The title of this research paper is Financial Satisfaction of Personal Retirement Planning among Malaysian Youth EPF Contributors during the COVID-19 Pandemic, which is also the main focus of our study. This research will contribute to the research field of finance where the perception of youth EPF contributors is important towards financial satisfaction of personal retirement planning during the COVID-19 pandemic.

Introduction

- Introduction

- Research Background

- Research Problem

- Research Objective

- General Objective

- Specific Objective

- Research Questions

- Significance of Study

- Investor

- Malaysia Government and Central Bank

- Employee Provident Fund (EPF)

- Future Researchers

- Conclusion

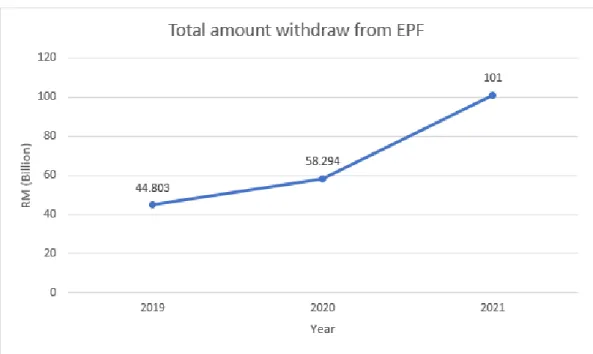

In the year 2021, the worsening of the epidemic caused the total amount withdrawn from the EPF to rise to the highest level compared to previous years, which is RM101 billion. The continued worsening of the epidemic has also not resulted in any improvement in the economy.

Literature Review

Introduction

For the research problems, a few problems have been listed from the section, such as limited sample size or unevenly distributed sample between rural and urban areas may lead to a result that is non-ideal, the exclusion of macroeconomic factors on research may not give a complete picture of the result, the limitation of variable inclusion in one research study, where only a few variables can be entered, not all or as much as the researchers want to do because of the complexity. For the importance of the study, several parties such as investors, the government, the central bank and future researchers suggest using the result for further use.

Review of Theories

- Life Cycle Theory

- Theory of Planned Behaviour (TPB)

- Permanent Income Theory

As a result, it affects the life cycle behavior of retirement plans, leading to the performance that precedes the supply of consumer demand over different life cycles constrained by individuals (Daniel, 1982). According to the study of Arifin (2018) on the influencing factors on financial satisfaction with financial behavior as an intervening variable on Jakarta area workforce, it stated that financial satisfaction can be explained by the theory of financial behavior derived from the theory of planned behavior (TPB).

Review of Variables

- Dependent Variable

- Financial Satisfaction of Retirement Planning

- Independent Variables

- Retirement Planning

- Financial Literacy

- Financial Saving Behaviour

- Mediator Variables

- Education Level

- Income Level

- Age

The research of Jee (2019) shows that there is a significant relationship between education level and retirement planning. It has been proven that there is a significant relationship between education level and retirement planning (Muhammad & Hafinaz, 2017).

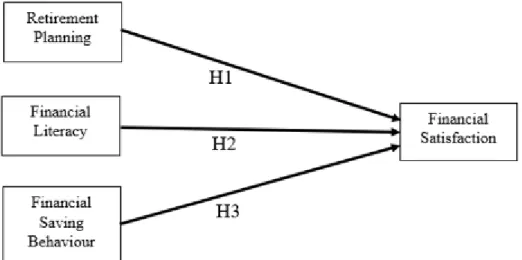

Conceptual Framework

Despite this, the dependent variable DV financial satisfaction in retirement planning is also illustrated by the theory of planned behavior (TPB). For example, hypothesis 4 will test the significant relationship from independent variable IV1 retirement planning through each of the three mediator variables MV1 education level, MV2 income level and MV3 age thus to the dependent variable DV financial satisfaction with retirement planning.

Hypotheses Development

- Significant Relationship between RP and FS

- Significant Relationship between FL and FS

- Significant Relationship between FSB and FS

- Significant Relationship between MVs, RP and FS

- Significant Relationship between MVs, FL and FS

- Significant Relationship between MVs, FSB and FS

According to Nyoro and Otieno (2016), the result shows a significant relationship between education level and financial literacy. Based on the research of Lu et al. 2021), there is a significant relationship between income level and financial saving behaviour.

