That is why we have adopted five strategic priorities, which are aligned with the five manifest priority areas of the ruling party. Let me start by saying that preparing the IDP and the budget was a big challenge. There should be no doubt about this Council's continued commitment to the needy and the poorest of the poor.

The Ministry of Tourism will spend R15 million on further development of the Bonkolo dam. 35% of the R15 million will be used for labour, the majority of which will come from local residents. Madam Speaker, returning to the main points of the day, allow me to turn now to the unpleasant part of our budget.

Tariff Proposals

We call on all our communities to make an effort to pay for the services they use so that we can further improve the living conditions of our people in the area. It will also be wrong, Madam President and the Council in general, not to mention the Audit Committee, who gave us the green light for the first time to proceed with this budget. Madam Chairman, for the first time we have to report to the Council that the IDP priorities are linked to the budget and that they have been defined as departmental needs that should define the services we must implement over the next five years.

Madam Chairman, I am formally moving the approval of the integrated development plan and budget strategy and expenditure framework for 2012/13 to 2014/15, as well as the revised budget-related policy for Lukhanji Municipality. I further advocate the adoption of the recommendations contained on pages 28 and 29 of the budget document. Finally, I am moving the approval of the proposed Rates and Rates as included in Annex A of the budget document from page 115 to 123.

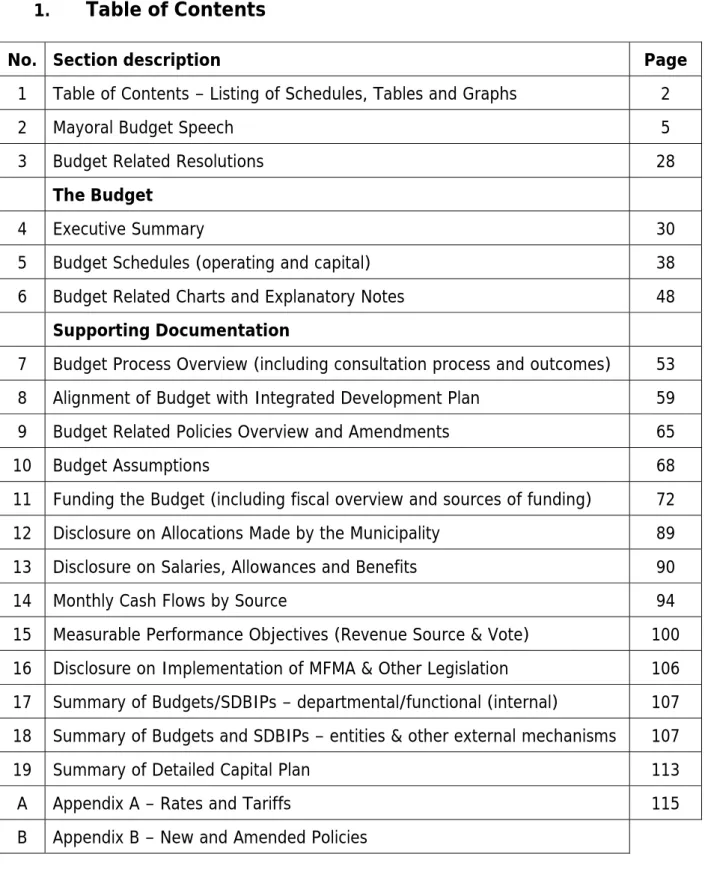

Budget Related Resolutions

4 Executive Summary

The operational budget provides for the payment of an agency by the Chris Hani District Municipality for the provision of water and sanitation services to the tune of R55,437,452 in the Lukhanji Municipal Area. In addition, the budget provides for the filling of all positions for the entire year, unless contract workers are used instead of a vacant position. In Rand terms, the salary and allowances budget increased by almost Rand 13.8 million compared to the adjusted budget in the current 2011/12 budget.

The main items include the allocation of R32 million in conditional capital grants awarded to the municipality, R39.5 million to be funded from surplus cash reserves and R26 million from a loan. The appendix provides a separate list of the various conditional grants/other funded items and programs included in the operational budget. The majority of these items (amounting to approximately R7.1 million) are funded through conditional grants, which specify exactly what the money can be spent on.

