On behalf of the IIUM Institute of Islamic Banking and Finance (IIiBF), the International Islamic University of Malaysia, I would like to congratulate the University of Darussalam, UNIDA Gontor, for successfully organizing and hosting the 7th ASEAN International Universities Conference on Islamic Finance of Islam. (AICIF 2019). The theme of the conference "Revival of Islamic Social Finance to Strengthen Economic Development Towards a Global Industrial Revolution" highlights the outstanding contributions and guidance of our beloved Prophet Muhammad (pbuh) on his various endeavors for social welfare and sustainable development policies. social. Several important global cases emerged from synergistic approaches involving Islamic social finance with sustainable digital technology.

A warmest welcome to the organizers and participants of the 7th Asian Conference on Islamic Finance (AICIF) 2019. Dear Main Organizer of the 7th AICIF University of Darussalam (UNIDA) GONTOR, Indonesia. On this occasion, the 7th AICIF raised the theme of Revival of Islamic Social Finance to Strengthen Economic Development towards a Global Industrial Revolution.

DR ABDUL NASIR BIN HAJI ABDUL RANI Dean

Firstly, I would like to take this opportunity to welcome you all to the 7th ASEAN Universities International Conference on Islamic Finance (7th AICIF) and to express our deepest gratitude to Universitas Darussalam Gontor, Indonesia for hosting this year's 7th AICIF which was held on 3rd. and December 4, 2019. Universiti Islam Sultan Sharif Ali (UNISSA), Brunei Darussalam, realized that this annual conference served as an important platform with researchers, professionals coming from all parts of the world to also further insights into the frontier to gain knowledge. as understanding the broader scope of Islamic Finance. I sincerely hoped that this conference will continue to play its role as an important platform for all stakeholders to meet and address issues related to Islamic Finance, especially in this era of globalization where Islamic Finance industries are growing significantly seen over the past years.

I also hope that this conference will be able to help promote and strengthen networks and collaboration between researchers, academics and professionals. On behalf of UNISSA, I would like to express my sincerest appreciation to the main organizer, co-organizers, sponsors and many thanks to everyone involved in organizing such a successful conference. To all participants and presenters attending this year's AICIF, I hope you will be able to benefit greatly from this conference and participate in strengthening the role of Islamic Finance in order to contribute to more sustainable economic growth and balanced in society. .

MINDANAO STATE UNIVERSITY PHILIPPINES Assalamu Alaykom Warahmatullahi Wa Barakato

HABIB W. MACAAYONG DPA President MSU System

It is a privilege for Tazkia University College of Islamic Economics to co-host the 7th ASEAN Universities International Conference on Islamic Finance which was held on December 3 and 4, 2019 at the University of Darussalam Gontor. Tazkia University College of Islamic Economics is a pioneer of the development of Islamic economics and finance in Indonesia. Tazkia University College of Islamic Economics has contributed to the development of Islamic Economics and Finance in Indonesia since 2 decades.

Selain itu, Sekolah Tinggi Ekonomi Islam Universitas Tazkia juga memberdayakan basis tersebut dengan mendirikan “Tazkia Islamic Village” yang berlokasi di Babakan Madang, Kabupaten Bogor. Zulkifli1, Tatiek Nurhayantie2, Widodo3 dan Ayu Widya Wardani4 ..37 DAMPAK PENDAPATAN AGAMA ISLAM TERHADAP PEMBANGUNAN EKONOMI NEGARA DI MALAYSIA. Abdul Ghafar Ismail, Syahrul Annuar Ali dan Muhammad Hasbi Zaenal..38 DAMPAK LITERASI EKONOMI ISLAM TERHADAP DAYA PEMBELIAN MAHASISWA UNIDA DI UNIT BISNIS UNIDA (U3).

