I find that in 1999, the least religious firms with the highest level of operational efficiency and the highest level of accrual management have shareholders. My results show that in 2006, shareholders continue to favor the least religious firms with the highest level of earnings management on an accrual basis, but at a decreasing rate. My results also show that in 2006, shareholders began to favor the most religious companies with the highest levels of operational efficiency.

Low, medium and high return management..52 Figure 3 Average stock returns from 1999, broken down by degree of religiosity and.

Introduction

Investors who want to earn a return while exercising their religious values through their investments use faith-based funds. For example, faith-based funds avoid companies involved in abortions based on the biblical principle that life begins at conception. As another example, faith-based funds screen out companies that deal in pornography, based on the principle that mere thought and sight can cause sexual sin.

Some faith-based funds also avoid companies in the tobacco, alcoholic beverages, and gambling industries (Boasson et al. 2006).

Prior Research

The religious beliefs of the decision maker can influence each stage (Rest 1986; Brammer et al. 2007). Previous research suggests that religion influences corporate financial reporting decisions (Dyreng et al. 2010; Grullon et al. 2010; McGuire et al. 2012). The study by McGuire et al. (2012) shows a negative relationship between abnormal accruals (a measure of accrual-based management) and religiosity.

Dyreng et al. (2012) study presents two characteristics of religious individuals that may inhibit optimistic acculturation choices.

Hypothesis

Previous research supports the idea that religious individuals are more likely to view corporations as having a more extensive set of responsibilities and duties than only making a profit (Brammer et al. 2007). This seems to be a reasonable hypothesis because the highly religious companies with the most efficient operating quality will produce a better return on assets for the shareholders. However, previous research shows that companies located in highly religious areas have less aggressive financial reporting, fewer restatements and a reduced risk of fraud (Hilary and Hui 2009; Dyreng et al.

They are also less likely to be involved in class action lawsuits, suggesting that religiosity influences financial reporting decisions (Grullon et al. 2010). Previous research also shows that managers in highly religious fields prefer real earnings management to benefits-based management because real earnings management is considered more ethical and less risky than real earnings management. accrual basis (Buns and Merchant 1990; Graham et al. 2005; McGuire). et al. 2004). Religious moral reminders cause managers to make fairer decisions, resulting in smaller deviations from actual accrual levels (Mazar et al. 2008; Dyreng et al. 2012).

Because of the risk-averse nature of religious individuals, religious managers often avoid potential litigation consequences by more conservatively reporting accruals (Watts 2003; Grullon et al. 2010; McGuire et al. 2012; Dyreng et al. 2012). Thus, it seems very reasonable to conclude that religion plays a role in managers' financial reporting decisions. Based on previous research, the more religious a corporation is, the better the quality of its financial reporting should be.

Consequently, shareholders should favor highly religious companies with the least amount of accrual earnings management; those managers portray a more honest and accurate financial picture of the underlying financial results for shareholders. Thus, religious companies make better operational and financial reporting decisions and as a result have a better return on their assets and a more accurate reporting of accruals in their financial statements than non-religious companies.

Methodology

By definition, followers are “all members, including full members, their children and an estimated number of other participants who are not considered members; for example, 'baptised', 'unconfirmed', 'unfit for communion', 'those who regularly attend religious services' and the like." The response rates by denomination in 1990 and 2000 were only 54 percent and 52 percent, respectively, but they captured larger congregations because 94.3 percent and 89.3 percent of all adherents recorded in the Yearbook of American Churches were reported in this survey, respectively. To get the necessary data for the years after 2000, they extrapolated using the slope of the line corresponding to the data points from 1990 and 2000. GAAP requires that they be recorded in the period in which they occur, rather than in the period in which they are paid .

With many management compensation packages that are based on revenue, one can understand why managers might attempt to manipulate the financial statements by not recording costs incurred in the period in which they were incurred but not yet paid. Again, GAAP requires that they be recorded in the period in which they are earned, rather than in the period in which payment is received. It is clear why managers may have incentives to generate more revenue than is actually earned in the period, to increase profits, and to meet expectations regarding compensation packages and stock analyst forecasts.