How the Total Budget Operating Revenue are funded (R524 million)

Sewer 3.02%

Water 5.34%

Elec 29.42%

Lic, Permits, Fines

Agency 10.57%

Other 7.41%

Transfers recognised -

Refuse 3.97%

Rates 8.28%

Cash Carry Forward

How the Total Budget Operating Expenditure are allocated (R487 million)

5.3 - Table A3 - Budgeted financial performance (income and expenditure by municipal vote) 5.4 - Table A4 - Budgeted financial performance (income and expenditure). Real estate rates (R-value threshold) Water (kiloliters per household per month) Sanitary (kiloliters per household per month) Sanitary (Rand per household per month) Electricity (kWh per household per month) Household waste (average liters per week). These charts align with the budget charts presented above and are presented to illustrate the related numerical chart.

The following schedule was accepted by Council in August 2011 and was followed in the preparation of the 2012/13 medium term budget document.

Lukhanji Municipality 2012/13

KEY DEADLINES FOR BUDGET PREPARATION SCHEDULE

Alignment of Budget with Integrated Development Plan

Every year the IDP must be reviewed as required by the Municipal Systems Law and the MFMA. It should be reviewed in terms of performance in achieving results and outcomes, as the current financial position and future fiscal outlook for the municipality will have a direct impact on achievement. The review should ensure that the plans are still within Lukhanji's financial capacity.

This section should give readers a good understanding of what is contained in the IDP and how it guides the allocations in the budget. The intention is not to attach the IDP as an attachment or to repeat everything in the IDP. However, it is critical that the user of the budget documentation obtains a good high-level overview of the IDP and is referred to the detailed IDP documentation.

Vision

Mission

Value

LUKHANJI DEVELOPMENT TARGETS FOR 2012/2017

This section seeks to provide a broad overview of the budget policy framework and highlight the amended policies to be approved by council resolution. This policy lays down the framework and the principles according to which the municipality deals with those citizens who either want to join the municipal services or fall into arrears with the municipal services for which their service is provided. This policy sets out the application process, the invoicing process and the mechanism to be used when carrying out the debt collection function.

The free basic services policy is written in accordance with national directives and recommendations and states that households registered as poor in the municipality will receive free 50kw of electricity and 10kl of water each month to provide basic services. In accordance with the MFMA, the council adopted a 'cash and investment policy' in the previous financial year, which sets out various principles and reporting requirements for the municipality's investments. In 2007/08, a debt management policy was also adopted, which defines the municipality's debt policy.

This policy sets out the framework a municipality uses when considering the use of debt for a project. This policy also sets self-explanatory limits on the total amount of debt a municipality can issue and the amount required each year for annual debt service. MFMA required the municipality to adopt and implement a new supply chain policy by 1 January 2006.

The policy set limits on the various procurement methods used in the municipality and delegated the authority to implement the policy to the accountant as required by the ZMFM. This policy delegates certain powers and responsibilities to the mayor and municipal manager and requires that all such expenditures be submitted to council in an adjustment budget as soon as possible. This policy is intended to set guidelines for the issuance, use or budget of debt instruments in the municipality.

In order to prepare meaningful budgets, it is necessary to assume internal and external factors that could affect the budget.

