E XECUTIVE S UMMARY

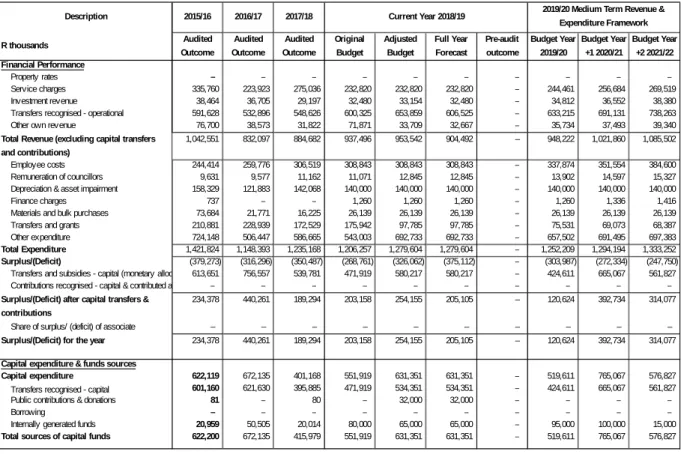

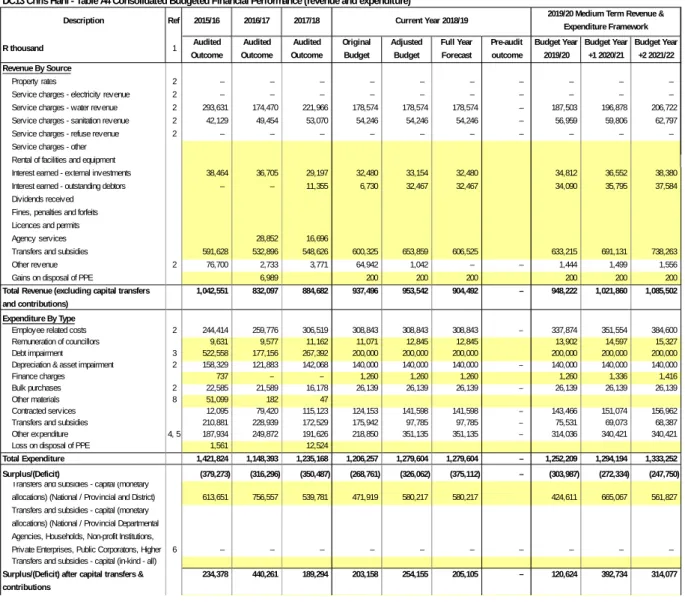

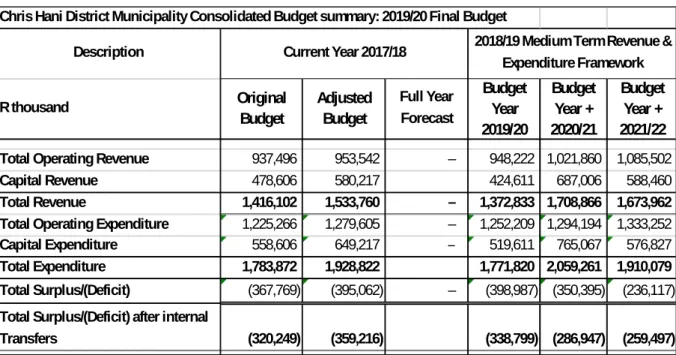

The operating deficit for the last two years is steadily decreasing from R 303.9 million in the current budget year to R 272.3 million and R 247.7 million in the last two years. These shortages indicate that the municipality must increase its own income from water and sanitation in order to eliminate the shortage. The capital programs show signs of an increase and decrease in the last two years to R 765.1 million and R 576.8 million respectively.

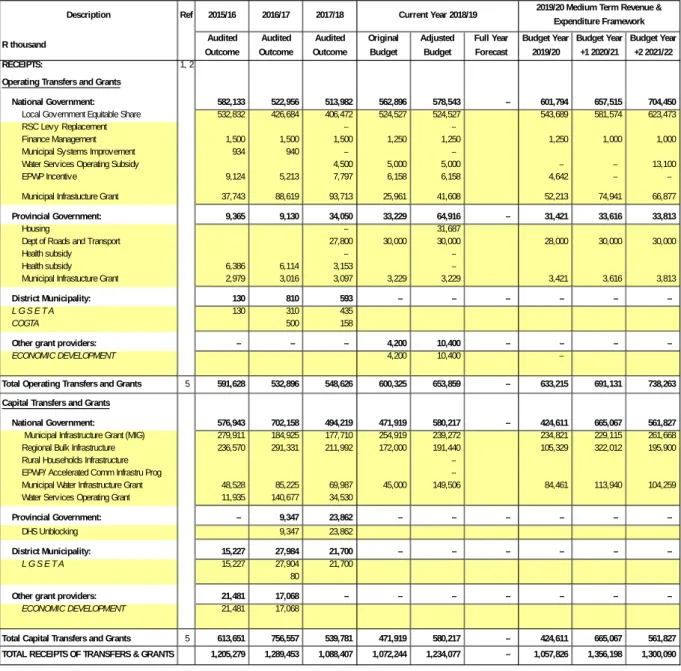

The main source of capital funding for the municipality is national conditional grants intended to finance infrastructure. The municipality must devise and fully implement a revenue-raising strategy to increase the municipality's revenue base. The municipality has to budget for the maintenance of the capital assets of the infrastructure in order to maintain its service delivery potential.