Conclusion

This is because people with higher income levels are more likely to have a retirement account. In other words, older individuals understand the importance of saving, therefore they are more likely to have the financial saving behavior.

Methodology

- Introduction

- Research Design

- Primary Research

- Quantitative Research

- Sampling Design

- Sampling Technique

- Target Population

- Sample Size

- Data Collection Methods

- Research Instrument

- Pilot Test

- Proposed Data Analysis

- Descriptive Analysis

- Inferential Analysis

- Conclusion

The above elements will be covered in Chapter 3 which is research methodology in the next sub-chapter. This sampling technique will be most effective when selecting a small portion of the total population.

Data Analysis

- Introduction

- Descriptive Analysis

- Respondent Demographic Profile

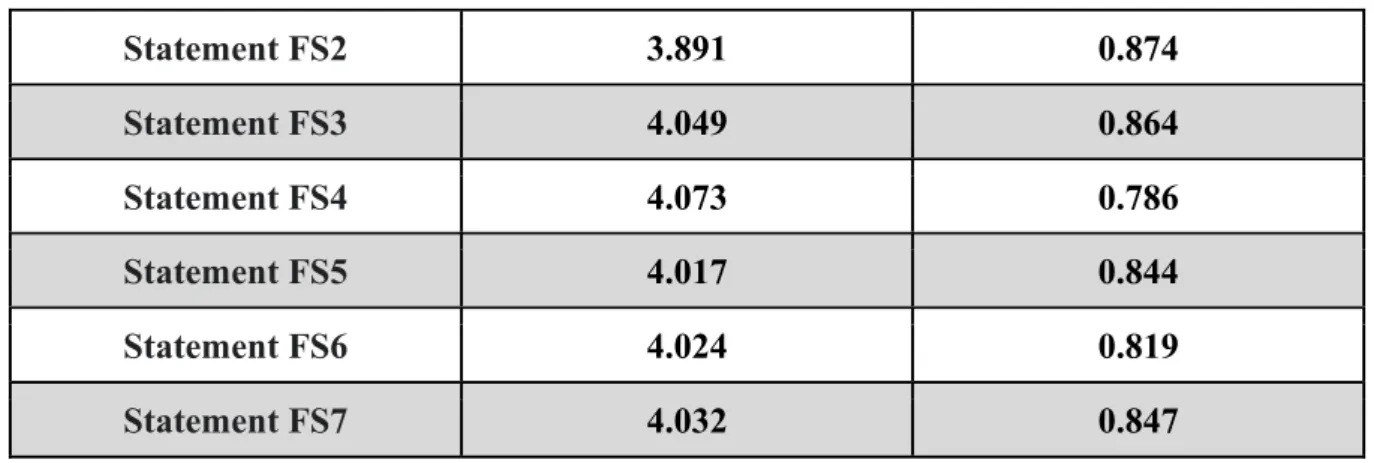

- DV - FS

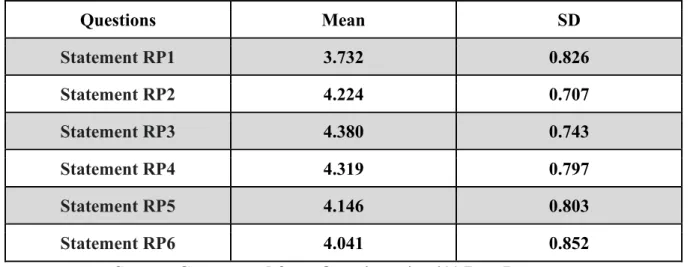

- IV - RP

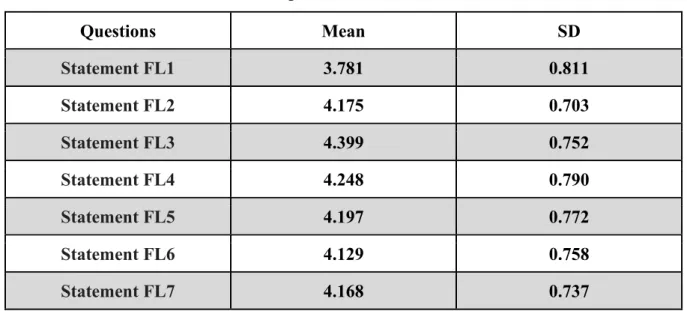

- IV - FL

- IV - FSB

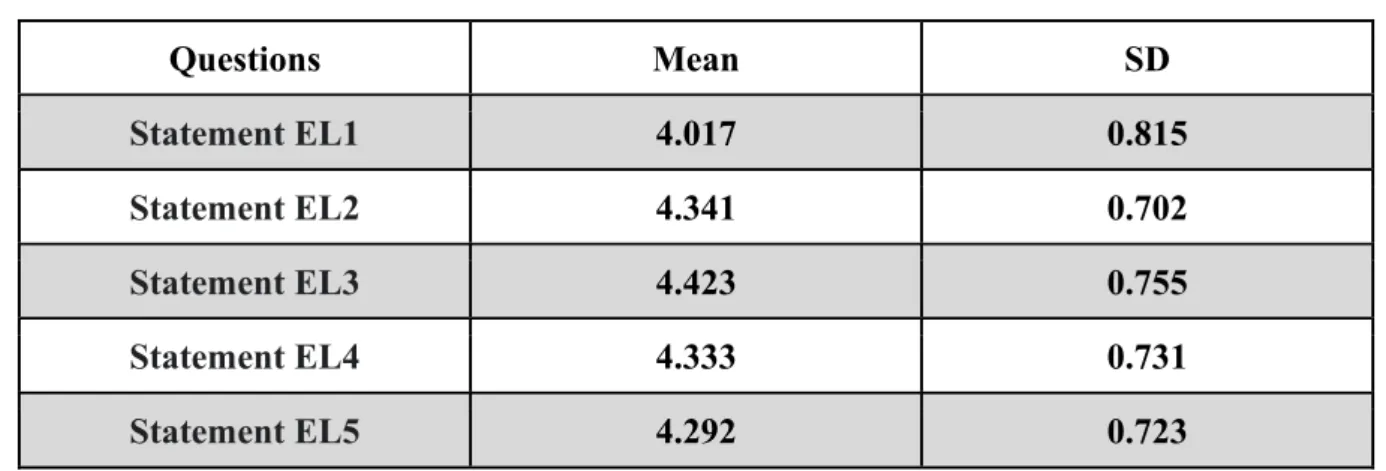

- MV - EL

- MV - IL

- MV - AG

- Inferential Analysis

- Target Endogenous Variable Variance

- Inner Model Path Coefficient Sized and Significance

- Reliability and Validity Test

- Bootstrapping Analysis

