Directory UMM :Data Elmu:jurnal:I:Insurance Mathematics And Economics:Vol26.Issue2-3.2000:

Teks penuh

Gambar

Dokumen terkait

This work was extended, ®rst for computing the uniquely identi®able parameter combinations of the same model class [3], then to similarly general catenary models with input and

This result can be used by firms to determine the optimal coupon value, based on the profit margin, the market response of the deal-prone segment, and the number of loyal

We will demonstrate that the maximum ODE-stable set is characterized by the combination of the following three conditions: (1) the autoregressive coefficient matrix in the

We show that (1) joint ownership can be superior to the other ownership structures by overcoming vertical externality of double marginalization; (2) collusive outcomes, however,

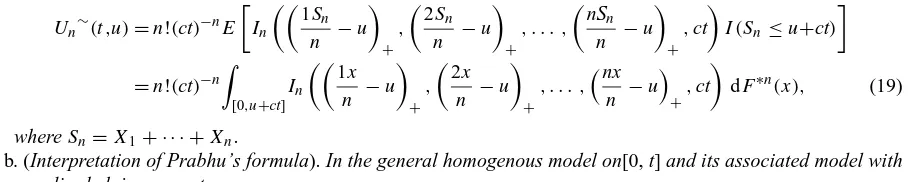

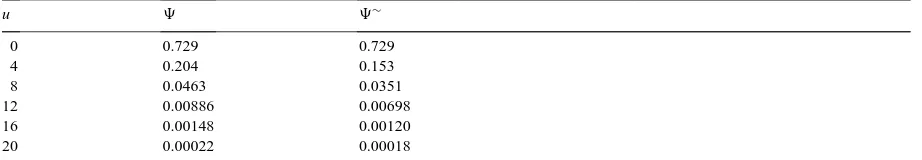

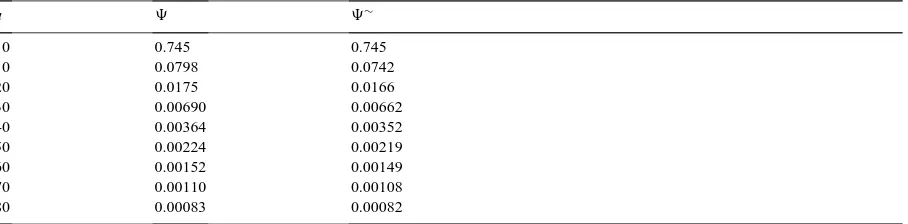

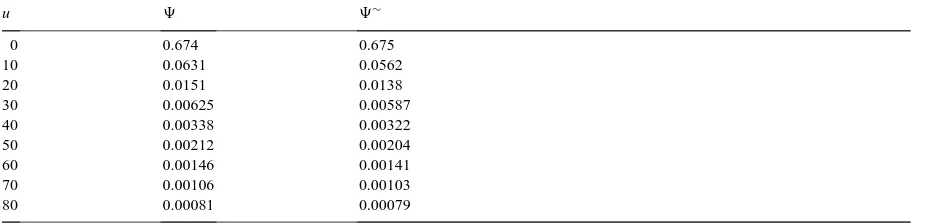

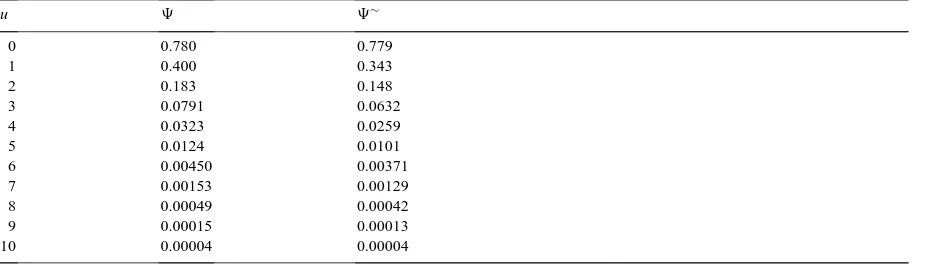

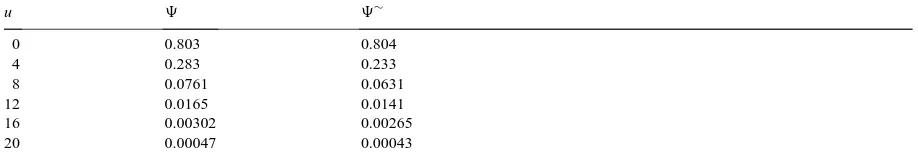

Furthermore, for the classical compound Poisson model we consider some asymptotic formulae, as initial surplus tends to infinity, for the severity of ruin, which allow us to

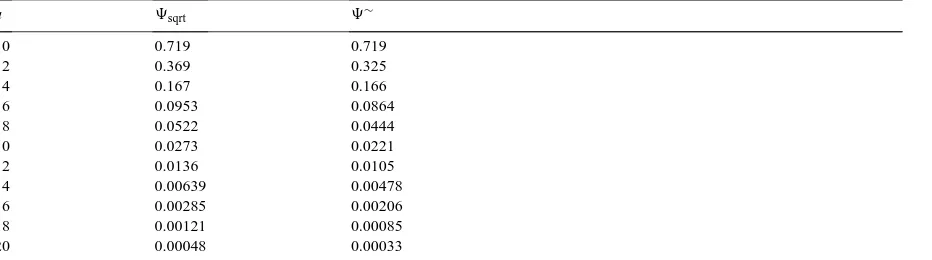

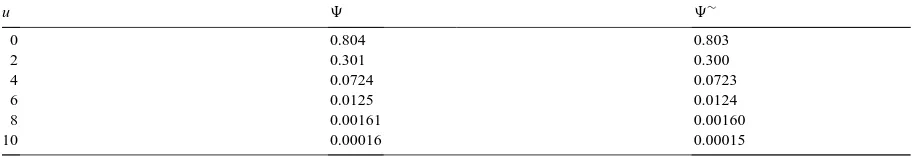

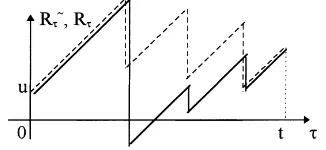

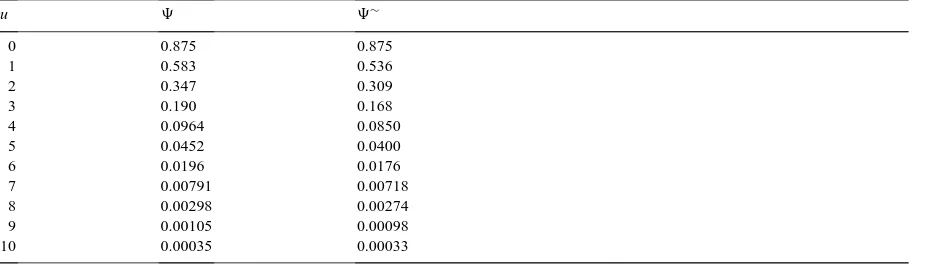

The paper presents a recursive method of calculating ruin probabilities for non-Poisson claim processes, by looking at the surplus process embedded at claim instants.. The

Among standard integral stochastic orderings used in actuarial sciences, the stochastic dominance (usually denoted by st ) is obtained when U ∗ S = U st , the class of

The topics covered include: a short overview of technologies used in adaptive nonlinear modeling; modeling considerations; the model development process; and a comparison of linear