A unique feature of this book is the inclusion of Concept Checks in the body of the text. What is the expected value and standard deviation of the rate of return on his portfolio.

SUPPLEMENTS

Standard & Poor’s Educational Version of Market Insight

PowerWeb

ACKNOWLEDGMENTS

Gopala Vasuderan Suffolk University Joseph Vu De Paul University Simon Wheatley University of Chicago Marilyn K. Finally, we thank Judy, Hava and Sheryl, who contributed to the book with their support and understanding.

THE INVESTMENT ENVIRONMENT

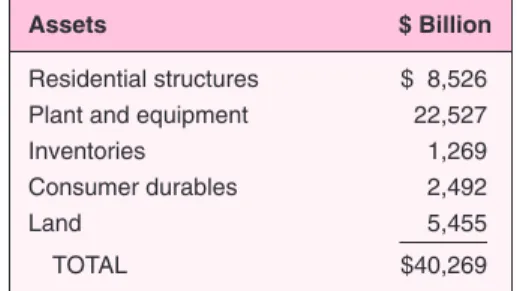

REAL ASSETS VERSUS FINANCIAL ASSETS

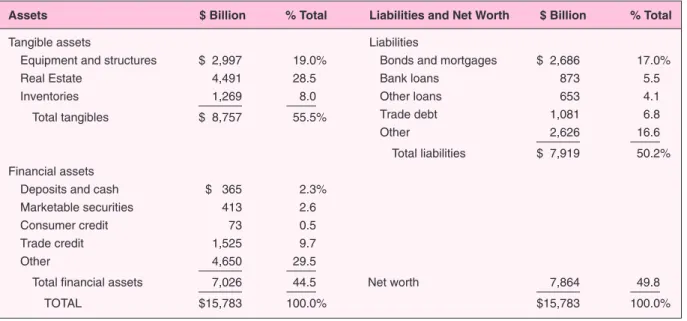

In this way, the values of financial assets are derived and depend on the value of the underlying real assets of the company. While real assets only appear on the asset side of the balance sheet, financial assets always appear on both sides of the balance sheet.

FINANCIAL MARKETS AND THE ECONOMY

Consumption Timing

Allocation of Risk

For example, if GM raises the funds to build its auto plant by selling both stock and bonds to the public, the more optimistic or risk-tolerant investors buy stock in GM. When investors can self-select into security types with risk-return characteristics that best suit their preferences, each security can be sold at the best possible price.

