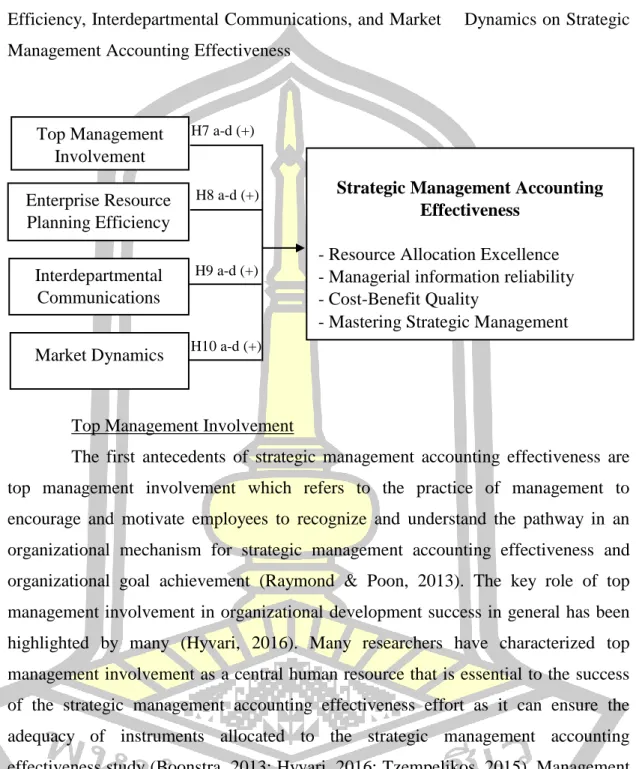

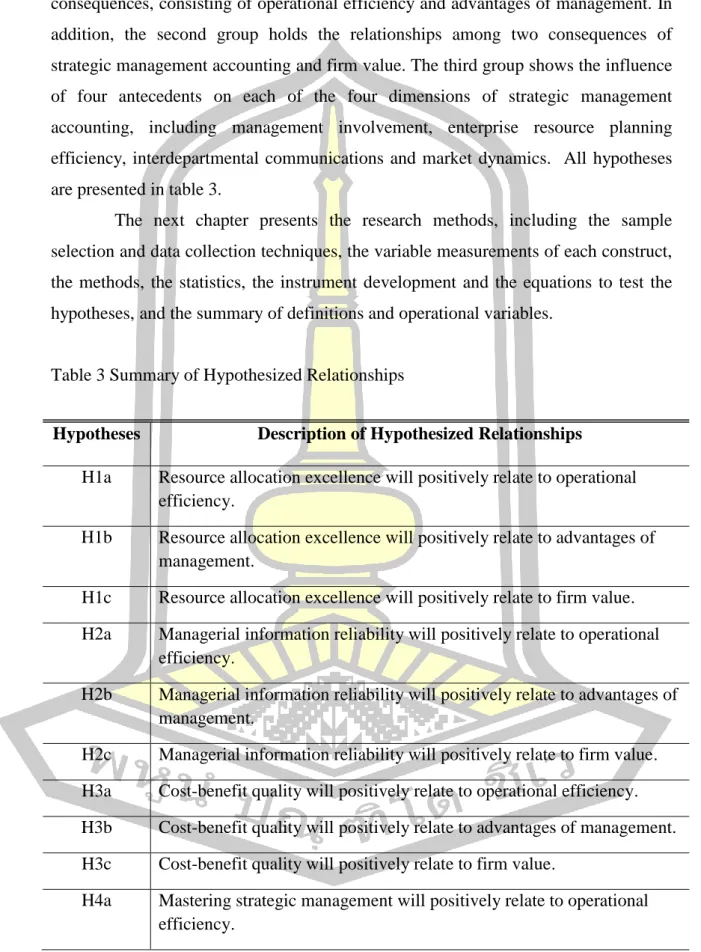

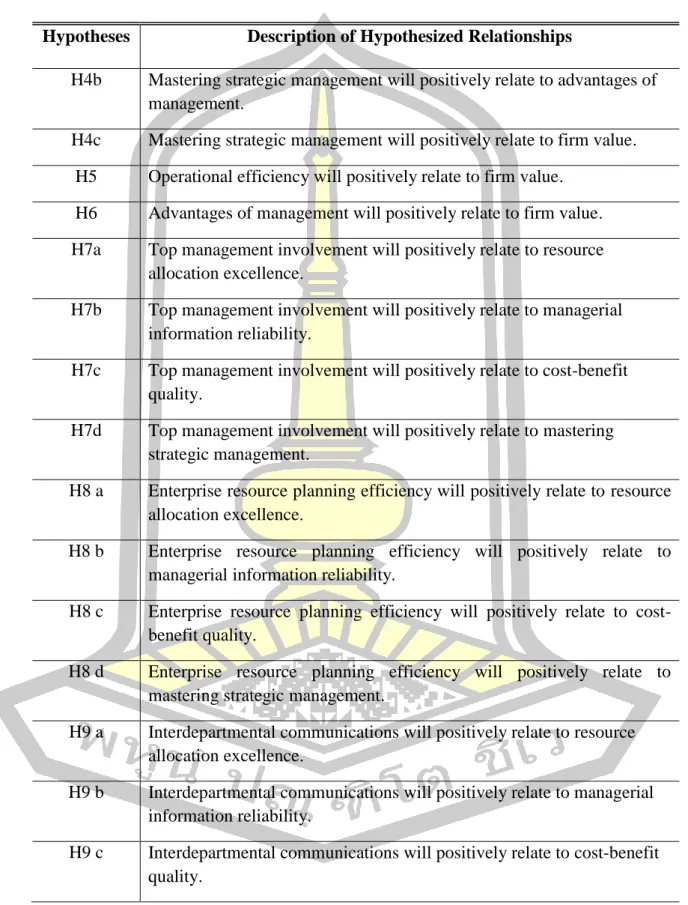

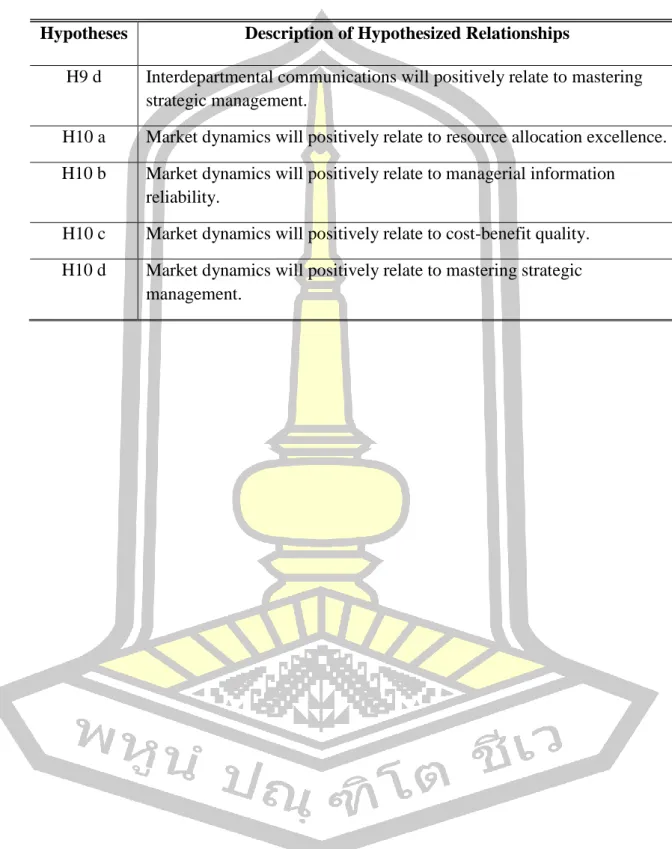

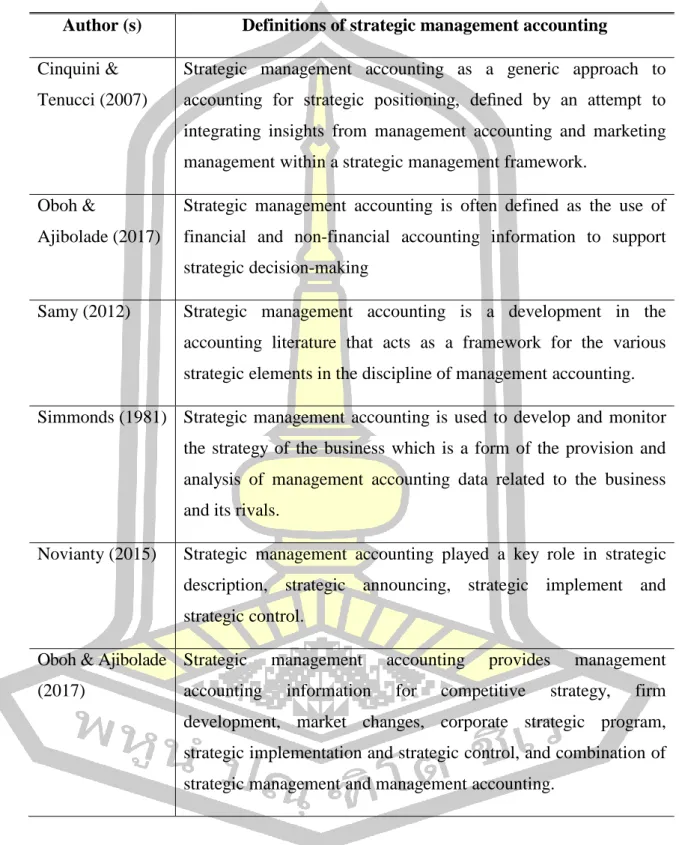

The primary purpose of this study is to investigate the effects of strategic management accounting effectiveness on firm value. Furthermore, the effects of strategic management accounting effectiveness on operational efficiency and the benefits of