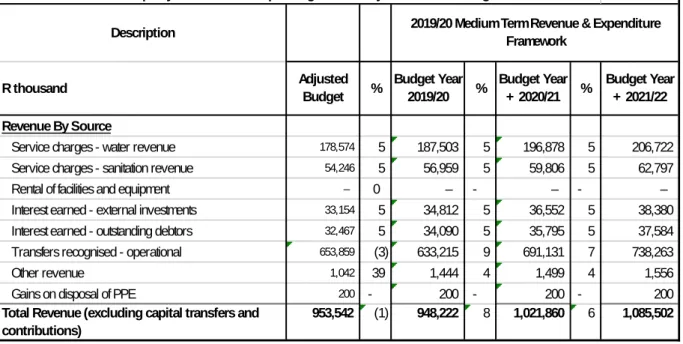

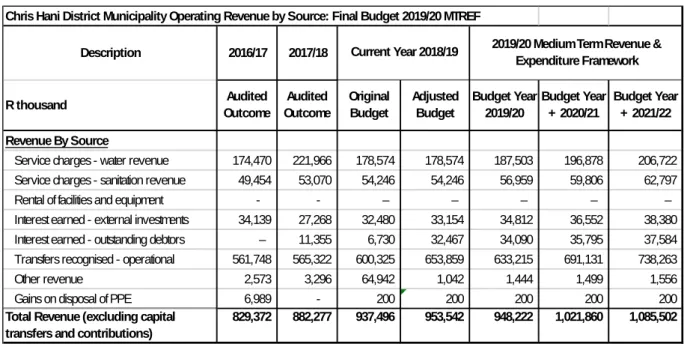

O PERATING R EVENUE F RAMEWORK

Known operational transfers which are actually operating grants, are the main source of revenue flow and account for 66.7% of the municipality's total operating revenue amounting to R633.2 million. In the 2019/20 financial year, revenue from water service charges amounted to R187.5 million or 19.7% of total operating revenue and sanitation services are 56.9 and account for 6% of total revenue operative. Water revenue increases to R196.8 and R206.7 million in the respective MTREF financial years.

An effective and efficient revenue raising strategy will improve the collection rate of budgeted revenues from the municipality. Service charges – water and sewerage revenues account for 25.7% of total operating revenues, therefore the municipality needs to focus on effective implementation of the credit control policy to improve the debt collection rate. The municipality as an Authority and Water Service Provider is currently facing challenges in billing, debt collection and enforcement of water charges across the county.

The above allocations are not sufficient to maintain, restore and ensure the sustainability of the water infrastructure assets which should generate a revenue base for the municipality in order to cover operating and capital costs. Attached is Annex A, which shows the breakdown of the rates to be implemented in the recognition of own income from water and sanitation services.

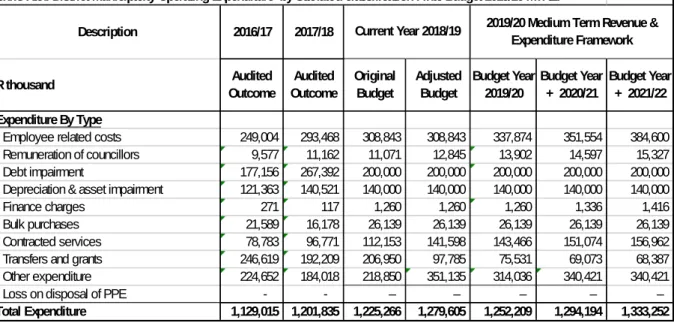

O PERATING E XPENDITURE F RAMEWORK

The budgeted allocation for employee-related costs for the financial year 2019/20 amounts to R 337.8 million, which corresponds to 26.9% of the total operating expenses. Based on the 3-year collective agreement for wages and salaries, wage increases have been included in this budget with a percentage increase of 7% for the financial year 2019/20. An annual increase of 6.9% is included in the last two years of the MTREF.

The municipality has also prioritized filling all vacant and critical positions within the 2019/20 financial year. The budget allocations in this connection amount to R 140 million. for the financial year 2019/20 and corresponds to 11.2% of the total operating expenses. The municipality will engage in a revenue promotion strategy, joint internal audit, security services and support for the preparation of the annual accounts, and therefore use consultants to assist with the processes.

In the 2019/20 financial year, these combined expenses amount to R 32.3 million and have decreased by 2.5% compared to the third adjustment budget. As part of the process to identify further cost efficiencies, a business process redesign project will commence in the 2019/20 financial year to identify alternative practices and procedures, including building internal capacity for certain activities that are currently outsourced. Other expenditure decreased by 11% for 2019/20 budget year, compared to the third adjustment budget.

