* Corresponding author: [email protected]

The Impact of Voluntary and Involuntary Intellectual Capital Disclosure on Firm Value

ANIN DYAH LUTHFIANI ANI WILUJENG SURYANI*

Universitas Negeri Malang, Indonesia

Abstract: The digital era has changed corporate asset structures and business models.

It requires companies to have more value-added resources to be more competitive, one of which is intellectual capital. Prior studies have analyzed the intellectual capital disclosure in annual reports. This approach, however, is unable to identify the depth of intellectual capital information. This study builds on previous studies using the involuntary disclosure concept to examine how information created by stakeholders and other parties outside of management may affect a company’s reputation. In addition to annual reports, this study also measures intellectual capital disclosure information using new data sources such as social media and online business media. This study examines the impact of voluntary and involuntary disclosure of intellectual capital on a firm's value. The sample of this study consisted of 32 banks listed on the Indonesia Stock Exchange in 2019. The study results indicate that intellectual capital disclosure affects the firm value. These findings provide a practical implication for managers to disclose intellectual capital relevant to the market's demands and focus on the quality of the information to increase firm value and sustain in a competitive environment.

Keywords: Firm value, Intellectual Capital, Involuntary Disclosure, Voluntary Disclosure

Abstrak: Era digital telah mengubah struktur aset perusahaan dan model bisnis. Hal ini menyebabkan perusahaan membutuhkan lebih banyak sumber daya yang dapat memberikan nilai tambah agar memiliki daya saing, salah satunya modal intelektual.

Penelitian terdahulu seringkali menggunakan laporan tahunan sebagai media pengungkapan modal intelektual. Namun, laporan tahunan memiliki keterbatasan karena belum mampu mengidentifikasi kedalaman informasi modal intelektual.

Penelitian ini memperbaiki penelitian sebelumnya dengan mengangkat konsep pengungkapan baru yaitu secara involuntary untuk melihat bagaimana reputasi perusahaan bisa dipengaruhi oleh informasi yang dihasilkan oleh stakeholders dan pihak lain di luar manajemen. Selain itu, penelitian ini juga menggunakan sumber data baru melalui media sosial dan media bisnis online untuk mengukur informasi pengungkapan modal intelektual selain di laporan tahunan. Penelitian ini bertujuan untuk melihat pengaruh pengungkapan modal intelektual secara voluntary dan involuntary pada nilai perusahaan. Sampel penelitian ini menggunakan perusahaan perbankan yang terdaftar BEI tahun 2019. Data modal intelektual diperoleh dari laporan tahunan dan sumber pengungkapan baru berbasis internet yaitu media sosial

50

dan media bisnis online. Hasil penelitian menunjukkan bahwa pengungkapan modal intelektual berpengaruh terhadap nilai perusahaan. Temuan penting ini memberikan implikasi praktis bagi manajer untuk mengungkapkan modal intelektual yang relevan dengan tuntutan pasar dan fokus pada kualitas informasi untuk meningkatkan nilai perusahaan dan mempertahankan lingkungan yang kompetitif.

Kata Kunci: Nilai Perusahaan, Modal Intelektual, Involuntary Disclosure, Voluntary Disclosure

1. Introduction

Investors' perceptions of the company determine the firm's value, which is frequently expressed through stock price in the market (Huynh et al., 2020).

PricewaterhouseCoopers (2017) reported that in 2009 and 2017, the capital market consistently placed a higher value on shareholder equity (market value) than the value that appears on the balance sheet. The difference between the company’s book value and the market value indicates a failure to disclose hidden values (Boekestein, 2009;

Soetanto & Liem, 2019; Whiting & Miller, 2008). This failure resulted in information asymmetry between the company and its external users (Gomes et al., 2019; Shahwan

& Fathalla, 2020). The term hidden value refers to a type of intellectual capital that is not disclosed in the annual report (Mondal & Ghosh, 2012). Agency theory implies that additional information must be voluntarily disclosed to reduce the information gap between managers and principals (Goebel, 2018). Intellectual capital, which contributes to firm value creation, is additional information that can be disclosed (Alrowwad et al., 2020; Molodchik et al., 2019).

Intellectual capital is a form of intangible assets created by developing and managing knowledge (Garanina & Dumay, 2017). Over the past four decades, the utilization of intangible assets has governed the ownership of tangible corporate assets (Lestari & Suryani, 2020). This indicates that the asset structure is continually changing.

These changes require companies to manage and disclose intangible assets such as intellectual capital to create competitive advantages and increase their value (Secundo et al., 2017). The more a company discloses intellectual capital, the higher the ability to create a positive image, ensuring its long-term sustainability (Festa et al., 2021).

51 Currently, most research on intellectual capital disclosure focuses on the voluntary disclosure from annual reports (Dumay & Cai, 2015; Dumay & Guthrie, 2017), whereby it is a choice for the company's management to provide for the users. Annual reports are one of the most commonly used data sources for intellectual capital disclosure because they allow for measuring trends and comparing companies, industries, and countries (Abeysekera, 2007). Several empirical studies investigated the relationship between intellectual capital and firm value from annual reports found a positive effect (Haris et al., 2019; Kadim et al., 2020; Ni et al., 2020) and negative effect (Britto et al., 2014;

Dženopoljac et al., 2016; Rahayu, 2019). This shows that the research on intellectual capital disclosure remains inconsistent (Giacosa et al., 2017; Massaro et al., 2017;

Nimtrakoon, 2015). One of the causes of this inconsistency is the limitation of the annual report, which rarely includes intellectual capital information (Cuozzo et al., 2017; Dumay & Cai, 2015). Intellectual capital disclosure in financial statements is limited to patents and goodwill, but other critical information has been omitted (Dumay

& Guthrie, 2019). The limitation on disclosure in the annual report may result in information asymmetry between external parties and internal parties (Salvi et al., 2020).

In addition, annual reports serve as promotional or advertorial media for businesses, and as such, additional media capable of disclosing a more complex intellectual capital are necessary (Dumay & Guthrie, 2017).