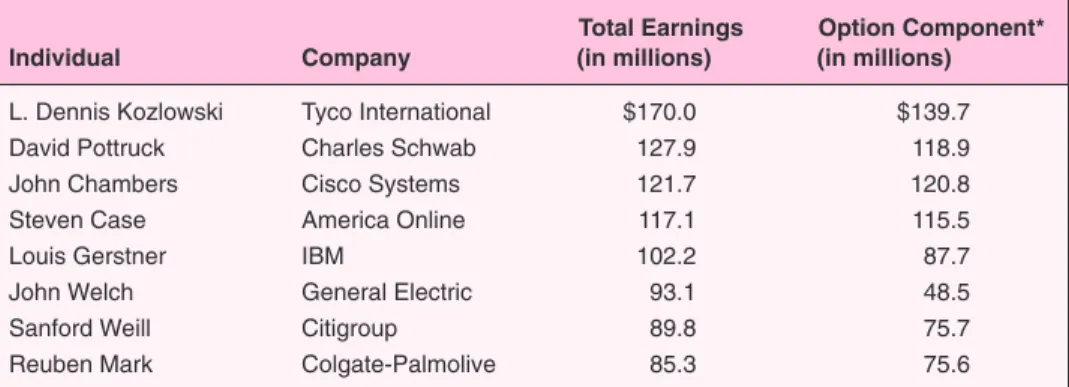

Separation of Ownership and Management

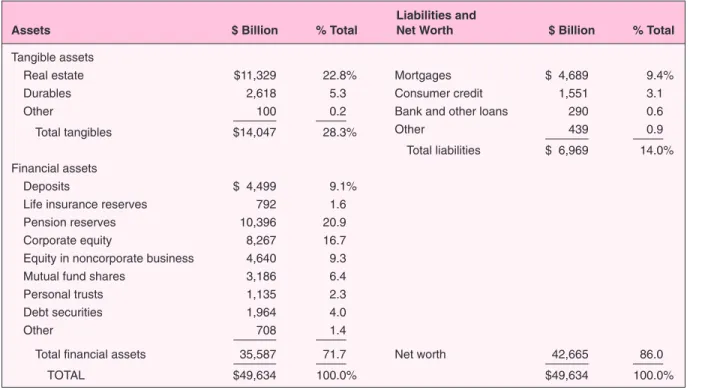

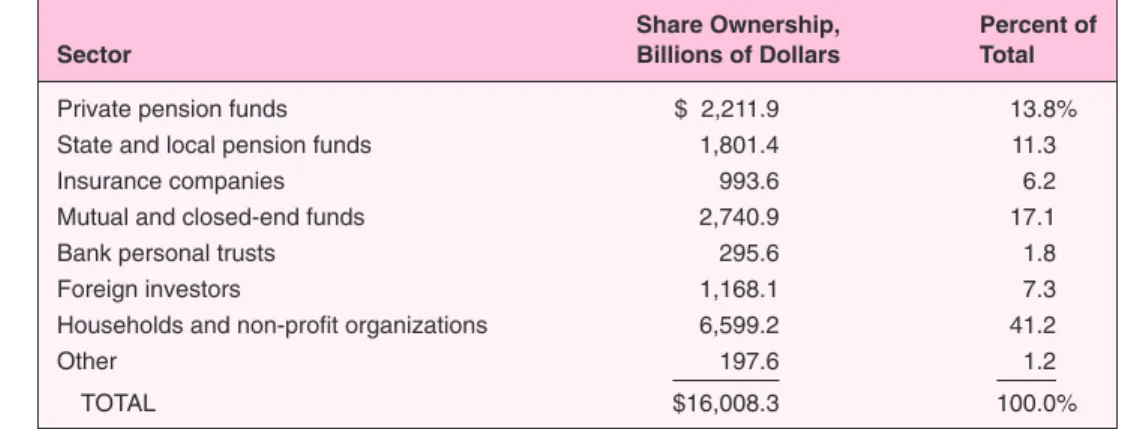

CLIENTS OF THE FINANCIAL SYSTEM

We begin our analysis with a broad view of the main customers that make demands on the financial system. The clientele of the investment environment can be classified into three groups: the household sector, the corporate sector and the government sector.

The Household Sector

At an obvious level, differences in risk tolerance create demand for assets with a variety of risk-return combinations. One way to hedge the risk is to buy securities that will increase in value as Florida real estate becomes more expensive.

The Business Sector

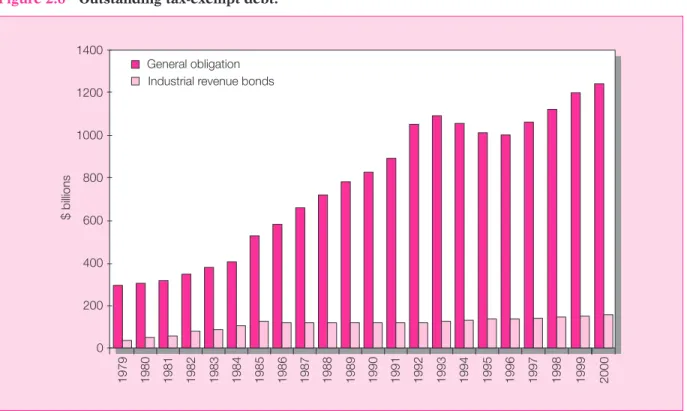

A desire to reduce taxes also leads to a demand for securities that are exempt from state and local taxes. In other words, differential tax status creates "tax clients" which in turn give rise to demand for a range of assets with a variety of tax implications.

The Government Sector

THE ENVIRONMENT RESPONDS TO CLIENTELE DEMANDS

Let us consider the market's reactions to the different demands of the three sectors.

Financial Intermediation

Mutual funds pool the limited resources of small investors into large amounts, gaining the benefits of large-scale trading; investors are allocated a pro rata share of the total funds depending on the size of their investment. This system offers small investors benefits that they are willing to pay in the form of a management fee to the investment fund manager.

Investment Banking

This observation reveals a profit opportunity filled by mutual funds offered by many investment companies. Some investment companies manage "commingled funds", in which the funds of different clients with similar objectives are pooled into a "mini-mutual fund", which is managed according to the general preferences of those clients.

Financial Innovation and Derivatives

In contrast, returns on derivative securities depend on additional factors related to the prices of other assets. For the time being, however, we refer you to the introduction to derivatives in the box below.

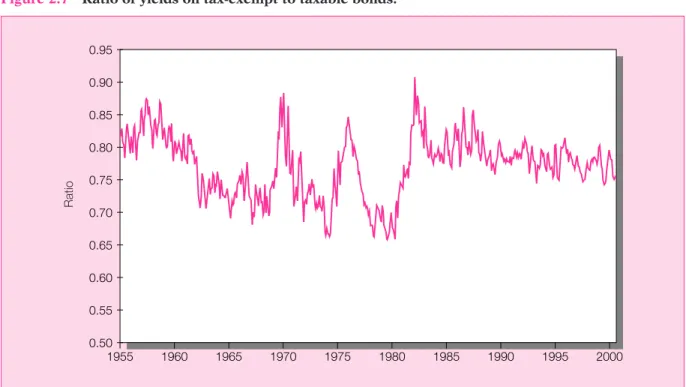

Response to Taxation and Regulation

MARKETS AND MARKET STRUCTURE

The next level of organization is a mediated market. In markets where trading in a good is sufficiently active, brokers may find it profitable to offer search services to buyers and sellers. An important brokerage investment market is the so-called primary market, where new issues of securities are offered to the public.

ONGOING TRENDS

Of course, a fair amount of market activity is required before making a market an attractive source of income. The most integrated market is an auction market, in which all transactors in a good converge in one place to bid or offer a good.

