Midstream Estate, a security village was started six years ago and is currently in the development stage. Due to the high risks associated with property development, E.T Construction wants to establish a framework for the successful development of these five houses. This study will mention the different aspects that can affect this problem and also focus on the best possible project approach so that everyone will benefit from this project.

The aim will be to evaluate all the different alternatives, and finally draw up a framework for a successful residential real estate development, and to determine all the positive and negative aspects of the decision that will be made.

Introduction and Background

Project Aim and Scope

Specific Objectives

Deliverables

Project Team

Scope

Literature Study

Introduction to Property Development

- Property Development Framework

- Requirements for a Successful Property Development

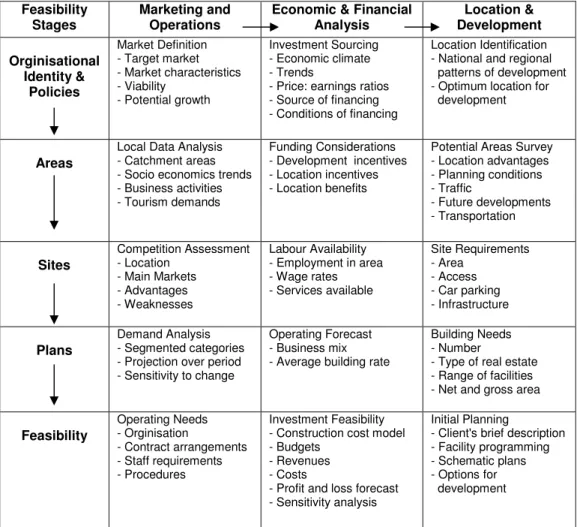

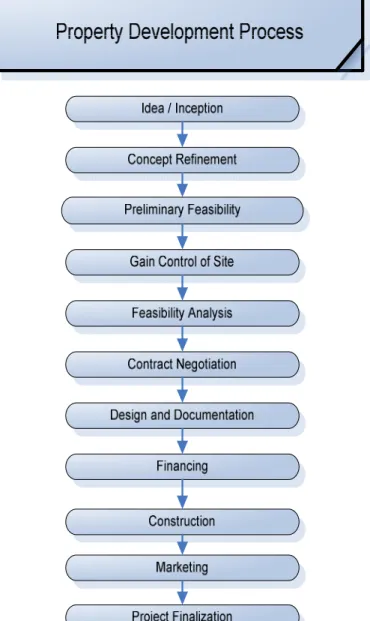

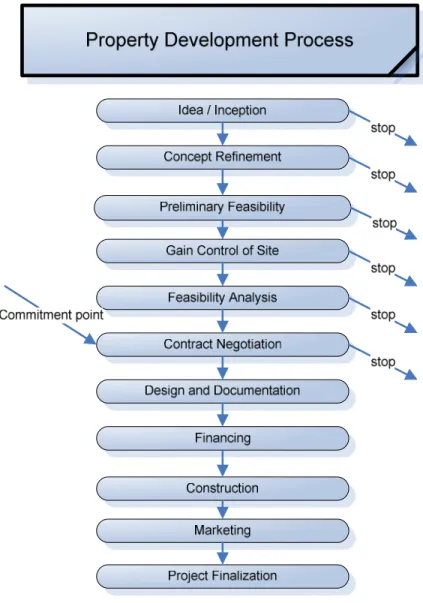

As a brief introduction to the property development process, the following framework illustrates the approach suggested for the developer. The ability of an architect to design a product that will meet the requirements of the cost structure and at the same time ensure maximum demand.

Property Development

- Property Development Process

- Project Objectives and Strategies

- Types of Property Developments

- Single Family Homes vs. Multi - Family Residence

- Benefits and Drawbacks of Different Properties

The developer must prepare schematic architectural layouts and determine whether the project is physically feasible. If the detailed feasibility study does not meet all of the client's goals, the project must be abandoned and the client must either leave. At this point, the developer will get a permanent loan, if that is the case.

This handover should only take place if all the relevant practical issues have been addressed by the developer for the successful completion of the project. The following questions will provide answers to the developer in terms of the project objectives (Adapted from Baltin et al. Another advantage is that the developer can make relatively large profits if the project is successful.

The disadvantage is that full-time site management will be required and the developer must be good.