To address these problems, Dumay & Guthrie (2017) introduced a new method of measuring intellectual capital disclosure, namely involuntary disclosure, as what stakeholders and stakeseekers disclose about the company. They include the term stakeseekers because there are also groups that seek to uncover privately held information and put new issues on the corporate agenda, such as those with social, environmental, and governance concerns who are not investors or do not have a direct influence on a company (Holzer, 2008). Involuntary disclosure is not the same as mandatory disclosure. Involuntary disclosure was introduced by Dumay & Guthrie (2017), which refers to information linked to intellectual capital that stakeholders and external parties inadvertently expose. This unintentionally disclosed information frequently goes against the manager's interests (Parshakov & Shakina, 2020) because

52

the information disclosure is voluntary or not regulated/controlled. However, it is published by stakeholders and parties outside management's control to highlight some facts about the company’s condition that managers do not share (Dobija et al., 2020).

One example of involuntary disclosure is material published by mass media journalists about the firm, which might be positive or negative news. This disclosure can present both opportunities and risks to the company's reputation. Hence, involuntary disclosure of intellectual capital can be seen through media news regarding the company's condition, can affect public perception, and reduce information asymmetry (Dumay &

Guthrie, 2017).

The concept of involuntary disclosure opens new opportunities for research into the impact of information generated by stakeholders and other parties outside the management on the company’s reputation (Dumay & Guthrie, 2017). In addition to traditional media, involuntary disclosure can also be seen in social media. This is due to the limitations in financial statements that create a new source of information in disclosing intellectual capital through social media content. Social media content usually has a greater social influence than traditional media. Thus, stakeholders respond to firm information more quickly via social media (Pisano et al., 2017). A recent market report reveals that almost 80% of institutional investors use social media as part of their regular workflow. The majority of these investors agree that the information obtained through social media directly influences their investment recommendations or decisions (Reiter et al., 2017). Additionally, social media and other innovative technology platforms enable companies to create and develop interactive relationships with stakeholders through the information delivered and replied to immediately (Giacosa et al., 2017).

Prior studies have investigated involuntary intellectual capital disclosure. Lardo et al. (2017) empirically tested the impact of social media (Facebook, Twitter, and Google Plus) on the earnings of European football teams and players listed on the stock exchange. This study found that news coverage in the media affects the disclosure of intellectual capital involuntary from the aspects of human capital and relational capital, in addition to popularity on social media which is also positively correlated to market

53 capitalization and club player income (Lardo et al., 2017). Dumay dan Guthrie (2017) also found that involuntary disclosure impacted the company's reputation. This is observed in the case of Volkswagen, which in 2014 was reported to have supplied incorrect information about the disclosure of fuel used in its annual report, causing public skepticism and lowering the value of the company's shares.

In Indonesia, intellectual capital disclosure for each industry sector is relatively low, with an average of 50% of each component (Mukhibad & Setyawati, 2019;

Purnomosidhi, 2006). In more detail, financial companies disclosed only 6.27% (M. W.

Ningsih & Laksito, 2014), 22.29% for non-financial companies (Leonard & Trisnawati, 2015), 36.38% for the banking sector (Utama & Khafid, 2015), and 39.9% in newly listed companies (Widarjo et al., 2019). This low level of disclosure is due to the lack of awareness of the importance of intellectual capital disclosure in developing competitive advantage and improving company value (Suhardjanto & Wardhani, 2010).

Moreover, the use of tangible assets is no longer capable of supporting Indonesia compete at the ASEAN level because of its characteristics that are easy to imitate and less innovative (Soetanto & Liem, 2019). In this case, intellectual capital is one of the intangible assets that Indonesia urgently needs to gain a competitive advantage, especially during the ASEAN Economic Community's era (Suryani & Nadhiroh, 2020).

Therefore, further research is needed regarding intellectual capital disclosure and its impact on firm value.

Despite its significance, the concept of involuntary disclosure of intellectual capital has received little attention, particularly in Indonesia. Additionally, no prior research has investigated the usage of social media and online business media as a platform for disclosing intellectual capital. This study examines the impact of voluntary and involuntary intellectual capital disclosure on firm value. This study adds to the body of knowledge about intellectual capital disclosure by examining a new type: involuntary disclosure. For this reason, this study incorporates new data sources, such as social media and online business media, and the conventional source of intellectual capital found in annual reports. This research also provides insight for investors when making

54

investment decisions and considerations for management in understanding the characteristics of intellectual capital disclosure that lead to business value creation.

The remainder of the paper is structured as follows. Section 2 discusses the literature and hypotheses. Then, section 3 describes the data and methodology, while section 4 presents the empirical findings. Finally, section 5 concludes the study.

2. Theoretical Framework dan Hypothesis Development

This study examines the impact of voluntary and involuntary intellectual capital disclosure on firm value using the agency theory framework. The central concept of the agency theory is a separation between management and principal (Jensen & Meckling, 1976), which results in information asymmetry since the manager, acting as an agent, obtains more information about the company’s prospects and internal conditions than the owner (Huynh et al., 2020). On the other hand, the principal may assume that managers behave in their self-interest rather than the company's best interest (Deegan, 2014). As a result, the owner limits managerial incentives and establishes monitoring systems to ensure that corporate resources are used efficiently (Goebel, 2018). To prevent a reduction in incentive payments, managers are motivated to demonstrate that their activities are aligned with the corporate goals (Watts & Zimmerman, 1990).

Within the agency theory framework, intellectual capital may be linked as additional information that is released freely by management to minimize the level of information asymmetry and convince owners about the management of intellectual capital resources (Goebel, 2018). The existence of information asymmetry that arises between managers and owners generates agency costs consisting of monitoring management activities, guaranteeing costs for management actions, and limiting incentives to management (Blanco-Alcántara et al., 2019; Naimah & Mukti, 2019). To prevent this incentive loss, management is driven to provide more information in the annual report to stakeholders, one of which is intellectual capital. Disclosure of intellectual capital is important for stakeholders because it can explain various kinds of activities carried out by the company both in terms of human resources (human capital), company relations with external parties (relational capital), and the company's ability to

55 carry out routines and structures (structural capital), thus, providing a view of how companies improve their competitiveness and create corporate value (Goebel, 2018).

This study is in line with the principles of agency theory which argues that managers are encouraged to disclose additional information such as intellectual capital to reduce information gaps by outlining how intellectual capital adds value to the company.

One strategy to address information asymmetry is disclosing additional information in the annual report. Intellectual capital is one information that management frequently discloses voluntarily to reduce information asymmetry (Goebel, 2018).