Globalization

A major step towards globalization was made in 1999 when 11 European countries introduced a new currency called the Euro. The idea behind the euro is that a common currency will facilitate global trade and encourage the integration of markets across national borders.

Securitization

Financial Engineering

Financial engineers view securities as bundles of (possibly risky) cash flows that can be cut up and repackaged according to the needs or desires of security market traders. Many of the derivative securities we talked about earlier in the chapter are products of financial engineering.

Computer Networks

Suppose you discover a treasure chest of $10 billion in cash

This site contains a card that gives you access to all Federal Reserve Bank sites. The San Francisco Fed has a search engine available for all of the banks' research articles.

MARKETS AND INSTRUMENTS

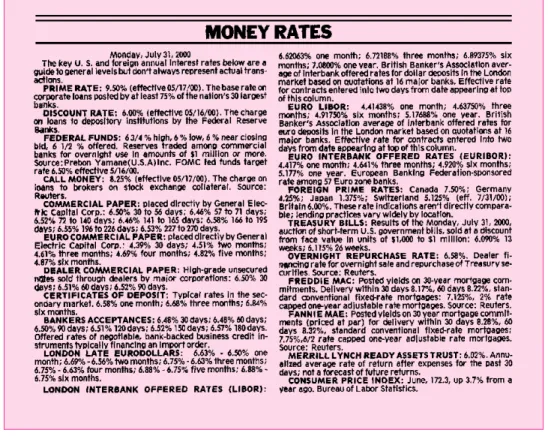

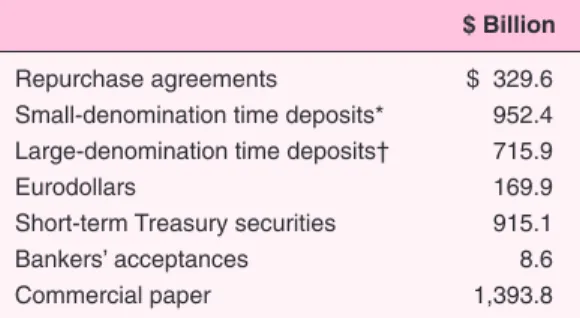

THE MONEY MARKET

These mutual funds pool the resources of many investors and purchase a wide variety of money market securities on their behalf. It includes the different instruments of the money market that we will describe in detail.

Treasury Bills

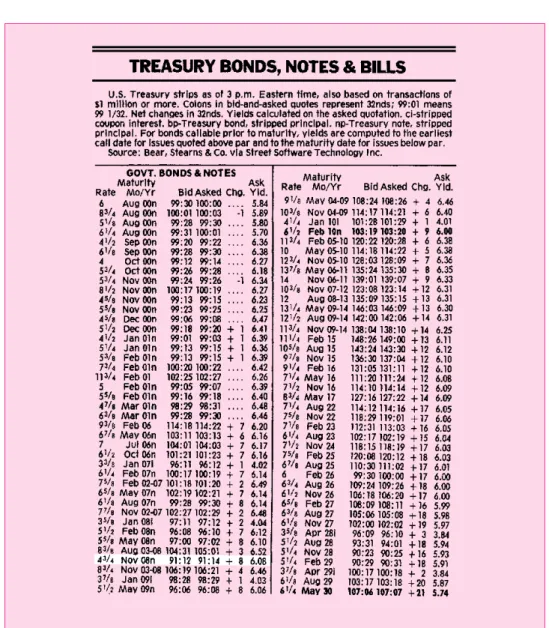

The origin of the discrepancy between the bank discount yield and the effective annual yield can be highlighted by examining the bank discount formula: Note that the bond yield equivalent correctly uses the bill price in the denominator of the first period and the 365-day year in the second period for annualization.

Certificates of Deposit

This is the bill's yield over its lifetime, assuming it is bought for the asking price. The bond equivalent yield is the yield on the bill over the period corresponding to its remaining maturity multiplied by the number of such periods in a year.

Commercial Paper

Bankers’ Acceptances

Eurodollars

Repos and Reverses

Federal Funds

Brokers’ Calls

The LIBOR Market

Yields on Money Market Instruments

THE BOND MARKET

Treasury Notes and Bonds

Federal Agency Debt

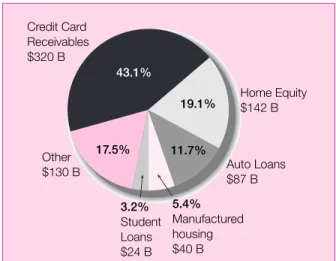

The major mortgage-related agencies are the Federal Home Loan Bank (FHLB), the Federal National Mortgage Association (FNMA, or Fannie Mae), the Government National Mortgage Association (GNMA, or Ginnie Mae), and the Federal Home Loan Mortgage Corporation (FHLMC, or Freddie Mac). Some of these agencies are government-owned and therefore can be seen as branches of the US.

International Bonds

Other agencies, such as the farm credit agencies, the Federal Home Loan Bank, Fannie Mae, and Freddie Mac, are simply federally sponsored. Although the debt of federally sponsored agencies is not explicitly guaranteed by the federal government, it is widely assumed that the government would step in with assistance if an agency were close to failure.