management are examined. Finally, this study tests the effects of top management involvement, corporate resource planning efficiency, interdepartmental communication, and market dynamics on the effectiveness of strategic management accounting.

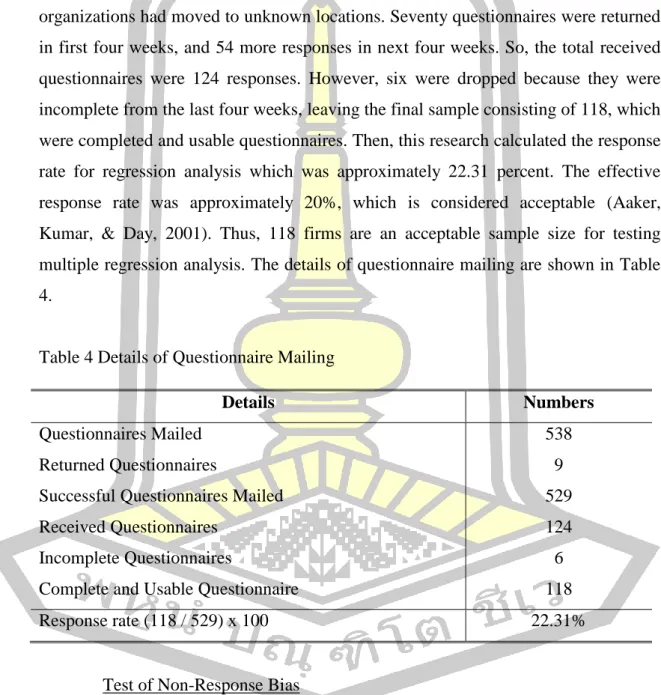

In this research, the main contribution is that strategic management accounting effectiveness plays an important role in improving operational performance in Thai listed companies. Finally, top management involvement, enterprise resource planning effectiveness, interdepartmental communication, and market dynamics have a positive effect on four dimensions of strategic management accounting effectiveness. In summary, this research concentrates on dimensions of strategic management accounting effectiveness that provide a significant extension to prior knowledge and the relevant strategic management accounting literature.