Managers are compensated for providing more information to demonstrate to the owners that intellectual capital is being created and utilized (Blanco-Alcántara et al., 2019; Mouritsen et al., 2005; Naimah & Mukti, 2019). Intellectual capital consists of resources, skills, expertise, and competencies used to boost shareholder value (Abdolmohammadi, 2005; Martín-de Castro et al., 2019). Intellectual capital comprises relational, structural, and human capital that can add value to a company’s competitive advantage (Bozzolan et al., 2006; Cuozzo et al., 2017; Sánchez Medina et al., 2007).

Prior studies have empirically analyzed the relationship between intellectual capital and firm value. The positive relationship between intellectual capital and the value of technology sector firms has been investigated using the Pulic model (Nimtrakoon, 2015). Amir and Lev (1996) found that financial and non-financial information such as intellectual capital combined can better explain the market value. Since then, many studies have documented the importance of information on intellectual capital for the efficiency of the capital market (Holland, 2003; Lee & Guthrie, 2010; Maditinos et al., 2011). While some of these studies have resorted to the examination of value relevance and predictive ability of types of information, others have investigated the perceived usefulness of types of information to capital market actors or examined the information they have used (Lee & Guthrie, 2010; Salvi et al., 2020; Tran & Vo, 2018). Other studies also found a positive influence of intellectual capital on firm value (Kadim et al., 2020;

Ni et al., 2020; Suryani & Nadhiroh, 2020). However, others have found that intellectual capital has a negative impact on firm value (Britto et al., 2014; Dženopoljac et al., 2016).

The inconsistency of prior research findings shows that while the concept of intellectual

56

capital was predicted to increase firm value, its disclosure in traditional financial reports was insufficient to capture the entirety of the company’s knowledge assets (Amyulianthy & Murni, 2015; Cuozzo et al., 2017; Dumay & Cai, 2015).

Intellectual capital research has focused on voluntary disclosure (Abdolmohammadi, 2005; Oliveira et al., 2006). This is consistent with the agency theory that disclosing additional information to principals can be accomplished by providing intellectual capital information in the annual report (Bozzolan et al., 2003;

Guthrie & Petty, 2000). According to the agency theory, intellectual capital information can reduce information asymmetry and improve company performance (Garanina &

Dumay, 2017). Voluntary disclosure of intellectual capital may positively affect the company's value, investors, and stakeholders (Castilla-Polo & Ruiz-Rodríguez, 2017;

Maaloul & Zéghal, 2015; Whiting & Miller, 2008). Furthermore, an efficient market will be reflected in the rapid investors' reaction to the entry of new information, such as intellectual capital; if investors consider such good news, then there will be a reaction of investors is reflected by an increase in stock price and trading volume (Massaro et al., 2017). However, the annual report has limitations because it does not disclose much about intangible assets, especially intellectual capital.

Moreover, the annual report is constructed only from the company's perspective.

As a result, additional media are required to understand better information on intellectual capital disclosure (Cuozzo et al., 2017; Dumay & Cai, 2015). With the advancements in technology and information, investors are evaluating companies through the annual report and the social media managed by the company. Social media disclosures enable a company to immediately acquire stakeholders' perceptions of the company (Dumay & Guthrie, 2017). However, no research in Indonesia examines voluntary intellectual capital disclosure in both the annual report and responses to corporate social media. As a result, the following hypotheses are proposed:

H1a: Voluntary intellectual capital disclosure on social media positively affects firm value.

H1b: Voluntary intellectual capital disclosure in the annual report positively affects firm value.

57 According to the agency theory (Jensen & Meckling, 1976), management should provide a voluntary disclosure of additional information to the principal. Intellectual capital is an intangible asset (resources, talents, and competencies) that is voluntarily disclosed by managers in the interest of a firm’s value creation (Abdolmohammadi, 2005; Chen et al., 2005; Firer & Williams, 2003; Martín-de Castro et al., 2019).

However, management's voluntary disclosures in conventional reports have limitations.

These limitations exist because the annual report is primarily used for promotional purposes. Its reporting is limited to the company's perspective, making it an ineffective medium for identifying intellectual capital disclosure (Dumay & Guthrie, 2017).

Involuntary disclosure is one approach to overcoming these limitations (Dumay &

Guthrie, 2017; Lardo et al., 2017).

Involuntary intellectual capital disclosure is different from voluntary disclosure because stakeholders carry it out to expose the company’s condition. Involuntary disclosure presents new ideas about how information created by parties other than its management can affect a company's reputation or value (Dumay & Guthrie, 2017).

Lardo et al. (2017) employed digital media (Facebook, Twitter, and Google Plus) to analyze involuntary intellectual capital disclosure and found that those media influence human and relational capital and that digital media popularity is positively correlated to market capitalization. Thus, intellectual capital information disclosed through mass media that is public and easily accessible is quite likely to reduce information asymmetry because it can provide signals about the company's value useful for trading decisions (Cuozzo et al., 2017). However, research on the relevance of involuntary intellectual capital disclosure to firm value has not been widely carried out. Hence, the following hypothesis is proposed:

H2: Involuntary intellectual capital disclosure has a positive effect on firm value.

3. Research methodology

This study was conducted in banks listed on the Indonesia Stock Exchange in 2019 (n=45), chosen based on companies with official social media accounts, either Facebook or LinkedIn or both (n=32). Banks were chosen because they are highly regulated and

58

tend to disclose more information to the public (Ulum, 2015). Additionally, the banking sector is a fiduciary industry. It offers knowledge-based products and services by integrating professional competencies and market demands to obtain a positive image and customer loyalty (Gokmenoglu & Amir, 2020; Kaura & Sharma, 2015; Gandhan et al., 2020). Banking is also an industry that uses innovation and technology to deliver value to clients (Al-Dmour et al., 2020). Therefore, if a bank can manage and appropriately disclose its intellectual capital, which consists of knowledge, skills, competence, innovation, and experience, it will benefit the bank, increasing the firm value (Kryscynski et al., 2020; Vaid & Honig, 2020).

This study was conducted from January to December 2019 because, in that year, McKinsey Global Institute (2021) reported that the rising investment in intangibles (innovation capital, human and relational capital, brand capital) had been linked with increasing total factor productivity of entire economies. Furthermore, at the beginning of 2019, President Jokowi launched the Making Indonesia 4.0 Roadmap to encourage companies to adopt technology more rapidly as a strategy to face the industrial revolution (Yuniartha, 2019). The use of technology cannot be separated from the challenges of managing intellectual capital with specific skills (Duho & Onumah, 2019).

The government also stated that, with the beginning of the 4.0 industrial revolution in 2019, the corporate valuation would be focused on intangible investments and innovations (Kemenperin, 2018).