- Conclusion

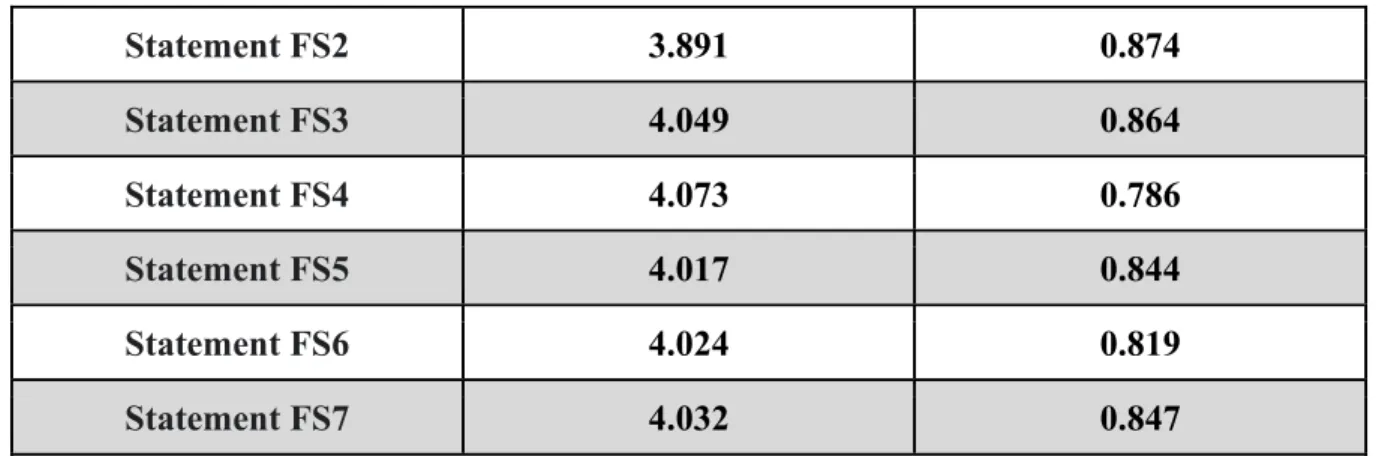

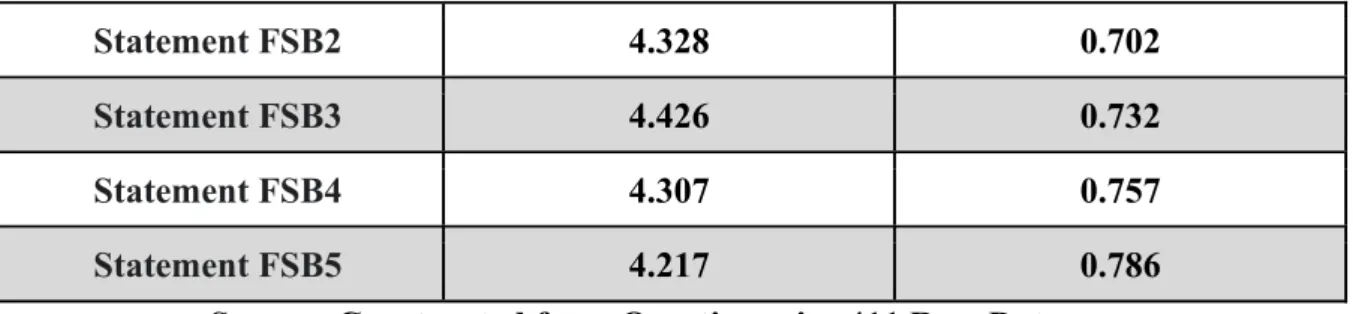

According to Table 4.5, the highest average value is 4.426 according to FSB3 statement (Refer to Appendix). The highest mean value in table 4.8 is according to statement A3 (Refer to Appendix) which is 4.533. On the other hand, the lowest mean value in table 4.8 is according to statement AG1 (Refer to Appendix) which is 3.976.

In addition, the highest SD value in Table 4.8 is according to statement AG5 (Refer to Appendix) which is 0.834. Conversely, the lowest SD value in Table 4.8 is according to statement AG2 (Refer to Appendix) which is 0.641.