In the opinion of the case, Justice Black stated that the First Amendment, made applicable to the states by the Fourteenth Amendment, requires that a state "make no law respecting an establishment of religion or prohibiting the free exercise thereof" (Everson 1947) . The "Religion" clause found in the First Amendment is intended to "erect a wall of separation between church and state" (Everson 1947) And third, it is difficult to observe many aspects of religion because they are inherent in the way people behave.

Second, there is some degree of bias in the measurement as the characteristics of the non-respondents are not reported, but due to the high level of coverage the bias is kept to a minimum. Williams used the estimated adjustment for adherents included in the 2000 RCMS provincial data in their definition of religious adherence.

Results

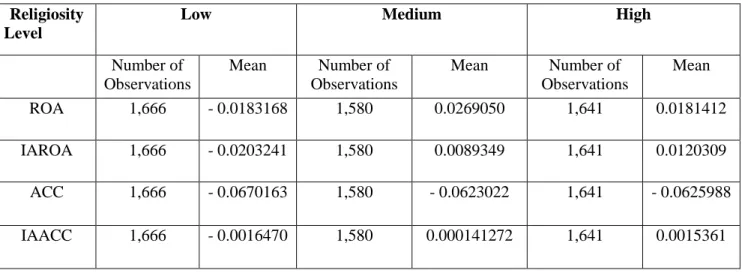

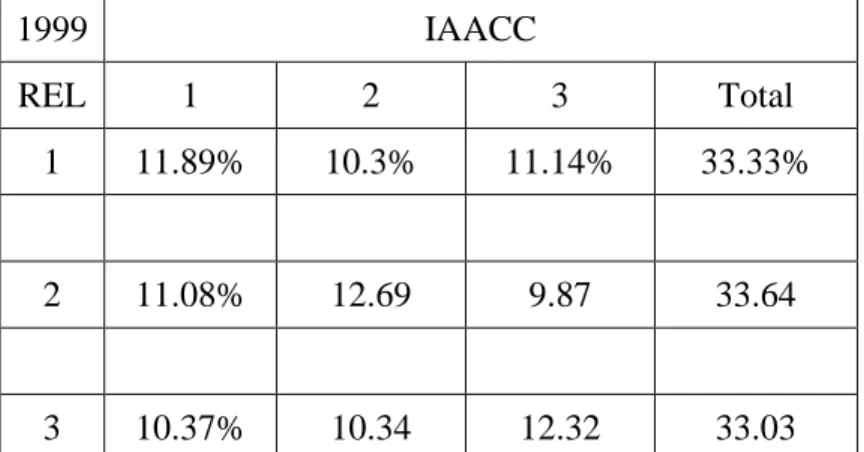

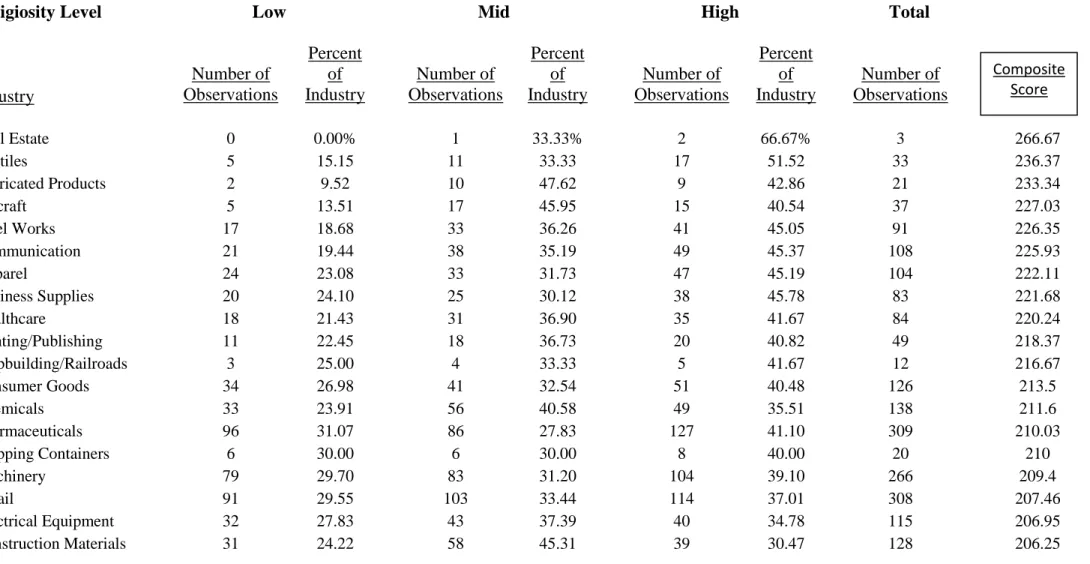