Municipal Bonds

Note that the equivalent taxable rate increases with the investor's tax bracket; the higher the class, the greater the value of the municipal exemption. The marginal tax bracket is given by the solution of Equation 2.4 for the tax bracket where the after-tax returns are the same.

Corporate Bonds

We can also use Equations 2.4 or 2.5 to find the tax range where investors are indifferent between taxable and tax-exempt bonds. Note, however, that it is difficult to precisely control for differences in the risks of these bonds, so the cutoff tax bracket should be taken as approximate. considerations when purchasing corporate bonds, and Chapter 14 discusses this issue in great detail.

Mortgages and Mortgage-Backed Securities

EQUITY SECURITIES

Common Stock as Ownership Shares

Characteristics of Common Stock

Limited liability means that most shareholders can lose if the corporation fails is their original investment. Unlike owners of unincorporated businesses, whose creditors can lay claim to the owner's personal assets (home, car, furniture), corporate shareholders can at worst have worthless shares.

Stock Market Listings

The highest and lowest price per share the stock traded at on that day were 50.69 and 50.13 respectively. The last, or closing, price of 50.63 was up 0.25 from the previous day's closing price.

Preferred Stock

STOCK AND BOND MARKET INDEXES Stock Market Indexes

Today, the first step in calculating the Dow is still to add up the prices of the component stocks. Still, it accounted for a whopping 5.5% of the Dow Jones industrials because it was one of the highest priced stocks in the Dow.

Dow Jones Averages

As a result, the composition of the average is occasionally changed to reflect changes in the economy. The fate of many companies once considered “the bluest of the blue chips” is a striking testament to the changes in the US.

Standard & Poor’s Indexes

The total market value of XYZ shares outstanding increases from $100 million to $110 million regardless of the stock split, making the split irrelevant to the performance of the index. Vanguard offers an index mutual fund, the Total Stock Market Portfolio, which allows investors to achieve the performance of the Wilshire 5000 Index.

Equally Weighted Indexes

Also note from Tables 2.3 and 2.4 that stock splits do not affect the market value weighted indices. The FTSE is published by the Financial Times of London and is a value-weighted index of the 100 largest corporations on the London Stock Exchange.

Bond Market Indicators

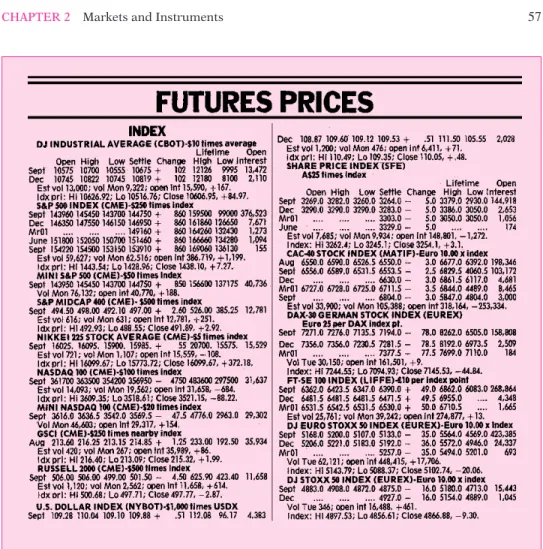

DERIVATIVE MARKETS

These instruments provide returns that depend on the values of other assets such as commodity prices, bonds and stocks Table 2.5 Example of MSCI Stock Indices. For this reason these instruments are sometimes called derivative assets, or contingent claims. Their values derive from or are conditioned by the values of other assets.

Options

The two columns to the right of EMC indicate the exercise price and expiration month for each option. This makes sense because the right to buy a share at a higher exercise price is worth less.

Futures Contracts

The repeated number below the company name is the current price of EMC stock, $70. The originator who issued the mortgage is merely servicing the mortgage, simply "passing through" the payments to the purchasers of the mortgage.

KEY TERMS

A call option is a right to buy an asset at a set exercise price on or before an expiration date. A futures contract is an obligation to buy or sell an asset at a specified futures price on an expiration date.

WEBSITES

The following multiple-choice problems are based on questions that appeared in past CFA examinations

Calculate the rate of return on a price-weighted index of the three shares for the first period (t0 to t1). The market value weighted index return is calculated by calculating the increase in the value of the stock portfolio.

HOW SECURITIES ARE TRADED

HOW FIRMS ISSUE SECURITIES

These new issues of stocks, bonds or other securities are typically marketed to the public by investment bankers in what is called the primary market. The purchase and sale of already issued securities among private investors takes place on the secondary market. We also distinguish between two types of primary market issuance: a public offering, which is an issue of shares or bonds sold to the general investor public, which can then be traded in the secondary market; and a private placement, which is an issue sold to at most a few wealthy or institutional investors and, in the case of bonds, usually held to maturity.

Investment Bankers and Underwriting

Initial public offerings, or IPOs, are shares of stock issued by a formerly private company that is selling shares to the public for the first time.