Discussion, Conclusion, and Implication

Discussion on Key Findings

- RP and FS

- FL and FS

- FSB and FS

- RP -> MVs -> FS

- FL -> MVs -> FS

- FSB -> MVs -> FS

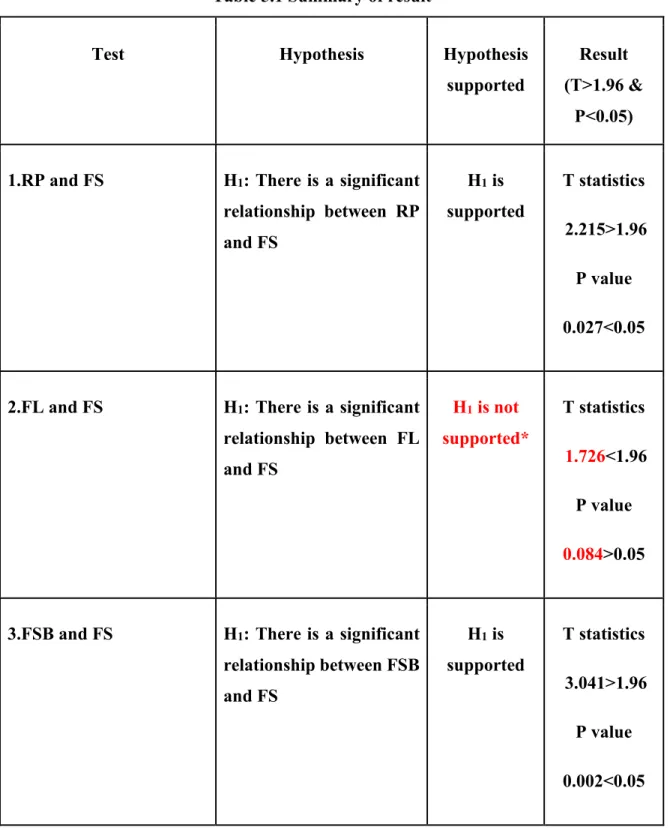

According to Elder & Rudolph (1999), the results show that there is a significant relationship between retirement planning and financial satisfaction with retirement planning. According to Yeung & Zhou (2017), the result shows a significant relationship between retirement planning and financial satisfaction of retirement planning. According to Hsion and Dambaravdan (2016), financial saving behavior has a significant relationship with the financial satisfaction of retirement planning.

Marimuthu (2018) the results show that there is a significant relationship between financial saving behavior and financial satisfaction with retirement planning. According to Thakur et al. 2017), income level will not significantly affect financial saving behavior and financial satisfaction of retirement planning.

Research Implication of Study

- Investors

- Malaysian Government and Central Bank

- Employee Provident Fund (EPF)

- Future Researchers

The result in table 5.1 shows that the mediator variable education level will not have a significant influence on the financial saving behavior and financial satisfaction with retirement planning (T-statistic 1.299<1.96 & P-value 0.194>0.05). According to Kassim, Tamsir, Azim, Mohamed and Nordin (2018), the results show that the level of education will not have a significant influence on financial saving behavior and financial satisfaction with retirement planning. The result in table 5.1 shows that age, the mediator variable, will have a significant influence on financial saving behavior and financial satisfaction with retirement planning (T: . 2.618>1.96 & P: 0.009<0.05).

According to Zulfaka and Kassim (2021), the results show that age will have a major impact on financial saving behavior and the financial satisfaction of retirement planning. All these illustrations mean that the targeted respondents were not satisfied with their financial condition, especially in terms of retirement planning, purposely for the period of COVID-19.

Limitation of Study

- Internal Validity

- External Validity

All the statements (40 statements in total) in the questionnaire are written in conditional sentences with affirmative form, which according to our research title (Financial Satisfaction of Personal Retirement Planning among Malaysian Youth EPF Contributors during the COVID-19 Pandemic). Some of the respondents feel that they need more time when completing the questionnaire. Most of the reason is that their responses are in the language of the questionnaire.

In addition to the language of the questionnaire, we found that respondents with professional qualifications will have a better understanding when completing the questionnaire. With the independent variables of (financial literacy, financial saving behavior, retirement planning) and mediator variables of (educational level, income level and age), the results of the study must be limited and presented only based on the listed variables.