For each level of religiosity—low, medium, and high—the table shows the number of observations in each industry and the percentage of the industry that falls into each. The medium religious group lags behind the high religious category with 32.33 percent of represented industries. For example, it's no surprise that the precious metals industry is rated the least religiously because of all the news about corruption and manipulation in the industry.

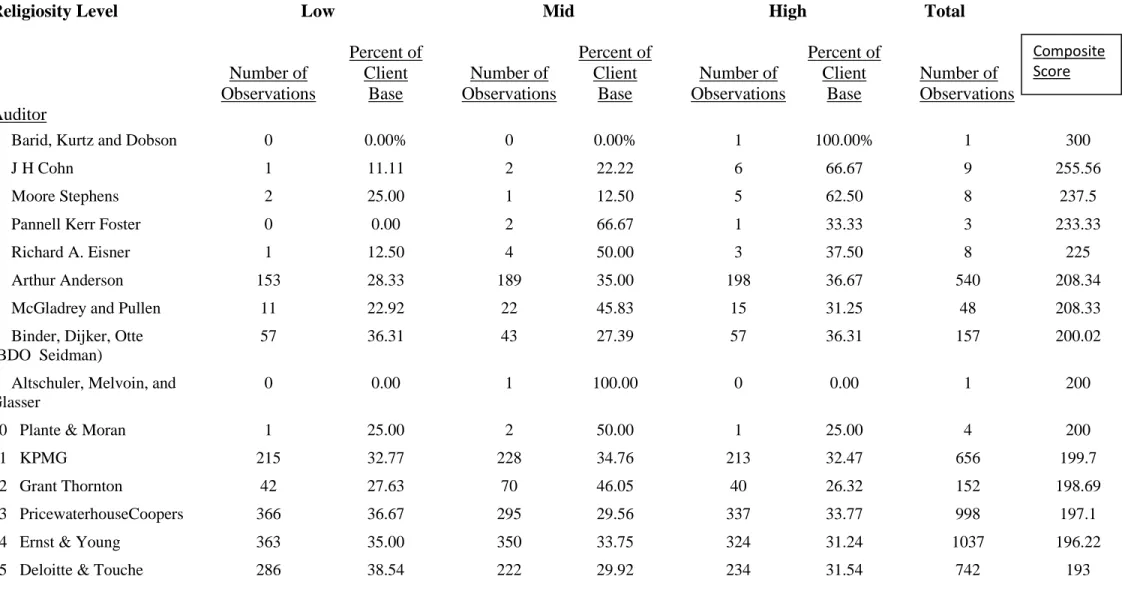

When making investment decisions, religious investors may shy away from less religious industries in favor of more religious ones. Similar to Table 2, at each religiosity level, the number of observations in each audit client portfolio and the percentage of client portfolios in each religiosity category are listed. Of the auditors with at least 100 client observations and ignoring others, Deloitte & Touche appears to be the least religious client auditor with a composite score of 193 in a range of 100-300.

