07350015%2E2012%2E715958

Teks penuh

Gambar

Garis besar

Dokumen terkait

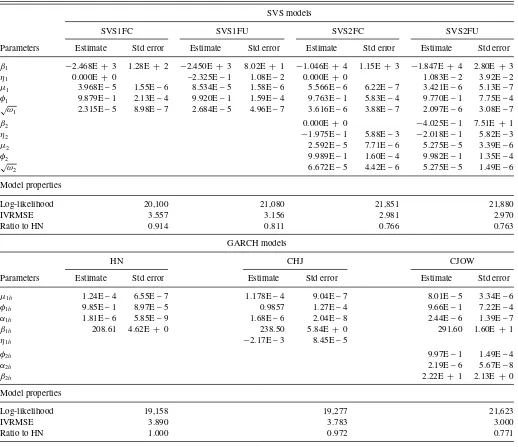

The proposed models are fitted to daily returns and realized kernel of six stocks: SP500, FTSE100, Nikkei225, Nasdaq100, DAX, and DJIA using an Markov Chain Monte Carlo

I use flexible jump–diffusion models and the Hull–White (1987) option valuation approach to derive the relationship between the future quadratic variation of returns and

We study the estimation of RBCSV models using daily returns of TOPIX with two alternative volatility proxies: RV 1min and TSRV 5min.. To sample parameters, we employ the

The Granger causality tests, GARCH and EGARCH models were utilized to examine the relationship between the daily stock returns volatility and trading volume over the period of January

Table 12.1 Comparative Analysis of Amul and E-Choupal Models Criteria AMUL E-choupal Cooperative Corporate Motive to establish Better value and Improve market increased returns

1.5 Objectives Of The Study The objectives of this study are to find the best fitting models and to model volatility of asset returns for both monthly and daily data for both