The independent variables in this study are voluntary intellectual capital disclosure (X1) and involuntary intellectual capital disclosure (X2). This study uses quantitative content analysis to classify the voluntary and involuntary intellectual capital disclosure before determining their impacts on the firm’s values. This method involves categorizing information according to predefined criteria and analyzing the relationship between these categories using statistical methods (Riffe et al., 2019).

The measurement of intellectual capital disclosure is conducted by assigning a code to each relevant data source (annual reports, comments on social media, and online business media) following the intellectual capital framework. Each code obtained is

59 then summed up to obtain the overall score for each data source from the banking company.

The voluntary intellectual capital disclosure (X1) was obtained from sentences from the annual report and comments on Facebook and LinkedIn posts. The annual report was chosen as the data source because managers usually communicate by signaling essential issues through the reporting mechanism (Guthrie & Petty, 2000). As mentioned earlier, involuntary disclosure can be found in several sources such as social media and mass media (Lardo et al., 2017). Social media was chosen because the usage of social networking sites for corporate disclosure has increased over the last decade (Pisano et al., 2017). More importantly, social media are emerging as a critical source of information for investors when they make investment decisions (Chung et al., 2020).

Particularly, a firm's Facebook business page reflects intellectual capital disclosure because it can handle customer messages to capture feedback, enhance market research, and display a firm's interaction with other stakeholders. In addition, LinkedIn is also a social media that is generally considered one of the most popular and widely used social network sites for recruiting (Pisano et al., 2017). Some studies consider LinkedIn as a medium for connecting professionals, sharing knowledge and experiences, and gathering information about potential employees (Caers & Castelyns, 2011; Fisher et al., 2014; Zide et al., 2014). This shows that information about intellectual capital, especially human capital, can be known through LinkedIn.

Each sentence in the annual report that contains information about intellectual capital disclosure is coded as 1. However, social media posts are coded differently.

Researchers checked for official account data for each sample company's social media.

The official account search was done by searching through the Google search engine by entering the company name keyword, then opening the company's official website and looking for the company's social media contact information which is usually listed at the bottom of the website page or in the company's contact information menu. If the company website did not provide information about the firm's social media, another option was to use the search feature directly on each social media. The search was carried out in the same way as previously, by inputting keywords in the form of the

60

company's name. An account is considered an official company account if it has one or more of the following criteria: (a) is marked with a blue tick which means it has been verified; (b) it is written in the bio that the account is an official account of the company;

(c) attach a link to the official website of the company concerned.

Furthermore, posts were traced on each of the company's social media (Facebook and LinkedIn), which were continually carried out from January to December 2019.

Company posts are documented if they transmit content relating to intellectual capital disclosure following the intellectual capital disclosure framework from Bozzolan et al.

(2003) & Guthrie et al. (2003). If a post receives negative comments, a score of -1 is applied. If a positive comment is received, indicating support for the company, code 1 is assigned. However, if there is no public response or if the response is irrelevant spam comments, 0 is assigned.

Involuntary intellectual capital disclosure can be sourced from social media and business media. According to Brown and Deegan (1998), the mass media can change public perceptions on a particular topic. Prior studies have shown that the mass media can influence investors' stock trading decisions and predict business failure (Sheng &

Lan, 2018; Yang et al., 2017). As a result, the more news provided to the company, the stronger the public's projection of current conditions and the company's future viability.

Therefore, online business media was chosen as a source of data to analyze how the media covers a company's intellectual capital disclosure, which later impacted the resources invested and increased the firm's value. This study employs more than one source of online business media to collect data on involuntary intellectual capital disclosure from lowering subjectivism, as many online business media support the government, entrepreneurs, or particular interest (Ardy, 2011).

Different from X1, involuntary intellectual capital disclosure (X2) is obtained through online business media: Kontan and SWA business magazines. These two sources are the pioneers in delivering news about Indonesia's economy, business, and investment. Their readers are segmented as public decision-makers, entrepreneurs, politicians, investors, and stock players (Ludiyanto, 2020; Martinus, 2019; Yunus, 2014). The data for the X2 is collected by coding the contents of published news articles.

61 Each news item is coded differently according to the type of information contained, whether positive or negative. For example, the negative news is coded as -1, while positive news is coded as 1.

To identify and classify intellectual capital disclosures, the researcher developed a framework based on Bozzolan et al. (2003) and Guthrie et al. (2003) (see Table 1).

Intellectual capital disclosure in this study is classified into three: human capital, structural capital, and relational capital (Bozzolan et al., 2006; Cañibano et al., 2002;

Sánchez Medina et al., 2007). Human capital is a crucial element of intellectual capital because it contains employee competencies, such as education, knowledge, skills, talents, and experiences, enabling the company to achieve its purposes (Bayraktaroglu et al., 2019; Ting et al., 2020). Structural capital refers to intellectual property, including organizational culture, technology use, trademarks, and the company’s ability to innovate (Beltramino et al., 2020). Relational capital is a company's relationships with external parties, such as its reputation and relationships with stakeholders (Paoloni et al., 2020).

Table 1

Intellectual Capital Disclosure Framework

Human Capital Structural Capital Relational Capital Employee Commitment Corporate Culture Business Collaborations Employee Development Information Technology (IT) Community

Entrepreneurial Spirit Innovation Company Names

Recruitment Financial Relations Customer Base

Staff Profile Organizational Flexibility Environmental Activities

Equality Intellectual Property Market Share

Social Matters

Stakeholders Information Source: Bozzolan et al. (2003) & Guthrie et al. (2003)

We downloaded the annual report from the bank’s websites, documented posts and comments from official social media accounts, and documented company news on online business media websites. In total, we collected 6178 text data. These data are classified according to the three types of intellectual capital disclosure. In content analysis studies, it is essential to assess the reliability of the classification procedure (Dumay & Cai., 2015). For this reason, the researchers first created a codebook by

62

developing a coding instrument with well-specified categories and decision rules. This codebook is fundamental for ensuring a reliable coding process and minimizing errors or biases associated with text data classification (Krippendorff, 2013). Second, reliability is also ensured by independent coders. One of the researchers and the coder independently coded about 10% of the data using the made codebook. After comparing the coding results, the intercoder reliability measured by the Cohen’s Kappa was 0.85, showing a good agreement and considered acceptable (Stevens et al., 2014). After this process, the research stage continued by coding the remaining text data for the researchers. After all the text data has been classified, the researchers collect financial data through the OSIRIS database and analyze quantified text data with financial data using statistical tests to examine the effect of intellectual capital disclosure on firm value.