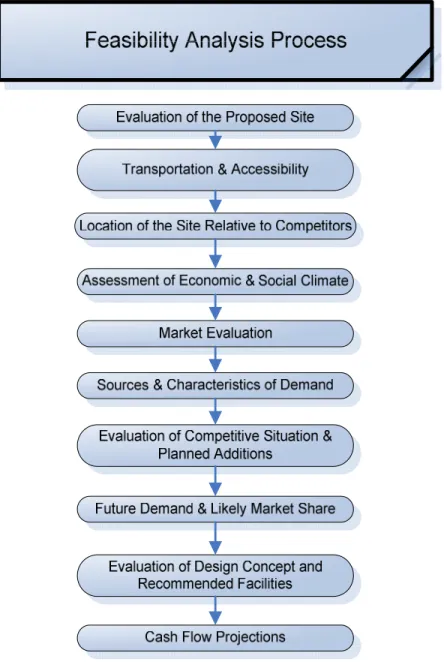

Property Development Feasibility

- Feasibility Analysis Process

Property Development Market Analysis

- Property Development Market Study Framework

- Performing a Property Development Market Study

Risk Management

- Types of Risk

- Property Development Risks

Based on our experience of reviewing real estate development projects, the most common risks of real estate development are as follows" (Echavarren. It is clear that all developments have a series of risks that will dramatically affect the success or failure of a project.

Financing Property Development Projects

- Sources of Property Development Financing

- Property Development Financing Methods

- Preparing a Loan Package

Real Estate Development Investment Trusts (REITs): Originating in the US, the modern REIT is a real estate development mutual fund that allows mall investors to participate in large real estate projects. Management contracts: Developers with little operational experience invest in real estate development projects, creating fertile ground for management companies to offer their expertise. The ability to analyze, interpret and forecast trends in the equity and debt financing markets is essential to success in the.

A project team's ability to choose an appropriate method depends on its experience and understanding of the dynamics. Today, developers and operators usually turn to specialists in the field of real estate financing for an explanation of the financing alternatives of a project and a program for obtaining the best financing package” (Baltin et al, 1999: 56). Developers use short-term and mezzanine debt when permanent financing does not cover the entire cost of the project.

A cover letter to the lender from the project team clearly indicating the requested loan amount.

Project Team

- Selecting a Team

The Environmental Engineer is responsible for evaluating environmental features and developing methods for controlling the impact of related features. The Geotechnical Engineer is responsible for analyzing the soil composition and ensuring that all specifications are met. The town planner is responsible for ensuring that land use complies with local authority codes, policies and regulations.

The developer should look for similar projects that have been successfully completed and ask questions about which professionals have been engaged in these projects. This process will usually take considerable time, but is necessary to get a suitable professional team that fits the objectives and needs of the developer's project.