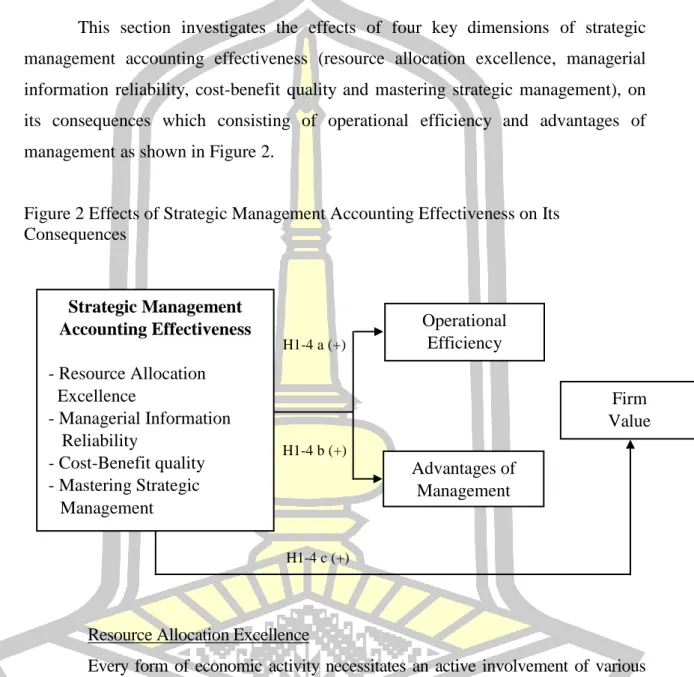

The most important managerial instruments are strategic management accounting (Kamal & Lukman, 2017) and strategic management accounting, which are considered critical factors to increase revenue for the success of large firms (Albelda, 2011). Therefore, strategic management accounting supports operational efficiency, management advantages and firm value (Kitenga & Thuo, 2014). To investigate the effects of four dimensions of strategic management accounting effectiveness (resource allocation excellence, management information reliability, cost-benefit quality and strategic management mastery) on operational efficiency, management advantages and firm value.

This study focuses on the effectiveness of strategic management accounting in the context of companies listed in Thailand. Accordingly, the implications of strategic management accounting effectiveness consist of operational efficiency, benefits of management and business value. The core construct of the conceptual model in this study is the phenomenon of strategic management accounting effectiveness.

First, this study approached the test of the main effect of strategic management accounting effectiveness on firm value. The effectiveness of strategic management accounting plays a key role in the benefits of the management process.

RESULT

Independent Variables

Independent Variables

The finding shows that the higher reliability of management information helps the company to obtain greater operational efficiency, management benefits and business value. 2008) supported that the reliability of management information had a strong, direct effect on operational efficiency and business value. Furthermore, Kunst et al. 2018) found that the reliability of management information has a positive effect on the overall benefits of management. Reliability of management information is one of the most important effects of strategic management accounting, which aims to provide reliable, complete, accessible and understandable information in a timely manner to maintain competitive advantage, such as operational efficiency, benefits of management and business value.

These results show evidence that companies that use more cost-benefit quality tend to achieve the operational efficiency, the benefits of the management and the value of the company. Cost-benefit quality is also one of the strategic management accounting effects required to achieve success in the operational efficiency, which is expected to have a significant positive impact on operational efficiency and benefits of management and firm value (Kohli & Jaworski, 1990). ). Cost-benefit quality should provide favorable conditions for making rational decisions and choosing the optimal varieties of operational efficiency and benefits of management (Modhiya & Desai, 2016).