The dependent variable in this study is the firm value measured by the price to book value ratio (PBV). The PBV ratio is used because it enables investors to interpret the financial market's assessment of a company's financial condition (Nimtrakoon, 2015).

Additionally, this ratio has several advantages compared to other company value measurements. First, book value is a relatively stable measurement compared to market prices. This allows investors who are less confident in making investment decisions to use the book value ratio. Second, PBV allows comparison among companies in the same industry to indicate overvalued or undervalued assessments. Third, PBV allows assessing companies with negative profits (Brigham & Daves, 2006; Chasanah & Adhi, 2017). PBV can be formulated as follows (Moyer et al., 2014):

𝑃𝐵𝑉 = 𝑆𝑡𝑜𝑐𝑘 𝑚𝑎𝑟𝑘𝑒𝑡 𝑝𝑟𝑖𝑐𝑒

−𝑏𝑜𝑜𝑘 𝑣𝑎𝑙𝑢𝑒 𝑝𝑒𝑟 𝑠ℎ𝑎𝑟𝑒

There are three control variables used in this study: ROA, firm size, and firm age (Meles et al., 2016; Maji & Goswami, 2016; Nimtrakoon, 2015; Rahayu, 2019;

Dzenopoljac et al., 2017). ROA is calculated using the ratio of net income to total assets recorded for one year (Meles et al., 2016). Firm size is measured using the natural logarithm of the firm's asset value (Maji & Goswami, 2016; Nimtrakoon, 2015). The company's age is calculated from the time the company is listed on the Indonesia Stock

63 Exchange until the year of observation. The listing’s age can provide perspective into the company’s ability to survive and operate (Dzenopoljac et al., 2017). Additionally, companies that have been listed for an extended period are typically involved in more public relations to attract investors (Mahendri & Irwandi, 2017).

This study employed multiple linear regression analysis to examine the impact of voluntary and involuntary intellectual capital disclosure on firm value. The classical assumption test tested normality, heteroscedasticity, and multicollinearity (Hair et al., 2019). We initially found that ICDms, ICDlt, ICDbo, PBV, ROA, and Listing Age variables were not normally distributed. A logarithmic transformation was carried out to overcome this problem because the data showed a positive skewness (Tabachnick &

Fidell, 2014). Following transformation, data became normal and aligned to the normality requirements. Other classical assumption tests, such as heteroscedasticity and multicollinearity, were also conducted and found acceptable for regression analysis. The regression equations used in this study are as follows:

𝑌 = 𝑎 + 𝛽1𝐼𝐶𝐷𝑉𝑂𝐿(𝑀𝑠)𝑖+ 𝛽2𝐼𝐶𝐷𝑉𝑂𝐿(𝐿𝑡)𝑖+ 𝛽3𝐼𝐶𝐷𝐼𝑁𝑉𝑂𝐿(𝐵𝑜)𝑖+ 𝜀𝑖 (1) 𝑌 = 𝑎 + 𝛽1𝐼𝐶𝐷𝑉𝑂𝐿(𝑀𝑠)𝑖+ 𝛽2𝐼𝐶𝐷𝑉𝑂𝐿(𝐿𝑡)𝑖+ 𝛽3𝐼𝐶𝐷𝐼𝑁𝑉𝑂𝐿(𝐵𝑜)𝑖+ 𝛽4𝐶𝑅𝑂𝐴+ 𝛽5𝐶𝑆𝐼𝑍𝐸+ 𝛽6𝐶𝐴𝐺𝐸+ 𝜀𝑖 (2) in which:

Y = PBV

ICDVOL(Ms)i = Number of voluntary intellectual capital disclosures from company social media i ICDVOL(Lt)i = Number of voluntary intellectual capital disclosure from company’s annual report i ICDINVOL(Bo)i = Number of voluntary intellectual capital disclosure from company’s online business news i

CROA = ROA

CSIZE = SIZE

CAGE = LISTING AGE

α = Constant

𝛽1− 𝛽9 = Regression Coefficients ε = Error

4. Results and discussion

Table 2 shows the content analysis results from the three data sources, social media, annual reports, and online business news. The disclosure of intellectual capital information is not uniform, with structural capital and relational capital being more disclosed than human capital. These findings are confirmed with the t-tests analysis.

The disclosure of structural capital (Mean=48.59, SE=4.338) was significantly higher

64

than human capital (Mean=33.13, SE=3.572), t(62)=2.753, p<0.01, r=0.04. However, there is no significant difference between structural and relational capital or relational and human capital disclosure.

Table 2

Content Analysis Results

Intellectual Capital Social media Annual report Online business

media %

Structural Capital 493 1036 1268 44.4%

Relational Capital 665 1131 640 38.7%

Human Capital 214 691 155 16.9%

Amount of Disclosure 1372 2858 2063 100%

Based on the total disclosures in each media, voluntary disclosures in social media and annual reports provide more information about relational capital. In contrast, involuntary disclosures in online business media provide more information about structural capital (see Table 2). These findings show that structural and relational capital are considered essential components for banks to disclose. The disclosure of structural capital is essential because it shows management's or stakeholder's awareness of the importance of information in managing a company’s knowledge assets through innovation and management strategies (Bayraktaroglu et al., 2019; Beltramino et al., 2020; Ordoñez de Pablos, 2005). Similarly, disclosure of relational capital is deemed critical because it provides context for the company’s interactions with stakeholders and the environment (Corvino et al., 2019; Khalique & Shaari, 2011). The difference in disclosure levels could explain that banks typically prioritize customer loyalty and focus on technology investment in establishing long-term competitive advantages (Adesina, 2019).

Table 3 shows that banks have high growth prospects because the mean of PBV is above one (Soewarno & Tjahjadi, 2020) indicating a much higher market value than the book value (Heryana et al., 2020). Bank Central Asia (BCA) achieved the highest PBV ratio due to the continued strength of BCA’s shares with low volatility (Melani, 2019;

L. Ningsih, 2019). On the other hand, Bank Artha Graha International had the lowest

65 PBV value. This might be a consequence of the company’s poor financial condition in 2019 due to a decrease in credit quality (Richard, 2019).

