Quantitative Finance authors titles recent submissions

Teks penuh

Gambar

Dokumen terkait

The studies reveal at least four fundamentally distinct channels for the propagation and amplification of shocks within the financial system and to the macroeconomy: (i)

boosting method is using numerical response variable, while random forest is. through

We applied the model on real financial data and we shown that the model is able to reproduce important statistical fact of financial volumes as the autocorrelation function of

With only minimal ingredients, this model is able to capture the aggregate e ff ect of idiosyncratic shocks to aver- aged economic output growth measures.. It thereby establishes

We study in this paper a class of constrained linear-quadratic (LQ) optimal control problem formu- lations for the scalar-state stochastic system with multiplicative noise, which

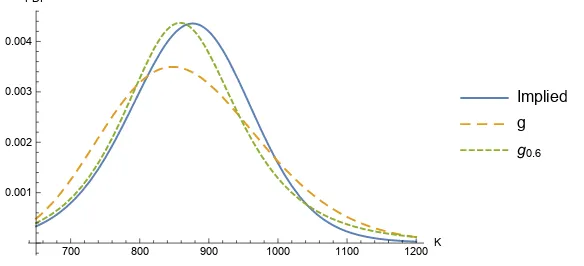

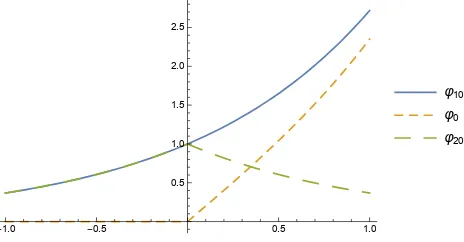

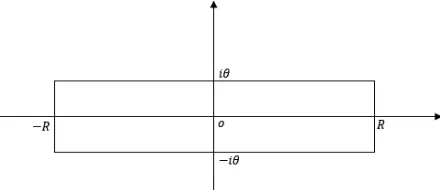

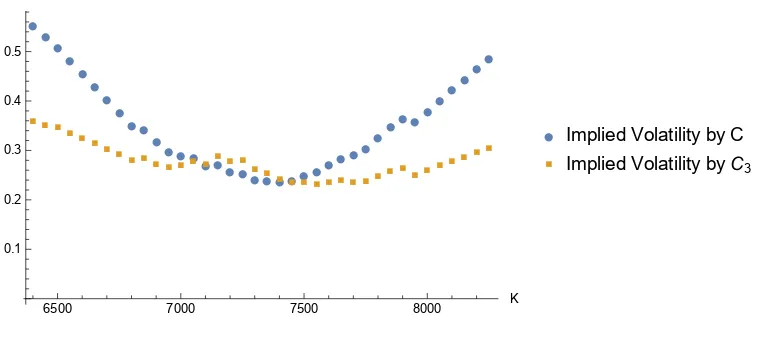

We apply the theory to set up a variance-optimal semi-static hedging strategy for a variance swap in both the Heston and the 3/2-model, the latter of which is a non-affine

∗ Corresponding author, [email protected].. using the analytical approaches developed in the cross-disciplinary research fields in- volving econophysics and

We improve their genus 2 case algorithm, generalize it for genus 3 hyperelliptic curves and introduce a way to deal with the genus 3 non-hyperelliptic case, using algebraic