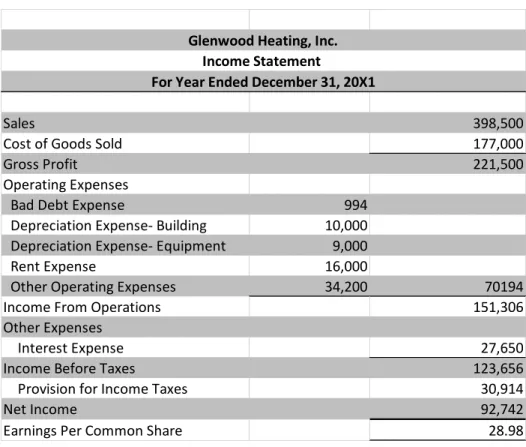

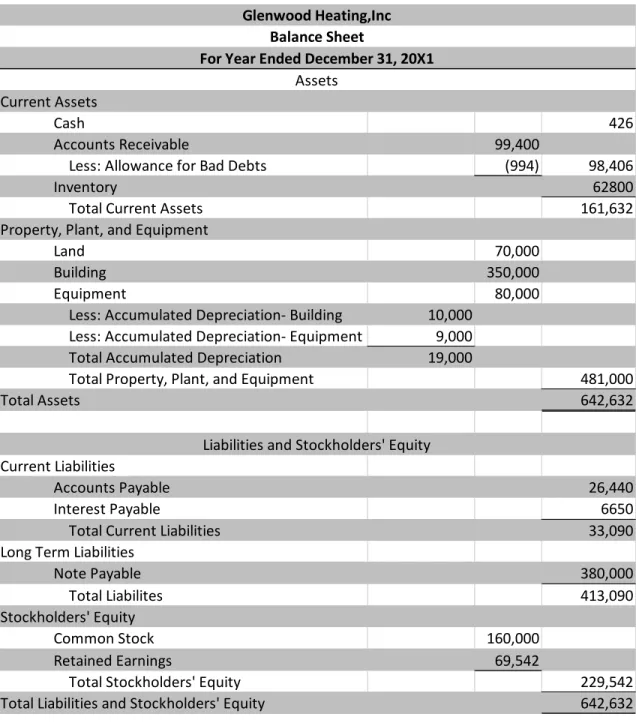

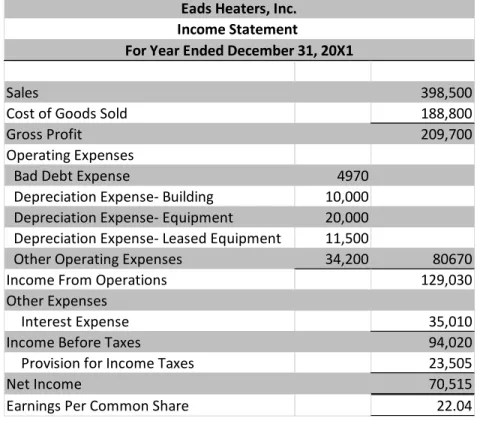

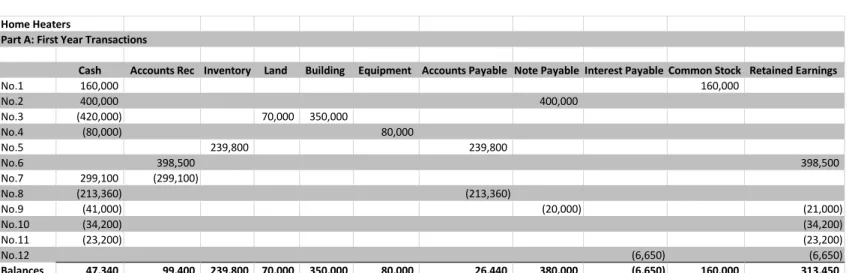

Cash Accounts Receivable Inventory Land Construction Equipment Accounts Payable Note Payable Interest Payable Common Stock Retained Earnings. Conclusion: Analysis of the financial statements and the resulting financial ratios confirms the idea that Glenwood would be the better investment of the two companies.