Annas Syams Rizal Fahmi1 and Fikri Muhammad Arkhan2 ..40 DEFINITION OF ISLAMIC MUTUAL FUNDS AS AN INDICATOR OF THE. Abdelrahim El-Brassi1, Syed Musa Alhabshi2, Anwar Hasan Abdullah Othman3 ..48 THE ESTABLISHMENT OF ISLAMIC FINANCE AND ITS EFFECT IN IT. Azi Haslin Abdul Rahman1 and Rusni Hassan2 ..54 ACHIEVING MAQASID OF ISLAMIC FINANCE THROUGH SOCIAL IMPACT BONDS (SIB) AND SUSTAINABLE AND RESPONSIBLE INVESTMENT (SRI) SUKUK.

Hafiza Harun1 and Muhammad Hafiz Shmsuddin2 ..61 COMPARATIVE ANALYSIS OF FINANCIAL PERFORMANCE OF ISLAMIC BANKS AND CONVENTIONAL BANKS. Rahma Yudi Astuti ..68 BUILDING THE OPTIMAL LEVEL OF PRESSURE FOR THE RESILIENCE OF ISLAMIC BANKING IN INDONESIA. Hendar1 ..93 EASY SUSTAINABILITY THROUGH KNOWLEDGE MANAGEMENT OF ISLAMIC SOCIAL FINANCE: THE EXPERIENCE OF UNIVERSITAS DARUSSALAM GONTOR, INDONESIA.

Fajar Surya Ari Anggara1 and Roghiebah Jadwa Faradisi2 ..99 THE INFLUENCE OF ISLAMIC BUSINESS ETHICS ON PARTNERSHIP.

NEW INTEGRATED FINANCIAL TECHNOLOGY MODEL ON ISLAMIC SOCIAL FINANCE FOR ECONOMIC

DEVELOPMENT

ABSTRACT

LITERATURE REVIEW

- Cash Waqf and the Welfare of the Society

- Integrated Financial Technology on Islamic Social Finance

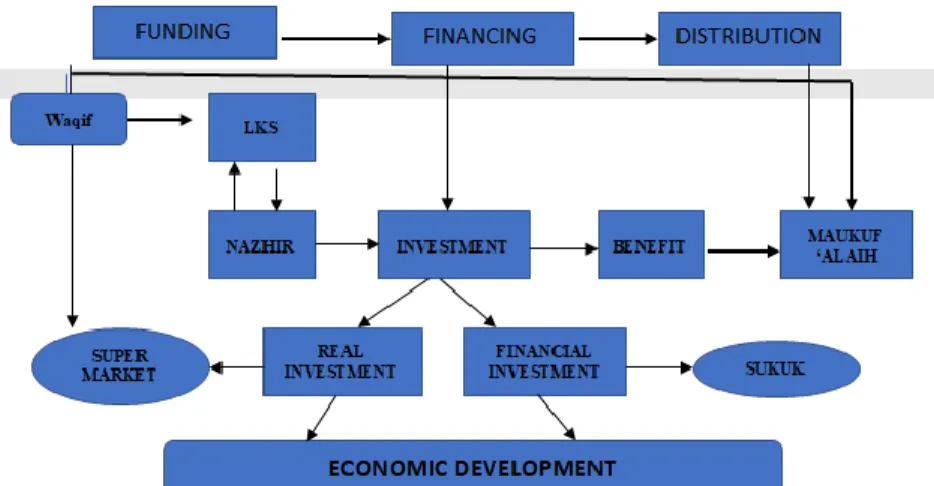

2014) define cash waqf as handing over a certain amount of money from someone and setting up a waqf based on a certain amount and then managing it for investment. Cash waqf should not be submitted directly to the mauquf 'alayh, but should be managed by the waqf management institution whose results are submitted to the mauquf 'alayh. In the cycle of waqf management, from funding, financing to benefit distribution, there is a high potential for fraud, so it must be managed using financial technology.

Cash Waqf as Islamic social finance has several advantages, including: a) the amount of cash waqf can vary from IDR 1,000,000 to unlimited, so that the potential to achieve muaqif is wider and more comprehensive, b) through cash waqf, waqf assets in the form of empty land can be put to good use, by building a building or processing for agricultural land, c) cash waqf funds can also help some Islamic educational institutions, d) cash waqf is more flexible and becomes a driver for waqf of objects to be more productive, e) cash waqf provides opportunities to create investments to provide religious services, educational services and social services. Financial technology (Fintech) can be used to support the management of cash waqf or Islamic Social Finance. Romānova & Kudinska (2016), define fintech as one of the software and modern technology-based businesses that provide financial services.