Shelf Registration

Private Placements

Initial Public Offerings

WHERE SECURITIES ARE TRADED

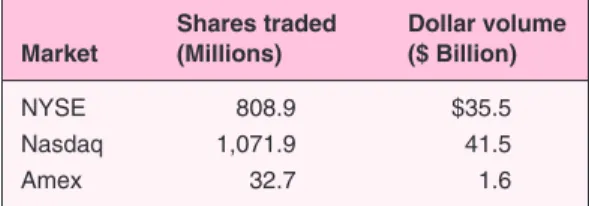

The Secondary Markets

Today, approximately 70% of transactions in NYSE-listed stocks are actually conducted on the NYSE. The over-the-counter Nasdaq market (described in detail shortly) has presented the NYSE with a greater competitive challenge.

The Over-the-Counter Market

These market makers hold inventory of a security and are constantly ready to buy or sell these shares to the public at the quoted bid and ask price. In practice, the corporate bond market is often quite "thin", in that there are few investors interested in trading a particular bond at any particular time.

The Third and Fourth Markets

In particular, major brokerage firms such as Goldman Sachs and Merrill Lynch are calling for the NYSE to increase its capabilities to automate orders without human intervention. This has made it difficult for the NYSE to flexibly respond to the impending challenge of ECNs.

The National Market System

TRADING ON EXCHANGES

The Participants

All trading in a given stock takes place at one location on the floor of the exchange called the specialist's post. The specialist firm can also act as a trader in the share and trade for its own account.

Types of Orders

In this case, the share is sold if its price falls below the agreed level. As the name suggests, the order allows you to sell shares to prevent further accumulation of losses.

Specialists and the Execution of Trades

However, occasionally the specialist's bid and ask prices will be better than those of any other market participant. Likewise, the effective bid price is the higher of the unexecuted limit purchase orders or the specialist's bid.

Block Sales

As the market buys and sells randomly hit the floor, the stock price will fluctuate between $30 and $32. The specialist in such circumstances understands that a position in the stock offers little downside risk and significant upside potential.

The SuperDOT System

Many trading strategies (such as index arbitrage, a topic we will study in Chapter 23) require an entire portfolio of stocks to be bought or sold simultaneously in a coordinated program. SuperDOT is the tool that allows the multiple trade orders to be sent out at once and executed almost simultaneously.

Settlement

TRADING ON THE OTC MARKET

In July 1996, the Justice Department reached a settlement with Nasdaq traders accused of colluding to maintain large spreads. In August 1996, the SEC settled with the National Association of Securities Dealers (NASD) as well as the Nasdaq stock exchange.

Market Structure in Other Countries

In October 1994, the Justice Department announced an investigation into the Nasdaq stock market for possible collusion among market makers to keep spreads at artificially high levels. The settlement called for NASD to improve oversight of the Nasdaq market and take steps to prohibit market makers from colluding over spreads.

The London Stock Exchange

The Tokyo Stock Exchange

However, Saitoris do not trade for their own accounts and are therefore quite different from traders or specialists in the United States. On the TSE, however, if order imbalances would result in price movements across consecutive trades deemed too extreme by the exchange, the saitori could temporarily halt trading and advertise the imbalance in the hope of attracting additional trading interest to the "weaks." ” side of the market.

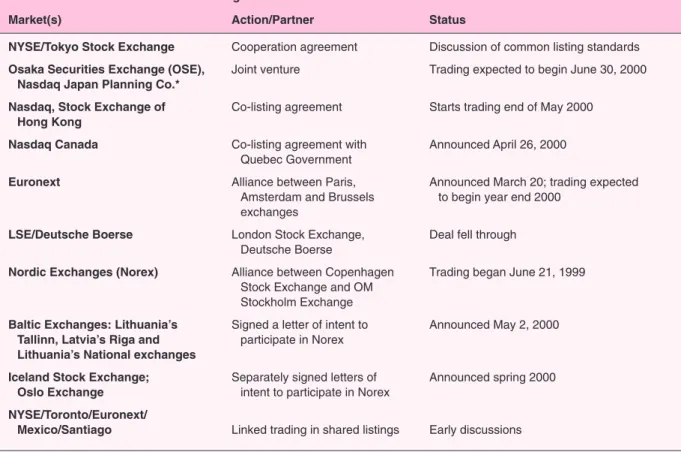

Globalization of Stock Markets

- TRADING COSTS

- BUYING ON MARGIN

- SHORT SALES

- REGULATION OF SECURITIES MARKETS Government Regulation

If the stock price fell below $57.14 per share, the investor would receive a cover call. So when the share price changes, so does the value of the loan.

BUYING ON MARGIN

The 1934 Act established the Securities and Exchange Commission to administer the provisions of the 1933 Act. The Act thus established the SEC as the administrative agency responsible for broad oversight of the securities markets.

SHORT SALE

The SEC is concerned only with the disclosure of relevant facts; investors themselves assess the value of the security. The various state laws were somewhat unified when many states adopted parts of the Uniform Securities Act, which was proposed in 1956.