Appendix: Included in the appendix is the supporting information that led to the

A1: Glenwood Trial Balance

Debits Credits

Glenwood Heating, Inc

Adjusted Trial Balance- Part B

A2: Glenwood Transaction Summary

A3: Glenwood Adjusting Entries

A4: Eads Trial Balance

A5: Eads Transaction Summary

A6: Eads Adjusting Entries

Case Study Two

Molson Coors Brewing Company: Income Statement Analysis Nick Egorshin

Introduction: The following case study presents various financial statements of Molson Coors Brewing Company and supplemental information related to those statements

Classification of the income statement makes it easier to read and identify specific items that affect the financial position of the company. Conclusion: The case study above provides insight into the aspects of the income statement that affect the resulting net income.

Conclusion: The case study above provides insight into the aspects of the income statement that affect the resulting net income. One common theme realized

This is calculated by dividing the income tax expense by the income from continuing operations, before dividing the income tax expense by the income from continuing operations before income taxes.

Case Study Three

Pearson plc: Analysis of Accounts Receivable Nick Egorshin

Introduction: The following case focuses on the analysis of accounts receivable for Pearson plc. In order to benefit from such analysis and gain an understanding of

If the accounts aging method is used, managers need data on how long each delinquent account has been outstanding. The aging of account method is more accurate as it logically takes into account the amount of time an account has been outstanding. This income does not always come in the form of direct cash payments, as most customers often receive a good or service on credit.

It is risky to let customers pay on credit because they sometimes cannot pay off their debts. But it's a matter of convenience to let them do that. In addition, if the customer is another business, buying on credit gives him time to generate income himself and thus pay off the product he bought on credit. Accounts receivable expense is an income statement and allowance for doubtful accounts is a balance sheet account.

Provision for Sales Returns (£ Millions)

The provision for bad debts and doubtful debts is included in the operating expenses section of the profit and loss account. Sales returns and allowances are an offset to sales revenue and are therefore an income statement.

Conclusion: The Pearson plc case study focused primarily on accounts receivable. The case begins with important concepts and terminology necessary to truly grasp the way

Trade Receivables (£ Millions)

On my honor, I promise that I have not given, received or witnessed any unauthorized assistance regarding this case study signed Nick Egorshin.

Case Study Four

Pearson plc: Analysis of Cash Receipts and Disbursements Nick Egorshin

The January cash disbursements recorded in the December cash register liquidated liabilities of $22,450, which were subject to discounts of $250. The sales discount was subsequently calculated and is presented on your account, which can be seen in the credit column. Sales in the amount of 45,640 are also shown, which consists of the entire sale realized on the cash and receivables account, without sales discount.

The account payable is shown in the gross amount, as the purchase discounts are the own account. To what extent could Francis Equipment Co. show a more favorable balance sheet on December 31 by keeping its cash book open. working capital and current ratio). The decision to leave the cash book open for ten days actually turned out to be detrimental to the balance sheet.

Case Study Five

Palfinger AG: Analysis of Property, Plant and Equipment Nick Egorshin

Introduction: The following case consists of the financial statements of Palfinger AG, a manufacturer of heavy machinery and equipment for the. This is represented by the cost of the respective assets, minus the accumulated depreciation on them. These awards are either realized as deferred income or deducted from the carrying value of the respective assets.

The net book value of the disposal is calculated by deducting the depreciation of the disposal (€12,298) from the purchase value of the asset. The profit from the sale of equipment would be shown in the income statement in the chapter "other income or Conclusion: An analysis of the property, plant and equipment account of Palfinger AG reveals many aspects and consequences of the decisions made.

Conclusion: The analysis of Palfinger AG’s property, plant, and equipment account uncovers many of the aspects and implications of the decisions that

However, when the greater depreciation expense under this method is considered and compared to that of the straight-line method, the effect on net income is actually the same.

Case Study Six

Volvo: Analysis of Research and Development Costs Nick Egorshin

Introduction: The following case study consists of the analysis of Volvo group’s financial statements, specifically in regard to research and development costs and

The net amount of capitalized product and software development costs is 11,409 million SEK and is factored into the “intangible assets” line of the

- Product and software

- Total R&D expense on the income statement

Total R&D costs incurred during the year

Volvo capitalized 19.12 percent of total R&D costs in 2007, 15.77 percent in 2008 and 20.15 percent in 2009

This is probably due to IFRS standards being more suitable for R&D spending than GAAP. Conclusion: The analysis of Volvo's research and development costs revealed important aspects of R&D spending and its effects on the company's finances. The case specifically highlights the impact that the difference in IFRS standards and GAAP standards has on R&D spending.

As the example shows, this results in much higher R&D spending over time and allows companies to invest in R&D without directly impacting their bottom line. The example also highlights some of the factors that influence decision-making in relation to R&D expenditure. Overall, an analysis of Volvo Group's research and development costs provides insight into how these costs affect the company's finances and how managers should approach R&D decisions.