Fintech is able to provide financial services that are highly standardized, low-cost, and Internet-based (Romānova & Kudinska, 2016). Shin (2018), Fintech promises a new ecosystem for the financial industry with lower costs and more efficient quality of financial services. Fintech according to Bank Indonesia Regulation number 19/12 / PBI / 2017 regarding the Implementation of financial technology can organize financial activities in the form of: a) Payment System, b) Market Supporter c) Investment Management and Risk Management , d) Loans, financing and capital supply, e) Other financial services. The management and development of Islamic social finance in Indonesia can be achieved through investments in the products of Islamic financial institutions and/or Islamic financial instruments (Sifa, 2016).

Fundraising (financing), management (financing) and distribution of investment returns, in order to be more efficient and well controlled, must use information technology. There are several advantages of an Islamic social financing system based on integrated financial technology, including: a) easier mobilization of waqf funds from the public with a wider area coverage, b) Islamic social financing is more flexible and becomes a driver for optimizing non-productive waqf funds , c) promoting an even distribution of mauquf 'alaih, d) easier monitoring and control over the behavior of waqf administrators so that no client is harmed. This is reasonable as integrated financial technology will increase transparency, accountability and responsibility of all stakeholders related to waqf.

METHODOLOGY

- New Framework of Integrated Financial Technology on Islamic Social Finance for Economic Development

- Key Success Factor of Implementation of Integrated Financial Technology on Islamic Social Finance for Economic Development

The potential for cash waqf in Indonesia reaches 3 trillion per year, with an estimated number of generous Muslims of 10 million and an average monthly income of Rp 500,000 to Rp. However, waqf management in Indonesia has not been maximized as expected compared to other Muslim countries such as Bangladesh, Malaysia and Egypt, which have optimally developed cash waqf. 2019) find that in Indonesia, with a large majority of Muslims, the use of cash waqf is still low and the majority of waqf is in the form of land and buildings, which is traditionally called waqf management, while Singapore with a Muslim minority, the use of cash waqf is optimal and more productive, it is called the professional waqf management. New Framework of Integrated Financial Technology for Islamic Social Finance for Economic Development Financing for Economic Development.

Cash waqf as Islamic social finance involves many stakeholders in its operation, starting with muaqif, nadzir and mauquf 'alaih, which links financing, destiny, financing and mauquf 'alaih. Likewise, the distribution of investment assets in the form of monetary waqf (monetary waqf portfolio) can be carried out with the stipulations of 60% (sixty percent) investment in LKS instruments and 40% (forty percent) outside of LKS. But it must involve Islamic financial institutions as strategic partners in the management of Islamic social finance.

However, because cash waqf is in the form of movable money that is easily lost, the value of cash waqf is secured in Islamic financial institutions. Likewise for the cash waqf portfolio value with a combination of 60% cash waqf funds to be invested in financial investments (for example sukuk, sharia shares, sharia mutual funds), while 40% is real investment. Nazir even knows who are the beneficiaries of the waqf investment in money and its amount.

Key Success Factor of Implementation of Integrated Financial Technology on Islamic Social Finance for Economic Development on Islamic Social Finance for Economic Development. Integrated Financial Technology on Islamic Social Finance for Economic Development will succeed if there are several conditions, including: commitment of all parties and leadership.

CONCLUSION AND RECOMMENDATION 5.1. Conclusion

- Recommendation

In addition, future research should identify important components that will implement the model, including: quality and quantity of human resources, adequate infrastructure and supporting regulations. For future research, it is better to identify important factors that determine the successful implementation of integrated financial technology in Islamic social finance for economic development, such as: the quality and quantity of human resources, culture, adequate infrastructure and supporting regulations.