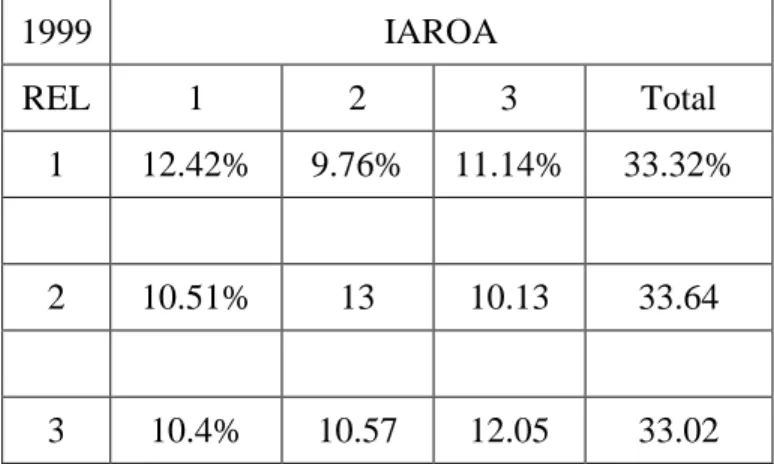

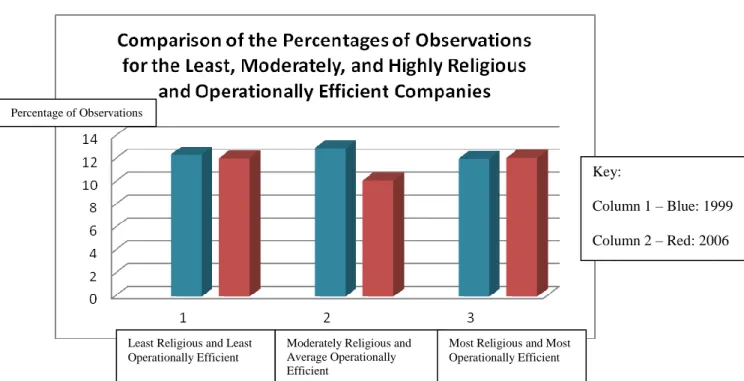

Interestingly, of the auditors with at least 100 client observations, Arthur Anderson appears to be the auditor of the most religious clients with a composite score of 208.34 in a range of 100-300. There is not a significant difference in the percentage of observations between the least religious and most religious corporations for 1999 or 2006 because the data were separated into thirds at the start of the test, but it allows one to see where more of the observations lie . In 1999, the most observations are in the category of the least religious and least operationally efficient companies, and the least number.