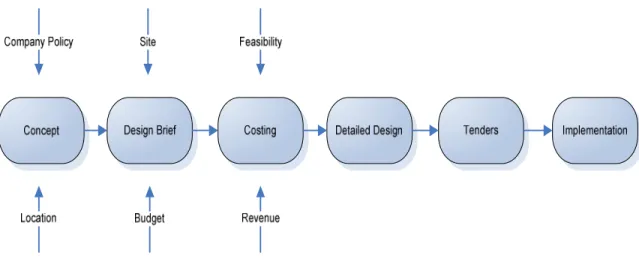

Property Development Design

Property Development Construction

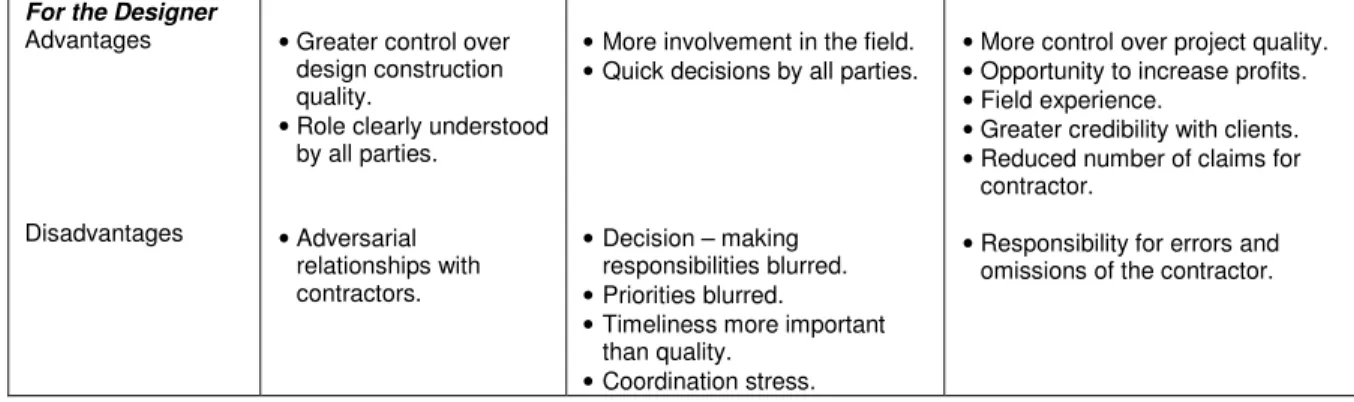

- Construction Contract Options

- Management of the Construction Process

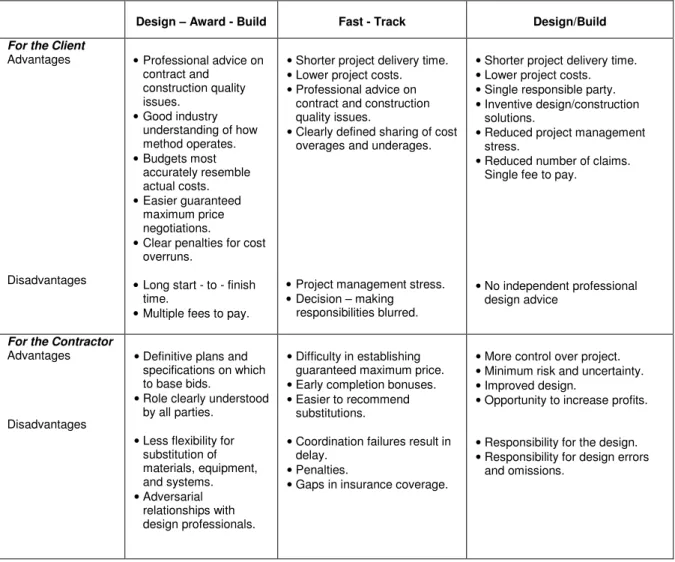

Multi-point liability' whereby several individual organizations are separately responsible to the client for design and for construction. Single point of liability' whereby a single organization is responsible to the client for all aspects of design and construction. Although there is much ongoing debate about which process best serves the client, the evolution of new skills such as risk management and value management encourages greater collaboration between client, designers, construction process managers and suppliers.

Baltin et al (1999) explain that the construction contract has a lot to do with the delivery time, cost and quality of the project. Despite the time required to design and specify the building for the first time, it is still the best contract option (Baltin et al, 1999). This allows long lead time items to be ordered before the design is completed, speeding up the delivery process.

This approach best serves projects in which the design needs and solutions are known, and the owner is comfortable with the contractor relationship. By using this option, the owner can often do without the services of an independent architect and also without the services of a contractor manager. Design/build does not function as well when the development goal is an innovative product” (Baltin et al.

The client should retain ownership of the project, and to ensure this he/she should follow the main steps in the construction project's success (Ransley and Ingram.

Empirical Study

Introduction

Idea / Inception and Concept Refinement

- S.W.O.T Analysis

Midrand Estate is not fully developed therefore Centurion and Pretoria are not fully accessible due to unfinished roads. Midrand Estate is part of the Ekhurhuleni Metro, which means that municipal costs are higher than at Tshwane. Midlands Estate is still in the development phase and therefore the full potential of the Estate will not be realized for another three years.

Luxury homes will be developed and therefore the cost of the property will be higher than average. The development of high-quality houses offers the opportunity to obtain large contracts with other firms. The fact that Midlands is in its early stages of development offers the opportunity to develop further in the coming years.

Supply may begin to outstrip demand due to strong demand in recent years. An increase in construction and material costs can mean that the price of the property is too high for the average buyer. From the S.W.O.T analysis it is clear that the strengths and opportunities are greater than the weaknesses and threats.