Also included in other expenses are fair co-financed IDP projects from various departments to the value of 103.1 million. R, which is linked to SDBIP, and repairs and maintenance corresponding to R 112.1 million. or 9% of the total operating budget. The provision for debt write-downs is budgeted at R 200 million. in the financial year 2019/20 and constitutes 15.9% of the total operating expenses. This was determined based on an estimated collection rate of 20% and the municipality's debt write-off policy.

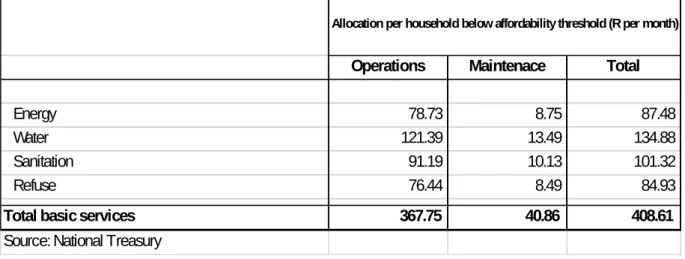

To receive these free basic services, households must register under the municipality's needy policy regarding water and sanitation. The cost of indigent support to the registered indigent households is largely financed by the national government through the local government's fair share received in terms of the annual Division of Revenue Act. The basic services component provides a subsidy of R 408.61 per month in 2019/20 towards the costs of providing basic services to each of these households.

C APITAL EXPENDITURE

The Council made a provision from its reserves of R 95 million for 2019/20, R 100 million and R 15 million for the two outer years to deal with fleet shortages, CHDM Village and to improve on trade aids.

A NNUAL B UDGET T ABLES - P ARENT M UNICIPALITY

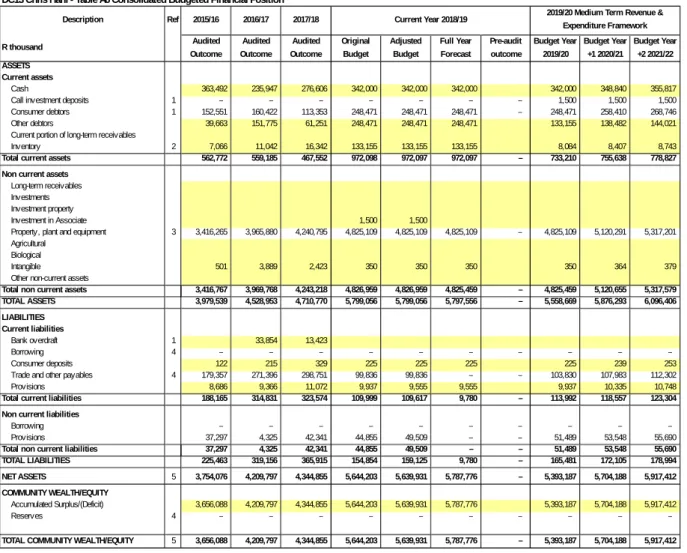

This requires the simultaneous assessment of the Financial Performance Budget, Financial Position and Cash Flow, along with the Capital Budget. This puts the municipality in a very vulnerable financial position, as the rate of revenue collection from water and sewerage services is very low and needs to be increased. The municipality must ensure that it improves billing and revenue collection from water and sanitation services so that there is money available to finance the provision of services and waste infrastructure.

It remains relatively constant in the medium term, this revenue stream is the revenue base for the municipality that needs to be improved in the future. These grants make up 66.8% of the municipality's total revenue base and are therefore an indication that the municipality needs to focus on invoicing and collection of own income in order to have a better cash flow position. Employee-related costs are the biggest cost driver for the municipality at 27% of the total operating expenditure budget.

These costs have risen sharply over the years due to filling vacancies in the municipality and also annual increases in accordance with the collective labor agreement of the negotiating council. The budget appropriations for the last two years are indicative allocations based on the business plans of the departments as informed by the IDP and will be reviewed annually to assess the relevance of the expenditure in relation to the strategic objectives and service obligations of the municipality. These appropriations have been included for the assessment of the financing of the MTREF, but no commitments will be made against one-year appropriations for the last two years.

The justification is that ownership and the net assets of the municipality belong to the community. As an example, the collection rate assumption will have an impact on the cash position of the municipality and subsequently inform the level of cash and cash equivalents at the end of the year. It can be seen that the cash levels of the municipality increase slightly over the years 2019/20 to 2021/22 due to the average increase in Equitable Share and conditional grants received by the municipality and increased operating expenditure levels.

Furthermore, the municipality must take into account a realistic collection rate as this has implications for the funding of the budget. According to the proposal, the increase must be linked to the consumer price index (CPI) which is estimated to be 5.2% for 2019/2020. The rates related to consumption of water will be charged from 01 July 2019 on all accounts linked to water and accounts opened after July 2019 will be charged for the relevant period of the year.

However, any connection larger than 20 mm and the house is not used exclusively for residential purposes will be charged according to the rates. Applicable rates for sanitary services are applicable from 01 July 2019 and accounts opened after July 2019 will be charged for the applicable period of the year.