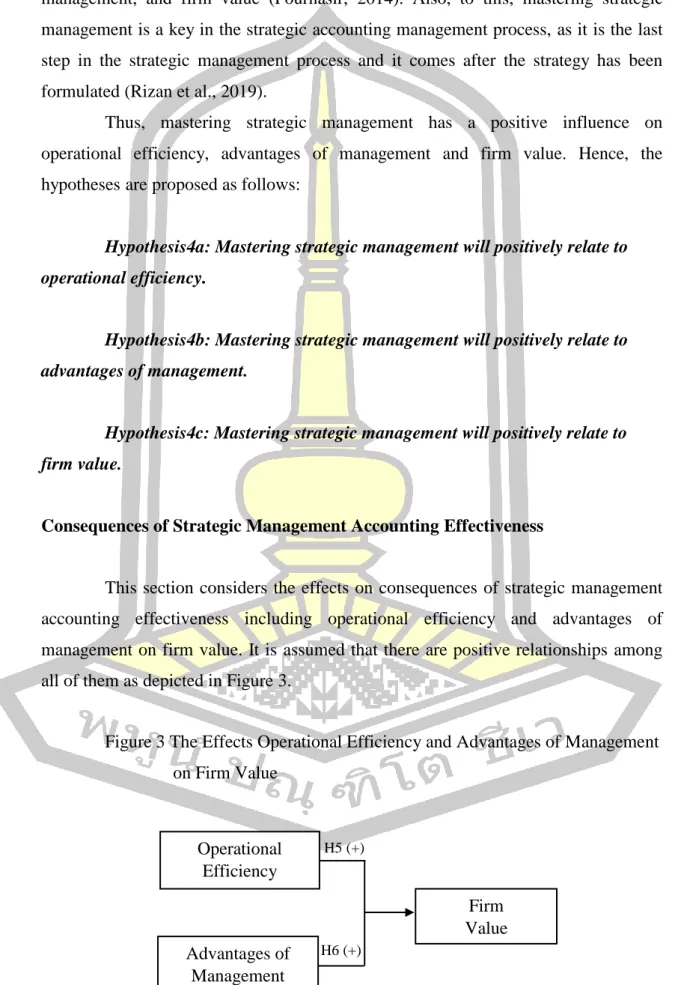

Thus, cost-benefit quality has proven to be a useful tool to support this type of operational efficiency, management advantages and firm value. These results show evidence that firms that use strategic management mastery tend to achieve operational efficiency, management advantages, and firm value. Also, Bolo (2011) examined the relationship between mastery of strategic management and managerial advantages using a cross-sectional sample of Kenyan manufacturing companies.

Mastering strategic management is about gaining leadership advantages through being uniquely different in one's industry (Farzin, Kahreh, Hesan & Khalouei, 2014). Thus, mastering strategic management has proven to be a useful tool to support this type of operational efficiency, management benefits and business value. This implies that longer time in operation does not affect operational efficiency, management benefits and company value.

Likewise, firm size has no significant effect on operational efficiency, managerial advantages, and firm value.

Independent Variables

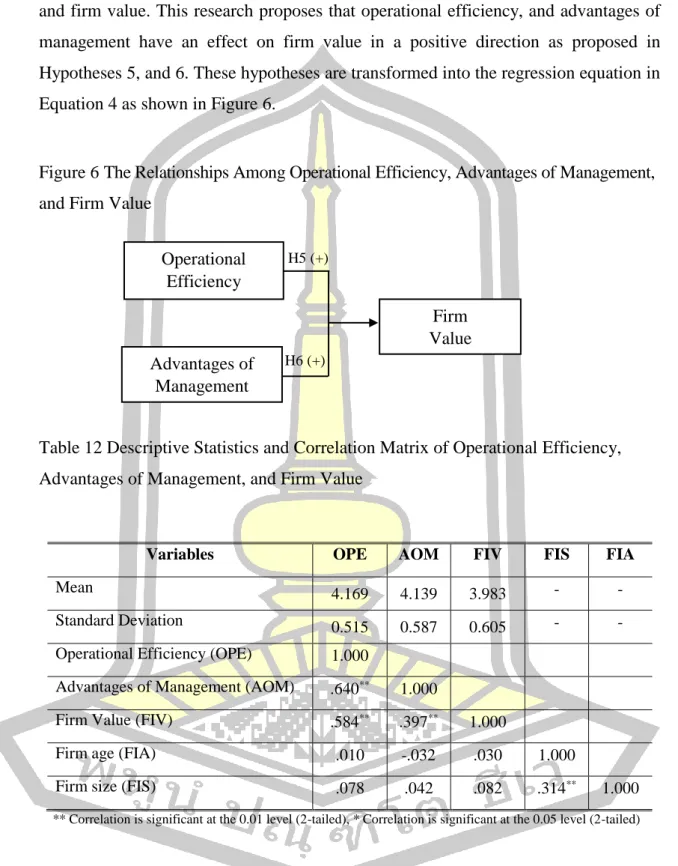

In addition, the finding indicates that the relationship between benefits of management and firm value showed a significant positive relationship (β p < .01). This conclusion is in accordance with that of Me (2018) who states that the acceptance of benefits of management is indispensable in organizations. It should therefore form part of their method of improving organizational performance to enable them to cope with the changes and challenges of the global economy.