Table 3

Descriptive Statistics

Variable Minimum Maximum Mean SD

Y PBV 0.13 5.73 1.57 1.35

X1.1 ICDms 16.00 96.00 42.88 24.05

X1.2 ICDlt 41.00 212.00 89.31 34.02

X2 ICDbo 1.00 414.00 64.47 94.49

Z ROA -0.30 13.60 1.68 2.49

Z Size 12.75 18.44 15.29 1.68

Z Listing Age 1.00 30.00 15.09 9.16

Confirming Table 2, banks are more likely to disclose information about intellectual capital in their annual report than in social media and online business news.

This finding shows that the annual report remains the primary medium for management to disclose intellectual capital information to the readers (Sirojudin & Nazaruddin, 2014). Table 3 also shows that banks have managed their assets efficiently in obtaining profits, as seen from the average ROA value of 1.68 (Singh et al., 2016). Meanwhile the average firm size of 15.29 indicates that banks are in medium industry (Irawati, 2012) and are relatively young according to the average age of the company (18.44) (Harahap et al., 2017).

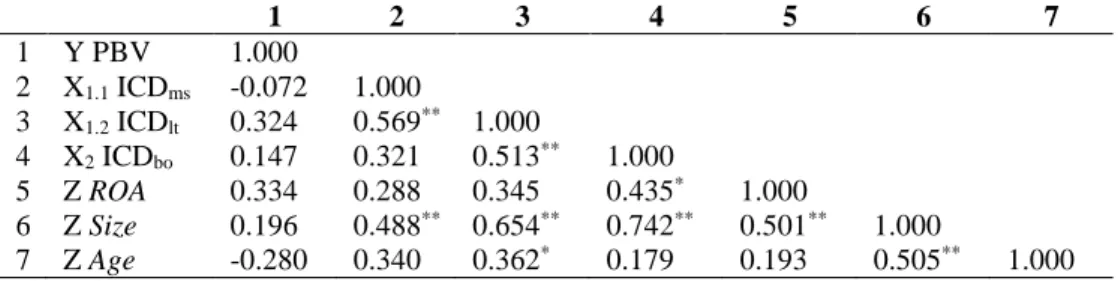

Table 4 shows a positive correlation between intellectual capital disclosure variables. This indicates that disclosures created in one media enable companies to make additional disclosures in other media, including social media, annual reports, and online business news. As a result, the market has higher expectations for young companies.

Table 4

Pearson correlation

1 2 3 4 5 6 7

1 Y PBV 1.000

2 X1.1 ICDms -0.072 1.000

3 X1.2 ICDlt 0.324 0.569** 1.000

4 X2 ICDbo 0.147 0.321 0.513** 1.000

5 Z ROA 0.334 0.288 0.345 0.435* 1.000

6 Z Size 0.196 0.488** 0.654** 0.742** 0.501** 1.000

7 Z Age -0.280 0.340 0.362* 0.179 0.193 0.505** 1.000 Note: **Significant correlation at 0.01, *Significant correlation at 0.05

66

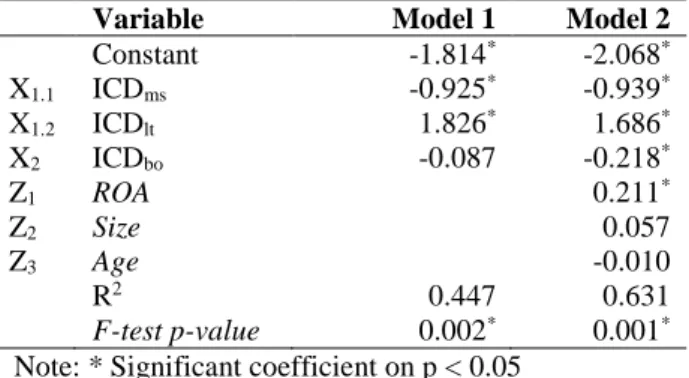

Table 5 shows the analysis of the regression results whereby the disclosure of intellectual capital from social media (ICDms), annual reports (ICDlt), and online business news (ICDbo), as well as control variables, simultaneously affect firm value.

The coefficient of determination in model 2 shows that voluntary and involuntary disclosure of intellectual capital can explain 63.1% of the variation in firm value.

Further, the intellectual capital disclosure from the annual report positively affects firm value. However, the intellectual capital disclosure from social media and online business news affects a firm’s value in the opposite direction from the hypotheses.

Table 5

Regression Test

Variable Model 1 Model 2

Constant -1.814* -2.068*

X1.1 ICDms -0.925* -0.939*

X1.2 ICDlt 1.826* 1.686*

X2 ICDbo -0.087 -0.218*

Z1 ROA 0.211*

Z2 Size 0.057

Z3 Age -0.010

R2 0.447 0.631

F-test p-value 0.002* 0.001* Note: * Significant coefficient on p < 0.05

Table 5 shows the effect of voluntary intellectual capital disclosure via social media and annual reports on firm value. Intellectual capital disclosure on social media negatively affects firm value, which means that the higher the level of intellectual capital disclosure on social media, the lower the firm value. This result contradicts the research by Lardo et al. (2017) and Massaro et al. (2017), which states that social media affects value creation and contributes to the development of intellectual capital. This difference is due to the assessment of intellectual capital disclosure on social media based on public sentiment. As expressed through social media comments, public sentiment can change investor perceptions (Dissanayake et al., 2019; Yang & Liu, 2017).

Banks' social media posts aimed at disclosing information on intellectual capital elicited negative responses from netizens. At least 16 banks had experienced these negative comments, and four of them were state-owned banks which are the most influential banking group in Indonesia (Sumantri & Susanti, 2016). This is supported

67 by the results of the t-test analysis, which revealed that state-owned banks (Mean=60.75, SE=30.955) received more negative comments than private banks (Mean=3.32, SE=1.160), t(30)=5.260, p<0.01. In this case, Mandiri Bank, one of the state-owned banks, has faced a lot of criticism and negative comments from netizens in 2019. This was caused to a significant error in user accounts that lasted several days, preventing customers from using Mandiri's ATM services (Tri, 2019). The netizen’s response on social media can affect stock prices in various industries (Cabral, 2016).

This opinion is supported by the survey results conducted by Microsoft (2021) through the Digital Civility Index (DCI), which shows that Indonesian netizens have the lowest politeness on digital platforms in Southeast Asia. This predicate has resulted in many negative comments on company social media posts related to intellectual capital that can affect the public’s perspective and investment decisions of investors.