Self-Regulation and Circuit Breakers

The Securities Investor Protection Act of 1970 established the Securities Investor Protection Corporation (SIPC) to protect investors from losses if their brokerage firms fail. State laws to prohibit fraud in securities sales were enacted before the Securities Act of 1933.

Insider Trading

If the price falls to $30 per share by the end of the year, what is the remaining margin in her account. How high can the price of the stock go before you get a margin call if the maintenance margin is 30% of the value of the short position.

MUTUAL FUNDS AND OTHER INVESTMENT COMPANIES

INVESTMENT COMPANIES

Diversification and shareability. By pooling their money, investment companies allow investors to hold fractional shares of many different securities. Professional management. Many, but not all, investment companies have a full-time staff of security analysts and portfolio managers who seek to achieve superior investment results for their investors.

TYPES OF INVESTMENT COMPANIES

Lower transaction costs. Because they trade large blocks of securities, investment companies can realize significant savings on brokerage fees and commissions. Although all investment companies pool the assets of individual investors, they must also distribute the claims on those assets among those investors.

Unit Investment Trusts

Managed Investment Companies

To see why this is a puzzle, consider a closed-end fund that sells at a discount to net asset value. Interestingly, while many closed-end funds are sold at a discount to net asset value, the prices of these funds are typically above NAV when originally issued.

Other Investment Organizations

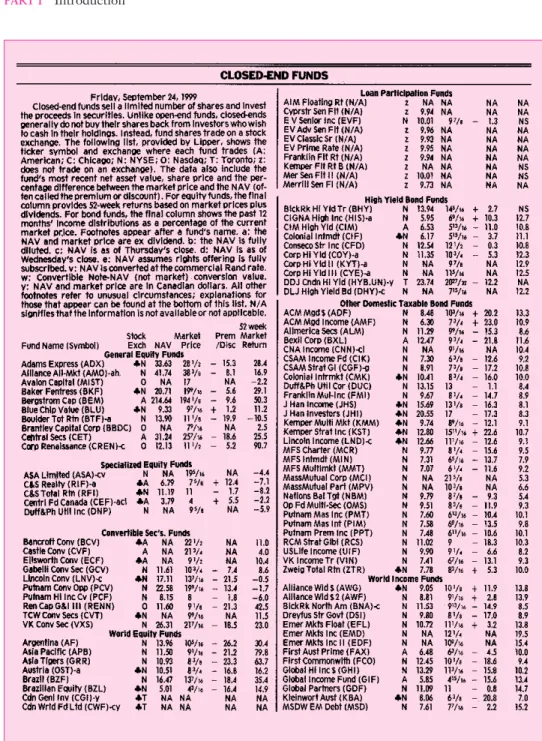

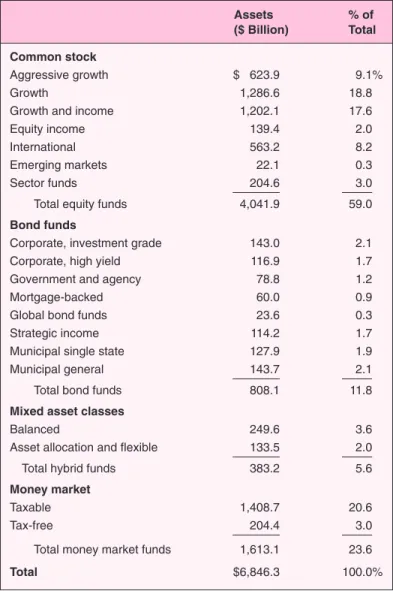

MUTUAL FUNDS

It is the dominant investment company today, accounting for approximately 90% of the investment company's assets.

Investment Policies

Asset Allocation Funds These funds are similar to balanced funds in that they hold both stocks and bonds. For example, the Vanguard Group funds are listed beginning at the bottom of the first column.

How Funds Are Sold

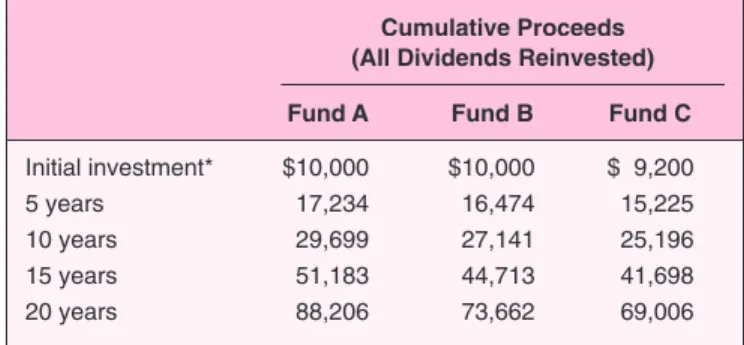

COSTS OF INVESTING IN MUTUAL FUNDS Fee Structure

Therefore, 12b-1 fees (if any) must be added to operating expenses to arrive at the fund's true annual expense ratio. For example, Merrill Lynch introduced Class D shares of some of its funds that include entry loads and 12b-1 fees of .25%.