Case Study Seven

Volvo: Analysis of the effects of Blockchain Technology on the Accounting Industry

Nick Egorshin

The Blockchain Revolution

With the total market capitalization of cryptocurrencies surpassing the $175 billion mark, the accounting industry is certainly quickly adapting to the emergence of digital transactions conducted with these cryptocurrencies. VeraNet is an accounting and auditing platform designed to address cryptocurrency accountability challenges. VeraNet and similar platforms that will inevitably emerge in response to this crypto revolution will not only add a whole new element to the accounting industry, but are absolutely necessary for the industry if we as an economy intend to widely adopt the use of cryptocurrencies in everyday life.

This is further illustrated by the fact that the American Institute of CPAs and the Wall Street Blockchain Alliance are currently working together to establish the actual principles and policies that will be needed to fully integrate cryptocurrencies into our current accounting systems. The companies that issue and use cryptocurrencies need these policy changes as much as the industry needs them. Change in the industry is inevitable and is clearly already in the works as the widespread use of cryptocurrencies continues to grow.

Case Study Eight

Rite Aid Corporation: Analysis of Long Term Debt Nick Egorshin

Introduction: The following case study consists of an analysis of Rite Aid Corporation's long-term debt. Rite Aid has a variety of different notes with different interest rates, expiration dates, and other requirements set as terms of the notes. The case includes examples of the issuance of some Rite Aid notes, as well as the payment and accrual of interest.

This means that the payments made will be exactly the same over the life of the loan. Convertible debt is debt issued with the option to convert the outstanding debt equivalent into common stock as a means of payment. Annual interest expense is calculated by multiplying the principal with the card's coupon rate (7.5%).

Conclusion

Case Study Nine

Analysis of Stockholders Equity: Merck & Co

The dollar value of common stock reported on the balance sheet is calculated by multiplying the number of shares issued by the par value of the common stock ($0.01). In the Shareholders' Equity section of the balance sheet, treasury stock is recorded as "Less treasury stock, at cost". Merck's treasury stock certainly holds value, but unlike if the company were to invest in another company's stock, treasury stock does not generate any return.

The issuance of stock should be reported in the statement of stockholders' equity, but it should also be reflected in that section of the balance sheet. The repurchase of treasury stock reduces both assets and stockholders' equity, but it is also reported in the financing activities section of the statement of cash flows. Analysis of the dividends paid results in a drop in share price as well as a reduction in cash.

Case Study Ten

Analysis of Marketable Securities: State Street Corporation Nick Egorshin

The journal entry for an increase in market value is made through the fair value adjustment account. If there is an increase (gain), the fair value adjustment account is debited and the unrealized holding profit account is credited. As with trading securities, an increase in the fair value of an available-for-sale security is recorded through a fair value adjustment account.

Therefore, the company does not recognize changes in fair value, and there will be no posting. The difference in market value and amortized cost represents the amount of change in fair value over the year. The original price of the security is the amount reported as "Investment in AFS Security" in the previous entry.

Case Study Eleven

Analysis of Deferred Income Taxes: ZAGG Inc

Due to the separate recognition of the tax expenses that must be reported in a financial statement and the tax that must be paid according to the tax return. Permanent tax differences - A permanent tax difference is a difference between recognized tax expense and income taxes that are payable. A company must report deferred income taxes as part of total income tax expense in order to accurately recognize the tax liability to be reported for the period.

A deferred tax liability arises if there is a temporary difference caused by a discrepancy in the tax code and financial reporting conventions. ZAGG's effective tax rate is calculated by dividing the tax burden by the book income. The net deferred tax asset balance is the sum of the current deferred tax assets and the long-term deferred tax assets reported on the balance sheet.

Case Study Twelve

Analysis of Revenue Recognition Principles: Apple Inc

Prior to the recognition of the existence of a contract, the company recognizes any remuneration received from the customer as an obligation. This indicates the company's obligation to either transfer goods or services in the future or repay the consideration it has received. When determining the transaction price, the company must determine the amount of consideration that it expects to receive in exchange for the transfer of promised goods or services.

Once the expected amount is calculated, the company must allocate the transaction price to the contract. Apple's Annual Report also featured several instances in which the company takes deliberate steps related to revenue recognition. The purchase of gift cards is a more unique example of how the company should recognize revenue.