However, voluntary disclosure via annual reports positively affects firm value. The findings show that more intellectual capital is disclosed in an annual report. The results of this study indicate that the annual report plays a role in increasing the company’s competitive advantage and value creation (Gołacka et al., 2020; Jordão & Novas, 2017;

Kadim et al., 2020). This occurs because the company's management prepares the annual report and frequently attempts to beautify the annual report to create a positive impression on stakeholders (Abeysekera, 2007; Schaper et al., 2017). Additionally, the annual report is still the primary source for external users to obtain important company information. The amount of disclosures in the annual report is positively correlated with the company's number of reports compared to other media (Haris et al., 2019; Parshakov

& Shakina, 2020; Ting et al., 2020; Vanini & Rieg, 2019). This result implied that banking companies had disclosed information in their annual reports, with state-owned banks disclosing the most information. According to the t-test results, it was found that state-owned banks (Mean=121.5, SE=19.294) have a higher disclosure in their annual reports than private banks (Mean=84.71, SE=5.940), t(30)=2.136, p<0.05. State-owned banks are government-owned and act as public representatives; hence disclosure is maximized to show excellent management performance (Islamadinna et al., 2021).

68

As aforementioned, a new type of disclosure is needed to overcome the limitation of voluntary intellectual capital disclosure by management (Dumay & Guthrie, 2017).

This study indicates that involuntary disclosure of intellectual capital through online business news (Kontan and SWA) has a negative effect on firm value. The finding of this study shows that Kontan is an online business media that covers more intellectual capital than SWA. Intellectual capital disclosure in the news media discusses more financial relations (29 companies), IT (20 companies), innovation (19 companies), customer base (18 companies), and company names (13 companies). The findings of this study contradict the research of Dumay and Guthrie (2017) and Dumay and Tull (2007), which state that involuntary disclosure of intellectual capital in the news positively affects stock prices and firm value.

The differences in this study can be explained through several reasons. First, even if a piece of positive news brings advantages to some stakeholders, it can negatively impact others (Agnihotri, 2014). For example, management announced the layoff of 25% of the employees to increase profits. This may be viewed positively by shareholders due to the transparency of the goals, but not by employees who have a negative opinion due to the threat of unemployment. Second, positive or negative news about the company released in online business media can bring opportunities and challenges for managers seeking to retain their position within the organization. This motivates managers to continue disseminating positive news by controlling online business media to generate a strong corporate influence and, at the same time, maintain their position (Agnihotri, 2014). This action in controlling news about the company also affects the attitudes and reactions of readers and investors, who tend to respond with various suspicions if the company is always reported positively and receives a lot of public support (Meijer & Kleinnijenhuis, 2006). As a result, investors do not completely absorb information that is considered good or bad news when making an investment decision; instead, they rely on intuition or a specific portfolio trend rather than on information spread through the mass media (Cabral, 2016; Lako, 2003; Myllylahti, 2014).

69 Overall, the findings show that voluntary and involuntary disclosure of intellectual capital is consistent with the principles of agency theory (Massaro et al., 2018). The use of social media and annual reports to provide intellectual capital information voluntarily can reduce information asymmetry and affect a firm’s performance (Garanina &

Dumay, 2017). Companies may not only easily reach a broader range of stakeholders in real-time by using social media, but they can also communicate with them and facilitate online information sharing among stakeholders (Du & Jiang, 2015; Vernuccio, 2014).

Companies that use social media platforms such as Facebook and LinkedIn typically have many followers interested in company information. When companies opt to use social media to disclose financial and non-financial information, they typically do so as part of online communication strategies to improve their positive image and satisfy stakeholders following its aims (Basuony et al., 2018). However, according to this study, even when companies publicly explain their intellectual capital on social media, comments made by other users can significantly impact the company’s reputation and value creation efforts. Using social media for communication and intellectual capital disclosure entails both opportunities and risks to the company’s reputation because negative opinions and thoughts can easily spread virally on the digital platform (Jones et al., 2009). Consequently, companies can utilize social media to disclose information and reduce information asymmetry if management can provide positive feedback to negative comments from other users, thereby maintaining the company's public image (El-Badawy & Chahine, 2017).

Meanwhile, our research suggests that voluntary intellectual capital disclosure in annual reports positively affects firm value. This shows that management's intellectual capital disclosure in the annual report can overcome the information gap (Goebel, 2018).

This finding is consistent with prior research arguing that, according to agency theory, a manager's disclosure of intellectual capital information can persuade principals about the company’s resource practices and create a competitive advantage (Massaro et al., 2017). As a result, the high level of voluntary disclosure of intellectual capital in the annual report will narrow the information gap for investors and other capital market

70

participants, enhancing the accuracy of investment decisions (Boujelbene and Affes, 2013).

Involuntary disclosure also supports the agency theory concept. The separation of interests between management and the principal can result in information asymmetry, where the principal suffers business risk but lacks access to managerial information (Jensen & Meckling, 1976; Ross, 1973). To ensure that the principal's requests for information are fulfilled, management chooses to voluntarily report more information about intellectual capital (Olaniyi, 2019; Watts & Zimmerman, 1990). Unfortunately, this solution is still insufficient because some of the company's information may differ from what stakeholders demand (Lau et al., 2019). Another method of reducing information asymmetry is to use external media, one of which is online business news (Lardo et al., 2017; Parshakov & Shakina, 2020). Disclosures via online business media can help alleviate the problem of information asymmetry, as several published reports are occasionally kept hidden or go against the manager’s wishes (Dumay & Guthrie, 2017). This is because the disclosure of this information is not controlled or voluntary but is instead published by stakeholders and parties outside of management. Therefore the information obtained by the owner about the company is more than what is disclosed by the manager (Holzer, 2008).

This study also found that age has a negative effect on firm value in this study. This could be attributed to a variety of factors. First, newly listed companies on the IDX face more significant challenges, so they have a larger incentive to perform well than those in business for a long time (Al-Saidi and Al-Shammari, 2015). As a result, companies with a longer listing record will see their value decline due to the emergence of new companies that are more attractive to investors (Hariyano & Juniarti, 2014). Second, as the listing age increase, the company will stop making riskier investments and instead focus on maintaining existing ones, potentially resulting in a decline in the company’s reputation among stakeholders (Shao, 2019). The decline in the company’s value over time may also reflect increasing agency problems between managers and principals (Choi et al., 2012). Managers prefer more comfortable work, and they choose to work

71 less by avoiding risky investments and research and development (R&D) projects and focusing on available business lines (Loderer & Waelchli, 2016).

