsibility to implement, comply with and improve the quality of BCA's internal control system so that it is reliable and effective.

BOARD OF COMMISSIONERS

EFFECTIVENESS OF BANK RISK MANAGEMENT SYSTEMS

- BCA Capital

- Disclosure of Risk Exposure and Implementation of Risk Management

- A. Disclosure of Credit Risk Exposures and Implementation of Credit Risk Management

- B. Disclosure of Market Risk Exposures and Implementation of Market Risk Management

- C. Disclosure of Operational Risk Exposures and Implementation of Operational Risk

- D. Disclosure of Liquidity Risk Exposure and Implementation of Liquidity Risk Management

- E. Disclosure of Legal Risk Exposure and Implementation of Legal Risk Management

- F. Disclosure of Strategic Risk Exposure and Implementation of Strategic Risk Management

- G. Disclosure of Reputation Risk Exposures and Implementation of Reputation Risk

- H. Disclosure of Compliance Risk Exposure and Implementation of Compliance Risk

SKMR also has the authority to provide input to the Board in the formulation of risk management policies, strategies and framework. The Board of Commissioners and the Board of Directors are responsible for ensuring that liquidity risk management is carried out in accordance with the strategic objectives, scale, business characteristics and liquidity risk profile of the Bank.

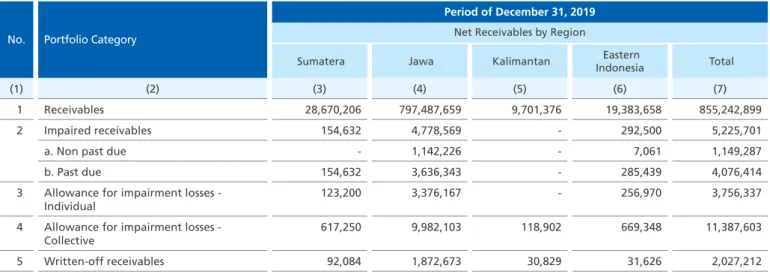

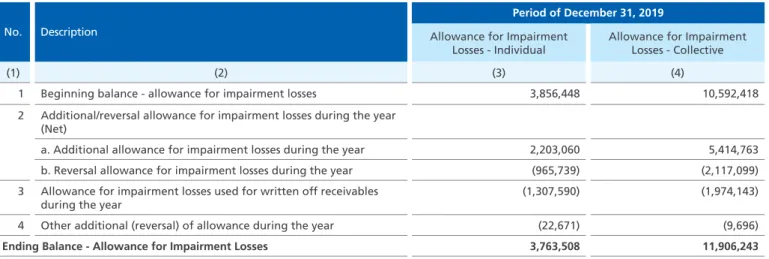

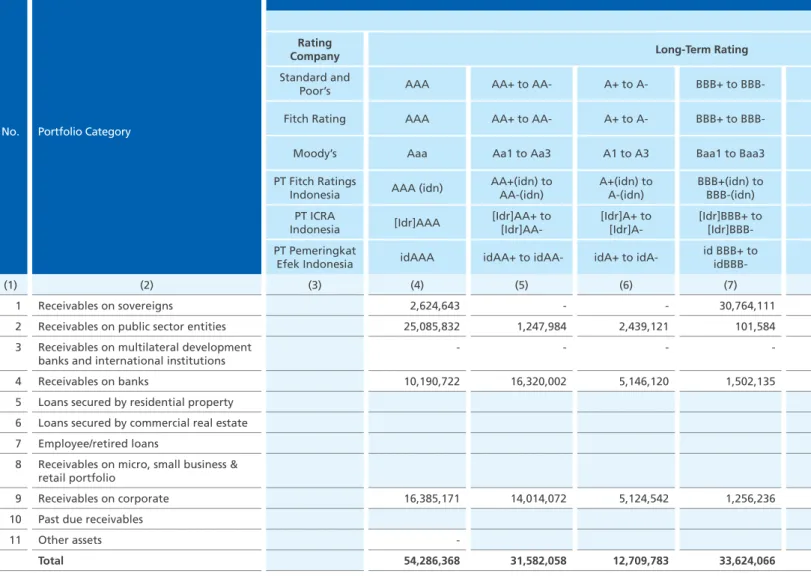

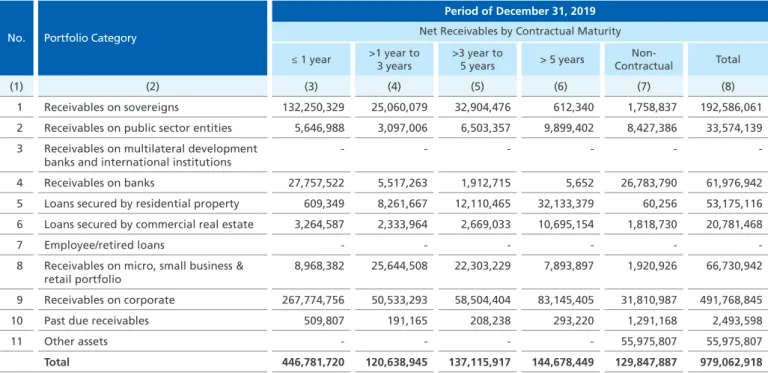

Risk Management Table

Disclosure of Interest Rate Risk in Banking Book Exposure (IRRBB) - Bank Only (Currency: Rupiah). in EVE) or projected income (in NII). Disclosure of Interest Rate Risk in Banking Book Exposure (IRRBB) - Consolidated (Currency: Rupiah). in EVE) or projected income (in NII).

HUMAN

RESOURCES

The development of mindset, competence, and governance

Qualified Human Resources and Preparing Future Leaders

Moreover, the Bank continues to strengthen its brand awareness through social media to attract interest from people looking for job opportunities in the banking sector. From the second semester of 2019, BCA started rolling out a referral program through internal employees.

Business Support HUMAN RESOURCES

Career Development and Preparing Future Leaders

For the longer term, the Bank conducted various career development programs to prepare potential successors for leadership positions. It was the eighth IKF event which promoted the theme Nurturing Mindset for The Next Era of Capital Culture.

HR Governance for Productivity