This means that the professional management must possess capabilities to maintain a competitive level at the moment and in the future, and to achieve organizational goals with good quality operations. Furthermore, benefits of management had a positive correlation with the result of the firm value (Tapera, 2016). According to Unam & Akinola (2015), benefits of management is the process by which managers determine an organization's long-term direction, set specific performance goals, develop strategies to achieve these goals in light of all the relevant internal and external circumstances, and undertake the execute chosen action plans that cause firm value (Lee, Gunarathne, & Herold, 2017).

For control variables, the results show that company age has no statistically significant effects on business efficiency and company value (β22= 0.027, p > 0.05). It means that operational efficiency and management advantages are not influenced by the size and age of the company. Therefore, each size and age of the company does not have a significantly different effect on operational efficiency and management advantages.

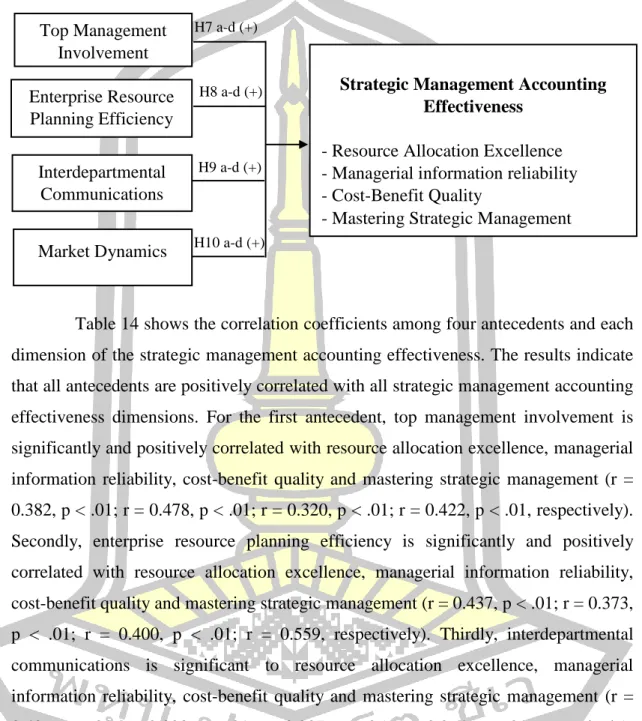

The results indicate that all antecedents are positively correlated with all strategic management accounting effectiveness dimensions. In the area of correlation coefficients among four antecedents of dynamic management accounting orientation, the results of Table 14 also show that all correlations are less than 0.80.