5. Conclusion, Implication, and Limitation

This study provides new empirical evidence about the effect of intellectual capital's voluntary (social media and annual reports) and involuntary disclosure (online business media) on firm value. The finding shows that voluntary intellectual capital disclosure through social media has a negative effect on firm value. Although the management has disclosed the intellectual capital to the fullest extent possible, negative responses from netizens continue to impact the company's reputation significantly. A similar outcome occurs when intellectual capital is disclosed inadvertently via online business news.

Involuntary disclosures in online business news have a detrimental effect on the company’s value, as stakeholders' perceptions of the news differ according to their purposes.

Additionally, managers frequently control good news about the company to improve the impression in the public while maintaining their positions within the company. Indeed, this act elicits investors' skepticism and distrust. As a result, they tend to consider their investment decisions against the published news. This study also finds that the disclosure of intellectual capital in the annual report positively affects firm value because it contains valuable information for investors when making investment decisions.

The results of this study contribute to the literature by establishing a new source of intellectual capital disclosure that relates to the firm value. Furthermore, this study offers practical implications for investors and management. Investors have a piece of additional new information other than the annual report to consider when making investment decisions, such as social media and online business news. Additionally, this research suggests that managers understand the potential of intellectual capital to be disclosed to increase the firm’s value. Managers must distinguish the concepts of quality and quantity in disclosing information because disclosing much information does not always increase firm value. For this reason, managers must provide relevant intellectual

72

capital information to the market. This strategy fulfills stakeholders' requirements and influences their decision-making process.

Despite offering several contributions, this study can be enhanced in several ways.

This study uses price to book value as a proxy for firm value measurement. However, many other indicators can measure company value, such as Tobin’s Q, price-earnings ratio, or earnings per share. Future studies may compare the results of using several measurement models on firm value. The data in this study has been suffering from non- normality issues, and transformation is used to solve these problems. Future research avenues may choose other strategies to deal with non-normality data, such as winsorizing and comparing the results to select the best method.

References

Abdolmohammadi, M. J. (2005). Intellectual capital disclosure and market capitalization.

Journal of Intellectual Capital, 6(3), 397–416.

https://doi.org/10.1108/14691930510611139

Abeysekera, I. (2007). Intellectual capital reporting between a developing and developed nation.

Journal of Intellectual Capital, 8(2), 329–345.

https://doi.org/10.1108/14691930710742871

Adesina, K. S. (2019). Bank technical, allocative and cost efficiencies in Africa: the influence of intellectual capital. North American Journal of Economics and Finance, 48, 419–433.

https://doi.org/10.1016/j.najef.2019.03.009

Agnihotri, A. (2014). Mass-media-based corporate reputation and firms’ market valuation - Evidence from emerging markets. Corporate Reputation Review, 17(3), 206–218.

https://doi.org/10.1057/crr.2014.10

Al-Dmour, H., Asfour, F., Al-Dmour, R., & Al-Dmour, A. (2020). The effect of marketing knowledge management on bank performance through fintech innovations: A survey study of Jordanian commercial banks. Interdisciplinary Journal of Information, Knowledge, and Management, 15, 203–225. https://doi.org/10.28945/4619

Al-Saidi, M., & Al-Shammari, B. (2015). Ownership concentration, ownership composition, and the performance of the Kuwaiti listed non-financial firms. International Journal of Commerce and Management, 25(1), 108–132. https://doi.org/10.1108/IJCOMA-07- 2013-0065

73 Alrowwad, A., Abualoush, S. H., & Masa’deh, R. (2020). Innovation and intellectual capital as

intermediary variables among transformational leadership, transactional leadership, and organizational performance. Journal of Management Development, 39(2), 196–

222. https://doi.org/10.1108/JMD-02-2019-0062

Amyulianthy, R., & Murni, Y. (2015). Intellectual capital and firm performance. International Journal of Business and Management Invention, 4(9), 13–23.

https://doi.org/10.1108/sd-03-2020-0053

Balcony, M. A. ., Mohamed, E. K. ., & Samaha, K. (2018). Board structure and corporate disclosure via social media: An empirical study in the UK. Online Information Review, 42(5), 595–614. https://doi.org/10.1108/OIR-01-2017-0013

Bayraktaroglu, A. E., Calisir, F., & Baskak, M. (2019). Intellectual capital and firm performance:

An extended VAIC model. Journal of Intellectual Capital, 20(3), 406–425.

https://doi.org/10.1108/JIC-12-2017-0184

Beltramino, N. ., García-Perez-de-Lema, D., & Valdez-Juárez, L. . (2020). The structural capital, the innovation and the performance of the industrial SMES. Journal of Intellectual Capital, 21(6), 913–945. https://doi.org/10.1108/JIC-01-2019-0020

Blanco-Alcántara, D., Díez-Esteban, J. M., & Romero-Merino, M. E. (2019). Board networks as a source of intellectual capital for companies: Empirical evidence from a panel of Spanish firms. Management Decision, 57(10), 2653–2671.

https://doi.org/10.1108/MD-12-2017-1238

Boekestein, B. (2009). Acquisitions reveal the hidden intellectual capital of pharmaceutical companies. Journal of Intellectual Capital, 10(3), 389–400.

https://doi.org/10.1108/14691930910977806

Bozzolan, S., Favotto, F., & Ricceri, F. (2003). Italian annual intellectual capital disclosure: An empirical analysis. Journal of Intellectual Capital, 4(4), 543–558.

https://doi.org/10.1108/14691930310504554

Bozzolan, S., O’Regan, P., & Ricceri, F. (2006). Intellectual Capital Disclosure (ICD): A comparison of Italy and the UK. Journal of Human Resource Costing & Accounting, 10(2), 92–113. https://doi.org/10.1108/14013380610703111

Brigham, E. F., & Daves, P. R. (2006). Intermediate Financial Management (9th ed.). South- Western College Pub.

Britto, D. ., Monetti, E., & Rocha Lima Jr, J. (2014). Intellectual capital intangible intensive firms: The Case of Brazilian Real Estate Companies. Journal of Intellectual Capital, 15(2), 333–348. https://doi.org/10.1108/JIC-10-2013-0108

Cabral, L. (2016). Media Exposure and Corporate Reputation. Research in Economics, 70(4), 735–740. https://doi.org/10.1016/j.rie.2016.07.004