On a continuing effort to manage employee demographics, BCA continues to focus on human resource recruitment and succession planning. The Bank also continuously promotes a conducive and productive work environment to maintain employee loyalty and to attract new joiners.

NETWORK AND OPERATION

BCA is supported by more than 1,200 branches, 17,000 ATMs,

Reliable Digital Banking Network

Extensive Branch and ATM Network

NETWORK AND OPERATION

Quality Services For Customers

Future Development Plan

INFORMATION TECHNOLOGY

Enhancing Innovation and Productivity with Technology

High quality transaction banking services require a

BCA has developed a series of initiatives to strengthen the

In stages, BCA is developing a future branch concept with self-service options and an automated/centralized back office that allows customers to complete faster banking transactions. The future branch offers various services such as self-service cash deposits/withdrawals, mobile or internet banking registration, credit card applications and transaction/account information enquiries.

INFORMATION TECHNOLOGY

Strengthening IT Infrastructure Capabilities

Strengthening Transaction Banking System Security

This initiative enables the bank to collaborate with partners in e-commerce and fintech to exploit potential business opportunities. The bank will increase the use of machine learning and artificial intelligence technology to protect network exposure and customer and transaction information by detecting data pattern anomalies.

Amid the vulnerable global economic condition in 2019,

OVERVIEW OF MACROECONOMICS AND THE BANKING SECTOR

GLOBAL ECONOMY

INDONESIAN ECONOMY

Indonesia's sustained economic growth came as a result of sound monetary and fiscal policies adopted by the government and regulators in 2019. This was in line with the Fed's rate cuts and expectations of slowing economic growth influenced by the global recession economy.

Banking Sector Overview

BI also reduced the banking sector's reserve requirement twice during the year by a total of 100 bps to 5.5%.

FINANCIAL PERFORMANCE OVERVIEW BCA IN 2019

ASSETS

Consumer loans accounted for 22.5% of total loans at Rp132.6 trillion, up slightly from last year's Rp131.7 trillion. The total LAR amounted to Rp22.6 trillion or 3.9% of total loans, up by Rp2.4 trillion or 12.1% from a year earlier, mainly from the corporate segment.

LIABILITIES

The growth of CASA was also supported by the increase in the number of accounts, which increased by 14.3% in 2019. This contributed to a significant increase of 34.5% in the number of banking transactions, especially from the Internet and mobile banking networks.