Recommendation

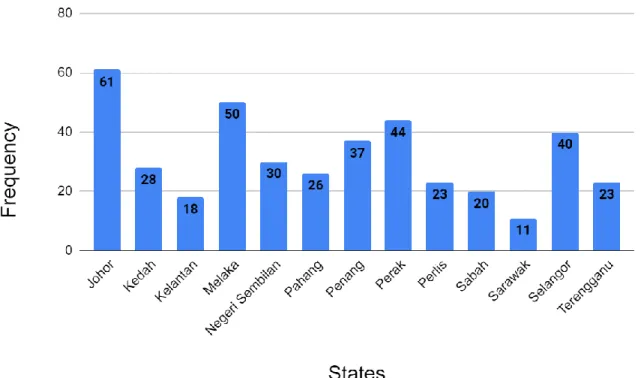

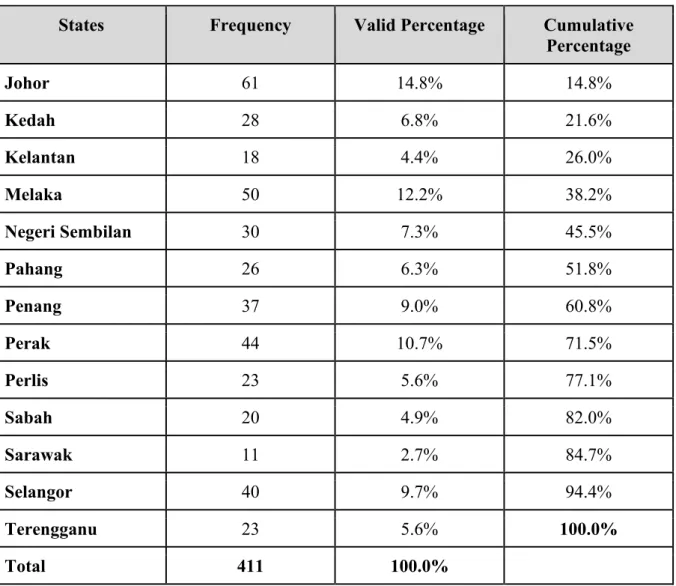

Respondents who completed the questionnaire are mostly Malaysian Youth EPF contributors working in the capital cities in the 13 states of Malaysia. Finally, it is strongly recommended that future researchers increase the number of research sample sizes. Large sample size may be more effective in capturing small changes in the research result compared to small sample sizes.

Also, a large sample size is able to include more areas which may have a more diverse result as different states will have different lifestyles, especially the price of goods and services. As an example, the price of goods and services in Kuala Lumpur is higher compared to the price of goods and services in Kuala Terengganu.

Conclusion

However, IV2 financial knowledge is not relevant to DV's financial satisfaction with retirement planning. Retirement planning behavior of working individuals and legal proposal for a new pension system in Malaysia. Influence of age, gender, income, education and financial literacy towards retirement planning among generation 'y' in Malaysia, 3 (1).

The influence of financial literacy, risk aversion and expectations on retirement planning and portfolio allocation in Malaysia. A conceptual review of the effect of attitudes toward retirement on savings intentions and retirement planning behavior.

Survey Questionnaire

FL1 During the COVID-19 pandemic, I would budget for my own purposes to achieve my financial satisfaction through retirement planning. FL2 During the COVID-19 pandemic, I would record my daily expenses to be comfortable with my retirement planning. FSB3 During the COVID-19 pandemic, I would save money for my future emergency fund to meet my financial satisfaction through retirement planning.

FSB4 During the COVID-19, I would save money to make some investments to meet my financial fulfillment from retirement planning. FSB5 During the COVID-19, I would save the money first before spending to meet my financial satisfaction from retirement planning.

Targeted Respondent Demographic Profile

Result of Target Variable Variance

Result of Outer Loadings

Result of Cronbach’s Alpha

Result of Composite Reliability

Result of Average Variance Extracted (AVE)

Result of Fornell-Larcker Result

Result of Heterotrait-Monotrait Ratio (HTMT)

Result of Bootstrapping (Total Direct)

Result of Bootstrapping (Total Indirect) …

Result of Bootstrapping (Outer Loading)

Result of Bootstrapping (Mediating Latent Variable)

Result of Turnitin Report

It is hereby certified that Ngo Yu Xun (Student Name) (ID No: 19ABB05710) has completed this last year project entitled "The Financial Satisfaction of Personal Retirement Planning among Malaysian Youth EPF Contributors during COVID-19 Pandemic" under the supervision of Puan Noor Azizah of the Department of Supervisor Shaari (Finance) and Finance Department of Business. I understand that the university will upload a soft copy of my final year project in pdf format to the UTAR Institutional Repository which can be made available to the UTAR community and the public. It is hereby certified that Pong Yi Xiang (Student Name) (ID No: 17ABB04588) has completed this final year project titled "The Financial Satisfaction of Personal Retirement Planning among Malaysian Youth EPF Contributors during COVID-19 Pandemic" under the supervision of Puan Noor Azizah, Finance of Business, Finance Department and Bt Shazizah Finance Department.

It is hereby certified that Saw Min Zher (Student Name) (ID No: 17ABB04351) has completed this last year project titled "The Financial Satisfaction of Personal Retirement Planning among Malaysian Youth EPF Contributors during COVID-19 Pandemic" under the supervision of Puan Noor Azizah Bt. Form Title: Supervisor's Comments on Originality Report Generated by Turnitin for Final Year Project Report Submission (for undergraduate programs). Final Year Project Title The Financial Satisfaction with Personal Retirement Planning Among Malaysian Young EPF Contributors During the COVID-19 Pandemic.

Based on the above results, I hereby declare that I am satisfied with the originality of the end-of-year project report submitted by my student(s) as stated above.