Preliminary Feasibility

- Rough Cost Analysis

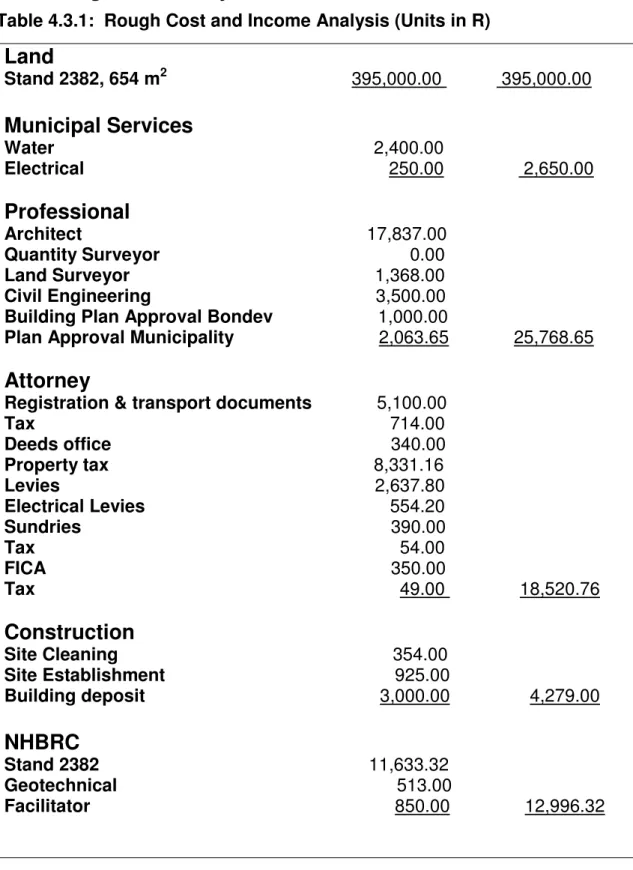

A rough cost analysis has been made in the table above. construction costs, contractor fees, completion costs, land costs, local authority fees etc. All the above mentioned costs are the initial costs that were spent on preparing the land. Similar planning and implementation strategies will be followed to ensure that no violations of HOA law occur.

Gain Control of Site

- Detailed Cost Analysis on Stand 2382

- Bill of Quantities

- Detailed Budget of Materials and Labour

- Profitability Analysis

- Cost - Price Analysis

- Profit Margin Analysis (Excluding Estate Agent Commission)

- Profit Correlation

- Total Cost and Profit

It was paramount to determine the average selling price of the properties in Midrand Estate. Midteam is one of the best real estate agencies selling properties in Midrand Estate. The first chart clearly illustrates that the price range and sizes of the properties vary widely.

The range of sizes varies between the smallest which is 197 m2 and the largest which is 842 m2. With the second graph, the variation in sizes of the properties is more clearly indicated. This low selling price may be due to cheap finishing, a lower than average profit margin, incompleteness of the project or even bankruptcy.

Andre Naude of Arch-Studio in Garsfontein is a qualified architect and registered with Midrand Estate as a Professional Senior Architectural Technologist, which is one of the residential design requirements set by the Midrand Estate Home Owners Association. After the conceptual drawings were approved, a detailed project cost analysis had to be carried out to determine the feasibility of the project and whether the result of the feasibility study was in accordance with all the requirements of the developer. Some quantities were determined by subcontractor bids and in consultation with E.T Construction.

The estimation methods, used in the early stages of the cost planning process, depended on reliable historical cost data and an analytical approach based on applying current prices for resources to a well-developed design. The cost price - price per square meter had to be determined to estimate the total cost of the project. The total costs of the project on stand 2382 were determined by adding the total costs of the stand in section 4.3.1 to the total material and labor costs in section 4.5.2.2.

The costs - The price per square footage was then determined by dividing the project's total cost by the home's total square footage. The total profit that the developer will make can be determined by subtracting the total cost of the project from the selling price of the property. By multiplying Cost – Price per square meter by the area in square meters of each of the five properties, the estimated construction and sales prices were determined per square meter. property.

A total revenue and cost analysis was performed by adding all total revenue per stand together and all total cost per property together to verify development feasibility.

Contract Negotiations

Financing Options

- Option 1: ABSA Development Bond

- Option 2: Own Financing

- Option 3: Bond on Land

A single stand bond can be registered in the company's name, but must be paid in full before the first property can be registered in the new owner's name. Although financing costs are minimized at a cost of R 10,398.41 per property, the developer requires high working capital. A bond on one stand and a bond on two of the properties covering construction costs.

Only bonds on two properties at a given time can be registered and therefore accurate.

Construction

- Flow of Construction Activities (Gantt Chart)

Conclusion…

Bibliography