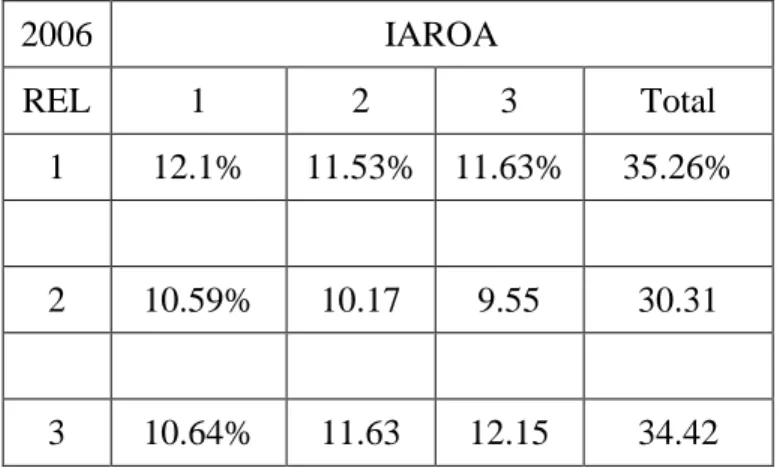

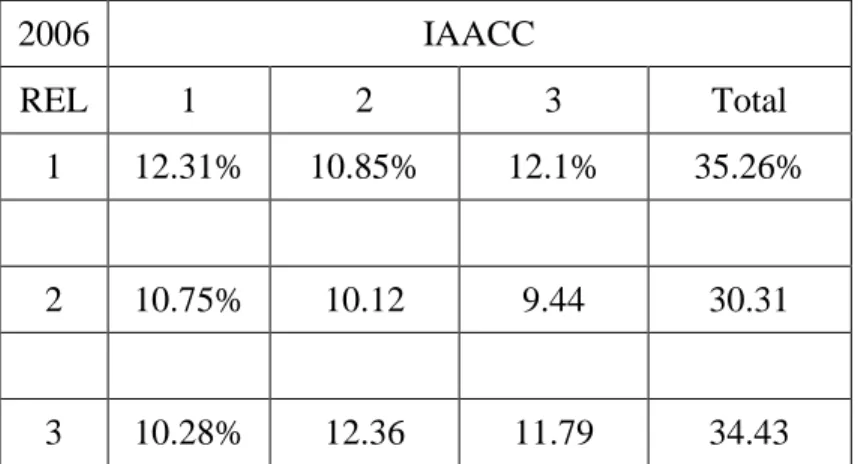

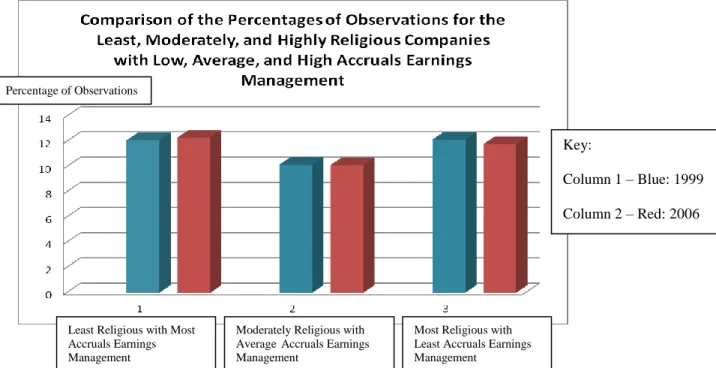

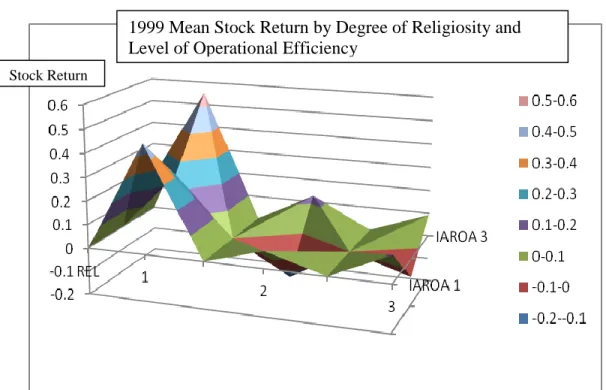

In 2006, the majority of observations are in the category of more religious and more operationally efficient companies, and the least number of observations are in the category of moderately religious and more operationally efficient companies. Figures 3 and 4 show stock return plots on surface charts for 1999 and 2006, respectively. As with Figures 3 and 4, Figures 5 and 6 show the stock return plots on surface diagrams for 1999 and 2006, respectively.

The purpose of the charts is to give users a visual representation of stock returns across increasing levels of religiosity and accrual earnings management.

Discussion

Thus, I hypothesized that shareholders reward strongly religious firms that have less accrual earnings with higher stock returns than non-religious firms with high levels of accrual earnings. Similarly, I observed how shareholders respond to the financial reporting quality of religious firms by examining the mean. In 1999, the least religious firms had the highest stock returns across all levels of operating efficiency, and the highest stock returns came from the least religious and most operationally efficient firms.

As noted in the Item Analysis, it appears that stock returns for the religious companies have not increased significantly, but stock returns for the least religious companies have decreased significantly. The reason why shareholders in 1999 preferred the least religious companies is not clear to me. However, I offer some possible explanations for the change from 1999 – from shareholders preferring the least religious companies – to 2006 – when shareholders preferred the least religious companies.

Based on previous research, it seems reasonable that shareholders will reward the most religious companies with the least amount of accrual earnings. But in 1999, the least religious companies with the highest amount of accrual earnings had the highest. In 2006, the highest average stock returns were still among the least religious companies with the highest amount of accrual earnings.

However, as noted in the Item Analysis for 2006, the most religious companies have average accruals. I can't draw a clear conclusion about my hypothesis that shareholders would favor the most religious companies with the lowest accrual profits. Although the most religious companies with average accrual earnings management have stock returns in 2006 that are almost as high as the least religious companies with the highest amount of accrual earnings management, the average stock returns are greater for the companies with the most accrual earnings management . than for the companies with the fewest accrued profits.

This increased focus on financial accuracy has the potential to lower average stock returns for the poor accrual earnings management of the least religious companies.