Fees and Mutual Fund Returns

- TAXATION OF MUTUAL FUND INCOME

- EXCHANGE-TRADED FUNDS

- MUTUAL FUND INVESTMENT PERFORMANCE: A FIRST LOOK

- INFORMATION ON MUTUAL FUNDS

- Would you expect a typical open-end fixed-income mutual fund to have higher or lower operating expenses than a fixed-income unit investment trust? Why?

The brief explanation of the fund's investment policy is in the upper right corner: Magellan is a More data on the fund's results can be found in the graph at the top right of the figure.

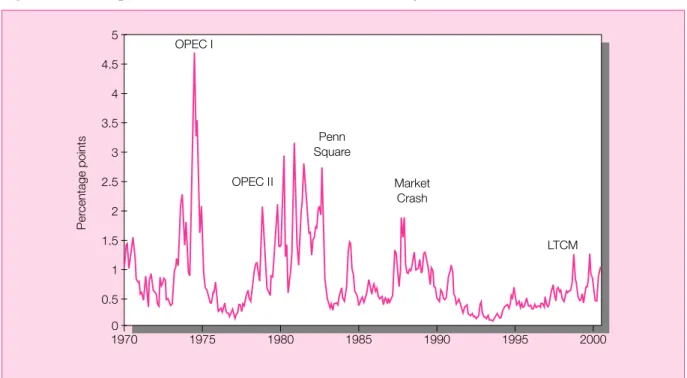

HISTORY OF INTEREST RATES AND RISK PREMIUMS

DETERMINANTS OF THE LEVEL OF INTEREST RATES

Interest rates and forecasts of their future values are among the most important inputs in an investment decision. Forecasting interest rates is one of the most notoriously difficult parts of applied macroeconomics.

Real and Nominal Rates of Interest

If, for example, the interest rate on a one-year CD is 8% and you expect inflation to be 5% over the coming year, using the approximation formula you expect the real interest rate to be r8% – 5% 3% . You can thus only derive the expected real interest rate on these investments by subtracting your expectation of the inflation rate.

The Equilibrium Real Rate of Interest

In other words, because future inflation is risky, real returns are risky even if the nominal interest rate is risk-free. So while the fundamental determinants of the real interest rate are the propensity of households to save and the expected productivity (or we could say profitability) of investments in physical capital, the real interest rate can also be affected by fiscal and monetary measures of government. policy.

The Equilibrium Nominal Rate of Interest

The government and the central bank (Federal Reserve) can shift these supply and demand curves either to the right or to the left through fiscal and monetary policies. This increases the demand for government loans and shifts the demand curve to the right, which causes the equilibrium real interest rate to rise to point E'. That is, a forecast showing higher than previously expected government borrowing raises expected future interest rates.

Bills and Inflation, 1954–1999

Nominal interest rates can be seen as the sum of the required real interest rate on nominally risk-free assets plus a "noisy" forecast of inflation. This implies that expected returns on longer bonds may contain a risk premium, so that the expected real interest that bonds with varying maturities offer may also vary.

Taxes and the Real Rate of Interest

RISK AND RISK PREMIUMS

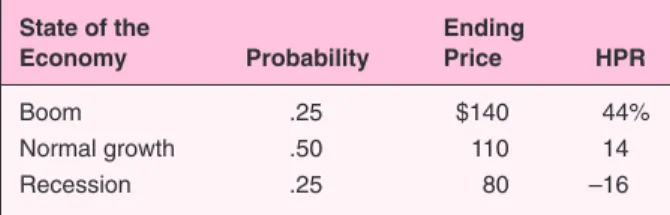

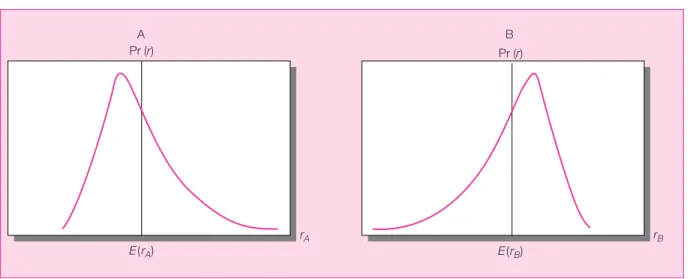

The expected return is a probability-weighted average of the return in each scenario. The standard deviation of the rate of return does not distinguish between these two; it treats both simply as deviations from the mean.

THE HISTORICAL RECORD

Bills, Bonds, and Stocks, 1926–1999

REAL VERSUS NOMINAL RISK

The distinction between the real and the nominal rate of return is crucial in making investment choices when investors are interested in the future purchasing power of their wealth. Looking again at Table 5.3, you can see that an investor expects an inflation rate of 8%.

The economy’s equilibrium level of real interest rates depends on the willingness of households to save, as reflected in the supply curve of funds, and on the expected prof-

Even professional economic forecasters admit that their inflation forecasts are not certain even for the next year, not to mention the next 20. and on prof-.

You have $5,000 to invest for the next year and are considering three alternatives

18. You are faced with the probability distribution of the HPR of an exchange-traded index fund given in Table 5.1 of the text. What is the probability distribution of your dollar return at the end of the year.