EQUITY

In response to market conditions, BCA adjusted its time deposit rate as part of liquidity management measures. Maximum time deposit rates were reduced by 125 basis points in 2019, so the average cost of funds for time deposits reached IDR 5.5%.

PROFIT AND LOSS STATEMENT

Non-interest operating income increased by 19.2% to Rp 21.1 trillion, attributable to increased fee and commission income which contributed 64.4% to total non-interest operating income. Communication expenses increased by 18.2% to Rp 1.7 trillion, mainly related to the increase in the volume and frequency of transactions, which increased the processing cost paid.

CASH FLOW

Total comprehensive income attributable to equity holders of the parent increased by 16.3% to Rp 31.1 trillion. Cash flow from financing activities was Rp 7.3 trillion in 2019, especially from the increase in dividend payment to Rp 8.8 trillion compared to Rp 6.4 trillion in 2018.

KEY FINANCIAL RATIOS

During the year, BCA managed its cash flow optimally and reserved cash and cash equivalents of Rp 113.1 trillion compared to Rp 103.3 trillion last year. This is particularly derived from third-party funds of Rp 24.4 trillion from Rp 46.0 trillion a year ago to Rp 70.4 trillion in 2019 and the decline in full-year loan disbursement to Rp 52.8 trillion from Rp 71.3 trillion last year.

PT BCA Finance

SUBSIDIARY

PERFORMANCE OVERVIEW

BCA Finance was named the Best Performing Multifinance Company at the Bisnis Indonesia Financial Awards 2019 and the Most Profitable Financial Company at the Infobank Multifinance Awards 2019.

PT BCA Multi Finance

PT Bank BCA Syariah

PT BCA Sekuritas

PT Asuransi Umum BCA

PT Asuransi Jiwa BCA

In 2019, the Indonesian Contact Center Association (ICCA) won the Best Contact Center Indonesia 2019 Award for the Best Platinum Telesales Category, and Warta Ekonomi magazine won the Best Indonesia Insurance 2019 Award: Enhancing Adaptability and Resilience in the Best Innovation Company Category.

BCA Finance Limited

PT Central Capital Ventura

PT Bank Royal Indonesia

TARGET ACHIEVEMENT IN 2019 AND PROJECTION FOR 2020

OTHER MATERIAL INFORMATION

PROSPECT AND STRATEGIC PRIORITIES

The Bank's initiatives to strengthen transaction banking capabilities have focused heavily on the development of digital platform services, such as online account opening via BCA Mobile. The Bank continued to strengthen collaboration with e-commerce and fintech companies to expand the coverage of its payments ecosystem.

MARKETING ASPECT

Offering comprehensive financial products and services complemented our core banking transactions and created cross-selling opportunities to support overall performance. These platforms have been enhanced and improved in terms of product and service information, as well as through the addition of new features (eg online account opening and e-branch). s) IMPROVEMENT 6)2.

DEBT SERVICE ABILITY AND LOAN RECEIVABLES COLLECTABILITY

CAPITAL STRUCTURE AND MANAGEMENT POLICY

DIVIDEND POLICY

MATERIAL COMMITMENTS FOR CAPITAL EXPENDITURE

REALIZATION OF CAPITAL EXPENDITURE

INFORMATION AND MATERIAL INFORMATION AFTER THE DATE OF FINANCIAL REPORTING

MANAGEMENT AND/OR EMPLOYEE STOCK OPTION PLAN (MSOP/ESOP)

REALIZATION OF PUBLIC OFFERING FUNDS

MATERIAL INFORMATION REGARDING INVESTMENT, EXPANSION, DIVESTMENT AND

INFORMATION ON MATERIAL TRANSACTIONS WITH CONFLICTS OF INTEREST

DISCLOSURE OF TRANSACTIONS WITH RELATED PARTIES

GROUP-WIDE FUNDING, COMMITMENTS AND OTHER FACILITIES TO SINGLE OUTSIDE DEBTORS

IMPACT OF CHANGES IN LAWS AND REGULATIONS

CHANGES IN ACCOUNTING POLICIES

BUSINESS CONTINUITY

PRIME LENDING RATE