Independent Variables

Independent Variables

Independent Variables

Independent Variables

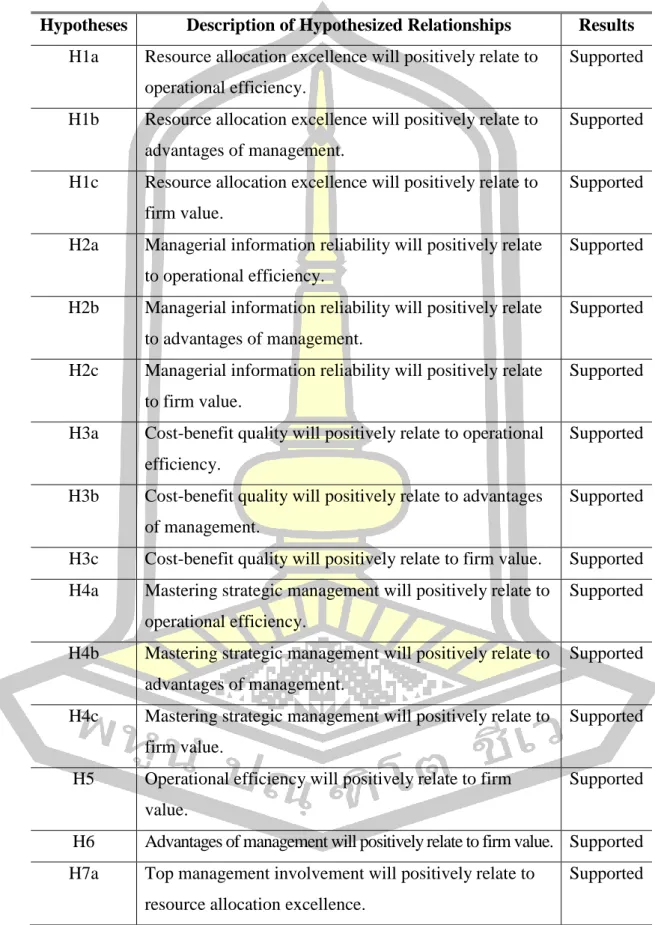

The results showed that all dimensions of the effectiveness of strategic management accounting (excellence of resource allocation, reliability of management information, quality of cost-benefit ratio and mastery of strategic management) have a strong and positive impact on all its consequences ( operational efficiency, management benefits and business value). . Regarding the preceding factors, top management involvement is the most influential determinant of four dimensions of strategic management accounting effectiveness. Strategic management Accounting effectiveness - Excellent resource allocation - Reliability of management information - Quality of costs and benefits - Mastering strategic management.

Second, this research addresses operational efficiency and benefits of management as the mediators of strategic management accounting effectiveness and firm value in the contingency theory. These results support the assumption that top management involvement is positively associated with each dimension of strategic management accounting effectiveness. The proposed dimensions of strategic management accounting effectiveness consist of excellence in resource allocation, management information reliability, cost-benefit quality and the mastery of strategic management.

In addition, mastery of strategic management has a positive impact on operational efficiency, management benefits and company value. Fully Supported (3) How does top management involvement, efficiency in enterprise resource planning, communication between departments, market dynamics influence strategic management accounting effectiveness. Top management involvement has a positive influence on resource allocation, reliability of management information, cost-benefit quality and mastery of strategic management.

First, the conceptual framework tests four dimensions of strategic management accounting effectiveness and its relationship with consequences. This is because the characteristics of strategic management accounting effectiveness are dynamic and continuous organizational development. In this research, an important contribution is the identification of the antecedents and consequences of the effectiveness of strategic management accounting.

The results of this research confirm that the effectiveness of strategic management accounting has a positive and influential impact on firm value through operational efficiency and management advantages.

Enhancing the governance of government-related companies through strategic management accounting practices and value creation. Strategic management accounting techniques: relationships with business strategy and strategic effectiveness of manufacturing organizations in Bangladesh. The Effects of Management Accounting Practices on the Financial Performance of Manufacturing Companies in Kenya Master of Science Degree in Finance, School.

The implementation of management accounting practices and its relationship with performance in small and medium-sized enterprises. Managerial Perceptions of the Role of Strategic Management Accounting Techniques in Decision Making: A Study of Nigerian Petroleum Marketing. Business strategy, strategic role of accountant, strategic management accounting and their relationship with business performance: An exploratory study of manufacturing companies in Malaysia.

APPENDICES

RAE2 The firm focuses on the appropriate use of information technology to achieve excellent resource savings. RAE4 The business uses resources that are appropriate, appropriate and maximize the benefits to the business. MIR2 The firm believes that providing management account information that is relevant will lead to accurate decisions.

MIR4 The company believes that the timely use of management account information will help increase the effectiveness of the decision. CBQ2 The company believes that there are estimates of the benefits over the cost of the resources required to invest in the project. CBQ4 The company uses various techniques (such as break-even point, NPV, IRR) so that the investment in the project receives the expected return.

MSM4 The company focuses on using the Theory of Constraints to effectively solve slow performance problems. OPE1 The company focuses on the timely production of products or services that meet the standard, including the delivery of products to customers in a short period of time. OPE5 The company is committed to operating with flexibility to achieve success in operating under uncertain conditions.

AOM1 The company is capable of producing standardized products or services on time, including rapid delivery of products to customers. FIV1 The company is able to prepare a profitability target and company plans. FIV3 The company is accepted by stakeholders as the most effective and efficient business operation.

ERP5 The firm focused on the application of enterprise resource planning systems to enable operations to achieve the objectives.