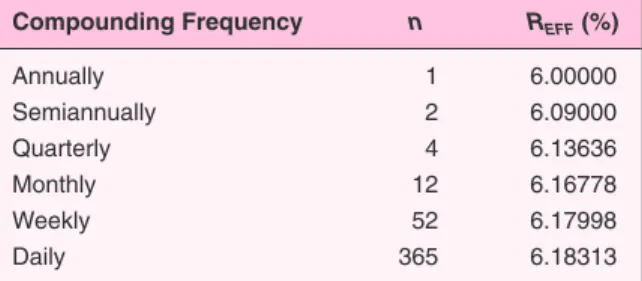

APPENDIX: CONTINUOUS COMPOUNDING

Assume that the price of a put option on a share of the index fund with an exercise price of $110 and a maturity of one year is $12. What is the probability distribution of the HPR on a portfolio consisting of one share of the index fund and one put option.

RISK AND RISK AVERSION

RISK AND RISK AVERSION

Risk with Simple Prospects

Therefore, the expected marginal or incremental return of the risky portfolio over the investment in safe Treasuries is Indeed, one of the central concerns of finance theory (and much of this text) is measuring risk and determining the risk premiums that investors can expect from risky assets in well-functioning capital markets.

Risk, Speculation, and Gambling

What is more likely, however, is that the bet is the result of differences in the probabilities that Paul and Mary assign to the outcome. However, if Paul and Mary regularly enter into such contracts, they will recognize the information problem in one of two ways: either they will realize that they are creating gambling when each wins half of the bets, or the consistent loser will recognize that he or she has bet based on inferior predictions.

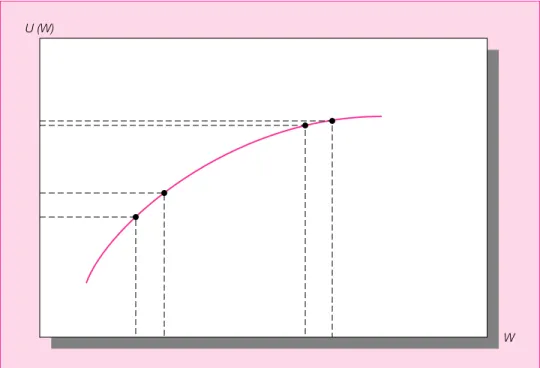

Risk Aversion and Utility Values

PORTFOLIO RISK

Asset Risk versus Portfolio Risk

A Review of Portfolio Mathematics

The rate of return for each scenario is the simple average of the rates on Best and SugarKane because the portfolio is split equally between the two stocks (see rule 3). The desirability of a risky portfolio to a risk-averse investor can be summarized by the portfolio's security equivalent value.

WEB SITES

The risk premium must be large enough to compensate a risk-averse investor for the risk of the investment. The inmium must be large enough to compensate a risk-averse investor for the risk of the investment. Based on the utility formula above, which investment would you choose if you were risk averse with A4.

APPENDIX A: A DEFENSE OF MEAN-VARIANCE ANALYSIS Describing Probability Distributions

The importance of all moments outside the variance is much smaller than that of the expected value and variance. Samuelson, "The Fundamental Approximation Theorem of Portfolio Analysis in Terms of Means, Variances and Higher Moments," Review of Economic Studies37 (1970).

Normal and Lognormal Distributions

Using a specific investor benefit function (such as log utility) allows us to calculate the equivalent safety value of the dangerous perspective for a particular investor. The safety equivalent of the risky venture is less than the expected outcome of $100,000.

兹 W CE

There is a 0.001 probability that your house will burn to the ground and its value will be reduced to zero. How much would you be willing to pay for insurance (at the beginning of the year) with a log function of wealth at the end of the year.

CAPITAL ALLOCATION

BETWEEN THE RISKY ASSET AND THE RISK-FREE ASSET

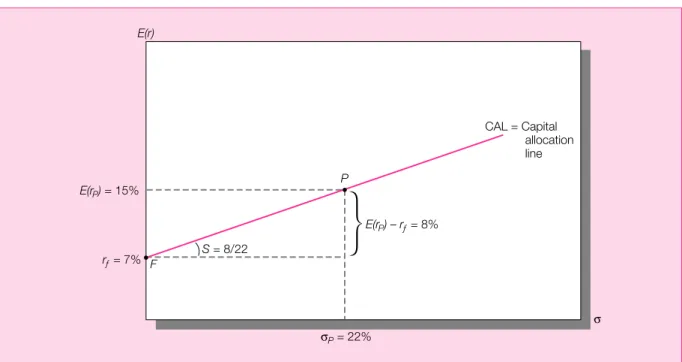

- CAPITAL ALLOCATION ACROSS RISKY AND RISK-FREE PORTFOLIOS

- THE RISK-FREE ASSET

- PORTFOLIOS OF ONE RISKY ASSET AND ONE RISK-FREE ASSET

- RISK TOLERANCE AND ASSET ALLOCATION

Rather, we reduce the relative weight of the risky portfolio as a whole in favor of risk-free assets. What will change is the probability distribution of the rate of return on the complete portfolio consisting of the risky asset and the risk-free asset.