Budget Assumptions Table 2012/13

Table 10 – Revenues by Source and Vote

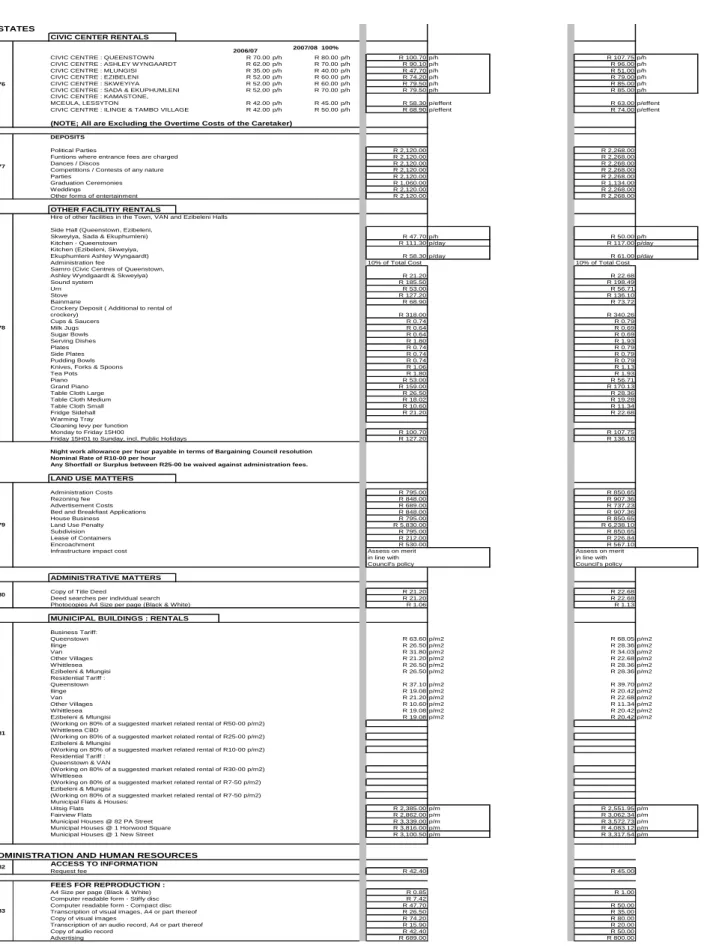

Electricity Distribution 367,000 Electricity Reconnection / Tamper Charges This is a fee payable where services to the property have been cut off due to non-payment or an individual has tampered with that service. Sports fields 155,500 Rental of real estate This is a cost-covering levy for the use of sports facilities by the. Housing: Estates 1,999,577 Rental of real estate These are properties owned by the municipality and rented out on the market.

Civic Centres: Estates 361,080 Real Estate Rentals These are public centers that are rented to the public for functions ect. Traffic Administration 3,500,000 Motorcycle Registration This is a fee paid by the Eastern Cape Province for the provision of a service. 287,700 Construction costs These are cost-covering costs only and will grow as a result of construction activities.

Streets 76,000 Connection costs: Private work This is a cost-covering fee only for doing private work for the. Unit 8,657,246 Project Fees These are cost recovery costs for managing projects on behalf of third parties. Cemetery 430,000 Graves Graves This is a compensation for digging graves for the community.

5,000 pound grazing fees and commonage This is a fee to cover the cost of feeding impounded animals by the pound. Pound and Commonage Fees £675,000 This is a fee to cover the cost of keeping impounded animals in the pound. Protective Services Control 134,621 WSSA Contribution This is a fee to recover the cost of providing a 24-hour response center at.

Traffic Administration 375,000 Roadworthiness Certificates This is a cost recovery charge when people test their vehicles.

Lukhanji Municipality BUDGET

APPENDIX A

RATES AND TARIFFS

If the owner/operator of a commercial or business enterprise wants to improve his building by paving the sidewalk next to the building, the owner/operator will provide all the materials and the municipality will only provide labour. Type of connection From existing low voltage network (LV) to the consumer's distribution board mounted in the interior of the home. Consumer type Domestic/commercial (1 phase) Government products only Type of connection From existing low-voltage grid connection (lv) to the.

Type of Consumer Domestic/Commercial (3 Phase) (Prepaid) Type of Connection From the existing low voltage network (lv) to. Type of Connection From the existing low voltage network (lv) to the point of supply of consumers to a meter booth mounted on the border of the consumer's premises or booth or meter room. Type of connection From the existing substation to the low voltage network supply point (lv) to a meter booth mounted on the boundary of the consumer's premises or a booth on the consumer's premises or a metering room.

Type of Supply Connection Point located adjacent to or integral with the substation building at the customer's premises. Connection Type 11kv supply from Municipal meter switch to 11kv customer switch. However, a customer could supply all the material and carry out all your work, but on the day of commissioning of the supply point, the whole installation is handed over to the Municipality.

The funds now belong to the municipality, which will be responsible for all maintenance and repairs in the future. There is no benefit for the customer, so the municipality is responsible for supplying the relay free of charge. iii). For animals delivered to a pond, one or more per kilometer or part of a kilometer R5.00 R5.50.

These fees will not be applicable to the following: Local schools, welfare or non-profits.